Alright, let's get you set up to trade crypto. The journey starts with a few key milestones: picking a solid crypto exchange, getting your account locked down, adding some funds, and then, finally, pulling the trigger on your first trade.

Think of these four steps as the foundation. Get them right, and you're building on solid ground.

Your Crypto Trading Starting Point

Jumping into the world of crypto trading can feel like trying to decipher a secret code. You're bombarded with terms like "blockchains," "altcoins," and "market volatility." But here's the thing—the actual path from spectator to participant is surprisingly straightforward. This guide is your map.

We're going to break down the entire process into a simple, actionable game plan. No fluff, just the essentials:

- Picking a Trustworthy Exchange: This is your home base, your gateway to the market. We'll cover what really matters when choosing one.

- Locking Down Your New Account: Security isn't an afterthought; it's job number one. We’ll show you how to protect your assets from day one.

- Funding Your Account Without a Hitch: Getting your capital in place is the next step. We’ll go over the most common and safest ways to do it.

- Placing Your First Trade: Understanding basic order types is what separates guessing from executing a plan.

By seeing the full picture upfront, you'll know exactly where we're headed before we dive into the details of each stage.

Understanding the Opportunity

You’re stepping into a market that’s not just growing—it’s exploding. The global crypto market was valued at around USD 5.7 billion and is on track to more than double to USD 11.7 billion by 2030. That kind of growth is turning heads, from individual traders like you to the biggest names on Wall Street. You can find plenty of data on this crypto market growth, but the takeaway is simple: the field is expanding, and so are the opportunities.

I always tell newcomers the same thing: your most critical first move isn't finding the next big coin. It's building a solid foundation. A secure account on a reliable exchange, paired with a real understanding of the basics, will do more for your long-term success than any single lucky trade.

This isn't the wild west it used to be. The market's maturity means there are more quality resources and learning tools available than ever. For instance, digging into educational hubs like the vTrader Academy can give you structured lessons to build your confidence one concept at a time. The goal here isn't just to help you make a trade; it's to help you build smart habits that will stick.

Essential Crypto Trading Checklist for Beginners

To help you keep track of everything, I’ve put together a quick checklist. Think of it as your cheat sheet for getting started on the right foot, covering the key actions and what to watch out for at each phase.

| Phase | Action Item | Key Consideration |

|---|---|---|

| Preparation | Choose a reliable exchange. | Look for low fees, strong security (2FA), and good liquidity. |

| Setup | Create and verify your account. | Have your ID ready for KYC (Know Your Customer) verification. |

| Security | Enable Two-Factor Authentication (2FA). | Use an app like Google Authenticator, not just SMS. |

| Funding | Deposit funds into your account. | Start with a small amount you're comfortable losing. |

| Education | Learn basic order types. | Understand the difference between Market, Limit, and Stop-Loss orders. |

| Execution | Place your first trade. | Double-check the asset pair, order type, and amount before confirming. |

| Management | Develop a risk management plan. | Decide your entry/exit points and stop-loss levels before you trade. |

This table provides a high-level view of the process. As you move through this guide, we'll unpack each of these items in much greater detail, giving you the practical knowledge to tackle them confidently.

Choosing the Right Crypto Exchange for You

Picking a crypto exchange is one of the most important first steps you'll take. Think of it as your home base for the entire digital asset market—it’s where you’ll buy your first Bitcoin, dabble in altcoins, and watch your portfolio grow. Getting this choice right from the start has a huge impact on your security, fees, and overall trading experience.

Let's be clear: not all exchanges are built the same. Some are geared towards professional traders with complex interfaces that look like a space shuttle cockpit. Others are designed for absolute beginners, prioritizing a simple, clean experience. The trick is finding the platform that matches your personal goals and comfort level.

Key Factors for Evaluating an Exchange

When you start comparing platforms, it’s easy to get distracted by flashy marketing. Instead, you need to cut through the noise and focus on what really matters.

Here’s what I always look for:

- Security Protocols: This is the absolute deal-breaker. An exchange must offer Two-Factor Authentication (2FA). It's also critical that they hold the vast majority of assets in cold storage (offline wallets), which keeps your funds safe from online hacks.

