The Modern Gold Rush

The crypto market has transformed from a playground for coders and fundraisers into one of the most dynamic financial ecosystems on the planet. It’s open around the clock and powered by digital assets, some of which can swing in price by 30% before the end of the day. That volatility creates risk, but also the incredible opportunities that traders need to make money.

There is a lot to learn for new traders: wallets, exchanges, gas fees, trading pairs, and charts. But with the right training, anyone can start and learn how to make money off of crypto’s ups and downs. This guide tells you everything you need to know about how the market works, where to start, and how to make a trading plan that will give you a better chance of success.

What Is Crypto Trading?

Trading crypto means buying and selling digital currencies to make money when their prices go up or down. Traders guess whether the price of a coin will go up or down by either holding the asset directly on an exchange or using platforms that let them take on more risk.

It’s important to remember that trading cryptocurrencies is not the same as investing for the long term.

- Trading is all about taking advantage of short- and medium-term opportunities. These positions can last for minutes, hours, or days.

- Investing means keeping assets for months or years and not worrying about short-term changes in value in order to see long-term growth.

Traders use technical analysis, market data, and strict risk management to capitalize on price swings, while investors rely on the fundamental economics of a project’s long-term potential.

How is Crypto Different from Traditional Markets

Crypto is unlike any market the world has ever seen before. Here’s how it stands apart from stocks and forex:

- The crypto market is open 24 hours a day, 7 days a week, with no single centralized exchange.

- Daily price movements of 5–10% are common. That volatility is both opportunity and danger.

- Regulation varies globally, and new rules are being created as adoption grows.

- Many assets trade on blockchain-based exchanges that remove the need for intermediaries. It’s decentralized

This constant accessibility and innovation are part of what attracts traders to crypto.

Your First Steps into the Crypto Market

Let’s go through the basics that ensure your journey begins safely and on the right footing.

Choosing a Crypto Exchange

A crypto exchange is your entry point to the market, it’s your personal trading floor. It allows you to buy, sell, and trade cryptocurrencies (using fiat money or other digital assets).

When selecting an exchange you want to look for these key factors:

- Look for 2-Factor Authentication (2FA), withdrawal whitelists, and cold wallet storage.

- Every trade has a fee or commission. Compare the maker/taker fees and check the deposit and withdrawal charges.

- The exchanges that have higher liquidity allow for faster execution and better prices. (CoinMarketCap’s Liquidity Score, CoinGecko’s Exchange Rankings)

- You want a clean and intuitive UI that has charting tools and indicators to fit your strategy.

- Always make sure the exchange lists the assets you intend to trade.

You’ll need to decide between using a Centralized Exchange (CEX) (like vTrader, Binance or Coinbase) or a Decentralized Exchange (DEX), (e.g., Uniswap or PancakeSwap).

Centralized exchanges hold your coins, while decentralized ones give you full control of your funds but require more technical knowledge and best security practices from you.

Creating and Securing Your Account

After you choose your exchange, you will need to register. This usually means verifying your email and doing KYC (Know Your Customer) identification, which means uploading your ID documents. KYC might seem like an invasion of privacy, but it’s the law to stop fraud and meet compliance standards.

Then, turn on 2FA right away. This adds a second layer of protection by requiring a code from your phone or authentication app each time you log in or withdraw funds.

Never skip this step. Exchanges are prime targets for hackers, and 2FA is your best line of defense.

👉 Need more help? Visit: Setting Up a Trading Account

Funding Your Account

With your account secured, the next step is depositing funds. Exchanges usually offer multiple deposit methods:

- Bank Transfer (ACH/SEPA): Low fees, but slower processing (usually 1–3 business days).

- Credit/Debit Card: Instant deposits, but much higher fees.

- Wire Transfer: Fast and suitable for large amounts, though some banks may charge additional fees.

If you’re transferring crypto instead of fiat, make sure you use the correct blockchain network (e.g., ERC20, BEP20, TRC20). Sending funds to the wrong network will result in the permanent loss of your funds.

How Much Do You Need to Start?

You don’t need a lot of money to begin trading. In fact, starting small is the best way to learn without unnecessary risk. Many exchanges let you start trading with as little as $10.

