When you're staring at the order entry screen, the choice between a limit and a stop order really comes down to a single question: what’s more important to you, price or execution?

A limit order is your way of telling the market, "I'll buy or sell, but only at this specific price or better." It puts you in the driver's seat on price, but there's a catch—if the market never hits your number, your order just sits there, unfilled. A stop order, on the other hand, is all about getting the trade done. Once the market touches your stop price, it flips into a market order, executing at whatever the current best price is. You get in or out, but the final price might not be exactly what you hoped for.

A High-Level View Of Key Distinctions

Getting these two order types straight is one of the first major hurdles for any trader. Though they both seem to be about setting a future price, they serve completely different strategic goals. Think of a limit order as an offensive move—you're actively trying to get a good deal. A stop order is defensive; it's your safety net.

Your decision here directly impacts your trade's outcome. Do you want to risk missing the move entirely for the sake of a better price (non-execution risk with a limit order)? Or would you rather guarantee your exit, even if it means accepting a slightly worse price in a chaotic market (slippage risk with a stop order)?

There's no single right answer—it all depends on the market's pulse and your personal strategy. Keeping an eye on market developments, like those covered on https://www.vtrader.io/en-us/news, can give you the context needed to make the right call. And if you're looking to broaden your knowledge, you can explore broader trading insights and strategies to see how these concepts fit into the bigger picture.

Quick Comparison Limit Vs Stop Order

To really nail down the differences, let's break it down side-by-side. This table cuts through the noise and lays out the core functions of each order type.

| Feature | Limit Order | Stop Order |

|---|---|---|

| Primary Goal | Price Control: Execute at a specific price or better. | Execution Certainty: Trigger a trade to limit losses or enter a breakout. |

| Trigger Mechanism | The market price must reach your specified limit price. | The market price must hit your designated stop price. |

| Execution Type | Executes only at the limit price or a more favorable one. | Becomes a market order and executes at the next available price. |

| Main Risk | Non-Execution: The order may never be filled if the price isn't met. | Slippage: The execution price may be worse than the stop price. |

Ultimately, this table is your cheat sheet. A limit order is about precision, while a stop order is about action. We'll dig deeper into when and why you'd choose one over the other in specific trading scenarios next.

Mastering Limit Orders for Price Control

A limit order is your tool for trading with precision. It gives you direct command over the exact price you’re willing to pay or accept. This isn't like a market order, which just executes at whatever the current price happens to be. With a limit order, you call the shots—your trade only goes through at your price, or a better one.

This level of control is a game-changer for both entering and exiting the market. It lets you build a trading plan around specific price targets, taking the emotion and guesswork out of the equation when things get volatile. But this precision isn't without its own trade-off.

How Buy and Sell Limit Orders Work

Limit orders come in two flavors, depending on whether you’re buying or selling, and each serves a very different strategic goal.

A buy limit order is always set below the current market price. Let's say Bitcoin is trading at $65,000, but your chart analysis tells you a stronger entry is down at a support level near $63,500. You’d place a buy limit order at $63,500. This way, you avoid chasing the price up and only commit your capital if the market dips to your target.

On the other hand, a sell limit order is placed above the current price. If you snagged some Ethereum at $3,000 and it’s now trading at $3,400, you might set a sell limit order at $3,600 to automatically take profits. Your order will only trigger if the price hits $3,600 or higher, guaranteeing that exit price for you.

The Trade-Off: Price Control vs. Execution Risk

The biggest win with a limit order is undeniable: absolute price control. You know you'll never pay more than your limit price on a buy, and you’ll never get less than your limit on a sell. This is a huge advantage in fast-moving markets, protecting you from getting a terrible price (slippage) on your trade.

A limit order is an exercise in patience. It’s best used by traders who have a specific price thesis and are willing to wait for the market to come to them, rather than chasing a moving target.

But here’s the catch—the major drawback is non-execution risk. If the market never actually trades at your limit price, your order just sits there, unfilled. In our Bitcoin example, if you set your buy limit at $63,500 but the price only drops to $64,000 before shooting up, you've missed the boat entirely.

