Ever wonder how you can make your crypto work for you, beyond just waiting for its price to go up? Think of it like a high-yield savings account, but for your digital assets. By staking your crypto, you’re essentially locking it up to help keep a blockchain network running smoothly and securely.

In return for your help, the network pays you rewards in the form of more crypto. It’s one of the most popular ways to generate a passive income stream in the crypto world.

What Is Crypto Staking and How Does It Work?

Crypto staking might sound complex, but the core idea is pretty straightforward. It's the process of participating in transaction validation on a blockchain that uses a Proof-of-Stake (PoS) model. When you stake your coins, you’re basically putting them up as a security deposit to prove you're committed to the network's health.

Let's use an analogy. Imagine a blockchain is a bustling digital city. To keep things in order, the city needs trustworthy guards (called validators) to confirm that every transaction—whether it's sending money or data—is legitimate. In a PoS system, anyone holding the city’s native currency can volunteer to be a guard by "staking," or locking up, some of their coins.

This staked amount is like putting down a bond. It sends a clear message: "I have skin in the game, so you can trust me to act honestly." The more coins you stake, the better your odds of being chosen to create the next block of transactions and earn rewards.

Before we go deeper, let's nail down these core concepts.

Key Staking Concepts at a Glance

For anyone new to staking, a few key terms pop up again and again. This table breaks them down into simple, easy-to-understand ideas.

| Concept | Simple Analogy | Core Function |

|---|---|---|

| Proof-of-Stake (PoS) | A digital voting system | A consensus mechanism where network participants lock up crypto to validate transactions and create new blocks. |

| Validator | A digital security guard | A node (computer) on a PoS network responsible for verifying transactions and maintaining the blockchain. |

| Staking | Putting up a security deposit | The act of locking crypto assets to support a network’s operations and earn rewards. |

| Staking Rewards | Earning interest or a salary | The crypto paid out to stakers and validators for their role in securing the network. |

Understanding these terms is the first step to confidently navigating the world of staking and putting your assets to work.

The Reward for Participation

So, why would anyone lock up their valuable crypto? The answer is simple: rewards. When a validator successfully confirms a new block of transactions and adds it to the chain, they earn newly created coins as a payment for their work.

A portion of these rewards is then shared with the individuals who delegated their coins to that validator. This creates a powerful, win-win loop:

- You Stake Your Coins: You commit your crypto to a validator to help secure the network.

- Validators Do the Work: They use the collective staked funds to validate transactions and propose new blocks.

- The Network Pays Out: The blockchain protocol automatically rewards honest validators and the people who staked with them.

- The Network Gets Stronger: As more people stake, the network becomes more decentralized and secure, making it much harder and more expensive for anyone to attack it.

Staking is more than just a way to earn passive income. It’s a chance to become an active participant in securing and decentralizing a blockchain you believe in. You're aligning your own financial success with the long-term health of the entire ecosystem.

This dynamic is exactly why so many investors are drawn to staking. Today, platforms have made it incredibly easy to get started, letting you stake your assets in just a few clicks. For example, you can check out the different staking options available on vTrader to see just how simple it is to put your crypto to work. What was once a highly technical process is now a straightforward strategy for growing your portfolio.

Understanding Proof of Stake: The Engine of Staking

To really get what crypto staking is all about, you have to pop the hood and look at the engine that drives it: Proof of Stake (PoS). This is the consensus mechanism—a fancy term for the rulebook—that a decentralized network uses to agree on which transactions are legit. In short, PoS is what makes staking possible and, more importantly, profitable.

The easiest way to understand it is by seeing how it differs from its older sibling, Proof of Work (PoW), the system that keeps Bitcoin running. Imagine PoW as a massive, hyper-competitive lottery where thousands of powerful computers (miners) are all racing to solve a ridiculously complex puzzle. The first one to crack it gets to add the next "block" of transactions to the chain and collect a reward.

Proof of Stake completely flips that script.

Instead of a raw power-based competition, PoS operates more like a shareholder vote. Your chance to validate transactions and earn rewards isn't determined by how much computing horsepower you have, but by how many coins you're willing to put up as collateral.

This shift in approach is a game-changer. It's why PoS is widely seen as a greener, more scalable alternative. Networks like Ethereum have made the high-profile switch from PoW to PoS, slashing their energy consumption by an incredible 99.95%. This move not only makes the network more sustainable but also opens the door for more people to participate.

The Role of Validators and Collateral

In a PoS system, the participants who lock up their crypto to help run the network are called validators. To get a shot at proposing a new block of transactions, a validator has to put their own coins on the line. This staked crypto acts as a security deposit—a clear signal that they’re committed to playing by the rules.

