If you're new to crypto, the difference between a "coin" and a "token" can be a bit fuzzy. It’s one of those fundamental concepts that trips a lot of people up, but it's actually pretty simple once you get the hang of it.

A crypto token isn’t its own currency system. Instead, it’s a digital asset that lives on top of an existing blockchain. Think of a blockchain like an entire country's financial system; a crypto token is like a stock certificate, a concert ticket, or a loyalty point that operates within that system. It's not the native money, but it represents something of value.

The Digital Vending Machine: A Token's True Role

To make this crystal clear, let's use an analogy.

Imagine a giant, fully automated digital vending machine. This machine is the blockchain—say, Ethereum. The machine needs its own internal currency (a coin, like Ether) to pay for electricity and keep itself running. But the interesting stuff is what's inside the machine.

Those items inside are the tokens. Each one does something different. One token might get you access to a piece of software. Another could represent your vote on a project's future. A third might be a rare digital trading card.

They all exist inside the vending machine, totally dependent on its security and programming to function. This setup is brilliant because it lets developers create all sorts of new digital assets without the insane cost and difficulty of building a whole new blockchain from scratch. For more on this, check out this a simple explanation of what a crypto token is.

What Makes a Token a Token?

So, what really sets these digital assets apart? Unlike native cryptocurrencies, tokens are defined by their relationship to an existing platform. At their core, they are digital contracts that play by a specific set of rules.

To give you a better idea, here's a quick summary of what defines a crypto token.

Crypto Tokens at a Glance

| Characteristic | Explanation |

|---|---|

| Built on Existing Blockchains | Tokens don't have their own native blockchain; they are issued on established networks like Ethereum, Solana, or BNB Chain. |

| Represents an Asset or Utility | A token's value is tied to what it represents—ownership, access rights, or a stake in an app (dApp). |

| Created via Smart Contracts | Developers deploy self-executing code called a "smart contract" on a blockchain to create, manage, and issue new tokens. |

| Interoperable within an Ecosystem | Tokens following a common standard (like Ethereum's ERC-20) can seamlessly interact with wallets, exchanges, and other dApps on that blockchain. |

This ease of creation has kicked off an explosion of digital assets. We now have thousands of different crypto coins and tokens out there, showing just how diverse the crypto world has become.

Here's a simple way to remember it: The blockchain is the operating system (like iOS or Android), and tokens are the apps that run on it. Each app has a different purpose, but they all need the OS to work.

Grasping this fundamental relationship is the first step to seeing the bigger picture. To get a better feel for the variety out there, you can explore different types of crypto assets in our other guides. Once you understand this distinction, you're well on your way to navigating the digital asset space with confidence.

Understanding Tokens vs Coins

One of the biggest hurdles for anyone new to crypto is getting a handle on the difference between a coin and a token. They often get used interchangeably, but they're fundamentally different beasts. Nail this concept, and you're already way ahead of the game.

The easiest way to think about it is by imagining a country's economy.

A crypto coin, like Bitcoin (BTC) or Ether (ETH), is the native currency of its own digital nation. Think of it as the U.S. Dollar or the Euro. It operates on its own blockchain—an independent financial system with its own rules, security, and way of processing transactions.

A crypto token, however, is like an asset that exists within that economy. It could be a stock in a company, a ticket to a concert, loyalty points from a coffee shop, or even the deed to a house. It doesn't run the whole system; it relies on the country's existing infrastructure to have any value or function.

The Foundation vs. The Building

Let's dig a little deeper into that idea. A coin and its blockchain are the foundation. The Bitcoin network, for instance, was custom-built from the ground up to do one thing really well: securely transfer its native coin, BTC, from one person to another. Its entire existence is about maintaining its own ledger, and miners get paid in BTC to keep it secure.

Tokens, on the other hand, are the buildings constructed on top of a ready-made foundation. They're created on programmable blockchains like Ethereum, which was designed to be a platform for developers. Instead of building a whole new blockchain from scratch for every single idea—a massive undertaking—developers can just build their apps on Ethereum and issue tokens to represent assets or actions within those apps.

