Let’s cut through the noise: Know Your Customer (KYC) in crypto is simply an identity check, much like the one you’d do to open a new bank account. It’s the process exchanges use to make sure you are who you say you are before you can start buying, selling, or trading digital assets. Think of it as a standard security step designed to make the financial world safer for everyone involved.

What KYC in Crypto Actually Means for You

Ever tried opening a checking account? The bank doesn't just take your word for it—they ask for a driver's license and maybe a utility bill to prove your address. KYC in the crypto space is built on the very same idea. It’s what connects the often pseudonymous world of crypto with the regulated rules of traditional finance.

So, when a crypto exchange like vTrader asks you to go through KYC, they're not trying to be nosy. They’re following critical legal and security rules designed to build a platform that’s both safe and trustworthy.

The Core Goals of KYC

At its heart, the KYC process has two primary missions. First, it throws a wrench in the plans of criminals looking to use crypto for shady purposes. Second, it protects you—the user—by fostering a trading environment that’s both transparent and accountable.

Here’s what it’s really all about:

- Stopping Financial Crime: KYC acts as a first line of defense against money laundering, terrorist financing, and other illegal schemes. It's a serious issue—the United Nations estimates that a staggering $2 trillion is laundered every year, and crypto has become a prime target.

- Fighting Fraud and Identity Theft: By confirming every user's identity, exchanges make it much harder for someone to open an account in your name or use stolen credentials.

- Staying on the Right Side of the Law: Governments around the globe now mandate that crypto platforms, known as Virtual Asset Service Providers (VASPs), adhere to strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations.

You can think of KYC as the digital bouncer for a crypto exchange. Its job is to check IDs at the door, ensuring the venue stays safe, operates legally, and keeps bad actors from ruining the party for everyone else.

Why This Matters for Your Safety

Without KYC, crypto platforms would quickly become a free-for-all for scammers and criminals, making the whole ecosystem a much riskier place to be. Anonymous accounts could be used to manipulate markets, wash money from hacks, or launch fraudulent token sales. By requiring an identity check, exchanges weed out many of these threats before they can ever affect legitimate traders.

This creates a more stable foundation for the entire market. It builds trust not just with individual investors but also with big-money institutions and regulators, paving the way for wider crypto adoption and long-term, sustainable growth. For you, it all boils down to one thing: a safer, more reliable place to manage your digital assets.

Why Crypto Exchanges Suddenly Require Your ID

If you've been in crypto for a while, the sudden demand for your driver's license might feel like a total betrayal of the space's core principles. After all, wasn't this all supposed to be about privacy and anonymity?

Early on, it was. The crypto world was a largely unregulated playground. But as digital assets exploded into a multi-trillion-dollar industry, the regulators inevitably came knocking. This shift wasn’t random—it was a calculated move to pull the crypto world into line with long-established financial standards.

The main reason? A global crackdown on financial crime. International bodies like the Financial Action Task Force (FATF) started laying down the law for what they call Virtual Asset Service Providers (VASPs)—a fancy term for crypto exchanges and similar platforms. They saw the potential for crypto to become a wild west for money laundering and wanted to shut it down.

To do that, they insisted crypto exchanges adopt the same Anti-Money Laundering (AML) rules that traditional banks have followed for decades. Just like that, crypto platforms had to pivot from scrappy tech startups to full-blown financial institutions. KYC became non-negotiable.

The Travel Rule Changes Everything

One of the biggest game-changers from the FATF was the "Travel Rule." This is the regulation that really underscores why you need to know what is KYC in crypto today.

Think about a standard bank wire. When you send money, both your bank and the recipient's bank have to collect and share info about who you are and who you're sending it to. The Travel Rule brings that exact same logic to crypto.

- The sending exchange has to verify the sender's identity.

- They also have to know who the receiver is.

- Most importantly, this information must "travel" with the transaction to the destination exchange.

This one rule makes large, anonymous transfers between regulated exchanges practically impossible. It effectively closed a massive loophole that criminals had been happily exploiting for years. And with fraud on the rise, the regulatory pressure has only intensified.

