At its core, a cold storage wallet is a way to secure your crypto by keeping your private keys entirely offline, completely cut off from the internet. You can think of it as a Fort Knox for your digital assets, making them unreachable to online hackers. The whole point is to create an "air gap"—a physical dead-end between your crypto keys and the online world.

Understanding Your Digital Fortress

To really get what a cold storage wallet is all about, let's use a simple, real-world comparison. Picture two ways you might store your money. First, there's the wallet in your pocket. It's always with you, perfect for grabbing a coffee or making quick purchases. In the crypto universe, this is your 'hot wallet'—it’s connected to the internet, great for frequent trading but also far more vulnerable to theft.

Then there's the second way: a locked safe, tucked away securely in your home. This is your 'cold wallet.' It isn't designed for daily spending; it's built for serious, long-term security. By keeping your private keys—basically, your safe's combination—offline, you eliminate the single greatest risk in crypto: internet exposure.

The Core Principle: Offline Security

The defining trait of a cold wallet is that it lives offline. Since it never touches the internet, your private keys are completely shielded from the common digital attacks that plague online hot wallets.

These threats include:

- Hacking and Malware: A virus can't infect a device that isn't connected to a network.

- Phishing Scams: Thieves can't trick a device into giving up its keys if that device is physically isolated.

- Remote Attacks: There's simply no digital pathway for an attacker to access your wallet from afar.

This uncompromising security is exactly why long-term investors and anyone holding a significant amount of crypto lean on cold storage. As more people get into crypto, the demand for rock-solid security is exploding. The hardware wallet market, which is mostly cold wallets, was valued at USD 469.39 million in 2024 and is on track to hit USD 3.3 billion by 2033.

For a deeper dive into this growth, you can check out more data on the hardware wallet market. A smart strategy for today's investors is pairing these ultra-secure tools with a trusted exchange, something you can learn more about in our guide to the vTrader platform.

To quickly sum up what makes a cold storage wallet what it is, here's a simple breakdown.

Cold Storage Wallet At a Glance

| Feature | Description |

|---|---|

| Connectivity | Completely offline; never connects to the internet. |

| Primary Use Case | Long-term holding ("HODLing") of significant crypto assets. |

| Security Level | The highest level of security available against online threats. |

| Convenience | Less convenient for frequent, small transactions. |

| Typical Forms | Hardware devices (like Ledger, Trezor), paper wallets, sound wallets. |

This table highlights the fundamental trade-off: you sacrifice a bit of convenience for a massive gain in security, which is a deal most serious investors are happy to make.

Why Offline Storage Is Your Best Defense

So now that we know what a cold storage wallet is, the big question is: why bother taking your crypto offline in the first place? It all comes down to a simple but powerful security concept known as an "air gap."

Imagine a top-secret government computer that holds classified information. It's never, ever connected to the internet or any other network. By keeping it physically isolated, you create a bubble that online threats simply can't penetrate.

A cold wallet does the exact same thing for your crypto. By keeping your private keys on a device that stays completely disconnected from the internet, you’re creating an impenetrable barrier between your funds and the outside world. You’re essentially pulling your most valuable assets off the digital battlefield where hackers and malware are constantly on the prowl.

This offline strategy isn’t just another security feature—it’s a fundamental change in how you protect your assets, one that completely neutralizes the most common and devastating digital attacks.

Neutralizing Key Digital Threats

Hot wallets, because they're always online, are constantly in the line of fire. Cold storage, by its very design, sidesteps these dangers completely.

It makes you immune to:

- Remote Hacking: Hackers can't break into a device they can't connect to. A cold wallet has no digital doors for them to kick down because it's completely offline.

- Phishing Scams: That sketchy email with a fraudulent link can’t trick your hardware into giving up its private keys. The keys are never exposed to your computer in the first place.

- Spyware and Keyloggers: Malicious software on your PC that records every keystroke is rendered useless. You confirm transactions directly and securely on the cold wallet itself, far away from prying eyes.

By never letting your private keys touch an internet-connected device, you shut down the main avenues that thieves rely on. It's a massive security advantage that no online solution can ever truly match.