Key Takeaway: Coins are the native currency of a blockchain. They power the network and keep it secure. Tokens are assets created by projects that piggyback on another blockchain’s infrastructure.

This isn't just a technicality; it has huge implications for how a digital asset is made, secured, and used.

Key Practical Differences

The core differences show up in everything from security to how you pay for transactions.

-

Security: Coins are protected by their own dedicated network of miners or validators who work to keep the blockchain honest. Tokens simply "inherit" the security of their host blockchain. A token on Ethereum is exactly as secure as the Ethereum network itself—no more, no less.

-

Transaction Fees: When you send Bitcoin, you pay the transaction fee (or "gas") in BTC. But if you want to send a token built on Ethereum, you have to pay the gas fee in Ether (ETH), not the token. The host blockchain's native coin is always the fuel needed to make anything happen on its network.

-

Development: Launching a new coin is a monumental task. It requires deep technical knowledge, a ton of resources, and the ability to attract a community to secure the new, independent blockchain. Creating a token, however, is far simpler thanks to established standards like Ethereum's ERC-20, which provides a plug-and-play template.

To make this crystal clear, let's put them side-by-side.

Coins vs Tokens: A Side-by-Side Comparison

This table breaks down the fundamental differences between the two.

| Feature | Crypto Coins (e.g., Bitcoin, Ethereum) | Crypto Tokens (e.g., UNI, LINK, SHIB) |

|---|---|---|

| Underlying Technology | Operate on their own independent, native blockchain. | Built on top of an existing blockchain platform. |

| Primary Purpose | Function as a store of value, medium of exchange, or to pay for network transaction fees. | Represent a specific asset, utility, or right within a particular application or project. |

| Creation Process | Created through complex processes like mining or staking that secure the network. | Issued through smart contracts deployed on a host blockchain. |

| Transaction Fees | Paid in the native coin itself (e.g., BTC pays for Bitcoin transactions). | Paid in the host blockchain's native coin (e.g., ETH pays for ERC-20 token transactions). |

Getting these distinctions right is crucial for making smart decisions in the crypto space. Knowing whether you're dealing with a coin or a token tells you a lot about its purpose, its dependencies, and its place in the digital economy.

If you're looking to build on this knowledge, the vTrader Academy has structured courses that help you master these core crypto concepts.

How Crypto Tokens Are Actually Made

Ever wonder how thousands of different tokens can pop up, each with its own specific job? It’s not magic. It’s a clever system built on smart contracts and shared rulebooks called token standards.

Instead of going through the incredibly expensive and complex process of building a new blockchain from the ground up, developers can launch new assets on top of established networks like Ethereum.

Think of a token standard as a universal blueprint. It’s a battle-tested template that lays out a set of rules every token of that type must follow. This guarantees that any new token created with this blueprint will instantly work with existing wallets, exchanges, and apps in that ecosystem.

This plug-and-play approach is why we see so much innovation in crypto. Teams can focus on their actual product or service without getting bogged down in the massive technical lift of creating and securing a new blockchain.

The Power of Token Standards

The most famous blueprint by far is Ethereum’s ERC-20 standard. It’s the foundation for the huge majority of tokens you’ve probably heard of. The standard is really just a checklist of functions that a smart contract needs to include to be considered a proper ERC-20 token.

These functions dictate a token's most basic behaviors, including:

- Total Supply: Defines how many tokens will ever exist.

- Balance Of: A way to check how many tokens a specific wallet address holds.

- Transfer: The core function for sending tokens from one address to another.

- Approve & TransferFrom: These allow a user to give another user (or a smart contract) permission to spend a certain number of their tokens.

When a developer launches an ERC-20 token, they're really just deploying a smart contract that follows all these rules. This ensures every ERC-20 token—whether for a gaming platform or a lending protocol—speaks the same technical language.

Key Insight: Token standards are like the USB port for crypto. Just as any USB device can plug into any USB port, any token following a standard can "plug into" any compatible wallet or dApp on its blockchain.

