Table of Contents

Altcoins are the center of activity in the cryptocurrency space. Despite Bitcoin’s reputation as a secure and scarce digital currency, the thousands of coins that followed have increased the potential of blockchain technology exponentially.

Altcoins support decentralized finance (DeFi), power NFT marketplaces, and make it easier to convert traditional assets into digital ones. Due to their extreme volatility, altcoins give traders and investors both tremendous potential for profit and very high risk.

The goal of this guide is to provide you with the big picture. We’ll begin with the fundamentals, examine why altcoins vary from Bitcoin, look at their various classifications, and point out the key players of today.

Next, we’ll explore how to assess projects, safely purchase and store tokens and employ smart techniques to stay ahead. This guide lays out the information you need to navigate the most volatile area of the cryptocurrency market, regardless of your level of experience. It may help to bookmark the page while you learn what makes altcoins special and how to find your next trading edge.

Understanding altcoins

To understand where the market is heading, we need to start with the fundamentals of what altcoins are and how they developed.

What is an altcoin?

Originally, any cryptocurrency that wasn’t Bitcoin was referred to as an altcoin, which stands for “alternative coin.” In the early days, Bitcoin dominated the conversation so much that all other digital assets were simply referred to as alts. That term has kept up despite the fact that there are now thousands of projects with vastly different capabilities.

Quick history recap

Here is a summary of the evolution of cryptocurrency. The first decentralized currency, Bitcoin, went live in 2009. Several years later, new consensus designs and quicker payments were tested by Ripple, Namecoin, and Litecoin.

The introduction of smart contracts by Ethereum in 2015 opened the door for decentralized apps and programmable currency. Then, in 2020, the field exploded with new protocols, real world asset tokenization (RWA), layer 2 scaling, and new projects for tokenizing compute power and bandwidth.

How do altcoins work?

Altcoins are digital assets built on blockchains, but they each have very different purposes. Some, like Ethereum or Solana, run their own networks and act as the foundation for other projects. On top of those networks, platforms like Uniswap issue their own tokens, which represent utility or governance rights within that ecosystem.

These tokens are powered by smart contracts, which are self-executing pieces of code that remove the need for intermediaries. Ethereum’s ERC-20 standard set the template for how tokens are created and traded, and similar frameworks like Solana’s SPL and Binance’s BEP-20 followed.

Keeping these networks secure requires consensus mechanisms, the rules that decide who validates transactions. Proof-of-Stake relies on validators who lock up their tokens and earn rewards for confirming blocks. Delegated Proof-of-Stake (DPoS) takes it further by letting token holders vote for validators, adding a governance layer.

Solana introduced Proof-of-History, a system that timestamps events to increase transaction speed. And in more centralized setups, Proof-of-Authority relies on a small set of approved validators, usually well-known companies or institutions, to prioritize efficiency over decentralization.

Finally, every altcoin has its own tokenomics, that is the built-in economics that influences supply and demand. This includes staking rewards, token release schedules, maximum supply, and governance rights. For traders, understanding these mechanics is critical, since they often explain why some tokens hold value over time while others quickly fade.

Use cases and innovation of altcoins

Altcoins have become the testing ground for most of crypto’s major breakthroughs. Here are some of the best innovations:

- Decentralized finance (DeFi) is the clearest example. Lending, borrowing, and trading without banks or brokers is possible only because of altcoins.

- Non-fungible tokens (NFTs) opened new markets in gaming, collectibles, and digital art, proving that tokens could represent more than just money.

- Real world asset (RWA) tokens go a step further by linking blockchains to commodities, real estate, and even corporate debt.

- AI protocols are now trying to tokenize access to computing power, letting developers trade processing tokens for machine learning tasks.

- Data marketplaces, decentralized cloud storage, and energy-related projects are also emerging.

As you can see, the frontier keeps expanding. Altcoins are where new ideas get tested in real time, some collapse quickly, but the ones that survive often reshape the entire market.

