Think of a liquidity pool in crypto as a big, community-owned pot of digital money. It’s a place where anyone can instantly trade one crypto asset for another, without having to wait for a specific buyer or seller to show up. It all runs on its own, powered by automated code.

What Are Crypto Liquidity Pools

You know those currency exchange booths at the airport? They keep a stock of dollars, euros, and other currencies so travelers can make quick swaps. A crypto liquidity pool does the exact same thing, but for the digital world of decentralized finance (DeFi). It's essentially a big pile of tokens locked up in a smart contract on the blockchain.

These pools are the engines that make decentralized exchanges (DEXs) work. They completely do away with the old-school "order book" system where you have to find someone willing to take the other side of your trade. Instead, you trade directly with the pool itself, making transactions nearly instantaneous.

The Core Components

So what makes one of these pools tick? It all comes down to two key ingredients working in tandem:

- Locked Tokens: Everyday users, who we call liquidity providers (LPs), deposit an equal value of two different tokens. For instance, in an ETH/USDC pool, an LP would have to deposit both Ethereum (ETH) and USD Coin (USDC).

- Smart Contracts: This is the self-executing code that acts as the rulebook. It manages all the funds, automatically calculates prices based on supply, and makes sure trading fees are paid out to the people who provided the tokens.

This setup creates a totally open and automated market. Anyone can add their assets to a pool, and anyone can use that pool to trade. It’s this permissionless access that defines the DeFi movement, breaking down the walls you’d find in traditional finance.

Key Takeaway: Liquidity pools allow regular crypto users to become market makers. By adding your assets, you’re stocking the shelves of a decentralized exchange and earning a slice of the trading fees for your trouble.

Why Liquidity Pools Matter

Simply put, without liquidity pools, DeFi would seize up. They provide the all-important liquidity—the ability to easily swap an asset for another—that keeps the market moving smoothly and efficiently. This mechanism is what powers some of the most popular activities in DeFi, like token swapping and yield farming.

Getting your head around this concept is a must for anyone serious about getting involved in the DeFi ecosystem. For those ready to go deeper, you can dive into more crypto topics in our comprehensive VTrader Academy, which is packed with detailed guides and lessons. Once you understand how these community-funded pools work, you've grasped one of the biggest game-changers in the entire crypto space.

How Automated Market Makers Drive Trading

If a crypto liquidity pool is the community-owned town square, then the Automated Market Maker (AMM) is the tireless robot running the market stall. AMMs are protocols built on smart contracts that completely ditch the old system of matching individual buyers and sellers.

Instead of posting an order and waiting for someone to fill it, you deal directly with the AMM. It instantly gives you a price and executes your trade. This is what makes decentralized exchanges (DEXs) run 24/7 without needing a team of people watching over them. Everything is handled by pure math coded into a smart contract, creating a trading world that’s always on and open to everyone.

At the heart of most AMMs is a deceptively simple bit of math called the constant product formula.

The Constant Product Formula Explained

The most famous formula in the AMM world is x * y = k. It might look like a flashback to high school algebra, but it’s the magic ingredient that powers countless liquidity pools.

Here’s a quick guide to what each letter represents:

- x = The amount of Token A in the pool (like ETH)

- y = The amount of Token B in the pool (like USDC)

- k = The pool's total liquidity, a constant value that can't change during a trade

Let's walk through an example. Imagine a pool has 10 ETH (x) and 40,000 USDC (y). The constant (k) for this pool would be 10 * 40,000, which equals 400,000. This number, k, is the pool's sacred value—it must always stay the same.

Now, a trader comes along and wants to buy 1 ETH from the pool. This means the amount of ETH (x) will drop to 9. For the formula to stay true, the amount of USDC (y) has to go up. The AMM calculates exactly how much USDC the trader needs to put in to keep k at 400,000. That calculation instantly sets the price for that 1 ETH.

This constant product model is brilliant because it means the pool can never truly run out of either asset. As the supply of one token gets lower, its price shoots up exponentially, keeping the system balanced and the market alive. For a deeper dive into how platforms manage this, check out these data solutions supporting the Osmosis decentralized exchange, a major DEX that relies on AMMs.

The AMM Rule: The total liquidity value (k) in a pool must stay the same before and after every trade. The only time k changes is when liquidity providers decide to add or take out their funds.

