Paper trading crypto is your chance to trade with virtual funds—think of it as a flight simulator for the crypto markets. It lets you test-drive trading strategies and get a feel for a platform’s mechanics without putting a single dollar on the line.

What Is Paper Trading and Why It Matters for Crypto

Ever wanted to learn how to drive a high-performance race car? You wouldn’t just jump onto the track on race day. You'd start in a simulator to get a handle on the controls, push its limits, and learn the course without the risk of a disastrous crash.

Paper trading crypto is the exact same idea, just applied to the financial world. It’s a powerful tool that drops you into a hyper-realistic market environment where you can buy and sell digital assets like Bitcoin and Ethereum, all with simulated money. This isn't just some basic game, either. Top-tier paper trading platforms mirror live market conditions with stunning accuracy, factoring in real-time price moves and even trading fees to give you an authentic experience.

The Essential Training Ground for a Volatile Market

Let's face it: the crypto market is famous for its wild speed and volatility, which can be seriously intimidating for newcomers. This is precisely where paper trading becomes a game-changer. It acts as a safe playground for beginners to master the fundamentals—placing orders, reading charts, and managing a portfolio—without the pressure.

For seasoned traders, it’s more like a sophisticated lab. They can experiment with complex new strategies, like automated bot trading or tricky day-trading techniques, before committing real capital. The whole point is to build genuine confidence and practical skills in a zero-stakes setting, making sure you’re ready for whatever the market decides to throw at you.

The real magic of paper trading is how it bridges the gap between knowing the theory and actually doing the work. It gives you the freedom to make mistakes, learn from them, and sharpen your approach without the emotional and financial gut-punch of real losses.

Building Skills in a Realistic Environment

To practice effectively, you need an environment that feels real. The best paper trading platforms are designed to help traders make the leap to live markets by building their confidence and getting them comfortable with professional-grade tools.

Given how crypto can be swayed by everything from global regulations to a single tweet, this risk-free simulation is priceless for developing profitable strategies and truly understanding how the market breathes. To learn more about the basics of trading and investing, you can find a wealth of resources in the vTrader Academy.

By 2025, this method is widely seen as a crucial first step for anyone serious about navigating crypto, whether you're testing scalping strategies or figuring out swing trading. You can learn more about how to perfect your crypto skills without risk on Coinrule.com.

Unlock Key Benefits with a Crypto Trading Simulator

Jumping into crypto paper trading is about way more than just learning your way around a platform. It's a training ground that forges disciplined, savvy, and tough traders. These aren't just abstract perks; they're tangible skills you need to survive and thrive in the real market.

The biggest, most obvious win? A completely risk-free education. Think of it as your personal financial lab where experiments have no real-world consequences. You can finally see for yourself how a market order differs from a limit order, or watch a stop-loss trigger in real time.

This hands-on practice kills the fear of making expensive rookie mistakes. Instead of putting your hard-earned money on the line while you're still figuring things out, you can click, explore, and test everything without a single worry.

Develop and Refine Your Strategies

A crypto trading simulator is the ultimate sandbox for your strategies. It's an environment literally built for trial and error, giving you the freedom to cook up and perfect any trading approach you can think of.

Whether you’re crafting a simple buy-and-hold strategy for giants like Bitcoin or putting a complex automated trading bot through its paces, the simulator gives you all the data and tools you need. You get a front-row seat to see how your ideas stack up against actual market swings, helping you spot the weak points and shore up your plan.

This is how you build a battle-tested trading plan. You can put your theories to the test on things like:

- Technical Indicators: Does your strategy built around moving averages or RSI actually hold water over a few weeks or months?

- Portfolio Allocation: Mess around with different asset mixes to get a feel for risk, reward, and the power of diversification.

- Profit and Loss Targets: Get into the habit of setting your exit points ahead of time—and actually sticking to them.

This sandbox also helps you grasp concepts that are bigger than just trading. For instance, while you can’t actually stake crypto in a demo account, you can see how different assets might generate returns over time. You can learn more about how vTrader approaches crypto staking and factor that thinking into your broader investment strategy.

A simulator gives you permission to fail safely. Every virtual loss is a lesson learned, and every successful trade becomes a blueprint for the real thing—all without ever touching your bank account.

