A stop limit order is a sophisticated trading command that essentially provides a two-step safety net for your trades. It cleverly combines a 'stop' price, which acts as a trigger, with a 'limit' price, which sets the absolute price boundary for your order. This two-part instruction gives you far more precision than a standard market or stop-loss order.

What Is a Stop Limit Order in Simple Terms

Think of it like setting an alert for an online sale you've been eyeing. You tell yourself, "If this item's price drops to $100 (the stop price), I’ll try to buy it, but I absolutely refuse to pay more than $102 (the limit price)."

In this scenario, the $100 price tag is just the trigger that gets you to act. The $102 is your hard ceiling, protecting you from overpaying if a sudden buying frenzy pushes the price up.

This trading tool merges a stop order with a limit order, handing you enhanced control over when and how your trade executes. While the concept has been around, it became widely accessible to everyday traders with the boom of electronic trading platforms in the early 2000s, ushering in a new era of risk management.

A stop limit order essentially tells your trading platform: "Wait for a specific trigger price to be hit, and only then place a limit order to buy or sell at my chosen price or better."

To really make this click, let's pull apart the two key components that make this order type work.

The Two Parts of a Stop Limit Order

To truly master this order type, you have to understand how the stop and limit prices work in tandem. Each one has a very distinct job to do in the trade execution process. For real-time market insights that can help you set these prices more effectively, be sure to check the latest updates on the vTrader news hub.

Here's a simple breakdown of the two core elements of a stop limit order.

The Two Parts of a Stop Limit Order

| Component | Function | Analogy |

|---|---|---|

| Stop Price | The trigger that activates your limit order. Nothing happens until the market reaches this price. | The sale alert you set on a product. |

| Limit Price | The specific price (or better) at which you're willing to buy or sell. This is your price boundary. | Your absolute maximum budget for that sale item. |

In short, the stop price gets your order in the game, and the limit price dictates the rules it has to play by.

How Stop Limit Orders Actually Work Step by Step

To really get a feel for what a stop limit order is, you have to see it in a real-world trading scenario. The best way to think about it is as a two-part instruction you hand over to the exchange. First, you name a trigger price. Second, you set your ultimate price limit. Nothing happens until both of those conditions are met, one after the other.

Let’s walk through this with a concrete example using Bitcoin (BTC). We’ll look at both how to use it to get into a trade and how to use it to protect one you already have.

The Buy Stop Limit Order in Action

Let’s say Bitcoin is trading at $68,000. You’ve done your analysis and believe that if BTC can just push past the $70,000 resistance level, it’s going to keep climbing. The problem? You don't want to get caught buying at the very top of a flash spike that immediately collapses.

This is where a buy stop limit order comes in. Here’s how you’d set it up:

-

Stop Price (The Trigger): You set your stop price just above the resistance at $70,100. This is the magic number. Your order is essentially asleep, completely invisible to the market, until the price of Bitcoin hits this mark.

-

Limit Price (The Boundary): Next, you set your limit price at $70,300. This is the absolute highest price you’re willing to pay for one Bitcoin. No exceptions.

So, once the market price for BTC climbs and touches $70,100, your limit order to buy at $70,300 or lower instantly gets placed on the order book. If sellers are offering BTC at or below $70,300, your order will start to fill. But if the price shoots straight past $70,300 in a flash, your order just sits there, unfilled, protecting you from overpaying in a frenzy.

Key Insight: Think of it like this: the stop price is the green light that says "Go!" The limit price is your safety net, making sure you don't chase the price higher than you're comfortable with.

