When it comes to crypto, spot trading is the simplest way to get in the game. It’s just like it sounds: buying or selling digital assets like Bitcoin or Ethereum right now, at whatever the market price is at this very moment.

Think of it like buying groceries. You pick what you want, pay the price on the tag, and walk out with your items. It's a clean, immediate transaction. Spot trading is the crypto equivalent of that—you pay your money, you get your coins. Simple as that.

A Simple Analogy for Crypto Spot Trading

Imagine you want to buy a bar of gold. You’d walk into a dealer, check the current market price (the "spot price"), hand over your cash, and walk away with the gold. You own it. No strings attached, no future promises.

That’s exactly how spot trading works in crypto. When you place a spot order to buy one Bitcoin, you’re swapping your cash for the coin itself. The moment the trade settles, that Bitcoin lands in your exchange wallet. It’s yours to hold, sell, or move wherever you want.

This isn’t some IOU or a complicated contract to buy later. The entire exchange happens on the spot, which is what makes it the most fundamental type of trade out there.

To give you a clearer picture, here's a quick breakdown of what makes spot trading what it is.

Crypto Spot Trading At a Glance

| Characteristic | Description |

|---|---|

| Ownership | You get full, direct ownership of the crypto asset. |

| Settlement | Transactions are settled almost instantly ("on the spot"). |

| Pricing | Trades are executed at the current market price (the spot price). |

| Risk Profile | Your primary risk is asset price volatility. You can't lose more than your initial investment. |

| Complexity | It’s the most straightforward and beginner-friendly way to trade. |

Essentially, what you see is what you get. You buy the asset, you own the asset.

The Foundation of the Crypto Market

Because it's so direct, spot trading is the bedrock of the entire crypto ecosystem. It’s how the real-time prices of assets are set, and it provides the liquidity that makes the whole market run.

The numbers here are staggering. As of 2025, spot trading is the single biggest source of liquidity in the crypto market. We're talking about monthly trading volumes that often blow past $2.8 trillion. Bitcoin alone typically sees a 24-hour spot volume of around $38.9 billion, which shows just how central it is to everything. Discover more insights about crypto market liquidity statistics.

This massive volume means there’s almost always someone on the other side of your trade, ready to buy or sell at a fair market price. If you're new to crypto, getting a handle on spot trading is your first, most important step.

For a deeper dive into core crypto concepts, check out the resources over at the vTrader Academy.

How a Crypto Spot Trade Actually Works

So what really happens when you click “buy” or “sell”? You're not just sending a request into the void—you’re jumping into a live digital marketplace called the order book.

Think of it as a constantly shifting list of every buy and sell intention for a specific pair, like BTC/USD. It's the engine room of any exchange, and it's split right down the middle:

- Bids: This is the "buy" side. It shows the highest prices buyers are willing to pay and how much they want to buy.

- Asks: This is the "sell" side. It lists the lowest prices sellers are willing to accept and how much they have available.

The spot price you see on the screen? That’s just the real-time result of the top bid meeting the bottom ask.

The Key Players: Market Makers and Takers

In this ecosystem, you’re either a market maker or a market taker. The role you play comes down to how you place your order.

A market maker is someone who adds to the order book. They place a limit order—an instruction to buy or sell at a specific price that might not get filled right away. By doing this, they add liquidity, essentially building the market for everyone else.

A market taker, on the other hand, wants their trade done now. They place a market order, which grabs the best available price from the order book instantly. This action "takes" liquidity from the market.

The bottom line: Makers build the market by patiently placing orders, while takers execute against those orders for immediate trades. This push and pull is what keeps everything moving.

Let’s say you place a market order to buy 1 ETH. The exchange immediately matches you with the lowest-priced "ask" orders on the book until your order is full. The whole thing is nearly instant, and just like that, the ETH is in your wallet.

Understanding this matters because it directly impacts your trading fees. Most exchanges, including vTrader, have different fee structures for makers and takers to encourage people to provide liquidity. You can see exactly how it works by checking out the vTrader fee schedule and how it rewards market makers.

Spot Trading vs. Futures and Margin Trading

Getting into crypto with spot trading is the most straightforward path—you buy it, you own it. Simple. But it’s just the beginning. The crypto world has other, more complex ways to play the game, like futures and margin trading.