If a validator tries to pull a fast one by approving a fraudulent transaction, they risk losing some or even all of their staked collateral. This punishment, known as slashing, serves as a powerful financial deterrent against bad behavior.

- Rewards: For honestly and successfully adding new blocks, validators are rewarded with a cut of transaction fees and newly created crypto.

- Penalties (Slashing): Validators who act dishonestly or are negligent get their staked funds confiscated.

It's a classic carrot-and-stick system. It makes sure validators have far more to gain by upholding the network’s integrity than by trying to undermine it. This economic model is the very foundation that keeps the entire network secure.

The Foundation of Trust

At its heart, Proof of Stake relies on the underlying blockchain technology. Taking a moment to understand what the blockchain is really helps clarify how staking works to secure these digital ledgers. The whole point of PoS is to protect this distributed database.

By aligning the financial goals of participants with the health of the network, PoS creates a robust, self-policing ecosystem of trust. When you stake your assets, you’re doing more than just earning rewards; you're transforming from a passive owner into an active guardian of the blockchain.

Exploring Different Ways to Stake Your Crypto

So, you’ve wrapped your head around the "why" of staking. Now let's get into the "how." The world of crypto staking isn't a one-size-fits-all game; it’s a spectrum of different approaches. Each one is built for different levels of tech-savviness, risk appetite, and how much flexibility you want. Picking the right path is everything.

You’ll generally find three main options on the table: staking directly by running your own validator, handing your stake over to a pro service, or using a liquid staking provider to keep your capital working for you. Let's break down the pros and cons of each.

Direct Staking: Running Your Own Validator

The most hands-on, down-in-the-trenches method is direct staking, where you run your own validator node. Think of it as being the captain of your own ship. You're the one responsible for the hardware, the non-stop internet connection, and running the software that validates transactions and builds new blocks.

This path offers the biggest payday because you don't share the profits with anyone. But with great reward comes great responsibility—and risk.

- Pros: You pocket 100% of the staking rewards your node brings in. Plus, you’re directly contributing to the network's security and decentralization.

- Cons: This isn't for the faint of heart. It demands serious technical chops, a hefty initial investment for the minimum stake (like the 32 ETH needed for Ethereum), and you bear the full brunt of slashing penalties if your node ever messes up or goes offline.

Delegated Staking and Staking Pools

For most investors, a much more practical route is delegated staking. This is usually done through staking pools or directly on an exchange like vTrader. Instead of captaining your own vessel, you're essentially buying a ticket on a massive, professionally managed cruise ship. You "delegate" your coins to a pro validator who handles all the technical grunt work.

This model, which is the backbone of Delegated Proof-of-Stake (DPoS) networks, has blown up in popularity because it dramatically lowers the barrier to entry. You can stake with just a small amount of crypto and don't need to know the first thing about running a node. The validator just takes a small fee from your rewards for their troubles.

By delegating, you're tapping into the expertise and robust infrastructure of a professional operator. This cuts down your personal risk of getting slashed while you still earn a steady passive income on your assets.

Liquid Staking: Unlocking Your Capital

The latest and arguably most exciting evolution in the space is liquid staking. This innovation tackles one of staking's biggest pain points: locked-up funds. When you traditionally stake your crypto, it’s stuck—illiquid and unusable for anything else until you unstake it.

Liquid staking flips that script. When you stake through a liquid staking service, you get a special derivative token in return, known as a liquid staking token (LST). This LST represents your staked position and quietly accrues staking rewards, but here’s the magic: it’s also a fully functional token you can trade, lend out, or use as collateral in other DeFi apps.

As you can see, every staking model is designed to help you generate passive income and strengthen the network. Each method—direct, delegated, or liquid—simply offers a different mix of control, risk, and flexibility, letting you choose the strategy that perfectly aligns with your financial goals.

The Real Rewards and Risks of Staking

Staking can be an exciting way to grow your crypto holdings, but it's crucial to go in with your eyes wide open. While those big annual percentage yields (APYs) are what usually grab the headlines, the real benefits—and the potential pitfalls—run much deeper. To make smart decisions, you need to understand both sides of the coin.

