Stripped down to its core, tokenomics is just the economics of a crypto token. It’s the entire rulebook that dictates how a cryptocurrency is created, supplied, distributed, and valued within its own digital world. Think of it as the economic policy for a digital asset.

What Is Tokenomics and Why It Matters

Picture a country's central bank making decisions on how much money to print, how it gets into circulation, and which policies will keep inflation in check. Tokenomics does the exact same job for a crypto project. The crucial difference? Instead of a group of people making these calls, the rules are usually baked directly into the blockchain's code.

This framework is the project's economic blueprint, and it's what determines whether the token has a shot at long-term health and stability.

Understanding a project's tokenomics isn't just for seasoned traders; it's a fundamental skill for anyone dipping their toes into the crypto space. It lets you cut through the market hype and really see what gives a token its underlying value.

The Pillars Holding It All Together

At its heart, tokenomics rests on a few key pillars that shape how a token behaves over its lifetime. A project's chance of success often comes down to how well these elements are designed and balanced.

Let’s break them down.

The Core Pillars of Tokenomics

Before diving deeper, it's helpful to see the main components in one place. These three pillars form the bedrock of any token's economic model, and understanding them is the first step to a proper analysis.

| Pillar | What It Governs | Why It Matters for Value |

|---|---|---|

| Token Supply | How many tokens will ever be created. | Defines scarcity. A capped supply, like Bitcoin, can drive value up if demand grows. |

| Token Distribution | How tokens are allocated from the start. | Reveals who holds the power. Fair distribution builds community trust. |

| Token Utility | The token's real-world use cases. | Creates organic demand. The more you can do with a token, the more people will want it. |

A well-designed model that balances these three elements is often a sign of a project that’s built to last.

From Blueprint to Real-World Value

Ultimately, these economic rules aren't just lines of code; they have a direct impact on a token's scarcity, demand, and how its users behave. They influence everything from investor confidence to market adoption.

A token’s value is deeply tied to its tokenomics. A capped supply combined with a regular token burn mechanism, for example, can shrink the available supply and boost value if demand keeps up. By 2022, the crypto world had largely agreed that solid tokenomics were non-negotiable for a project's survival.

A thoughtful system encourages people to hold and participate in the ecosystem. A poorly designed one? It can lead straight to wild price swings and, often, project failure. If you're looking to build up your crypto knowledge, our vTrader Academy offers a ton of resources to get you started.

Learning how to read this economic blueprint is your first major step toward making smarter, more informed decisions in the crypto market.