- Fee Structure: Those tiny fees can add up and eat into your profits over time. You'll hear about "maker" fees (when you add liquidity with a limit order) and "taker" fees (when you remove it with a market order). Finding a platform like vTrader, which offers zero-fee trading, can make a massive difference to your bottom line.

- Asset Variety: Does the exchange have the coins you want to trade? A massive list of every coin under the sun isn't always a good thing. I often see it as a sign of quality when a platform offers a curated list of reputable, well-vetted projects.

- User Experience (UX): A clean, intuitive design makes all the difference when you're just learning how to trade crypto. A confusing layout is more than just frustrating; it can lead to expensive mistakes, like placing the wrong order.

Putting It Into Practice with vTrader

Let's use vTrader as a quick example of a platform that balances ease of use with powerful features. The sign-up process is built to be as smooth as possible without ever compromising on security.

You can see below just how clean and simple the initial sign-up page is. There's no clutter, no confusion—just the essentials.

This kind of straightforward design is exactly what you want to see. It gets you into the action quickly and securely, without overwhelming you from the get-go.

A great exchange also grows with you. Once you get comfortable with basic trading, you'll want to explore more. For instance, you can put your assets to work by earning rewards through vTrader's staking program.

The best exchange for you is one that makes you feel confident and secure. Red flags include unclear fee schedules, a lack of transparency about security measures, or consistent negative user reviews regarding withdrawals.

By stepping into crypto, you're joining a massive global movement. More than 560 million people—about 6.8% of the world's population—now own digital assets. That number has grown at a staggering compound annual rate of 99% from 2018 to 2023, blowing past the growth of traditional finance products.

Your choice of exchange really does set the tone for your entire crypto journey. So take your time, do your homework, and pick a platform that feels right for you.

Setting Up and Funding Your Trading Account

Now that you’ve zeroed in on a solid exchange like vTrader, it’s time to get your account set up and funded. This part is pretty straightforward, but you’ll want to pay close attention to the details—especially when it comes to locking down your security from day one.

Signing up is the easy part. You'll just need a valid email and a strong, unique password. Think of it as being handed the keys to your new trading hub. But before you can start trading, you have to verify who you are.

Completing Identity Verification

The next step is what the industry calls Know Your Customer (KYC). You'll need to submit a government-issued ID, like a driver's license or passport, and probably snap a quick selfie. It might feel like an extra step, but KYC is a critical regulatory hurdle that keeps everyone safe.

Regulated exchanges like vTrader use KYC to comply with anti-money laundering (AML) laws and prevent bad actors from using their platforms. It creates a much safer trading environment and adds a layer of trust. It’s no different than a bank asking for your ID to open an account—just a standard security check.

An account without proper verification and security is like leaving the front door of your house wide open. Take these initial setup steps seriously; they are the foundation of your entire trading security strategy.

Securing Your Account with 2FA

As soon as your identity is confirmed, your very next move should be enabling Two-Factor Authentication (2FA). This is not optional. 2FA adds an essential second line of defense by requiring you to approve any login from a separate device, usually your phone.

This means that even if a hacker somehow gets your password, they're stopped in their tracks because they don't have your phone. For the best protection, use an authenticator app like Google Authenticator or Authy.

Choosing Your Funding Method

Alright, let's get some trading capital into your account. Most exchanges give you a few different ways to deposit funds, and each one has its own trade-offs between speed, cost, and convenience.

Here’s a quick rundown of the most common options you'll find on vTrader:

| Method | Speed | Fees | Best For |

|---|---|---|---|

| Bank Transfer (ACH) | 2-5 business days | Often free or very low | Cost-effective deposits without needing a card. |

| Wire Transfer | Within 24 hours | Can be $15-$30 | Larger deposits where speed is a priority. |

| Debit Card | Instant | Typically 2-4% | Small, fast purchases when you need to act quickly. |

For most people just starting out, an ACH bank transfer is the way to go. It's the most cost-effective option and helps you dodge the higher fees that come with instant card purchases. This way, more of your initial capital goes toward your first investment instead of getting eaten up by transaction costs—a smart first move on your crypto journey.

How to Place Your First Crypto Trade

Alright, your vTrader account is funded and ready to go. You're officially at the starting line, and this is where the real action begins. Looking at the trading dashboard for the first time can feel a bit like stepping into the cockpit of a spaceship, but don't worry—it’s just a set of tools designed to help you execute your trades precisely.

