In the wild world of crypto, you've probably heard traders buzzing about "bull runs." But what exactly does that mean? Put simply, a crypto bull run is when the market goes on a hot streak. It’s a prolonged period where prices for major digital assets like Bitcoin and Ethereum don't just inch up—they charge forward with serious momentum.

This isn't just a couple of good days. We're talking about a wave of market-wide optimism, strong buying pressure, and infectious investor confidence that can stretch on for months.

Decoding the Crypto Bull Run

Think of it like a snowball rolling down a hill. It starts small, with a few early, clued-in investors noticing a shift. But as it gathers speed, more and more snow sticks to it. That’s a bull run. Early investors create a buzz, and soon, driven by positive news, exciting tech updates, and a healthy dose of FOMO (fear of missing out), the crowd rushes in, pushing prices to new heights.

This isn't just random chaos. A bull run is a powerful cycle kicked off by a fundamental change in how traders feel about the market. Skepticism and caution get thrown out the window, replaced by a shared belief that the only way is up. During this time, the demand to buy crypto completely overwhelms the available supply, creating a feedback loop that sends prices soaring.

To help you get a clearer picture, here’s a quick breakdown of what a bull run typically looks like.

Key Characteristics of a Crypto Bull Run

| Characteristic | Description |

|---|---|

| Skyrocketing Prices | Almost every major coin sees consistent, significant price growth, not just one or two outliers. |

| Exploding Trading Volume | Exchanges are buzzing with activity as trading volumes hit new highs, signaling intense market interest. |

| Positive Media Frenzy | Mainstream news and social media are filled with success stories and optimistic predictions. The general vibe is electric. |

| Mainstream Adoption | Big companies start accepting crypto, and major financial players announce they're getting in on the action, adding legitimacy. |

| "Altcoin Season" | Smaller, alternative coins (altcoins) often experience explosive gains as investor confidence spills over from Bitcoin and Ethereum. |

These signs all point to a market that’s running hot, driven by widespread conviction and a powerful narrative of growth.

Core Characteristics of a Bull Market

Spotting a true bull run means looking for a few key ingredients that, when mixed together, create that unstoppable upward momentum.

- Sustained Price Increases: This is the most obvious sign. We're not talking about a one-day spike; it's a consistent, upward trend across the entire crypto market.

- High Trading Volume: As the hype builds, everyone wants a piece of the action. This flurry of buying and selling causes daily trading activity to explode.

- Positive Market Sentiment: The narrative flips entirely. News headlines are glowing, social media is full of rocket emojis, and the average investor feels like they can't lose.

- Increased Mainstream Adoption: Suddenly, your favorite coffee shop might accept crypto, or a Wall Street giant announces a new Bitcoin fund. This validation adds serious fuel to the fire.

A bull run is fundamentally about collective belief. When the majority of market participants believe prices will continue to rise, their buying actions turn that belief into a self-fulfilling prophecy, at least for a while.

Ultimately, recognizing these characteristics is what separates a temporary blip from a genuine, market-shaping bull run. It's in these moments that fortunes can be made, but it's also when the risks are highest. Understanding the environment is your first step to navigating it successfully.

How to Spot an Approaching Bull Run

Timing is everything in crypto, but you don’t need a crystal ball to get a sense of when a bull run is forming. Smart traders learn to look beyond the daily price charts, using a whole toolkit of indicators to get a read on where the market is headed.

Think of it like learning to read a weather map. You’re not just looking at the temperature; you’re combining signals like wind speed, pressure, and cloud cover to forecast the coming storm of buying activity. Spotting these signs before the mainstream crowd catches on is how you get ahead of the FOMO.

Reading the Technical Tea Leaves

Technical analysis gives us some powerful clues about market sentiment and where prices might be going. While no single indicator is a magic bullet, certain patterns have historically been solid signals of building bullish momentum.

One of the most classic signs is the "golden cross." This happens when a shorter-term moving average (like the 50-day) slices up through a longer-term one (like the 200-day). It’s a visual cue that recent price action is picking up serious steam, often heralding the start of a longer uptrend.

Here are a few other critical technical and on-chain metrics to keep on your radar:

- Surging Active Addresses: When you see a jump in the number of unique wallets sending or receiving coins on a network like Bitcoin or Ethereum, it’s a great sign. It means more people are actually using the network, which is a fundamental indicator of health and adoption.