Even with stricter KYC, global crypto fraud has jumped an average of 48% in recent years. In response, regulators are doubling down. The EU, for example, is harmonizing the Travel Rule across all member states, forcing firms to share customer data on every transfer and leaving criminals with nowhere to hide. You can discover more insights about this global regulatory shift on sumsub.com.

Building Trust and Legitimacy

While it all sounds like a hassle, these rules are actually legitimizing the entire crypto industry. By rolling out solid KYC procedures, exchanges are sending a clear signal to regulators, big-time investors, and the public that they're serious about security.

This is how you build trust—the kind of trust needed for long-term, sustainable growth. It gives huge investment firms the confidence to enter the market, bringing in the capital and stability the industry needs. For platforms like us at vTrader, compliance isn't just a box to check; it’s a core part of building a secure and reliable trading environment for our users. Find out more at https://www.vtrader.io/en-us/about.

It's a deliberate step away from the Wild West and toward a future where crypto is a trusted part of the global financial system.

A Step-By-Step Guide to the KYC Process

So, what actually happens when a crypto exchange asks you to "do KYC"? It might sound a bit formal or even intimidating, but the reality is usually a quick and painless process. Think of it as a digital handshake—a way for the platform to confirm who you are before handing you the keys to the kingdom.

The whole verification journey is designed to be logical. It starts with the basics and then asks for more secure proof of identity, building a trusted profile piece by piece. This isn't just for their benefit; it’s about making sure you are who you say you are, which protects everyone from potential fraud.