Bitcoin vs altcoins

Altcoins and Bitcoin have very different functions. The proof-of-work architecture that powers Bitcoin is energy intensive but has been shown to be reliable. Proof-of-stake or other models that reduce energy costs and speed up processing are preferred by the majority of altcoin projects.

Altcoins use a range of monetary policies, from inflationary supply to capped models with burn mechanics. In contrast Bitcoin’s has a 21 million coin hard cap. There is no central hub for the vast network of miners that make up Bitcoin. Many altcoins initially use more centralized governance at first before moving to community control.

- 👉 If you want to learn more, check out: Differences Between Bitcoin and Altcoins

Features at a glance

| Feature | Bitcoin | Altcoins |

| Issuance | Fixed 21M supply | Varies: capped, inflationary, burn models |

| Consensus | Proof of Work | PoS, DPoS, PoH, PoA, hybrids |

| Utility | Store of value, payments | Smart contracts, DeFi, NFTs, RWAs, much more |

| Volatility | High, but relatively stable | Higher, market swings are amplified |

| Developer activity | Conservative, slow upgrades | Fast-moving, experimental |

Fig 1. – Comparing features of Bitcoin and Altcoins

Understanding the altcoin universe

Why categories matter

Treating all altcoins as though they belong in the same basket is a mistake. They don’t. Some are memes with little more than community hype behind them, some are made for payments, while others exist only to grant governance rights. Altcoins are much simpler to assess when grouped according to their intended use.

- One popular kind of token is a utility token, which provides access to a service. For example, Filecoin enables users to purchase decentralized storage space.

- Security tokens, on the other hand, are governed by securities laws and symbolize actual ownership in a business or asset.

- Holders of governance tokens, such as Uniswap’s UNI, have the ability to vote on protocol modifications and other project specific decisions.

- When traders want to avoid volatility, stablecoins like USDT and USDC are a great option because their value is tied to the US dollar. We have a separate article where you can learn more: 👉 Stablecoins vs. Altcoins

- Then there are meme coins, such as Dogecoin and Shiba Inu. These frequently begin as online jokes and sometimes go on gathering huge online communities. To find out how to analyze them check out: 👉 Meme Coins: What to Know

- While infrastructure tokens like Polkadot’s DOT or Chainlink’s LINK act as the backbone that keeps different blockchains connected and functional. Instead of being used directly for payments or trading, they provide the critical services that other projects rely on.

- For people looking for anonymity there are privacy coins like Monero and Zcash which conceal transactions.

- Lastly, by shifting activity off the main chain, layer 2 scaling tokens such as Arbitrum’s ARB or Optimism’s OP enable Ethereum to process more transactions.

These categories are so important that we have a separate article for them: 👉 Altcoin Categories Explained

The major players today

Measuring success by market cap

Market capitalization is a fast way to rank cryptocurrencies. The calculation is simple:

Price x supply in circulation = Market Cap

Although this measure lacks metrics on adoption and liquidity, it provides a baseline against which you can compare other projects.

Altcoin leaders

Ethereum continues to be the most significant altcoin by that metric. Long term holders found it appealing after it switched to proof-of-stake, which reduced energy consumption and added staking rewards.

Solana is a favorite for applications that require high speed because of its distinctive proof-of-history design, which allowed it to carve out its own niche of lightning speed and inexpensive fees.

- 👉 To learn more check out Top Altcoins

Cardano (ADA) has adopted a methodical, research based approach, releasing updates only after undergoing peer review. Security and long-term scalability are given priority over rapid iteration in this slower method.

The Ripple network’s token, XRP, was developed especially for quick and inexpensive international payments. For financial institutions wishing to transfer funds internationally without depending on cumbersome, costly banking systems, it has been promoted as a currency bridge.

Then we have infrastructure initiatives like Polkadot (DOT) and Avalanche (AVAX) which are creating multi-chain ecosystems, which set up the efficient scaling and interaction of various different blockchains.