The heart of trading really comes down to just a few key commands, or "order types." Getting a handle on these is what separates a passive crypto holder from an active trader.

Your First Orders, Demystified

Let's cut through the noise and focus on the most fundamental commands you'll use to interact with the market. For your very first trade, you'll most likely be using one of these two.

- Market Order: This is the "just get it done" option. A market order tells the exchange to buy or sell a crypto for you immediately at the best price currently available. It’s perfect when you value speed over getting a specific price.

- Limit Order: This one puts you in the driver's seat. A limit order says, "Buy this crypto for me, but only if the price drops to my target or lower." It’s your way of ensuring you never pay more than you’re willing to.

Say Bitcoin is trading at $67,500. If you place a market order, you'll buy it instantly right around that price. But with a limit order, you can be more tactical. You could set it to only trigger a purchase if the price dips to your desired entry point of $65,000.

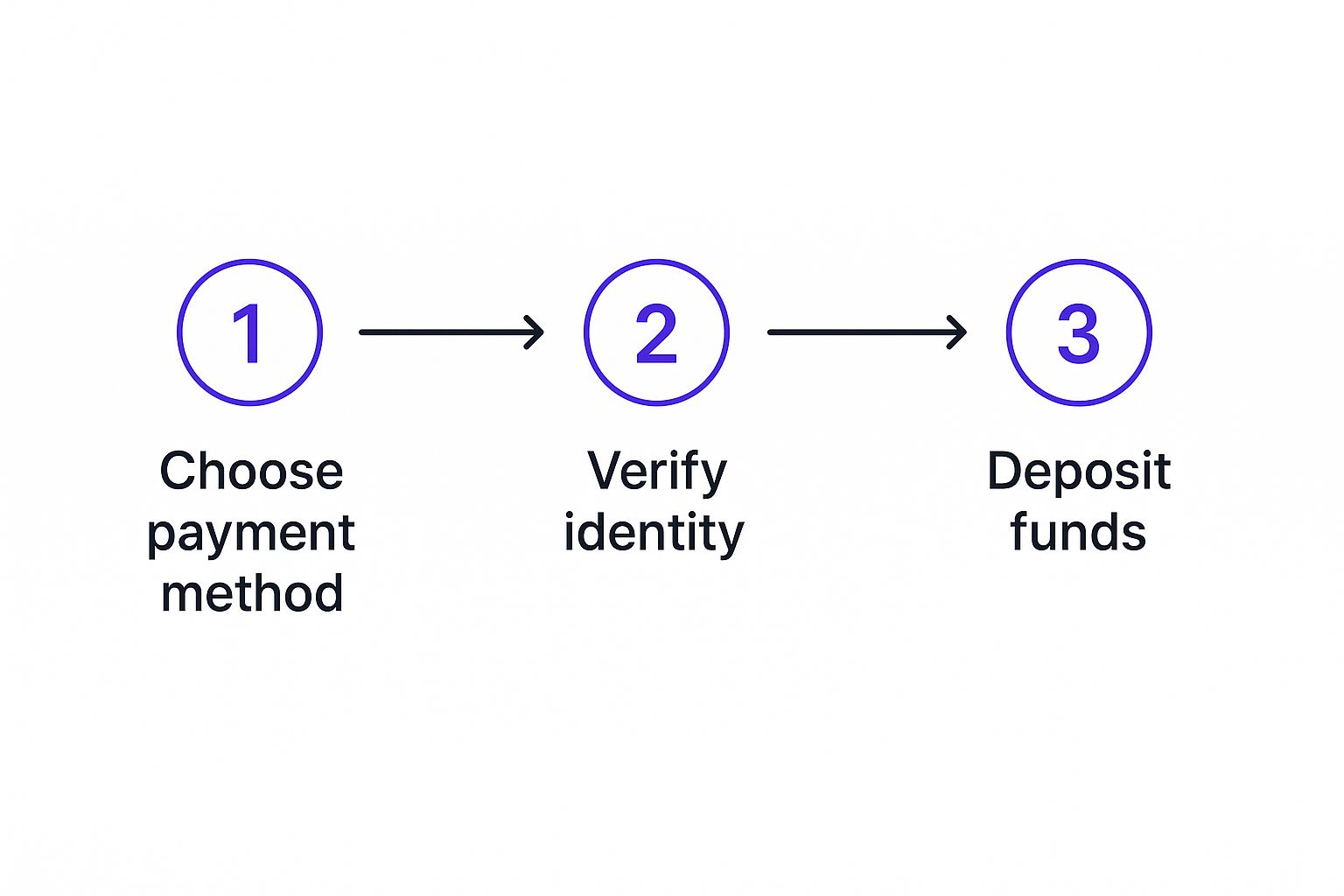

Getting your funds into position for these trades is a simple process, as you can see below.