The key principle is risk-controlled learning. Trade with an amount you can afford to lose while focusing on improving your strategy and mastering emotional control. If you lose a few trades, don’t worry, think of your first few trades as tuition in understanding market mechanics.

A well-disciplined trader can grow a small account through consistency, don’t try to do it through big bets.

👉 If you want to start small we have a guide for you: How to Start with Small Investments

The Core Concepts of Trading

Once your account is ready and funded, it’s time to learn how to analyze the market. This is where theory meets practice.

An Introduction to Charts

Crypto price charts show how buyers and sellers interact over time.

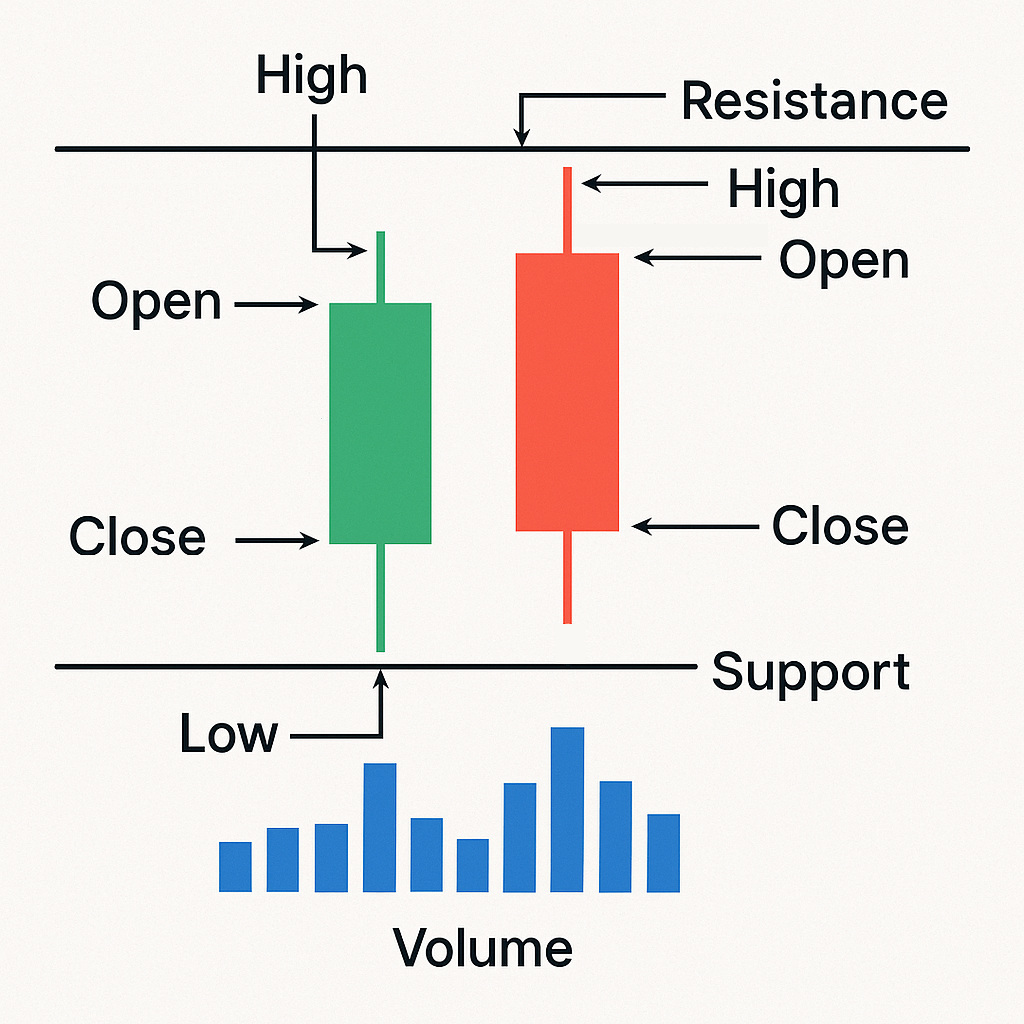

The most common type of chart used in trading is called the candlestick chart. Each candle represents the price action over a specific period (e.g., 1 minute, 1 hour, 1 day).

Each candlestick shows you the following:

- Open: The price when the period began.

- Close: The price when the period ended.

- High and Low: The highest and lowest prices during that period.

