Table of Contents

XRP Price Prediction 2026 (Year Forecast)

What will XRP be worth in 2026?

XRP’s 2026 outlook depends on liquidity, major catalysts (ETF/legal), macro conditions, and adoption signals. This forecast provides bullish, base, and bearish ranges plus key levels and clear confirmation/invalidation triggers for each scenario.

2026 XRP Forecast Summary:

- Base Range: $2.50 – $4.50 (most likely pathway)

- Bull Range: $5.00 – $8.00 (if major catalysts confirm)

- Bear Range: $1.20 – $2.00 (if bear scenario triggers)

Key Levels for 2026:

- Major Support: $1.80 – $2.00 zone

- Major Resistance: $3.80 – $4.00 zone (2018 ATH area)

- Bull Invalidation: Monthly close below $1.50

Last Updated: January 14, 2026 | See Update Log below

For the complete forecasting framework, see the XRP price prediction methodology. For all price drivers, see the XRP catalysts hub.

2026 XRP Forecast at a Glance (Ranges + Scenarios)

| Scenario | Range | Key Assumptions | Confirmation | Invalidation |

| Base | $2.50-$4.50 | Stable macro; legal clarity maintained; moderate adoption growth | Hold above $2.00; range continuation | Monthly close below $1.80 |

| Bull | $5.00-$8.00 | ETF approval + strong flows; risk-on macro; accelerated adoption | Break + hold above $4.00; volume expansion | Rejection and close below $3.50 |

| Bear | $1.20-$2.00 | Macro risk-off; regulatory setback; liquidity contraction | Break below $1.80 support | Reclaim and hold above $2.20 |

Base Scenario (Highest Probability Pathway)

The base scenario ($2.50-$4.50) represents the most likely pathway for XRP in 2026:

- Post-settlement legal clarity maintained; no new major regulatory threats

- Macro environment remains neutral to moderately supportive

- Continued Ripple/XRPL ecosystem development and adoption

- ETF progress without major breakthrough or disappointment

Bull Scenario (Conditions + Confirmations)

The bull scenario ($5.00-$8.00) requires multiple positive catalysts to confirm:

- XRP ETF approval with sustained net inflows

- Risk-on macro environment (accommodative Fed, strong equity markets)

- Accelerated institutional and enterprise adoption

- Bitcoin in strong bull cycle ($150K+)

- Confirmed break and hold above $4.00 with volume

For ETF impact analysis, see the XRP ETF hub.

Bear Scenario (Risks + Invalidation)

The bear scenario ($1.20-$2.00) activates if negative conditions materialize:

- Macro risk-off environment (recession, tight monetary policy)

- New regulatory threats or adverse legal developments

- ETF rejection or significant disappointment

- Bitcoin extended bear market

- Confirmed monthly close below $1.80 support

Key Levels for 2026 (Support, Resistance, Invalidation)

| Level Type | Zone | Why It Matters | Hold = | Break = |

| Support 1 | $1.80-$2.00 | Major structural support; 2024 breakout zone | Base intact | Bear scenario |

| Support 2 | $1.20-$1.50 | Bear case support; multi-year demand | Bear bounce | Deep bear |

| Resistance 1 | $3.80-$4.00 | 2018 ATH zone; psychological barrier | Range high | Bull scenario |

| Resistance 2 | $5.00-$5.50 | Bull scenario target; extension zone | Bull confirmation | Strong bull |

Major Support Zones (Risk Control)

The $1.80-$2.00 zone is the critical support for 2026. This area marked the 2024 breakout and has been tested as support multiple times. A monthly close below this zone would shift the outlook to bear scenario. For detailed level analysis, see the XRP technical analysis hub.

Major Resistance Zones (Breakout Confirmation)

The $3.80-$4.00 zone represents the 2018 all-time high area and is the primary resistance for 2026. A confirmed break above this zone with sustained volume would activate the bull scenario. The $5.00-$5.50 zone is the bull extension target.

Invalidation Level and the ‘What Changes Next’ Plan

Bull scenario invalidation: Monthly close below $1.50. If this occurs, the bear scenario becomes primary with $1.20 as the next major support. Bear scenario invalidation: Reclaim and sustained hold above $2.20, which would restore the base scenario. For feasibility checks on target levels, see the XRP price targets hub.

