Setting up your first Bitcoin wallet is a lot less intimidating than it sounds. It really just comes down to a few simple moves: picking the right kind of wallet for you (like a mobile app or a physical hardware device), getting it installed, and then—most importantly—safeguarding your recovery phrase. Think of this phrase as the master key to your digital vault.

Understanding Bitcoin Wallets Before You Begin

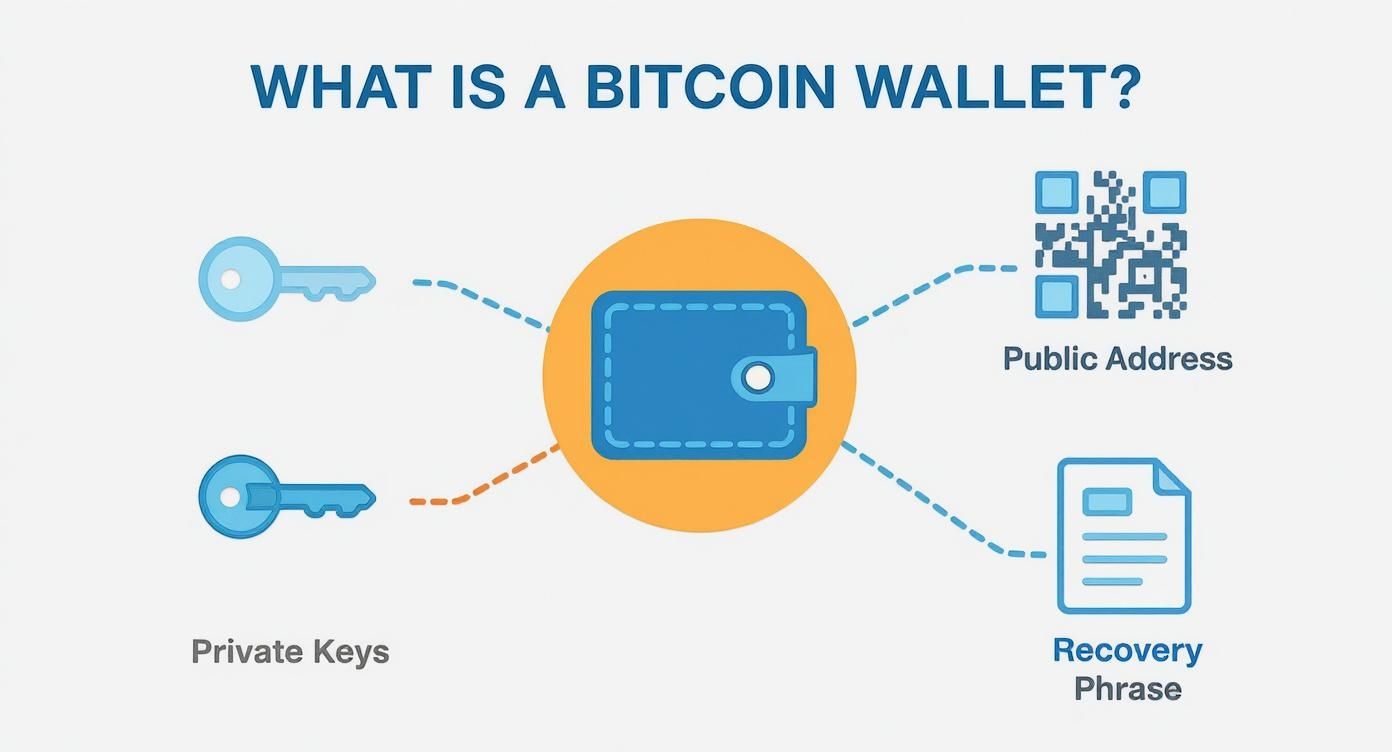

Before you even think about downloading an app, it's crucial to get your head around what a Bitcoin wallet actually is. It’s not a physical thing that holds your coins like a leather billfold. Instead, a crypto wallet is a digital tool that manages the keys that give you access to your Bitcoin on the blockchain. Taking a moment to really understand this is the single most important thing you can do to keep your crypto safe.

This is more important than ever. The global crypto wallet market hit $15.54 billion in 2025 and is expected to balloon to over $100 billion by 2033, according to Grandview Research. That explosive growth just shows how central these tools have become for millions of people.

The Core Components of Your Wallet

Your wallet is basically a specialized keychain for your digital assets. It holds two different but equally important types of keys. If you’re serious about managing your own crypto, knowing what they are isn't optional.

- Public Address: This is like your bank account number. You can share it freely with anyone who wants to send you Bitcoin. There’s absolutely no risk in making this public.

- Private Key: This is the password to everything. Anyone who gets their hands on this key can access and spend your Bitcoin. You must guard it with your life.

