At its core, KYC in crypto is an identity verification process that most centralized exchanges use to make sure you are who you say you are. Just think of it like showing your ID to open a traditional bank account—it’s a crucial step to shut down fraud and follow financial rules, but built for the digital age.

Understanding What KYC in Crypto Actually Means

KYC is short for "Know Your Customer" or, in some circles, "Know Your Client." It's a required set of checks that financial players, including crypto exchanges, must run to verify who their users are. The main point is to create a safer financial world by stopping illegal activities before they start.

This whole process is a big step away from crypto's early "wild west" days of complete anonymity. By gathering and checking user information, exchanges can put up a serious fight against money laundering, terrorist financing, and other financial crimes. If you want to get a better handle on crypto's foundational concepts, the vTrader Academy is packed with great resources.

Why Do Crypto Platforms Require KYC?

Exchanges don't just add KYC for fun; they're legally obligated to in most parts of the world. Regulations like the Bank Secrecy Act (BSA) in the United States require Virtual Asset Service Providers (VASPs)—a fancy term for crypto exchanges—to do their homework on customers.

This compliance isn't just about ticking boxes; it serves a few critical purposes:

- Keeps Bad Actors Out: It makes it much, much harder for criminals to use exchanges to clean dirty money or fund illegal projects.

- Boosts Platform Security: When platforms know their users are legitimate, they can better shield everyone from scams and account takeovers.

- Builds Legitimacy and Trust: KYC helps cement cryptocurrency's place as a serious part of the global financial system, which in turn encourages more people and institutions to get involved.

In short, KYC acts as a digital bouncer for the crypto world. It helps ensure the people joining the party are legit, which protects the integrity of the entire system for everyone inside.

To give you a clearer picture, the table below quickly breaks down what KYC means for the average crypto user.

Crypto KYC at a Glance

This table offers a quick snapshot of the core components of Know Your Customer (KYC) and what you should expect when you encounter it on a crypto platform.

| Component | What It Means for You |

|---|---|

| What It Is | An identity verification check to confirm your personal details are accurate. |

| Why It's Needed | To follow anti-money laundering (AML) laws and prevent financial crime. |

| Who Requires It | The vast majority of centralized crypto exchanges, wallet providers, and trading platforms. |

| Typical Documents | A government-issued ID (like a passport or driver's license) and proof of address. |

Essentially, it's a straightforward process designed to protect both you and the platform, making the crypto space a safer place to trade and invest.

The Global Push for Crypto KYC Regulations

If you've ever wondered why crypto exchanges need your ID, you're not alone. But it's not some arbitrary rule—it's part of a massive global effort to bring the crypto world out of the "wild west" era and into the mainstream financial system.

This worldwide push is being steered by powerful international organizations and national governments all working toward the same goal: stamping out financial crime. Groups like the Financial Action Task Force (FATF) are setting the tone, establishing the global playbook for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF).

Their guidelines aren't just polite suggestions; they become the foundation for financial laws in most countries. As crypto’s popularity exploded, regulators quickly realized that its anonymous nature could be a magnet for illegal activity. That's why traditional banking rules are now being applied to crypto, with KYC sitting right at the heart of this new framework.

The Travel Rule Explained

One of the most talked-about pieces of this puzzle is the FATF’s "Travel Rule." Don't let the name fool you—it has nothing to do with booking a flight.

Think of the Travel Rule as a caller ID for crypto transactions. It forces Virtual Asset Service Providers (VASPs)—like crypto exchanges—to collect and share information about the sender and receiver for any transfer over a certain amount, typically around $1,000.

This means when you send a large crypto sum from one platform to another, the two exchanges have to share identifying details. It creates a clear paper trail, making it incredibly difficult for bad actors to move dirty money around without getting noticed.

Building a Foundation for Broader Trust

This regulatory groundwork is absolutely critical for crypto's long-term survival and growth. By putting solid KYC and AML systems in place, the industry builds the kind of trust needed to attract not just everyday users but also the big-money institutional investors.

