Here’s the thing about trading orders: the difference between a limit and a stop order really boils down to one simple concept. A limit order guarantees your price but not the trade itself, while a stop order guarantees the trade will happen, but not at what price.

Think of it like this: a limit order is you making a firm, non-negotiable offer. A stop order is more like setting up an emergency alarm that triggers a market sale once things hit a certain point.

Understanding the Core Difference

When you're just starting out, that order ticket screen can look pretty complex with all its different choices. But getting a solid grip on the two most common order types—limit and stop—is your first real step toward executing trades with intention. The choice you make here decides whether you care more about the price you get or the certainty of the trade actually going through.

It’s not a question of which order type is "better." It's about which one serves your immediate goal. Are you patiently trying to enter the market at a specific price you've calculated? Or are you trying to protect your capital from a sudden, sharp move against you?

The Trade-Off of Control vs. Execution

The entire decision comes down to what you're willing to risk. It’s a classic trade-off.

- With a limit order, your risk is that you miss the trade completely. If the market zips past your price without ever touching it, your order just sits there, unfilled.

- With a stop order, your risk is "slippage." That’s the gap between the price you wanted to trigger the trade at and the actual price it executes at. In a fast, volatile market, that gap can sometimes be surprisingly wide.

Key Takeaway: A limit order puts you in the driver's seat on price. A stop order, on the other hand, lets go of price control to make sure your position is either opened or closed, no matter what.

To make this crystal clear, here’s a simple breakdown. Use this table as a quick reference to match the order type to your goal before we get into the nitty-gritty of how they work and when to use them.

| Feature | Limit Order | Stop Order |

|---|---|---|

| Primary Goal | Price Control | Trade Execution |

| Guarantees | The price will be your limit or better | The order will execute (as a market order) |

| Main Risk | Order might not get filled | Slippage (execution price may differ from stop price) |

| Analogy | Making a firm, non-negotiable offer | Setting up a safety net or an alarm |

How Limit Orders Provide Price Certainty

Limit orders are your number one tool for taking absolute control over the price you pay for an asset. When you set a limit order, you're essentially laying down your terms to the market: you won’t pay a cent more than your specified price to buy, or accept a penny less to sell. This gives you powerful price certainty, a cornerstone of any disciplined trading strategy.

This control is broken down into two order types, each with a distinct purpose depending on whether you're getting into or out of a trade.

- Buy Limit Order: This is your order to buy an asset at or below a specific price. You’d use this when you feel a stock or crypto is a bit pricey and you only want to pull the trigger if it drops to a level you find more attractive.

- Sell Limit Order: This is an order to sell an asset at or above a specific price. It’s the classic way to take profits, making sure you cash out your gains once an asset hits your target.

A Real-World Example in Action

Let’s say a hot tech stock is currently trading at $155 per share. You've done your homework and decided that a fair entry point is actually $150. Instead of buying at the current market rate, you place a buy limit order for 10 shares at $150.

Your order is now logged in the exchange’s order book, sitting patiently. If the stock’s price dips to $150 or even lower, your order will activate and fill at $150 or a better price. But, if the stock just keeps climbing and never looks back, your order will simply remain unfilled.

The Primary Trade-Off: The fundamental compromise with a limit order is crystal clear. You get guaranteed price protection, but you lose execution certainty. The market has to come to you.

This is the key statistical difference between a limit order and a stop order—it’s all about which guarantee you prioritize. A limit order guarantees your price but not your trade. A stop order, on the other hand, becomes a market order once triggered, prioritizing getting the trade done over locking in a specific price. For instance, a sell stop at $18 will sell your stock once it hits that price, even if the final fill is slightly off.

This level of precision is invaluable for traders whose strategies hinge on exact entry and exit points. Platforms like vTrader are built to give traders direct access to these powerful tools, helping them execute their game plan with confidence. To learn more about our mission to empower traders with advanced, yet accessible tools, you can find out more at https://www.vtrader.io/en-us/about. By mastering the mechanics of a limit order, you can stop overpaying for assets and start systematically locking in your profits.