Candles are colored green for upward movement (growth – bullish) and red for downward (decline – bearish).

A sequence of green candles indicates bullish momentum (buyers in control), while red candles indicate bearish momentum (sellers are dominating).

If you draw a line connecting the highs and lows you’ll also see support and resistance levels. These are price levels where the market has been shown to react. Support holds price from falling lower, while resistance acts as a ceiling.

How to Read Candlesticks

Fig 1. – Showing Open High Low and Close on Bullish and Bearish Candlesticks

👉 For an in depth explanation on chart analysis please visit: How to Read Crypto Charts

Placing Your Order

When you want to place a trade, you’ll encounter several order types. Each serves a specific purpose:

- Market Order: Executes immediately and at the current market price. It’s fast, but offers no price control.

- Limit Order: Executes only at a set price or better. Gives control, but might not fill if price never reaches it.

- Stop-Loss Order: Triggers a sell when the price drops to a preset level, limiting your downside.

It’s very important to know when to use each one. Limit orders are better in markets with low liquidity where prices can change. Market orders are fine for small trades in pairs with high liquidity, like BTC/USDT.

👉 For more advanced order types like Take-Profit, OCO, and Trailing Stops: Understanding Trade Order Types.

Selecting Your First Cryptocurrency

There are thousands of coins to choose from, but Bitcoin is the one that most people talk about. What asset is best for you depends on your trading strategy and how interested you are in the project’s fundamentals.

When you decide which cryptocurrency to trade, think about the following:

- BTC and ETH are large-cap assets that are more stable. Small-cap coins, on the other hand, can give you bigger gains but also add more risk.

- Always check 24-hour volume. A liquid asset lets you enter and exit positions smoothly. This is especially important if you’re trading with size.

- Research what the crypto actually does. Does it solve a real problem, or is it just hype?

Ethereum benefits from consistent developer activity and network upgrades, while smaller tokens may rely on marketing-driven cycles. As you’re starting out, it’s often best to start with top-tier coins until you’re comfortable analyzing new projects.

👉 For a detailed guide on research and analysis: Choosing the Right Cryptocurrency for Trading

Why You Should Always Worry About Liquidity

Liquidity means how easily an asset can be bought or sold without moving the market price.

When liquidity is high, large trades settle smoothly. When it’s low, even small orders can shift prices dramatically, leading to slippage (when you receive a worse price than expected).

You can check liquidity by looking at the order book depth on your exchange. Deep order books with many buy and sell orders mean smoother execution and less volatility.

Professional traders almost always prioritize liquidity. Remember, you can’t profit from an asset you can’t exit.

👉 For an in-depth explanation with examples, please visit: Importance of Liquidity in Trading

Your Strategy and Risk Management

Let’s imagine you’ve got an account, funds ready, and a grasp on how markets move. Now comes the most important phase of all – developing your personal trading strategy.

Trading isn’t just about guessing which direction a coin will move next. It’s about structure, probability, and being consistent with your approach. The goal isn’t to win every trade, it’s to manage your capital in such a way so that even when you lose, you stay in the game long enough to profit.

Choosing the Trading Strategy That Fits You

There isn’t a single “best” way to trade crypto. The right strategy depends on your time availability, how you want to trade, and your skillset. Below are the main styles that dominate crypto markets today:

Day Trading

Day traders open and close positions within the same day. They make money from intraday volatility, using short timeframes. It demands a lot of focus, discipline, and the ability to make fast decisions. However, it can be mentally exhausting and is not recommended for beginners.

Swing Trading

Swing traders hold positions for several days or weeks, trying to capture medium-term “swings” between overbought and oversold areas on the graph. This approach is ideal for beginners because it doesn’t require constant screen time but still provides steady learning opportunities and sizable gains.

Scalping

Scalping involves opening dozens of small trades in a session, each lasting seconds or minutes. Profits are small per trade, but frequency makes up for it. Scalpers rely heavily on low-fee environments and high liquidity. It’s effective, but requires speed, precision, and advanced execution tools.

If you’re just starting out, swing trading is usually the best entry point. It gives you time to think, evaluate your moves, and understand how markets behave without the noise of minute-to-minute reactions.

