Setting up a price alert is pretty straightforward: you pick an asset, punch in a target price, and vTrader will hit you up the second that price gets triggered. Think of it as your own personal market watcher, making sure you never miss a critical price movement again, whether you're at your desk or out and about.

Why Price Alerts Are Your Secret Weapon in Trading

Let's be real: nobody can stare at charts all day. Not only is it a terrible strategy, but it's a fast track to burnout and emotional trading. This is where price alerts come in. They're more than just a handy feature; they are an essential tool for any trader who values discipline and efficiency.

Price alerts flip your entire approach from reactive to proactive. You get to execute a well-defined plan with surgical precision.

Instead of just guessing or hoping, you can set an alert for a stock that’s getting close to a key support level you've identified. Or maybe for a crypto that's bumping up against a major resistance point. When that notification hits your phone, you aren't scrambling to make a decision in a panic. You're simply acting on a strategy you already put in place when you were thinking clearly.

Remove Emotion and Execute with Confidence

One of the toughest hurdles for any trader to overcome is emotion. Fear of missing out (FOMO) tricks you into buying too high, and sheer panic can make you dump your holdings at the absolute worst time. Price alerts act as a crucial buffer between you and those knee-jerk market reactions.

A well-placed alert is the difference between chasing the market and letting the market come to you. It automates your vigilance, freeing up your mental energy to focus on strategy, not noise.

For instance, say you've done your homework and identified a potential breakout point for an asset. You can set an alert just a hair above that level. If it triggers, you know it's go-time based on your plan, not on a sudden whim. This kind of systematic trading is a hallmark of the pros.

Stay Informed Without Constant Monitoring

The market never sleeps, but you have to. Price alerts are your 24/7 connection to the opportunities you care about most, without chaining you to a screen. This is a game-changer for keeping tabs on volatile assets.

You can dive deeper into what's moving the markets over at the vTrader news hub. At the end of the day, this simple tool helps you seize opportunities and sidestep major losses—all without sacrificing your life to the charts.

Setting Your First Price Alert on vTrader Desktop

Jumping into a new platform can feel a bit overwhelming, but setting your first price alert on the vTrader desktop app is surprisingly simple. We’ll walk through a classic scenario: you've done your homework and identified a key support level for a major tech stock. Now, you want to be notified the second it hits that price.

This isn’t just about setting a reminder; it’s about turning your analysis into an automated action.

First thing's first, you'll want to pull up the asset's page within vTrader. Look for an icon near the price chart—usually a bell or a button that says "Alert." A quick click on that will open the alert creation menu. Think of this as your command center for telling vTrader exactly what to watch for.

Now we get to the fun part: defining the trigger.

Dialing in Your Trigger Conditions

The trigger condition is the heart of your alert. It’s the specific rule that tells the system when to ping you. vTrader gives you three main options, and knowing the difference is crucial for setting alerts that actually help your strategy, not just create noise.

- Crossing: This is your go-to, all-purpose trigger. The alert goes off the instant the price moves through your target price, whether it's going up or down. It’s perfect for those critical support or resistance levels where any breach is a big deal.

- Above: Use this when you only care if the price breaks through a specific ceiling. For example, setting an alert for a price above a known resistance could be your signal for a potential breakout.

- Below: On the flip side, this is your best friend for downside protection. An alert set for a price below a support level can warn you of a breakdown or serve as a mental cue to review a stop-loss.

Choosing the right condition isn't just a technicality. It’s about aligning the tool with your trading hypothesis. Are you looking for a breakout, a breakdown, or just any significant move at a key price point?

For our example—monitoring that support level—we’ll set the trigger to “Crossing” at $150. This ensures we get notified the moment the stock even touches that price, giving us the chance to reassess our position immediately. The rise of automated tools like this is a game-changer in today's fast-moving markets, as discussed in this study on price alert systems.

Once your conditions are locked in, just save the alert. That's it. vTrader’s servers are now keeping an eye on the market for you, 24/7. And if you're looking to sharpen your trading skills even more, be sure to explore the resources over at the vTrader Academy.

