Table of Contents

XRP ETF (Impact on XRP Price Prediction)

How would an XRP ETF affect XRP price?

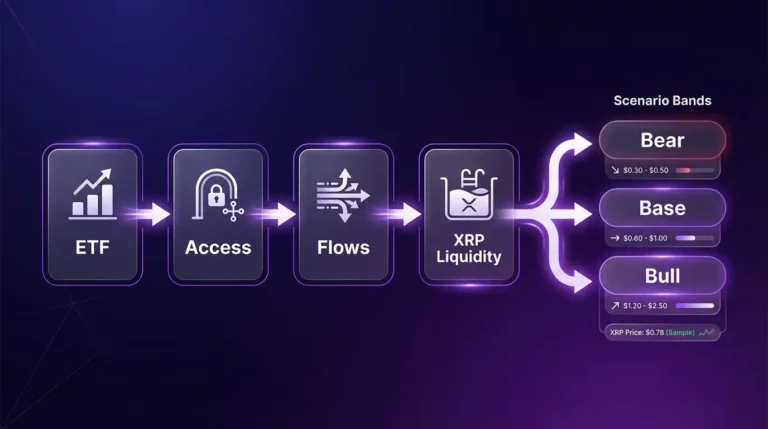

An XRP ETF could impact price by expanding market access and channeling sustained demand through inflows, which can deepen liquidity and change volatility. The effect depends on the product type, flow size, and market regime—so VTrader models ETF outcomes as scenarios, not guarantees.

XRP ETF Status Snapshot (January 2026):

- Multiple XRP ETF filings under SEC review

- Legal clarity improved following SEC settlement (August 2025)

- No approved spot XRP ETF in the US as of this update

Last Updated: January 14, 2026 | See Update Log below

ETF Scenario Impact Summary:

- Positive progress: Access expands, sentiment improves, bull scenario probability rises

- Slow/uncertain: Range-bound narrative, base scenario maintained

- Negative shock: Rejection or disappointment, bear scenario probability rises

For the complete forecasting framework, see the XRP price prediction methodology. For all price drivers, see the XRP catalysts hub.

What Is an XRP ETF? (Entity Definition)

An XRP ETF (Exchange-Traded Fund) is a financial product that would allow investors to gain exposure to XRP through traditional brokerage accounts without directly holding the underlying asset. The ETF structure is familiar to mainstream investors and operates within regulated market infrastructure.

ETF Structure in Plain Terms

- Shares: Investors buy ETF shares that represent exposure to XRP

- Fund manager: An asset manager creates and manages the fund

- Custody: The manager handles custody of the underlying asset (or derivatives)

- Trading: ETF shares trade on traditional exchanges during market hours

Spot vs Futures-Style Exposure (High-Level)

- Spot ETF: Designed to track the asset price directly; fund holds actual XRP (or claims on it)

- Futures-based ETF: Uses derivatives (futures contracts) to gain exposure; can behave differently due to roll costs and basis

Why an ETF Could Move XRP Price (Mechanism)

| ETF Event | Access Effect | Demand Effect | Liquidity Effect | Scenario Shift |

| Filing/Progress | Signals future access | Anticipatory buying | Modest increase | Bull bias |

| Approval | Access opens | New buyer channel | Deepens over time | Bull scenario |

| Net Inflows | Access utilized | Sustained demand | Deepens liquidity | Supports base/bull |

| Net Outflows | Access exists | Selling pressure | May thin liquidity | Bear pressure |

| Rejection/Delay | Access blocked | Sentiment hit | Volatility spike | Bear scenario |

Market Access Expansion (New Buyers)

An ETF lowers barriers to entry. Investors who cannot or prefer not to hold crypto directly (retirement accounts, institutional mandates, brokerage-only portfolios) gain access through a regulated structure. This expands the potential buyer pool beyond current crypto-native participants.

Demand Channels and Flow Dynamics

ETF demand flows through creation/redemption mechanisms. When investors buy ETF shares, the fund manager may create new shares by acquiring XRP (or derivatives). Sustained net inflows mean persistent demand. Headlines can cause short-term spikes, but durable price impact requires ongoing flow.

Flow Sensitivity: Outcome depends on sustained net inflows, not headlines alone. A single approval day may spike volatility, but lasting price effects require ongoing capital allocation through the ETF structure.

Liquidity Depth, Spreads, and Volatility Effects

Broader access and higher participation can deepen liquidity and tighten spreads over time. But around key events (approval, rejection, flow surprises), volatility can spike as positioning shifts. The net effect depends on flows, regime, and market structure. For liquidity interpretation, see the XRP sentiment and liquidity hub.

ETF Scenarios for XRP Price (Scenario Switch Model)

Positive Progress Scenario (Access and Sentiment Expand)

If ETF progress accelerates (approval, strong initial flows):

- Access expands to new investor segments

- Sentiment shifts positive; risk premiums compress

- Bull scenario probability increases across horizons

- Higher targets become more feasible (still require adoption + liquidity)

Slow/Uncertain Scenario (Range-Bound Narrative)

If ETF progress stalls or remains uncertain:

- Access unchanged; existing market structure dominates

- Sentiment range-bound; base scenario maintained

- Other drivers (adoption, technical structure, macro) become primary

Negative Shock Scenario (Rejection/Disappointment)

If ETF is rejected or progress disappoints expectations:

- Access pathway blocked; sentiment hit

- Volatility spike; bear scenario probability increases

- Forecast ranges widen; key support levels become critical

What Evidence to Watch (Signals)

Filings, Approvals, and Official Communications (Dated)

- SEC filings and public comment periods

- Official approval/rejection announcements

- Regulatory guidance or rule changes

- For regulatory context, see the SEC lawsuit impact hub

Institutional Product Signals (Custody, Venues)

- Custody solutions from major providers

- Exchange listings and trading venue expansion

- Asset manager product announcements

Market Reaction Signals (Liquidity/Volatility)

- Order book depth and spread changes

- Volatility spikes or compression

- Derivatives positioning shifts (funding, OI)

Constraints and Overhype Filters (Feasibility)

Flows Required vs Implied Market Cap Assumptions

Higher price targets imply larger market caps. Achieving those market caps through ETF flows alone would require substantial sustained inflows. Use constraint math: if XRP at $10 implies ~$575B circulating market cap, what flow magnitude is required to support that valuation? For feasibility checks, see the XRP price targets hub.

