Crypto cold storage simply means taking your private keys—the secret passcodes that prove you own your crypto—completely offline. It's the digital equivalent of putting cash in a high-security bank vault instead of leaving it in your wallet. This makes your assets virtually invisible to online hackers and thieves, establishing it as the gold standard for long-term security.

Your Digital Vault for Cryptocurrency

Think of your cryptocurrency as digital gold. You wouldn't just leave gold bars sitting on your kitchen counter, right? You'd lock them away somewhere safe. Cold storage provides that exact same level of ironclad protection for your digital assets.

The entire idea hinges on one powerful concept: isolating your private keys from any and all internet connections. This simple act of creating an "air gap" between your keys and the online world shuts down the main highway cybercriminals use to attack. If a thief can't find your vault online, they have no way to crack it open.

Core Concepts of Cold Storage

To really get what cold storage is all about, it helps to break down the key ideas behind it. Understanding these concepts is the first step to truly securing your digital assets. After all, strong information security practices can protect against financial insecurity—and that's what we're aiming for here.

Let's look at the foundational principles in a nutshell.

Cold Storage Core Concepts

The table below breaks down the foundational ideas behind crypto cold storage.

| Concept | Explanation |

|---|---|

| Offline Keys | Your private keys are generated and stored on a device that is never connected to the internet. |

| Transaction Signing | Transactions are signed offline on your secure device before being broadcast to the online network. |

| Physical Control | You have direct, physical possession of the device holding your keys, giving you total control. |

| Reduced Attack Surface | By staying offline, your crypto is shielded from malware, phishing attempts, and remote hacks. |

This offline-first approach puts you back in the driver's seat.

And this isn't some niche strategy; it's a rapidly growing movement. By 2025, cold wallets are projected to make up 22-30% of the entire crypto wallet market's revenue, a clear signal that serious investors are prioritizing security. You can dig into more of the numbers in this comprehensive report on cold wallet trends.

The golden rule in crypto has always been, "Not your keys, not your coins." Cold storage is the most powerful and direct way to live by that principle, giving you absolute ownership over your digital wealth.

If you're looking to go deeper on asset security or other essential crypto topics, we've built a whole learning center just for that. Continue your journey over at the vTrader Academy.

Why Offline Storage Is Your Best Defense

The crypto world is full of horror stories about exchange hacks and catastrophic failures. These events all point to the same uncomfortable truth: keeping your assets on an exchange means you're trusting someone else to protect them. Cold storage flips that model completely, moving you from a position of trust to one of total self-control.

This isn't just about security—it's about ownership. When you take your private keys offline, you have absolute authority over your own money. It’s the embodiment of the crypto mantra, "not your keys, not your coins." You stop being a simple account holder and become the true owner of your digital wealth.

Shielding Your Long-Term Investments

If you're holding crypto for the long haul, the constant worry about online attacks can be exhausting. Cold storage is the solution. It brings a level of peace of mind that hot wallets just can't match. Knowing your assets are physically disconnected from the internet takes them off the digital battlefield entirely.

This defensive posture is why cold storage is the standard for serious individual investors and large financial institutions alike. They all understand the simplest rule of cybersecurity: the best way to guard against online threats is to not be online in the first place. This approach has become more critical than ever, with attacks getting more frequent and sophisticated.

Think of it like this: leaving your crypto on an exchange is like keeping your life savings in a cash register out front. Moving it to cold storage is like locking it away in a private, impenetrable bank vault. That peace of mind is priceless.

And the motivation to make that move is only getting stronger. In 2024 alone, thieves made off with over $2.2 billion in crypto from various platforms, a figure that's pushing more investors to take custody of their own assets. You can dig into this trend and see how it's influencing new security tech by exploring the latest reports on cold crypto wallet cards.

The Tangible Benefits of Going Offline

Beyond just fending off hackers, offline storage strengthens your entire investment strategy. It gives you a solid foundation to build on, free from constant worry. Of course, you still need to keep up with the market, and you can stay on top of the latest moves by checking out the latest crypto news and market updates.

Here’s what you really gain by going offline:

- Immunity to Remote Hacking: Hackers can't touch what they can't connect to. Malware, phishing attacks, and other remote exploits simply don't work against an offline device.

- Complete Asset Sovereignty: You hold the keys, so you make the rules. No third party can freeze your funds, lose them, or block you from accessing them.

- Protection from Exchange Failures: Your assets are completely separate from the business risks of an exchange, whether it’s insolvency, a regulatory shutdown, or just bad management.

- Long-Term Security: It’s the perfect "set and forget" solution for your core holdings, giving you confidence that your assets will be safe for years to come.