A cold storage wallet doesn't just add a layer of security; it moves your assets to an entirely different, safer environment. It's the difference between locking your front door and moving your valuables to a private island.

This growing awareness around security is fueling some serious market growth. The global hardware wallet market was valued at around USD 348 million in 2025 and is projected to hit USD 1.53 billion by 2032 as more investors make asset protection their top priority.

It’s this intense focus on security that demands clear operational standards from platforms, which helps build user trust at every level. You can see this commitment in action by checking out our transparent vTrader refund policy.

At the end of the day, offline storage is your best defense because it removes the opportunity for theft, making it practically impossible for digital thieves to get their hands on your funds.

Exploring Different Types of Cold Wallets

The term "cold storage wallet" isn't a one-size-fits-all product. It's a whole category of offline security solutions designed to keep your crypto safe. They all share one core mission: keeping your private keys completely disconnected from the internet.

But in the wild, they come in different shapes and sizes, each with its own quirks and benefits. Figuring out these differences is the first step to picking the right fortress for your digital assets.

The most popular and arguably most user-friendly form of cold storage is the hardware wallet. These are small, physical devices that usually look like a fancy USB stick or a credit card. They are purpose-built for one thing: securing your crypto.

Think of a hardware wallet as a tiny, digital Fort Knox. When you want to send funds, you plug it into your computer or phone. The critical step—signing the transaction—happens entirely inside the secure chip on the device, meaning your private keys never touch the internet-connected machine. It's this clever blend of security and ease of use that makes them a go-to for serious investors.

The Sleek and Secure Hardware Wallet

Hardware wallets have become the gold standard, striking a perfect balance between top-tier security and everyday practicality. They’re built for people who want to actively manage their crypto without taking unnecessary risks.

- How They Work: Your private keys are generated and locked away on a tamper-proof chip inside the device. To approve anything, you have to physically confirm it on the wallet's screen, which keeps your keys completely isolated.

- Best Use Case: Perfect for long-term holders ("hodlers") who still need to move their funds around from time to time. It’s the ideal setup for securing a significant portfolio while keeping it accessible.

- Popular Examples: You've probably heard of the big names. Brands like Ledger and Trezor are practically household names in crypto, known for their solid reliability and tough security features.

The Simple and Sturdy Paper Wallet

Let's rewind to one of the OGs of cold storage: the paper wallet. This method is as basic as it gets but still surprisingly effective. It's literally just a piece of paper with your public and private keys printed on it, often as QR codes.

A paper wallet is the ultimate "set it and forget it" solution. You use an offline tool to generate your keys, print them out, and then stash that piece of paper somewhere incredibly safe, like a fireproof safe or a bank deposit box.

By printing your keys, you create a tangible asset that is completely immune to digital attacks like hacking and malware. The trade-off? You now have a physical vulnerability. If that paper is lost, stolen, or destroyed in a fire—and you don't have a backup—your crypto is gone for good.

Other Advanced Cold Storage Methods

For the truly paranoid or those protecting massive sums, there are even more advanced techniques. One of the most hardcore is the air-gapped computer. This is a machine that has never, and will never, be connected to the internet.

The process is meticulous. You generate your keys and sign transactions on this offline computer, then shuttle the signed transaction data over to an online machine using a USB stick to broadcast it to the network. It offers an incredible level of security, but it also demands a high degree of technical skill and discipline, which puts it out of reach for most everyday users.

Each of these methods—hardware, paper, or air-gapped PC—presents a different balance between security, convenience, and complexity.

Hot Wallets vs Cold Wallets: A Head-to-Head Comparison

To really get what a cold storage wallet brings to the table, it helps to put it right next to its online cousin. Think of it like your checking account versus a long-term savings vault. Each has a job to do, and knowing the difference is the secret to managing your crypto wisely.

A hot wallet is all about easy access. It's an app on your phone or computer, always connected to the web, which makes it great for quick trades and everyday use. On the flip side, a cold wallet is built for one thing above all else: security. It keeps your private keys completely offline, far away from hackers and other online threats.

This single difference—being online vs. offline—creates a fundamental trade-off between security and convenience.