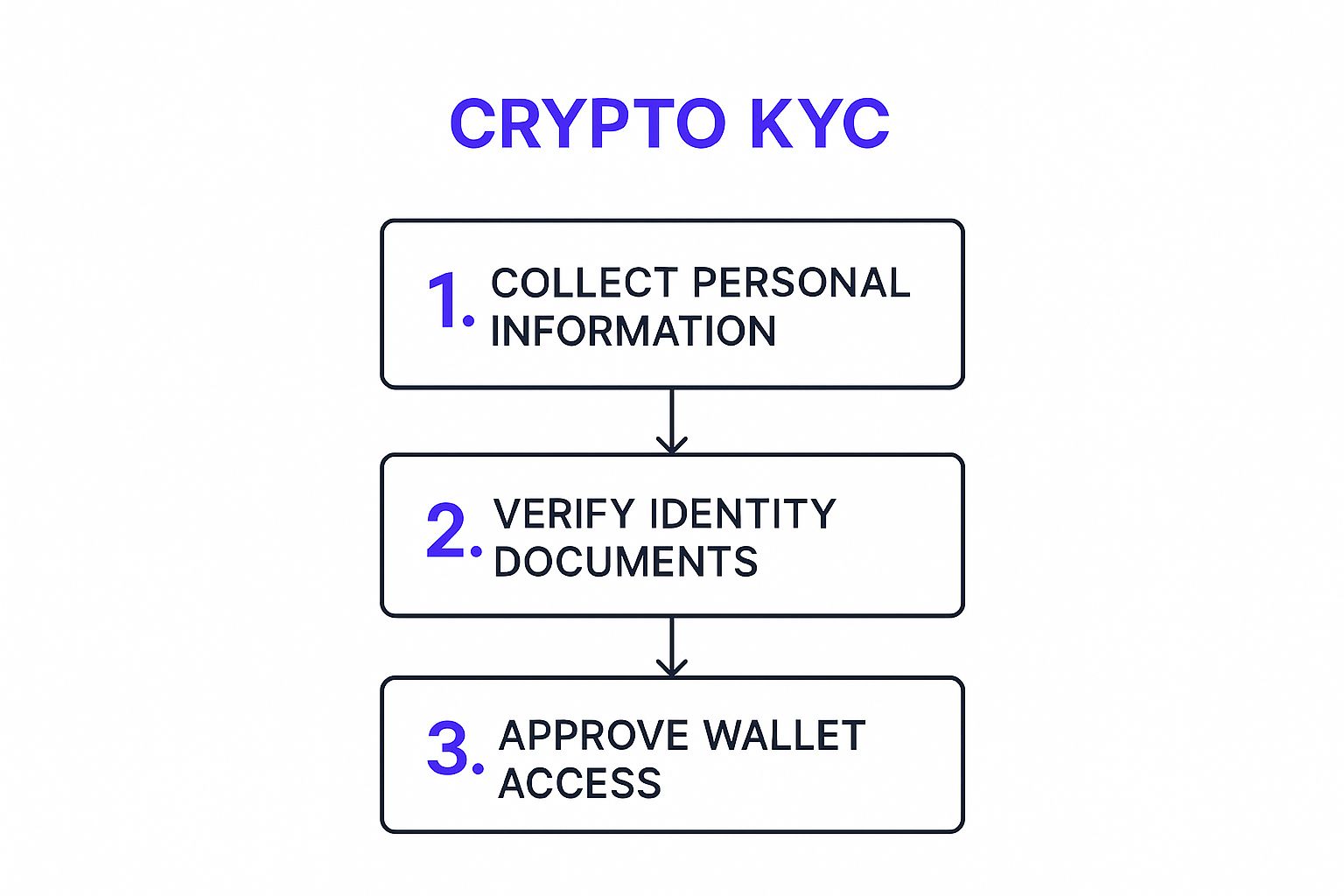

This visual breaks down the typical flow of a crypto KYC check.

From collecting your info to verifying documents and giving the final green light, the goal is a secure and clear path to getting your crypto wallet up and running.

The Typical Verification Journey

While the exact steps can differ from one exchange to another, most of them follow a pretty standard three-part playbook.

- Providing Basic Personal Details: The journey almost always kicks off with the essentials. You’ll be asked for your full legal name, date of birth, home address, and usually a phone number. This first step simply establishes the baseline of your identity.

- Uploading Official Documentation: Next up, you’ll need to prove you’re you. This means uploading a photo of a government-issued ID. A passport, driver's license, or national ID card are the usual suspects. The platform's system scans the document to make sure it's legit and that the name and other details match what you entered in step one.

- Completing a Liveness Check: This is the final, high-tech piece of the puzzle. You'll use your phone or computer camera to take a selfie or a short video. Behind the scenes, sophisticated software confirms you’re a real person in that moment—not just a photo—and matches your face to the picture on your ID. It’s a powerful way to stop fraudsters from using stolen documents.

Understanding Tiered Verification

You’ll find that many exchanges use a tiered verification system. It’s a simple concept: the more info you provide and verify, the more access you get.

This tiered approach is a smart way to let new users get started quickly. You can dip your toes in the water with minimal hassle, but the higher-risk activities—like large withdrawals or fiat trading—are reserved for fully vetted users.

Here's a look at how these tiers commonly break down.

Standard Crypto KYC Verification Tiers

This table shows how different levels of verification unlock more features and higher limits on a typical crypto exchange.

| KYC Tier | Required Information | Typical Features & Limits |

|---|---|---|

| Tier 0 (Unverified) | Email address and password only | Platform exploration, no trading or withdrawals |

| Tier 1 (Basic) | Name, DOB, address, phone number | Limited crypto deposits and trading, small withdrawal limits (e.g., <$2,000 daily) |

| Tier 2 (Full) | Government-issued ID upload & liveness check | Full access to all features, including fiat deposits, high withdrawal limits, and margin trading |

Thanks to major tech improvements, this whole process is getting incredibly fast. The average KYC verification time on major exchanges has been slashed from seven minutes down to just 3.5 minutes in recent years.

If you're looking to dive deeper into crypto security, trading concepts, and more, the vTrader Academy is packed with valuable resources to get you up to speed.

The Debate Over Privacy and Security in Crypto

Few topics get the crypto community as fired up as Know Your Customer, or KYC. It’s a real tug-of-war. On one side, you have the argument that it’s a vital step for security and bringing crypto into the mainstream. On the other, it’s seen as a direct assault on the core ideals of privacy and decentralization that this whole space was built on.

This debate really gets to the heart of what the future of digital finance is going to look like. For many, KYC is the necessary bridge connecting the wild world of crypto to traditional finance. It adds a layer of accountability needed to build a market that’s safe and stable for everyone, not just the pioneers.

