Table of Contents

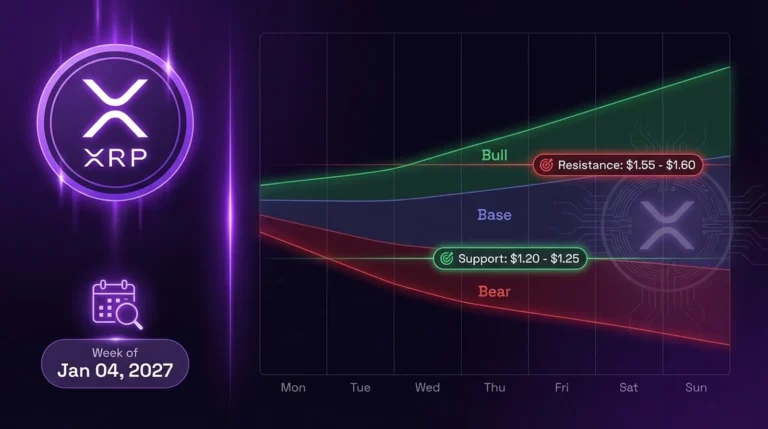

XRP Weekly Forecast: Week of January 04, 2027

What is XRP price prediction for this week?

This week’s XRP outlook is best modeled as ranges and scenarios. This update provides a weekly forecast band with key support/resistance zones and clear confirmation/invalidation triggers, plus catalysts that can switch scenarios.

Forecast Window: January 04–10, 2027 (Monday–Sunday UTC)

Last Updated: January 04, 2027, 08:00 UTC

Weekly Outlook Summary:

- Base Range: $4.20 – $4.65 (new year consolidation)

- Bull Range: $4.70 – $5.10 (if breakout confirms)

- Bear Range: $3.85 – $4.15 (if support fails)

- Volatility Expansion: $3.60 – $5.30 (if major catalyst triggers)

Key Zones This Week:

- Primary Support: $4.15 – $4.20 zone (year-end accumulation zone)

- Primary Resistance: $4.65 – $4.75 zone (breakout trigger)

- Weekly Invalidation: Daily close below $4.00

Top Catalysts This Week:

- NFP Jobs Report (Fri Jan 08) – labor market health; Fed narrative

- FOMC Minutes Release (Wed Jan 06) – policy tone insights

- BTC volatility regime – testing $125K resistance; new year momentum

- XRP ETF trading volume – first week 2027 flow dynamics

- Ripple Q4 2026 metrics – expected adoption data release

- New year institutional rebalancing – fresh allocation cycles

Scenario Triggers:

| Scenario | Trigger | Confirmation | Invalidation |

| Base | Hold $4.15-$4.20 support | Range bound consolidation | Break below $4.15 or above $4.75 |

| Bull | Break above $4.75 | 4H close + volume expansion | Rejection back below $4.60 |

| Bear | Break below $4.15 | 4H close below; volume spike | Reclaim $4.25 with strength |

| Vol Expansion | NFP surprise + BTC break | Range exceeds 18% intraday | Volatility compresses <10% |

Navigate: This week XRP outlook | Next week scenarios | Methodology confirmation rules | Technical analysis hub

Weekly Forecast at a Glance (Jan 04–Jan 10, 2027)

| Scenario | Range | Drivers | Trigger | Confirmation | Invalidation |

| Base | $4.20-$4.65 | New year consolidation; neutral macro | Hold support | Range bound | Break S/R |

| Bull | $4.70-$5.10 | Strong NFP; BTC breakout; ETF flows | Break $4.75 | 4H close + vol | Fail at $4.75 |

| Bear | $3.85-$4.15 | Hawkish FOMC; BTC rejection; risk-off | Break $4.15 | 4H close + vol | Reclaim $4.25 |

| Vol Expansion | $3.60-$5.30 | NFP shock + BTC regime shift | Major catalyst | >18% daily range | Vol compresses |

Base Scenario (Most Likely Path)

The base scenario ($4.20-$4.65) represents new year consolidation. XRP holds above $4.15 support established in December while respecting $4.65-$4.75 resistance. This path assumes neutral FOMC minutes, an in-line NFP report, and stable BTC regime around $125K. First-week-of-year trading often sees reduced volume before institutional rebalancing kicks in. Probability: ~50%.