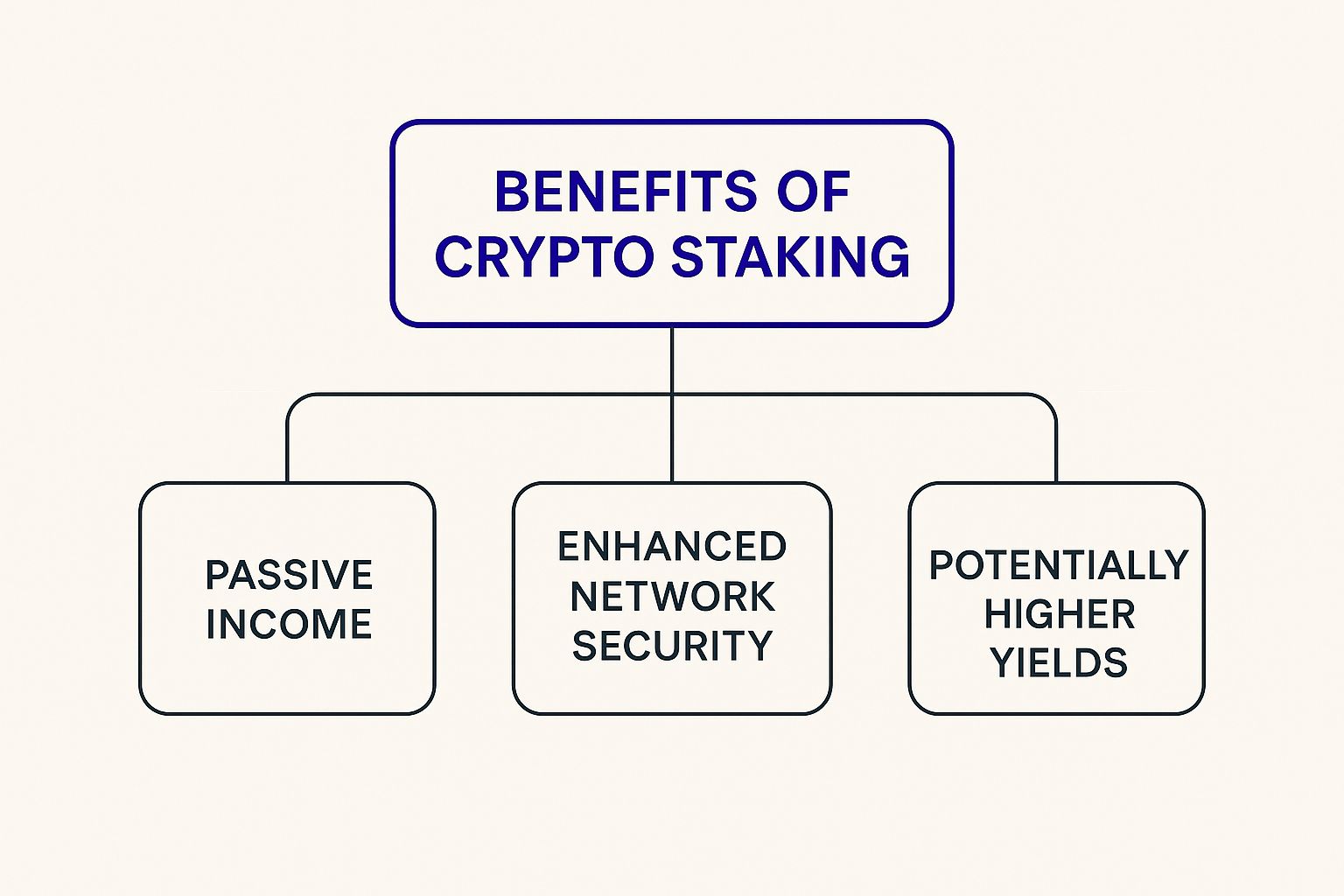

The most obvious perk is earning passive income. By staking your crypto, you’re essentially putting your idle assets to work, generating a steady flow of rewards that can really add up over time. But the advantages don't just stop at your wallet.

The Upside Beyond APY

Staking is about more than just a return on investment; it’s a direct way to back the projects you believe in. When you lock up your tokens, you’re actively helping to secure and decentralize the blockchain, making the entire network stronger and more resilient.

On top of that, many networks give stakers governance rights. This means you get a real voice in the project's future, with the ability to vote on important protocol upgrades and proposals. It changes your role from just a holder to an active participant shaping the ecosystem.

Staking beautifully aligns your personal financial interests with the network's long-term success. As the network gets more secure and robust, its native token often becomes more valuable, creating a virtuous cycle for everyone involved.

Understanding the Potential Downsides

Of course, no investment comes without risk, and staking is no exception. Before you commit your funds, you have to be fully aware of the challenges you might face.

Here are the primary risks you need to keep on your radar:

- Market Risk: This is the big one. The price of your staked crypto can drop, sometimes dramatically. Even if you're earning a 5% APY, a 50% drop in the token's market price means you're still facing a significant loss.