You can stay on top of how these evolving rules are shaking up the market by checking out the vTrader news hub.

This shift has also opened up a whole new career path. For anyone fascinated by this side of the industry, looking into crypto compliance jobs offers a peek into a rapidly expanding field. Ultimately, global KYC standards are paving the way for crypto to become a secure, trusted, and essential part of the modern financial world.

Your Step-by-Step Guide to the KYC Verification Process

Getting through a KYC check might seem like a roadblock, but it’s really just a simple security checkpoint. The whole thing is designed to be quick and painless, thanks to some pretty smart tech that confirms you are who you say you are.

Let's break down exactly what to expect. Most crypto platforms funnel you through a similar four-step journey to get verified. Think of it as a digital handshake before you’re cleared for takeoff.

Stage 1: Account Creation and Information Entry

First things first, you'll create an account. This is the easy part, where you'll plug in your basic personal details.

This usually involves providing:

- Your full legal name, exactly as it shows up on your ID.

- Your date of birth to confirm you’re old enough to trade.

- Your current residential address, which will be checked later.

This initial info lays the groundwork for the real identity verification to come. It’s the foundation of your secure trading account.

Stage 2: Submitting Your Identification Documents

Next up, you’ll need to prove you’re the real deal by uploading a government-issued photo ID. This is where the platform cross-references the info you just entered with an official document.

You’ll typically be prompted to snap a clear picture of your ID using your phone or webcam. The most common forms of identification accepted are:

- A valid Passport

- A government-issued Driver's License

- A National Identity Card

Modern verification systems scan the document almost instantly, checking for any signs of tampering while pulling the key details to match against what you provided in the first step.