Bull Scenario (Breakout + Continuation)

The bull scenario ($4.70-$5.10) activates on a confirmed break above $4.75 with volume. Drivers include strong NFP supporting risk-on sentiment, BTC breakout above $130K, positive XRP ETF flows in the new year, or Ripple Q4 metrics exceeding expectations. Confirmation requires a 4H close above $4.75. Probability: ~25%.

Bear Scenario (Breakdown + Risk-Off)

The bear scenario ($3.85-$4.15) activates on a confirmed break below $4.15 support. Drivers include hawkish FOMC minutes, weak NFP triggering recession fears, BTC rejection at $125K, or risk-off start to 2027. Confirmation requires a 4H close below $4.15 with volume. Probability: ~15%.

Volatility Expansion Scenario (Wide-Range Week)

The volatility expansion scenario ($3.60-$5.30) activates if a major catalyst combines with a BTC regime shift. NFP surprise (either direction) plus a BTC breakout or breakdown could produce outsized moves. New year repositioning can amplify volatility. Watch for >18% daily ranges as confirmation. Probability: ~10%.

Key Levels for the Week (Support, Resistance, Invalidation)

| Zone | Type | Why It Matters | Confirms | Risk Signal |

| $4.15-$4.20 | Support | Year-end accumulation zone; institutional bids | Bounce with vol | Break = bear trigger |

| $4.00 | Invalidation | Daily close below = weekly structure flip | N/A | Full bear scenario |

| $4.65-$4.75 | Resistance | Range high; breakout trigger zone | Break + close | Rejection = range |

| $5.00-$5.10 | Extension | Bull target if $4.75 clears with strength | Follow-through | Fail = retest range |

Primary Support Zone(s) + What Confirms Defense

The $4.15-$4.20 zone is the primary weekly support. This level saw strong accumulation during year-end trading in December 2026. A bounce from this zone with volume confirms the base scenario. For detailed level analysis, see the technical analysis hub.

Primary Resistance Zone(s) + What Confirms Breakout

The $4.65-$4.75 zone is the primary weekly resistance and breakout trigger. A confirmed break above (4H close with volume expansion) would trigger the bull scenario targeting $5.00-$5.10. Watch for rejection candles as an early signal of failed breakout attempts.

Weekly Invalidation and Scenario Switch Rules

A daily close below $4.00 invalidates the base weekly scenario and confirms the full bear case. This level represents a structural flip on higher timeframes. If triggered, expect $3.85 as the next support zone. The volatility expansion scenario becomes more likely if invalidation occurs with >18% daily range.

What Changed Since Last Week? (Delta)

Key Changes (Week of Dec 28 → Week of Jan 04):

- Structure: Support held at $4.15; resistance tested at $4.65 (no break)

- Range: Holiday compression; tighter channel forming

- Volatility: 7-day realized vol compressed to 28% (holiday effect)

- Funding: Neutral at +0.008% (balanced positioning)

- Open Interest: Stable at $2.85B; year-end deleveraging complete

- BTC Regime: Consolidating at $125K; new year breakout watch

- ETF Flows: Light holiday week; fresh allocation cycle starting

- Catalysts: Macro calendar resumes (FOMC minutes, NFP)

Structure Changes (Levels Held/Broke)

XRP held the $4.15-$4.20 support zone through year-end trading. Resistance at $4.65 was tested but not broken. The structure remains neutral—neither bullish continuation nor bearish breakdown. Holiday volume compression created a tighter range, setting up potential expansion as normal trading resumes.