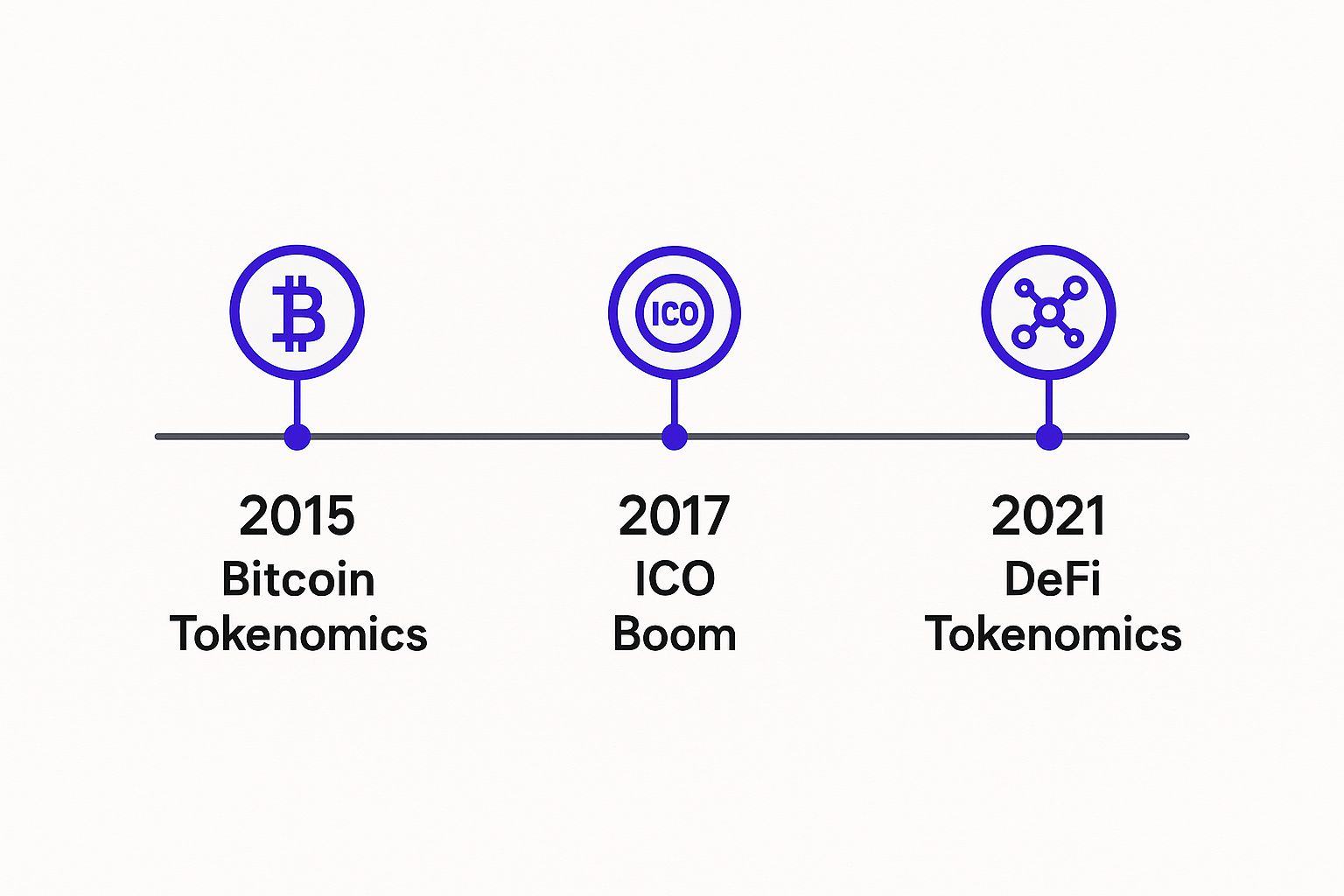

The Evolution of Tokenomics from Bitcoin to Today

The idea of tokenomics wasn't born overnight. It grew out of the brilliant, yet simple, design of Bitcoin. Before Satoshi Nakamoto's whitepaper, digital money had a huge problem: you couldn't prove it was scarce, making it easy to copy and paste into oblivion.

Bitcoin flipped the script with one powerful rule coded into its DNA: a fixed maximum supply of 21 million coins. This single move created true digital scarcity for the first time. It established a predictable, deflationary model that became the foundation for everything that followed.

This was a groundbreaking idea. The concept of a fixed supply offered a completely new way to build an economy based on scarcity. Since Bitcoin’s launch in 2009, this field has exploded. By 2021, there were over 10,000 different cryptocurrencies in existence, with nearly all of them trying out unique tokenomic designs to attract users and investors.

The Rise of Utility with Ethereum

The next giant leap forward came with Ethereum. If Bitcoin was designed to be digital gold, Ethereum was built to be a global computer—and a global computer needs fuel to run.

This gave birth to the utility token. Ether (ETH) wasn't just a store of value like Bitcoin; it was a functional asset needed to pay for network computations, better known as "gas fees." This forged a direct link between the token's demand and the network's health. The more people built and used applications on Ethereum, the more ETH they needed.

This was a major turning point. Suddenly, a token's worth wasn't just about how rare it was, but what you could do with it inside a living, breathing digital ecosystem. It handed developers an entirely new playbook.