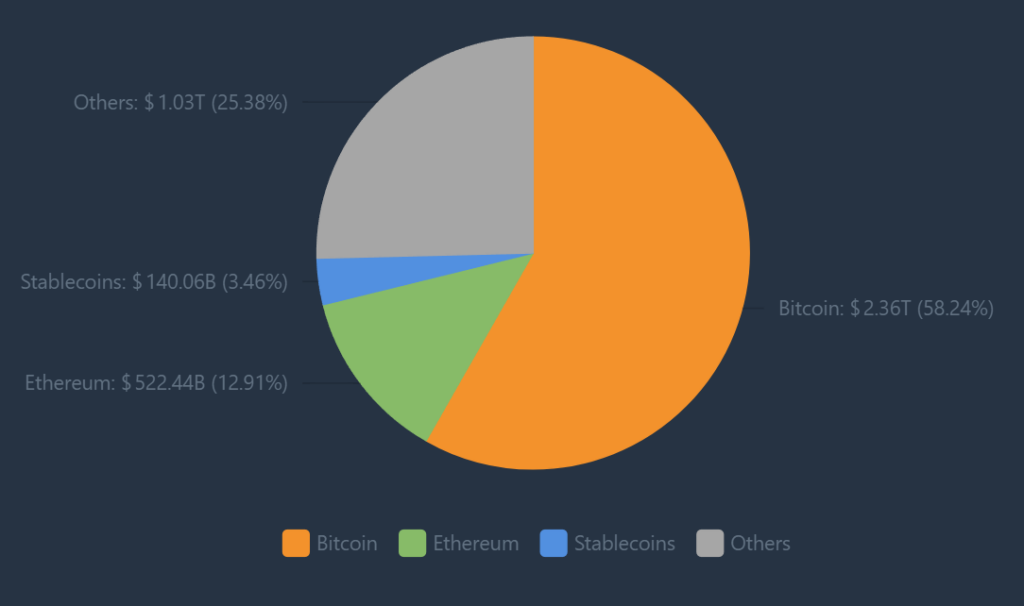

Crypt Market Cap Chart

Fig.2 – Coincodex Crypto Market Cap Chart

Evaluating an altcoin

Traders often lose money, and in most cases it happens because they never looked into the fundamentals of what they were purchasing, not because their timing was off. So much suffering can be avoided by doing just a little research.

Team, governance, and community

A project’s team is always the first place to have a good hard look. Do the founders have real experience in crypto or related industries, or are they unproven newcomers hiding behind anonymity? Anonymous teams that refuse audits should be treated with caution.

Development activity is another key signal. Open source projects with an active GitHub show ongoing progress, while long periods of silence often suggest that the momentum has stalled. Governance also matters, projects that move toward transparent community voting and treasury management have historically built stronger foundations.

Finally, no altcoin succeeds without genuine community support. Marketing campaigns can create short term commotion, but sustained growth usually comes from honest engagement, where users actively contribute, debate, and build around the project.

Technology and market fit

The first step is to determine whether the project is merely hype or has a practical application. A good roadmap should be understandable, attainable, and above all followed by the team. Metrics such as growing transaction volume and active wallets aid in distinguishing traction in projects from those that make empty promises. A global brand’s willingness to integrate with a cryptocurrency project is typically an indication that the underlying crypto technology has some real world applications.

Tokenomics

Tokenomics is equally significant. Think of them like a project’s financial accounting. First, think about the supply, how many tokens are in circulation now, how many are locked up, and when will they be made available? Keep an eye on when early investors, founders, and team members are allowed to sell their tokens.

If early backers can dump large amounts of tokens onto the market without restrictions, retail traders will usually take the hit. Also, look at the token’s role. Does it power transactions, grant governance rights, or provide access to a service? Or is it just a speculative chip with no real utility?

Other metrics

Additional hints that will aid your decision process can be found on off-chain (outside the blockchain) and on-chain data (on the blockchain). For instance, the amount of capital that people are willing to commit is indicated by total value locked, or TVL. The network’s daily usage can be determined by looking at active addresses and fee income.