Build Your Emotional Armor

This might be the most underrated benefit of them all: paper trading crypto gives you the chance to build emotional armor. The psychological whiplash of real trading—where FOMO (fear of missing out) and greed can take over—is often the biggest obstacle for traders.

A simulator lets you experience those emotional triggers in a safe, controlled space. You can watch your fake portfolio take a massive dive or skyrocket overnight and practice keeping a level head through it all. It’s here that you develop the discipline to stick to your strategy when the pressure is really on.

By going through the motions of market chaos again and again, you learn to manage your gut reactions. This kind of psychological conditioning is priceless, turning you from someone who reacts to the market into someone who strategizes within it. It’s not about learning which buttons to press; it’s about mastering the mindset you need to win in the long run.

How To Start Your First Crypto Paper Trade

Jumping into the world of paper trading crypto is an exciting move toward sharpening your skills. Getting started is pretty straightforward, but the most critical decision you'll make right out of the gate is picking the right platform. A great simulator isn't just a toy—it's a serious training ground.

This quick guide will walk you through everything from choosing a platform to placing your very first virtual trade.

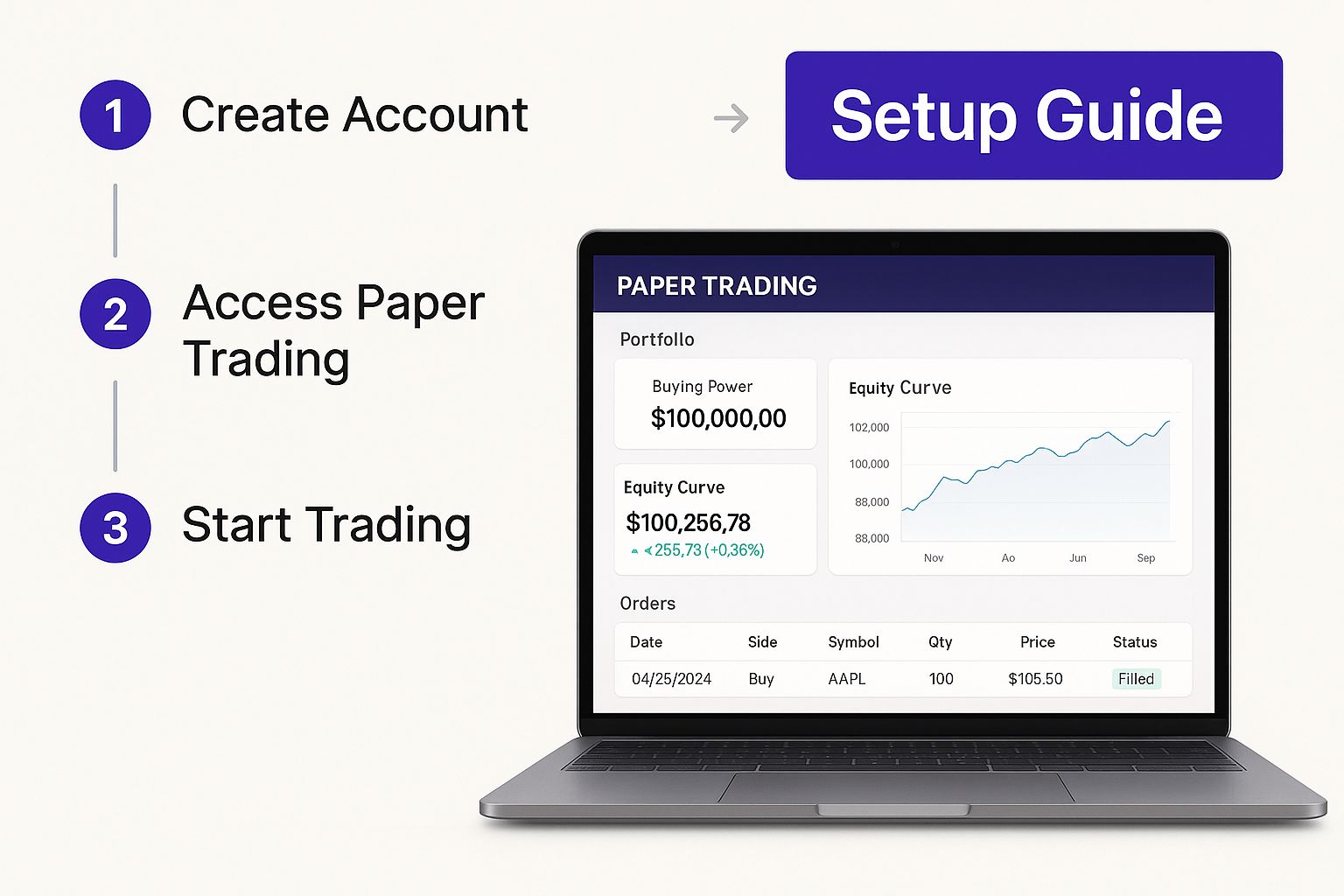

This visual breaks down the simple path to setting up a paper trading account, from selection to execution. The whole process is designed to be user-friendly, clearing any hurdles so you can get straight to the learning.

Choose The Right Platform

Your first mission is to find a trading simulator that actually feels like the real deal. Not all platforms are built the same, so you need to look for one with the essential features that deliver a truly realistic experience.

Here’s what should be on your checklist:

- Real-Time Market Data: The platform absolutely must use live price feeds. Trading with delayed data is like trying to learn how to drive by watching a replay of a race.

- Diverse Crypto Selection: You'll want access to a wide range of cryptocurrencies, from giants like Bitcoin and Ethereum to various altcoins. This lets you get a feel for different corners of the market.

- Intuitive User Interface: A clean, easy-to-use dashboard means you can focus on your strategy instead of fumbling around trying to figure out how the platform works.

- Realistic Fee Simulation: The best simulators factor in trading costs. You can learn more about how vTrader structures its commission-free trading fees to get a sense of what to expect in a live environment.

The good news is that dedicated crypto paper trading apps have made risk-free practice more accessible than ever. By 2025, top platforms are offering virtual accounts with significant simulated capital—often around $100,000—to let users practice in live market conditions.

Features To Look For in a Crypto Paper Trading Platform

