What Are Liquidity Pool Crypto Assets and Why They Matter

Imagine a bustling marketplace, but instead of negotiating prices with individual sellers, you interact with a large pool of assets. This is the essence of a liquidity pool, designed to make crypto trading instant. Instead of waiting to find a matching buyer or seller, you trade directly with this pool, enabling 24/7 trading without traditional brokers. This approach lies at the heart of Decentralized Finance (DeFi) and is changing how we invest and trade digital assets. Interested in learning more about DeFi investing? Check out our guide on investing in DeFi.

These pools are filled with crypto assets deposited by users – known as liquidity providers. By contributing to the pool, you effectively become part of the "house," earning fees from each transaction that occurs. It's like owning a small piece of the exchange itself, democratizing market-making, an activity previously dominated by large financial institutions.

Liquidity pools are vital to the growth of DeFi. They ensure smooth and efficient trading within the ecosystem, overcoming the limitations of traditional order book exchanges, which can struggle with low liquidity, especially for lesser-known assets. Think about it: on a traditional exchange, it can be difficult to buy or sell quickly if there aren't enough people actively trading the asset you're interested in. Liquidity pools resolve this issue. By early 2025, the total value locked (TVL) in DeFi protocols – where liquidity pools play a central role – surpassed $50 billion. Major platforms like Uniswap, Curve, and Balancer each manage billions in pooled assets. Discover more insights about leading crypto liquidity pools.

Understanding Liquidity Pool Crypto Assets

Assets within a liquidity pool are usually paired, for example, ETH and USDC. The ratio of these paired assets is determined by a mathematical formula, which keeps the pool balanced and enables it to handle trades effectively. These formulas automatically adjust prices based on supply and demand, creating a dynamic and responsive market. Understanding these mechanics is crucial for navigating the DeFi landscape.

The strength of liquidity pools lies in their ability to provide instant liquidity, empowering individuals to participate in the financial markets in a fresh and engaging way.