This shift from a simple store of value to a functional, utility-driven asset set the stage for much more complex economic models. The team at vTrader is passionate about helping users navigate these evolving market dynamics, which you can read more about on our about us page.

This visual below neatly maps out the key milestones in this journey, from Bitcoin’s simple blueprint to the sophisticated systems we have today.

As the timeline shows, the core concepts behind tokenomics grew up fast, moving from basic scarcity to intricate utility and governance in just a matter of years.

From the ICO Boom to Modern DeFi

In the mid-2010s, the crypto world was rocked by the Initial Coin Offering (ICO) boom. Projects raised millions by selling their tokens directly to the public. While it was an exciting period of wild experimentation, it also delivered some hard lessons about poorly designed token economies, runaway inflation, and the dangers of lopsided token distribution.

The projects that survived—and ultimately thrived—were the ones that learned from those early mistakes. We see the results of those lessons today in the advanced tokenomics driving Decentralized Finance (DeFi) and GameFi.

Modern token models now bake in sophisticated features, including:

- Governance Rights: Giving token holders a direct say in the project's future, turning them from passive investors into active stakeholders.

- Dynamic Supply: Some tokens now have elastic supplies that can adjust based on network activity, helping to maintain price stability.

- Staking and Yield Farming: Rewarding users for locking up their tokens, which helps secure the network and reduces the available supply on the open market.

This constant progression proves that tokenomics isn't a set-it-and-forget-it discipline. It's a dynamic field that continues to adapt to new technology and market forces, constantly refining the economic engines that power the digital asset world.

How to Decode Key Tokenomics Metrics

To really get a handle on a crypto project, you’ve got to pop the hood and get comfortable with the numbers. The good news? You don’t need an economics degree to figure out what matters. These key figures tell a compelling story about a token's potential scarcity, its present-day valuation, and its long-term health.

Think of it like checking the specs on a new car. You wouldn't just base your decision on the paint job, right? You'd dig into the engine size, horsepower, and fuel efficiency. Tokenomics metrics are the technical details that empower you to make a smart, informed decision instead of just gambling on hype.

Let's break down the essential data points you’ll run into and what they actually signal about a project's future.

Understanding Token Supply

The first stop is always supply—it's the bedrock of scarcity and value. You'll usually find three different supply metrics, and knowing the difference is non-negotiable.

- Circulating Supply: This is the count of tokens that are unlocked and actively trading on the open market. It's the "in-the-wild" number that drives day-to-day price action.

- Total Supply: This figure includes every token that's been created, minus any that were permanently destroyed (or "burned"). It bundles the circulating tokens with all the locked ones—those held by the team, sitting in a treasury, or vested in smart contracts.

- Max Supply: This is the absolute ceiling—the maximum number of tokens that will ever exist. For a project like Bitcoin, the famous 21 million cap creates a powerful, hard-coded scarcity. Not every token has one; some are designed to be inflationary forever.

Getting these three numbers straight is the first step to grasping how rare a token is today and how rare it might become tomorrow.

Market Cap vs Fully Diluted Valuation

Once you've got a grip on supply, you can start assessing valuation. Two metrics are often shown together, but they tell two very different tales about a project's real worth.

Market Capitalization (Market Cap) is a straightforward formula: Circulating Supply x Current Token Price. This gives you a real-time snapshot of the project’s network value based on the tokens trading right now.

But Fully Diluted Valuation (FDV) offers a glimpse into the future. The calculation is: Max Supply x Current Token Price. This metric reveals what the project’s market cap would be if every possible token was already circulating at today's price.

A huge gap between the Market Cap and the FDV can be a massive red flag. It warns you that a flood of new tokens is waiting to hit the market, which could create intense selling pressure and dilute the value for everyone already holding the bag.

This is exactly why looking only at the market cap can be so deceptive. The FDV provides a more honest, forward-looking view of potential supply inflation.

Inflationary vs Deflationary Models

Finally, you need to know how the token supply will evolve. Projects generally stick to one of two economic models, and each one has a very different impact on long-term value.

