This guide is part of the “Guide to Bitcoin” series.

Bitcoin fees are not arbitrary, nor are they a hidden tax. They are the price of access to a decentralized financial network that allows global value transfer without intermediaries. If you’ve ever wondered why sending Bitcoin costs more at some times than others, or how to pay less without waiting forever, this guide is for you.

Whether you’re new to Bitcoin or an experienced trader managing daily transactions, understanding how Bitcoin fees work can help you save money, reduce wait times, and optimize your overall experience. This guide will break it all down, from miners to mempools to satoshis per byte.

Table of Contents

What are Bitcoin fees, and why do they exist?

Core function: Incentivizing miners

At the heart of Bitcoin’s security model is a network of miners. These are specialized computers that validate transactions and add them to the blockchain. Miners are rewarded in two ways: through the block reward and miner fees, also known as Bitcoin transaction fees.

The block reward refers to newly minted Bitcoin that miners receive for successfully creating a new block. Currently, this reward is 3.125 BTC, following the most recent halving on April 19, 2024. The block reward halves every 210,000 blocks, eventually trending toward zero. When that happens, the network must rely entirely on miner fees to stay secure.

This is why Bitcoin fees are essential. They provide a long-term, market-driven incentive for miners to continue securing the network, even as the block reward declines. Unlike fiat systems where transaction processors are paid by centralized entities, Bitcoin’s miner fees are open and competitive.

The blockspace market: A digital real estate auction

You can think of each Bitcoin block like a shipping container. It can only hold so many transactions before it’s full, specifically about 1–1.5 MB of data, or around 4,000 transactions on average.

Now imagine that 10,000 people are trying to send BTC at the same time. They’re all competing for limited space, and the way they compete is by bidding higher fees. This is why Bitcoin network congestion causes fees to spike. The higher the demand for space, the higher the “rent” you’ll pay per byte of your transaction.

This blockspace auction creates an open market. Your miner fee is your bid. If your fee is high, your transaction gets picked first. If it’s low, you could be waiting for hours.

How are Bitcoin fees actually calculated?

It’s not about the dollar value

One of the biggest misunderstandings is that the fee you pay is tied to the amount of Bitcoin you’re sending. That’s completely false. Whether you’re sending $5 or $500,000, the BTC transaction fee is based on data size, not value.

You could end up paying more for sending $20 worth of Bitcoin if your transaction is large in terms of bytes, compared to someone moving a million dollars in a compact transaction. This surprises many users, especially when BTC fees fluctuate wildly.

Transaction size in virtual bytes (vBytes)

Transactions are made up of inputs and outputs. Each input is a reference to a previous transaction and carries data. More inputs mean more data, and more data equals a larger transaction in bytes.

Bitcoin uses a measurement called virtual bytes (vBytes) to account for this. For example, consolidating many small BTC amounts into one transaction (common for power users and exchanges) leads to a bloated transaction that costs more in fees.

The fee rate – Satoshis per virtual byte (sat/vB)

This is where pricing happens. A Satoshi is the smallest unit of Bitcoin, equivalent to 0.00000001 BTC. When fee estimators suggest paying 35 sat/vB, that means you’re offering 35 satoshis per virtual byte of your transaction.

The formula is straightforward:

Total Fee = Transaction Size (vBytes) × Fee Rate (sat/vB)

For example, if your transaction is 250 vBytes and the market rate is 40 sat/vB, your fee will be:

250 × 40 = 10,000 sats (0.0001 BTC)

Use BTC fee calculator tools or your cryptocurrency wallet’s built-in estimator to help visualize this number.

Bitcoin’s transaction waiting room

The Bitcoin mempool (short for memory pool) is where all unconfirmed transactions wait until they’re included in a block. Think of it as a digital queue where each transaction is ordered by its fee rate.

When Bitcoin network congestion rises, the mempool fills up. Miners start with the highest-paying transactions and work their way down. If your fee is too low, your transaction might sit in the mempool for hours or even days, especially during peak times.

The mempool is also a great place to observe the current market rate. Sites like mempool.space visually show how crowded it is and what the average sat/vB is right now.

How to choose the right fee

The speed vs. cost trade-off

Most modern wallets offer a few options when sending Bitcoin:

- High Priority: For urgent transfers, usually confirmed in the next block.

- Medium Priority: Confirmed within 1–3 blocks.

- Low Priority: Can take hours or longer, but cheaper.

This is where you decide what matters more: speed or cost. If you’re paying a friend or moving coins to cold storage, low fees are often fine. If you’re arbitraging between exchanges or sending urgently during a market spike, speed becomes critical.

Using Bitcoin fee estimators

Your wallet likely estimates fees automatically based on real-time data from the Bitcoin mempool. However, external tools like mempool.space or ycharts can offer more transparent insights. Some traders and miners also use fee estimation APIs that update every minute.