How Liquidity Pool Crypto Mechanics Actually Work

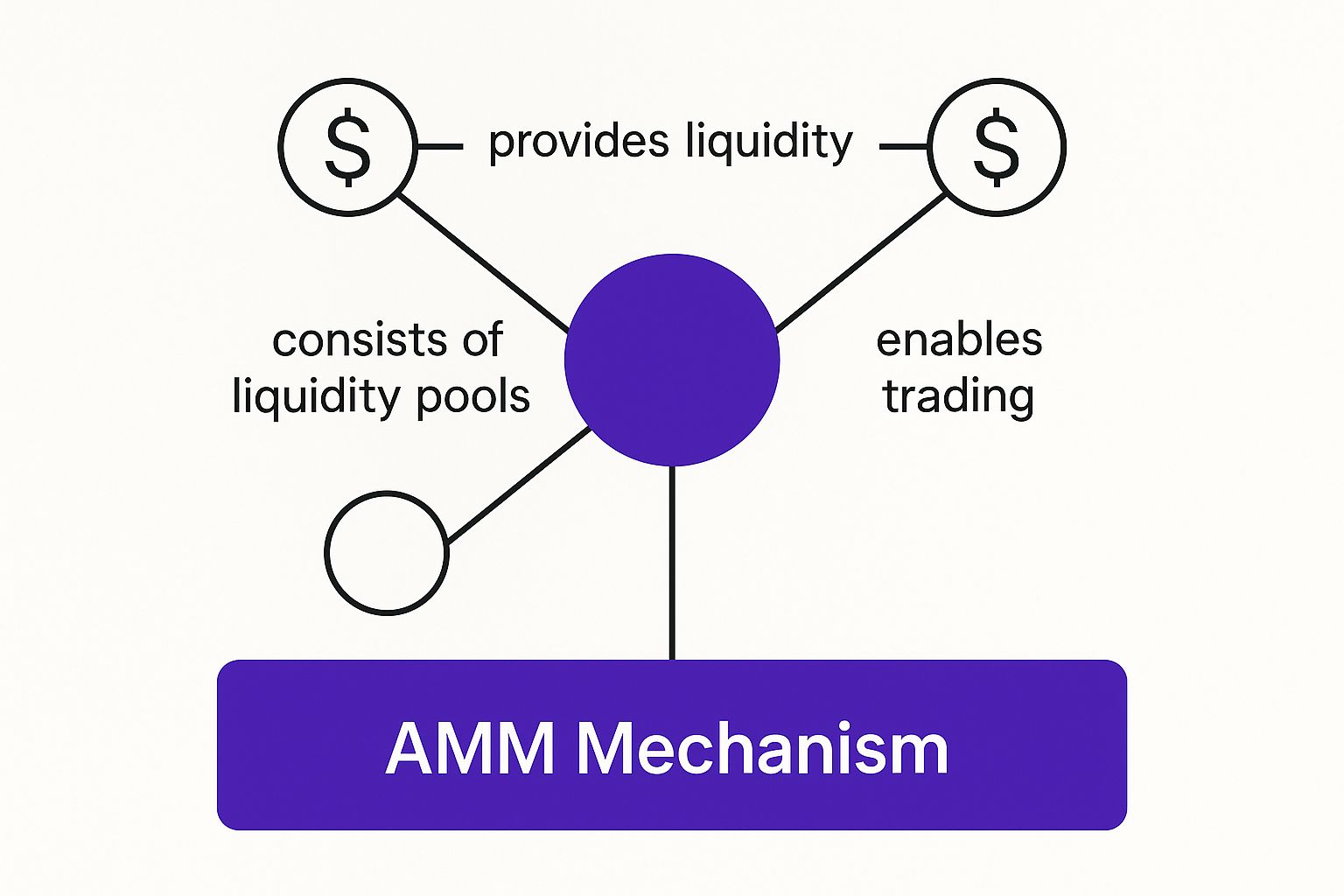

Let's explore how liquidity pools, the engines of decentralized finance (DeFi), determine cryptocurrency prices. Unlike traditional exchanges that match buyers and sellers directly, liquidity pools leverage Automated Market Makers (AMMs). Think of AMMs as self-adjusting scales, constantly balancing supply and demand to set prices automatically.

The Constant Product Formula: A Balancing Act

Most liquidity pool crypto platforms rely on the constant product formula (x * y = k). This simple yet powerful equation governs price fluctuations. Here's the breakdown:

- 'x' represents the quantity of the first token in the pool.

- 'y' represents the quantity of the second token.

- 'k' is a constant value.

Imagine buying token 'x'. This reduces 'x' in the pool. To maintain the constant 'k', the quantity of 'y' must increase. This, in turn, pushes the price of 'x' up and the price of 'y' down. It's a continuous balancing act.

This infographic illustrates the AMM mechanism, showing how the flow of assets within the pool automatically adjusts prices with each trade.

Exploring Different Pool Architectures

Liquidity pools come in various shapes and sizes, each with its own characteristics:

- 50/50 Split: The most common type, requiring equal value deposits of both assets. Think of it as a seesaw, perfectly balanced.

- Multi-Asset Pools: Holding more than two tokens, offering more diversification and complex trading strategies. Like a multi-pan scale, balancing multiple weights.

The 50/50 model is straightforward and well-suited for commonly traded pairs. Multi-asset pools, while more complex, provide greater flexibility for seasoned DeFi users. Interestingly, the concept of liquidity extends beyond the crypto world. Even domain names, through TLDs as liquidity pools, demonstrate the principles of supply and demand.

Pool Size: A Key Factor

The size of a liquidity pool significantly influences the trading experience:

- Larger Pools: Offer greater liquidity, allowing large trades with minimal price impact. Think of a deep lake, absorbing ripples easily.

- Smaller Pools: More susceptible to price volatility, with even small trades potentially causing significant price swings. Like a small pond, easily disturbed.