How Stop Orders Prioritize Trade Execution

Where limit orders give you surgical precision on price, stop orders are built for one thing: getting the trade done. Think of a stop order as a tripwire. It lies dormant until the market price hits a specific level you've set—your “stop price.” The moment that happens, it instantly springs to life as a market order, executing at whatever the next available price is.

This simple but powerful mechanism makes stop orders an indispensable part of any trader's toolkit, especially for two core strategies: clamping down on risk and jumping on momentum.

The Two Faces of Stop Orders

Stop orders aren't a one-trick pony. They come in two distinct flavors, each designed for a completely different market scenario. Knowing when to use which is fundamental to smart trading.

- Sell-Stop Order: This is the quintessential stop-loss. It’s your safety net, placed below the current market price when you’re in a long position. If the price tumbles and hits your stop, the order triggers a sale, getting you out of the market before things get any worse.

- Buy-Stop Order: This is your momentum-catcher. You place it above the current market price to get into a trade only after an asset proves its strength, usually by smashing through a known resistance level.

The rise of electronic trading has cemented the stop order's role, particularly in risk management. Just look at the data. A trader holding a stock at $25 might set a sell-stop at $22. If the stock suddenly nosedives, the order automatically triggers to limit their losses. You can find more key insights on order execution from Investopedia to see just how common this practice is.

The Unavoidable Risk of Slippage

The main trade-off for the certainty of execution is slippage. Because your stop becomes a market order once it's triggered, you have zero guarantee it will fill at your exact stop price.

Key Insight: In a fast or gapping market, the price can "slip" in the milliseconds between your stop being triggered and your order actually being filled. This often means your execution price is worse than your stop price.

Let's say you own a volatile crypto currently trading at $500. You wisely set a sell-stop order at $480 to protect your position. Bad news hits overnight, and the crypto gaps down, opening the next day at $470. Your $480 stop order triggers instantly, but it fills at the best available price—which is now $470.

You got out, which was the goal, but you experienced $10 of slippage per coin. In crypto, where high fees can also take a bite, understanding these dynamics is crucial. Keeping an eye on network congestion with an Ethereum gas tracker can give you a heads-up on the kind of market volatility that often leads to slippage.

Diving Deep into Order Mechanics

Getting the basic definitions of limit and stop orders is one thing, but to truly master them, you need to understand how they actually behave in the heat of a live market. Let's break down their mechanics to see the practical trade-offs you're making every time you choose one over the other.

This isn't just theory; it's about making the right choice for your specific trading goal.