How to Set Price Alerts From Anywhere with Mobile

The market doesn’t sleep, and your trading strategy can’t afford to either—even when you’re away from your desk. Getting the hang of the vTrader mobile app is your ticket to managing trades on the go and making sure a prime opportunity never slips through your fingers. It’s pretty straightforward, but a few details are worth paying attention to.

Picture this: you're watching a crypto asset inch closer to a critical resistance level. On the mobile app, you can pull up that asset in seconds and tap the little bell icon. The whole interface is built for the smaller screen, so setting your conditions—like "Above," "Below," or "Crossing"—is clean, simple, and only takes a couple of taps.

Fine-Tuning Your Mobile Notifications

Setting the alert is just the first step. The real test is whether you actually get it when it matters. I’ve seen countless traders miss out because they simply forgot to check their push notification settings. You have to give the vTrader app permission to send you alerts from your phone’s main settings menu.

It sounds basic, but this one check can be the difference between catching a wave and watching it from the shore. A quick visit to your phone's notification settings now can save you a world of pain later. Honestly, this is a non-negotiable part of knowing how to set price alerts that actually work for you.

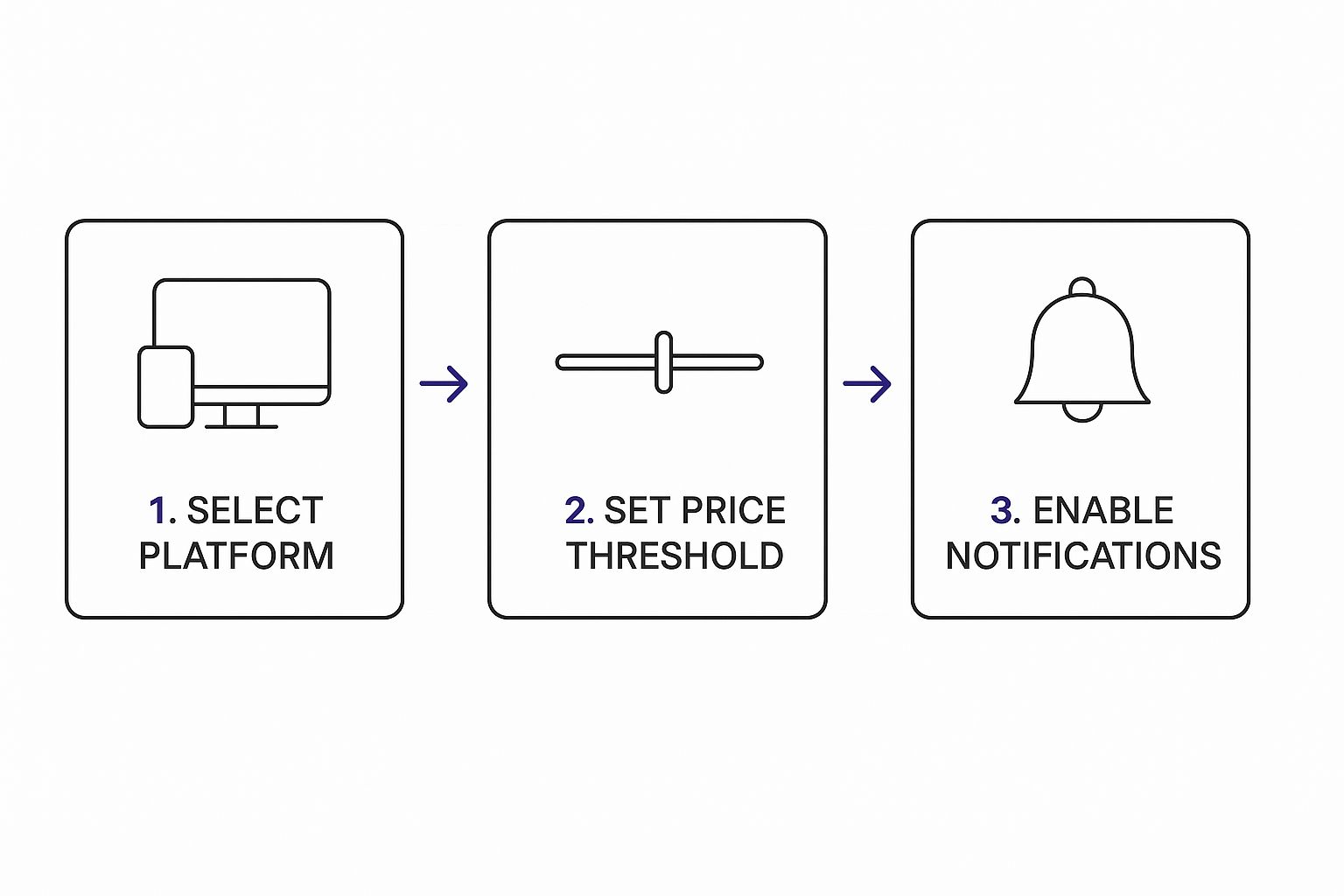

This infographic breaks down the essential workflow, which is pretty much the same whether you're on your desktop or your phone.

The core process is always the same: pick your platform, define the price trigger, and double-check that your notifications are on.

Think of a mobile alert as more than just a ping. It’s a direct link to your trading plan that fits in your pocket. The goal is to make it a reliable signal, not just more digital noise.

The mobile app also makes it incredibly easy to tweak an existing alert on the fly. If you’re in a rush, you can pull up your list of active alerts right from the main menu, adjust a price target, and save your changes in a matter of seconds. That kind of agility is a massive advantage when the market suddenly gets volatile.

If you’re curious about the company behind these tools, you can learn more about the mission of vTrader.

Advanced Alert Strategies to Automate Your Analysis

Once you've nailed down basic price targets, it’s time to unleash vTrader’s real power. The platform can become your automated trading assistant, moving beyond simple thresholds to anticipate market moves and give you a serious edge. This is where you graduate from just setting alerts to building an intelligent system that watches the charts for you.