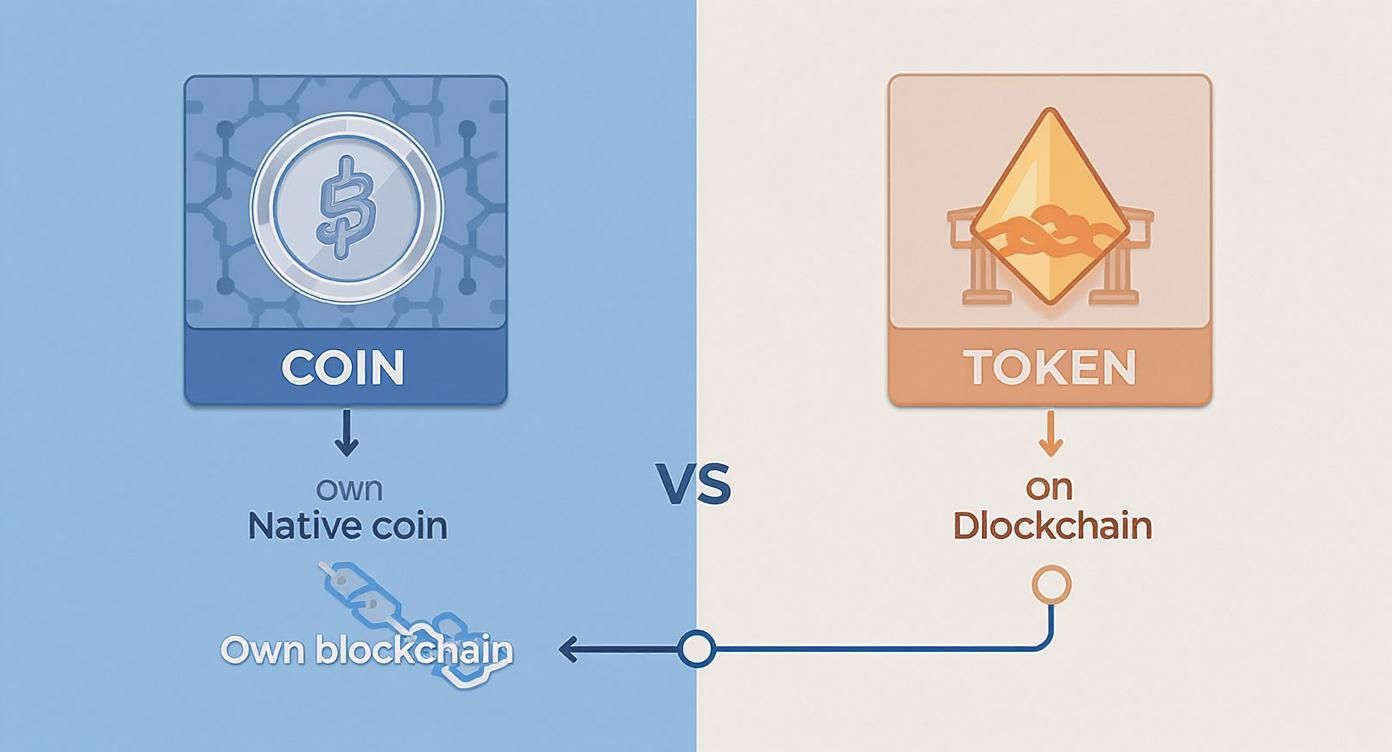

This infographic breaks down the core difference between a native coin running its own blockchain and a token built on top of an existing one.

As you can see, coins are the foundational layer. Tokens are the applications built on top of that foundation, which saves a massive amount of development time and effort.

Beyond the Basic Blueprint

While ERC-20 is the workhorse for fungible tokens (where each token is identical, like a dollar bill), other standards were created for different jobs. The most well-known is ERC-721, the standard that brought Non-Fungible Tokens (NFTs) to life.