This makes the limit order a double-edged sword. It shields you from overpaying but can also leave you watching from the sidelines as a big market move happens without you. If you want to get a deeper handle on different order types and when to use them, the vTrader Academy has some fantastic resources. Ultimately, choosing between a limit vs stop order boils down to what you value more: the certainty of price or the certainty of execution.

Using Stop Orders for Effective Risk Management

If you're serious about trading, stop orders are your best friend. Think of them as the bedrock of disciplined risk management—your first line of defense when the market turns against you.

Unlike limit orders, which are all about getting the best price, stop orders are about getting out. They're your automated escape hatch, designed to close a losing position before a small setback snowballs into a major disaster.

You'll need to get comfortable with two main types: the stop-market order and its more nuanced cousin, the stop-limit order. The one you choose can make a world of difference, especially when the charts get choppy.

The Stop-Market Order: Your Classic Safety Net

The most common stop order out there is the stop-market order, which you probably know as a "stop-loss." Its job is simple: once an asset’s price drops to your preset stop price, it instantly triggers a market order to sell.

The whole point here is speed and a guaranteed exit. Price precision takes a backseat.

This order is a lifesaver in a free-falling market. It gets you out, no questions asked, preventing a manageable loss from becoming a catastrophic one. But that certainty comes at a price, and that price is called slippage.

Slippage is the gap between the price you expected to trade at (your stop price) and the price you actually got. In a fast-moving market, that gap can be painfully wide.

Let’s say you set a stop-loss at $50 for a stock. Some bad news hits overnight, and the stock gaps down, opening at $45. Your order triggers immediately and sells at the next available price, which is probably right around $45. You wanted out at $50, but the market forced your hand at $45—that’s slippage in action.

The Stop-Limit Order: A Hybrid Approach

For traders who crave more control, the stop-limit order blends the features of both stop and limit orders. It’s a two-part command where you set two different prices:

- The Stop Price: This is your trigger. Once the market price hits this level, your order goes live.

- The Limit Price: This is your price floor. The order will only execute at this price or better.

This two-step process gives you a safety net against nasty slippage. You're essentially telling the market, "Get me out, but not at any cost." However, there's a crucial trade-off. A stop-market order guarantees you’ll get out, but not at what price. A stop-limit gives you price control but sacrifices the guarantee of execution.

The biggest risk here is that your order might never get filled. If the market plummets right past both your stop and limit prices, your order will activate but just sit there, unfilled, leaving you stuck in a losing trade.

Choosing the right tool for the job is everything. And before you place any trade, it's always a smart move to get familiar with any potential costs by checking out our straightforward breakdown of vTrader platform fees.

Choosing the Right Order in Real Trading Scenarios

Knowing the textbook definitions of limit and stop orders is one thing. Being able to fire off the right one in the heat of a live market is what really counts—it’s a skill that separates the pros from the pack. Let’s ditch the theory and jump into a few common scenarios you’ll actually face.

