Jumping into the world of crypto trading can feel like trying to drink from a firehose. But here's the secret: learning how to trade cryptocurrency is a skill you build, not a gamble you take. It all starts with a solid foundation—understanding the market, learning how to analyze what you see, and getting hands-on practice without risking a single dollar. This isn't about getting rich quick; it's about developing a strategic edge.

Your First Steps in Crypto Trading

This guide is your real-world roadmap. We're skipping the hype and focusing on what actually works when you're just starting out. For now, let's forget the overwhelming charts and confusing jargon. Our goal is to get you on a clear, straightforward path.

From Interest to Action

It's no secret the crypto space is exploding. By 2025, it's estimated that 28% of American adults will own cryptocurrencies, a figure that's nearly doubled since late 2021. Yet, 40% of those owners are still worried about security, which just goes to show how crucial a good education is before you invest.

This journey is all about turning that spark of interest into informed action. Before you even think about putting real money on the line, you need to learn the lay of the land.

That means getting a grip on:

- The core ideas that make the market tick.

- How to actually size up a project's potential.

- The practical skills of placing and managing your trades.

Trading without a plan is just guessing. The whole point here is to give you a framework for making deliberate, educated decisions instead of just reacting to the market's noise.

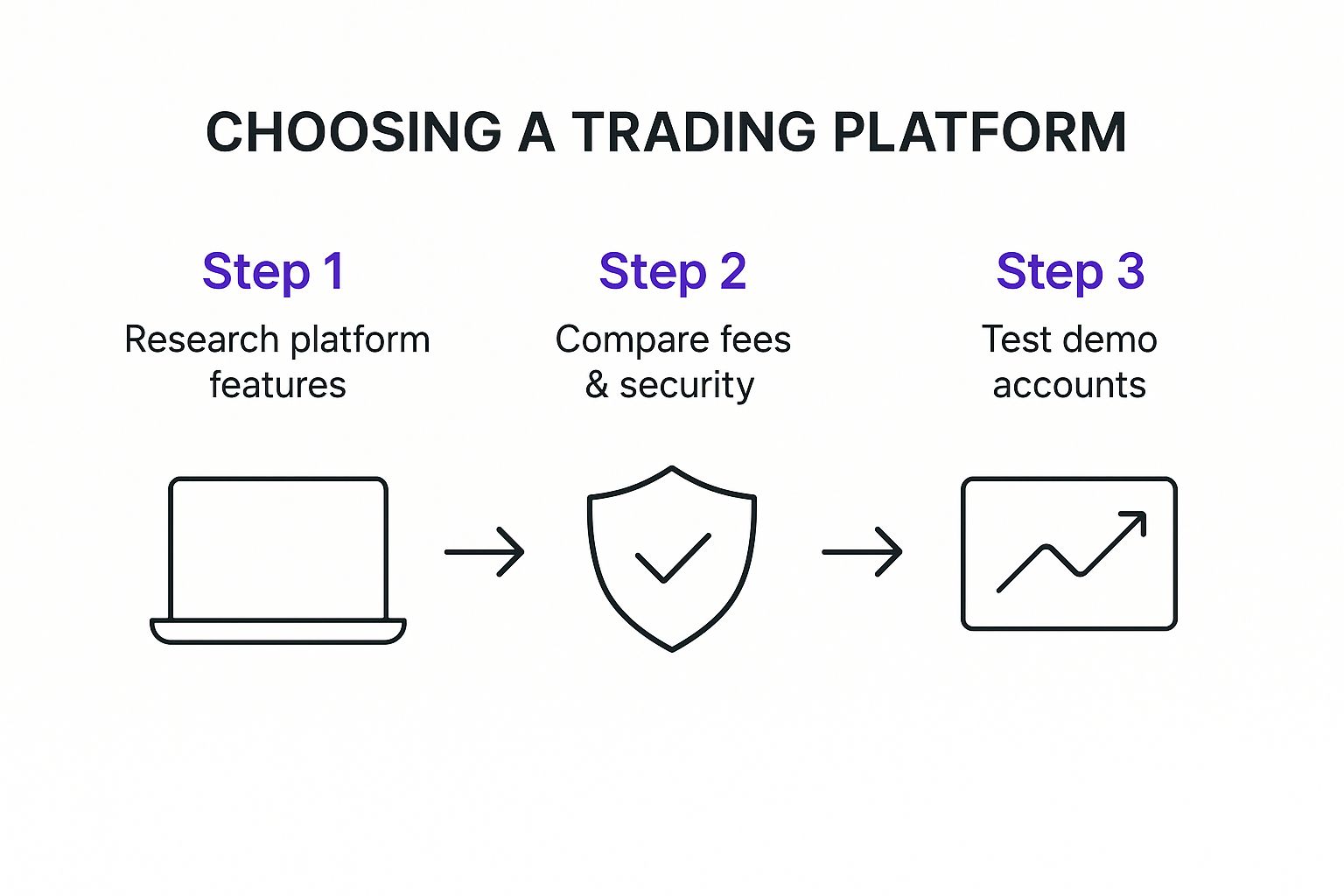

Understanding how a platform's costs are structured is another one of those critical first steps. Hidden charges can eat into your profits faster than you'd think, which is why it’s essential to review the trading fees of any exchange you’re considering.

Getting to Grips with Crypto Market Fundamentals

Before you can trade crypto well, you have to speak the language. This goes way beyond just knowing the big names like Bitcoin. You need to get into the nuts and bolts of what gives these assets value and purpose. Think of it as building your foundational toolkit for seeing the market clearly.

Everything starts with the blockchain. It’s essentially a public, unchangeable digital record book. Picture a shared notebook where every single transaction is logged forever, visible to everyone, and spread across thousands of computers. This is the very technology that makes cryptocurrencies work, keeping them secure and out of any single entity's control.

Coins vs. Tokens: What's the Difference?

You'll constantly hear about "coins" and "tokens," and they're not the same thing. Knowing the distinction is critical.

