When people first get into crypto, one of the biggest points of confusion is the difference between a coin and a token. They often get used interchangeably, but they are fundamentally different beasts.

Here’s the simplest way to think about it: a coin has its very own, independent blockchain. It’s the native currency for its network. A token, on the other hand, is built on top of an existing blockchain.

Think of it like this: a coin, like Bitcoin, is the engine and the fuel for its own unique digital highway. A token is more like a special-purpose car that has to drive on someone else’s highway—like Ethereum—and pay a toll (gas fees) for the privilege.

Unpacking The Core Differences

At a glance, both coins and tokens are just digital assets you can trade. But when you look under the hood, their technology, their reason for existing, and how they function in their ecosystems are worlds apart. Nailing this distinction is your first real step toward making smarter decisions in the crypto market.

Essentially, a coin is the base layer—the foundation. A token represents a specific use case or asset within an already established ecosystem.

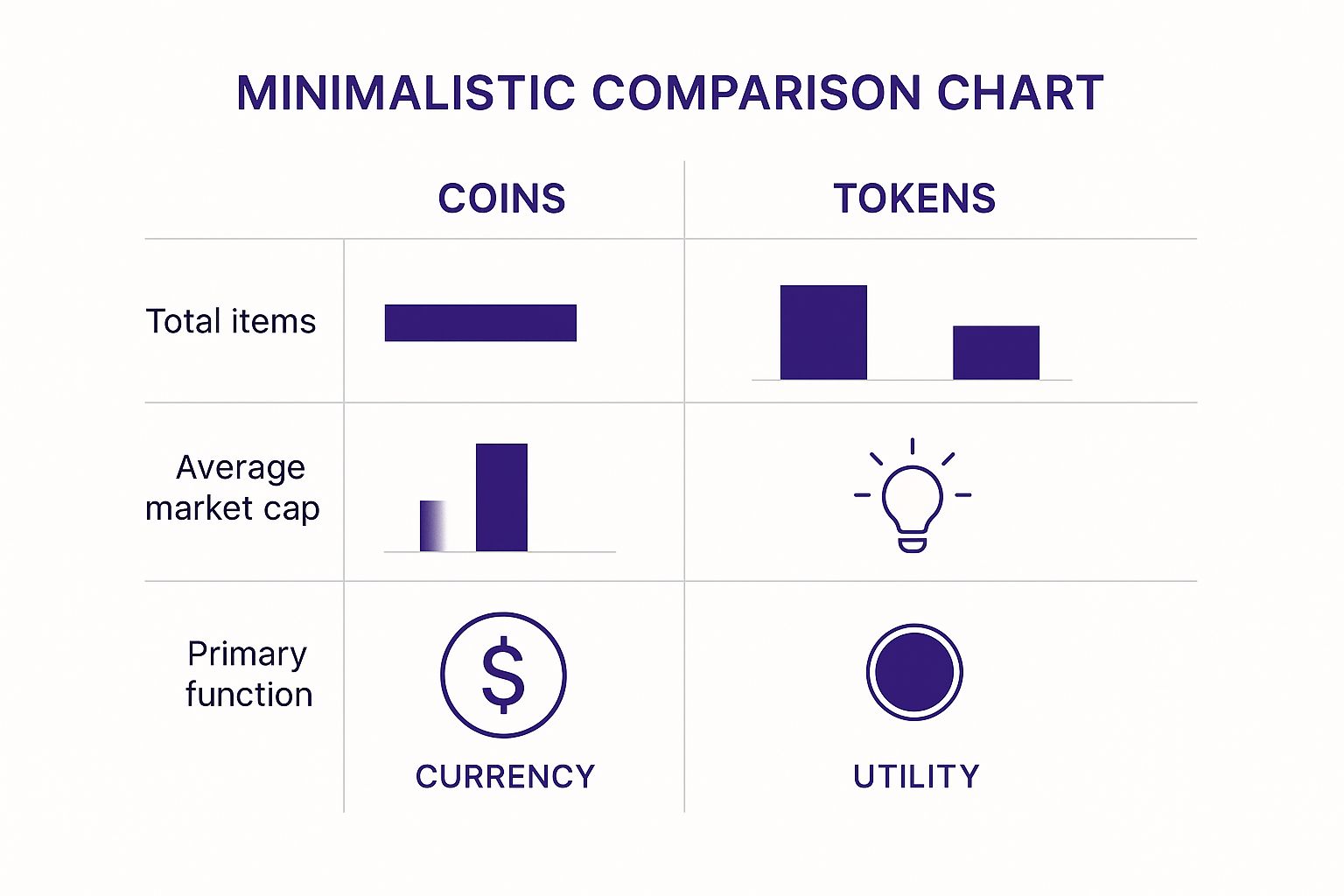

This image really drives the point home. While the top coins have a much larger average market cap, there are vastly more tokens out there. This highlights their specific, project-based nature compared to the foundational role of coins.

The Blockchain Foundation

The most critical difference in the coin vs. token debate always comes back to the blockchain. Coins are native to their own blockchains; they're literally what makes the network run.

For instance, Bitcoin (BTC), which got the whole ball rolling back in 2009, runs on its own blockchain and is treated primarily as a store of value. Likewise, Ether (ETH) is the coin that fuels the Ethereum network, paying for every transaction and computation.

Tokens don't have their own blockchain. They're digital assets created on top of other networks, with Ethereum being the most popular host by a long shot. This technical detail is a massive differentiator. If you want to dig deeper into these kinds of market dynamics, platforms like TokenMetrics.com are a great resource.

Key Takeaway: A coin acts as both a currency and the fuel for its own blockchain. A token is a digital asset that represents a project, utility, or right that simply runs on another blockchain.

Coin vs Token At a Glance

Sometimes a simple side-by-side comparison is the best way to see the differences clearly. This table breaks down the essential attributes that separate these two types of digital assets.

| Attribute | Coin | Token |

|---|---|---|

| Blockchain | Has its own independent blockchain | Built on an existing blockchain (e.g., Ethereum) |

| Primary Purpose | Acts as a store of value or medium of exchange | Represents a utility, asset, or governance right |