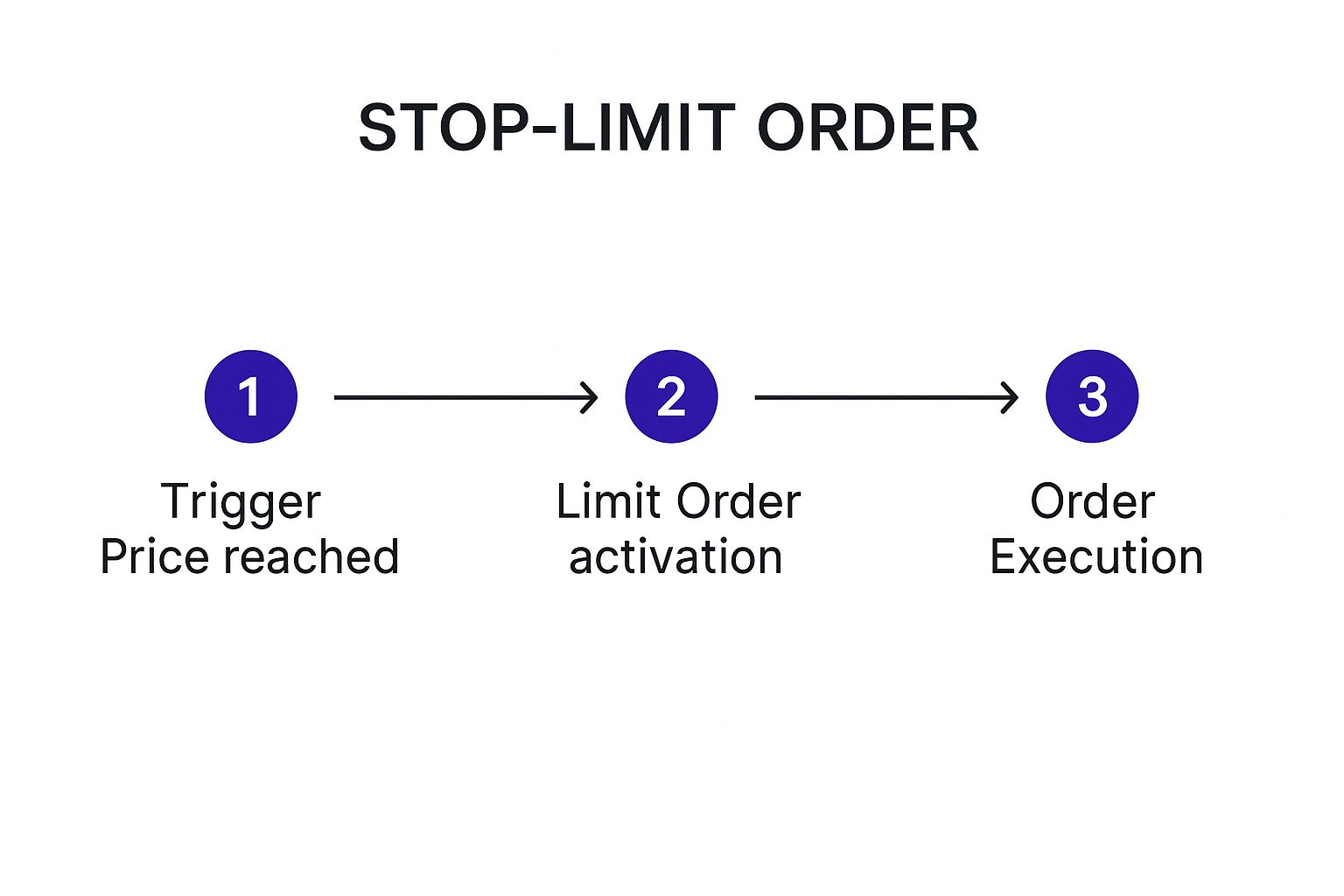

This visual breaks down how the process flows from the initial trigger to the final execution.

This simple trigger-activation-execution sequence is the heart of every single stop limit order.

The Sell Stop Limit Order for Protection

Now, let's flip the script. You already own Bitcoin and want to lock in your profits. The mechanics are the same, just in reverse—a two-price system to get you out of a trade.

Imagine you bought BTC at $65,000, and it's now trading comfortably at $72,000. You want to protect those gains from a sudden drop.

Here’s the setup:

- Current BTC Price: $72,000

- Your Stop Price: $71,000 (If the price falls to this level, you want to start selling).

- Your Limit Price: $70,900 (This is the absolute lowest price you’re willing to accept for your BTC).