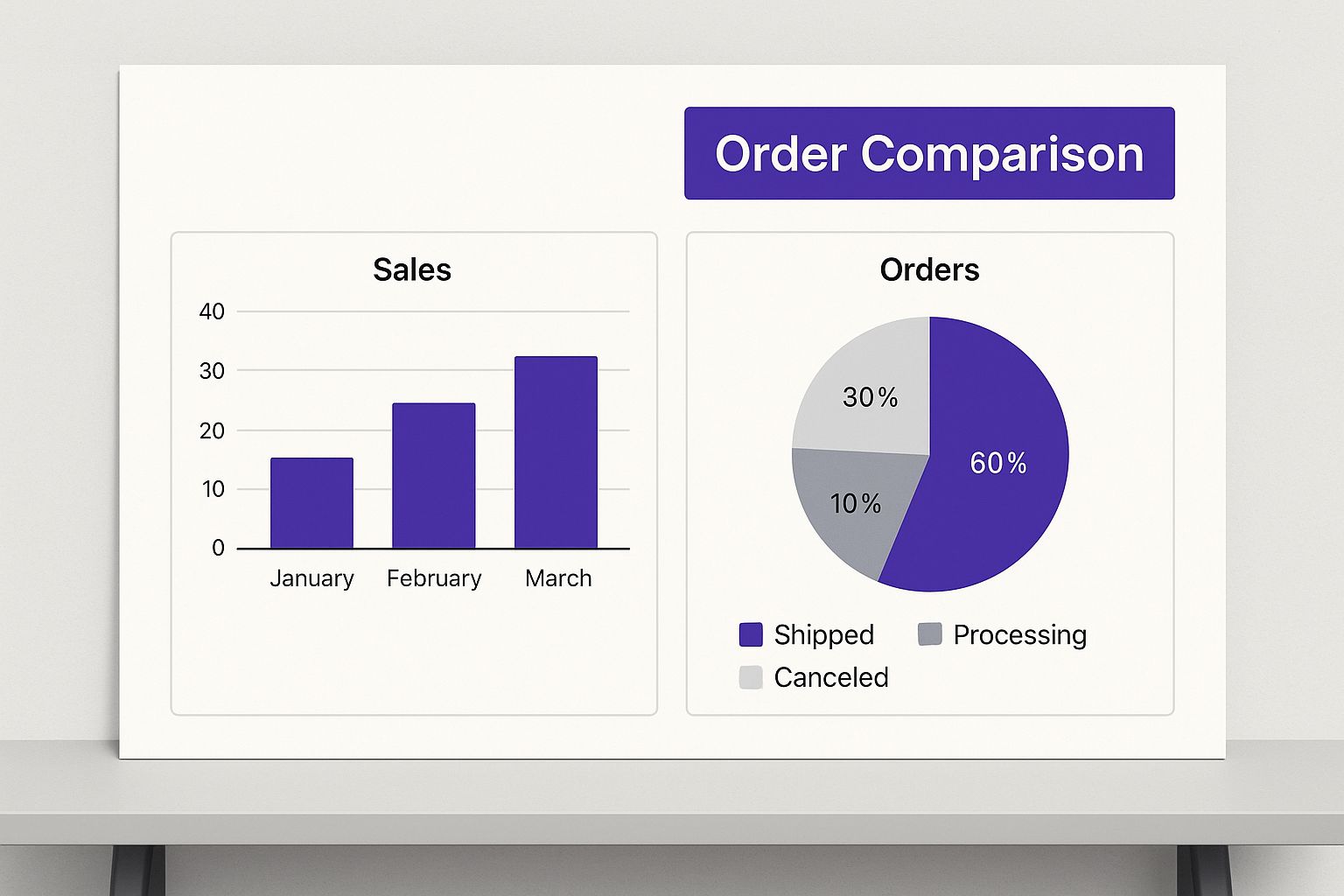

The image above perfectly captures the fundamental tension: a limit order is all about hitting a precise price, while a stop order is about triggering an action once a price is crossed. They serve two very different, but equally important, roles in any solid trading plan.

Price Control vs. Execution Priority

The absolute core of the limit vs. stop order debate boils down to what each one guarantees. Think of it as a trade-off.

With a limit order, you are guaranteed your price, but not the trade itself. You’re telling the market, "This is my price, take it or leave it." If the market never touches your specified price, your order simply won't fill.

On the other hand, a stop order guarantees execution but offers zero promises on the price. Once your stop price is hit, it immediately morphs into a market order, which then executes at whatever the best available price is. The priority is getting you in or out, period.

The Slippage Dilemma

Slippage—the gap between the price you expected and the price you actually got—is a huge factor here. It can make or break a trade, and each order type handles it differently.

- Limit Orders: These are your best defense against negative slippage. A buy limit order will only execute at your price or lower, while a sell limit will only execute at your price or higher. You'll never get a worse price, but the risk shifts. The real danger isn't slippage; it's that your order might not get filled at all if the price zooms past your level.

- Stop Orders: These are wide open to slippage. In a volatile market that's moving fast, the price can blow right through your stop level. This means your trade could execute at a price significantly worse than the one you set.

Key Insight: Choosing an order type is really about choosing your risk. A limit order risks missing the trade entirely. A stop order risks getting a bad price.

This mechanical difference isn't just academic; it has real-world consequences. During events like the 2010 Flash Crash, a wave of triggered stop-loss orders turned into market sell orders, which massively accelerated the price collapse. Conversely, a large cluster of limit orders can create powerful support or resistance zones, absorbing pressure. For a deeper dive, you can find detailed analyses from Seeking Alpha on how these orders shape market stability.

