When you're trading crypto, you've got a couple of ways to enter the market. The most common is the market order, which is like walking up to a stall and buying a piece of fruit at whatever the listed price is—instant, simple, done. But what if you think that price is a little high and you're willing to wait for a better deal?

That's where a limit buy order comes in.

It's an instruction you give the exchange to buy a crypto asset, but only at a specific price you set or lower. Instead of buying immediately at the current market rate, you decide the maximum you're willing to pay, giving you complete control over your entry point.

What Is a Limit Buy Order Anyway?

Think of it like bidding at an auction. You could get caught up in the heat of the moment, bidding higher and higher, and end up overpaying. Or, you could decide beforehand the absolute maximum price you're willing to spend and stick to it. A limit buy order is your way of doing just that in the crypto markets.

You're essentially telling the exchange, "I want to buy this coin, but only if the price drops to my level."

When you place a limit buy order, it doesn't execute right away. It sits in the exchange's "order book"—a live, digital list of all buy and sell orders for a particular asset. Your order just waits patiently in the queue until the market price of the crypto drops to your specified limit price. If it hits your price, your order gets filled. If it never drops that low, your order never executes.

This strategic patience is the key difference that separates a limit order from a market order. For a quick breakdown, here’s how they stack up against each other.

Limit Buy Order vs Market Buy Order at a Glance

| Feature | Limit Buy Order | Market Buy Order |

|---|---|---|

| Execution Price | Guaranteed at your set price or better. | Executes at the best available current market price. |

| Execution Speed | May take time or not execute at all. | Instant execution. |

| Trader Control | You control the maximum price you pay. | You have no control over the exact price. |

Ultimately, the choice between them comes down to your strategy: do you prioritize speed or price? A market order gets you in the game immediately, while a limit order ensures you don't overpay for your entry.