If the market starts to turn and the price dips to $71,000, your limit order to sell at $70,900 or higher is immediately placed. This setup is crucial because it ensures that even in a chaotic, fast-moving drop, you won't get stuck with a fill price far below your intended exit point.

Mastering these concepts is fundamental for any serious trader. You can always sharpen your skills and explore more advanced strategies with the resources in the vTrader Academy.

Applying Stop Limit Orders in Real Crypto Scenarios

It’s one thing to understand a concept in theory, but putting it to work in the real world is where a trader’s skill is really put to the test. The crypto market moves at lightning speed, demanding more than just knowing definitions—it’s about using tools like the stop-limit order with surgical precision.

Let’s walk through two common scenarios you’ll almost certainly encounter. These examples break down not just how to set the order, but more importantly, why you'd choose those specific price points. Getting the logic right is the key to making these strategies your own.

Scenario 1: Protecting Profits on a Volatile Altcoin

Imagine you got into a promising altcoin, which we’ll call NovaToken (NVT), at $1.50. After a huge project announcement, the price shot up to $4.00. You're sitting on a nice pile of gains, but you know NVT is a rollercoaster and could drop just as fast as it climbed.

Your goal here is to lock in those profits without getting shaken out by a minor dip that could just be a temporary blip before the next leg up. A sell stop-limit order is the perfect tool for this.

Here’s how you could set it up:

- Current Price: $4.00

- Stop Price (The Trigger): $3.60. This price is set below the current price but still above any obvious support levels. If NVT falls to $3.60, it could signal the rally is losing steam, triggering your order.

- Limit Price (The Safety Net): $3.55. This is the absolute lowest price you’re willing to sell for. By setting it just below the stop price, you create a small cushion that increases the chance of your order getting filled in a rapidly falling market.

Strategic Insight: That gap between your stop and limit price is critical. A $0.05 gap in this case gives the order a reasonable range to execute. If you set it too tight (like a $3.60 stop and a $3.599 limit), your order might get skipped entirely during a sharp nosedive.

With this setup, you can let your investment ride any further gains while having an automated exit plan ready to spring into action if the trend reverses.

Scenario 2: Entering a Strategic Breakout

Now, let's flip the script and look at entering a new position. Let's say Ethereum (ETH) is trading at $3,800, lingering just under a major resistance level at $3,850 that it has failed to break several times. You believe that if it finally smashes through that ceiling, a powerful rally is on the other side.

You want to buy ETH the moment it breaks out, but you don't want to chase the price and get stuck overpaying if it turns out to be a fakeout spike. A buy stop-limit order gives you the control you need.

Here’s the game plan for your entry:

- Stop Price (The Trigger): You'd set this just above the resistance at $3,860. Once ETH hits this price, it serves as confirmation of the breakout, activating your limit order to buy.

- Limit Price (Your Ceiling): You set your limit price at $3,880. This is the absolute maximum you're willing to pay for your ETH.

This configuration ensures your buy order is only placed after the breakout seems confirmed. If the price skyrockets straight past $3,880 in a flash, your order won't fill, protecting you from buying at an over-inflated peak. Knowing how these orders work on different platforms is also vital, especially when you’re using decentralized exchange aggregators like KyberSwap.

The Pros and Cons of Using Stop Limit Orders

Like any tool in a trader's kit, the stop limit order has its moments to shine and its potential pitfalls. Getting a handle on this balance is the key to using it well. After all, no single order type is perfect for every market swing, and knowing the trade-offs will help you decide when it’s your best friend and when another approach makes more sense.

Let’s first break down the advantages and see how this order can give you a real edge in managing your trades.

The Key Benefits of Stop Limit Orders

The biggest win for the stop limit order comes down to one word: precision. It hands you the reins, giving you explicit control over the price you’re willing to pay or accept. This is a massive advantage in volatile crypto markets where prices can whipsaw in seconds.

Here’s where it really helps:

- Pinpoint Price Control: You get to define the exact price (or a better one) that you'll accept. This is your line in the sand, preventing you from accidentally buying way higher than you wanted or selling for far less. That’s a common nightmare with simple stop-loss market orders.