Positioning Changes (Funding/OI/Liquidations)

Year-end deleveraging has completed. Open interest stabilized at $2.85B after December’s flush. Funding is neutral at +0.008%, indicating balanced positioning entering 2027. This clean positioning profile reduces immediate squeeze risk and supports the base consolidation scenario. For detailed positioning analysis, see the sentiment and liquidity hub.

Catalyst Changes (New Risks/Resolved Risks)

Resolved: Holiday quiet period. New this week: Macro calendar resumes with FOMC minutes (Wednesday) and NFP (Friday). First week of institutional rebalancing may bring fresh allocation flows. Ripple Q4 2026 metrics expected. For all catalysts, see the XRP catalysts hub.

Catalysts Calendar (This Week)

| Date | Event | Impact Channel | What Confirms Impact |

| Wed Jan 06 | FOMC Minutes Release | Policy tone; rate path expectations | Hawkish = risk-off; Dovish = risk-on |

| Fri Jan 08 | NFP Jobs Report | Labor market; recession/growth narrative | Strong = risk-on; Weak = recession fear |

| Ongoing | Institutional Rebalancing | Fresh 2027 allocation cycles | ETF flow surge = directional signal |

| Expected | Ripple Q4 2026 Metrics | Adoption data; ODL volume | Strong numbers = bull bias |

| Ongoing | BTC Volatility | Market regime; $125K level | BTC $130K break = risk-on |

Macro Calendar and Risk Windows

FOMC minutes (Wednesday) and NFP (Friday) are the key macro events. FOMC minutes provide insight into December’s rate decision rationale and forward guidance. NFP sets the tone for 2027 labor market expectations. A strong jobs report supports risk-on; a weak report could trigger recession fears. Both events create volatility windows mid-week and end-of-week.

Crypto Regime Risks (BTC Volatility, Liquidity, Stablecoin Flows)

BTC is consolidating at $125K after a strong 2026. A breakout above $130K would confirm new-year momentum and support XRP’s bull scenario. Failure at $125K and retreat below $120K would pressure XRP. Stablecoin positioning is neutral entering 2027—watch for fresh mints as institutional allocation cycles begin.

XRP-Specific Headlines (Legal/ETF/Ripple)

XRP ETF products are now established with 2026 approvals in place. First-week 2027 flows will indicate institutional appetite for the new year. Ripple Q4 2026 metrics are expected and could provide adoption catalysts. Legal/regulatory status remains stable—post-settlement clarity continues. For legal context, see the SEC lawsuit impact hub. For ETF analysis, see the XRP ETF hub.

Signals Dashboard (Definitions + Current Values)

Signal Dashboard (as of Jan 04, 2027 08:00 UTC):

| Signal | Current Value | Interpretation |

| Volatility (7d) | 28% | Holiday compressed; expansion expected |

| Funding Rate | +0.008% | Neutral; balanced positioning |

| Open Interest | $2.85B (stable) | Deleveraging complete; clean slate |

| Liquidation Risk | Low | Clusters at $3.95 (long) and $4.85 (short) |

| Liquidity Depth | Above average | Good absorption; supports clean moves |

Volatility Regime and Expected Range Width

7-day realized volatility compressed to 28% during the holiday period—the lowest since early November. This compression typically precedes expansion as normal trading resumes. With FOMC minutes and NFP this week, expect volatility to expand. If expansion occurs, the volatility expansion scenario ($3.60-$5.30) becomes more likely.

Liquidity Depth/Spreads

Order book depth remains above average with tight spreads on major venues. The established XRP ETF market has improved institutional liquidity. This liquidity profile supports cleaner price discovery and reduces slippage risk. Watch for depth around key levels as catalysts approach.