An inflationary model means new tokens are constantly being minted and added to the supply. This is the standard for most Proof-of-Stake networks, where new tokens are created to reward the validators who keep the network secure. While this can dilute existing holders, it's also the engine that incentivizes participation and network security.

On the other hand, a deflationary model sets out to shrink the token supply over time, making each remaining token more scarce and, theoretically, more valuable. The most popular method is token burns, where a percentage of tokens is sent to an inaccessible address, permanently removing them from circulation. These burns are often tied to network activity, like transaction volume.

Keeping an eye on these mechanics is crucial, but don't forget that other costs can eat into your returns. Understanding how different trading fees and network costs are structured will give you a much clearer picture of your potential profit.

By decoding these core metrics—supply, valuation, and economic model—you gain a powerful lens for evaluating the foundation of any crypto project. This is the practical knowledge that separates serious investors from the speculators.

Analyzing Token Distribution and Vesting Schedules

Once you’ve got a handle on a token’s supply metrics, the real detective work begins. The next crucial step is digging into who actually owns the tokens and—more importantly—when they’re allowed to sell them. A project might have the most groundbreaking tech in the world, but if a handful of insiders can dump their bags on the market at a moment’s notice, it’s a recipe for disaster.

This investigation starts with how the tokens were first released into the wild. Different launch methods create wildly different ownership landscapes right from the get-go.

For example, a fair launch tries to distribute tokens as evenly as possible, often without any presale or special team allocation. Bitcoin is the classic case; anyone with the right computer could start mining coins from day one. On the other end of the spectrum, an Initial Coin Offering (ICO) or pre-sale involves selling huge chunks of tokens to private investors and VCs long before the public ever gets a chance to buy.

Reading a Token Allocation Chart

Any project worth its salt will publish a token allocation chart, usually found in its whitepaper or on the official website. This pie chart is your first real glimpse into the project's economic DNA and whether it’s set up for fairness or failure.

You’ll typically see slices dedicated to a few key groups:

- Team and Advisors: Tokens earmarked for the core builders behind the project.

- Early Investors/VCs: Allocations for the heavy hitters who funded the project in its early stages.

- Ecosystem/Treasury: A war chest for funding future development, marketing campaigns, grants, and strategic partnerships.

- Public Sale: The portion sold directly to the public during an ICO or a similar launch event.

- Community Rewards: Tokens set aside for things like airdrops, staking rewards, and liquidity mining incentives.

A healthy-looking chart dedicates a significant chunk to the community and long-term ecosystem growth. The big red flag? When the team and early investors control a massive slice of the pie. This not only centralizes power but also creates a ticking time bomb of potential selling pressure down the road.

Why Vesting Schedules Matter

Just knowing who gets the tokens is only half the story. You absolutely need to know when they get them. This is where vesting schedules become one of the most important things to check. A vesting schedule is basically a mandatory lock-up period that prevents insiders, like the team and VCs, from selling their tokens right away.

Think of it as forcing them to have some skin in the game for the long haul. Instead of getting their entire allocation on day one, their tokens unlock gradually over a set timeframe, often spanning several months or even years. This is a critical defense mechanism to protect the market from a sudden crash caused by early backers who bought their tokens for pennies on the dollar.

Tokenomics often involve vesting schedules that lock initial large token allocations over months or years; such vesting reduces immediate sell-offs that depress prices. Major decentralized finance (DeFi) platforms employ these mechanisms precisely to stabilize their economies: vesting periods often range from 6 months to 2 years across top projects launched in 2021–2023. Data shows that tokens following these economic models exhibited roughly 20–30% less price volatility over six-month periods than those without clear vesting or burn strategies. To see more data on this, you can explore insights on tokenomics stabilization from Caleb & Brown.