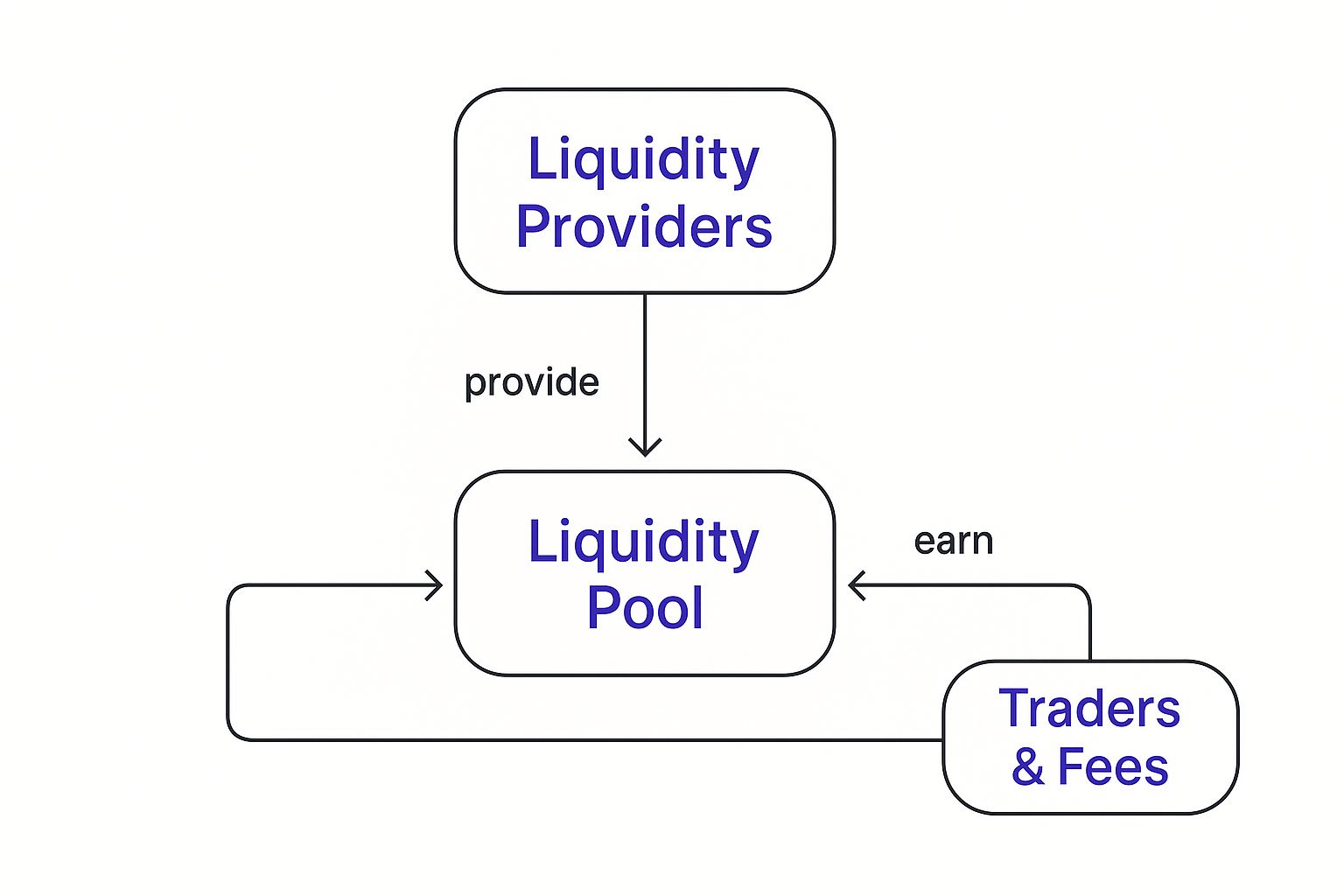

This creates a self-powering cycle between liquidity providers, the pools themselves, and traders. Providers supply the assets, traders use them to swap tokens, and the fees generated go right back to the providers as a reward.

This interconnected system is what DeFi is all about—community-owned assets fueling the market and creating returns for those who participate. This efficiency is why DEXs are grabbing more market share, with the DEX-to-CEX spot trading volume ratio hitting a remarkable 24% in Q2 2025.