Knowing the difference isn't just trivia; it's crucial for managing your risk and making sure your strategy actually fits your goals.

Think of it like this: spot trading is like buying a car with cash. You hand over the money, get the keys and the title, and drive it off the lot. It's yours, end of story.

So, What Are Futures and Margin?

Futures trading is a different beast entirely. It’s less like buying the car and more like placing a bet on what that car will be worth in three months. You’re not buying the actual crypto. Instead, you're locking in a contract to buy or sell it at a specific price on a future date. It's all about speculating on price direction.

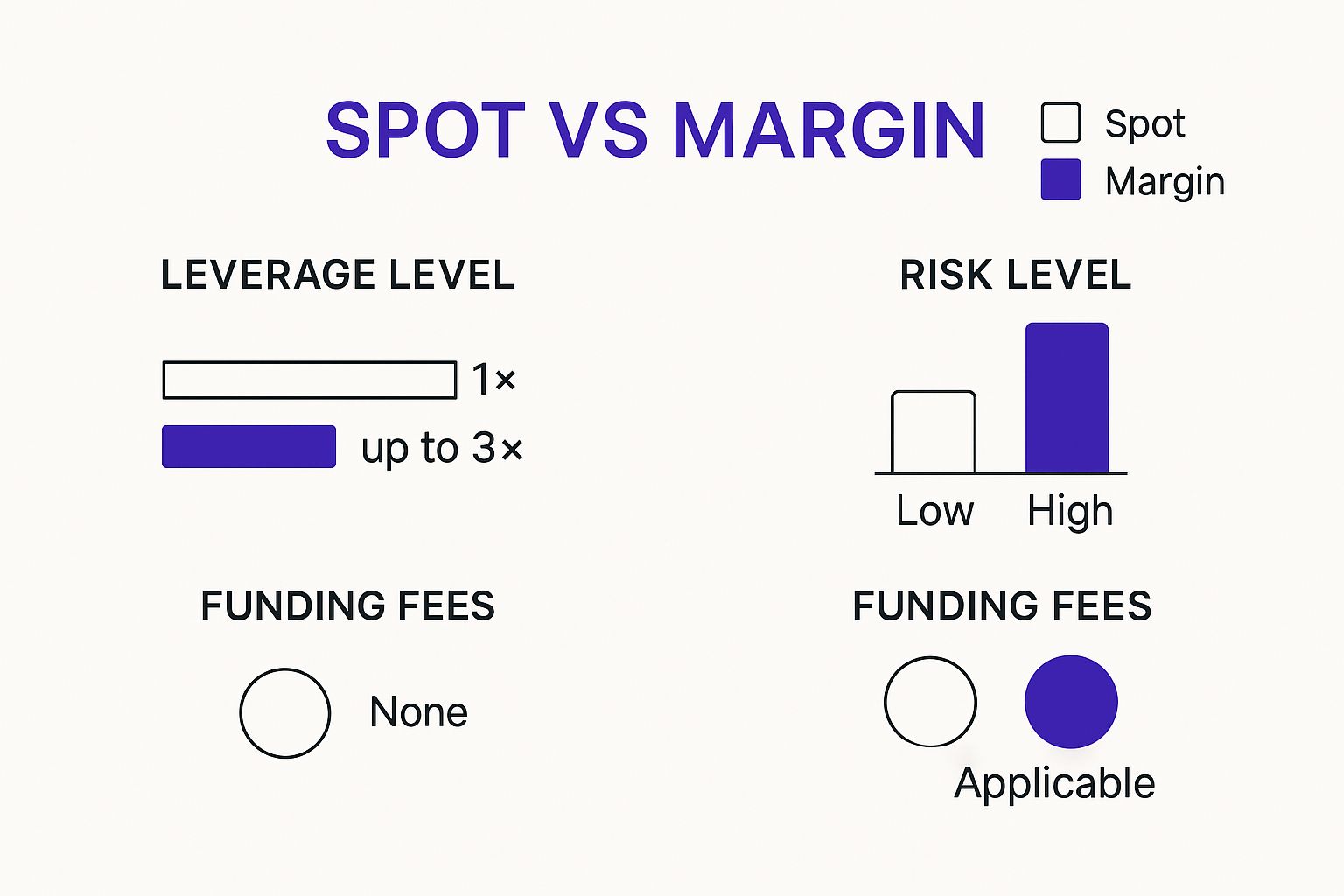

Then there's margin trading, which introduces borrowed money into the equation. This is like getting a loan to buy a much faster, more expensive car than you could afford on your own. You use your current crypto as collateral to borrow more, giving you more buying power. The upside? Bigger potential profits. The massive downside? Your losses get magnified just as easily.