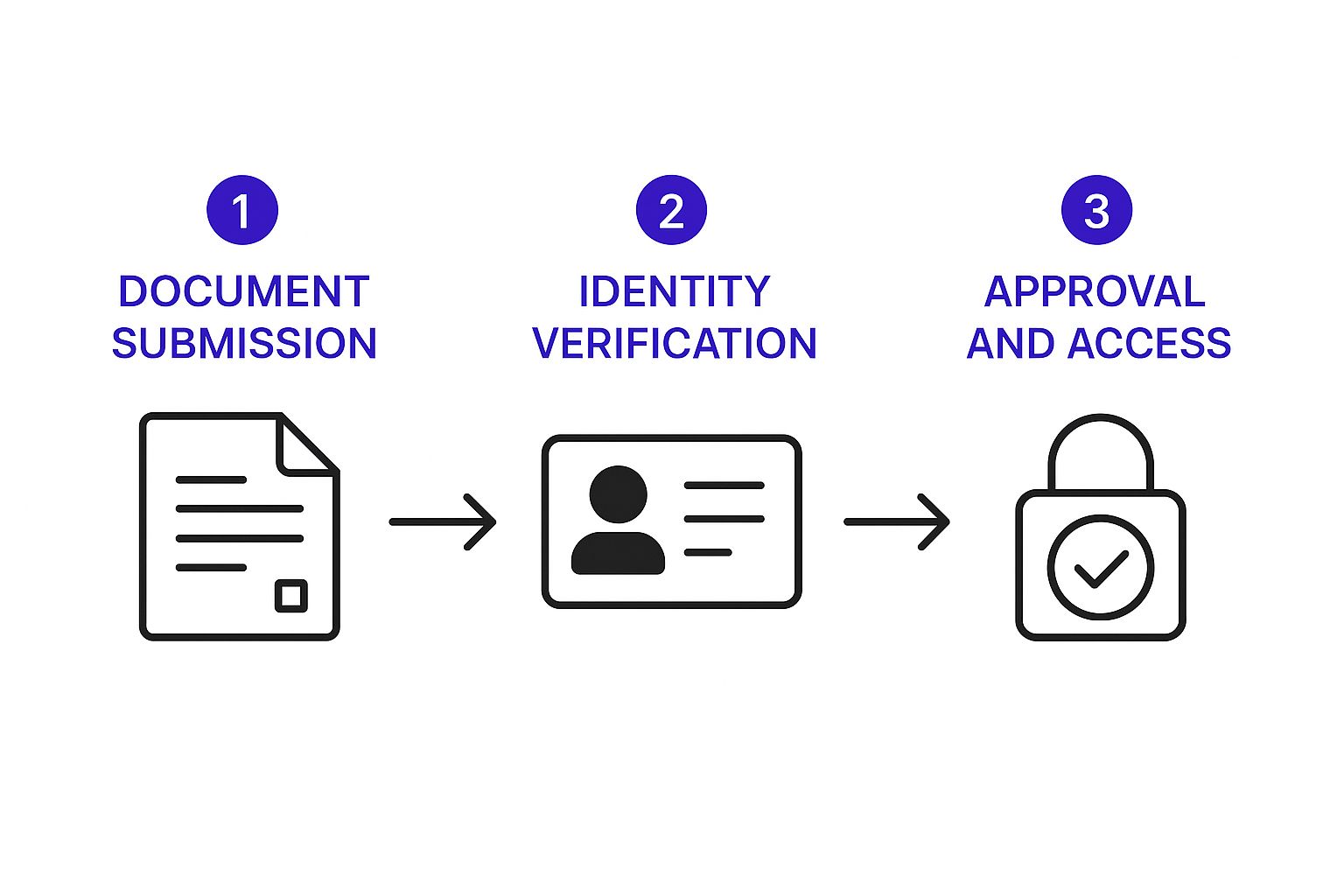

This visual just shows how each step flows logically into the next, from you submitting your info to the system giving you the green light.

Stage 3: The Liveness Check and Biometric Verification

This is where the process gets really clever. To make sure a fraudster isn’t just using a stolen photo of someone else, platforms run what’s called a "liveness check." You’ll be asked to take a live selfie, sometimes while doing something simple like turning your head or smiling.

This biometric scan confirms that a real, living person is present and that their face matches the one on the ID you just submitted. It’s a powerful tool against identity theft and one of the most effective security layers in the whole process. If you want a broader look at these steps, you can dive deeper into understanding the KYC verification process.

Stage 4: Address Verification and Final Review

As a final step, some exchanges may ask for proof of address to round out your profile. This usually means uploading a recent utility bill or bank statement with your name and address clearly visible. It’s just another way to confirm your physical location, which is a big deal for regulatory compliance.

Once everything is submitted, the platform's system—sometimes with a final check from a human reviewer—gives it one last look. If all your details line up, your account gets the thumbs-up. You're now free to trade, deposit, and withdraw. What used to take days can now often be wrapped up in a matter of minutes.

How KYC Builds a Safer Crypto Environment for Everyone

It’s tempting to look at Know Your Customer (KYC) checks as another box to tick, maybe even a bit of a hassle. But that's missing the bigger picture. Think of it less like paperwork and more like a digital fortress protecting the entire crypto market. This isn't about slowing you down—it's about making crypto safer for everyone.

By asking users to prove who they are, exchanges slam the door on anonymous bad actors. It's a simple step, but it makes life incredibly difficult for scammers, hackers, and money launderers trying to operate in the shadows. For the rest of us, it creates a far more secure and transparent place to trade.

This security layer is absolutely vital for building trust across the market. When new users and, just as importantly, large institutional investors see that platforms are serious about preventing crime, they feel confident enough to jump in.

Fostering Trust and Driving Growth

Trust is the fuel for any financial market, and crypto is no different. A solid KYC framework sends a powerful signal that an exchange is a legitimate, safe place to manage your assets. This is the bedrock for the industry's long-term stability and growth.