Unlike ERC-20 tokens, every ERC-721 token is unique and can't be divided. This standard was designed to represent ownership of one-of-a-kind digital or physical items—think digital art, collectibles, or even a real estate deed.

The creation process is similar; it still involves deploying a smart contract. The difference is that the ERC-721 blueprint includes functions to track the specific owner of each unique token ID, making it perfect for proving authenticity and ownership history.

Ultimately, making a token comes down to a few steps: choose a blockchain, pick the right standard, define its details (like name and total supply), and deploy the smart contract. Once it's live, the token is permanently recorded on the blockchain, ready to be used. Since most tokens live on Ethereum, transaction costs are a factor; you can keep an eye on them with our real-time ETH gas tracker.

Exploring the Main Types of Crypto Tokens

The term "crypto token" is really just a catch-all for a huge variety of digital assets, and each one is designed for a specific job. Think of your physical wallet: it holds cash, credit cards, and maybe a driver's license. They're all different tools. A digital wallet is the same, holding tokens with completely different functions.

These assets are not one-size-fits-all. They’re specialized tools, purpose-built for distinct jobs inside a blockchain ecosystem. The global crypto market, which is made up of this wide range of tokens, has seen explosive growth and shows no signs of slowing down. In fact, some analysts predict the market could expand with a compound annual growth rate of over 17% in the years ahead. You can read the full research on cryptocurrency market growth to get into the details.

This growth is being fueled by the wildly different applications for tokens, which we can generally sort into four main categories.

Utility Tokens: The Keys to a Digital Kingdom

The most common type you'll run into is the utility token. The best way to think of it is like a digital key or an arcade token. Its main purpose isn't to be an investment; it's to grant you access to a product or service inside a specific crypto project.

For example, a decentralized cloud storage network might issue its own utility token that users have to spend to upload files. Or a blockchain game could have a token you need to buy in-game items or enter special events. The value of these tokens is directly wired to how much demand there is for the project's services. If more people want to use the platform, more people need the token, which naturally drives up its value.

- Function: To provide access to a service or product.

- Analogy: A pre-paid pass for a specific software or a ticket to enter a digital event.

- Example: Filecoin's token (FIL) is what you use to pay for decentralized data storage on its network.

Governance Tokens: A Voice in the Project

As decentralized projects get bigger, they need a way for the community to make decisions together. That's where governance tokens come into play. Holding these tokens gives you voting rights, which means you can help shape the future of a protocol or a decentralized autonomous organization (DAO).

It's a lot like being a shareholder in a traditional company. The more tokens you hold, the more weight your vote carries. Token holders can propose and vote on all sorts of things, like changing platform fees, deciding how to spend treasury funds, or approving upgrades to the code. This model pushes control away from a small central team and puts it directly into the hands of the community.

Key Concept: Governance tokens are the backbone of decentralization. They empower users to become active participants in a project's evolution, making sure its development actually aligns with what the community wants.

Security Tokens: Representing Real-World Ownership

Security tokens are the bridge connecting the traditional financial world to the blockchain. These are digital assets that represent ownership of a real-world, tradable asset—things like company equity, a piece of real estate, or even fine art. Because they represent ownership in an investment contract, they fall under federal securities regulations.

Imagine a huge commercial building being "tokenized." Instead of one person owning the whole thing, its ownership could be split into thousands of digital tokens. Each token would represent a tiny, legally recognized share of the building, giving the holder a right to a slice of the rental income. This process makes illiquid assets like real estate much more accessible to a wider pool of investors.

Non-Fungible Tokens: Certifying Unique Ownership

Finally, we have Non-Fungible Tokens (NFTs). While most tokens are "fungible"—meaning one is identical to another, just like a dollar bill is the same as any other dollar bill—each NFT is totally unique and can't be replaced. This makes them the perfect tool for proving ownership of one-of-a-kind items, whether they're digital or physical.

NFTs basically act as a digital certificate of authenticity that's permanently recorded on the blockchain. They got famous for representing digital art, but their uses go way beyond that.

- Digital Art and Collectibles: Proving you own a unique piece of digital art.

