This guide is part of the “Guide to Bitcoin” series.

Bitcoin is one of the most revolutionary assets in financial history, and for those actively trading it, possibly the most profitable. This is not only because of it disrupting the financial system as we know it, but also because of the massive price swings. Its price discovery went from turning early adopters into millionaires to wiping out billions in days. Bitcoin’s market volatility is extreme, to say the least, even by modern standards.

But this volatility isn’t the root cause. As with currency, volatility is the end result of several different factors influencing the price. Unlike fiat currency, which is backed by central banks, Bitcoin operates on a decentralized ledger with no central authority to stabilize its price. The disruptive design, limited circulating supply, speculative demand, and fast news cycles all play into the daily drama.

This article takes a data-driven look at why Bitcoin is so volatile, with historical references, practical insights, and a breakdown of how price discovery really works in crypto markets.

Whether you’re a retail trader, investor, or crypto bro, understanding the dynamics of Bitcoin price movements is essential to managing your portfolio. Let’s go over the mechanics of Bitcoin’s price discovery and what it reveals about the growing crypto markets.

Table of Contents

The core factors driving Bitcoin’s volatility

Speculation and market sentiment

Bitcoin is a speculative asset by design. Its market value is largely driven by beliefs about its future potential, not just by its current usability. This speculative dynamic means Bitcoin is highly sensitive to shifts in market sentiment (what other investors think).

FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) create price movements that are often disconnected from fundamentals. For example, in February 2021, Bitcoin surged over 50% in a matter of weeks after Elon Musk tweeted about it and Tesla announced it had purchased $1.5 billion in BTC.

The rise of derivatives like ETFs, futures, and options also increases the volatility. Leveraged positions increase exposure to price changes, which often lead to sudden sell-offs when price drops cross certain thresholds. This was seen during the May 2021 crash, where over $8 billion in long positions were liquidated within 24 hours.

Supply and demand dynamics: Fixed supply meets demand

Bitcoin’s fixed supply of 21 million coins is one of the most defining features of its likeness to gold. This scarcity was intentionally coded by the creator(s) to make Bitcoin a “hard” monetary asset, meaning it can hold some intrinsic value. In contrast to fiat currencies, which can be printed indefinitely by central banks.

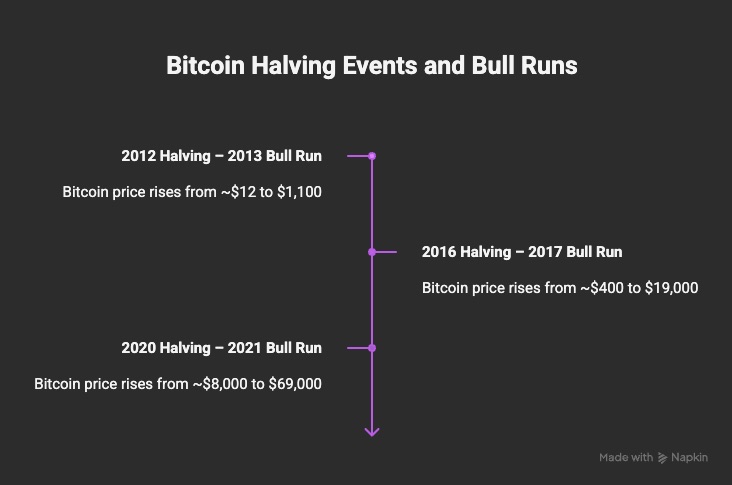

Every four years, there is a halving event. A Bitcoin halving cuts the block reward given to miners in half.

After each halving, the rate of new supply drops significantly. These are very important to pay attention to because, historically, Bitcoin halving events have preceded major bull runs:

- 2012 Halving → 2013 Bull Run (from ~$12 to $1,100)

- 2016 Halving → 2017 Bull Run (from ~$400 to $19,000)

- 2020 Halving → 2021 Bull Run (from ~$8,000 to $69,000)

The fixed supply combined with sudden spikes in demand creates powerful upward pressure.

Keep in mind that it also means when demand dries up, there’s no supply expansion to cushion the fall, making the asset highly susceptible to rapid price drops.

The “store of value” hypothesis

People often call Bitcoin “digital gold,” and the nickname makes sense. Like gold, Bitcoin is scarce, divisible (can be divided into smaller units), and isn’t controlled by any government or central bank. But here’s the catch, gold has been trusted for thousands of years. Bitcoin? Well, it’s barely a teenager.

So while many investors want to believe Bitcoin can act like gold, as a safe place to park value during inflation or market chaos, the reality is, this idea is still being tested. And every bit of news can shake that belief.