To put it simply, with spot trading, you own the asset. With futures, you own a contract based on its future price. And with margin, you’re borrowing money to own more of the asset—cranking up both the risk and the potential reward.

The table below breaks it down even further.

Spot vs. Futures vs. Margin Trading

| Feature | Spot Trading | Futures Trading | Margin Trading |

|---|---|---|---|

| Ownership | Direct ownership of the crypto asset. | No direct ownership; you own a contract. | Direct ownership, but with borrowed funds. |

| Leverage | None. Your buying power is 1:1. | High leverage available, amplifying trades. | Moderate to high leverage, amplifying trades. |

| Risk Level | Lower. You only lose what you invest. | Very high. Losses can exceed your initial capital. | High. Losses are magnified by leverage. |

| Goal | Long-term holding (HODLing) or direct use. | Speculating on short-term price movements. | Increasing exposure for larger potential gains. |

| Complexity | Simple and beginner-friendly. | Complex; requires advanced knowledge. | Moderately complex; requires risk management. |

As you can see, each style serves a very different purpose. Spot trading is the bedrock, while the others are for more advanced, high-risk strategies.

The market is even starting to blend these concepts. We're seeing new products like spot-quoted futures, which try to give traders the best of both worlds. These kinds of innovations are part of what drove a 53.7% surge in spot trading volume to $2.2 trillion back in July 2025.

At the end of the day, while futures and margin have their place, nothing beats the solid foundation of direct ownership through spot trading. Once you actually own some crypto, a whole new set of doors opens up. For instance, you can put those assets to work, and a popular next step is to learn more about crypto staking.

The Pros and Cons of Spot Trading

Spot trading is the bedrock of the crypto world. But before you jump in, it’s smart to get a feel for both its bright spots and its blind spots. Understanding the trade-offs is key to making sure your strategy actually lines up with what you’re trying to achieve.

The biggest win for spot trading? It's all about simplicity and direct ownership. When you buy crypto on the spot market, you own the real thing. No strings attached. This makes it the perfect starting point for newcomers and a solid choice for long-term believers who are in it for the tech.

Key Benefits of Spot Trading

The lower risk profile is a huge draw. Unlike margin or futures trading where things can get complicated fast, you can't lose more than you put in. There’s no leverage amplifying your losses and no risk of getting liquidated because the market had a bad morning. It’s a much saner entry point into the wild ride of crypto.

Here’s what makes it so appealing:

- Straightforward Pricing: You see a price, you buy at that price. No messy calculations for interest rates or weird fees.

- Full Asset Control: The coins are yours. You can send them to your own wallet, use them to buy something, or put them to work earning yield through staking.

- Lower Stress: Without borrowed money or ticking clocks on contracts, you can make clear-headed decisions based on your long-term view, not short-term panic.

The concept is as basic as it gets: if you buy one Bitcoin, you own one Bitcoin. Your main risk is just the price going up or down over time—which is a hell of a lot easier to wrap your head around than the complex dangers of leveraged products.

Potential Downsides to Consider

Now, spot trading isn’t a silver bullet. The most glaring limitation is the lack of leverage. Your potential gains are capped at a 1:1 ratio with your capital. If you put in $100 and the asset doubles, you walk away with $100 in profit. That's it.

You’re also completely exposed when the market turns south. If the price gets chopped in half, so does your investment. Spot trading doesn't have built-in tools like short selling that allow you to profit from a market that’s heading down—a go-to move for more seasoned traders.

The Battle Between Centralized and Decentralized Exchanges

https://www.youtube.com/embed/ObE-Q-_K5Wg

When you get into spot trading crypto, where you trade is just as important as what you trade. The whole scene is pretty much split down the middle: you've got centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Think of a centralized exchange like vTrader or Coinbase as your traditional stockbroker, but for crypto. It’s a company that holds your funds, manages the order book, and connects buyers with sellers. You get a clean user interface, fast trades, and someone to call if you need help.