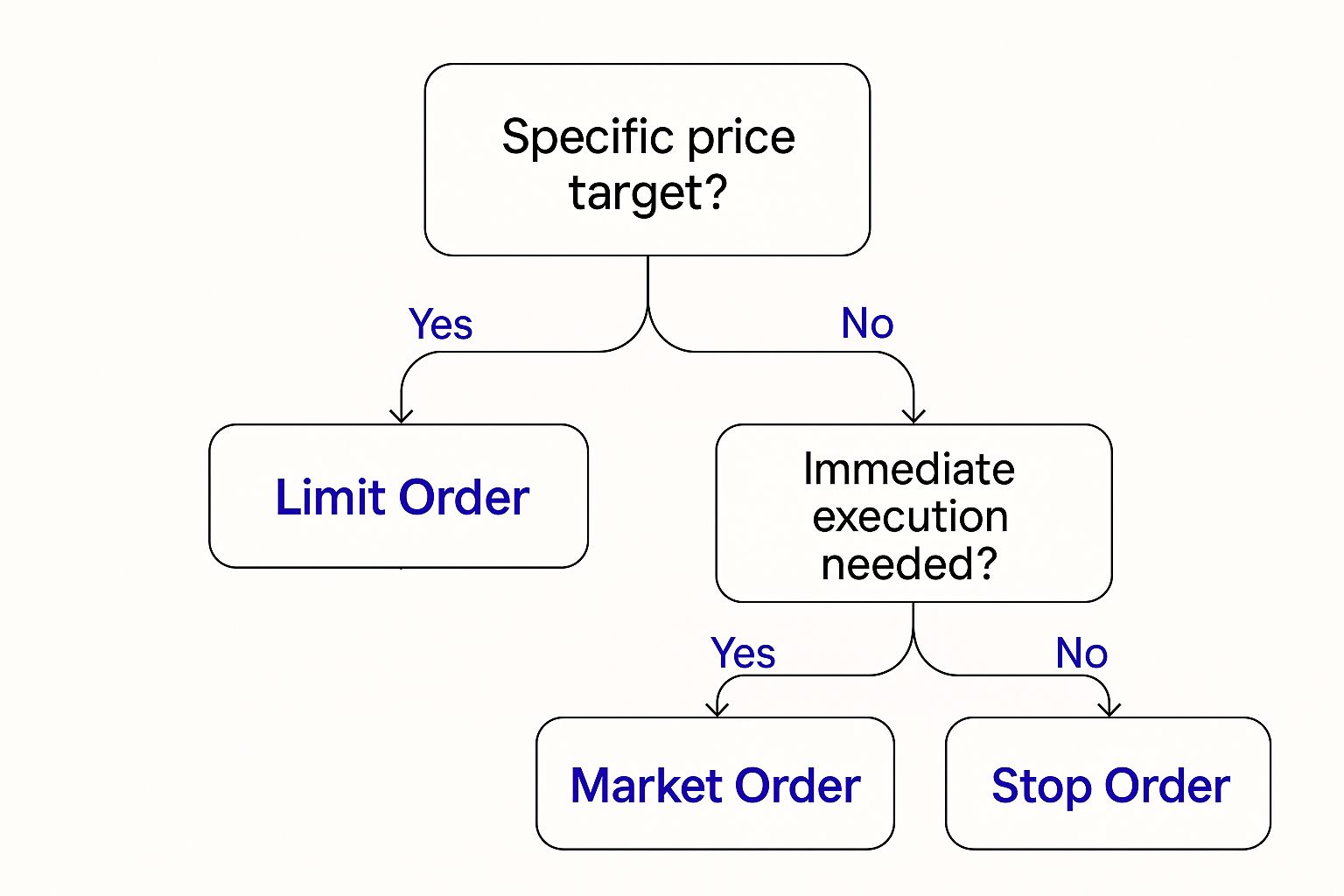

This is about building the muscle memory you need to make the right call, every time. The core question is simple: are you chasing a specific price, or is getting your order filled the absolute priority?

This graphic boils it down perfectly. Your goal dictates your tool. Let's look at how this plays out.

Entering a Position with Precision

You've done your research on a stock, but you feel it's running a little hot and is due for a small pullback. The last thing you want to do is chase the price higher.

- Scenario: You want to buy a stock on a dip, but refuse to overpay.

- Optimal Order: A buy limit order.

You’d set this order below the current market price, right at the level you’ve identified as a solid entry. This forces you to be disciplined, ensuring you only get into the trade at your price or better. The only catch? If the stock never dips to your price, your order never fills, and you could miss the move entirely.

Locking in Profits During Volatility

Now, let's say you're holding a winning position in a company that's about to announce quarterly earnings. We all know how wild those events can be, with prices swinging violently in either direction.

- Scenario: You need to protect your gains ahead of a major, volatile news event.

- Optimal Order: A sell limit order (often called a take-profit order).