- Gaming: Representing unique in-game items, like a legendary sword or a character skin.

- Event Tickets: A unique ticket that's impossible to counterfeit.

- Digital Identity: A secure, verifiable form of personal ID.

Once you understand these core types, you start to see that the question "what is a crypto token?" has a lot of different answers. Each one is a tool designed for a specific purpose, from unlocking services and granting voting rights to representing real-world assets and proving something is one-of-a-kind.

Real-World Examples of Tokens in Action

Theory is one thing, but the real test is how technology works in the wild. Crypto tokens are no longer just abstract ideas; they're solving tangible problems in finance, art, gaming, and even global trade.

These aren't just small-scale experiments, either. We're talking about active ecosystems that handle massive value and are genuinely changing how entire industries operate. Tokens are unlocking new efficiencies, empowering communities, and creating forms of ownership that simply weren't possible before.

Reshaping Finance with DeFi Tokens

Decentralized Finance (DeFi) is probably the best-known example of tokenization at work. DeFi platforms leverage tokens to create an open financial system that cuts out traditional middlemen like banks and brokers.

Look at a protocol like Uniswap, a decentralized exchange that lets anyone swap tokens directly from their wallet. Its governance token, UNI, gives holders actual voting power over the platform's future. The community—not a corporate board—gets to decide on key upgrades and fee changes.

Lending platforms like Aave use a similar model. Users can deposit their crypto to earn interest or use it as collateral to borrow other assets. The platform's native token gives holders perks like lower fees and a voice in governance, which helps build a self-sustaining ecosystem.

Creating True Digital Ownership with NFTs

Non-Fungible Tokens (NFTs) have completely flipped the script on what it means to "own" something online. An NFT is basically an unbreakable digital certificate of authenticity and ownership, secured on the blockchain.

We’ve all seen this play out in the art world. Artists can now sell digital works directly to collectors and earn royalties on every future sale—a feature baked right into the token's smart contract. Projects like CryptoPunks and Bored Ape Yacht Club proved that NFTs could build entire communities around digital collectibles.

But this crypto token has applications far beyond just JPEGs:

- Gaming: In games like Axie Infinity, your in-game items—characters, land, gear—are NFTs. This means you truly own them and can freely buy, sell, or trade them on open markets.

- Ticketing: Event organizers can issue tickets as NFTs to kill counterfeiting and scalping, creating a far more secure and transparent system.

- Digital Identity: Imagine your college degree or professional certifications as an NFT. It becomes a secure, verifiable, and portable part of your digital identity.

Powering Global Trade and Remittances

Beyond the hype of DeFi and NFTs, tokens are quietly making global commerce a lot more efficient. Stablecoins like Tether (USDT) and USD Coin (USDC) have become absolute giants, processing enormous transaction volumes for cross-border payments. The latest data on global crypto adoption shows just how significant this trend has become.

By pegging their value to a stable asset like the U.S. dollar, stablecoins eliminate the price volatility common with other cryptocurrencies. This makes them an ideal medium for sending money across borders quickly and affordably, bypassing slow and expensive traditional banking networks.

Building Transparent and Efficient Systems

The utility of tokens also extends to solving complex logistical and organizational problems.

In supply chain management, a company can use tokens to represent physical goods moving from a factory to a store shelf. Every step is recorded on the blockchain, creating a transparent, tamper-proof record that verifies authenticity and fights fraud.

You also have Decentralized Autonomous Organizations (DAOs), which use governance tokens to run community-led groups without a top-down management structure. Members use their tokens to vote on everything from how to spend funds to which projects to approve, creating a truly democratic way to operate.

To stay on top of how these innovations are moving the markets, keep an eye on our crypto news and analysis hub.

How to Safely Navigate the World of Tokens

Diving into the world of crypto tokens is exciting, but this is one area where preparation is everything. The space is filled with incredible innovation, but it also comes with very real risks, from wild market swings to clever scams. Knowing how to protect yourself isn't just a good idea—it's essential.