The private key is everything—it gives you total ownership and control over your Bitcoin. The golden rule in crypto is brutally simple: "Not your keys, not your coins." If you don't control the private key, you don't really own your crypto.

Custodial vs. Non-Custodial Wallets

One of the first big decisions you'll face is who gets to hold those private keys. Before you start the installation, you need to understand the fundamental differences between custodial and non-custodial wallets, because this choice dictates how much control you truly have.

A custodial wallet is where a third party, usually a crypto exchange, holds onto the private keys for you. It's convenient, sure, but you're placing your trust and your assets in someone else's hands.

On the flip side, a non-custodial wallet puts you in the driver's seat. You are 100% responsible for managing and protecting your private keys. This guide is all about setting up a non-custodial wallet, which is how you become your own bank.

If you want to get a better handle on these concepts and other crypto essentials, the resources over at the vTrader Academy are a great place to start.

Choosing the Right Wallet for Your Needs

Picking the right Bitcoin wallet is your first real decision point, and it’s a classic trade-off between easy access and rock-solid security. There’s no single "best" wallet—it all comes down to what you plan to do with your crypto. It helps to think of it like your bank accounts: one is a checking account for everyday spending, and the other is a high-security vault for your long-term savings.

This isn't just a minor detail. Your choice dictates who actually controls your private keys and where they're stored. The two big categories you'll run into are hot wallets and cold wallets, and they serve completely different purposes.

This breakdown shows you the core pieces every wallet has to manage.

As you can see, your wallet is really just a digital keychain. It holds your public address (for getting paid), your private keys (for spending), and that all-important recovery phrase in case you ever lose access.

Hot Wallets for Everyday Use

Hot wallets are basically software programs living on your phone or computer, which means they’re always connected to the internet. This group includes mobile apps like Trust Wallet or Exodus and even browser extensions like MetaMask. Because they're always online, they’re incredibly handy for making frequent, smaller transactions.

Say you want to buy a coffee with some BTC or make a few quick trades on an exchange. A mobile hot wallet is perfect for that. It’s fast, accessible, and built for a life on the move.

And people love the convenience. Hot wallets completely dominated the market in 2024, grabbing a 56% revenue share. With predictions that over 87% of all crypto transactions will be done on mobile by 2025, it’s obvious that most people prioritize ease of use for their daily crypto needs.

Cold Wallets for Long-Term Security

On the complete other end of the spectrum, you have cold wallets. These are physical hardware devices from brands like Ledger or Trezor that keep your private keys totally offline. Since they aren't connected to the internet, they're pretty much immune to the online hacks, malware, and phishing attacks that plague hot wallets.

If you're putting serious money into Bitcoin—an amount you absolutely can't afford to lose—a cold wallet isn't just a nice-to-have. It's a must.

Think of a cold wallet as your personal Fort Knox. It’s designed for one primary job: to keep your long-term Bitcoin holdings secure. It's less about convenience and all about robust, offline protection for serious investments.

For instance, if your plan is to buy and hold Bitcoin for a few years (HODL!), you’d move your coins from an exchange directly to your hardware wallet. Your keys stay offline, completely safe from digital thieves, until you physically connect the device to a computer and approve a transaction. It's a deliberate, manual process that adds a massive layer of security.

If you're building a portfolio and want to see what other assets you might want to secure, you can explore different cryptocurrencies on vTrader to figure out what you'll be storing.

To make the choice even clearer, let's break down the key differences between these two wallet types side-by-side.

Hot Wallets vs Cold Wallets A Quick Comparison

This table puts the most important distinctions in black and white, helping you match a wallet type to your specific needs—whether you're a daily trader or a long-term investor.

| Feature | Hot Wallet (Software/Mobile) | Cold Wallet (Hardware) |

|---|---|---|

| Connectivity | Always online | Completely offline |

| Security | Vulnerable to online threats | High; immune to online threats |

| Best For | Frequent, small transactions | Long-term HODLing, large amounts |

| Convenience | High; fast and easy to use | Low; requires physical device |

| Examples | Exodus, Trust Wallet, MetaMask | Ledger, Trezor |

Ultimately, the best strategy for most people is using both: a hot wallet with a small balance for daily use and a cold wallet to secure the bulk of your investment. This gives you the best of both worlds—convenience when you need it and Fort Knox-level security for the assets that really matter.

Installing Your First Bitcoin Wallet

Alright, enough theory. It's time to get your hands dirty and set up your first actual software wallet. This is where you’ll create the digital home for your Bitcoin, and it's less complicated than you might think. We'll use a popular mobile wallet like BlueWallet or Exodus for this walkthrough, but honestly, the core steps are almost the same no matter which reputable wallet you choose.