Creating demand

Demand for a token can be supported in different ways. Staking gives holders a reason to lock up their coins in exchange for yield, which reduces the amount available on the market. Token burns permanently remove coins from circulation, tightening the supply over time. Governance rights let holders vote on the direction of the project, creating a sense of ownership and keeping the community actively involved. Together, these mechanics encourage people to keep holding rather than to sell, which helps to stabilize the demand.

Always watch for red flags. Projects that release too many tokens too quickly, promise unrealistic guaranteed returns, or show unnatural trading patterns often end up collapsing. In crypto, anything that looks too good to be true almost always is.

How to buy and store altcoins

Buying an altcoin is a straightforward process if you’re doing it through an exchange, but keeping it safe for the long run is where most people slip up.

- Selecting a trustworthy exchange is the first step in the process. Large companies like Binance, Coinbase, and vTrader dominate the market. You want to trade on platforms that are regulated. After passing KYC and depositing cash or cryptocurrency into your account, you can buy altcoins.

- Leaving your coins on the exchange is a common mistake made by many traders. It’s usually safer to withdraw money into your personal wallet. Hot wallets like Phantom or MetaMask run on your phone or browser and are convenient for everyday use, but since they stay connected to the internet, they carry more risk. The downside is they always have an internet connection.

👉 To learn the full process in detail visit: How to Buy and Store Altcoins

Since they store keys offline, cold wallets like Trezor or Ledger are better options for larger holdings. There are also multisig wallets available, which need multiple approvals to move funds, but they are frequently used by teams or treasuries to add an extra layer of security.

How to make sense of the opportunity

Allure of high rewards

Altcoins appeal to traders because they offer an asymmetric upside that very few other assets can match. There are many examples of success in the cryptosphere. Ethereum started raising capital at 30 cents in 2014, it’s now worth $4,392. Another example is Solana’s parabolic run in 2021 where SOL grew by 12,000% in a single year. Not to mention the dozens of smaller projects that turned modest allocations into life changing returns.

Altcoins also let investors spread exposure across different narratives. Much of crypto’s innovation comes from the altcoin space, which is why if you ever get in early on a project it often feels like sitting in the front row of a sci-fi movie.

- 👉 If you want to learn more, we have a special article that covers where volatility comes from: Altcoin Volatility.

Inherent risks

The risks, however, are just as sharp. Altcoin volatility is brutal, with 30% daily swings being the norm. Entire projects can collapse once the hype fades. It leaves long term investors trapped. Fraud also remains a problem in unaudited DeFi protocols and meme coin communities. That’s where rug pulls are most frequent. Regulatory changes and uncertainty adds yet another layer of uncertainty, as governments continue to redefine the legal status of tokens.

This push-and-pull between extraordinary potential and outsized risk is what defines altcoin investing. Traders who survive it are not the ones who ignore the downside, but the ones who anticipate it, hedge against it, and position their trades with changing factors in mind.

- 👉 To learn more about profitable investing in altcoins, visit Investing in Altcoins: Risks and Rewards.

How altcoins launch and grow

Back in 2017, initial coin offerings (ICOs) were the big thing. It was the birth of a new industry and the rules for it did not exist yet. ICOs are basically fundraisers. Development teams sold tokens directly to the public, raising huge amounts of money in short periods. It was fast and open.

As the industry evolved, major exchanges stepped up and started offering initial exchange offerings (IEOs), where they handled the token launch themselves. This option gives you some added confidence and provides immediate liquidity to your investments. The trade off is that IEOs were under the control of the exchange.

Decentralized exchanges brought their own version to the market with initial DEX offerings or IDOs. These made new launches even easier to do but automated trading bots often dominated the order flow, front running retail buyers and capturing the most favorable pricing before the broader market could react.

Finally, security token offerings (STOs) issue tokens that are legally classified as securities, similar to stocks or bonds. Because of this, they must follow strict financial regulations and usually only accredited investors get involved. The benefit with them is stronger legal protection and greater regulatory credibility, but STOs are slower to launch and carry higher upfront costs compared to other token offerings.