This just shows the quick path from picking a payment method to having your funds ready to deploy—the last step before you hit that "buy" button for the first time.

Mastering the Basic Order Types

To really understand how these tools work in practice, let's break them down. Each one has a specific job, and knowing when to use them is a core trading skill.

| Order Type | How It Works | Best Used For |

|---|---|---|

| Market Order | Executes your trade instantly at the current best available market price. | When you need to get in or out of a position quickly and are less concerned about the exact price. |

| Limit Order | Lets you set a specific price at which you want to buy or sell. The order only executes if the market hits that price. | Entering or exiting a trade at a price you’ve pre-determined, giving you more control over your cost. |

| Stop-Loss Order | An order to sell your asset automatically if it drops to a specific price, designed to limit your potential losses. | Protecting your capital from a significant downturn and taking emotion out of your exit strategy. |

These three orders form the foundation of most trading strategies. Start with these, and you'll have a solid toolkit for navigating the market.

Your First Risk Management Tool

Smart trading isn't just about picking winners; it's about protecting your capital when a trade goes south. This is where that third crucial order type, the stop-loss, becomes your best friend.

A stop-loss order is a defensive play. It's an instruction you give the exchange to automatically sell your crypto if the price falls to a level you've already decided on. For instance, if you buy Ethereum at $3,500, you might place a stop-loss at $3,200. If the market turns against you, your position is sold, capping your loss.

A stop-loss is your pre-planned exit strategy. It takes emotion out of the equation during a stressful market drop, forcing you to stick to your plan and protect your initial investment.

Using market, limit, and stop-loss orders together gives you a powerful framework for both entering and exiting trades with a clear, disciplined approach. And as you trade, remember that platforms like vTrader are built to handle your data securely. For a full rundown, you can always review the vTrader privacy policy.

Once your order is placed, you can watch its status right on your vTrader dashboard. You’ll see your open positions, track their performance in real-time, and manage them as the market moves.

Congratulations—you're no longer on the sidelines. You're an active participant in the crypto market.

Building Smart Habits and Managing Risk

Landing your first successful trade is an electrifying moment, but let's be clear: long-term success isn’t built on one-off wins. It’s forged in the less glamorous world of smart habits, disciplined strategy, and, most importantly, rock-solid risk management.

Anyone can get lucky on a trending coin during a bull run. The professionals—the ones who stick around—are those who obsess over protecting their capital. True sustainable trading means shifting your focus from chasing those explosive profits to preserving what you have. This all boils down to having a plan for every single trade. Not just when to buy, but when to sell, both for a profit and for a loss.

Adopting a Beginner-Friendly Strategy

One of the simplest yet most powerful strategies out there is Dollar-Cost Averaging (DCA). Instead of trying to "time the market" and dump a lump sum at the perfect low—a nearly impossible feat—DCA smooths out your entry price over time.

With DCA, you commit to investing a fixed amount of money at regular intervals, no matter what the price chart says. For instance, you could decide to buy $50 worth of Bitcoin every Friday.

- When the price is high, your $50 gets you a smaller slice of Bitcoin.

- When the price is low, that same $50 buys you a much larger chunk.

Over months, this approach averages out your cost basis, dramatically reducing the impact of volatility and taking the emotional stress out of trying to pinpoint the absolute bottom.

The Power of Diversification

Another critical habit to build is diversification. Throwing all your funds into a single, hyped-up altcoin is just gambling with extra steps. A real strategy involves spreading your investment across several different cryptocurrencies.

A good starting point could be a mix of established players like Bitcoin and Ethereum, blended with a few smaller, well-researched projects. This approach helps insulate your portfolio from the inevitable downturns that can hit any single project.

The golden rule of crypto trading sounds deceptively simple but is absolutely critical: only invest what you can comfortably afford to lose. The market is notoriously volatile, and no returns are ever guaranteed. Treat your trading capital as risk capital, always.