The Case for KYC: More Security, More Legitimacy

The argument for KYC is pretty straightforward: it makes the entire ecosystem safer. When exchanges verify who their users are, it dramatically cuts down the risk of fraud, market manipulation, and other financial crimes. This isn't just theory; it has real, tangible benefits.

- Fighting Fraud: Verified identities make it incredibly difficult for scammers to spin up fake accounts, launch bogus projects, or pull off identity theft.

- Recovering Assets: If funds are stolen, having KYC info on file can give law enforcement the critical leads they need to hunt down criminals and maybe even get your money back.

- A More Stable Market: By weeding out bad actors who engage in schemes like wash trading, KYC helps create a trading environment that's more transparent and stable for honest participants.

- Building Mainstream Trust: Big-money institutional investors and traditional financial firms won’t touch crypto without seeing that platforms are serious about complying with global anti-money laundering regulations. KYC is the price of admission.

A huge part of KYC is its role in tackling financial crime. The United Nations estimates that a staggering $800 billion to $2 trillion is laundered across the globe each year. KYC protocols are one of the main weapons we have to disrupt these illicit flows in the crypto world.

The Privacy Dilemma: A Clash with Crypto's Core Principles

Of course, the counterargument is just as powerful and hits right at the philosophical core of crypto. Remember, Bitcoin was created to be a peer-to-peer electronic cash system—one that didn't need a bank or any other trusted third party. For the purists, forcing users to verify their identity feels like a betrayal of that foundational idea.

And the concerns are completely valid. When you hand over sensitive personal info to a centralized exchange, you’re creating a honey pot for hackers. If that exchange gets breached, the personal details of millions of users—names, addresses, government IDs—could get dumped on the dark web. That’s a goldmine for identity thieves. It's crucial to understand how a platform protects your data; you can see how compliant exchanges handle this in the vTrader privacy policy.

On top of that, KYC can put up walls. In many parts of the world, people simply don't have access to official government-issued ID. This effectively locks them out of the very financial system crypto was supposed to open up for everyone, clashing directly with the goal of financial inclusion. The debate over what is KYC in crypto is really about finding that delicate balance between security and the ideals of a truly decentralized future.

How KYC Is Making the Crypto Market Safer

It’s easy to think of an identity check as just a small, personal step. But when millions of crypto users complete one, it fundamentally changes the entire market for the better.

Imagine this: a single house with a security system is safer, sure. But what about a whole neighborhood where every single home has one? Suddenly, that area becomes a terrible place for criminals to operate. That’s exactly what KYC is doing for the world of digital assets.

By stripping away the anonymity that bad actors hide behind, KYC verification makes the entire ecosystem a much tougher target for scammers, hackers, and people trying to manipulate the market. When every account is linked to a real person, it dramatically raises the stakes for anyone thinking about breaking the rules. This accountability is a direct line to protecting your investments, creating a more transparent and stable place to trade.

Attracting Institutional Capital and Building Trust

Beyond protecting individual users, KYC compliance is what unlocks the door for the big players: institutional investors.

Hedge funds, major financial firms, and corporations all operate under incredibly strict regulations. They simply can’t—and won’t—get involved with platforms that don't meet global anti-money laundering (AML) standards. For them, strong KYC isn't just a nice-to-have feature; it's a non-negotiable requirement before they'll even consider investing.

When this "smart money" enters the crypto space, it brings a tide of benefits:

- Increased Liquidity: More large-scale investors mean deeper, more stable markets. This makes it easier for everyone to buy and sell assets without accidentally causing wild price swings.

- Enhanced Credibility: The involvement of major financial institutions sends a powerful signal to the rest of the world that crypto is a serious, maturing asset class.

- Long-Term Growth: Unlike retail traders who might be in it for a quick flip, institutional investors are typically focused on long-term value, helping build a more sustainable foundation for the industry.

Ultimately, these measures are all about creating a trusted environment where you can invest in cryptocurrency safely and avoid scams.

The Measurable Impact of Widespread KYC

The move toward mandatory identity checks isn't just a passing trend—it's becoming a market-wide standard with results you can see.