Exploring Different Types of Cold Wallets

Not all offline crypto storage is built the same. Just like you can stash cash in a simple safe or a high-tech bank vault, crypto cold wallets come in different flavors, each with its own balance of security, ease of use, and setup complexity.

Getting to know these options is the first step in picking the right one for you. Let's break down the most popular types, starting with the modern favorite and then covering the old-school and ultra-secure methods.

Hardware Wallets: The Modern Standard

Think of a hardware wallet as a purpose-built USB drive designed for one thing: keeping your crypto safe. These are small, physical devices that generate and store your private keys on a protected, offline chip. When you need to send funds, you plug it into your computer or phone, but the real work happens inside the wallet itself.

The transaction is signed internally, on that offline chip, without ever letting your private key touch the internet-connected device. It's like signing a legal document inside a sealed room and passing only the signed paper out through a slot. The critical secret—your signature—never leaves that secure space.

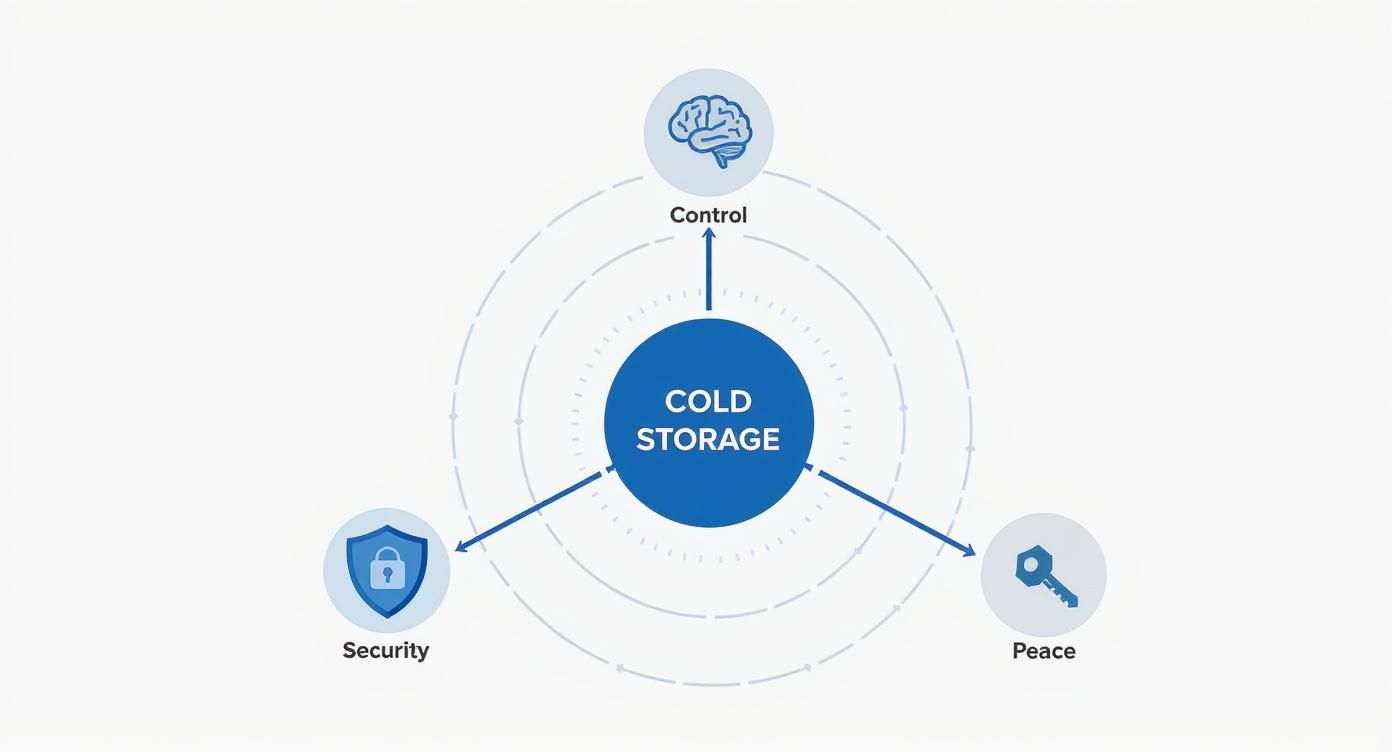

This infographic lays out the core reasons cold storage, especially hardware wallets, is so compelling.

As you can see, these wallets deliver not just hardcore security but also total user control and priceless peace of mind.