- Decreasing Exchange Balances: Watch for a trend of people moving their crypto off exchanges into private wallets. This often means they're in it for the long haul and aren't planning to sell anytime soon, which squeezes the available supply.

- Rising Stablecoin Inflows: A huge influx of stablecoins onto exchanges is like seeing investors load their cannons. They’re getting cash ready to deploy, signaling they’re preparing to buy crypto assets in a big way.

Key Takeaway: A real bull run isn’t just about the price going up. It's a perfect storm of strong technicals, growing on-chain activity, and a major shift in the broader economic and social mood.

Monitoring Real-World Catalysts

Beyond the charts, real-world events are often the rocket fuel for a bull run. These catalysts can flip market perception on its head and pull waves of fresh capital into the crypto space, sometimes almost overnight.

An influx of institutional money is a massive tell. When a major hedge fund or a Fortune 500 company announces a big Bitcoin purchase, it sends a powerful message of legitimacy to the rest of the market and can trigger a copycat effect.

Likewise, good news on the regulatory front, like the approval of a Bitcoin ETF, can open the floodgates for everyday investors. Favorable government policies slash uncertainty and make digital assets a much more palatable investment for the masses. And never underestimate the power of media hype—as positive stories start hitting the headlines, they create a feedback loop that pulls in retail investors who are terrified of missing out.

To really sharpen your market analysis skills, you can dig into the resources at the vTrader Academy. Combining these outside signals with the hard on-chain data gives you a much richer, more complete picture of when the next bull run might just be getting started.

Lessons from the First Major Bitcoin Rally

To really wrap your head around what a bull run in crypto is, you have to go back to the beginning. The 2013 Bitcoin rally wasn't just another price jump; it was the event that dragged crypto out of obscure online forums and into the global spotlight. It basically wrote the playbook for the wild boom-and-bust cycles we've all come to know.

This rally was a perfect storm, showing just how much a powerful story can move a market. It wasn't about the tech or the code. A huge piece of the puzzle was the 2013 banking crisis in Cyprus, where the government literally seized money from citizens' bank accounts. That chaos created the perfect narrative for Bitcoin: a "safe haven" asset, a new financial system completely outside the control of shaky banks and governments.

That story caught on like wildfire, sparking a massive wave of speculation that fueled some truly insane growth.

A Parabolic Rise and a Painful Fall

The numbers from that time are just mind-boggling. In one of the earliest and most dramatic bull runs, Bitcoin’s price shot up from around $145 in May 2013 to over $1,200 by December. That's a staggering 730% increase that pushed Bitcoin into the mainstream consciousness.

But what goes up must come down. The explosive growth was followed by an equally dramatic crash. By 2014, Bitcoin’s price had plummeted below $300, wiping out about 75% of its value from the peak. You can dive deeper into these crypto market cycles and their history.

This pattern—a parabolic rocket ship ride up, followed by a brutal correction—became a signature move for crypto bull runs. It was a tough lesson for early investors: assets that go vertical can fall just as fast.

The Mt. Gox Collapse: A Sobering Reminder

Adding to the turmoil was the spectacular collapse of Mt. Gox. At the time, it was the biggest Bitcoin exchange in the world, handling over 70% of all BTC transactions. In early 2014, the exchange went belly-up after a massive, long-running hack resulted in the theft of hundreds of thousands of bitcoins.

The Mt. Gox disaster was a harsh wake-up call, exposing the massive risks lurking in a young, unregulated market. It proved that even when prices are soaring, the very infrastructure you're relying on could be dangerously fragile.

Key Lesson: The 2013 bull run proved that stories and market psychology are just as critical as the underlying technology in crypto. It also laid bare the dangers of immature infrastructure—a risk that every trader still has to keep in mind today.