- Coins, like Bitcoin (BTC) and Ethereum (ETH), have their very own blockchain. Their main job is to act as a form of digital money or a store of value.

- Tokens, like Chainlink (LINK) or Uniswap (UNI), don't have their own blockchain. Instead, they're built on top of an existing one, usually Ethereum. They typically grant you access to a specific application or service.

Grasping this helps you understand what you're actually looking at. Are you buying into a massive, foundational network, or are you investing in a specific app that runs on that network? The answer changes your entire analysis.

Look Beyond the Price Tag

One of the biggest mistakes newcomers make is focusing only on the price of a single coin. A far more powerful metric is market capitalization (or market cap). You get this number by multiplying the current price by the total number of coins in circulation. It gives you a much truer picture of the project's overall size and influence in the market.

A coin worth $1 with 100 billion in circulation has a massive $100 billion market cap. A different coin priced at $1,000 with only 10,000 in circulation has a tiny $10 million market cap. Context is everything.

Finally, you have to think about security from day one. Wallets are where you'll store your crypto. They come in two main types: hot wallets (connected to the internet, great for active trading) and cold wallets (offline hardware devices, best for locking down your long-term holdings).

If you want to dive deeper into these concepts, the vTrader Academy is a fantastic resource to help you build a solid knowledge base.

Learning to Analyze the Crypto Market

Trading on gut feelings is a recipe for disaster. If you want to get serious about trading crypto, you need to learn how to analyze the market and understand what drives price movements. This isn't about guesswork; it's about developing a repeatable process.

Most successful traders rely on two primary methods of analysis: fundamental and technical. They’re two sides of the same coin, each offering a unique perspective on a crypto asset's potential.

What Is the Project Actually Worth? Fundamental Analysis

Think of fundamental analysis (FA) as playing detective. You’re trying to determine a crypto project's real, underlying value, completely separate from its current market price.

This means you're digging into the nitty-gritty:

- The Technology: Is it innovative? Does it solve a genuine problem?

- The Team: Who is behind the project? Do they have a proven track record?

- Community & Partnerships: Is there a strong, active community? Have they secured any meaningful partnerships?

A project with strong fundamentals is more likely to weather market storms and grow over the long term.