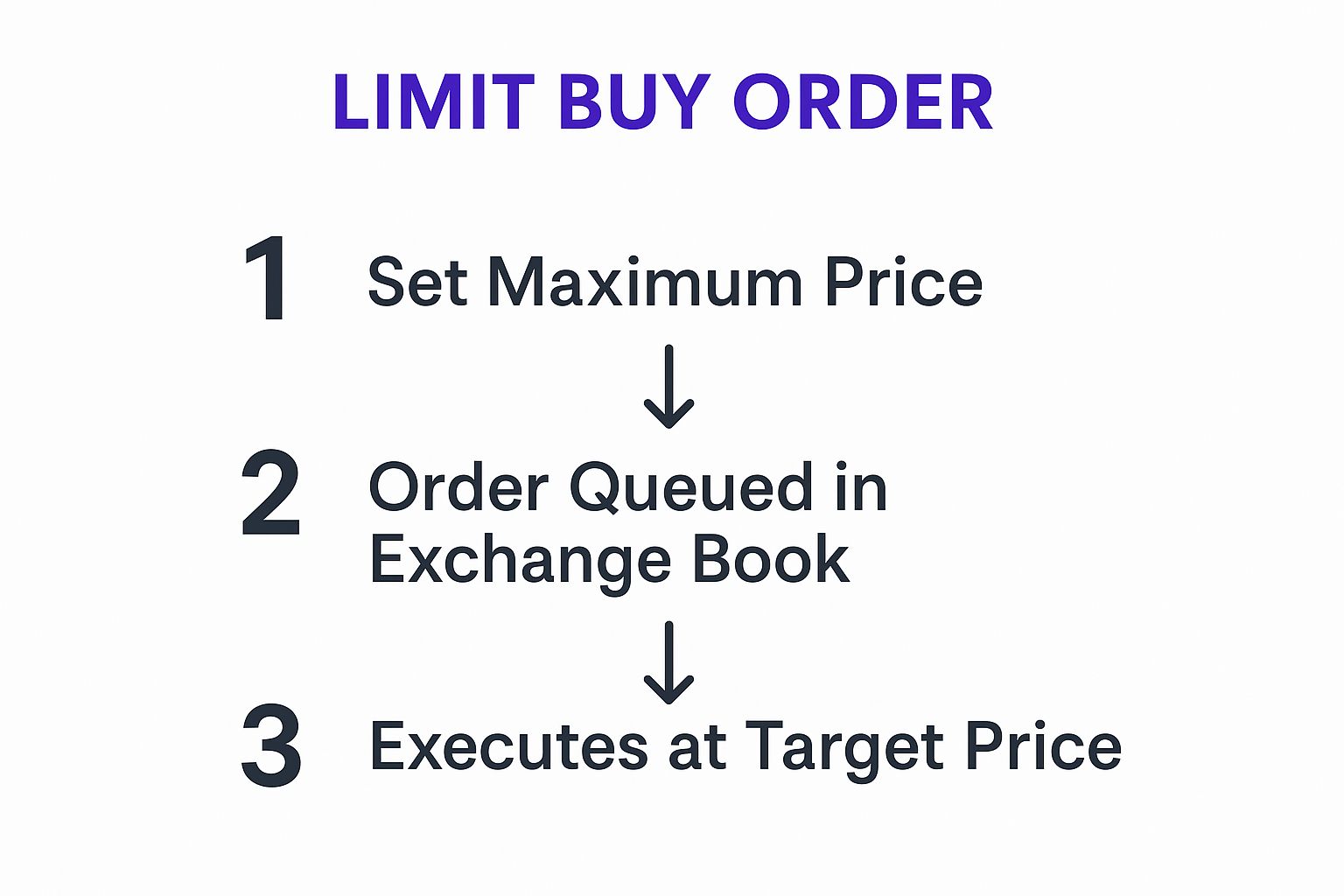

The infographic below really nails down the simple, three-step flow of how a limit order works from the moment you place it.

As you can see, you define your price, the order waits, and it only triggers when the market comes to you. This is what gives traders discipline and control.

Mastering fundamental concepts like this is key to building a solid trading approach. To go deeper on other essential skills, check out the vTrader Academy.

How Limit Buy Orders Actually Work

When you set a limit buy order, it doesn't just fire off into the market and execute right away. Instead, it gets added to a digital queue called the order book, which is basically the heart of any crypto exchange.

Think of the order book as a bustling marketplace ledger, split into two sides. On one side, you have the "bids"—all the traders lined up saying, "I'm willing to buy at this price." Your limit order joins this line. On the other side, you have the "asks," which are all the sellers declaring, "I'm willing to sell at this price."

Your order patiently waits in the bid line. For your trade to actually happen, the market has to move in your favor. The lowest seller's price (the "ask") must drop down to meet the price you set. The moment a seller is ready to offload their crypto at your price, the exchange plays matchmaker and your trade goes through.

The Lifecycle of Your Order

This whole process plays out within a 'price window'—the small gap between the highest bid and the lowest ask where trades are actively happening. If you place a buy order below the current highest bid, you’re simply getting in line, waiting for the market to come to you. You can dive deeper into the mechanics of limit order markets from this research.

Understanding this lifecycle is key, because it highlights two make-or-break outcomes you need to be ready for.

A limit buy order is just an instruction to trade if, and only if, your conditions are met. Because there's no guarantee the market will meet them, your trade might not go exactly as planned.

Here's what can happen:

- Partial Fill: Sometimes, there just isn't enough crypto available at your limit price to fill your entire order at once. Imagine you want to buy 10 ETH at $3,000, but only 4 ETH are being sold at that price. The exchange will fill that part of your order, and the rest of your order for 6 ETH stays open, waiting for more sellers to show up.

- Non-Execution: This is the big one. If the crypto's price never drops to your limit price, your order will never execute. It will just sit there—open and unfilled—until you either cancel it or it expires. You could end up missing a major market move if you set your target too low and the price skyrockets away from you.

When Should You Use a Limit Buy Order?

Knowing what a limit order is and knowing when to actually use one are two different things. Real trading skill comes from knowing exactly when to pull this tool out of your bag. This order type is perfect for the patient, strategic trader who prefers to execute a thought-out plan rather than just react to market chaos.