Core Differences Limit Order vs Stop Order

To put it all together, let's look at a direct, side-by-side comparison. This table strips away the noise and focuses on the key attributes that define how these orders function.

| Attribute | Limit Order | Stop Order |

|---|---|---|

| Primary Goal | Price Control | Guaranteed Execution |

| Slippage Risk | Low to None (risk of non-fill instead) | High (especially in volatile markets) |

| Price Guarantee | Yes, executes at your price or better | No, executes at the current market price after trigger |

| Execution Guarantee | No, only if the price is met | Yes, once the stop price is triggered |

| Order Transformation | Stays a limit order | Becomes a market order after trigger |

| Market Condition Use | Stable, predictable markets | Volatile, trending, or breakout markets |

This table makes the trade-offs crystal clear. Your decision ultimately hinges on whether getting the exact price you want is more important than ensuring your trade gets executed, no matter the final price.

Placement Relative to the Market Price

Finally, where you place the order in relation to the current market price is what defines its purpose. The rules are simple but strict.

A buy limit order must be placed below the current price. You’re essentially betting on a dip to buy an asset at a discount. In contrast, a sell limit order is placed above the current price, designed to lock in profits at a higher valuation.

Stop orders are the mirror image. A sell-stop order (your classic stop-loss) goes below the current price to protect a long position from a downturn. A buy-stop order is placed above the current price, used to jump into a trade as soon as an asset breaks through a key resistance level.

Strategic Scenarios for Using Each Order Type

Knowing the difference between a limit order and a stop order is one thing, but deploying them effectively is what separates seasoned traders from beginners. Let's move past the theory and dive into real-world situations where one order type is the clear winner. This is about making your tools work for your specific market strategy.

To get a feel for the markets where these orders are most powerful, it's always smart to keep an eye on current trends. For instance, checking out the latest DeFi statistics can give you a sense of the sheer scale and momentum in decentralized finance, a field built on this kind of strategic trading.

When to Use a Limit Order

Think of limit orders as your tool for precision and patience. They truly shine when the price you pay is more important than getting into the market right now.

Scenario 1: Buying a Pullback

You've got your eye on a quality crypto you want to add to your portfolio, but you feel it's a bit overheated at the moment. It’s currently trading at $110, but your analysis points to a strong support level at $100.

- A Trader’s Angle: "I'm not chasing this rally. I'll set a buy limit order at $100. This way, I only enter if the price drops to what I consider a fair value. If it never hits my price, so be it—I’ve avoided overpaying."

Scenario 2: Taking Profit at a Target

You snagged a stock at $50, and it's had a nice run up to $68. Your research tells you there's a major wall of resistance at $75, and you want to cash in your profits before it potentially reverses.

- A Trader’s Angle: "I'm setting a sell limit order at $75. It’s an automated exit strategy that takes my profits off the table right at my target. This keeps greed in check and locks in my gains at the price I want."

Key Insight: Limit orders are for proactive traders who are sensitive to price. You set the rules, and the market has to come to you. They are essential for value investing, swing trading between specific price levels, and even for generating passive income through strategies like crypto staking on vTrader.

When to Use a Stop Order

Stop orders are your defensive line. They are reactive by nature, designed to protect your capital or jump on a moving train, even if it means you don't get the perfect price.

Scenario 1: Setting a Stop-Loss

You're holding an asset that's currently trading at $200. To protect your capital from a sudden crash, you decide you're only willing to stomach a 10% loss on this position.

- A Trader’s Angle: "I need a safety net here. I’m placing a sell-stop order at $180. If the price tumbles to that level, my order becomes a market order and gets me out fast, preventing a small loss from turning into a devastating one."

Scenario 2: Entering a Breakout Trade

A stock has been trading sideways for weeks, trapped below a stubborn resistance level at $90. You believe that if it can finally push past this barrier, it's headed for a significant rally.

- A Trader’s Angle: "I don't want to buy while it's still stuck in this range. I'll place a buy-stop order at $91. This ensures I only jump into the trade after the price has proven its upward momentum by breaking through that key resistance."

Placing Orders on vTrader Step by Step

Knowing the theory behind a limit vs. stop order is one thing, but actually putting that knowledge to work is what builds real confidence in your trading. We designed the vTrader platform to make this process as straightforward and clean as possible.

Let’s walk through exactly how to place both order types, so you can stop thinking and start doing.