By placing a sell limit order above the current price, you’re setting a clear exit target. If the earnings report is a blockbuster and the price spikes, your order triggers automatically. You lock in your profits at your goal price without having to frantically click buttons.

Cutting Losses When a Breakout Fails

Not every trade is a winner. You bought a crypto asset as it broke through a key resistance level, but the buying pressure vanished and the price is now heading south—fast.

- Scenario: A bullish breakout is reversing, and you need to get out immediately to contain the damage.

- Optimal Order: A stop-market order.

In this situation, speed trumps everything. Price is secondary. You place a stop-market order just below your entry, and the moment the price hits your stop, it becomes a market order to sell immediately. This is non-negotiable risk management for preventing a small paper cut from becoming a gaping wound.

The most crucial decision in risk management is not if you will exit a losing trade, but when. A stop-market order removes hesitation and enforces discipline when you need it most.

We’ve seen how critical this choice can be in historical market meltdowns. During the infamous flash crash on May 6, 2010, countless stop-market orders triggered, instantly converting to market sell orders that poured fuel on the fire. This executed trades at prices far lower than anyone imagined.

Traders who used stop-limit orders had some price protection, but the market plunged so fast that many of their orders were simply never filled, leaving them fully exposed to the crash. You can learn more about how different orders performed during this event and why this choice is so critical.

To make this even clearer, let's map out which order to use for different trading goals.

Order Type Decision Matrix for Common Trading Scenarios

This table is your quick-reference guide for aligning your trading objective with the correct order type.

| Trading Scenario | Recommended Order Type | Primary Rationale |

|---|---|---|

| Buying a stock after it breaks a key resistance level | Buy Stop | To enter a trade only after upward momentum is confirmed by price action crossing a specific threshold. |

| Selling a stock to protect profits at a target price | Sell Limit | To lock in gains at a predetermined price or better, ensuring a disciplined exit on your terms. |

| Buying a stock you believe is undervalued, but only on a dip | Buy Limit | To enter a position at a specific price point you're comfortable with, avoiding chasing the market higher. |

| Exiting a losing trade immediately if it drops below support | Sell Stop (Market) | To exit a position as quickly as possible once a predefined loss level is hit, prioritizing speed over price. |

| Protecting a short position if the price moves against you | Buy Stop | To automatically buy back shares and close a short trade if the price rises to your maximum acceptable loss level. |

This matrix isn't just a list; it’s a framework for thinking strategically. By matching your intent to the right tool, you move from reactive trading to proactive execution.

Placing an Order on the vTrader Platform

Knowing the difference between a limit and a stop order is one thing, but actually putting that theory into action is where it counts. The vTrader platform was built to bridge that gap, making it easy to translate your strategy into a live trade. Let’s walk through exactly how to set up both types of orders.

Think of the order entry panel as your mission control. It's where you define the asset, the amount, and the exact market conditions for your trade, ensuring your plan is executed with precision.

Your Step-by-Step Guide to Setting Up a Trade

Putting your strategy to work on vTrader is a straightforward process. Whether you're aiming to buy a dip with a limit order or protect your gains with a stop, the workflow is designed to be intuitive.

- Head to the Trading Panel: First things first, pick the crypto pair you want to trade, like BTC/USDT.

- Select Your Order Type: Click on the 'Order Type' dropdown. This is the crucial part where you'll choose 'Limit', 'Stop-Market', or 'Stop-Limit' depending on your goal.

- Input Your Price Levels: If you're setting a limit order, you’ll enter your target limit price. For a stop-limit order, you'll need to specify both the stop (trigger) price and the limit (execution) price.

- Define the Amount: Punch in the quantity of the asset you're looking to buy or sell.

- Choose the Duration: Decide how long you want the order to stay active. 'Good 'Til Canceled' (GTC) keeps the order open indefinitely until you cancel it, while a 'Day' order will expire when the trading day ends.

- Review and Confirm: Always give everything a final once-over—order type, prices, and amount—before hitting the 'Buy' or 'Sell' button to send your order to the market.