Understanding these dynamics is essential for managing risks and maximizing returns. Analyzing key pool metrics can help you spot opportunities and make informed decisions about capital allocation.

To help you compare different pool types, let's look at the following table:

Popular Liquidity Pool Types Comparison: This table compares different liquidity pool models, their advantages, disadvantages, and best use cases.

| Pool Type | Asset Ratio | Best For | Risk Level | Typical APY Range |

|---|---|---|---|---|

| 50/50 | 50% / 50% | Stable pairs, beginners | Low to Medium | Varies greatly depending on the assets and platform |

| 80/20 | 80% / 20% | Reducing exposure to volatile assets | Medium | Generally lower than 50/50 pools |

| Multi-Asset | Variable | Diversification, experienced traders | Medium to High | Highly variable, potential for high rewards and high risks |

As you can see, each pool type presents different levels of risk and potential reward. Choosing the right one depends on your investment goals and risk tolerance. Learning to analyze pool analytics empowers you to assess potential profits and identify hidden risks. This understanding is key to navigating the exciting world of DeFi.

The Real Money Behind Liquidity Pool Crypto Rewards

So, you're curious about how much you can actually earn with liquidity pool crypto, and whether it's worth the risk? Let's dive into the different ways liquidity providers can generate income. Think of it like exploring various investment strategies, each with its own potential and pitfalls. We'll cover trading fees, liquidity mining rewards, governance tokens, and special incentives some platforms offer.

Earning Potential: From Steady to Speculative

The potential earnings from liquidity pool crypto are a bit like a spectrum. On one end, you have conservative strategies, often involving stablecoin pairs, that might yield a consistent 8-20% APY. Think of this like a reliable bond, offering steady returns.

On the other end, you have higher-risk pools with more volatile or exotic token pairs. These might offer returns in the triple digits – imagine hitting the jackpot! – but the risk is significantly higher. It's more akin to investing in a high-growth startup: big potential, but also a chance of losing big. You might be interested in: How to Start Trading Cryptocurrency.

The annualized percentage yields (APYs) for providing liquidity have become more competitive and transparent. Many pools offer double-digit returns on popular pairs, attracting a growing number of participants. In April 2025 alone, over 3 million unique addresses provided liquidity to DeFi pools. That's a lot of people diving into the pool! Discover more insights on liquidity pool trends. Keep in mind, these returns fluctuate based on factors like trading volume, pool size, and the platform's specific reward mechanisms.

Understanding Reward Mechanisms

Different platforms use different reward structures, much like different companies offer different compensation packages. Some offer simple fee sharing, where providers receive a percentage of the trading fees generated by the pool. Imagine owning a small piece of a bustling marketplace and getting a cut of every transaction.

Others utilize more complex tokenomics designs, distributing governance tokens or platform-specific rewards to incentivize liquidity provision. This is like receiving stock options in addition to your salary – you're invested in the platform's success.

Calculating and Evaluating Yields

Understanding how yields are calculated is crucial for evaluating the long-term health of a liquidity pool. Think of it like analyzing a company's financial statements before investing. Some high APYs might be driven by temporary incentives or unsustainable token emissions – like a flash sale that won't last. It's important to distinguish between genuine, long-term value creation and short-lived “bubble” rewards.

Advanced Strategies and Tax Implications

Experienced liquidity providers often employ strategies like compounding earnings to maximize their returns. This involves reinvesting earned rewards back into the liquidity pool, like rolling your snowball downhill to make it bigger and bigger.

However, it's crucial to be aware of the tax implications of liquidity providing. These can vary significantly depending on your location and specific circumstances, so consulting with a tax professional is always a good idea. Think of it as navigating the legal landscape to ensure you're playing by the rules. Understanding these factors will allow you to make informed decisions and optimize your liquidity pool strategy.

The Hidden Dangers of Liquidity Pool Crypto Investing

Let's have a frank conversation about the potential downsides of liquidity pool crypto investing. The rewards can be attractive, sure, but understanding the risks is crucial. One of the biggest risks is impermanent loss, a concept that can be a real head-scratcher for those new to the game. Let's break it down and see how it can affect your returns.