Reading the Story of the Charts: Technical Analysis

Technical analysis (TA) takes the opposite approach. It ignores the fundamentals and focuses entirely on what the price chart is telling you. The core belief here is that all known information—the good, the bad, and the ugly—is already baked into an asset's price and trading volume.

TA is all about spotting patterns and trends in historical data to forecast what might happen next. You'll hear traders talk about concepts like:

- Support and Resistance: Imagine these as price floors and ceilings. Support is a level where a downtrend tends to pause, while resistance is where an uptrend often stalls. Nailing these levels helps you find better entry and exit points.

- Chart Patterns: Formations like a "head and shoulders" or a "double bottom" can signal that the current trend is running out of steam and might be about to reverse.

- Indicators: These are tools that add another layer to your chart. The Relative Strength Index (RSI), for example, helps you see if an asset is potentially "overbought" or "oversold," giving you a clue about market momentum.

To make sense of these analytical methods, it helps to see how they stack up side-by-side.

Fundamental vs Technical Analysis

| Aspect | Fundamental Analysis (FA) | Technical Analysis (TA) |

|---|---|---|

| Primary Focus | A project's intrinsic or "fair" value. | Price history, chart patterns, and trading volume. |

| Key Question | "Is this project a good long-term investment?" | "When is the right time to buy or sell?" |

| Tools Used | Whitepapers, team background, tokenomics, roadmap, community engagement. | Price charts, indicators (RSI, MACD), trend lines, support/resistance levels. |

| Timeframe | Typically used for medium to long-term investing. | Often used for short to medium-term trading. |

Ultimately, many traders find that the most powerful approach is to blend both.

You might use FA to identify a handful of promising projects you believe in. Then, you can switch to TA to pinpoint the perfect moment to enter a trade when the market conditions look favorable.

Once you have a grasp of these concepts, the next step is finding the right place to put them into practice.

This process—researching, analyzing, and then testing on a platform—is key to building confidence. As you grow, you can see how the pros do it. For a real-world example of market analysis, check out this in-depth Bitcoin price prediction to see how experts interpret complex chart data.

Building Your Personal Trading Plan

Here’s a hard truth: without a plan, you aren't trading—you're gambling. A solid trading plan is the only thing that separates disciplined action from emotional guesswork, especially when the market gets choppy. It's your personal rulebook, designed to keep you logical when your gut wants to take over.

First things first, you need to figure out your style. Are you a day trader who thrives on quick, small-scale price movements, closing out all your positions by the end of the day? Or does being a swing trader sound more like you, holding onto assets for a few days or weeks to ride a larger market wave?

Your answer to that question changes everything. A day trader lives on the 15-minute charts, while a swing trader is looking at the bigger picture on daily or even weekly charts. Or maybe you'd prefer a more hands-off approach entirely, exploring options like crypto staking to earn passive rewards instead of actively trading.

Defining Your Rules of Engagement

Once you know how you want to trade, it's time to create the non-negotiable rules you'll live by. This is the core of your plan and where real discipline comes from.

Your rules need to be crystal clear. You should be able to answer these questions without hesitation:

- What's my entry signal? What exact technical pattern, indicator crossover, or fundamental event has to happen before I buy? An example might be, "I will only go long when the price closes above the 50-day moving average and the RSI is below 70."

- When do I take profits? Have a specific price target or percentage gain in mind before you even enter the trade.

- When do I cut my losses? This is your stop-loss, and it's the most important rule you have. At what point do you accept the trade was a mistake and get out?

A fantastic starting point is the 1% rule: never risk more than 1% of your entire trading account on one trade. If you're working with a $1,000 account, that means your maximum loss on any single position is just $10. This one simple rule can be the difference between a bad day and blowing up your account.

Managing Risk and Reward

Every single trade is a calculated risk. Before you hit that "buy" button, you need to know if the potential upside is worth the potential downside. We do this with the risk-to-reward ratio.

Think about it like this: if you set your stop-loss at a point where you could lose $50, but your profit target could net you $150, you have a 1:3 risk-to-reward ratio. Most experienced traders I know won't touch a trade unless it offers at least a 1:2 ratio. This strategy ensures that your wins are powerful enough to more than cover your losses over time.