It’s all about setting your entry price based on solid analysis, not gut feelings or FOMO. Many traders use limit buy orders to snag an asset precisely when it hits a level they’ve identified, which lines up with their understanding of price targets.

To Capitalize on Dips

One of the most common and powerful ways to use a limit order is to "buy the dip." Instead of being chained to your screen waiting for a price drop, you can identify a key support level where you believe an asset is a bargain and just set your limit buy order there.

If the market takes a temporary dive and tags your price, your order gets filled automatically. This simple trick lets you take advantage of volatility without having to monitor the charts 24/7.

Pro Tip: Try setting your limit order just a fraction above a major support level. This can give you an edge, increasing the odds of your order getting filled since tons of other traders often place their orders right on that exact psychological number.

To Enter Volatile or Illiquid Markets

Jumping into markets with low trading volume or wild price swings using a market order is asking for trouble. You’re opening yourself up to price slippage—that frustrating gap between the price you thought you’d get and the price you actually paid.

A limit buy order sidesteps this risk entirely. It puts a hard ceiling on your entry price, making it a much safer way to build a position in a thinly-traded altcoin or during a market frenzy where prices are swinging violently by the second. At the end of the day, it guarantees you never overpay.

The Strategic Edge of Using Limit Buy Orders

Seasoned traders lean heavily on limit buy orders for a reason, and it goes far beyond just getting a decent price on an asset. The single biggest advantage is having absolute price control. When you set your maximum purchase price, you draw a line in the sand. You’re guaranteeing you'll never overpay, which is a lifesaver during sudden price spikes or when the market gets choppy.

This control is really the foundation of smart trading. Instead of just reacting to the market's whims, you're executing a strategy you've already thought through. To really round out your game plan, it's not just about setting your entry points; you also need to understand crucial risk management tools like stop-loss orders to protect your capital when a trade goes south.

Forging Trading Discipline

Using a limit buy order forces you to be disciplined. There’s no room for impulse buys. It makes you do the research, figure out a logical entry point, and stick to it—a fantastic defense against emotional decisions driven by hype or the dreaded fear of missing out (FOMO). This methodical approach is what builds healthier, more sustainable trading habits over the long haul.

And this isn't just some niche tactic; it’s a core strategy for many. Data from the US equity markets shows that limit orders account for roughly 25.5% of all retail orders. Why? Because traders are actively using them to manage their costs and dodge paying a premium when volatility kicks in. Read the full research about retail order types.

When you set a limit buy order, you're not just placing a trade. You're making a calculated statement about what you believe an asset is worth based on your own analysis and risk appetite.

Playing a Part in Market Health

Looking at the bigger picture, every limit order you place actually helps the market. Your order gets added to the order book, creating liquidity by giving a seller an opportunity to make a trade. This collective depth of buy and sell orders is what helps create a more stable and efficient market for everyone.

It might feel like a small action, but your single order contributes to a healthier overall trading environment. Plus, understanding how different order types affect your bottom line is key—taking a look at our guide to vTrader fees can help you see how it all fits together.

How to Place a Limit Buy Order on vTrader

Alright, you get the theory behind a limit buy order. Now, let’s get our hands dirty and actually set one up. Putting one into action on the vTrader crypto exchange is a breeze, designed to give you pinpoint control over your trades.

First things first, log into your account and pull up the main trading dashboard. This is your command center, where all the market analysis and trade execution happens.

Finding and Setting Up Your Order

Once you’re on the trading screen, you’ll spot a dedicated order panel. This is where the magic happens. Everything you need to input the specifics for your trade is right there, clean and simple.

Here’s a quick look at the vTrader interface where you’ll be building your order.

As you can see, the key fields are all laid out: picking your crypto, choosing the order type, and punching in your price and amount.

Just follow these steps to get your order on the books:

- Select Your Asset: Over on the top left of the trading panel, pick the cryptocurrency you’re looking to buy (like Bitcoin or Ethereum).

- Choose 'Limit Order': Right below the asset selection, you'll see a few order types. Go ahead and click on ‘Limit’. This will bring up the right interface.