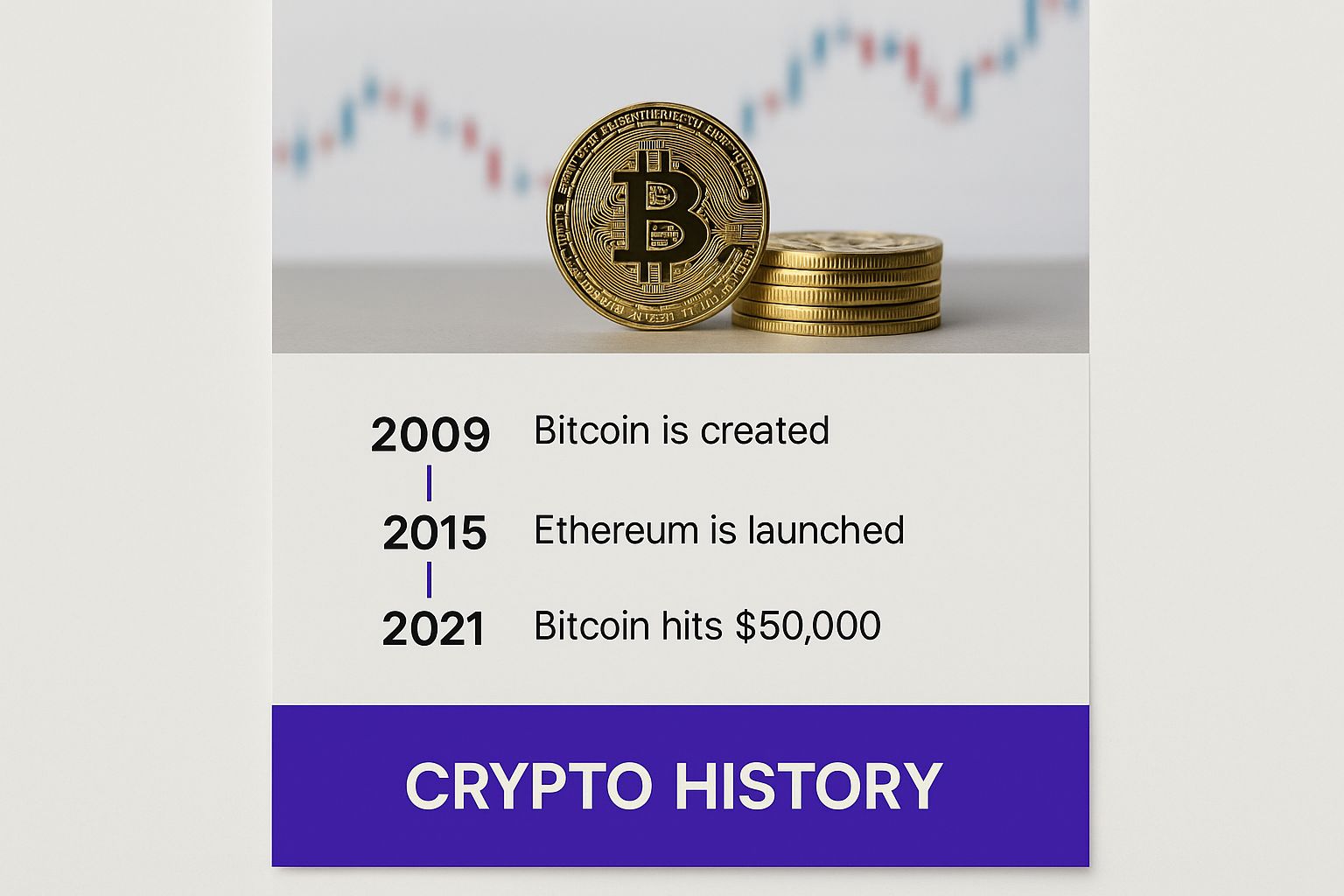

This infographic gives you a great visual timeline of crypto's early days, highlighting key moments like the 2013 rally.

The visualization really drives home how outside financial events and early exchange failures shaped where the market is today. This first bull run established a powerful, if volatile, cycle of hype, lightning-fast adoption, and painful corrections that would play out again and again, offering timeless lessons for modern traders.

Anatomy of the Great 2017 Crypto Boom

If the 2013 rally put Bitcoin on the map, the 2017 bull run made it a household name. This wasn't just another price pump; it was a cultural tidal wave that created a new generation of investors and burned terms like "HODL" and "altcoin" into the public consciousness.

Unlike earlier runs that were mostly fueled by niche tech communities, the 2017 boom was a perfect storm of easy access and wild hype. The arrival of user-friendly exchanges like Coinbase meant that buying crypto was suddenly simple for anyone. Combine that with a media frenzy that wouldn't quit, and you had an explosion of retail investors flooding the market.