The reward model here is unique to providing liquidity. If you're curious how it stacks up against other crypto earning methods, you can learn more about crypto staking in our other guide.

The Rewards And Risks Of Providing Liquidity

Becoming a liquidity provider (LP) is a fantastic way to make your crypto assets work for you, but it’s a two-sided coin. You’re looking at some serious potential rewards, but they come with equally notable risks. Getting a firm grip on this trade-off is absolutely crucial before you even think about depositing your tokens into a liquidity pools crypto ecosystem.

The biggest draw for LPs is the chance to earn passive income. It’s pretty straightforward: every time a trader uses the pool you've contributed to, they pay a small fee. Those fees are then split among all the liquidity providers based on how much they've staked.

You can think of it like being a part-owner of a bustling currency exchange. The more transactions that go through, the more fees roll in, and the bigger your slice of the pie gets.

The Incentives For Providing Liquidity

Often, the rewards go well beyond just the trading fees. Many DeFi platforms roll out the red carpet with extra incentives to pull in more liquidity—a practice you’ll often hear called yield farming.

These bonus rewards can show up in a few different ways:

- LP Tokens: When you deposit your assets, you get special LP tokens back. These are basically your receipt, proving your share of the pool. The cool part is you can often stake these tokens elsewhere to earn even more rewards on top.

- Bonus Tokens: To sweeten the deal, projects might hand out their own native tokens as a bonus for providing liquidity to certain pools. This can seriously pump up your annual percentage yield (APY).

When you stack these incentives, providing liquidity can become incredibly lucrative. This is especially true for popular pools or new ones where token demand is through the roof. The fees can generate a steady income stream, effectively turning your idle crypto into a productive asset. For a closer look at how these fees are structured, you can check out detailed crypto trading fee breakdowns on various platforms.

The Critical Risk Of Impermanent Loss

Now for the other side of the coin. The potential for high returns is balanced by a unique and frequently misunderstood risk known as impermanent loss. This isn't a "loss" in the way you might think, but rather an opportunity cost that pops up when the price of your deposited tokens shifts away from their value when you first put them in.

Impermanent Loss Defined: This is the difference in value between keeping your tokens in a liquidity pool versus just HODLing them in your wallet. If the prices of the two tokens diverge significantly, the total value of your assets when you pull them out of the pool could be less than if you had just left them alone.

This risk is baked right into the DNA of automated market makers. Analyses have shown that when token prices in a pool drift apart, LPs can end up with a lower financial return compared to simply holding the original assets. For instance, you might deposit 10 ETH and 1,000 of another token, but if the market moves, your withdrawn share might be worth slightly less than if you’d never joined the pool. It’s a major factor that can make some potential providers hesitate, though new strategies are always being developed to help reduce this risk.

Let's break it down with an example. Say you deposit into an ETH/DAI pool when 1 ETH is worth 3,000 DAI. If the price of ETH skyrockets to 6,000 DAI, the AMM automatically rebalances the pool to maintain its ratio. This leaves you with less ETH and more DAI than you started with. If you were to withdraw at that moment, you might realize you would have made more money just by holding onto your original stack of ETH.

The "loss" here is the missed opportunity—and it only becomes permanent if you withdraw your funds.

To help you weigh the options, here is a quick look at the pros and cons.

Risk vs Reward For Liquidity Providers

| Factor | Potential Rewards (Pros) | Potential Risks (Cons) |

|---|---|---|

| Income Source | Earn a share of trading fees from every swap in the pool, creating a passive income stream. | If trading volume is low, the fees earned might not be substantial enough to be worthwhile. |

| Additional Incentives | Gain extra rewards through yield farming, including bonus native tokens and staking LP tokens. | The value of reward tokens can be highly volatile and may drop significantly, reducing overall profit. |

| Market Impact | Token prices remain stable or trade within a tight range, maximizing fee collection relative to asset value. | Impermanent loss occurs if token prices diverge, potentially making you worse off than just holding the assets. |

| Protocol Security | The smart contract is audited, secure, and has a strong track record of protecting user funds. | Risk of smart contract bugs, exploits, or hacks that could lead to a total loss of your deposited funds. |

| Project Viability | Supporting a promising and legitimate project can be profitable as the protocol grows and attracts more users. | The project could fail or turn out to be a "rug pull," where developers abandon it and run off with the funds. |

Ultimately, providing liquidity is a balancing act. The key is to go in with your eyes open, fully aware of both the potential upside and the inherent risks you're taking on.