| Creation | Requires building an entirely new blockchain | Created easily using smart contract templates |

| Example | Bitcoin (BTC), Ethereum (ETH), Solana (SOL) | Uniswap (UNI), Chainlink (LINK), Shiba Inu (SHIB) |

As you can see, creating a coin is a monumental task involving building a whole new network from scratch. In contrast, tokens can be whipped up relatively easily using established smart contract standards on platforms like Ethereum. This is why we've seen an explosion of tokens, each serving a unique function from governance to in-game currency.

How Coins and Tokens Are Actually Created

If you really want to get to the heart of what separates a coin from a token, look no further than how they’re made. This process tells you everything you need to know, revealing why launching a new coin is a massive undertaking, while new tokens pop up seemingly overnight. It’s a crucial distinction that directly impacts their investment profiles in the whole token vs coin debate.

When someone decides to create a new coin, they’re essentially committing to building an entirely new blockchain from the ground up. This isn't a weekend project; it's a huge technological and financial challenge.

- Building a Consensus Mechanism: First, the team has to design and code a secure method for everyone on the network to agree on transactions. This is where you hear terms like Proof of Work (PoW) or Proof of Stake (PoS) come into play.

- Growing a Community of Miners or Validators: A coin is worthless if there’s no one to secure its network. This means convincing thousands of people or groups around the world to dedicate their computers or capital to the cause.

- Creating the Infrastructure: Beyond the core code, you need wallets, block explorers, and all the software that makes the network usable. It's a huge development lift that takes serious time and resources.

Because this process is so difficult and expensive, genuinely new coins are few and far between. Each one represents a massive gamble on creating a brand-new digital economy from scratch.

The Streamlined World of Token Creation

Creating a token, on the other hand, is a completely different ballgame. Instead of building a new highway, developers are just creating a new type of car to drive on a road that already exists—like the Ethereum network. They get to piggyback on its security and infrastructure, which is made possible by smart contract standards.

The most famous of these is ERC-20. Think of it as a fill-in-the-blanks template on the Ethereum blockchain that lays out a standard set of rules for how a token should behave. It dictates how tokens are transferred, how transactions are approved, and how data is accessed. For a deeper dive into these technical standards, you can find a ton of great material in the vTrader learning academy.