👉 If you want to better understand these market mechanics, please visit: How Altcoins Are Launched.

Some projects avoided presales altogether and opted for a fair launch, that’s where everyone had the same chance to acquire tokens. Bitcoin itself was a fair launch, and Yearn Finance later followed that model to great success.

Each method tries to solve balancing decentralization, fairness, and their fundraising needs in different ways. But for us traders, we are trying to understand how a coin launch can provide us context to its tokenomics, its community, and its future potential.

Future of altcoins

The altcoin market is constantly evolving. Every cycle brings in fresh ideas and a new batch of winners. Looking ahead to 2026, a few themes stand out.

- One is tokenized real world assets (RWAs). We’re starting to see everything from equity to real estate move onto blockchains. Projects working on this could open the door for much bigger institutional involvement in crypto.

- Another hot area is DePIN, or decentralized physical infrastructure networks. These projects let people earn tokens by contributing resources like internet coverage or GPU power. Helium and Render are prime examples.

- Then there’s the crossover with AI. Tokens that are tied to decentralized compute power or AI marketplaces are drawing a lot of attention from investors, especially as demand for processing power surges.

- Finally, regulation is beginning to catch up. Europe’s MiCA rules and similar frameworks in Asia are creating clarity, while the U.S. is still working through its stance. Tokens that align with these new rules early may have a smoother path to institutional adoption. All crypto is starting to look a little safer now that governments set rules in place. Before we were worried if what we were doing was legal or not.

In short, the next era of altcoins looks set to be defined by projects that bridge blockchains with the real economy. 👉 You can find a deep dive on the topic here: Future of Altcoins.

Frequently asked questions

Investors often have the same recurring questions when it comes to altcoins, so this section answers those for you.

How many altcoins exist?

There are more than 10,000 altcoins listed on exchanges and data trackers. However, the vast majority are inactive or have almost no trading volume. In fact, only a few hundred projects maintain real liquidity, have active development teams, and active communities.

Can an altcoin replace Bitcoin?

Probably not. Bitcoin has established itself as digital gold, with the strongest security, decentralization, and brand recognition in the entire crypto market. While altcoins excel in other areas like DeFi, faster payments, and blockchain interoperability, none have really managed to take over Bitcoin’s role as the primary store of value.

What is altcoin season?

Altcoin season is a period when alternative cryptocurrencies collectively outperform Bitcoin. This usually happens during phases of heightened speculation, when investors feel safe enough to move away from Bitcoin into higher risk tokens looking for bigger gains. These cycles can be extremely profitable because they are so volatile, but often they end with sharp corrections.

Are altcoins safe?

Altcoins generally carry more risk than Bitcoin because they have less liquidity and a shorter track record. Safety depends on the legitimacy of the project team, how secure the network is, and whether you’re storing your tokens properly.

Are all altcoins good investments?

No. In fact, most altcoins fade away within a few years due to weak fundamentals or developer abandonment. The real challenge for investors is to spot the few projects that evolve into lasting infrastructure, like Ethereum and Solana. The survivors typically solve real world problems and attract strong ecosystems of users and developers.

Key takeaways

Altcoins are the frontier of crypto – volatile, experimental, and often unpredictable. They come in many forms, from utility tokens to meme coins. Bitcoin may be the most expensive crypto, but altcoins are where the new ideas are tested and sometimes they turn into a homerun.

Doing your own research (DYOR) matters. Research the team, the technology, and the tokenomics before committing your capital. Remember that the rewards can be enormous, but the risks are just as real.

The future likely belongs to altcoins that tie into the real economy, whether through tokenized assets, decentralized public infrastructure, or AI.

Ready to put this all into practice? vTrader gives you access to the widest selection of altcoins, with 0% trading fees and a fully regulated platform. Whether you are looking at DeFi tokens, AI plays, or the next big thing, you can buy, sell, and manage your portfolio securely in one place.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.