The first step is to accept the risks for what they are. Token prices can pump or dump based on market hype, a single piece of news, or even a tweet. Beyond that, bad actors are always looking to launch flashy projects with zero substance, designed only to cash in on investor excitement. This is why “Do Your Own Research” (DYOR) is the number one rule in crypto.

Doing Your Own Research

Following hype trains or acting on tips from anonymous accounts is a recipe for getting burned. Instead, you need a methodical way to investigate a project, helping you cut through the noise and spot the red flags. Real research means digging into a project’s fundamentals.

Here are the key areas to focus on before putting any money into a token:

- The Whitepaper: This is the project's blueprint. It needs to clearly explain what problem it solves, how the technology actually works, and its tokenomics (the economic model of the token). A whitepaper that's vague, poorly written, or copied from another project is a giant red flag.

- The Team: Who’s steering the ship? Look for a team with real names and verifiable track records, like detailed LinkedIn profiles and relevant industry experience. Anonymous teams are a massive risk.

- Community and Communication: Jump into the project’s official channels like Discord, Telegram, and Twitter. A healthy project has an active community that discusses the tech and its progress, not just the price. The team should also be transparent and consistent with their updates.

Critical Takeaway: A legitimate project isn’t afraid of tough questions and will provide clear, verifiable information. If a project relies on vague promises, pressure tactics, or anonymous founders, treat it with extreme caution.

Practical Steps for Asset Protection

Beyond solid research, how you actually manage your assets is just as important. The tools you use to buy, sell, and store your tokens can be the difference between keeping them safe and losing them forever.

Start by using only reputable and regulated exchanges. These platforms invest heavily in security and follow compliance rules, giving you a baseline layer of protection. And always, always enable security features like Two-Factor Authentication (2FA) on your exchange accounts to block unauthorized access.

For any tokens you plan to hold long-term, get them off the exchange and into a secure digital wallet where you control the private keys. Hardware wallets, which keep your keys offline, are considered the gold standard for security. This applies when you explore earning opportunities, too; for instance, participating in crypto staking safely requires you to manage your assets securely. You can learn more by reading our complete guide on what crypto staking is and how it works.

By taking these deliberate steps, you can explore the token ecosystem with confidence while keeping common risks at bay.

Frequently Asked Questions About Crypto Tokens

Let's clear up a few common questions that tend to hang around, even after you've got the basics down. These are the details that often trip people up.

Can a Crypto Token Become a Coin?

Absolutely. In fact, it's a pretty common path for successful crypto projects.

A team might start with a token on a battle-tested blockchain like Ethereum. This lets them build a community and prove their concept without the massive cost and complexity of launching their own network from scratch.

If the project takes off, they can eventually build and launch their own independent blockchain—what's known as a mainnet. At that point, the original tokens are swapped for new, native coins that run the new chain. The most famous example is Binance Coin (BNB), which began life as an ERC-20 token before migrating to its own BNB Chain.

Are All Tokens Meant to Be Valuable Investments?

Not at all. While the market loves to speculate on token prices, many are built for pure function, not financial gain. For these tokens, their real "value" is their utility.

Think of it like this: a token might represent a vote in a project's future or act as an access pass to a service. Its job is to be used inside its ecosystem. That use case doesn't always translate to a high price on the open market. A token's value is always tied directly to its purpose and the demand for that purpose.

How Can I Tell Which Blockchain a Token Uses?

This is actually pretty easy to check.

Just head over to major crypto data sites like CoinGecko or CoinMarketCap. Look up the token you're interested in, and you'll find a "Contract" address listed in its details.

That address is your golden ticket. It will usually link straight to a blockchain explorer—like Etherscan for Ethereum-based tokens or BscScan for those on the BNB Chain. This confirms which blockchain it lives on and gives you a transparent, permanent record of every transaction it has ever been a part of.

Ready to explore the world of tokens with zero trading fees? At vTrader, you can buy, sell, and manage your assets with advanced tools and state-of-the-art security. Start your journey today at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.