What Could Move XRP in 2026 (Drivers & Catalyst Windows)

| Driver | Attribute | Measurable Signals | Effect | Scenario Support |

| Regulatory Clarity | Legal status | Exchange listings, custody access | Access/liquidity | Bull if positive |

| ETF Progress | Approval, flows | Filing status, AUM, net flows | Demand channel | Bull if approved + flows |

| Macro Regime | Risk sentiment | Fed policy, rates, equity markets | Capital allocation | Bull if risk-on |

| Adoption | Utility growth | ODL volume, partnerships, XRPL activity | Fundamental demand | Bull if accelerating |

| Market Structure | Liquidity/positioning | Depth, spreads, OI, funding | Price behavior | Affects all scenarios |

Regulation / SEC / Legal Outcomes

The SEC settlement in August 2025 improved XRP’s legal clarity. Continued clarity supports the base/bull scenarios by maintaining market access. New regulatory threats would shift probability toward bear. For legal impact analysis, see the SEC lawsuit impact hub.

ETF Narrative and Market Access/Liquidity Effects

ETF approval with sustained inflows would be a major bull catalyst. ETF rejection or disappointment could trigger short-term volatility but wouldn’t necessarily invalidate the base case. Watch filing progress, approval announcements, and net flow data.

Macro Liquidity Regime (Rates, Inflation, Risk Sentiment)

The macro environment affects capital allocation to risk assets. An accommodative Fed and strong equity markets support bull scenarios. Tight policy, recession risk, or persistent inflation support bear scenarios. XRP often follows broader crypto risk sentiment.

Ripple/XRPL Ecosystem Adoption Signals

Growing adoption strengthens the fundamental case. Watch ODL volume growth, new banking partnerships, RLUSD development, XRPL developer activity, and enterprise integrations. For fundamental analysis, see the XRP fundamentals hub.

Market Structure (Liquidity Depth, Derivatives Positioning)

Liquidity depth and derivatives positioning affect price behavior. Thin liquidity can amplify moves; heavy leverage can trigger cascades. Monitor order book depth, spreads, funding rates, and open interest for structural context.

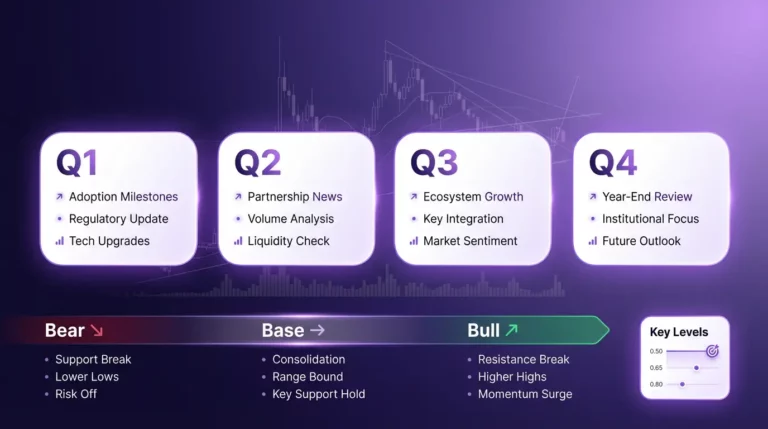

2026 Roadmap by Quarter (Q1–Q4)

Q1 2026: Catalyst Windows + Levels to Watch

- Catalysts: ETF filing deadlines, Fed January meeting, BTC halving cycle positioning

- Key levels: $2.00 support, $2.80 resistance

- Watch for: Trend establishment; early year positioning

Q2 2026: Catalyst Windows + Levels to Watch

- Catalysts: ETF decision windows, macro data (CPI, employment), earnings season

- Key levels: $2.50 support, $3.50 resistance

- Watch for: Scenario confirmation; range expansion or compression

Q3 2026: Catalyst Windows + Levels to Watch

- Catalysts: Summer liquidity effects, Jackson Hole, regulatory developments

- Key levels: $3.00 support, $4.00 resistance

- Watch for: ATH zone tests; volatility compression/expansion

Q4 2026: Catalyst Windows + Levels to Watch

- Catalysts: US elections aftermath, Fed December meeting, year-end rebalancing

- Key levels: $3.50 support, $5.00+ resistance (if bull scenario active)

- Watch for: Year-end positioning; 2027 setup

Monthly Forecast Links (Navigation)