- Dodging Slippage: Slippage is that frustrating gap between the price you expected and the price you actually got. In a market that’s moving at lightning speed, a standard stop-loss can trigger and fill at a price that leaves a serious dent in your capital. A stop limit order’s price boundary is your defense against this.

- Set-It-and-Forget-It Strategy: You can map out your entry and exit points ahead of time and just walk away. This takes the emotion out of the equation and lets your trading plan run on autopilot, even when you're not glued to the charts.

This degree of control is precisely why these orders are so popular for risk management. In fact, market studies often show that 20-30% of retail investor trades on major exchanges use some form of stop or stop limit order, especially when things get choppy. It’s a statistically proven tool for helping traders sidestep unintended losses.

Key Takeaway: At its core, the stop limit order is your shield against bad prices. It ensures you don't overpay when buying into a spike or get a terrible fill when exiting a position during a market panic.

The Main Drawback You Must Consider

For all its strengths, the stop limit order has one major catch you absolutely need to be aware of: your order might never get filled.

This is the fundamental trade-off. A regular stop-loss (which turns into a market order) guarantees you'll get out of your position, but it could be at any price the market offers. A stop limit order guarantees your price, but it doesn't guarantee the trade will execute at all.

Picture this: you set a sell stop limit with a stop price of $50 and a limit price of $49. Suddenly, major news hits, and the market gaps down violently, jumping from $50.01 straight to $48.50. Your stop at $50 gets triggered, but since the price is already well below your $49 limit, your sell order just sits there, unfilled. You're now stuck holding the bag as the price keeps dropping.

On platforms like vTrader, it’s crucial to remember that while there are no trading commissions, managing your execution risk is a key part of your overall cost strategy. You can see more on the cost structure by reviewing the vTrader fee schedule.

This risk of non-execution makes the stop limit order a poor choice for those "get me out now" moments where exiting the position, no matter the price, is the only thing that matters.

How to Place a Stop Limit Order on vTrader

Alright, let's move from theory to action. This is where you really start to get a feel for things. I'll walk you through setting up your first stop limit order on vTrader, step by step.

The platform is designed to be pretty intuitive, making a complex-sounding order feel straightforward once you know your way around.

Setting Up Your Order Step by Step

Placing a stop limit order really just comes down to filling in three key fields. Getting these right is everything—it’s what ensures your trade goes off exactly how you mapped it out.

Let's break it down.

-

Find the Trading Panel: First, head to the crypto trading pair you're interested in, like BTC/USD. You'll see the order entry box. Click the dropdown menu, which probably says 'Limit' or 'Market' by default, and pick 'Stop-Limit'.

-

Enter Your Stop Price: This is your trigger. In the 'Stop' field, you’ll put the price that activates your limit order. If you're selling, this price will be below the current market price. If you're buying, it will be above.

-

Set Your Limit Price: This is your line in the sand. In the 'Limit' field, type in the exact price you’re willing to trade at once your stop price gets hit. It’s the absolute maximum you'll pay to buy or the minimum you'll accept to sell.

-

Define the Amount: In the 'Amount' field, just specify how much crypto you want to buy or sell. vTrader often includes a handy percentage slider (25%, 50%, etc.) to make this quick.

-

Review and Go: Give those three numbers—Stop, Limit, and Amount—one final look. If everything lines up with your plan, hit the 'Buy' or 'Sell' button to get the order on the books.

Pro Tip: Before you lock in your limit price, take a quick glance at the vTrader order book. It shows you all the live buy and sell orders. Placing your limit price near a level with lots of existing orders (high liquidity) can give your trade a better shot at getting filled.

The screenshot above shows you exactly what the vTrader interface looks like with the 'Stop-Limit' order type ready to go, highlighting the fields we just discussed.

Having this visual makes it crystal clear where your Stop, Limit, and Amount values go, so you can follow along without any guesswork. The platform's focus on a user-friendly design is a big part of its mission, which you can read more about if you check out the details on the vTrader platform.

With this guide, you now have the practical know-how to add this powerful tool to your trading arsenal.