The ICO Craze and Retail FOMO

A huge part of what lit the fuse in 2017 was the Initial Coin Offering (ICO) boom. Thousands of new crypto projects popped up, all promising to be the "next Bitcoin," and they raised billions of dollars in the process. This sparked a speculative mania where investors would throw money at almost any new token, hoping for a 100x return. This, in turn, just dragged more capital and attention into the entire crypto space.

The result? Pure, unadulterated market euphoria. Bitcoin’s climb was absolutely breathtaking.

The 2017 Bitcoin bull run is a textbook example of just how speculative and volatile crypto can be. Starting the year around $1,000, Bitcoin’s price went parabolic, rocketing to nearly $20,000 by December. That's a mind-blowing 1,900% gain in less than a year.

But as we all know, what goes up that fast often comes down even faster. The spectacular rise gave way to a brutal correction, with Bitcoin crashing all the way down to $3,200 by December 2018—a staggering 84% drop from its peak.

Lessons from the Crypto Winter

What followed the 2017 peak was a painful, drawn-out bear market that earned the name "crypto winter." The ICO bubble burst spectacularly. Countless projects that had raised millions went straight to zero, completely wiping out the portfolios of hopeful investors. It was a harsh but necessary reality check for the entire industry.

It drove home a few critical truths for anyone in the market:

- Euphoria Doesn't Last: Markets driven by pure greed and FOMO are built on sand. When a chart goes vertical, expect a violent correction.

- Risk Management is Everything: The crash was a painful reminder that having a plan to take profits and cut losses is just as important as picking the right coin.

- Fundamentals Win in the End: The projects that actually survived the crypto winter were the ones with real-world use cases and dedicated development teams, not just slick marketing.

The 2017 boom-and-bust cycle was a masterclass in market psychology. It showed just how quickly sentiment can flip from unbreakable optimism to widespread panic. Staying on top of market-moving events is essential, and you can keep a pulse on the latest action in our crypto news hub. This chapter in crypto history remains one of the best arguments for why you absolutely need a disciplined strategy to survive a bull run.

Proven Trading Strategies for a Bull Market

Knowing a bull run is happening is one thing. Actually profiting from it? That's a whole different game. The intense upward momentum creates incredible opportunities, but it also demands a clear plan to keep you from making emotional, heat-of-the-moment decisions.

A disciplined framework is your best friend here. It helps you cut through the market noise with logic and turn the chaos into actionable steps. Let's dig into some proven strategies for making the most of a crypto bull run.

The Power of Buying and Holding

One of the most straightforward and time-tested strategies is simply "HODL"—buy and hold. This approach is perfect for long-term believers who have high conviction in the future of the assets they’ve chosen.

Instead of trying to perfectly time every peak and valley, you just acquire your positions and hold on through the inevitable volatility. This method strips away the stress of daily trading and keeps your focus on the bigger picture, which, during a bull run, is a powerful upward trend.

To get a better feel for the macro environment, checking out broader financial market updates can provide valuable context. This wider perspective often shines a light on the fundamental strengths driving a crypto rally in the first place.

Capitalizing on Dips

Even the strongest bull markets have moments where they pull back. These short-term price drops, or "dips," are golden opportunities for traders looking to add to their positions at a discount.

The "Buy the Dip" strategy involves setting your buy orders at key support levels where you expect the price to find a floor and bounce. This takes a bit more active monitoring than HODLing, but it can seriously boost your returns by letting you accumulate more assets just before the next leg up.

The key is to distinguish a minor dip from the start of a major trend reversal. Using technical indicators and understanding market structure on a platform like vTrader can help you make more informed decisions.

This strategy is all about combining patience with readiness, ensuring you're prepared to strike when the market gives you a favorable opening. While holding is a powerful long-term play, strategically adding during pullbacks is a core tactic for maximizing gains.

The Crucial Art of Taking Profits

In the middle of a bull market, it can feel like the gains will never end. Spoiler alert: they do. Systematically taking profits is arguably the most important—and most difficult—skill for any trader to master.

You need to establish clear price targets for your investments before you even enter a trade. A common and effective method is to sell off a portion of your holdings at predetermined intervals as the price climbs.

For example, you could:

- Sell 25% of your position when the price doubles (a 100% gain).

- Sell another 25% when it hits your next major price target.

- Let the rest ride the trend, adjusting your stop-loss as the market evolves.