👉 Learn advanced methods like arbitrage, grid bots, and algorithmic trading: Types of Crypto Trading Strategies

How to Manage Your Risk

Every professional trader lives by one rule: protect your capital. Without risk management, even the best strategy will eventually fail and when it does it will take a chunk out of your account.

Here are the rules for smart risk control:

1. The 1% Rule

Never risk more than 1% of your total trading balance on a single trade. If your account is $1,000, your maximum loss per trade should be $10. It sounds small, but this rule is designed to keep you alive during bad streaks. Ten consecutive losing trades would only cost you 10% of your capital, allowing you to recover.

2. Risk-to-Reward Ratio (R:R)

Before entering a trade, calculate how much you stand to lose versus how much you might gain. A common target is a 1:3 ratio. That means risking $10 to potentially earn $30. You can lose two trades and win one, and still be profitable.

3. Your Safety Net

A stop-loss order automatically sells your position if the price drops to a certain level. It removes emotion from your decision making and prevents small losses from turning catastrophic. Never trade without one.

👉 For advanced topics like portfolio hedging and position sizing formulas please visit: Risk Management in Crypto Trading

Understanding Market Cycles

The crypto market moves in emotional waves that repeat over time. Recognizing these cycles will help you adapt your strategy to the broader environment rather than fighting against it.

Bull Markets

These are characterized by optimism, rising prices, and new all-time highs (higher highs, higher lows). Retail traders flood in, social media buzzes, and FOMO (Fear of Missing Out) drives prices beyond fundamentals. During bull runs, trends are your friend. Use momentum trading strategies here.

Bear Markets

This is when prices decline sharply (continuous lower lows and lower highs), volume dries up, and fear dominates on social media. This is when traders often give up, but smart ones switch strategies to capitalize on shorting opportunities or accumulate positions for the next recovery phase.

Consolidation Phases

Sideways movements come after large rallies or crashes. Markets move between defined support and resistance levels. Patience pays off here, after you identify the support and resistance of this zone, you want to buy low and sell high.

Understanding these patterns helps you time your strategies effectively. Scalping during low-volatility ranges can be profitable, while breakout trading thrives when markets start trending (bullish or bearish).

👉 Detailing sentiment analysis, on-chain data, and the Bitcoin halving cycle: Crypto Market Trends

Market Psychology The Force Behind Every Trade

No strategy will save a trader who can’t manage their emotions. Fear, greed, and ego are the silent killers of trading accounts. Let’s break down how each emotion misguides traders and what to do about it:

- FOMO (Fear of Missing Out): You see a coin pumping and jump in late, only to watch it crash right after. Always trade based on your own setup, not hype.

- FUD (Fear, Uncertainty, Doubt): Panic-selling during temporary dips leads to realized losses. Stick to your stop-loss, not your nerves.

- Revenge Trading: Trying to “win back” after a loss usually leads to more losses. Take a break after a losing streak and reset mentally.

A trading plan isn’t just technical, it’s also very much psychological. Discipline is your solution here. Keep your trading journal updated, limit your downside, and never let emotions dictate entry or exit.

👉 More techniques to develop emotional control: Trading Psychology

Journaling – The Secret Weapon

Every serious trader keeps a journal. Why? Because trading success is statistical, and it helps to measure your results. A journal transforms your trades into a data set that can be analyzed and improved over time.

For every trade you should be recording:

- Entry and exit prices

- Reason for entering the trade (your setup)

- Stop-loss and take-profit levels

- Outcome (profit/loss)

- Emotional state during the trade

After 20 or 30 trades, visible patterns emerge. Maybe you take impulsive trades after a win, or skip your stop-loss after a loss. Journaling exposes these habits to you and gives you control over them.

By documenting and reviewing your performance regularly, you can refine your edge and improve consistency. Over time, this process compounds your experience into a real skill.

👉 For a guide to creating and using a trading journal, visit: How to Learn from Past Trades

What to Avoid Early On

The fastest way to improve as a trader is to avoid what most beginners do wrong. Here are three costly traps to avoid:

Going All-In on One Coin. Crypto is unpredictable. Putting everything into one position is reckless. Diversify your positions across a few assets to balance risk.

Ignoring Risk Management. Many beginners treat stop-losses as optional. Professionals treat them as mandatory. Failing to plan your exit is planning to lose.