This blend of top-tier security and user-friendliness has made hardware wallets the default choice for most serious investors. Their rising popularity signals a major shift in how people think about protecting their assets. In fact, the market for these devices is blowing up. Valued at about $680 million in 2025, the global market is expected to surge to over $4.7 billion by 2035, growing at an impressive 21% annually. You can find more stats on this growth over at the Coinlaw hardware wallet market statistics page.

Paper Wallets: The Original Low-Tech Method

Before hardware wallets were everywhere, the original form of cold storage was the paper wallet. It’s a truly low-tech but effective method where you generate your public and private keys offline and print them out on a piece of paper, often as QR codes.

You then take that piece of paper and lock it away somewhere physically secure, like a fireproof safe or a bank deposit box. To spend the crypto, you'd need to "sweep" the private key into a software (hot) wallet.

A paper wallet is the ultimate in offline simplicity. It completely eliminates digital attack vectors, but it introduces physical risks. If the paper is lost, damaged by fire or water, or stolen, your funds could be gone for good.

Because of these physical weak points and the clunky user experience, paper wallets are less popular now. Still, they remain a viable, no-cost option for long-term "deep freeze" storage. You can explore crypto assets on our platform to see which ones are often held in long-term storage.

Air-Gapped Computers: Maximum Security

For the truly paranoid or those protecting a fortune, there are air-gapped computers. An air-gapped device is a computer that has never been connected to the internet or any other network. Ever. Its only job is to generate keys and sign transactions in complete isolation.

The process is a bit involved:

- Create Transaction: An unsigned transaction is put together on a normal, online computer.

- Transfer: This unsigned transaction is moved to the air-gapped computer using a USB drive or QR code.

- Sign Offline: The transaction is signed with the private keys stored on the secure, air-gapped machine.

- Broadcast: The newly signed transaction is moved back to the online computer and broadcast to the network.

This method offers an insane level of security by guaranteeing the private keys never even get a whiff of a networked device. But it demands serious technical skill and is usually reserved for institutions or individuals guarding massive amounts of crypto.

Comparing Cold Storage and Hot Storage

When you’re deciding between hot and cold crypto storage, it’s not about finding a single "best" option. It's about choosing the right tool for the job. The easiest way to think about it is by comparing it to your regular finances.

A hot wallet is like your checking account or the cash you carry around. It's connected to the internet, which makes it super convenient for everyday spending, trading, and quick transactions. You need easy access to these funds, but you’d never keep your life savings there because of the risk.

A cold wallet, on the other hand, is your savings vault. It's completely disconnected from the internet, making it far more secure, though a bit less accessible. This is where you lock down the assets you aren’t planning to touch anytime soon, protecting your long-term holdings from online threats.

Key Differences at a Glance

The choice between the two really boils down to the classic trade-off: security versus convenience. Hot wallets give you speed and simplicity, while cold storage offers fortress-like protection and peace of mind.

For most serious investors, the best strategy isn't an either/or decision—it's using both.

This hybrid approach lets you enjoy the flexibility of a hot wallet for active trading while keeping the bulk of your portfolio safe and sound in an offline vault. You can use a hot wallet to explore DeFi or try out new platforms without putting your main stash at risk. For instance, many people first learn about earning rewards through crypto staking with a small amount in a hot wallet before moving larger sums from cold storage.

The core principle is simple: use a hot wallet for what you're willing to actively manage and potentially risk, and use a cold wallet for what you want to protect for the long term.

To make the comparison totally clear, let’s break down how each wallet type stacks up across the most important features. This head-to-head view shows you exactly what you gain—and what you give up—with each choice.

Hot Wallet vs Cold Wallet Feature Comparison

Here’s a quick table to show you how hot and cold wallets compare on the features that matter most.

| Feature | Hot Wallet (Online) | Cold Wallet (Offline) |

|---|---|---|

| Security | Lower. Vulnerable to online threats like malware, hacking, and phishing. | Highest. Immune to remote attacks as private keys are never exposed to the internet. |

| Convenience | High. Assets are instantly accessible for fast trading and transactions. | Lower. Requires physical access to the device to approve transactions, adding extra steps. |

| Primary Use Case | Frequent trading, daily payments, interacting with decentralized applications (dApps). | Long-term holding ("HODLing"), securing large amounts of crypto, protecting generational wealth. |

| Cost | Typically free. Most software and exchange-based wallets cost nothing to set up. | Involves an upfront cost, usually between $50 to $200, for a physical hardware device. |

Best Practices for Managing Your Cold Storage

Just getting a cold storage wallet isn't the finish line—it’s the starting block. Proper management is what turns that device into an unbreachable vault for your crypto. If you get lazy with these practices, you might as well have left your assets on an exchange.

