Thinking about jumping into the Tron ecosystem? Getting your hands on some TRX is actually pretty straightforward. It boils down to picking a crypto exchange you trust, setting up an account, and making the trade. Once you’re signed up and verified, you just need to deposit some funds and you're ready to buy.

But before we get into the nitty-gritty, let's talk about why Tron has been turning so many heads lately.

Why Tron Is Gaining Momentum

It’s easy to get lost in the sea of cryptocurrencies, but Tron isn't just another coin. It has carved out a serious role for itself in the blockchain world, especially when it comes to stablecoin transfers and decentralized apps (dApps). The entire point of Tron is to build a decentralized web where creators can connect directly with their audience, cutting out the corporate middlemen.

The numbers show this vision is resonating. As of Q3 2025, the TRON network has seen explosive growth, with over 338 million total user accounts and processing a staggering 11 billion transactions. It’s not just a ghost chain, either—with an average of 2.6 million daily active users, it's one of the busiest blockchains on the planet. For a deeper dive into these stats, you can check out reports on sites like cryptoslate.com.

For those who need the essentials fast, here’s a summary of the core steps to purchase Tron.

Quick Guide to Buying Tron (TRX)

| Phase | Action Required | Key Consideration |

|---|---|---|

| Setup | Choose a reliable crypto exchange and create an account. | Look for platforms with strong security and low fees. |

| Funding | Deposit funds into your exchange account (e.g., USD, EUR). | Check deposit methods and any associated costs. |

| Execution | Find the TRX trading pair and execute your purchase. | Decide between a market order (instant) or a limit order (specific price). |

| Security | Withdraw your TRX to a secure, self-custody wallet. | Never leave large amounts of crypto on an exchange long-term. |

This table gives you the 30,000-foot view, but understanding the why behind each step is crucial for making smart decisions.

The Power of Low-Cost Transactions

One of the biggest reasons people use Tron is its incredibly cheap transaction fees, which often cost just pennies. This has made it the undisputed king for moving stablecoins like USDT around the globe.

By acting as a global settlement layer, Tron facilitates fast and affordable cross-border payments, making it a practical tool for daily use—not just speculative trading.

This real-world utility is what fuels the demand for its native token, TRX. With that context in mind, you’re in a much better position to understand the value as we walk through the practical steps of buying it.

And to stay on top of what’s happening in the broader crypto market, you can always check out the latest updates in our vTrader news hub.

Finding the Right Exchange to Buy Tron

Before you buy your first bit of Tron (TRX), you have to decide where you’re going to buy it. This decision is just as important as the investment itself and really comes down to two kinds of platforms: centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Your typical CEXs, like Binance or Kraken, are usually the starting point for anyone new to crypto. They operate like a traditional brokerage, making it simple to swap your fiat currency (like USD) for crypto using a credit card or bank transfer. It’s a familiar and straightforward process.

DEXs, such as SunSwap, are a different beast entirely. They run on smart contracts without any central company pulling the strings, which means you trade directly from your own wallet. It gives you full control, but it also comes with a steeper learning curve.

What to Look for in an Exchange

As you sift through the options, you’ll want to zero in on a few key things: security, fees, and ease of use. The best platform is the one that fits your comfort level and priorities.

- Security Features: Non-negotiables include two-factor authentication (2FA). I also look for exchanges with a solid track record and proof-of-reserves, which shows they hold user funds responsibly.

- Transaction Fees: These can sneak up on you. Always check the trading fees, but don’t forget about what it costs to deposit or withdraw your funds. Some platforms, like vTrader, have a zero-fee trading structure that can make a huge difference to your bottom line.

- Regulatory Compliance: Make sure the exchange is allowed to operate where you live. The last thing you want is to find your account locked or your funds inaccessible down the road.

To help you get a clearer picture, I've put together a quick comparison of the different types of exchanges you'll encounter.

Comparing Top Exchanges for Buying Tron (TRX)

Here’s a head-to-head look at popular cryptocurrency exchanges where you can buy Tron, focusing on features that matter for new buyers.

| Exchange Type | Key Features | Best Suited For |

|---|---|---|

| Centralized (vTrader) | Zero-fee spot trading, user-friendly interface, strong security protocols. | Beginners and active traders looking to maximize profits by avoiding fees. |

| Centralized (Binance) | Huge selection of coins, advanced trading tools, high liquidity. | Experienced traders who need a wide variety of assets and charting tools. |

| Centralized (Kraken) | Strong reputation for security, good customer support, fiat on-ramps. | Security-conscious investors and those in the US/EU looking for a reliable platform. |

| Decentralized (SunSwap) | Trade directly from your wallet, no KYC required, community-governed. | Advanced users who prioritize self-custody and are comfortable with Web3 tech. |

Each type of exchange serves a different purpose. While DEXs offer ultimate control, centralized exchanges provide the on-ramps and support that most new users need to get started safely.