How To Get Started With Liquidity Pools

Diving into liquidity pools crypto might seem intimidating, but it’s a lot more straightforward than you’d think. With a little prep work and a clear game plan, you can put your digital assets to work and start earning as a liquidity provider (LP).

The very first thing you need is a self-custody crypto wallet that can talk to decentralized applications (dApps). Popular choices like MetaMask or Trust Wallet are fantastic starting points, giving you total control over your funds and a key to the entire DeFi world. Think of it as your passport to the ecosystem.

Once your wallet is set up and loaded with some crypto, your next move is to pick a decentralized exchange (DEX). These are the platforms where liquidity pools live and breathe. Well-known DEXs like Uniswap, PancakeSwap, or SushiSwap are popular for a reason, though each has a unique feel and its own set of available pools.

Selecting The Right Liquidity Pool

This is where your research really counts. Not all pools are built the same, and picking the right one is absolutely crucial for a good experience. It's tempting to chase the highest Annual Percentage Yield (APY), but you need to look at the whole picture.

Before you commit any funds, weigh these critical factors:

- Trading Volume: A pool with high trading volume is a busy pool. More trades mean more fees are being generated, which translates directly into higher potential earnings for you.

- Total Value Locked (TVL): This metric shows you how much capital is already in the pool. A high TVL can be a sign of trust from other investors, but it also means your slice of the fee pie will be smaller.

- Impermanent Loss Risk: You have to consider the volatility of the two tokens in the pair. A pool pairing a stablecoin with a major crypto (like USDC/ETH) is generally much safer from impermanent loss than one with two highly volatile, lesser-known altcoins.

Pro Tip: The golden rule of crypto applies here: Always do your own research (DYOR). Dig into the project behind the tokens. "Rug pulls," where developers simply abandon a project and drain all the money from the pool, are a very real danger. Schemes like the $LIBRA token, which tanked by over 96% in a flash, prove that even high-profile noise can be dangerously misleading.

Making Your First Deposit

Once you’ve zeroed in on a pool, the final steps are pretty simple. Just navigate to the "Pool" or "Liquidity" section on the DEX you've chosen.

- Connect Your Wallet: Securely link your MetaMask or other wallet to the DEX. This usually just takes a couple of clicks.

- Select Your Tokens: Pick the two tokens for your chosen pool from the dropdown menus.

- Deposit in a 50/50 Ratio: This is key. You must deposit an equal value of both tokens. So, if you're depositing $500 worth of ETH, you'll need to match it with $500 of the other token.

- Approve and Confirm: The DEX will ask for permission to use your tokens first (an "approve" transaction), followed by the final deposit transaction. Keep an eye on network gas fees during this step.

After your transaction is confirmed on the blockchain, you’ll receive LP tokens in your wallet. These tokens are your receipt, representing your share of the pool. And just like that, you're officially a liquidity provider, earning a cut of the fees from every trade in that crypto liquidity pool.

The Future Of Liquidity Provision

The world of liquidity pools crypto is anything but static. This corner of DeFi is in constant motion, driven by developers working to make the entire system safer, more efficient, and deeply interconnected. The core mechanics are solid, but the real excitement is in how the model is being refined to solve today’s biggest challenges.

The most critical evolution is a direct assault on impermanent loss. Smarter, more sophisticated models are popping up, giving liquidity providers far better tools to manage their risk and get more from their capital.

Smarter And Safer Liquidity Models

One of the biggest game-changers is concentrated liquidity. Pioneered by platforms like Uniswap V3, this lets LPs put their money to work within specific price ranges instead of spreading it thin across the entire price spectrum. Think ETH will trade between $3,000 and $4,000? You can focus your capital right there. This approach makes your funds vastly more efficient, letting you rack up more fees while sidestepping price action outside your target range.

Another exciting development is single-sided liquidity. The old way required LPs to deposit two different tokens of equal value. That’s changing. New protocols are emerging that let you provide just one asset to a pool, dramatically lowering the barrier to entry and simplifying the whole experience.

Key Insight: These innovations are all about squeezing more value out of every dollar while handing control back to the LP. The goal is simple: maximize fee earnings while giving providers precise tools to shield themselves from market swings and the sting of impermanent loss.