Impermanent Loss: The Silent Threat

Imagine you're putting tokens into a liquidity pool, like adding ingredients to a baking recipe. Now, let's say the price of one of those ingredients, like super-rare saffron, suddenly skyrockets while the price of flour stays the same. Impermanent loss happens when the value of your combined ingredients in the pool becomes less than if you'd just kept them separate in your pantry.

It's called "impermanent" because if the price of saffron comes back down, your initial value could be restored. But if the price difference remains, the loss becomes permanent when you finally decide to withdraw your liquidity. This can be a major setback, especially in volatile crypto markets.

For example, let’s say you deposit equal values of ETH and USDC into a pool. If ETH doubles in price while USDC holds steady, you’ll experience impermanent loss. You would’ve actually made more money simply holding onto your ETH. This highlights why carefully selecting your token pairs and understanding market trends is so important.

Beyond Impermanent Loss: Other Risks

Impermanent loss is a key concern, but it’s not the only risk in the liquidity pool world. Several other potential issues are lurking beneath the surface:

-

Smart Contract Vulnerabilities: Just like any software, smart contracts can have bugs. Exploits can drain a pool's funds, leaving investors empty-handed. Events like the $LIBRA token incident, where millions were potentially lost due to a rug pull, highlight this risk.

-

Rug Pulls: Imagine a seemingly legitimate project that suddenly pulls the rug out from under its investors. Malicious developers can drain the liquidity pool and disappear with the funds. This is a common scam in the DeFi space, as seen with the $SQUID token incident where investors were locked out and the creators vanished.

-

Regulatory Uncertainty: The world of crypto regulation is constantly evolving. Changes in these regulations can impact the legality and profitability of participating in liquidity pools. Keeping up-to-date is essential.

-

Market Volatility: Crypto markets are famous (or infamous) for their wild price swings. This volatility can magnify impermanent loss and create other unexpected problems. Even seemingly "safe" stablecoin pools can feel the impact of market turmoil.

Assessing and Mitigating Risks

To help you navigate these potential pitfalls, I’ve put together a table outlining the risks associated with liquidity pool crypto and how to mitigate them.

Before we dive in, let me explain what the table covers. It's called the Liquidity Pool Risk Assessment Matrix and it's designed to give you a comprehensive breakdown of different risk types, their likelihood of occurring, their potential impact, strategies to mitigate them, and finally, some warning signs to watch out for.

Liquidity Pool Risk Assessment Matrix

| Risk Type | Likelihood | Potential Impact | Mitigation Strategy | Warning Signs |

|---|---|---|---|---|

| Impermanent Loss | Medium | Moderate to High | Diversify across pools, choose stable pairs | Significant price divergence between paired assets |

| Smart Contract Vulnerability | Low to Medium | High | Research the project thoroughly, look for audits | Lack of transparency, unknown developers |

| Rug Pull | Low to Medium | High | Due diligence on project team, community sentiment | Hype-driven projects, unrealistic promises |

| Regulatory Uncertainty | Medium | Moderate to High | Stay informed on regulations, consult legal advice | Regulatory announcements, legal challenges |

| Market Volatility | High | Moderate to High | Diversification, risk management strategies | Sudden price fluctuations, market crashes |

The key takeaway from this table is that being aware of the risks and having a plan to address them can make a big difference. By understanding these risks and implementing the right mitigation strategies, you can navigate the DeFi landscape with more confidence and safety. Remember, while liquidity pool crypto offers exciting opportunities, a cautious and informed approach is always the best strategy.

Choosing Winning Liquidity Pool Crypto Opportunities

Finding the right liquidity pool isn't as simple as chasing the highest Annual Percentage Yield (APY). It's more like finding the perfect fishing spot – you need to consider several factors before casting your line. Picking the wrong pool can lead to losses, so let's explore how to evaluate opportunities in the liquidity pool crypto market.