The Security and Convenience Tradeoff

At its heart, the choice between a hot and cold wallet comes down to risk. A hot wallet’s constant internet connection makes it a prime target for hackers, malware, and sophisticated phishing schemes. That convenience is also its biggest weakness.

A cold wallet, however, completely sidesteps this risk. By creating a physical "air gap" between your private keys and the internet, it offers the Fort Knox standard of crypto security. The trade-off? You have a few extra steps to take when you want to move your funds, making it less ideal for frequent, small transactions. It's a trade-off many are willing to make; research shows that over 60% of crypto owners opt for cold storage to keep their assets safe. You can dive deeper into these consumer trends at alwin.io.

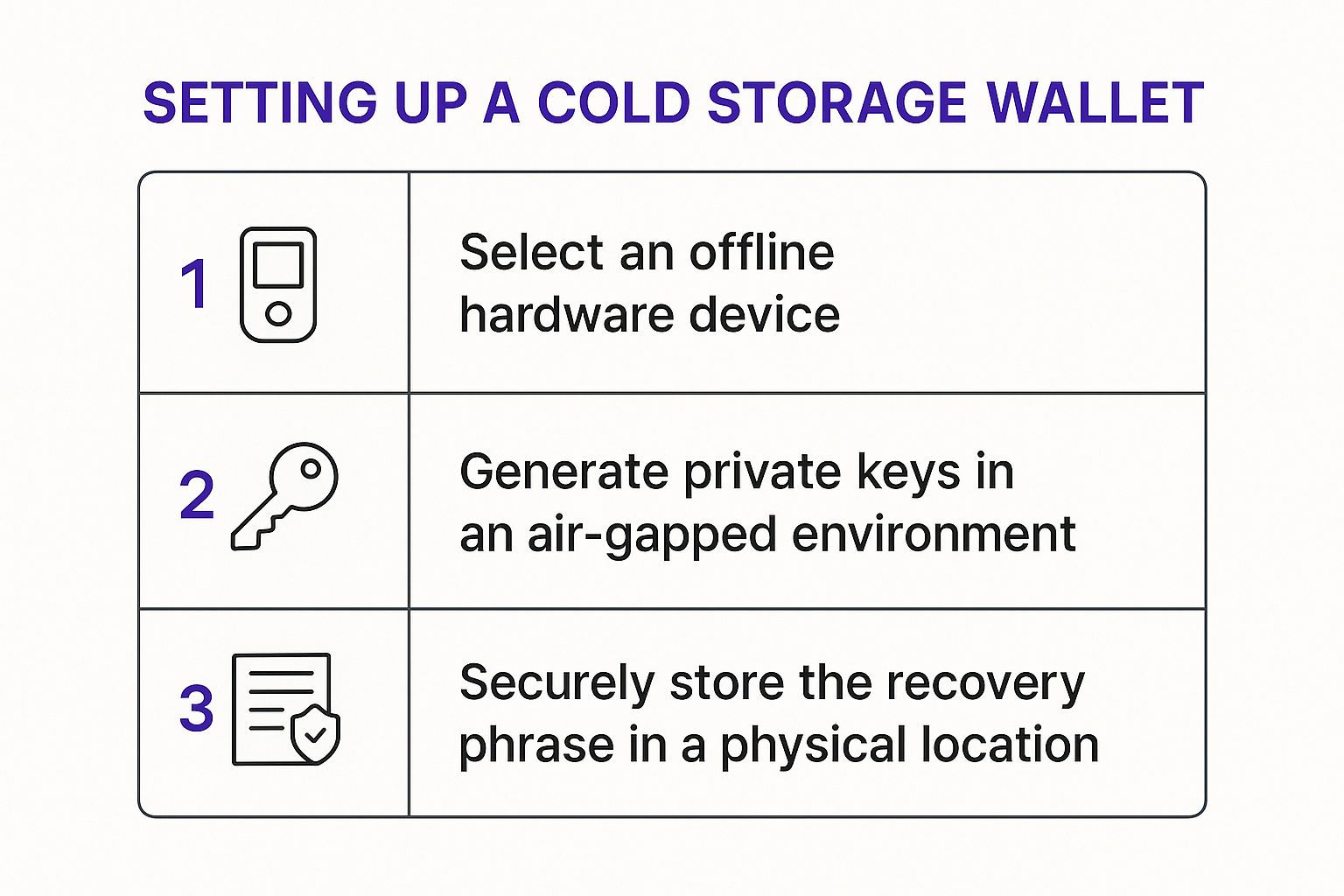

The setup process itself drives this point home, as seen in the infographic below.