How to Place a Limit Order on vTrader

A limit order is all about control. You call the shots on your entry or exit price, and the order will only go through if the market plays ball and hits your number.

Here’s a look at the order placement screen on vTrader—no clutter, just the essentials.

As you can see, the interface keeps everything clean, with distinct fields for price, quantity, and order type. This is all about helping you execute your strategy with precision.

- Bring Up the Trade Ticket: Just select the asset you’re looking to trade, and the order form will pop up.

- Pick Your Order Type: Head to the dropdown menu and choose Limit Order.

- Set Your Limit Price: This is where the magic happens. If you’re buying, enter the absolute maximum price you're willing to pay. If you’re selling, this is the minimum price you’ll accept.

- Enter the Amount: Input how much of the asset you want to buy or sell.

- Choose the Order Duration: Decide how long you want the order to stay active. A Day order will automatically expire when the trading day ends. A Good 'til Canceled (GTC) order will remain open indefinitely until it's either filled or you manually cancel it.

- Confirm Everything: Give the details one last look and hit submit. Your order is now in the market.

How to Place a Stop Order on vTrader

Think of a stop order as your safety net or your trigger for jumping on a breakout. It activates a market order the moment the price hits a specific level you've set.

- Open the Trade Ticket: Same as before, start by selecting your asset.

- Select Stop Order: From the menu, this time you'll pick Stop Order.

- Enter Your Stop Price: This is your trigger. For a sell-stop (often called a stop-loss), you'll set it below the current market price. For a buy-stop, you'll set it above the current price to catch upward momentum.

- Input the Amount: Decide on the quantity you want to trade as soon as the stop is triggered.

- Submit the Order: Double-check your stop price and amount, then confirm to place your protective order.

Mastering these simple steps means you can trade with intention, not just on impulse. For more practical tutorials and to sharpen your trading skills, check out the comprehensive guides in the vTrader Academy.

Common Questions About Trading Orders

Even after you've got a handle on the basics, a few specific questions always seem to pop up when traders compare limit and stop orders. Getting these details straight can mean the difference between a successful trade and a costly mistake, so let's clear up some of the most common points of confusion.

One of the first things traders often ask about is a hybrid order that seems to blend the two.

What Is a Stop-Limit Order

A stop-limit order is a two-part instruction that gives you the best of both worlds—the trigger of a stop order and the price protection of a limit order. It uses a stop price to activate the trade and a separate limit price to set your execution boundary.

Think of it this way: imagine a stock is trading at $50. You could place a sell stop-limit order with a stop price of $48 and a limit price of $47.50. If the stock’s price falls to $48, your broker doesn't just sell at the market price. Instead, it places a limit order to sell your shares for $47.50 or better. This gives you far more control than a standard stop order, but it comes with a trade-off: if the market price plummets past your limit price too quickly, your order might not get filled at all.

What Happens if My Limit Order Is Only Partially Filled

This is a really common scenario. Sometimes, there just isn't enough volume available at your price to fill your entire limit order in one go. When this happens, your order is marked as partially filled.

The part of your order that didn't execute doesn't just disappear. It stays active on the order book as a live limit order, waiting for more volume to become available at your price. It will remain there until it's either completely filled, you decide to cancel it yourself, or it expires (like at the end of the day for a 'Day' order).

Key Reminder: Your stop-loss placement is a strategic decision balancing risk and opportunity. There is no single "correct" distance for every trade.

Should I Set My Stop-Loss Tight or Wide

Figuring out exactly where to place your stop-loss is one of the most critical decisions in managing your risk. It’s a real balancing act.

- A tight stop is great for minimizing your potential loss on any given trade. The downside? You run a higher risk of getting knocked out of a perfectly good position by normal, everyday market fluctuations.

- A wide stop gives your trade more breathing room to move around without getting stopped out prematurely. However, it also means you're accepting the risk of a much larger loss if the trade ultimately goes against you.

Ultimately, the best distance depends on your personal risk tolerance, how volatile the asset is, and your overall trading strategy. For more answers to your trading questions, be sure to explore the vTrader FAQ page.

Ready to trade with zero fees and advanced tools? Sign up for vTrader today and get a $10 bonus to start building your portfolio. Join now at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.