Fundamental Analysis: Beyond the Surface

Think of a bustling marketplace. What makes it thrive? Size and activity. For liquidity pools, this translates to Total Value Locked (TVL) and trading volume. A high TVL means more crypto assets are locked in the pool, suggesting stability and liquidity. High trading volume, like a busy market, indicates strong demand and potential for higher earnings for liquidity providers.

Fee structures are another crucial factor. They vary across pools, some charging a fixed percentage per trade, others using tiered systems. Understanding these is like knowing the commission rates before joining a sales team. It’s crucial for estimating your potential earnings. You might also be interested in learning more about overall portfolio allocation: Check out our guide on Crypto Portfolio Allocation.

Advanced Analysis: Uncovering Hidden Insights

Beyond the basics, consider factors like pool concentration ratios, historical performance patterns, and protocol tokenomics. Pool concentration refers to how much liquidity a small group controls. High concentration carries risk, as these large players could influence the market. Think of it like a small group holding most of the wealth in a small town.

Analyzing historical performance is like checking a company's track record. Has the pool consistently generated returns? How did it weather market storms? These questions help you assess long-term viability. Finally, understanding the project's tokenomics—how tokens are distributed and used—reveals the platform's long-term incentives and sustainability.

Interestingly, S&P Global reports that over 40% of crypto spot trading now happens on decentralized exchanges using liquidity pools, with average daily volumes exceeding $10 billion during peak activity. Discover more insights about crypto asset trading liquidity. This highlights the growing role of liquidity pools in the crypto world.

Token Pair Selection and Risk Management

Token pair selection is crucial. Pairing a stablecoin with a volatile asset offers different risks and rewards compared to pairing two volatile assets. Diversification is also key. Just like in traditional investing, spreading your capital across different pools helps manage risk, especially given the volatile nature of DeFi. Finally, timing your entries and exits is essential. Savvy liquidity providers analyze market trends and pool dynamics to maximize gains and minimize losses. The goal is a resilient portfolio that can withstand market swings while capturing potential growth.

Your Step-by-Step Liquidity Pool Crypto Action Plan

Ready to explore the exciting world of liquidity pool crypto? This guide will walk you through everything you need to know, from setting up your wallet to understanding more advanced strategies. Think of it as your personal roadmap to navigating this fascinating corner of the crypto universe.

Getting Started: The Basics

Before you jump in, let's talk about the essentials. Security is paramount. Treat your crypto wallet like you would a vault containing precious jewels. A reputable hardware wallet offers the strongest protection, and always double-check every transaction detail before hitting confirm.

Next up are gas fees, the tolls you pay for transactions on the blockchain. Imagine trying to avoid rush hour traffic – strategic timing can significantly reduce these costs. A great starting point is making a small test deposit in a liquidity pool. This allows you to get a feel for the process before committing significant funds.

Here’s a quick checklist to get you started:

- Secure Wallet Setup: Choose a reliable wallet like MetaMask or Ledger and enable two-factor authentication.

- Gas Fee Optimization: Use tools like GasNow to monitor gas prices and find the cheapest times to transact.

- Test Deposit: Start with a small amount to understand the mechanics.

- Record Keeping: Keep detailed records of all your transactions for tax purposes.

Joining a Liquidity Pool: A Practical Guide

Let’s walk through joining a pool on a popular platform like Uniswap. You'll typically connect your wallet, select a token pair (like ETH/USDC), and specify the amount of each token you want to contribute.

This screenshot shows the Uniswap interface. Notice how user-friendly the design is – it's surprisingly easy to navigate and participate in decentralized finance (DeFi).

Here's how to troubleshoot some common issues:

- Insufficient Funds: Make sure you have enough of both tokens in your wallet, plus extra for those gas fees.

- Transaction Errors: Double-check all the details and try again later if the network is congested.

- Wallet Connectivity Issues: Sometimes a simple browser refresh or trying a different wallet can resolve the problem.