The first rule is a big one: only purchase hardware wallets directly from the official manufacturer. Buying from third-party sellers on sites like eBay or Amazon is asking for trouble. It opens you up to supply chain attacks, where a thief could tamper with the device before it ever gets to you.

Secure Your Seed Phrase Above All Else

Your recovery seed phrase isn't just a password; it's the master key to every single asset you own. If your hardware wallet gets lost, stolen, or smashed, this string of words is the only way to get your funds back. Guarding it is everything.

Never, ever store it digitally. That means no photos on your phone, no text files saved to the cloud, and definitely no emailing it to yourself. A digital copy completely negates the point of cold storage, putting your master key right back into the online world where hackers live.

Think of your seed phrase as the deed to your house. You wouldn't leave a photo of it on a public server, and you must give your crypto keys the same level of respect and protection.

Instead, go with physical, old-school methods built to last.

- Metal Plates: Stamp your seed phrase onto a steel or titanium plate. It makes it virtually immune to fire, water, and just fading over time.

- Split Locations: A bit more advanced, but smart. Break your seed phrase into multiple parts and store them in different, secure locations. This eliminates any single point of failure.

- Tamper-Evident Bags: Once you've written down your phrase, seal it in a tamper-evident bag. You'll know instantly if someone has tried to access it.

Establish Strong Operational Security

Protecting your seed phrase is mission-critical, but so are your day-to-day habits. This stuff might seem specific to crypto, but the core principles are the same as broader personal cybersecurity best practices. A disciplined routine is your best defense.

Always set a strong PIN for your device, and don't make it obvious. Forget birthdays or "1234." Your PIN is the first line of defense if someone physically steals your wallet, buying you critical time to move your funds to safety using your seed phrase.

And before you send your life savings to your new wallet, run a small test. Send a tiny amount of crypto first, then practice restoring the wallet from your seed phrase. This little drill confirms your backup works perfectly and gives you the confidence that you can recover your assets when it really matters. It's a small step that can save you from a catastrophic mistake later on.

Frequently Asked Questions About Cold Storage

It’s completely normal to have questions when you first consider moving your crypto into cold storage. Even after seeing the benefits, taking that first step can feel like a big deal.

We’ve put together some straightforward answers to the most common concerns people have. Think of this as your go-to guide for clearing up any confusion and building the confidence to manage your assets securely.

Can My Crypto Be Stolen from a Hardware Wallet?

If you follow the rules, it’s exceptionally difficult. A hardware wallet keeps your private keys entirely offline, which means there’s no way for a hacker to reach them over the internet. The risks you need to worry about shift from digital to physical.

The two biggest threats are:

- Physical Theft: Someone gets ahold of your device and tries to break in by guessing your PIN.

- Social Engineering: You get tricked into giving away your secret recovery phrase.

As long as you guard that seed phrase and keep it private, your crypto is safe—even if the physical wallet itself is lost or stolen.

The entire security of your hardware wallet hinges on one thing: protecting your seed phrase. That list of words is the master key to everything. Keeping it secret is your most important job as an investor.

What Happens If I Lose My Hardware Wallet?

Losing the device itself isn't the disaster you might think it is, provided you’ve backed up your recovery seed phrase. Your crypto doesn't actually live on the wallet; it's on the blockchain. The wallet is just the key.

That means you can simply buy a new hardware wallet—it doesn't even have to be the same brand—and use your original seed phrase to restore complete access to all your funds.

Do I Need a Cold Wallet for a Small Amount of Crypto?

This really comes down to what you’re comfortable with. If you only have an amount of crypto you wouldn't be crushed to lose, a reputable software (hot) wallet might be just fine. They’re convenient for small, active balances.

However, once your portfolio grows to a value that’s significant to you, a hardware wallet becomes one of the smartest investments you can make for your own peace of mind. Many people start with a hot wallet and upgrade to cold storage as their holdings grow. If you have more questions, our detailed vTrader FAQ page has additional guidance.

Is It Difficult to Set Up and Use a Cold Wallet?

It can definitely seem intimidating from the outside, but modern hardware wallets are designed to be surprisingly user-friendly. The initial setup usually only takes about 15-20 minutes.

The device walks you through every step, from creating a strong PIN to, most importantly, writing down your seed phrase. When it comes to making a transaction, you just add one simple step: physically checking the details on the device’s screen before you approve it. Most people find that after doing it once or twice, the whole process feels completely natural.

Ready to trade with confidence and zero fees? vTrader offers a secure, commission-free platform for over 30 cryptocurrencies, complete with advanced tools and a rich learning ecosystem. Join today and take control of your financial future. Start trading for free at vTrader.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.