By 2025, a staggering 92% of centralized crypto exchanges across the globe are expected to be fully KYC compliant. This shift is also what users want; 58% of crypto users in the United States actually prefer platforms that require verification. And for the big money, it's even more critical: 67% of institutional investors point to strong KYC protocols as a top factor when deciding where to trade.

The proof is in the numbers: KYC adoption has been directly linked to a 38% reduction in crypto fraud risk, making the entire space safer for everyone involved.

KYC isn't about putting up barriers; it's about building a trusted foundation for the future of digital finance. It ensures that platforms operate with integrity, protecting users and paving the way for mainstream adoption.

Here at vTrader, implementing these rigorous standards is central to our commitment to user safety and regulatory compliance. By sticking to these protocols, we help ensure a secure and reliable trading experience for all our users. For a full breakdown of our user obligations and platform rules, you can always review our terms and conditions.

The Future of Identity Verification in Crypto

Identity verification isn’t stuck in the past; it’s getting smarter, faster, and a whole lot more secure. The days of clunky, manual KYC processes are numbered, making way for a smoother experience that doesn't feel like a chore. This shift is all thanks to new technologies designed to make compliance more effective for exchanges and less of a headache for you.

Leading the charge is Artificial Intelligence (AI). AI-powered systems can now scan identity documents with mind-boggling speed and accuracy, picking out sophisticated fakes that would easily trick a human eye. On top of that, machine learning algorithms are constantly watching for suspicious behavior, adding a dynamic layer of security that works 24/7 to keep the ecosystem safe.

Innovations Shaping Tomorrow's KYC

As crypto continues its march into the mainstream, the tools used to secure it are evolving right alongside it. Several key innovations are set to completely change how platforms verify identities, aiming for a much friendlier and more robust process. It's all about finding that sweet spot between tough regulatory rules and the privacy-first spirit that crypto was built on.

The best modern KYC systems are already setting some impressive performance standards. We’re talking document and biometric capture in under 10 seconds and machine learning risk scoring with a precision rate above 92%. For even tighter security, video KYC processes are expected to wrap up in less than four minutes, while automated systems can prefill at least 80% of a Suspicious Activity Report (SAR), giving compliance teams a massive head start. For a deeper dive, shuftipro.com offers a complete guide to these fast-changing regulations.

The Rise of Decentralized Identity

Perhaps the most exciting development on the horizon is the arrival of Decentralized Identity (DID) systems. Picture this: a secure, digital identity that you—and only you—control. Instead of uploading your passport over and over again to different exchanges, you could simply grant them permission to verify specific details from your DID wallet without ever handing over the actual data.

With Decentralized Identity, you become the true owner of your personal information. You decide who sees it, what they see, and for how long, turning the traditional KYC model on its head.

This approach really does offer the best of both worlds. For users, it means getting your privacy and control back. For exchanges, it provides a trustworthy, verifiable identity without the huge security burden of storing millions of sensitive documents on a central server. As this technology continues to develop, it’s paving the way for a future where knowing your customer doesn’t have to mean giving up your privacy.

Common Questions About Crypto KYC Answered

Getting into crypto often means running into the term "KYC," and it's natural to have a few questions. Let's tackle some of the most common queries that pop up.

Can I Still Trade Crypto Without KYC?

The short answer is yes, but it comes with a catch. While you can find some decentralized exchanges (DEXs) that let you trade without verifying your identity, most of the big players—especially those dealing with fiat-to-crypto trades—insist on it.

Opting for a no-KYC platform often means you're dealing with lower trading volumes, fewer advanced features, and, frankly, higher security risks.

How Safe Is My Personal Data During KYC?

Any reputable exchange takes your data security very seriously. They use heavy-duty encryption and secure storage to keep your sensitive information locked down. Of course, no digital fortress is ever 100% foolproof.

Your best bet is to stick with platforms that have a solid security reputation and always, always enable two-factor authentication (2FA). It’s an essential extra layer of defense. For a closer look at our own security policies, you can always check our detailed FAQ page.

Ready to trade with confidence on a secure, compliant platform? Join vTrader today and start building your portfolio with zero commission fees. https://www.vtrader.io

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.