Table of Contents

XRP Price Prediction for Tomorrow

What will XRP price be tomorrow?

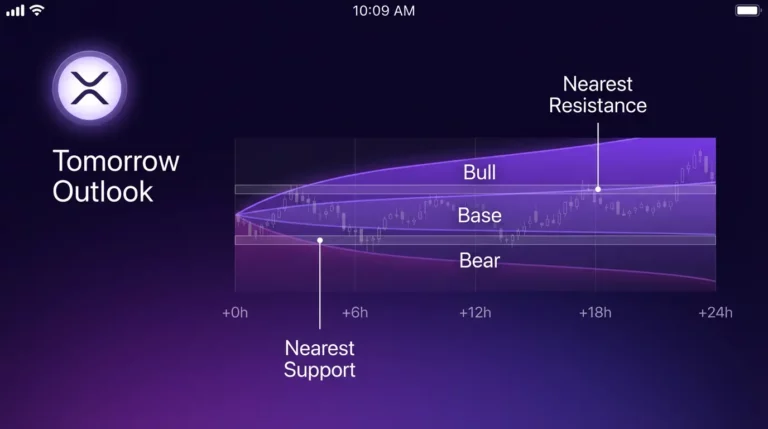

Tomorrow’s XRP price depends on short-term market structure, liquidity, and headline risk. This page gives base, bullish, and bearish ranges plus key support/resistance levels and clear confirmation and invalidation triggers for each scenario.

Forecast Window (UTC): Wednesday, January 15, 2026 00:00 UTC → 23:59 UTC

Last Updated: January 14, 2026, 16:00 UTC | See Update Log below

Tomorrow’s Forecast Range (Jan 15, 2026):

- Base Range: $2.12 – $2.28

- Bull Extension: $2.32 – $2.40 (if resistance breaks with confirmation)

- Bear Extension: $2.00 – $2.08 (if support fails)

Key Levels for Tomorrow:

- Primary Support: $2.10 – $2.12 zone

- Primary Resistance: $2.28 – $2.32 zone

- Invalidation: Daily close below $2.05 shifts to bear scenario

What to Watch Tomorrow:

- BTC regime ($100K-$103K range; breaks change outlook)

- US Retail Sales data release

- ETF flow momentum

- Funding rate and OI changes

- Ripple/XRPL headline surprises

- Volatility regime (compression vs expansion)

For the complete forecasting framework, see the XRP price prediction methodology.

Tomorrow’s XRP Forecast at a Glance (Ranges + Scenarios)

| Scenario | Range | Trigger | Confirmation | Invalidation |

| Base | $2.12-$2.28 | Range continuation; BTC stable | Support holds on retest | Daily close below $2.05 |

| Bull | $2.32-$2.40 | Break above $2.28 resistance | 4H close above + volume | Rejection and close below $2.25 |

| Bear | $2.00-$2.08 | Break below $2.10 support | 4H close below zone | Reclaim and close above $2.12 |

Base Scenario (Highest Probability)

The base scenario expects XRP to trade within the $2.12-$2.28 range tomorrow:

- BTC remains in consolidation ($100K-$103K)

- No major catalyst or regulatory headline

- Current trend structure remains intact

- Funding and OI stay moderate

Bull Scenario (Trigger + Confirmation)

Bull scenario requires a confirmed break of the $2.28-$2.32 resistance:

- BTC breaks above $103K with momentum

- Strong ETF inflows or positive Ripple news

- 4H close above $2.28 with elevated volume

- Retest of broken resistance holds as support

Bear Scenario (Trigger + Risk)

Bear scenario activates on a confirmed break of the $2.10-$2.12 support:

- BTC breaks below $100K with follow-through

- Risk-off shift (macro surprise, negative headline)

- 4H close below $2.10 with volume

- Liquidation cascade triggers below $2.05

Key Levels to Watch Tomorrow

| Type | Zone | Why It Matters | Confirms | Invalidates |

| Support 1 | $2.10-$2.12 | 4H demand zone; multiple bounces | Bounce + hold | Close below |

| Support 2 | $2.00-$2.05 | Structural support; liquidation cluster | Strong bounce | Close below |

| Resistance 1 | $2.28-$2.32 | 4H supply zone; prior rejection | 4H close above | Rejection |

| Resistance 2 | $2.38-$2.42 | Daily resistance; weekly pivot | Break + retest | Fail at zone |

Nearest Support Zone (Buyers Expected)

The $2.10-$2.12 zone is tomorrow’s most important support. XRP has bounced from this area multiple times in recent sessions. A clean bounce with follow-through confirms the base scenario remains valid. For detailed level analysis, see the XRP technical analysis hub.

Nearest Resistance Zone (Sellers Expected)

The $2.28-$2.32 zone is tomorrow’s primary resistance. XRP has been rejected here twice recently. A 4H close above $2.28 with volume would shift probability toward the bull scenario with $2.38-$2.42 as the next target.

Invalidation Level (What Breaks the Base Case)

The base scenario is invalidated by a daily close below $2.05. This signals that $2.10 support has failed and the bear scenario ($2.00-$2.08 range) becomes the primary path. Watch for $1.95 as the next major support if invalidation occurs.