Managing Your Liquidity Pool Positions

Once you're in a pool, it's essential to keep a close eye on your positions. Monitor your earnings, be aware of the potential for impermanent loss (we'll cover that in another section), and adjust your strategy as needed.

Here’s a guide to staying on top of things:

- Monitoring: Regularly check your pool's performance and the current value of your staked assets.

- Adding/Removing Liquidity: Strategically adjust your holdings based on market conditions and your own risk tolerance.

- Reinvesting Rewards: Consider compounding your earnings by reinvesting them back into the pool or exploring other opportunities.

For a more in-depth look at using AI in your crypto trading, check out this guide: Master the Setup: Navigating AI-Driven Crypto Trading Bots.

Advanced Strategies and Risk Management

As you gain experience, you can explore advanced strategies like liquidity migration, which involves moving your assets between different protocols in pursuit of higher yields. Yield farming is another popular tactic, involving actively shifting assets between various DeFi platforms to maximize returns.

Staying informed about new opportunities is key, but always carefully assess the risks. Remember, position sizing and risk management are crucial. Diversify your investments – don't put all your eggs in one basket. And never invest more than you can afford to lose. Avoiding these common pitfalls is essential for long-term success in the world of liquidity pool crypto.

Your Liquidity Pool Crypto Success Blueprint

This guide distills everything we've discussed into practical advice for navigating the world of liquidity pool crypto. Think of it as your personal roadmap for smarter decisions and reaching your financial goals in DeFi. You might also be interested in: Exploring the benefits of digital asset investments.

Defining Your Liquidity Pool Crypto Success

What does success in liquidity pools look like to you? Is it a steady income stream from stablecoin pairs, or are you more interested in higher-risk, higher-reward opportunities? Setting clear goals is crucial. This could mean targeting a specific APY, aiming for a certain amount of accumulated rewards, or simply gaining experience in DeFi.

Recognizing Exit Signals

Knowing when to leave a position is just as important as knowing when to enter. What are your red flags? Identifying these warning signs in advance can help you quickly reassess your strategy. A sudden drop in TVL (Total Value Locked), suspicious activity within the pool, or major market shifts that change the risk profile are all potential exit signals.

Scaling Your Involvement Strategically

Start small and grow your involvement as you become more comfortable. It's like learning to swim – you wouldn't dive into the deep end on your first try. Begin with a small test deposit to get a feel for the process, then gradually increase your position as you learn the ropes of liquidity pool dynamics.

Essential Checklists for Success

Here are some helpful checklists for your liquidity pool journey:

Due Diligence Checklist:

- TVL and Trading Volume: How big is the pool, and how active is it?

- Fee Structure: How are fees calculated and distributed to liquidity providers?

- Token Pair: What are the risks and potential rewards of the assets in the pool?

- Protocol Security: Has the project been audited? Who is on the team?

Position Management Checklist:

- Regular Monitoring: Keep an eye on your pool's performance and market conditions.

- Strategic Adjustments: Don't be afraid to adjust your liquidity based on your analysis.

- Reward Reinvestment: Think about compounding your earnings for greater returns.

Risk Assessment Checklist:

- Impermanent Loss: Understand how price fluctuations can impact your returns.

- Smart Contract Risks: Be aware of potential vulnerabilities and security breaches.

- Market Volatility: The crypto market can be unpredictable. Be prepared for price swings and manage your risk accordingly.

Building a Sustainable Strategy

Your liquidity providing strategy should match your financial goals, risk tolerance, and the time you have available. Avoid chasing short-term gains if it compromises your long-term success. Develop a sustainable plan you can stick with, even when the market gets bumpy. Remember to refine your strategy as you learn and adapt to the ever-evolving DeFi landscape.

Start your crypto journey with vTrader today! Visit vTrader to explore our commission-free exchange and access advanced trading tools, real-time market data, and a comprehensive learning ecosystem. Take control of your financial future with vTrader's secure and user-friendly platform.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.