Choosing the right tool is half the battle. A good platform doesn't just let you place trades; it immerses you in a realistic environment where you can learn effectively.

| Feature | Why It's Important | Example Platforms |

|---|---|---|

| Real-Time Data | Ensures your practice reflects actual market movements. Trading on delayed data teaches bad habits. | vTrader, eToro, TradeSanta |

| Realistic Fees | Simulates trading costs like commissions and spreads, teaching you to factor them into your profit calculations. | vTrader, Cryptohopper |

| Wide Asset Selection | Allows you to explore different coins and tokens beyond the majors, broadening your market knowledge. | Binance, OKX, vTrader |

| Advanced Tools | Provides access to charting tools, technical indicators, and order types you'll use in real trading. | TradingView, vTrader |

A platform that nails these features will give you a powerful training experience that translates directly into real-world skills.

Set Up Your Demo Account

Once you’ve picked your platform, setting up a demo account is usually a breeze. You'll typically just need an email address and a password. No need for the lengthy identity verification you'd find on a real exchange.

After you sign up, the platform will instantly fund your account with a hefty sum of virtual cash, often $100,000 or more. Remember, this isn't real money, but it's crucial to treat it like it is. This is how you build disciplined trading habits right from the start.

Key Takeaway: The goal here isn't just about racking up fake profits—it's about mastering the process. Focus on making smart, well-reasoned decisions with your play money, just as you would with your own hard-earned capital.

Execute Your First Simulated Trade

With your account loaded up, you’re ready to dive in and place your first trade. This is where the real practice begins.

Follow these simple steps to get going:

- Select a Cryptocurrency: Pick a coin you’ve been researching or want to learn about, like Bitcoin (BTC) or Ethereum (ETH).

- Choose an Order Type: Keep it simple to start. Use a market order (buying or selling at the current price) or a limit order (buying or selling at a specific price you set).

- Enter the Amount: Decide how much of your virtual capital you want to put into this trade. It’s always smart to start with smaller position sizes.

- Review and Confirm: Always double-check your order details—the coin, order type, and amount—before hitting that "Confirm" or "Execute" button.

And just like that, you’ve completed your first crypto paper trade. Now you can track its performance, practice setting stop-loss orders to manage your risk, and start crafting a trading strategy that’s all your own.

Common Mistakes to Avoid in Paper Trading

Paper trading crypto is a fantastic way to sharpen your skills, but its risk-free environment can sneakily build some terrible habits. Think of it like a driving simulator that doesn't account for black ice—it can give you a dangerous sense of confidence if you don't recognize its limits.