The Rise Of Cross-Chain Liquidity

Perhaps the most ambitious frontier is cross-chain liquidity. Right now, a liquidity pool on Ethereum is an island, completely cut off from a pool on Solana. This fragmentation makes the crypto market clunky and inefficient, with capital trapped inside blockchain silos.

Cross-chain solutions are designed to tear down these walls. Picture a future where a single, unified liquidity pool can serve traders on multiple blockchains at once. This would unlock deeper, more stable markets, slash trading fees, and let capital flow freely across the entire crypto ecosystem. As this tech matures, it promises to make the entire market more fluid and connected.

We're also seeing a blend of decentralized finance and old-school Wall Street expertise. In 2025, market makers are more vital than ever, with major firms bridging the gap between traditional and digital finance. This fusion bolsters market depth and efficiency, supporting a crypto market projected to swell to $6.8 trillion as over 11% of the world’s population adopts digital assets.

Staying on top of these trends is non-negotiable for any serious investor. For the absolute latest developments and market analysis, be sure to check out our crypto news and updates. The evolution of liquidity pools is a story of relentless improvement, paving the way for a more robust and accessible future for finance.

Frequently Asked Questions About Liquidity Pools

Even after getting the hang of the mechanics, it’s completely normal to have questions about how liquidity pools crypto concepts actually play out. Let's tackle some of the most common questions to make sure everything is crystal clear.

Order Books vs Liquidity Pools

So, what's the real difference between a liquidity pool and the old-school order book you see on traditional exchanges? It all comes down to who—or what—is on the other side of your trade.

Think of a traditional order book as a bustling auction house. It’s a live list of buy and sell orders from other people. To make a trade, you have to find someone on that list willing to meet your price. If there's no match, your trade doesn't happen.

A crypto liquidity pool flips that model on its head. Instead of trading with another person, you're trading directly with a smart contract. It’s like dealing with a fully automated, robotic broker. This system, the Automated Market Maker (AMM), ensures there's always a counterparty ready to trade, making transactions instant, 24/7.

Can You Lose Money Providing Liquidity?

Yes, absolutely. It's crucial to understand that providing liquidity isn't a risk-free way to earn fees. The main danger isn't just your tokens dropping in value; it's a unique risk called impermanent loss.

This kicks in when the prices of the two tokens in your pair move in different directions after you've deposited them. The AMM is constantly rebalancing the pool, and this process can leave you with a less valuable combination of assets than you started with. When you go to withdraw, the total dollar value of your tokens could be less than if you had just held them in your wallet.

Key Takeaway: You earn trading fees as a liquidity provider, but for it to be profitable, those earnings need to be greater than any potential impermanent loss. That's the core trade-off every LP has to consider.

For a deeper dive into risks and other crypto topics, feel free to check out the VTrader FAQ section for more detailed answers.

How Are APY Rewards Calculated?

When you see a big, juicy APY advertised for a liquidity pool, that number usually comes from two different places:

- Trading Fees: This is your base-level earning. You get a slice of the fees from every single trade that happens in the pool, proportional to how much liquidity you've provided. This income changes daily depending on how much trading activity there is.

- Bonus Incentives: To attract more liquidity, many projects will throw in extra rewards, often paid out in their own native token. This is a classic yield farming strategy and can seriously pump up the total APY.

Keep in mind that the advertised APY is an estimate based on recent activity. It can swing wildly and is never a guaranteed return, but it’s a helpful starting point.

Which Crypto Has The Best Liquidity Pool?

There’s no single "best" pool out there. The right choice for you depends entirely on your personal strategy and how much risk you're comfortable with.

- For Lower Risk: Pools that pair a major crypto with a stablecoin, like ETH/USDC or WBTC/DAI, are generally seen as safer bets. They have tons of liquidity and are less prone to the extreme price swings that cause major impermanent loss.

- For Higher Returns: On the other end, pools with new, volatile altcoins can offer some mind-blowing APYs. But with those high returns comes a much bigger risk of impermanent loss and the chance the project itself could go south.

The best pool is one that fits your financial goals and is run by a project you've thoroughly researched and trust.

Ready to put your knowledge into action? With vTrader, you can trade the assets you need for liquidity pools with zero commission fees. Sign up today and get a $10 bonus to start building your portfolio.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.