By using a pre-built framework like ERC-20, a developer with some basic coding skills can launch a new, fully functional token in hours, not years. This completely lowers the barrier to entry, letting new projects go from concept to reality almost instantly.

The image below gives you a glimpse of the key functions required by the ERC-20 standard. It’s a plug-and-play blueprint for anyone looking to create their own token.

This standardization is exactly why we see a constant flood of new tokens hitting the market, especially speculative assets like memecoins. A project can go from an idea to a tradable asset with almost no friction. It’s also why the token market is so much more dynamic—and often riskier—than the coin market.

How They Behave in the Investment Market

The technical split between a coin and a token creates two completely different beasts in the investment world. Getting this distinction right is the difference between building a solid portfolio and just gambling on the latest hype. It’s like choosing between investing in the market's bedrock versus chasing its most volatile, fast-moving trends.

Big-name coins, especially Bitcoin, often behave like the crypto market's version of digital gold. When serious money flows into crypto, it tends to hit Bitcoin first. This deep liquidity and widespread acceptance mean its price action can dictate the mood for the entire market, dragging nearly every other asset along for the ride.

The token scene, on the other hand, is a much wilder and more crowded place. The sheer ease of creating a token has unleashed a flood of new assets, all fighting for the same limited pool of investor cash and attention.

The Era of Sector Rotations

This token explosion has fundamentally rewired how the market works. We've seen a dramatic surge in tradable tokens, but the amount of new money coming in hasn't kept pace. As a result, the old "altcoin beta" trade—where a rising Bitcoin lifted all other coins—has lost much of its punch. For a deeper dive into crypto's growth, check out the analysis on Tangem’s blog.

Instead of these broad market rallies, what we see now are incredibly fast, narrative-driven sector rotations. Capital doesn't spread out evenly; it violently shifts from one hot theme to the next.

- Meme Coins: Assets born from internet culture can ignite in explosive but often short-lived rallies.

- AI Tokens: The moment a new AI story captures the market's imagination, money pours into any related project.

- Real-World Assets (RWA): When sentiment shifts towards tangible value, tokens representing physical things like real estate or bonds become the new darlings.

This makes token investing a game of timing and trend-spotting. You have to figure out which story has momentum.

Key Insight: While major coins act as capital sponges for the whole market, tokens are locked in fierce competition within their own narratives. Winning with tokens is less about the overall market's direction and more about nailing the next trending sector before everyone else does.

Navigating Different Investment Profiles

This clear behavioral divide in the token vs. coin discussion leads to two very different ways to invest.

Putting your money into a foundational coin like Bitcoin or Ethereum is usually a long-term play. It's a bet on the entire crypto ecosystem growing and gaining more adoption. Their value is anchored in network security, user growth, and their role as a reserve asset.

Playing the token market, however, demands a much more active and nimble approach. You're not betting on the market; you're betting on a specific project, its team, and the power of its story. The potential for 100x gains is absolutely real, but so is the risk of a project imploding or its narrative simply dying out, causing a catastrophic crash. A sharp token investor has to be a master of spotting trends, managing risk, and knowing when to get out.

Real-World Use Cases Beyond Price Speculation

While trading charts and price swings seem to get all the attention, the real substance in the token vs coin debate is what these assets actually do. Once you look past the speculative noise, their practical uses reveal two completely different stories and value propositions.

Coins are the native assets of their blockchains, serving as the foundational layer for everything that happens on-chain. Think of Bitcoin (BTC). It's often called "digital gold" because its main purpose is to be a secure store of value and a decentralized way to transfer wealth, operating outside the traditional financial system.

Then you have something like Solana (SOL), which was built for raw speed. It's designed to zip through thousands of transactions a second for pocket change. This makes it the engine for a high-octane ecosystem of apps that need instant results, from trading bots to decentralized social media.

The Specialized Roles of Tokens

Tokens, on the other hand, are built for very specific jobs within an existing ecosystem. Their value isn't about securing a massive network; it's tied directly to how useful and in-demand their particular project is. This creates a wild diversity of applications. To really get a handle on it, it pays to stay on top of the evolving Web3 ecosystem and see where things are headed.

Here's a quick breakdown of the main types:

- Utility Tokens: These are like digital keys that grant you access to a product or service. The Basic Attention Token (BAT), for example, is the currency inside the Brave browser's ad system, rewarding you for your attention.