Funding Rate / Open Interest / Liquidation Risk

Funding is neutral at +0.008%—the cleanest positioning profile in months. Open interest at $2.85B is stable after year-end deleveraging. Liquidation clusters are distant: longs at $3.95, shorts at $4.85. This clean positioning supports the base consolidation scenario but also creates room for directional moves if catalysts trigger.

How to Use This Weekly Forecast (Framework)

Confirmation vs Invalidation (Examples)

Each scenario has clear triggers:

- Base confirms: Price holds $4.15-$4.20 and respects $4.65-$4.75 (consolidation)

- Bull confirms: 4H close above $4.75 with volume expansion

- Bear confirms: 4H close below $4.15 with volume spike

- Vol expansion confirms: Daily range exceeds 18% on NFP or FOMC

Range Management (When to Widen/Tighten)

Widen expected ranges when: (1) FOMC minutes are hawkish/dovish surprise, (2) NFP significantly beats or misses expectations, (3) BTC breaks $130K resistance or loses $120K support. Tighten ranges if: catalysts resolve neutral and BTC consolidates—base scenario probability increases.

Related Reading

This Week / Next Week / Next Month

XRP this week outlook | XRP next week scenarios | XRP next month forecast

Methodology / Technical Analysis / Sentiment & Liquidity / Catalysts

Methodology confirmation rules | Technical analysis hub | Sentiment and liquidity analysis | XRP catalysts hub | XRP price prediction | XRP 2026 outlook

Frequently Asked Questions

What dates does the ‘week of Jan 04, 2027’ cover?

This weekly update covers January 04–10, 2027 (Monday through Sunday UTC). The week-start date is always Monday. All timestamps use UTC for global consistency.

What are the key XRP support and resistance levels this week?

Primary support: $4.15-$4.20 zone (year-end accumulation level). Primary resistance: $4.65-$4.75 zone (breakout trigger). Weekly invalidation: daily close below $4.00. These zones represent high-volume reaction areas from December 2026.

What does ‘weekly invalidation’ mean?

Weekly invalidation is the condition that proves the base weekly scenario wrong. For this week, a daily close below $4.00 invalidates the base consolidation and confirms the bear scenario. When invalidation triggers, the forecast shifts to the alternative scenario.

What could move XRP price most this week?

Top movers this week: FOMC minutes (Wednesday), NFP jobs report (Friday), BTC regime ($125K-$130K test), institutional rebalancing flows, and Ripple Q4 2026 metrics if released. The first full trading week of 2027 may see increased activity as normal volumes resume.

How do funding and open interest affect XRP over a week?

Funding (+0.008%) is neutral, indicating balanced positioning. Open interest ($2.85B) is stable after year-end deleveraging. This clean positioning profile reduces immediate squeeze risk but also creates room for directional moves if catalysts trigger. Watch for positioning changes as the new year trading begins.

How does Bitcoin volatility affect XRP’s weekly forecast?

BTC sets the market risk regime. BTC is consolidating at $125K with $130K as the breakout target. BTC continuation above $130K supports XRP’s bull scenario. BTC rejection and drop below $120K would pressure XRP. Watch BTC structure first.

How often is this weekly forecast updated?

One weekly post per Monday week-start date. Given FOMC minutes and NFP this week, intraweek updates may be added with timestamps if catalysts significantly shift the outlook. No duplicate URLs for the same week.

Where can I find next week’s XRP forecast?

Use the Next Week hub for the subsequent calendar week outlook. The newest dated weekly post will be published on Monday, January 11, 2027.

How is this weekly post different from the ‘This Week’ hub page?

The ‘This Week’ hub is evergreen and continuously updated. This post is a dated snapshot for the week of Jan 04, 2027, with specific levels, scenarios, and a ‘what changed’ delta section showing the shift from the prior week (Dec 28).

Update Log

| Date/Time (UTC) | Update Notes |

| Jan 04, 08:00 | Initial weekly forecast published. Base range: $4.20-$4.65. Key catalysts: FOMC minutes (Wed), NFP (Fri). |

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.