Always double-check when the network is busy. The difference between 15 and 30 sat/vB can mean hours of confirmation time.

What happens if my fee is too low?

When a transaction fee is below the market rate, it might stay unconfirmed for a long time. This is common when users set fees manually or rely on outdated wallet settings.

In these cases, two advanced tools can help:

- Replace-by-Fee (RBF): If your wallet supports RBF, you can re-broadcast the same transaction with a higher fee, effectively replacing the original.

- Child-Pays-for-Parent (CPFP): This technique allows you to send a second transaction with a higher fee that incentivizes miners to confirm both the new and original transaction together.

These strategies are the go-to for fee optimization and getting stuck transactions through during Bitcoin bottlenecks.

Proven strategies to reduce your Bitcoin fees

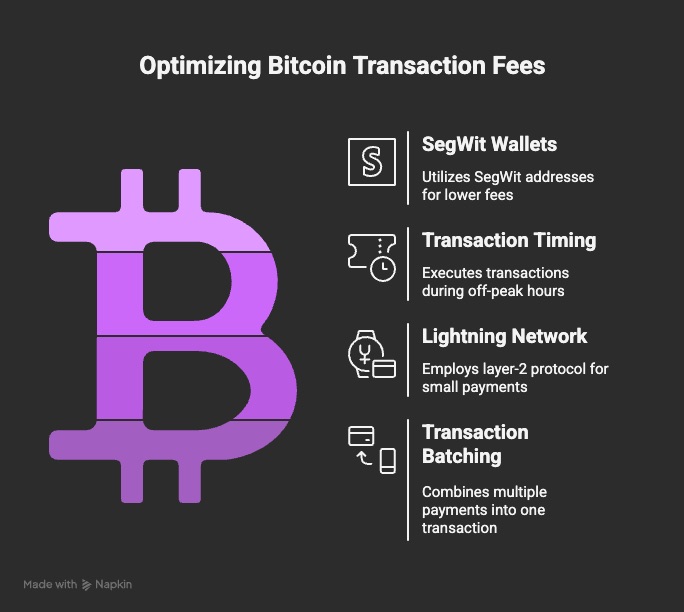

Use SegWit wallets

Segregated Witness (SegWit) is a protocol upgrade that separates signature data from transaction data, reducing size and improving efficiency. The smaller the vByte count, the less you pay.

Always use wallets that support Native SegWit addresses, which start with bc1. These use the bech32 address format and are the most fee-efficient (lowest data size).

If you’re still sending from legacy addresses (starting with “1”) or P2SH (starting with “3”), you’re likely overpaying. Upgrading your wallet can lead to significantly lower Bitcoin fees today.

Time your transactions

Just like highway traffic, Bitcoin congestion peaks during certain hours. Generally, weekends and late-night hours (UTC) are “off-peak.” Making trades during these times often results in low Bitcoin fees, even for high-priority transactions.

Fee optimization strategies often come down to timing. Watch the mempool space and strike when it’s nearly empty.

Consider the Lightning Network

For small payments, there’s no reason to rely on the main Bitcoin chain. The Lightning Network is a layer-2 protocol that processes instant, near-zero-cost payments off-chain.

Whether you’re buying coffee or sending micro-tips, Lightning enables high-speed, cheap transactions without competing for blockspace. It’s one of the key Bitcoin scalability innovations helping reduce pressure on the main chain.

Transaction batching (for businesses and power users)

If you’re sending multiple payments in a day: worker payroll, affiliate commissions, or bulk customer withdrawals, consider batching them into a single transaction. Instead of sending ten separate transactions, you create one transaction with ten outputs.

This dramatically reduces the average fee per payment because you’re only paying once for the shared transaction overhead. It’s a standard practice for exchanges, but advanced users and businesses can also use it to drive down cryptocurrency wallet fees. For high-volume users, batching is one of the best fee optimization strategies available.

Exchange fees vs. network fees

This is a critical area of confusion for many traders. When withdrawing Bitcoin from an exchange, you’re often charged a fixed withdrawal fee. Many assume this is the Bitcoin network fee, but it’s not always that simple.

The network fee is the actual cost of processing your transaction on the blockchain, determined by your transaction’s size and the current fee rate in satoshis per byte. The exchange fee, on the other hand, is a fee set by the exchange. It usually includes the actual miner fee plus an internal markup to cover operational overhead and delay risk.

In some cases, especially when Bitcoin network congestion is low, exchanges profit from this spread. This is why the withdrawal fee you see may not reflect the real-time market fee, especially during low activity periods.

Bitcoin fee trends over time

Understanding how Bitcoin fees have changed over the years helps predict future patterns.

- Early years (2009–2015): Fees were negligible. Blockspace demand was low, and most blocks weren’t even full. Users could send Bitcoin with 1 sat/vB or less and get confirmed quickly.