This approach locks in your gains, lowers your overall risk, and stops greed from clouding your judgment. It turns speculation into a structured, repeatable process. For those looking to put their holdings to work, exploring passive income options like https://www.vtrader.io/en-us/staking can be a great way to complement an active trading plan.

Navigating Bull Run Risks and Investor Traps

When a crypto bull run hits, the market feels electric. It's an intoxicating atmosphere where it seems like the green candles will never end. But this very excitement creates a perfect storm for emotional decisions that can lead to catastrophic losses. The biggest trap of all? FOMO, or the Fear Of Missing Out.

Seeing screenshots of massive gains plastered all over social media can trigger a primal urge to jump in, no matter the cost. This often leads to buying an asset at its absolute peak, right before the music stops. This is precisely the kind of hype-driven, emotional trading that seasoned investors learn to avoid. A disciplined strategy built around managing risk isn't just a good idea—it's essential for survival.

The Double-Edged Sword of Leverage

Leverage, which is basically trading with borrowed money, is one of the most powerful tools in a trader's arsenal. During a bull run, it can supercharge your profits. But it’s a double-edged sword that can just as easily magnify your losses, and a single bad move can wipe out your entire account.

Using high leverage during a bull market is like pouring gasoline on a fire. It might get you there faster, but one unexpected gust of wind—a sudden market correction—can cause the whole thing to go up in smoke, liquidating your position in seconds.

Even a brief, temporary price dip can be enough to trigger a margin call, forcing your position to close at a devastating loss. It's a high-stakes game that rarely ends well for traders who get swept up in the market euphoria.

Building Your Defensive Strategy

Protecting your capital is every bit as important as growing it. A solid defensive game plan lets you ride the wave of a bull run while protecting yourself from the inevitable downturn. Here are a few practical moves to make:

- Use Stop-Loss Orders: Think of this as your non-negotiable safety net. A stop-loss order automatically sells your crypto if the price falls to a level you've already decided on, cutting a losing trade short before it gets out of control.

- Diversify Your Portfolio: This is classic advice for a reason: don't put all your eggs in one basket. Spreading your capital across different types of crypto assets means a sudden crash in one coin won't sink your entire portfolio.

- Take Profits Systematically: As we’ve mentioned, you need an exit plan. Systematically selling off small portions of your holdings as prices climb is a great way to lock in real gains and lower your overall risk.

By putting these simple risk management techniques into practice, you stop gambling and start investing strategically. Understanding these ground rules is a fundamental part of responsible trading, as outlined in our platform’s terms and conditions, which we encourage all our users to read.

A Few Lingering Questions About Crypto Bull Runs

Even after you get the hang of what a bull run is, a few common questions always seem to pop up. Let's tackle them head-on.

How Long Does a Crypto Bull Run Typically Last?

There’s no magic number here. Historically, we've seen bull runs last anywhere from a few months to well over a year. The average tends to hover around 250 days.

The legendary 2017 rally, for instance, saw its most intense action unfold over 12 months, but others have been much quicker. It all comes down to a mix of macroeconomic winds, regulatory headlines, and the overall vibe of the market.

What Is the Difference Between a Bull Run and a Bear Market?

Think of them as polar opposites. A bull run is a party—a sustained period of rising prices fueled by optimism, hype, and a whole lot of buying. Everyone feels like a genius.

A bear market is the hangover. It's a prolonged period of falling prices, driven by fear, uncertainty, and widespread selling. While bull runs are about hitting higher highs, bear markets are defined by the pain of lower lows.

Key Takeaway: The switch from bull to bear can happen in the blink of an eye. It's often kicked off by a massive market correction, where prices plummet from their peak and panic sets in.

Should Beginners Invest During a Bull Run?

Jumping in during a bull run can be incredibly tempting, but it’s a minefield for beginners. The excitement and FOMO make it dangerously easy to buy an asset at an inflated price, right before the music stops.

If you’re just starting out, the golden rule is to only invest what you can comfortably afford to lose. Stick to the more established cryptocurrencies and resist the urge to chase every shiny new altcoin that pops up. For some more foundational knowledge, our crypto FAQ page is a great place to get your bearings.

Ready to trade the markets with an edge? vTrader gives you zero-fee trading, powerful tools, and a secure platform to help you capitalize on every market cycle. Join today and start building your portfolio at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.