The screenshot below points out the key fields in the vTrader order entry interface.

You'll notice how the interface keeps the price inputs for different order types distinct, which helps cut down on costly mistakes. If you're new around here, you can learn more about the team behind this seamless experience by reading about the vTrader mission.

Here's the key takeaway: The 'Limit Price' field is where you set the exact price you’re willing to pay or accept. The 'Stop Price' field is the trigger that activates your order—a critical tool for managing risk.

By following these simple steps, you can confidently turn your analysis into a live order, ready to execute precisely when your conditions are met.

Matching Your Order Type to Your Trading Style

The endless debate over limit vs. stop orders isn't about finding a single "best" tool. It’s about picking the right one for your strategy and how much risk you’re willing to take on. Your trading style really dictates which order type you should be leaning on, making sure your moves in the market line up with your ultimate goals.

A patient, value-focused investor, for instance, is almost always going to favor a limit order. Their entire strategy is built around getting into positions at specific, pre-planned prices, not chasing trends. They're totally fine with waiting for the market to come to them, even if it means missing out on a trade here and there.

On the other hand, a more risk-averse trader—someone whose main goal is protecting their capital—will lean heavily on stop-market orders. When volatility spikes or a position starts to turn against them, their priority is getting out immediately, no questions asked. They’ll accept the potential for slippage as a necessary cost to shield their portfolio from a major loss.

Finding a Balanced Approach

For the hands-on traders who want a bit of both—protection and precision—the stop-limit order offers a great middle ground. This order type acts as a safety net against huge losses while also preventing the kind of nasty slippage that can happen during a market panic. It’s perfect for those who are actively watching their positions and can jump in if a fast-moving market blows right past their limit price.

The best order type isn’t a one-size-fits-all solution. It's a direct reflection of your trading philosophy—whether you prioritize price, certainty of execution, or a calculated balance of the two.

Trading data backs this up. Brokerage analytics show that stop-market orders make up a staggering 60-70% of all exit orders placed by retail investors, which really highlights the focus on immediate risk control. Meanwhile, the more nuanced stop-limit orders account for about 20-25% of stop-related orders, typically used by traders looking to avoid a bad fill. You can dig deeper into how traders are using these different stop orders by checking out some great insights on stop-loss versus stop-limit strategies.

Common Questions on Order Types

Even traders who have been in the game for years still have questions when it comes to the nuances of limit vs. stop orders. Let’s tackle some of the most common points of confusion to help you sharpen your execution strategy.

Can a Stop Order Execute at a Better Price?

It’s possible, sure, but that’s not what it’s built for. A stop order’s job is to trigger a market order the moment your price target is hit. If the market happens to jump in your favor in that split second, you could get a better fill.

However, you should always be bracing for the opposite: the risk of a worse price, known as slippage. This is especially true when the market gets choppy.

What's the Real Difference Between a Stop-Loss and a Stop-Limit Order?

The core distinction boils down to execution certainty versus price protection. A stop-loss (also called a stop-market order) guarantees your trade will execute once triggered. It prioritizes a swift exit over the exact price you get.

A stop-limit order, on the other hand, adds a price floor. It will only execute at your specified limit price or better, which protects you from bad fills but introduces a new risk—your order might not fill at all if the market moves past your price too quickly.

Your choice is a simple trade-off: a stop-loss guarantees you an exit at any price, while a stop-limit guarantees a specific price but not necessarily an exit.

How Do I Choose the Right Price for My Stop-Loss?

Setting an effective stop-loss is more art than science; it’s not about just picking a number out of thin air. A widely used strategy is to pull up a chart and use technical analysis to find key support levels.

By placing your stop just below a strong support area, you give your trade some breathing room during normal market swings without getting stopped out too early. For more detailed answers to your trading questions, you can always explore the official vTrader FAQ section.

Ready to trade with precision and control? With vTrader, you get commission-free trading on over 30 cryptocurrencies, advanced tools, and a seamless platform to execute your strategy flawlessly. Open your vTrader account today and start trading smarter.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.