To make sure the lessons you learn actually stick in the real world, you have to sidestep a few common pitfalls.

One of the biggest traps is falling for unrealistic expectations. When a platform hands you $100,000 in virtual cash, it’s all too easy to start throwing down massive, speculative bets you’d never dream of making with your own money. This "monopoly money" effect makes you feel invincible, encouraging an aggressive trading style that would get you wrecked with a real, smaller portfolio.

It’s also easy to ignore the emotional side of trading. Without real money on the line, the gut-wrenching fear of a market dump or the euphoric rush of a rally just aren't there. This emotional vacuum makes sticking to a plan seem simple, but it doesn't prepare you for the psychological pressure cooker of live trading.

Trading Like It Is Real

To get real value out of paper trading, you have to treat it with the same seriousness as a live account. This is what separates casual practice from effective, professional training.

First, set up a realistic virtual portfolio. Ditch the default $100,000 and adjust your starting capital to whatever you'd actually invest. If you plan to start with $1,000, then practice with $1,000. This immediately forces you to think about proper position sizing and risk management.

Next, bring real discipline to every simulated trade. Follow your strategy religiously. Set your stop-losses and take your profits just as you would if your own hard-earned cash were at stake. This is how you build the mental muscle needed to execute your plan when real emotions are trying to take over.

Factoring in Real-World Costs

Another classic mistake is ignoring real-world trading costs. While many platforms like vTrader offer commission-free trading, other hidden factors can eat into your profits. Two critical elements often missing from simulations are slippage and liquidity.

- Slippage: This is the difference between the price you think you're getting and the price at which your order actually executes. In a fast-moving market, even a split-second delay can completely change a trade's outcome.

- Liquidity: In the real world, you can't always execute a large order without moving the market price. A simulator might fill a massive buy order instantly, but that's just not realistic for many smaller altcoins.

The goal of paper trading isn't just to rack up virtual profits; it's to build a repeatable process that holds up under real-world pressure. Ignoring costs and emotional discipline undermines that entire purpose.

If you don't account for these details, you can end up with a strategy that looks amazing on paper but falls apart in a live environment. It’s also smart to know the rules of any platform you’re using. Take a look at documents like the vTrader refund policy to understand exactly how transactions and account matters are handled.

By steering clear of these common blunders, you can transform paper trading from a simple game into a powerful training ground for building sustainable, real-world skills.

How to Transition from Simulation to Live Trading

Making the jump from a demo account to a live one is the final exam. This is where your practice meets reality, and suddenly, there's real money on the line. It’s a huge step, and rushing it is a recipe for disaster.

The move from simulation to the real deal can feel like stepping off a cliff, but it doesn't have to be a blind leap. With a clear, phased approach, you can protect your capital, manage your nerves, and build the kind of trading habits that actually last. The goal isn’t just to start trading—it's to start trading smart.

Start Small and Manage Your Risk

The first rule when you go live is to start small. Seriously. Never, ever trade with money you can’t afford to lose. This isn't just some tired old advice; it's the absolute foundation of staying in the game. Dip your toes in the water with just a tiny piece of your total planned investment.

This initial period is all about getting used to the psychological pressure. Trust me, the feeling of losing $10 of real money is worlds apart from losing $10 in a simulation. That gut punch is a crucial part of your education, and it’s better to learn that lesson with small stakes.

A successful transition isn't about making a killing overnight. It's about proving you can stick to your plan when the pressure is on. Your real test is whether your strategy—and your mindset—can handle the heat of a live market.

It's also critical to stick with the one strategy you've been perfecting. You put in the hours in the simulator, so now is the time to trust that work. Resist the urge to start flipping between different coins or strategies. That just adds chaos and makes it impossible to figure out what's actually working.

Keep Your Discipline and Track Everything

Just because you’re trading with real money doesn't mean the homework stops. You need to keep tracking every single trade with the same discipline you used on your demo account. Log your entry and exit points, write down why you made the trade, and even note how you were feeling. This journal is gold—it will show you patterns in your behavior you’d otherwise miss.

The need for a cautious entry into the market has never been greater. With over 560 million people worldwide owning crypto as of mid-2024, the space is packed with traders of all experience levels. This explosive growth, which leaves traditional finance in the dust, makes it essential for newcomers to have a solid plan.