This might be why a majority of crypto users in the United States actually prefer platforms that require identity verification. It’s a clear sign that user priorities are shifting toward security. Globally, a huge percentage of centralized crypto exchanges are fully KYC compliant, and reports show a significant drop in crypto-related fraud right after these rules were put in place. You can dive into more data on how KYC compliance reduces crypto risks on CoinLaw.io.

KYC is the bridge between crypto's decentralized ideals and the real-world need for security and accountability. It's the mechanism that allows the industry to mature, attract serious capital, and integrate safely into the global financial system.

This foundation of trust is exactly what gets the bigger players—like pension funds and investment banks—off the sidelines and into the market. Their involvement brings in capital and adds stability, which is a win for every single person on the platform.

Protecting Your Data and Your Assets

Of course, you’re providing personal information, and that comes with its own concerns. But regulated exchanges are bound by strict data protection laws. Reputable platforms like vTrader invest heavily in top-tier security to shield your data from anyone who shouldn't see it. The information collected is used strictly for verification and compliance, period.

This commitment to security is a core part of our promise to you. For a detailed look at how your data is protected, feel free to review our comprehensive vTrader privacy policy.

At the end of the day, the benefits of a robust KYC process far outweigh the minor inconvenience of getting set up. It accomplishes several critical goals all at once:

- It filters out criminals, making it harder for them to exploit the system.

- It enhances platform integrity by ensuring all users are who they say they are.

- It boosts investor confidence, clearing the path for mainstream adoption.

By completing KYC, you're not just securing your own account. You're actively helping to build a stronger, more resilient crypto economy for all of us.

Centralized vs Decentralized Exchanges and Their KYC Rules

If you've spent any time in crypto, you've probably wondered why some platforms demand a selfie and your driver's license while others let you trade freely. It all comes down to the deep-seated difference between two flavors of exchanges: centralized (CEXs) and decentralized (DEXs).

Think of a centralized exchange as the crypto world’s version of a traditional bank. It’s a company—like Coinbase or vTrader—that acts as a trusted middleman, holding your funds and making sure trades go through smoothly. Since these are registered financial businesses, they have to play by the rules of global regulators, and that makes Know Your Customer (KYC) checks a must-have.

Why Centralized Exchanges Have to Enforce KYC

For a CEX, KYC isn't just a suggestion; it's the law. These platforms are legally on the hook to follow strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws wherever they operate. This means they are required to verify who their users are to prevent the platform from being used for illegal activities.

CEXs are often the first stop for newcomers, offering familiar features like customer support and easy-to-use interfaces. The KYC process is baked into their commitment to security and staying on the right side of the law, which you can read more about in the official vTrader terms and conditions.

The Wild West of Decentralized Exchanges

On the flip side, you have decentralized exchanges, which run without anyone in charge. Instead of a company calling the shots, DEXs rely on smart contracts—basically just self-executing code on a blockchain—to handle trades directly between users' wallets.

This peer-to-peer setup historically allowed many DEXs to fly under the radar of traditional financial rules, giving users a high level of anonymity. You could just connect your wallet and start trading, no questions asked.

But the lines are starting to get blurry. Regulators are now taking a much closer look at the entire crypto ecosystem, and the pressure is mounting for all platforms to start verifying user identities in some way.

Even the world of decentralized finance (DeFi) is seeing more and more platforms adopt optional KYC. This isn't just about appeasing regulators; it's a sign that the market is maturing. Security and trust are becoming just as important as anonymity. Many DEXs now offer opt-in KYC to attract serious traders and big-money institutional investors who won't touch a platform unless it’s compliant.

Why Mainstream Crypto Adoption Depends on KYC

For crypto to shake off its "niche asset" label and truly go global, it needs more than just brilliant code. It’s got to earn trust, provide security, and operate with regulatory clarity. These are the three pillars that Know Your Customer (KYC) protocols build, making them the real catalyst for growth—not an obstacle.

