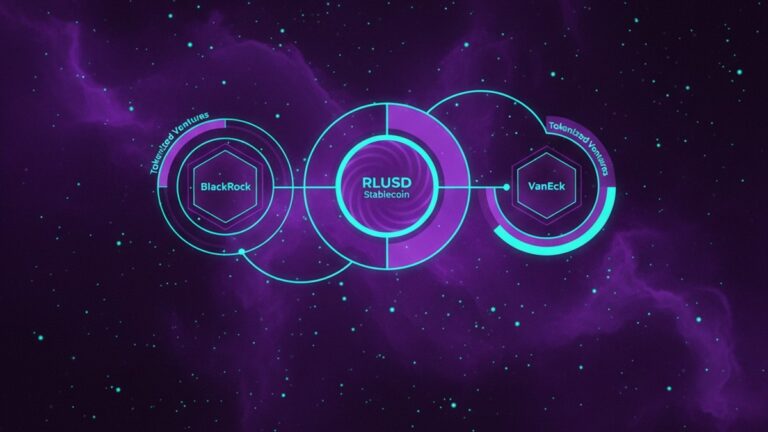

Ripple is making waves in the financial tech landscape once again. As of today, September 24, 2025, the company has announced a groundbreaking integration of its RLUSD stablecoin into tokenized money-market funds managed by industry giants BlackRock and VanEck. This development not only enhances the liquidity options for investors but also underscores Ripple’s commitment to bridging the gap between traditional finance and the burgeoning world of cryptocurrencies.

A New Era of Tokenized Finance

Investors in BlackRock’s BUIDL and VanEck’s VBILL funds now have a new, innovative tool at their disposal. Through a collaboration with Securitize, a leader in digital asset securities, these investors can seamlessly swap their shares for RLUSD using a new smart contract on Securitize’s platform. This mechanism provides a 24/7 stablecoin off-ramp for tokenized treasuries, allowing for on-demand redemption and adding a new dimension of flexibility and accessibility.

Ripple’s RLUSD acts as a settlement layer for real-world assets (RWA), an area of significant interest for institutional investors seeking to leverage blockchain technology without sacrificing regulatory compliance. This integration not only broadens RLUSD’s institutional footprint but also positions it as a key player in the intersection of digital and traditional finance.

Ripple’s Strategic Vision

Jack McDonald, Ripple’s Senior Vice President of Stablecoins, expressed enthusiasm about the partnership. In a prepared statement, he described the integration as a “natural next step” in Ripple’s ongoing mission to fuse traditional financial systems with the crypto world. McDonald emphasized that RLUSD is both regulatory-compliant and enterprise-grade, qualities that are crucial as financial institutions seek to navigate the complexities of digital assets.

Since its launch last year, RLUSD has seen impressive growth, surpassing $700 million in circulation. Backed 1:1 with liquid reserves and issued under a New York Department of Financial Services (DFS) trust charter, the stablecoin represents a significant milestone in Ripple’s strategic roadmap. The company has been actively promoting RLUSD for cross-border payments and DeFi pools, and this new development signals a deeper anchoring to institutional RWA platforms.

Balancing Compliance and Innovation

The financial world is no stranger to the challenges of integrating new technology within existing regulatory frameworks. RLUSD’s backing and regulatory compliance are significant advantages for institutions wary of the volatility and risks often associated with digital currencies. By ensuring that RLUSD meets stringent regulatory standards, Ripple is providing a stable and secure option for institutions looking to explore tokenized finance.

However, it’s not just about compliance. The integration with Securitize also paves the way for RLUSD’s deployment on the XRP Ledger, enhancing its usability in decentralized finance (DeFi) environments. This dual approach—focusing on regulatory compliance and DeFi usability—positions Ripple uniquely in the market, allowing it to cater to both conservative institutional investors and more adventurous DeFi enthusiasts.

Industry Implications

The integration of RLUSD into BlackRock and VanEck’s funds could have far-reaching implications for the financial industry. Tokenized money-market funds are increasingly seen as a way to bring the benefits of blockchain technology, such as transparency and efficiency, to traditional financial products. By allowing direct redemption into a stablecoin like RLUSD, these funds offer a more seamless and efficient way for investors to manage their assets.

Moreover, this move could inspire other financial institutions to explore similar integrations, further accelerating the adoption of blockchain technology in traditional finance. The potential for increased liquidity and the ability to transact 24/7 are compelling advantages that could drive broader acceptance of digital assets among institutional investors.

A Balanced Perspective

While the integration of RLUSD into BlackRock and VanEck’s funds represents a significant step forward, it’s important to approach these developments with a balanced perspective. The crypto industry has often been criticized for overhyping technological advancements, and while the potential is vast, the reality of widespread adoption may take time.

Challenges remain, particularly around educating traditional financial institutions about the benefits and risks of digital assets. The industry must also continue to work closely with regulators to ensure that innovation doesn’t outpace the creation of appropriate legal and regulatory frameworks.

Looking Ahead

Ripple’s integration with BlackRock and VanEck is an exciting development in the world of tokenized finance. By providing a stable, regulatory-compliant off-ramp for tokenized treasuries, RLUSD is poised to play a significant role in the evolution of digital finance. As the lines between traditional finance and crypto continue to blur, partnerships like these will be crucial in shaping the future landscape of global finance.

As we move forward, it’s clear that the financial world is watching closely. With innovation and regulation working hand in hand, the potential for digital assets to transform the financial ecosystem is more tangible than ever. Ripple’s latest move is a testament to the growing maturity and acceptance of blockchain technology in the mainstream financial industry.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.