Before you hit "install," we need to talk about the single most important step in this entire process: making sure you're downloading the official app. Scammers are brilliant at creating convincing fakes designed to steal your Bitcoin the second you send it.

Finding and Verifying the Official App

Here’s a simple rule of thumb: never search for a crypto wallet directly in the app store. It's a minefield of copycat apps. Instead, your first move should always be to go straight to the wallet provider’s official website—like exodus.com or bluewallet.io.

Once you're on their site, look for the official links that take you to the Google Play Store or Apple App Store. This small habit alone will protect you from a world of hurt.

Before you download, do a final check on the app store page:

- Developer Name: Does it match the company exactly? No weird spellings?

- Download Count: The real deal will have hundreds of thousands, if not millions, of downloads. A fake will have a tiny number.

- Reviews: Look for a long history of reviews. A brand new app with a handful of generic five-star reviews is a massive red flag.

Once you’ve triple-checked and feel confident it's the right one, go ahead and install it.

Your initial setup is your first line of defense. So many beginners rush through this and get burned. Always, always, always verify the source of your wallet software from the official website. It’s the easiest way to avoid the phishing scams that are everywhere in crypto.

Initial Wallet Creation and Password Setup

Fire up the app for the first time. You’ll see two options: "Create a new wallet" or "Restore an existing wallet." Since you're starting fresh, you’ll be creating a new one.

The app will generate your Bitcoin wallet in an instant. The next thing it will ask for is a strong password or PIN. It's crucial to understand what this password does. It only protects the app on this specific device. It is not your master key.

Think of it like this: the password is the key to your front door, but the recovery phrase (which we're getting to next) is the deed to the entire property. Choose a strong, unique password you haven't used for anything else.

Navigating the Wallet Interface

After setting your password, you'll land on the main dashboard. Every app has its own look, but the core functions are always the same. You'll see your Bitcoin balance (currently zero, of course) and two big, obvious buttons: Send and Receive.

The "Receive" button is what you'll use to find your public Bitcoin address—that long string of letters and numbers you give to someone to get paid. "Send" is, you guessed it, for paying others. Get comfortable with this basic layout before moving any money.

As you get settled in, you might want to check out the current Bitcoin price and market trends on vTrader to get a feel for the market. This foundational setup gets you ready for the most important step of all: securing your recovery phrase.

Mastering Your Recovery Phrase and Private Keys

Once your wallet is installed, you’ll hit the most critical step in your entire crypto journey: the backup. Your wallet will show you a recovery phrase, which is usually a list of 12 or 24 random words. This phrase is the master key to everything. If your phone gets lost or your computer crashes, these words are the only way to get your Bitcoin back.

Think of it like this: the password you set is just for the app on that specific device. The recovery phrase, on the other hand, can recreate your entire wallet on any compatible device, anywhere in the world. It’s the ultimate control.

This principle of self-custody is what separates serious Bitcoiners from the crowd. Retail users might make up 82% of all crypto wallet holders, but institutions are piling in, with over 31 million institutional wallets now active. The big difference? A whopping 43% of those institutional wallets are custodial, meaning they trust someone else with their keys. By setting up your own non-custodial wallet, you’re embracing the core idea of Bitcoin: you are your own bank.

The Non-Negotiable Rules of Phrase Security

This phrase is unbelievably powerful, so how you store it isn't up for debate. There is absolutely zero room for error. The number one rule is to never, ever store it digitally.

That means:

- No screenshots. A screenshot is just an image file that can be stolen from your device or cloud backup.

- No cloud storage. Don't even think about saving it in Google Drive, Dropbox, or iCloud.

- No password managers. These are great for passwords, but they are not the place for the master key to your wealth.

- No emails or text messages. Never, ever send the phrase to yourself or anyone else.

Your recovery phrase must stay completely offline from the moment it’s created. Any digital copy, no matter how clever you think you're being, opens up a vulnerability that hackers are experts at finding.

Reliable Offline Storage Methods

So, how do you secure it? The old-school methods are still the best because they’re immune to online attacks. The most common approach is simple: write the words down on paper, in the correct order, and store it somewhere incredibly safe.

An even better method is to use a metal stamping kit to etch the words onto a steel plate. This makes your backup resistant to things like fire and water damage, which paper definitely isn't.

Whatever you choose, it’s a good idea to make two copies and keep them in separate, secure physical locations. Think one in a fireproof safe at home and another in a safety deposit box at a bank.

But securing your phrase offline is only half the battle. You also need to make sure your online environment is locked down. Learning how to defend against network-level threats like Man-in-the-Middle attacks is just as important. Your Bitcoin is only truly secure when both your offline backup and your online habits are solid.