When big league names like MicroStrategy and Square started buying Bitcoin in 2020, it sent a powerful message to the entire investing community: “We trust this thing to hold value.” The market reacted fast and the whole world noticed the headlines. Prices soared, and the digital gold story looked stronger than ever.

But this narrative isn’t bulletproof. If governments crack down, if a major tech flaw is discovered, or if global markets panic, confidence in Bitcoin as a long-term store of value can vanish overnight. Belief drives the price, and belief is fragile.

Regulatory uncertainty and geopolitical events

Nothing affects the price of Bitcoin like regulatory news or news of G7 nations cracking down on crypto. Since Bitcoin operates outside of traditional financial systems, its legal status is constantly debated.

Have a look at how the price reacted to major bans and legalizations over the past 8 years:

- In 2017, China banned crypto exchanges, triggering a 30% crash. Chinese exchanges moved out of mainland China into more crypto-friendly jurisdictions – Japan, Russia, Malta, and Kazakhstan.

- In 2021, China’s crackdown on Bitcoin mining caused a temporary 50% price drop. Because China was responsible for 60% of global mining, due to the loss of miners, the hashrate dropped by 50%. Only as miners relocated over the course of 5 months did the hashrate recover.

- The SEC’s uncertainty about approving a spot Bitcoin ETF has caused recurring volatility in the price of Bitcoin. Ultimately, Bitcoin gained legitimacy as major financial institutions continued to push for approval, reinforcing long-term investor confidence despite short-term volatility.

- El Salvador adopting Bitcoin as legal tender in 2021 initially drove prices up, though it later spooked traditional investors.

Bitcoin regulation (or lack thereof) influences how accessible it is to global markets. It affects how easy it is to buy, people’s risk appetite, and how portfolio allocation is done. As long as Bitcoin laws remain under scrutiny, the price will continue to be sporadic.

Thin liquidity and market size

When compared to traditional asset classes like stocks, precious metals, or forex, Bitcoin has a relatively small market capitalization. While its daily trading volume is in the billions, it’s still dwarfed by global currency and bond markets.

Liquidity refers to how easily an asset can be bought or sold without affecting its market price. Bitcoin’s liquidity has improved over time, but it still lags behind major assets. When a large entity, or “whale”, places a massive buy or sell order, it can move the market dramatically.

We saw it in March 2020, when COVID-19 panic selling crashed the price of Bitcoin from $9,000 to $4,000 in just two days due to thin liquidity and high leverage.

Security breaches and exchange hacks

While the Bitcoin protocol itself is highly secure, the infrastructure surrounding it – wallets, exchanges, and custody platforms, have historically been vulnerable.

Let’s have a look at the most scandalous hacks that we’ve seen in Bitcoin’s history and what it did to the price action:

- Mt. Gox Hack (2014): Over 850,000 BTC lost. Bitcoin fell from $1,100 to $150.

- Bitfinex Hack (2016): 120,000 BTC stolen. Immediate price drop of nearly 20%.

- Binance Hack (2019): 7,000 BTC lost. Temporarily shook investor confidence.

As you can see, every time a major exchange gets hacked, it creates fear about the safety of people’s Bitcoin holdings, sparking sell-offs and suppressing price performance until trust is restored.

Bitcoin’s volatility – bug or feature?

The risks

Let’s look at the facts, Bitcoin’s high volatility makes it difficult to use as a medium of exchange. Imagine pricing goods in BTC, only to see the value fluctuate 10% within hours. Merchants and consumers both find it unreliable for day-to-day use.

Investors also face the risk of severe capital losses. A portfolio heavily weighted in Bitcoin can suffer massive drawdowns during bearish cycles. Massive drawdowns are taken very seriously by investors and clients of investment companies, not many people are willing to sit through -60% drawdowns when looking at their life’s earnings.

The opportunities

Having said that, let’s look at why trading Bitcoin is so lucrative. This very same market volatility is what makes Bitcoin attractive to traders and short-term speculators. Rapid price movements provide frequent entry and exit opportunities. For skilled traders who use proper risk management, volatility equals potential profit.

Because of this, Bitcoin is treated more like a high-beta asset than a traditional store of value. In financial terms, beta measures how volatile an asset is compared to the overall market. A high-beta asset like Bitcoin tends to experience sharper price swings, both up and down, making it appealing for those who make money on price movements.

At the same time, traders who consistently outperform the market in this environment are said to generate alpha returns (above what the market would deliver). In this sense, Bitcoin’s volatility offers not just risk, but also opportunity for alpha generation in the hands of a capable trader.