Thankfully, TRON’s massive role in the stablecoin market means TRX is available on almost every major platform. The network handles over 75% of all global USDT transfers, with daily volumes regularly soaring past $25 billion. This creates deep liquidity, making it easy to buy or sell TRX without any fuss.

Key Takeaway: For most people just getting started, a reputable centralized exchange offers the simplest and most secure path. It bridges the gap between your bank account and your first TRX holding without any of the technical headaches.

Setting Up Your Tron Wallet Before You Buy

First things first: before you even think about buying any TRX, you need a safe place to put it.

Jumping in and buying crypto without a wallet is like buying a bar of gold and leaving it on your front porch. It’s just not a good idea. Your wallet is the single most important piece of your security setup.

You’ve got two main choices here: a software wallet (often called a “hot wallet”) or a hardware wallet (a “cold wallet”). Software wallets, like the popular TronLink, are super convenient. They usually live on your phone or as a browser extension, making it easy to trade or use dApps on the Tron network.

Hardware wallets are a different beast entirely. Think of a small USB drive from a brand like Ledger or Trezor. These devices keep your private keys totally offline, making them virtually untouchable by online hackers.

A classic rookie mistake is leaving your new Tron sitting on the exchange where you bought it. Sure, it’s convenient, but exchanges are giant honey pots for hackers. True ownership in crypto means you control your own keys, and that happens in a personal wallet.

Choosing Your First Wallet

For anyone just getting their feet wet, a software wallet like TronLink is a fantastic starting point. It’s built for ease of use, has the official backing of the Tron Foundation, and makes sending or receiving TRX a breeze.

When you create your wallet, you'll hit the most critical step of the entire process: securing your seed phrase. You’ll be shown a list of 12 or 24 words. This isn’t just a password—it’s the master key that can restore your wallet and access all your funds. Treat it like gold.

- Write it down. On actual paper, with a pen. Don't ever save it as a text file, a note in your phone, or a screenshot.

- Store it somewhere safe. Put that piece of paper where it won't get lost, thrown away, or damaged by fire or water. Think of it like a will or the deed to your house.

- Never, ever share it. No support agent, developer, or company will ever ask for your seed phrase. If someone does, they are 100% trying to rob you.

Getting these security basics right from day one is non-negotiable. If you want to dive deeper into crypto security and the fundamentals of trading, the vTrader Academy is packed with great resources. Take these small steps now, and you’ll know your Tron has a secure home waiting for it the moment you buy.

Your Walkthrough for Purchasing Tron

Alright, with your secure wallet ready to go, it's time for the main event: actually buying some Tron. Don't worry, most exchanges have made this process pretty straightforward, guiding you from signup to your first purchase without much of a headache. Let's break down the key moments.

First things first, you'll need to create and verify your account on whatever exchange you picked. This is pretty standard stuff—you’ll provide an email, set a strong password, and then complete a Know Your Customer (KYC) verification. This usually means uploading a quick photo of your driver's license or another government ID and maybe snapping a selfie to prove you're you.

It might feel like a bit of a hurdle, but this is a critical security step required by regulators. It helps cut down on fraud and keeps the platform compliant, which is ultimately a good thing for protecting you and your funds.

Funding Your Account and Finding Tron

Once you get that "verified" email, the next move is to add funds. You've usually got a couple of options. You can link a bank account for an ACH transfer, which is almost always the cheapest way to go. Or, if you're in a hurry, you can use a debit or credit card for an instant deposit. Just be aware that instant access often comes with higher fees, so the bank transfer is your best bet for cost-effectiveness.

With money in your account, head over to the exchange's trading or market section and use the search bar to look up Tron's ticker: TRX. You'll be greeted with a price chart and an order panel.