Once you feel confident after paper trading, a complete guide on how to start investing can offer a broader perspective as you take your next steps.

A Phased Plan for Going Live

A gradual transition is the key to minimizing shock and maximizing what you learn. Follow these steps to move from virtual funds to real trading without blowing up your account:

- Fund a Small Account: Start with an amount you are 100% okay with losing. It should be small enough that it doesn't cause you stress.

- Trade Micro-Positions: Use the smallest trade sizes your platform allows. The goal is to get a feel for the live environment and the emotional rollercoaster.

- Focus on One Strategy: Only execute the exact strategy you validated during your paper trading sessions. No exceptions.

- Review and Analyze: After a set time, like 30 days, go back and review your trades and your journal. Be honest about what you find.

- Scale Up Gradually: If you’re consistently profitable and—more importantly—you’ve stuck to your plan, then you can slowly start increasing your position sizes.

This methodical approach is how you turn practice into real, sustainable results. It ensures you’re applying your hard-won skills thoughtfully and cautiously when it truly counts.

Your Top Paper Trading Questions, Answered

As you dive into the world of paper trading crypto, it’s completely normal to have questions. This whole practice is a powerful way to learn the ropes, but knowing the little details is what really helps you squeeze the most value out of it. We've gathered the most common questions we hear and cut straight to the answers.

Think of this as your guide to separating the facts from the fiction. Let's clear up any confusion before you even think about placing your first virtual trade.

Is Crypto Paper Trading Actually Free?

Mostly, yes. The good news is that the vast majority of reputable crypto exchanges and trading platforms, including vTrader, offer their demo accounts for free. They view it as a smart investment in you—helping you get comfortable with their tools and build confidence without asking for a dime.

But here’s the catch: "free" doesn't always mean "perfect." Some platforms might give you slightly delayed market data instead of a live feed, or they might lock away some of their more advanced trading tools. It's always a good idea to double-check what a demo account includes. Your goal is to find a no-cost option that doesn't skimp on a realistic, quality experience.

Key Insight: While the account won't cost you money, its true value comes from how well it mirrors the live market. A free tool with wonky, unrealistic data can end up teaching you all the wrong habits.

How Realistic Is Paper Trading?

This is the big one. A good crypto paper trading platform gets incredibly close to the real thing in some ways, but it’s fundamentally different in others.

On one hand, the best simulators use real-time market data. The Bitcoin price you see on your demo account should match the live exchange price tick-for-tick. This is huge, as it lets you test your strategies against actual market swings, practice your chart analysis, and get a feel for executing orders like market buys and limit sells.

On the other hand, paper trading completely strips away the most powerful force in any market: raw human emotion. The psychological gut-punch of watching your own hard-earned money rise and fall is something a simulator just can't replicate. Fear can trick you into selling at the absolute bottom, while greed can convince you to hold a winning trade way too long. Because that pressure is gone, sticking to a trading plan can feel deceptively simple. Also, simulators often fill your orders instantly with zero slippage, a luxury you won't always have in a fast-moving live market.

How Long Should I Paper Trade Before Going Live?

There's no magic number here. If someone tells you to "practice for exactly three months," they're giving you bad advice. A much better approach is to set performance-based goals, not time-based ones. Your results and discipline should tell you when you're ready to make the jump.

Instead of just marking days on a calendar, focus on hitting specific, measurable targets. Think of it like a checklist before launch:

- Consistent Profitability: Can you string together a positive return over a decent period, like a month or two, across different market conditions (not just a bull run)?

- Strategy Adherence: Did you actually stick to your trading plan without caving to emotional impulses, even when things got choppy in the simulation?

- Risk Management Mastery: Are you consistently sizing your positions correctly and using stop-loss orders on every single trade without fail?

Once you can confidently say "yes" to all of these, you’re probably in a good spot to start with a small, live account. The idea isn't to be perfect, but to prove to yourself that you've built a disciplined process you can count on. For more nitty-gritty details on how our platform works, check out our comprehensive vTrader FAQ page.

Ready to put theory into practice without risking a cent? vTrader offers a powerful, commission-free paper trading platform packed with real-time data and all the tools you need to sharpen your skills. Sign up today and start your trading journey the smart way.

Start Paper Trading for Free on vTrader

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.