Trading Based on Hype Alone. Social media influencers are not risk managers. A tweet can move prices short term, but fundamentals drive the long-term direction. Always verify before acting.

Avoiding these pitfalls early on saves months of frustration and capital loss.

👉 For an exhaustive list with explanations on how to avoid each one, visit: Common Mistakes in Crypto Trading

A Note on Continuous Learning

The market rewards those who adapt. What worked last year might not work today, and the traders who stay sharp are those who continue learning. Read whitepapers, watch tutorials, test new strategies on demo accounts, and stay active in the community.

Crypto evolves faster than traditional finance, and so must you.

Trade Smarter, Not Harder

Join vTrader, the zero-fee platform built for professional traders who value precision, liquidity, and execution speed.

Trading Tools and Understanding Hidden Costs

Trading success isn’t about learning hidden formulas. It’s about having the right tools, managing your emotions, and constantly learning from your results.

The Trader’s Toolkit

Behind every successful trader is a set of reliable tools. You don’t need a massive setup to start, but you do need a few key platforms that give you data, news, and control.

Charting Platforms

Charting software is where most of your market analysis happens. TradingView is the industry standard. It allows you to study price movements, draw trendlines, set alerts, and track multiple assets in real time.

Portfolio Trackers

Once you start trading more than one asset, tracking them manually becomes overly difficult. Free tools like CoinMarketCap and CoinGecko give you live prices, while apps like Zapper and Zerion help visualize portfolio value and your profit/loss (P&L).

News & Data Aggregators

Markets react to news before most traders can process it. Keeping a curated feed of reliable sources helps you stay informed without getting overwhelmed. Focus on announcements that impact supply, demand, or sentiment, not hype.

👉 For a comprehensive list please visit: Tools Every Beginner Trader Needs

Understanding the Trading Fees

Fees are often an overlooked factor that can eat into your profit, especially for active traders. Each trade incurs one of two types of fees:

- Maker Fee – charged when you place a limit order that adds liquidity to the order book.

- Taker Fee – charged when you place a market order that removes liquidity.

These rates vary by exchange and by your 30-day trading volume. On large platforms, fees can range from 0.10% to 0.20% per trade, and for scalpers or day traders, that adds up fast.

Withdrawal and deposit fees also differ across networks. Transferring Ethereum tokens can cost more than moving stablecoins on low-fee chains like Tron or Solana.

That’s why more professional traders are moving toward zero-fee platforms like vTrader where execution costs are eliminated. Over time, even a small difference in fees can dramatically affect your returns.

Trade smarter with vTrader, the 0% fee platform designed to help you maximize your returns without the hidden costs.

👉 Detailed comparison across major exchanges: What You Need to Know About Trading Fees

Frequently Asked Questions

How much money do I need to start trading crypto?

You may start with just $10. A lot of exchanges let you do micro-trades. In the beginning, you should spend most of your time on learning, not making money.

Is it possible to make money trading crypto?

Yes, but only if you have a strategy. Traders who are disciplined and manage their risks often do better than traders who let their emotions get the best of them.

What is the difference between trading and HODLing?

The goal of trading is to make money off of short-term price swings. HODLing means buying and holding for a long time, even when prices go up and down.

Can I trade cryptocurrencies 24/7?

Yes, the crypto market is always open. But liquidity and volatility change depending on the time zone, so stay away from low-volume hours when spreads get wider.

Is it safe to trade in cryptocurrencies?

Your behaviors make it safe. Use exchanges that you can trust, turn on two-factor authentication, and never give out your recovery phrases or private keys. Not the market itself, but bad security practices are what pose the most hazards.

Your Journey as a Trader Starts Now

Every successful trader begins with the same steps you’ve taken today: learning, refining, and trying. The difference between those who succeed and those who fail isn’t just intelligence or luck, it’s persistence and a stable process.

Start small, stay consistent, and treat every trade as a data point. As your skill grows, so will your confidence in your results, that’s when you can scale up. Markets will change, crypto will evolve, but the discipline you build now will stay with you for the rest of your life.

Don’t wait for the “perfect moment” to start. The perfect moment is the one where you begin.

Ready to Start Your Trading Journey?

Apply what you’ve learned today. Open a secure account and trade with 0% fees on vTrader, the platform built for professionals and traders who take their craft seriously.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.