2026 Monthly Forecast Index (Jan–Dec)

January 2026 | February 2026 | March 2026 | April 2026

May 2026 | June 2026 | July 2026 | August 2026

September 2026 | October 2026 | November 2026 | December 2026

See also: XRP monthly forecasts index | XRP yearly forecasts index

Methodology (Excerpt)

The 2026 forecast is built using VTrader’s Entity-Attribute-Value framework. We identify key drivers (regulation, ETF, macro, adoption, market structure), define their attributes, map measurable signals, and translate outcomes into scenario probabilities. Scenarios are expressed as ranges with explicit assumptions, confirmation conditions, and invalidation levels. Updates occur when driver signals materially change or when price action confirms/invalidates scenarios. For the complete methodology, see the XRP price prediction methodology hub. For AI-assisted modeling limitations, see the AI XRP prediction hub.

Common Mistakes in ‘XRP 2026 Prediction’ Articles (Debunk Patterns)

| Common Mistake | Better Approach |

| Single price target (“XRP will be $X”) | Use ranges with scenarios (base/bull/bear) |

| No invalidation criteria | Define clear invalidation levels for each scenario |

| Ignoring market cap constraints | Check feasibility with supply and liquidity math |

| No update mechanism | Use update log and scenario switch rules |

| Hype-driven predictions | Evidence-based with measurable signals |

Main hub: XRP price prediction | Short horizon: XRP today | XRP next week | Long horizon: XRP 2030 forecast

Frequently Asked Questions

Is XRP a good investment in 2026?

It depends on your risk tolerance and time horizon. Use this 2026 forecast to understand scenario ranges and key levels, then compare drivers (liquidity, regulation, adoption) with your risk limits. This is informational, not financial advice.

What is the XRP price prediction for the end of 2026?

This page provides a year-end range with three scenarios (bull/base/bear) rather than a single number. The important part is the assumptions and invalidation triggers that determine which scenario is becoming more likely.

Can XRP reach $5 or $10 in 2026?

It’s possible under specific liquidity and catalyst conditions. Use the Targets hub for feasibility math and compare those requirements with the bull-case conditions and confirmation signals in this 2026 forecast.

What factors will influence XRP price most in 2026?

Key drivers include market liquidity and structure, regulatory/legal outcomes, ETF expectations, macro risk sentiment, and adoption/utility signals from the Ripple/XRPL ecosystem. These drivers shift the probability of bull/base/bear scenarios.

How does XRP’s legal and regulatory situation affect the 2026 forecast?

Legal clarity can lower risk premiums and expand participation, while setbacks can restrict liquidity and raise uncertainty. This forecast treats legal developments as scenario switches with confirmation and invalidation signals.

How would an XRP ETF affect the 2026 outlook?

An ETF can increase accessibility and liquidity, potentially raising demand. The impact depends on flows and market structure, so ETF developments should adjust probability bands rather than replace the scenario framework.

What are the key support and resistance levels for XRP in 2026?

Key levels are higher-timeframe zones where price historically reacts and where liquidity concentrates. This page lists major support/resistance zones and explains what a hold/break implies for the 2026 scenarios.

What would invalidate the XRP 2026 bullish scenario?

Invalidation occurs when core assumptions fail—often a decisive break below a defined support zone that flips higher-timeframe structure, or a catalyst that reduces liquidity access. This page states the invalidation level/condition and the updated base/bear plan.

How accurate are XRP price predictions for a full year?

Year forecasts are uncertain. Accuracy improves when forecasts use ranges, scenarios, and clear conditions. The goal is an updateable model tied to evidence and invalidation triggers, not a single ‘perfect’ number.

Where can I find monthly XRP forecasts for 2026?

Use the Month Index Hub and select a 2026 month. Each month page includes ranges, key levels, and scenario assumptions, with links to the latest updates explaining changes.

How is the 2026 forecast different from the 2025 forecast?

Each year has different market structure context and catalyst windows. The 2026 hub emphasizes forward-looking probabilities and links back to 2025 only for historical context, while keeping 2026 as the primary planning horizon.

How is the 2026 forecast different from the 2030 forecast?

2026 focuses on higher-confidence, nearer-horizon structure and catalysts, while 2030 is driven by long-term adoption, regulatory regime stability, and market structure evolution. Use 2026 for actionable levels and 2030 for long-term pathways and constraints.

Update Log

| Date | What Changed | Why |

| Jan 14, 2026 | Initial 2026 forecast published | Year hub establishment |

| — | Future updates logged here | — |

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.