As you can see, every critical step—from generating your keys to stashing your recovery phrase—is done entirely in a secure, offline environment. This isn't just a feature; it's the whole point.

Ultimately, the choice isn't just about technology—it’s about strategy. Are you an active trader who needs funds at your fingertips, or are you a long-term investor building a digital nest egg? Your answer will point you to the right wallet, or combination of wallets, for your goals.

To make this even clearer, let's stack them up against each other.

Feature Showdown Hot Wallet vs Cold Wallet

Here’s a breakdown of how these two types of wallets compare on the features that matter most.

| Feature | Hot Wallet (e.g., Mobile App) | Cold Wallet (e.g., Hardware Device) |

|---|---|---|

| Connectivity | Always connected to the internet. | Completely offline; connects only to sign transactions. |

| Security | Vulnerable to online threats like hacking and malware. | Extremely high security; immune to online attacks. |

| Best Use Case | Frequent trading, daily spending, managing small amounts. | Long-term holding (HODLing) of significant assets. |

| Convenience | Highly convenient for fast, easy access to funds. | Less convenient; requires physical device for transactions. |

| Cost | Typically free (software-based). | Requires a one-time purchase (physical hardware). |

| Key Custody | Can be self-custodial or custodial (on an exchange). | Always self-custodial; you have full control. |

The table lays it out plainly: hot wallets are your go-to for speed and ease, while cold wallets are the undisputed champions of security.

How to Use a Cold Wallet Securely

Getting your hands on a cold storage wallet is a massive upgrade for your crypto security, but here's the reality: the device itself is only half the battle. Its protection is only as strong as the habits you build around it. Simply owning one isn't enough—using it correctly is what transforms that piece of hardware into a true digital fortress for your assets.

Think of it like owning a high-tech safe for physical gold; the safe is useless if you leave the key under the doormat.

Your security mission starts before you even crack open the packaging. It is absolutely crucial to purchase your hardware wallet directly from the official manufacturer or a verified reseller. Stay away from second-hand devices or sketchy online marketplaces. Buying from an unvetted source is just asking for trouble, as a bad actor could have already tampered with the hardware to siphon your funds down the line.

Once the device is in your hands, the setup process is your next major security checkpoint. This is when you'll generate your secret recovery phrase, which is typically a list of 12 or 24 words.

This phrase is everything. It’s the master key to all your crypto and the ultimate backup plan. If your device gets lost, stolen, or smashed, this phrase is the only thing that will let you restore your funds on a new one. Never, ever store it digitally. That means no screenshots, no text files, and definitely no cloud backups. Write it down on paper and stash it somewhere safe and offline.

Best Practices for Long-Term Security

After the initial setup, keeping your wallet secure is all about discipline and smart habits. Here are a few non-negotiable rules every cold wallet owner should live by:

- Always Send a Test Transaction: Before you even think about moving your life savings, send a tiny, insignificant amount of crypto to your new wallet. Then, go through the process of recovering the wallet using your seed phrase. This little drill accomplishes two things: it proves your setup is working perfectly and builds your confidence for when it really matters.

- Keep Your Components Separate: Never store your hardware device in the same physical location as your written-down recovery phrase. This is a simple but powerful security layer. If a burglar finds your device, they can't access it without the phrase, and if they find the phrase, it's useless without a device to input it into.

- Verify Addresses on the Device Screen: This is a big one. Malware on your computer can try to pull a fast one by swapping the address you copied with a scammer's address. Your hardware wallet's physical screen is your source of truth. Always double-check—and then triple-check—that the address displayed on your device matches exactly where you intend to send funds before you confirm anything.