- Lockup Periods: Many protocols require you to lock your crypto for a specific amount of time. During these "unbonding" periods, you can't sell or move your assets, leaving you vulnerable if the market takes a nosedive.

- Slashing Penalties: If the validator you delegate your stake to messes up—by going offline for too long or acting maliciously—the network can penalize them by "slashing" their staked assets. And since you delegated to them, your funds get slashed too. This makes choosing a trustworthy validator absolutely essential.

- Platform Fees: Services like vTrader make staking incredibly simple, but they typically charge a small fee, usually a percentage of your rewards. Always check the fee structure of any platform you use. You can see how vTrader manages fees to ensure everything is transparent.

Finally, remember that staking rewards are a form of income, and that comes with financial considerations. The rules can be tricky, so it's a good idea to look into resources that cover the tax implications of Bitcoin income for general guidance. Knowing these risks upfront allows you to approach staking strategically and protect your portfolio.

Ethereum Staking: A Real-World Deep Dive

To really wrap your head around crypto staking, there’s no better place to look than Ethereum. The network's seismic shift from Proof-of-Work to Proof-of-Stake, an event famously dubbed “The Merge,” was more than just a technical update; it was a revolution. It completely rewired how the second-biggest blockchain on the planet operates, ditching energy-hungry mining for a new security model built on staked capital.

This wasn't just code changing behind the scenes. It kicked open the door for anyone holding Ether (ETH) to get directly involved in securing the network—and get paid for it. This change unleashed a massive new economy centered around staking, turning Ethereum into the largest and most dynamic Proof-of-Stake ecosystem we have today.

Looking at Ethereum gives us a powerful, real-world window into how staking works at an incredible scale. It’s one thing to talk about concepts in theory, but it’s another to see them in action, securing a multi-billion dollar network that handles millions of transactions every single day.

The Sheer Scale of Ethereum Staking

The amount of money and participation flowing into Ethereum staking is genuinely mind-boggling. It’s a powerful testament to the trust investors have poured into its Proof-of-Stake model.

As of early 2025, the network is being secured by a colossal 33.8 million ETH. That figure represents a massive 27.57% of the total ETH supply, showing just how fundamental staking has become to Ethereum's security and its economy. The dominant force here is liquid staking, which now commands about a 31.1% market share. If you want to dive deeper into these numbers, you can explore the full Ethereum staking statistics on DataWallet.com.

This level of participation creates a fortress-like security system. For an attacker to compromise the Ethereum network, they'd need to control a majority of all that staked ETH—a heist that would cost tens of billions of dollars, making it virtually impossible from an economic standpoint.

The Staking Ecosystem and Its Rewards

The move to Proof-of-Stake has sparked a rich and diverse ecosystem of staking solutions. While die-hard enthusiasts can run their own validator node with 32 ETH, the high price tag and technical know-how have opened the door for much more user-friendly options.

- Staking Pools: These services let you pool your ETH with other users to collectively meet the 32 ETH requirement. Everyone then shares the rewards based on their contribution.

- Liquid Staking: This is where it gets really interesting. Providers like Lido and Rocket Pool issue liquid staking tokens (LSTs), such as stETH, that represent your staked ETH. These tokens earn rewards but remain "liquid"—meaning you can trade them or use them in other DeFi apps.

- Centralized Exchanges: Platforms like vTrader offer a streamlined, hands-off approach. They handle all the technical heavy lifting, making it incredibly simple for users to start earning rewards.

Rewards on Ethereum, usually shown as an Annual Percentage Yield (APY), aren't fixed. They go up and down depending on how busy the network is and how much total ETH is being staked. While the yield has mostly hovered below 5%, the real prize is knowing you’re contributing to the network's security while your assets work for you. Every transaction on the network adds to its value, and as a staker, you get a piece of that action.

You can get a sense of the network's pulse by watching its activity levels. Our ETH gas tracker is a great tool for monitoring real-time network costs and understanding what's driving rewards.

How to Get Started with Crypto Staking

Ready to put your crypto to work? Getting started with staking is far more accessible than most people think, but it pays to follow a clear process. This ensures your assets are safe and your efforts actually get rewarded.

Let’s walk through the exact steps to take you from a complete beginner to a confident staker.

Before you commit a single dollar, the first step is always research. You absolutely need to understand the cryptocurrency you plan to stake and the platform you intend to use. After all, not all digital assets can be staked, and not every platform is created equal.