- Set Your Limit Price: This is the most crucial part. In the ‘Limit Price’ field, type in the absolute maximum price you're willing to pay for each coin. The system won't fill your order unless the market price hits your target—or drops even lower.

- Enter the Amount: In the ‘Amount’ field, decide how much of the crypto you want to buy. You can also just use the slider to select a percentage of your available balance, which is pretty handy.

Quick tip: Always, and I mean always, double-check your numbers before you confirm. A single misplaced decimal in your limit price can mean the difference between a great entry and a completely missed trade. Precision is key.

After you've filled everything out, you'll see a quick summary of your order, including the total estimated cost. Give it one last look-over. If it all looks good, hit that ‘Buy’ button.

Just like that, your order is live. You'll find it sitting in your ‘Open Orders’ tab, waiting patiently for the market to come to you.

Common Mistakes to Avoid with Limit Buy Orders

Nailing a limit buy order is a game of precision, not just patience. While this tool gives you incredible control over your entry price, a few common traps can easily throw off your strategy, leading to missed opportunities or unexpected buys. Sidestepping these pitfalls is the key to making limit orders work for you, not against you.

One of the biggest blunders traders make is setting their limit price way too low. Everyone loves a bargain, but placing your bid far below the current market action is a surefire way to get left behind. The market could easily reverse and rally, leaving your order unfilled and you on the sidelines.

Another classic mistake is "chasing the market." This happens when an asset's price starts to climb, and a trader keeps canceling and raising their limit order to try and catch the moving train. This reactive approach completely defeats the purpose of a disciplined strategy and often ends with you entering at a poor price driven by emotion, not analysis.

Forgetting About Old Orders

It’s surprisingly easy to set a limit buy for some obscure altcoin and then completely forget about it. This can be a ticking time bomb. Weeks or months down the line, a sudden market crash could trigger that forgotten order, buying an asset for you under market conditions you never intended.

Always maintain a clean house. Get in the habit of regularly reviewing your open orders to make sure they still align with your current trading strategy and market outlook. A forgotten order is a risk you don't need to take.

Here are a few actionable best practices to keep in your back pocket:

- Set Realistic Prices: Don't just pick a number out of thin air. Base your limit price on solid technical analysis, like key support levels.

- Use Alerts: Set a price alert just a little bit above your limit price. This acts as an early warning system, giving you a chance to re-evaluate the trade before it executes.

- Manage Transaction Costs: On networks like Ethereum where gas fees can get wild, you have to factor in network costs. Using a tool like our real-time ETH gas tracker can help you avoid nasty surprises and make smarter decisions.

Limit Order Questions Answered

If you're just getting started with limit buy orders, you probably have a few questions. Let's tackle some of the most common ones traders ask.

What Happens If My Order Never Fills?

This is a classic scenario. If the price of a crypto never drops to your limit price, your order just sits there, open and unfilled.

It'll stay in the exchange’s order book, waiting patiently. You can either cancel it manually, or it will eventually expire if a specific timeframe was set. This usually happens when you set a target price that’s a bit too ambitious or too far below the current market action.

Can a Limit Buy Order Be Partially Filled?

Absolutely, and it happens all the time. A partial fill occurs when there just isn't enough crypto being sold at your target price to fill your entire order at once.

For example, say you want to buy 10 ETH, but only 4 ETH are up for grabs at your price. The exchange will snap up those four for you, leaving the rest of your order open until more sellers come along who are willing to meet your price.

A limit buy order guarantees your price, but it never guarantees execution. You're trading the certainty of getting into the market immediately for the power to name your price.

When Should I Just Use a Market Order Instead?

While limit orders give you pinpoint control, a market order is your best friend when speed is the name of the game.

If you're watching a fast-moving market and absolutely have to get into a position right now to catch a breakout, a market order is the right tool for the job. It buys instantly at the best available price, so you don't risk missing the boat entirely while waiting for your limit price to hit.

For more answers to your trading questions, you can always explore our comprehensive vTrader FAQ page.

Ready to trade with precision and control? Join vTrader today and experience zero-fee trading on Bitcoin, Ethereum, and over 30 other cryptocurrencies. Sign up now and start building your portfolio.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.