Why ETF ≠ Guaranteed Moon (Risk Premium + Regime)

Risk Premium Box: ETF approval can compress risk premiums and expand narratives. But macro regime, liquidity conditions, and adoption fundamentals still matter. Headlines alone don’t guarantee sustained price increases—flows do. And flows depend on ongoing demand, not a single event.

For fundamental drivers beyond ETF, see the XRP fundamentals hub.

How VTrader Updates Forecasts on ETF News (Method Excerpt)

What Triggers an Update

- Official status change (filing, approval, rejection)

- Material flow data (sustained inflows/outflows once product exists)

- Market structure break triggered by ETF news

- Significant regulatory guidance change

What Is Noise

- Unconfirmed rumors without official sources

- Social media speculation about dates

- Price moves without structural confirmation

How This Connects to Forecast Horizons (Navigation)

Tomorrow / Next Week (Headline Risk)

ETF news can move XRP quickly. Short-horizon forecasts treat ETF events as scenario switches—widening ranges and updating confirmation/invalidation conditions. See XRP price prediction tomorrow and XRP price prediction next week for tactical applications.

2026 / 2030 (Scenario Bands)

ETF access could be a catalyst that shifts scenario probabilities for annual forecasts. If approved and flows are sustained, bull scenarios become more feasible. If rejected or delayed, bear scenarios gain weight. See XRP 2026 forecast and XRP 2030 forecast.

Targets Pages (Constraint Math)

ETF flows can affect which price targets are feasible. Use the XRP price targets hub for constraint-based feasibility checks and the XRP AI modeling hub for AI limitations with exogenous catalysts.

Main hub: XRP price prediction | Technical context: XRP technical analysis hub

Common ETF Misconceptions for XRP (Debunk)

| Misconception | Reality |

| ETF approval = instant moon | Headlines spike volatility; sustained impact requires flows |

| Any ETF filing is bullish | Filings signal intent; approval and flows matter more |

| ETF solves all access problems | ETF expands access but doesn’t eliminate all friction |

| ETF flows are always positive | ETFs can see outflows; flows depend on investor sentiment |

| Approval date is predictable | Regulatory timelines are uncertain; avoid date speculation |

Frequently Asked Questions

Is there an XRP ETF today?

This hub provides a dated status snapshot and links to the latest VTrader coverage. Because products and filings can change, the page shows a ‘Last updated’ timestamp and a short update log for transparency.

Will an XRP ETF be approved?

No one can guarantee approval timing. Instead of predicting dates, this page focuses on mechanisms, constraints, and evidence-based signals. If official status changes, the hub updates with dated facts and links to the relevant news post.

How does an ETF increase demand for XRP?

An ETF can expand access by letting investors buy exposure through familiar brokerage rails. If it attracts sustained net inflows, that demand can translate into market buying pressure and improved liquidity conditions.

Would an XRP ETF guarantee a price rally?

No. Headlines can cause short-term volatility, but durable impacts require sustained inflows and supportive market regimes. That’s why VTrader treats ETF outcomes as scenarios rather than single-number promises.

How does an ETF affect liquidity and volatility?

With broader access and higher participation, liquidity can deepen and spreads can tighten. But around key events, volatility can rise as positioning shifts. The net effect depends on flows, regime, and market structure.

What’s the difference between a spot ETF and a futures-based product?

A spot-style structure is designed to track the asset more directly, while futures-based exposure depends on derivatives markets and can behave differently. Product details matter for how demand and liquidity are transmitted to the market.

How does regulation affect the chances of an XRP ETF?

Regulatory clarity can expand market access and reduce risk premiums, supporting product viability. Legal uncertainty can slow progress or increase friction. That’s why the ETF hub links to the SEC/legal hub for context.

Can ETF news move XRP price tomorrow or next week?

Yes. ETF headlines can widen forecast ranges and shift scenarios quickly. Short-horizon pages should treat ETF events as scenario switches and update based on confirmation/invalidation rather than emotion.

How do you track ETF-related signals and flows?

Track official filings/status updates, credible product announcements, and market reaction signals like liquidity depth, volatility, and derivatives positioning. Flows matter more than headlines—sustained net inflows are the key signal.

How would an XRP ETF change long-term targets like $10 or $100?

An ETF could improve access and participation, but high targets still require broad adoption, strong liquidity, and supportive macro conditions. Use feasibility checks (implied market cap and liquidity constraints) before treating extreme targets as likely.

How often is this XRP ETF page updated?

Update when official status changes or when evidence materially alters scenario probabilities. Use a ‘Last updated’ timestamp and a short update log to maintain freshness without duplicating evergreen pages.

Update Log

| Date (UTC) | What Changed |

| Jan 14, 2026 | Initial XRP ETF hub published. Status: multiple filings under review, no approved spot ETF. Mechanism and scenario framework established. |

| — | Future status updates will be logged here |

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.