Step 1: Choose Your Crypto and Platform

Start by zeroing in on a Proof-of-Stake (PoS) cryptocurrency that interests you. Think big names like Ethereum (ETH), Solana (SOL), or Cardano (ADA). Each one comes with its own set of rules, reward rates, and lockup periods, so you'll want to find one that aligns with your personal investment goals.

Next, you have to decide where you'll stake. Your main options really boil down to three choices:

- A Non-Custodial Wallet: Wallets like MetaMask or Phantom put you in the driver's seat, giving you full control over your private keys. This is a high-security route, but it demands more technical know-how as you connect directly to a staking protocol.

- A Centralized Exchange: Platforms like vTrader have dramatically simplified the entire process. They manage the technical heavy lifting, letting you stake your assets with just a few clicks. For anyone new to this space, it’s the most beginner-friendly path by a long shot.

- A Liquid Staking Service: These services give you a special derivative token that represents your staked assets. It’s a clever way to maintain flexibility, but it does introduce another layer of smart contract risk you need to be aware of.

For newcomers, starting on a trusted exchange is often the smartest move. It removes the technical headaches and gives you a secure, all-in-one place to buy and stake your crypto.

Step 2: Acquire and Stake Your Assets

Once you've picked your platform, you’ll need to get your hands on the crypto you want to stake. If you don't already own it, you can typically buy it right on the exchange using a linked bank account or debit card.

With the assets sitting in your account, it’s time to head over to the platform's staking section. The process itself is usually very straightforward:

- Select the Asset: Find the crypto you want to stake from the list of available options.

- Enter the Amount: Decide how much you're comfortable committing. Many people start small just to get a feel for how it all works.

- Review and Confirm: The platform will lay out the estimated APY and any lockup terms. Look these details over carefully, and once you’re ready, confirm the transaction.

That’s it. Seriously. Once you confirm, your assets are officially staked and helping to secure the network. You are now set up to start earning passive rewards.

Step 3: Monitor Your Rewards

After you’ve staked your crypto, your main job is to simply monitor your earnings. Most platforms feature a dashboard where you can watch your rewards accumulate, often in real-time. Depending on the network, these rewards are usually paid out daily or weekly.

As you get more comfortable with how staking works, you might feel ready to explore more advanced strategies. For a deeper dive into crypto concepts, the vTrader Academy is packed with valuable lessons and guides to expand your knowledge. Building a solid educational foundation is the key to making informed and confident investment decisions.

Frequently Asked Questions About Staking

As you get more comfortable with staking, you’re bound to have a few questions pop up. It’s only natural. This last section is all about giving you clear, no-nonsense answers to the most common queries we hear. Think of it as a quick reference to help you lock in the concepts from this guide and stake with confidence.

Can I Lose My Crypto by Staking?

It's a fair question, and the honest answer is yes, it's possible to lose crypto from staking. But don't let that scare you off—it’s not a common event if you're careful. The two big things to watch out for are slashing and good old market volatility.

Slashing is a penalty that happens when the validator you delegate your tokens to misbehaves or has too much downtime. In that case, the network can "slash" a portion of the staked assets (including yours) as a punishment. Separately, the price of your staked crypto can always drop. Even if you're earning great rewards, a steep market decline could mean your holdings are worth less in dollar terms. Your best defense is to stick with reputable validators and get a feel for the token's price history.

What Is the Difference Between Staking and Lending?

People often mix these two up, but they're fundamentally different ways to put your crypto to work.

When you're staking, you're directly involved in keeping a blockchain network running and secure. Your assets are essentially your vote of confidence, helping to validate transactions. The protocol rewards you for this vital service.

Lending, on the other hand, is more like what a traditional bank does. You give your crypto to a platform that loans it out to other users, and you earn interest from the borrowers. So, in a nutshell, staking secures a network, while lending provides market liquidity.

Staking directly supports the integrity and operation of a blockchain. Lending supports the financial activities built on top of it.

How Much Can I Earn from Staking Crypto?

This is where things can get really interesting. Staking returns, usually shown as an Annual Percentage Yield (APY), can be all over the map. Your earnings depend on which crypto you're staking, how many other people are staking it, and the token's own inflation schedule.

For major, well-established coins like Ethereum, you might see an APY in the 3-5% range. But if you look at newer or smaller projects, they often dangle much higher APYs to attract early supporters and build their network. Just remember, higher rewards usually come hand-in-hand with higher risk.

For more answers to common questions, our comprehensive vTrader FAQ page has you covered on everything from account security to transaction fees.

Ready to put your knowledge into action and start earning rewards? With vTrader, you can begin staking your crypto safely and easily, with zero commission fees. Join vTrader today and get a $10 sign-up bonus to kickstart your portfolio!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.