Ultimately, a good trading plan is your guide for Decision Making Under Uncertainty, which is the name of the game in crypto. Your plan is the tool that keeps you making those decisions with your head, not your fears.

Get Your Hands Dirty (Without Any Financial Risk)

Watching videos and reading charts is one thing, but the real learning in crypto trading doesn't start until you actually place an order. That's where paper trading comes in. It’s an absolute game-changer for new traders, letting you get a feel for the markets without putting a single dollar on the line.

Think of it as your personal trading sandbox. Platforms like vTrader give you a practice account that mirrors live market conditions. You can test out that trading plan you've been working on, get comfortable setting stop-loss orders, and see if your analysis actually works when real money is on the table—or, in this case, pretend money.

Fine-Tuning Your Skills in a Safe Space

The whole point of this exercise is to build confidence and iron out the kinks in your strategy. You'll still get the adrenaline rush from a great trade and feel the sting when a position goes against you, but your bank account remains untouched. Honestly, managing those emotions is half the battle.

For instance, you could try your hand at trading a notoriously volatile asset like Ethereum. As you do, you'll have to consider real-world variables, which is why checking a live ETH gas tracker is a good habit to build. It helps you understand how something as simple as network congestion can impact your trade execution.

A quick note on this: AI is making simulators even smarter. The new wave of learning platforms can create realistic market scenarios and even give you personalized feedback based on your trading patterns. This helps you spot bad habits and fix them way faster than you could on your own. You can see more on how AI is shaping trading education on vocal.media.

Using a simulator helps you find honest answers to some tough questions:

- Can I really stick to my trading plan, even when I'm losing?

- Am I letting fear make me cut my losses too soon? Or letting greed make me hold on too long?

- How does my strategy actually hold up when the entire market is tanking?

This is how you turn theory into skill. When you finally do decide to trade with real capital, you'll be walking in with experience, not just hope.

A Few Common Questions I Hear from New Crypto Traders

When you're just starting out in the crypto world, it feels like there's a mountain of things to learn. It's natural to have questions, and over the years, I've noticed a few that pop up again and again. Let’s get you some clear answers so you can move forward with confidence.

How Much Money Do I Actually Need to Start?

You can get started on most major exchanges with as little as $10. Honestly, the exact dollar amount you begin with isn't the important part.

What really matters is your mindset. Never, ever trade with money you can't afford to lose. Think of your first deposit as the cost of your education—you're paying for real-world experience, not buying a lottery ticket.

What's the Single Biggest Mistake New Traders Make?

Hands down, it's trading on "FOMO"—the Fear Of Missing Out. You see a coin's price shooting for the moon, and an emotional panic sets in. You jump in, praying the rocket ship keeps flying.

More often than not, this strategy has you buying at the absolute peak, right before the price tumbles. The best way to protect yourself from this is to build a solid trading plan before you enter a trade and have the discipline to stick to it.

Trading is a mental game. Success often comes down to disciplined execution of your strategy, not chasing after every exciting price spike you see on a chart.

How Long Until I'm Actually Good at This?

There's no simple answer here. Your progress is a direct reflection of your effort: how much you study, how consistently you practice, and how brutally honest you are when analyzing your losses.

For most people, it takes a few months to get a solid handle on the basics. But becoming consistently profitable? That can easily take a year or more. Forget about deadlines and focus on making small, steady improvements every single day.

Which Crypto Should I Trade First?

My advice is always to start with the big players: Bitcoin (BTC) or Ethereum (ETH). Their markets have been around for years, giving you a ton of historical data to analyze. This makes learning technical analysis much more reliable.

They also tend to be less volatile than the thousands of smaller altcoins out there, which gives you a more stable training ground to learn the ropes without getting completely whipsawed by sudden price swings.

Ready to put your knowledge into action in a safe, risk-free environment? vTrader offers a powerful paper trading simulator that lets you practice with live market data. Test your strategies, build your confidence, and start your trading journey with a $10 sign-up bonus today at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.