Then you have decentralized exchanges like Uniswap. These run on code—automated smart contracts that let you trade directly from your own crypto wallet. No middleman. You're always in control of your funds, which a lot of traders prefer for the privacy and security it offers. You aren't trusting a third party with your coins.

The Shifting Tides of Trading Volume

For a long time, CEXs were the undisputed kings, handling almost all spot trading volume. But the tide is turning.

While the big CEXs still dominate, posting $3.9 trillion in spot volume in Q2 2025, that number was actually a big drop from previous quarters. At the same time, DEX spot volumes jumped by 25.3% to hit $876.3 billion. That pushed the DEX-to-CEX volume ratio to an all-time high, proving more and more people are choosing the decentralized route. If you want to dig into the numbers, you can read the full crypto market report from CoinGecko.

This shift really boils down to a classic trade-off. CEXs offer the convenience and speed needed for high-frequency trading. On the other hand, DEXs give you self-custody and a lower risk of censorship. As DEXs get better, the biggest hurdle becomes transaction costs, which can get pretty high when a network is busy. If you’re trading on an Ethereum-based DEX, you have to watch those network fees like a hawk. That’s why a good ETH gas tracker is a non-negotiable tool.

Getting Started with Spot Trading on vTrader

Alright, ready to jump in? Making your first spot trade on vTrader is quick and painless. We’ve broken it down into four simple moves to get you from zero to owning your first crypto.

1. Set Up and Secure Your Account

First things first: you need a vTrader account. Just sign up with some basic info and run through the quick identity check—it's standard stuff to keep things secure.

Once you’re in, do this immediately: enable two-factor authentication (2FA). Seriously. It’s the single best thing you can do to bolt down your account and protect your funds.

2. Get Some Funds in Your Wallet

With your account locked down, it’s time to load up your wallet. You’ve got a couple of easy options here:

- Deposit Fiat: Link your bank account and send over some USD. It’s the most direct route.

- Transfer Crypto: Already have some crypto sitting somewhere else? Just send it over to your vTrader deposit address.

3. Find the Spot Trading Market

Wallet funded? Great. Now, head over to the "Spot Trading" section on the platform. This is where you'll see all the action. You’ll find a list of trading pairs like BTC/USD or ETH/USDT. Pick the one you’re interested in, and that’ll take you to the main trading dashboard.

Take a look around. You’ll see the order book on the left, the big price chart in the middle, and where you’ll place your trade on the right. Everything you need is right there in one clean view.

4. Place Your First Trade

This is the final step. Use the order panel on the right to make your move. You can place a market order if you want to buy instantly at the current best price, or a limit order if you want to name your own price and wait for the market to hit it.

Just punch in the amount, hit "Buy," and that’s it. The crypto will land in your wallet instantly. You're officially a spot trader.

A Few Common Spot Trading Questions

Alright, you've got the basics down. But a couple of practical questions always come up right before someone pulls the trigger on their first trade. Let's get those sorted so you can move forward with confidence.

Do I Actually Own the Crypto I Buy?

Yes. Full stop. When you make a spot trade, you're buying the real deal. The crypto gets sent straight to your exchange wallet, and you have 100% ownership of it.

From that moment on, you call the shots. HODL for the long haul, sell it when the time is right, or move it to your own private wallet. This is the biggest difference between spot and futures—you own the actual asset, not just a piece of paper tied to its price.

What Are the Common Fees in Crypto Spot Trading?

The main fee to watch for is the trading fee. It’s just a tiny slice of your total trade value. Most exchanges use a maker-taker model, which just means you pay a slightly different (and usually tiny) fee depending on whether your order adds liquidity to the market or takes it away.

You might also see small fees for deposits or withdrawals, but most platforms keep these pretty low or get rid of them altogether.

Key Takeaway: Spot trading is all about direct ownership. The goal is to get your hands on the actual crypto, giving you the freedom to hold it, sell it, or use it however you want.

If you've got more questions, you can always dig deeper on our complete vTrader FAQ page for more answers.

Ready to own your first crypto with zero hassle and zero commissions? vTrader offers a secure, fee-free platform to buy, sell, and manage your digital assets instantly. Start trading today.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.