Making Your First Bitcoin Transaction

With your wallet set up and your recovery phrase tucked away safely, it's time to actually use it. Making your first transaction can feel like a big deal, but it's a simple process once you get the hang of it. We'll walk through receiving a small amount of Bitcoin first, and then sending some out.

For most people, the journey starts on a centralized exchange where you can buy crypto with regular money. This is the main on-ramp into the ecosystem. In fact, Bitcoin is the engine driving this, with over $1.2 trillion in fiat currencies flowing into exchanges to buy BTC between mid-2024 and mid-2025 alone. You can dig deeper into this trend with the latest global crypto adoption research.

How to Receive Bitcoin

To get paid in Bitcoin, you need to share your public address. Think of it as your bank account number for crypto—it's completely safe to give out.

- Open your wallet and look for a "Receive" button.

- The app will show you your unique Bitcoin address. It will appear as a long string of letters and numbers, and also as a scannable QR code.

- You can either copy this text address or have the sender scan the QR code directly from your screen.

Pro Tip: I can't stress this enough: always double-check the first and last few characters of an address after you paste it somewhere. There's malware out there that can hijack your clipboard and swap in a scammer's address. A five-second check can save you from a very costly mistake.

Once you've shared your address, you just have to wait. Bitcoin transactions aren't instant like an email; they need to be confirmed on the network. You should see the transaction show up as "pending" in your wallet within a few minutes.

Sending Your First Bitcoin

Okay, now let's send a small amount to get comfortable with the other side of the process. This is the best way to build confidence without putting much at stake.

Fire up your wallet again, but this time, hit the "Send" option. You'll need two things: the recipient's public address and the amount you want to send.

After you punch those in, you'll see a field for the network fee, sometimes called a "miner fee." This is a small amount of Bitcoin you pay to miners to get your transaction included in the blockchain. Most wallets will suggest a fee for you based on how busy the network is at that moment.

- A higher fee usually means your transaction gets confirmed faster.

- A lower fee saves you a little money but might mean a longer wait.

For your first time, the standard fee suggested by your wallet is perfectly fine. It's good practice to understand how different platforms handle these costs; you can learn more about vTrader's fee structure and see how it all works.

Once you've confirmed the address, amount, and fee, go ahead and hit "Send." And that's it—you've just completed your first full Bitcoin transaction from start to finish. Congratulations

Common Bitcoin Wallet Questions Answered

Even with a perfect plan, you're bound to have questions when setting up your first Bitcoin wallet. It’s completely normal. Let’s walk through some of the most common ones to clear things up so you can move forward with confidence.

One of the first things people ask is about security. Is my crypto really safe just sitting in an app on my phone? The answer comes down to one thing: how you handle your private keys and that all-important recovery phrase. A solid non-custodial wallet is incredibly secure, but only if you follow the offline backup rules we talked about earlier.

Another hang-up is the difference between a wallet and an exchange account. Think of an exchange like vTrader as the marketplace where you go to buy and sell. Your non-custodial wallet, on the other hand, is something you personally own and control. It holds your assets on the blockchain, completely separate from any third party.

Can I Have More Than One Wallet

Absolutely. In fact, it’s not just possible—it’s a smart move. Many seasoned crypto users run multiple wallets for different things. It's a strategy called compartmentalization, and it’s a game-changer for security and organization.

For instance, you could have:

- A mobile hot wallet loaded with a small amount for quick, everyday transactions.

- A hardware cold wallet tucked away safely to store your long-term Bitcoin holdings.

- A dedicated desktop wallet just for interacting with specific decentralized apps (dApps).

This way, if one wallet ever gets compromised, the damage is contained. Your main stash remains untouched. It's a simple but incredibly effective security habit.

You can think of it just like your regular finances. You probably have a checking account for daily expenses and a separate savings account you don’t touch. Applying that same logic to your crypto is a foundational step toward managing your assets responsibly.

How Many Wallets Exist Today

The crypto world is growing faster than almost anyone predicted. To give you a sense of scale, industry data shows that in 2025 there are roughly 320 million active crypto wallets in use. On top of that, wallet downloads have been surging by 42% year-over-year. Discover more insights about these crypto statistics.

This explosive growth shows just how far Bitcoin's reach has extended globally and how diverse wallet use cases have become. As you get more comfortable, you’ll probably find yourself experimenting with different wallets to match what you’re trying to accomplish.

And for any other nitty-gritty questions about trading, fees, or account security, definitely check out the comprehensive vTrader FAQ section. It's an awesome resource for both newcomers and pros.

Ready to put your knowledge into action with zero trading fees? Join vTrader today and start building your crypto portfolio without compromise. Get started with vTrader now.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.