The soaring demand for these security measures tells a story about the crypto market's growing maturity. In fact, the crypto cold storage wallet market was valued at an estimated USD 1.63 billion in 2024, a clear sign of how essential offline storage has become for serious investors. You can dive deeper into these market dynamics in this comprehensive report.

For more practical lessons on crypto security and trading, the vTrader Academy is packed with valuable resources.

Deciding If a Cold Wallet Is Right for You

So, how do you know if a cold wallet is an essential part of your setup, a nice-to-have, or just overkill for now? The answer really comes down to your personal crypto strategy and what you’re doing with your assets day-to-day.

Different investors have vastly different needs when it comes to security. The key is to figure out which camp you fall into.

Matching the Wallet to the Investor

Your activity is the best guide to what kind of security you need.

- The Long-Term Investor (HODLer): If you're in it for the long haul—buying crypto to hold for months or even years—a cold wallet is absolutely non-negotiable. Your main concern is iron-clad security for assets you rarely touch. A hardware wallet essentially becomes your personal, offline vault.

- The Frequent Trader: Active traders still need a cold wallet, but they use it differently. Most adopt a hybrid approach: they keep a smaller, active trading balance on a trusted exchange for quick moves, then sweep profits over to their cold wallet for safekeeping.

- The Beginner: Just getting your feet wet with a small amount? A wallet on a reputable exchange is likely fine to start. But as soon as your holdings grow to a point where losing them would sting, it’s time to upgrade. Getting a cold wallet is a major milestone for any serious crypto investor.

For most people, a hybrid model is the smartest way to go. Think of your cold wallet as a high-security savings account for the bulk of your crypto, and a hot wallet as your checking account for daily trading or spending.

The rule of thumb is simple: any crypto you can't afford to lose belongs in a cold wallet. It's less of an expense and more of an investment in your own peace of mind.

This kind of strategic thinking is all about building a secure framework for your activities—a standard that applies to the platforms you choose, too. You can see the operational standards that keep our users safe by reading our detailed terms and conditions.

Frequently Asked Questions About Cold Wallets

Even after getting the hang of what a cold storage wallet is, some practical questions always pop up. Making the leap to offline storage can feel like a big move, but walking through these common concerns usually builds the confidence you need to secure your crypto the right way.

Let's dive into the questions we hear most often.

What if I Lose My Hardware Wallet?

This is probably the number one fear for anyone buying their first hardware wallet: what happens if this expensive little device gets lost, stolen, or just breaks down?

Fortunately, the device itself is completely replaceable. Your crypto isn't actually stored on the wallet—it's always on the blockchain. The wallet is just a key. As long as you have your secret recovery phrase (those 12 or 24 words you wrote down when you set it up), you can buy a new device and restore full access to your funds. You could even use a device from a totally different brand. That piece of paper is your real key to everything.

Can a Cold Wallet Get a Virus?

Another big question centers on digital threats. Is it possible for a cold wallet to get a virus or be hacked?

The simple answer is no. Since a cold wallet is kept entirely offline, there's no internet connection for malware or a hacker to exploit.

This "air gap" is the whole secret to its security. A virus can't jump onto a device it can't physically or digitally reach. When you sign a transaction, only the signature data is passed to your computer, never your private keys. They stay safely isolated from any online threats.

For more answers to common crypto questions, you can always check out the detailed information in our official vTrader FAQ section.

How Much of My Crypto Should I Keep in Cold Storage?

Finally, investors often ask what percentage of their portfolio should be moved offline. While there's no magic number that fits everyone, the best way to think about it is to go back to our "savings vs. spending" analogy.

Your cold wallet is your savings account. It's the vault. This is where you should keep the majority of your crypto—the funds you don’t plan to trade or spend anytime soon. Think of it as your long-term HODL stash.

You can keep a smaller, more disposable amount in a hot wallet for active trading or daily use, just like the cash you'd carry around in your pocket. This hybrid strategy gives you the best of both worlds: fortress-like security for your main holdings and easy access for day-to-day activity.

Ready to trade with confidence and zero fees? vTrader offers a secure, commission-free platform to buy, sell, and manage your crypto portfolio. Join vTrader today and start building your future.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.