- 2017 bull market: The mempool exploded. Fees reached over $50 per transaction in December 2017. This was Bitcoin’s first real test under global demand, and it highlighted Bitcoin’s scalability limits.

- 2018–2020: Fees dropped again as trading cooled. SegWit adoption increased, lowering average vByte size and normalizing fees to under $2 for most of this period.

- 2021–2022 cycle: Massive growth in exchanges, NFTs, and DeFi increased congestion. Fees regularly hit $20–$30 in peak moments. The push toward Lightning Network gained steam.

- 2023–present: Mempool congestion returned with Ordinals and BRC-20 tokens. This new form of “Bitcoin-native NFTs” introduced additional competition for blockspace, driving fees back up. Average fees often range from $5 to $15 during congestion, and spikes are still common during market volatility or protocol experimentation.

Analyzing these cause and effect relationships, it’s clear Bitcoin fees are cyclical, linked to adoption, speculation, and network experimentation. Let’s look at additional ways to save more.

Advanced tactics for developers and power users

Welcome to the expert section. If some of this is too hard to understand right now, don’t worry, bookmark the page and return when you’re ready.

Beyond everyday tips, here are some technical strategies that will unlock even more savings for those that can implement them:

- UTXO consolidation – When you use Bitcoin, small leftover pieces from past transactions (called UTXOs) pile up in your wallet. Sending a payment using many of these small pieces makes your transaction larger and more expensive. To avoid that, it’s smart to combine these small pieces into one bigger chunk during times when network fees are low. This is called UTXO consolidation. It makes future transactions cheaper and faster to confirm.

- Payjoin (P2EP) – Payjoin is a privacy technique where both the sender and the receiver help build the transaction. It breaks the usual pattern that observers use to guess how much was really sent. It also helps split the transaction fee more fairly. Payjoin makes it harder for outsiders to see who paid who or how much was paid.

- Dynamic fee adjustment scripts – If you’re a developer (or advanced user), you can use software tools like custom APIs or wallet libraries to monitor network conditions and set the best fee in real time. This helps you avoid overpaying when traffic is low, and speeds things up when the network is crowded.

- RBF by design (Replace-by-Fee) – Some transactions might get stuck if you set the fee too low. By enabling RBF when sending, you allow yourself the option to resend the same transaction later with a higher fee. This is especially useful when you need the payment to confirm quickly, and the fee market suddenly changes after you send it.

If you’re a business handling thousands of transactions per week, even small fee reductions add up. These techniques are part of running an efficient and scalable crypto operation.

Myths about Bitcoin fees

- “High fees mean the network is broken.”

False. High fees are a symptom of high demand, not system failure. They reflect real economic prioritization. - “You need to overpay to get confirmed.”

Often untrue. With smart fee estimation and tools like RBF, you can usually pay fair rates and still get confirmed within a few blocks. - “Fees are too unpredictable to manage.”

This is a wallet problem, not a network problem. Good tools give you real-time data and automation to avoid surprises. - “SegWit is complicated or risky.”

Totally outdated. SegWit and bech32 addresses are now standard, well-supported, and safer than older formats.

Cut through the noise. The more you learn, the more control you have.

The fee game and Bitcoin’s future

As Bitcoin matures and block rewards fall, miner fees will become the primary security budget for the network. This raises two critical questions:

- Will users be willing to pay enough fees to sustain security?

- Will Bitcoin developers continue innovating to expand utility without bloating blockspace?

Layer 2 systems like the Lightning Network, as well as protocol upgrades like Taproot and future scaling solutions, will help answer both questions.

Bitcoin scalability isn’t just a technical issue. It’s an economics game. A balance between accessibility, decentralization, and miner incentives will define how sustainable Bitcoin is over the next 10–20 years.

Taking control of your transaction costs

Bitcoin fees are not random, and they’re not penalties. They’re an open, dynamic mechanism that secures the network and rewards miners. They represent real economic incentives and create the marketplace that makes Bitcoin function.

- Bitcoin fees exist to reward miners for securing and processing transactions, not to punish users.

- Fees are calculated based on how much data your transaction uses (in satoshis per virtual byte), not how much money you’re sending.

- The biggest factor affecting fee prices is network congestion, more demand for blockspace means higher fees.

Ultimately, the goal is not just to understand Bitcoin fees, but to master them. By learning how to navigate network conditions and wallet settings, you can lower your costs, improve confirmation time, and take full advantage of Bitcoin’s global utility.

To explore this level of control, compare how Bitcoin and Ethereum handle network costs in our guide – BTC vs ETH fees.

If you’re ready to take the next step and buy BTC, do so through VTrader, a platform built for security and speed.

Learn the rules, use the tools, and pay only what you need. In Bitcoin, knowledge is purchasing power.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.