Forget just tracking a fixed price. Think in terms of percentages. This is a total game-changer for systematically managing risk or locking in gains without constant manual checks.

For example, you could set an alert to ping you if an asset tumbles 5% from its most recent high. This serves as an automated trigger to review your position and maybe tighten a stop-loss. It's a dynamic approach that adapts on the fly to market volatility, so you don't have to.

Triggering Alerts with Technical Indicators

This is where the magic really happens. With vTrader, you can build notifications right into your technical analysis, turning chart patterns and indicator values into instant, actionable triggers. You can set alerts for the exact conditions you'd normally hunt for by hand, saving you a massive amount of screen time.

Here are a couple of practical ways traders put this into action:

- Relative Strength Index (RSI): Get a notification the moment an asset's RSI dips below 30. For many, that's a prime signal to start investigating a potentially oversold asset and a great buying opportunity.

- Moving Average Crossover: You can create an alert for when the 50-day moving average crosses above the 200-day moving average. This is the classic "Golden Cross," a powerful bullish signal you can now get a heads-up on automatically.

To give you a clearer picture, let's break down how different alert types can fit into your strategy.

Basic vs Advanced Alert Types in vTrader

This table compares standard price alerts with some of the more advanced options you have. It should help you decide which approach best fits your trading goals at any given moment.

| Alert Type | Best Used For | Example Scenario |

|---|---|---|

| Fixed Price Target | Catching breakouts or entering/exiting at a specific, predetermined level. | Alert me when BTC hits $75,000 so I can take profit. |

| Percentage Change | Dynamic risk management and securing profits as the market moves. | Notify me if my ETH position drops 10% from its recent high. |

| Indicator-Based | Automating technical analysis to identify shifts in market momentum. | Trigger an alert when SOL's RSI goes above 70 (overbought). |

Choosing the right type of alert is less about which one is "best" and more about matching the tool to the trade. Simple price targets are great for set-and-forget trades, but dynamic and indicator-based alerts are what give you a real analytical edge.

This shift toward intelligent notifications is part of a much bigger trend. The global mass notification system market was valued at USD 14.22 billion in 2024 and is projected to skyrocket to USD 46.96 billion by 2030, largely because AI is making these systems smarter. To truly elevate your alerts, digging into real-time data analytics is the next logical step.