- Governance Tokens: These give you a voice. Holders of Uniswap's UNI token can vote on important protocol decisions, like fee changes or software upgrades.

- Non-Fungible Tokens (NFTs): Unlike other tokens, each NFT is one-of-a-kind. They act as a provable certificate of ownership for a specific item, whether it's digital art, a collectible, or even a real-world concert ticket.

Key Insight: A coin’s value is linked to the overall health, security, and adoption of its entire blockchain. A token's value is directly tied to the success and demand for the specific project it powers.

This difference is everything. For instance, Ether (ETH) is the gas that fuels the entire Ethereum network—a global computer. If you want to build or do anything on Ethereum, you have to pay with ETH, which creates a constant, underlying demand for the coin. If you're curious about this dynamic, you can get a feel for its market behavior by learning more about trading ETH on vTrader.

To make these distinctions even clearer, the table below maps out the functional differences between these asset types with real-world examples.

Real-World Application Comparison

This table offers a detailed look at the distinct functions and applications of coins versus various types of tokens, highlighting their specific roles in the digital economy.

| Asset Type | Primary Function | Example | Value Proposition |

|---|---|---|---|

| Coin | Network Security & Gas | Ether (ETH) | Powers all transactions on the Ethereum network |

| Utility Token | Application Access | Basic Attention Token (BAT) | Used within the Brave browser's ad ecosystem |

| Governance Token | Protocol Decision-Making | Uniswap (UNI) | Grants voting rights on platform changes |

| NFT | Unique Digital Ownership | CryptoPunks | Verifiable proof of ownership for a digital asset |

As you can see, each asset carves out its own niche. Coins provide the broad infrastructure, while tokens create specific value and utility on top of it, driving innovation and user engagement.

Navigating the Different Security Risks

Every investment comes with a bit of risk, but in the token vs coin debate, those risks couldn't be more different. Knowing exactly where the danger lies is the first step to protecting your capital. The threats you'll face holding a foundational coin like Bitcoin aren't the same as those tied to a new, project-specific token.

With the big players like Bitcoin or Ether, the primary concern is a fundamental flaw in the blockchain itself. The classic fear is a 51% attack, where a bad actor somehow gets control of enough of the network's computing power to start manipulating transactions. While it’s possible in theory, pulling this off on a massive, decentralized network is now outrageously expensive and almost practically impossible.

The Unique Risks of Tokens

Tokens, on the other hand, bring a whole different set of much more immediate and common dangers to the table. Because they're built on smart contracts, their security is only as good as the code they're written on.

A critical takeaway is that a token's security is entirely dependent on its project's developers, whereas a coin's security relies on its entire decentralized network. This shifts the risk from a broad network vulnerability to a very specific, human-centric one.

This concentration of risk opens the door to several threats every investor needs to be on the lookout for:

- Smart Contract Bugs: Even a tiny flaw in a token's code can be a golden ticket for attackers to drain funds. We've seen this happen time and again in high-profile DeFi hacks.

- Rug Pulls: This is a depressingly common scam. Developers launch a token, build up hype, attract investors, and then vanish—draining all the liquidity and leaving everyone else holding worthless assets. The infamous $SQUID token, which tanked from over $2,800 to nothing when its creators cashed out, is a perfect example.

- Team Credibility: A project’s fate is often tied directly to the integrity and skill of its team. An anonymous or unproven team is a huge red flag you can't afford to ignore.

A Practical Due Diligence Checklist

To get around these risks, doing your homework isn't just a suggestion; it's non-negotiable. Before you even think about investing in a token, run through this quick checklist:

- Scrutinize the Whitepaper: Does it clearly lay out the project's goals, tech, and tokenomics? Vague or copied-and-pasted whitepapers are an immediate warning.

- Verify Smart Contract Audits: Any serious project will pay to have its code audited by a third-party security firm. Look for the audit reports and check if they found any critical issues that haven't been fixed.

- Assess the Team: Are the developers public figures? Do they have a solid track record? A little digging into their backgrounds and past projects goes a long way.

- Evaluate Community Engagement: A healthy, buzzing community can be a great sign, but watch out for pure hype driven by bots or paid shills.