Without a clear and lengthy vesting schedule, there's nothing stopping insiders from cashing out at the first sign of a price pump, leaving retail investors who bought in later holding the bag. When you’re sizing up a project, look for vesting schedules that align the team’s financial incentives with the long-term health of the protocol. A short or non-existent vesting period is a massive warning sign that the project might be designed for a quick flip, not sustainable growth.

The Role of Utility and Governance in Token Value

A token without a clear job is just a digital collectible. It might be interesting, but it has no real function. This is where utility and governance come into the picture, giving a token a genuine reason to exist beyond pure market speculation.

These two functions are what give a digital asset a role to play within its ecosystem. They create organic demand and pave the way for sustainable, long-term value.

Think of it simply: utility is what you can do with the token, while governance is your say in the project's future. A project that nails both gives people powerful reasons to acquire and hold its tokens, shifting the focus from a quick flip to long-term participation.

The Power of Utility Tokens

A utility token is essentially a key. It unlocks access to a network’s products or services. Its value is directly hitched to the demand for that specific ecosystem. The more people want to use the network's features, the more they’ll need its native token, creating a steady stream of buying pressure.

The classic example is Ethereum's ETH. It’s the "gas" that fuels the entire network. Every single action on Ethereum—whether you're sending tokens or using a decentralized app (dApp)—requires a small payment in ETH. As the network buzzes with more activity, the built-in demand for ETH naturally rises.

This sets off a powerful cycle:

- Growing Adoption: More developers build on the platform, and more users flock to it, ramping up network activity.

- Increased Demand: All this action requires more tokens to pay for services, which in turn drives up demand.

- Potential Value Growth: When rising demand meets a controlled supply, the token’s market value is likely to increase.

A token with strong, clear utility has a much better shot at holding or increasing its value over time. How useful a token actually is can make or break its long-term success, making it a critical factor for anyone involved in the project.

Governance: The Right to Steer the Ship

While utility gives a token a job, governance gives its holders a voice. A governance token is your ticket to the decision-making table, granting you the right to vote on key proposals that will shape the project's future.

This instantly turns passive investors into active stakeholders. Suddenly, you have a real interest in the long-term health and success of the protocol.

This voting power isn't just for show; it can influence critical decisions:

- Adjusting transaction fees or other economic rules.

- Deciding how to spend funds from the community treasury.

- Greenlighting major technical upgrades or brand-new features.

- Approving partnerships or ecosystem grants to fuel growth.

Projects like Uniswap (UNI) and MakerDAO (MKR) are built on this principle. Their token holders can propose and vote on changes, ensuring the platforms evolve in a way that truly benefits the community. This decentralized approach builds trust and perfectly aligns the users' incentives with the network's overall health.

Many platforms also let users get involved in governance through staking. If you’re curious about how that works, you can learn more about staking crypto assets and the role it plays in network participation.

When governance is meaningful, it gives people a compelling reason to hold onto their tokens. The more influence you have, the less likely you are to sell at the first sign of trouble. This helps stabilize the token's price and cultivates a loyal, dedicated community for the long haul.

Alright, you've grasped the core concepts—metrics, distribution, and why a token needs a real job. Now it's time to roll up your sleeves and put that knowledge to work.

Analyzing tokenomics isn't a passive activity. It’s more like being a detective, asking the tough questions to see if a project's economic engine is built to last or just sputtering on hype.

This checklist is your field guide. Think of it as a set of x-ray goggles to see past the marketing fluff and evaluate any crypto project's true financial DNA.

Your Practical Tokenomics Analysis Checklist

Let's break down how to properly vet a project's tokenomics. This isn't just about finding numbers; it's about understanding what they signal for a project's future.

We've organized this into a simple table to guide your research. Follow these steps, and you’ll be miles ahead of the average investor who just buys based on a cool logo.