Strategies for managing Bitcoin volatility

In order to make the strategies easy to follow, we will leave out technical trading for the sake of readability. If you want additional help in forecasting the price of Bitcoin, here is a tool that can help, check out this free AI price prediction tool from vTrader.

Additionally, here are some time-tested strategies that will work in any market condition:

Dollar-cost averaging (DCA)

Dollar-cost averaging is a long-term strategy where investors allocate a fixed dollar amount to buy Bitcoin at regular intervals – weekly, monthly, or quarterly, regardless of the asset’s current price. By spreading out purchases over time, this strategy reduces the emotional pressure of market timing and smooths out the effects of short-term volatility.

Instead of trying to guess the perfect entry point, investors accumulate Bitcoin gradually, often buying more when prices are low and less when prices are high. This disciplined approach can lower the average cost per coin over time and helps build a position steadily, without reacting to market noise.

Diversification

No serious investor places all their capital into a single asset. The reasoning behind this is that balancing a portfolio across different asset classes, stocks, digital assets, commodities, helps reduce your overall exposure to any single point of failure.

When one market or sector underperforms, gains in other areas can help offset the loss. This balance not only protects capital during downturns but also creates more consistent long-term returns. In the context of crypto, holding Bitcoin alongside other asset types can help stabilize a portfolio that would otherwise be exposed to extreme volatility.

Adopting a long-term perspective (HODL)

The HODL philosophy, originating from a misspelled forum post in 2013, has become a battle cry for believers in Bitcoin’s long-term value. HODLing through market cycles is a way to bet on future adoption and price discovery, ignoring short-term fluctuations.

This approach is rooted in the belief that, over time, wide adoption and ongoing price discovery will drive value upward, making temporary volatility irrelevant in the bigger picture.

Setting stop-loss orders

For more active traders, stop-loss orders are a key risk management tool. They automatically trigger a sale when Bitcoin’s price falls below a predefined level, helping limit losses and protect capital.

In such highly volatile markets, stop-losses add structure to a trading strategy, preventing emotional decision-making and ensuring traders stick to their strategy even during unexpected price swings.

What does Bitcoin’s future hold?

As institutional adoption grows, trading volumes grow, and regulatory clarity improves, Bitcoin is gradually becoming a more mature asset. Larger players like pension funds, hedge funds, and publicly traded companies are entering the market, bringing with them more stable, long-term capital.

Will we ever see stability?

As liquidity increases and the asset base broadens, sharp price swings may become less frequent, paving the way for more stable price action over time. Several trends suggest that Bitcoin’s volatility may decrease over time:

- Institutional adoption: As large firms like BlackRock, Fidelity, and Goldman Sachs enter crypto markets, they bring more capital, longer time horizons, and professional-grade risk controls.

- Regulatory clarity: Clear rules around digital assets will remove uncertainty and improve investor confidence.

- Maturing infrastructure: More advanced exchanges, custodians, and financial products contribute to better liquidity and less disorderly price movements.

- Wider usage: As more people use Bitcoin for payments, or savings, the market stabilizes through real-world utility rather than speculation alone.

Argument for continued volatility

Despite the ongoing progress, Bitcoin remains heavily influenced by speculation. Its price often swings in response to headlines, tweets, regulatory developments, and macroeconomic shifts, reflecting a market still driven massively by sentiment (rather than fundamentals). Until Bitcoin achieves widespread integration into everyday life and is held by a more diversified base of long-term investors, this unpredictable volatility will likely continue.

Additionally, Bitcoin’s fixed supply means that there is no option to “print more” to absorb sudden changes in demand. In traditional markets, the production of goods can ramp up or down to help stabilize prices, but Bitcoin’s capped issuance makes it uniquely vulnerable to demand-side shocks.

As long as demand remains unpredictable, sharp volatility is likely to stay a defining characteristic of crypto.

Embrace the chaos but manage the risk

Bitcoin is volatile for a reason. It’s new. It’s decentralized. It challenges the entire concept of money. The bottom line is this: with every wild price swing, Bitcoin is undergoing price discovery. Whether viewed as digital gold, a store of value, or a speculative asset, its behavior mirrors a market searching for consensus. Volatility isn’t a flaw, it’s the cost of rewriting the rules of finance.

If you’re navigating the crypto space, don’t try to fight Bitcoin’s nature. Understand it. Respect the risks. Use tools like diversification, dollar-cost averaging, and stop-loss orders to stay grounded in this turbulent market. But if your conviction in this digital currency runs deep, maybe just HODL.

Ready to take your next step?

Explore where Bitcoin could be headed with this free AI-powered price prediction tool:

Start building your holdings today through a trusted and regulated exchange:

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.