By taking this structured approach, you can get much better at spotting legitimate projects and steering clear of potential scams.

On top of that, understanding how these assets are managed and secured can be a game-changer. Exploring concepts like crypto staking—which involves locking up assets to help secure a network—is a great next step. You can learn more about staking on vTrader and see how it plays a role in overall network security.

A Practical Guide to Trading on vTrader

Knowing the difference between a token vs coin is one thing, but turning that knowledge into a winning strategy on vTrader is where the real work begins. The secret is simple: don’t treat them the same. Your approach to a foundational coin should be worlds apart from how you trade a fast-moving, hype-fueled token.

For major players like Bitcoin or Ethereum, patience is often your greatest asset. These are the blue chips of the crypto world, defined by massive liquidity and market dominance. A smart play on vTrader might be setting up recurring buys to build your position over months or even years. Or, you could use technical analysis on longer timeframes to pinpoint major support and resistance levels for more strategic entry points.

Mastering Token Momentum

Trading tokens, on the other hand, is a different beast entirely. It demands a quick, active mindset because the token market thrives on lightning-fast narratives and short-term momentum. Forget about broad market trends; here, you need to zoom in on specific, red-hot sectors.

Here’s how you can tackle it:

- Hunt the Narrative: What's the market whispering about? Are AI tokens getting all the attention? Maybe Real-World Assets (RWA) are starting to heat up. Use vTrader’s market news and data to get ahead of these emerging trends.

- Pinpoint the Leaders: Once you’ve found the story, find the stars. Within that narrative, use vTrader's charting tools to spot the tokens with high relative volume and clear upward price action.

- Manage Risk Like a Pro: This is non-negotiable. The moment you enter a trade, set a stop-loss order. This is your safety net, automatically selling your position if the price tumbles, which is a common hazard in the wild world of tokens.

Trader’s Tip: Don't get emotionally attached to a token trade. You're here to ride the wave of hype and get out. The second a narrative begins to lose steam, take your profits and start looking for the next opportunity.

A sharp trader knows every asset needs its own game plan. It’s also smart to know the platform’s rules inside and out. To understand exactly how your funds are handled, you can get all the details in the vTrader refund policy for total clarity. Making sure you’re prepared for every part of the trading journey is just good business.

Frequently Asked Questions

When you’re digging into the crypto world, a few questions always seem to pop up. Let's tackle the most common ones about the coin vs. token dynamic to clear things up and get you on solid ground.

Can a Token Become a Coin?

Absolutely, and it’s a more common path than you might realize. The whole process is known as a mainnet swap. A project often kicks things off with a token on an established network like Ethereum. This lets them build a community and raise funds without the huge upfront cost of creating their own blockchain from scratch.

Once their own independent blockchain is fully developed and ready to go live, they migrate the existing tokens over. The old tokens are then swapped for the project's new, native coins. Big names like Binance Coin (BNB) and Crypto.com (CRO) are prime examples of projects that pulled this off successfully.

Is One a Better Investment Than the Other?

There’s no simple "better" here—it all comes down to your personal investment strategy and how much risk you’re comfortable with. This is really the heart of the token vs coin decision for any trader.

A savvy approach many experienced investors take is to use major coins as the stable, long-term foundation of their portfolio. They then treat tokens as higher-risk, but potentially higher-reward, plays on the success of a specific project or a trending narrative.

By building a diversified portfolio with both asset types, you can balance the relative stability of established coins with the explosive growth potential that tokens can sometimes deliver.

Why Are There So Many More Tokens?

It boils down to one simple thing: they are way easier to create. Launching a new coin means building an entire blockchain from the ground up, which is a massive, complex, and incredibly expensive undertaking.

On the other hand, a developer can create a token using the secure, ready-made infrastructure of a network like Ethereum. With standardized templates like ERC-20, a brand new token can be deployed with surprisingly little cost and technical skill. This low barrier to entry is what triggered the Cambrian explosion of tokens we see today.

For more answers to your crypto questions, check out the detailed guides in our vTrader FAQ section.

Ready to put what you've learned into practice? Join vTrader today to trade both leading coins and promising tokens with zero commission fees. Start building your diversified portfolio and take control of your crypto journey.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.