Tokenomics Analysis Checklist

| Category | Key Question to Ask | What to Look For (Green Flags / Red Flags) |

|---|---|---|

| 1. Token Supply | What's the supply structure? | Green: A hard cap (like Bitcoin's 21 million). Clear, predictable inflation tied to network security. Active burn mechanisms linked to usage. Red: No max supply with no explanation. A massive gap between circulating and total supply without clear unlock schedules. |

| 2. Token Distribution | Who actually owns the tokens? | Green: A large portion is allocated to the community, ecosystem fund, or public sale. Team/investor holdings are reasonable (e.g., < 30-40%). Red: Insiders (team, advisors, VCs) hold over 50% of the supply. This creates huge centralization and dumping risk. |

| 3. Vesting Schedules | When can the insiders sell? | Green: Long vesting periods (2-4+ years) with a 6-12 month cliff. Gradual, linear token releases. Red: Short vesting (under 1 year). No cliff. Large, single "unlock" events that can crash the market. |

| 4. Token Utility | What's the point of this token? | Green: The token has a real purpose: paying fees, governance rights, accessing features, or staking. Demand is driven by its function. Red: The only reason to hold it is hoping the price goes up (pure speculation). Utility feels forced or non-existent. |

By systematically working through this checklist for any project you're considering, you move from gambling to calculated investing. It forces you to build an evidence-based case for a project's economic design, rather than just riding a wave of social media excitement.

This framework is the foundation you need to perform a thorough analysis and separate the promising projects from the ones destined to fail.

Frequently Asked Questions About Tokenomics

Even after digging into the basics, a few key questions always seem to pop up. Let's tackle the most common ones head-on to clear up any confusion and make sure you're on solid ground.

What Is the Difference Between Tokenomics and Economics?

Think of it this way: traditional economics is the massive, overarching field that studies how entire countries and societies manage their resources. It’s the big picture—interest rates, global trade, GDP, and all the theories that have been built up over centuries.

Tokenomics, on the other hand, is a highly specialized discipline built for the digital age. It takes those foundational economic ideas and applies them specifically to the unique environment of a blockchain. It deals with concepts you just won't find in a standard economics textbook, like algorithmic supply changes, token burning, and on-chain governance.

In essence, tokenomics is where economic theory gets coded into a protocol. It’s the practical application of economic principles for a decentralized, digital world.

By focusing on these crypto-native mechanics, tokenomics gives us the precise tools we need to analyze the financial DNA of a digital asset.

Can a Project Change Its Tokenomics After Launch?

Yes, but it’s a huge deal. Tweaking a project's core economic rules after it's already live isn't something that happens on a whim. It usually requires a major network upgrade, sometimes even a controversial "hard fork."

For any genuinely decentralized project, these kinds of changes demand broad consensus from the community, typically through governance votes. Token holders get to weigh in on proposals to adjust things like supply, distribution, or the token's core utility.

This is a path teams tread very carefully. Messing with the foundational economic policy can have a massive ripple effect on a token's value, shake investor confidence, and destabilize the whole ecosystem. It's a power reserved for critical, heavily debated updates.

Where Can You Find a Project's Tokenomics Information?

Hunting down reliable data is probably the most crucial skill you can develop. Your first stop should always be the project's official channels—they are the source of truth.

- The Whitepaper: This is the project's bible. Any serious crypto project will have a whitepaper with a detailed section breaking down the token's purpose, supply, distribution schedule, and vesting periods for insiders.

- Official Documentation: Look for a "docs" section on the project's website. It often presents the tokenomics in a more digestible format than the highly technical whitepaper.

Once you've reviewed the primary sources, you can cross-reference what you've found with data aggregators. Sites like CoinGecko and CoinMarketCap are indispensable for checking real-time data like circulating supply, market cap, and trading volume. If you have more general crypto questions, a comprehensive crypto FAQ page can offer broader insights.

Always start with official documents. Never rely solely on a tweet or a Telegram message for something as important as a project's economic data.

Ready to put your knowledge into action? With vTrader, you can trade over 30 cryptocurrencies with zero commission fees, backed by advanced tools and state-of-the-art security. Get started today and claim your $10 sign-up bonus. Join vTrader and trade smarter.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.