This single principle is what protects your financial well-being from the market's wild swings. It's what allows you to make trading decisions based on logic and your pre-set plan, not gut-wrenching fear. If you aren't over-invested, you can stick to your strategy without letting emotion hijack your decisions. Smart habits also demand doing your homework; exploring various investment research tools will give you the edge needed to analyze market trends and make informed choices.

Golden Rules of Risk Management

Beyond broad strategies, a few non-negotiable rules will protect your capital and help you learn how to start trading cryptocurrency safely.

- Set Stop-Losses: As we've mentioned, a stop-loss is your automated safety net. It automatically sells your position if the price falls to a level you've predetermined, capping your losses before they spiral out of control.

- Have an Exit Plan: Before you even hit the "buy" button, you should know exactly where you plan to get out. Decide on a target price for taking profits and a stop-loss price for cutting losses. Write it down. Stick to it.

- Manage Position Size: Don't go all-in on one trade. A common rule of thumb is to risk no more than 1-2% of your total trading capital on any single position. This discipline ensures that one bad trade won't decimate your account.

As interest in crypto explodes—with surveys showing 24% of adults in the UK now hold crypto—the need for these foundational skills has never been greater. This growth signals mounting confidence in the market, and managing your risk becomes paramount. Keeping your costs low is also a huge part of the equation; you can review vTrader's fee structure to see how a zero-commission model helps protect your bottom line.

Common Questions About Starting Crypto Trading

Jumping into the world of crypto trading naturally brings up a lot of questions. Getting these common points of confusion cleared up is the final piece of the puzzle, giving you the confidence to get started on the right foot. Think of this as your quick-reference guide for those nagging "what ifs."

One of the biggest hurdles for newcomers is often the perceived cost of entry. Many people think you need a small fortune just to get in the game.

How Much Money Do I Need to Start Trading Cryptocurrency?

Here’s the good news: the barrier to entry is incredibly low. You absolutely do not need a huge bankroll to get started. Many exchanges, including vTrader, let you open an account and begin trading with as little as $10 or $20.

What's really important isn't the amount you start with, but your mindset. The golden rule is to only begin with an amount you are completely comfortable losing. This lets you focus on learning the ropes—placing orders, reading market movements, and managing your positions—without the emotional stress of risking significant capital.

The smart play is to start small. As you build confidence in your strategies and get a better feel for the market, you can always decide to add more funds later.

Exchange vs. Wallet: What Is the Difference?

This is a fundamental concept that trips up a lot of beginners. The easiest way to think about it is like a bank versus a personal safe you keep at home.

- Crypto Exchange: This is the marketplace, your "bank," where you actively buy, sell, and trade different cryptocurrencies. It’s built for transactions and high-frequency activity.

- Crypto Wallet: This is your "personal safe," designed purely for the secure storage of your assets. With a personal wallet, you hold the private keys, and nobody else can access your funds.

While exchanges like vTrader offer a convenient built-in (custodial) wallet, a personal (non-custodial) wallet gives you ultimate control. For active trading, keeping some funds on the exchange is practical. But for holding assets long-term, moving them to a personal wallet is widely considered the safer option. For a deeper dive, you can always explore the vTrader FAQ section.

Are Cryptocurrency Trading Profits Taxable?

In a word: yes. In most countries, including the United States, cryptocurrencies are treated as property for tax purposes. This has some serious implications for how you handle your profits and losses.

Any time you realize a gain from selling, trading, or even spending your crypto, it's typically a taxable event subject to capital gains tax. This makes keeping meticulous records of every single transaction—the date, amount, and value in your local currency at the time of the trade—absolutely essential.

Navigating crypto taxes can get complicated, and the rules are always changing. We strongly recommend talking to a qualified tax professional who specializes in digital assets. They can make sure you’re staying fully compliant with your local regulations.

Many exchanges, vTrader included, provide downloadable transaction histories to make record-keeping easier. Still, this is one area where getting professional advice is always a wise investment.

Ready to put your knowledge into action? With vTrader, you can start trading Bitcoin, Ethereum, and over 30 other cryptocurrencies with zero commission fees. Sign up today to get a $10 bonus and experience a platform designed to help you trade smarter, not harder. https://www.vtrader.io

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.