What Could Move XRP Tomorrow (Short-Window Catalysts)

Bitcoin Regime / Market-Wide Risk Sentiment

Bitcoin sets tomorrow’s risk regime. XRP’s path is heavily influenced by BTC:

- BTC above $103K: Risk-on; XRP bull scenario probability increases

- BTC $100K-$103K: Neutral; XRP base scenario most likely

- BTC below $100K: Risk-off; XRP bear scenario probability increases

Scheduled Macro Events (Rates, CPI, Jobs) – If Applicable

- US Retail Sales (Jan 15): Key economic health gauge; surprise could shift risk sentiment

- Fed speakers: Monitor for any scheduled commentary

For full catalyst tracking, see the XRP catalysts hub.

Ripple/XRP Headline Risk (Legal/Regulation)

No scheduled legal or regulatory events tomorrow. However, unexpected headlines can reprice risk instantly. Monitor for Ripple announcements, regulatory statements, or legislative developments. See the SEC lawsuit impact hub and XRP ETF impact hub for ongoing context.

Liquidity and Derivatives Positioning (Funding/OI)

Current funding is mild positive (~0.005%), indicating slight long bias but no extreme. Open interest is stable. Watch for sudden OI spikes or funding flips that could signal squeeze risk and widen tomorrow’s range. For detailed positioning analysis, see the XRP sentiment and liquidity hub.

How to Use This Forecast (Risk Framing)

Traders: Entries, Invalidation, Position Sizing

- Entries: Look for reactions at key zones with confirmation (4H closes)

- Invalidation: Define your exit before entry; use the stated invalidation levels

- Position sizing: Scale to the invalidation distance; never risk more than you can afford to lose

Investors: Why to Use Weekly/Monthly Instead

If you’re planning longer-term positions, tomorrow’s forecast is too narrow. Use the XRP price prediction next week for a 7-day view, monthly forecasts for broader planning, or the 2026 forecast hub for year-horizon scenario bands.

Related Forecast Pages (Semantic Navigation)

Horizon Selector: Today | Tomorrow (current) | Next Week | Months | 2026

Today

For the current day’s intraday outlook: XRP price prediction today

Next Week

For a broader 7-day planning view: XRP price prediction next week

Monthly (2026 Priority)

For longer-term planning: XRP price prediction by month | XRP price prediction by year | XRP price targets

Main hub: XRP price prediction

Methodology (Excerpt)

Tomorrow’s forecast is built using the same Entity-Attribute-Value framework as all VTrader XRP forecasts. We prioritize structure and liquidity: recent swing highs/lows, support/resistance zones, volatility, volume, and derivatives positioning (funding/OI). Indicators support structure; they don’t replace it. Scenarios are expressed as ranges with clear triggers, confirmations, and invalidation conditions. Updates occur at least daily and after any major catalyst or market-structure break. For the complete methodology, see the XRP price prediction methodology hub.

Frequently Asked Questions

Is the XRP price prediction for tomorrow reliable?

Next-day forecasts are probabilistic, not certain. Reliability improves when the page uses scenario ranges, clear triggers, and defined invalidation levels. Treat it as a risk framework that updates with new information, not a guarantee.

What time does ‘tomorrow’ mean for XRP markets (24/7 crypto)?

Crypto trades 24/7, so ‘tomorrow’ should be defined as the next 24-hour window in UTC (or clearly stated site timezone). The page should display the forecast window (start/end time) to avoid ambiguity.

What are the most important support and resistance levels for XRP tomorrow?

The most important levels are the nearest high-liquidity zones where price recently reacted. This page lists a primary support zone, a primary resistance zone, and the invalidation level that changes the base scenario.

What could make XRP move sharply tomorrow?

Sharp moves usually come from liquidity shocks (large buy/sell flows), sudden headline risk (legal/regulatory news), macro surprises, or Bitcoin regime shifts. The ‘tomorrow checklist’ highlights the highest-impact risks for the next 24 hours.

How does Bitcoin’s trend affect XRP tomorrow?

Bitcoin often sets the market’s risk regime. If BTC breaks key levels or volatility spikes, XRP can follow. Use BTC regime as a context layer for XRP scenarios rather than a single-cause explanation.

Should I use the tomorrow forecast or the next-week forecast?

Use tomorrow for tactical planning and short holding periods. Use next-week for a more stable view of trend and key levels. If you’re unsure, start with next-week and use tomorrow as a fine-tuning layer.

What does ‘invalidation’ mean in a next-day forecast?

Invalidation is the level or condition that proves the base setup is no longer valid—usually a decisive break of a key support/resistance zone. When invalidation happens, the page should state which scenario becomes most likely next.

Can news about Ripple or regulation change the tomorrow forecast?

Yes. Headline risk can change scenarios instantly. That’s why the forecast must include a short ‘headline risk’ section and link to the SEC/legal hub for ongoing context.

What indicators do you use for a one-day XRP prediction?

Prioritize structure and liquidity: recent swing highs/lows, support/resistance zones, volatility, volume, and derivatives positioning (funding/OI) when relevant. Indicators support structure; they shouldn’t replace it.

How often is the XRP tomorrow forecast updated?

It should be updated at least once daily and again if a major catalyst or market-structure break occurs. A visible ‘Last updated’ timestamp and mini update log signal freshness without publishing duplicate pages.

Update Log

| Date/Time (UTC) | What Changed |

| Jan 14, 2026, 16:00 | Initial tomorrow forecast published for Jan 15. Base range $2.12-$2.28. Support $2.10-$2.12, resistance $2.28-$2.32. |

| — | Future updates will be logged here |

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.