By combining these advanced triggers, you start building a comprehensive monitoring system. You could, for instance, read our guide on predicting BTC's price movements and then set up corresponding indicator alerts to see if the market confirms your analysis. This is how alerts transform from simple reminders into a core part of your strategic toolkit.

Common Mistakes to Avoid When Managing Your Alerts

Setting up price alerts is the easy part. The real art lies in managing them effectively so they actually help your trading instead of just creating noise. It’s a classic trap many traders fall into: setting dozens of notifications, only to get hit with a constant stream of pings that eventually just get ignored.

The goal here isn’t to track every tiny price tick. It’s to build a clean, effective system that actually serves your strategy.

Ditching the "Set It and Forget It" Mindset

One of the biggest blunders I see is the "set it and forget it" approach. An alert for a price that was critical last month might be completely irrelevant today. Market conditions shift, and so should your alerts.

Make it a habit to audit your active alerts weekly. This simple check-in ensures that every notification you get is meaningful, timely, and, most importantly, actionable.

Creating a Sustainable Alert System

Another pitfall is treating every alert like it's a five-alarm fire. Not every price movement requires an immediate, panic-inducing push notification to your phone. A much smarter way to handle this is to use different channels for different levels of urgency.

Think of it like this:

- High Urgency: Use push notifications for critical levels that demand immediate action, like a potential stop-loss trigger or a major breakout.

- Low Urgency: Stick to email for "good to know" updates. This is perfect for when a stock is slowly approaching a long-term watch level you've had your eye on.

This tiered system is your best defense against alert fatigue—that state where you’re so bombarded with notifications you start tuning them out and miss the one that really matters. Your system should filter the signal from the noise, not just amplify everything.

The demand for instant, reliable information is exploding everywhere. Just look at global finance, where over 266 billion real-time payment transactions happened in 2023 alone. You can find out more about how real-time payments are being adopted and see just how critical instant data has become.

An effective alert system isn't about how many alerts you can set; it's about how much strategic value you get from each one. Prune your list ruthlessly to keep it relevant.

By steering clear of these common mistakes, you can turn your price alerts from a chaotic distraction into a powerful tool that keeps your trading disciplined and strategic.

Your Top Questions About Price Alerts, Answered

Even with the best guide, a few questions always pop up when you're getting your hands dirty with a new feature. Let's tackle the most common ones traders ask about vTrader's price alerts so you can use this tool with total confidence.

How Many Price Alerts Can I Have?

One of the first things people want to know is if there's a cap on active alerts. With a standard vTrader plan, you can have up to 100 active price alerts running at the same time, synced across all your devices. If you're a high-volume trader, our premium plans kick that limit up to 500 alerts.

Frankly, that's more than enough for most trading strategies. It’s still a good idea to spring clean your alert list every now and then. Getting rid of old or triggered alerts keeps you focused on what’s happening now.

Do Alerts Still Work if My App Is Closed?

Yes, they absolutely do. vTrader’s price alerts are server-side, not device-side. This is a fancy way of saying they run on our systems, not on your phone or computer. Once you set an alert, our servers are watching the market for you 24/7.

This means your alert will trigger the second your price target is hit, whether the vTrader app is open on your phone or your laptop is shut down. You’ll get the notification you asked for, right on time.

Can I Set Alerts for Crypto, Stocks, and Gold?

You bet. We designed vTrader to be your all-in-one trading hub. You can set price alerts on a huge range of asset classes, from commodities like gold and oil to tech stocks and, of course, cryptocurrencies.

The beautiful part is that the process is exactly the same no matter what you're tracking. This consistency makes it incredibly simple to manage your entire portfolio from a single dashboard. For any other nitty-gritty questions about the platform, our vTrader FAQ page has you covered.

What Happens When an Alert Goes Off?

By default, once a price alert is triggered, it's automatically deactivated. This is a deliberate design choice to save you from a storm of notifications for the same price movement.

If you still want to watch that specific price level, you’ll just need to set a new alert. While some advanced settings let you create recurring alerts, sticking with single-trigger notifications is the cleanest way to manage your trading signals when you're starting out.

Ready to stop missing market moves and put these powerful tools to work? Join vTrader today for zero-fee trading, advanced charting, and the most reliable price alerts out there. Start trading for free.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.