Common Mistakes Traders Make with Stop Limit Orders

A stop limit order can be a trader’s best friend, offering surgical precision in a volatile market. But get it wrong, and it can quickly become a source of major headaches. Knowing the common pitfalls is the first step to making sure this powerful tool works for you, not against you.

One of the most frequent slip-ups is setting the stop and limit prices too close together. It might feel like you’re tightening your control and minimizing slippage, but in reality, you’re just upping the odds that your order never gets filled. Prices in a fast-moving market don't always move in a neat, orderly line; they often jump.

Critical Insight: If a sudden price spike or dip leaps right past both your stop and limit levels in one go, your order gets triggered but won’t execute. You’re left on the sidelines, completely exposed, which is arguably the worst-case scenario.

Placing Stops Too Tight

Another classic blunder is placing your stop price too close to the current action. This is a recipe for disaster in crypto, where small, meaningless price wiggles are the norm. Setting your stop just a few cents or dollars away from the live price is a great way to get "stopped out" of a trade that was otherwise perfectly sound.

You’ll be forced to watch as a minor dip triggers your sale, only for the price to rebound and head right where you thought it would. The fix? Take a look at the asset’s recent volatility and give your trade enough breathing room to ride out the normal market noise.

Forgetting About Open Orders

Finally, a surprisingly common mistake is the "set it and forget it" approach. Traders get busy and leave old orders sitting on the books. A stop limit order that was perfectly logical yesterday could be totally out of sync with today’s market conditions. Forgetting to cancel or adjust these legacy orders can lead to surprise trades that have no place in your current strategy.

To sidestep these costly but avoidable blunders, here’s what to do:

- Create a reasonable gap: Make sure there's enough space between your stop and limit prices to absorb sudden moves and give your order a fighting chance to get filled.

- Analyze volatility: Use tools like the Average True Range (ATR) indicator on your charts. This helps you set a stop that respects the asset's typical price swings, not just random fluctuations.

- Regularly review open orders: Get into the habit of checking your open orders at the start of every trading session. If an order no longer fits your plan, cancel it. No exceptions.

Frequently Asked Questions About Stop Limit Orders

Even when you feel like you've got the hang of stop limit orders, putting them into practice in a live market can bring up new questions. It's totally normal. Here are some quick, straightforward answers to the issues traders run into most often.

Whats the Difference Between a Stop Loss and a Stop Limit Order

This is a big one, and the distinction is crucial. The key difference is what happens after your trigger price gets hit.

A stop-loss order immediately becomes a market order. It’s built for speed and certainty of exit, firing off to sell at the next available price. The downside? You can get hit with slippage if the market is moving fast. A stop limit order, on the other hand, becomes a limit order. This gives you control, ensuring your trade only goes through at your specified price or better. It protects you from a bad fill but comes with the risk that your order might not execute at all if the price blows past your limit.

Can My Stop Limit Order Be Partially Filled

Absolutely, and it happens more often than you might think. A partial fill occurs when there isn't enough market depth—meaning not enough buyers or sellers—to fill your entire order at your limit price.

Imagine you want to sell 10 ETH, but at your limit price, there are only buyers for 4 ETH. In that case, only 4 ETH will be sold. The rest of your order for the remaining 6 ETH stays open on the books, waiting for the price to return so it can be filled, or until you decide to cancel it.

Key Insight: A partial fill is a classic reminder of how linked your order is to the market's liquidity. The more buyers and sellers on the order book (deeper liquidity), the better your chances of getting a full, clean execution.

How Long Does a Stop Limit Order Last

How long your order stays active all comes down to the Time in Force (TIF) setting you choose when placing it.

By far the most common option is Good 'til Canceled (GTC). Just like the name implies, this keeps your order on the books indefinitely until one of two things happens: it gets filled, or you manually cancel it. This is the default setting on many exchanges, including vTrader. If you're ever unsure about order settings, it's always smart to check the platform’s help center. For more detailed answers, you can dive into the comprehensive vTrader FAQ section.

Ready to trade with precision and without commissions? Join vTrader today and get a $10 sign-up bonus to start building your portfolio with advanced, fee-free tools. https://www.vtrader.io

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.