Think of KYC as the bridge connecting the wild west of crypto to the established world of mainstream finance. By verifying who is on their platforms, compliant exchanges create a much safer environment, shutting the door on illicit activities and protecting everyday users. It's this stability that gives people the confidence to jump in.

Paving the Way for Institutional Investment

The real game-changer for crypto's legitimacy? Big money. We're talking about large investment firms, pension funds, and corporations that manage trillions of dollars. But here's the catch: they simply can't dive into unregulated markets.

KYC provides the exact compliance framework they need. It gives them the green light to invest confidently, knowing that the platforms they use are playing by the rules and adhering to global Anti-Money Laundering (AML) standards. This flood of institutional cash does more than just pump up market caps; it brings much-needed stability and liquidity to the entire ecosystem, transforming crypto from a speculative gamble into a serious portfolio asset.

KYC is the handshake that legitimizes the crypto industry in the eyes of global finance. It signals that a platform is serious about security, compliance, and long-term viability, making it a safe harbor for both retail and institutional capital.

Building Widespread Consumer Trust

It’s not just about the big players. KYC is absolutely critical for winning over the general public. As more people get curious about digital assets, their number one concern is safety. With a huge percentage of American adults now owning crypto, strong compliance is what keeps them feeling secure, especially with regulators watching closely.

In fact, the vast majority of institutional investors point to robust KYC protocols as a non-negotiable factor when choosing where to trade. You can get a deeper look at the numbers in this annual consumer report on cryptocurrency.

Ultimately, KYC is the mechanism that lets crypto grow up. It fosters a regulated and trusted environment where real innovation can happen, clearing the path for digital currencies to become a permanent part of our financial future.

Frequently Asked Questions About Crypto KYC

Getting into crypto often stirs up a few questions, especially around KYC. Let's cut through the noise and get you some straight answers so you can trade with total confidence.

Is It Safe to Submit My Personal Information for KYC?

It absolutely is, provided you’re using a regulated and reputable exchange. Platforms like vTrader are legally bound to safeguard your personal data with serious encryption and security measures.

Think of it as a digital vault. That information is gathered strictly for identity checks and to comply with anti-money laundering laws—nothing else. Top-tier exchanges pour huge resources into their cybersecurity to keep your details locked down and confidential.

Can I Still Buy Crypto Without Doing KYC?

You can, but your options get pretty limited and a whole lot riskier. Decentralized exchanges (DEXs) and some peer-to-peer sites might let you trade without ID, but they often come without the security, support, or regulatory safety nets you get with a centralized exchange.

For most people, especially if you're just starting out, going through KYC on a compliant platform is the smarter, safer route. It unlocks all the good stuff, like higher withdrawal limits and the ability to move money directly from your bank.

The bottom line is, for any serious trading or to connect a bank account, KYC is pretty much non-negotiable on secure, regulated platforms. It’s the gold standard for safely participating in the crypto world.

How Long Does KYC Verification Usually Take?

The timeline can differ, but most exchanges have gotten lightning-fast. Thanks to automated systems that use AI to scan your documents and biometrics, you can often get verified in just a few minutes.

In some situations, if a human needs to step in for a manual review, it might take a few hours or, at most, a day. The trick is to submit clear, accurate documents from the get-go to avoid any hold-ups.

What Should I Do if My KYC Verification Fails?

First off, don't panic. If your verification doesn't go through, it's usually for a simple reason like a blurry photo, an expired ID, or a typo in your information.

The platform will almost always tell you what went wrong. The best thing to do is double-check the requirements, find a spot with good lighting to retake your photos, and resubmit everything. If you're still stuck, the help section is your best friend. For a full rundown of common verification issues, pop over to the vTrader FAQ page.

Ready to trade with confidence on a secure, commission-free platform? Join vTrader today to experience zero-fee trading on Bitcoin, Ethereum, and more. Get started in minutes and unlock your full trading potential. https://www.vtrader.io

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.