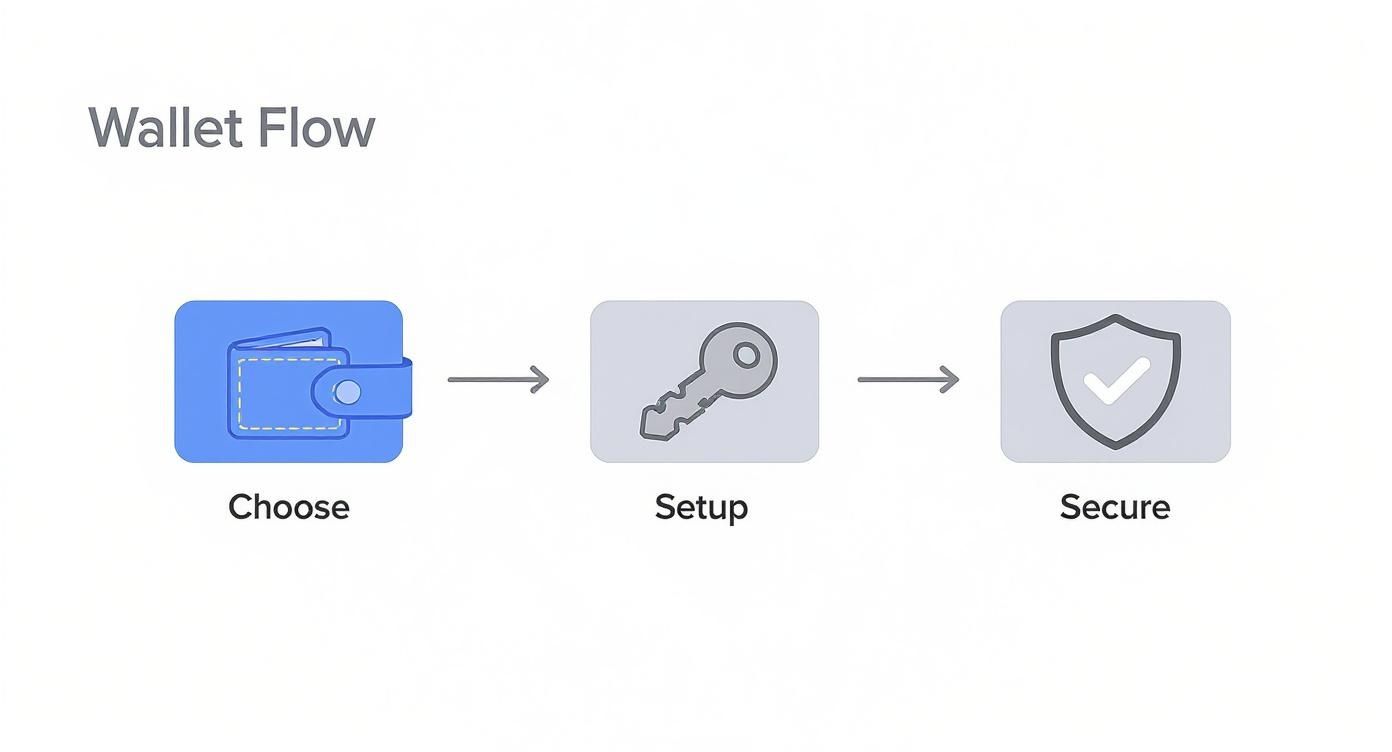

This process flow shows the core stages of setting up your wallet, a crucial prerequisite before you buy.

As you can see, it really boils down to three simple actions: picking the right wallet, setting it up properly, and—most importantly—securing that recovery phrase.

Placing Your First TRX Order

Now for the buy itself. You generally have two ways to do this: a market order or a limit order.

- Market Order: This is the "get it now" option. You tell the exchange how much money you want to spend, and it buys TRX for you instantly at the best available price. It's fast, simple, and perfect for getting your foot in the door.

- Limit Order: This gives you more control. You set the exact price you're willing to pay per TRX. Your order just sits there and will only go through if the market price drops to your target. This is a great tool if you've done your homework and think the price might dip a bit.

For your first time, a market order is probably the easiest way to go. Just get it done and see how it feels.

Pro-Tip: Always, always double-check your order before hitting that confirm button. Look at the total cost (including fees) and how much TRX you're getting. Once a trade executes on the blockchain, there's no undo button.

After your purchase is confirmed, there's one last, critical step. Withdraw your new TRX from the exchange and send it to the personal wallet you set up earlier. This puts your assets firmly in your control, away from any exchange-related risks. Just look for the "Withdraw" option, choose TRX, and carefully paste in your wallet’s public address.

Managing Your Tron After The Purchase

Getting your hands on some Tron (TRX) is a great first move, but what you do next is what really counts. The goal isn’t just to own it; it’s to make sure your assets are safe and, ideally, putting in some work for you.

Leaving your crypto on an exchange is like leaving cash on the counter at a bank. You don't truly control it. The single most important thing you can do right away is move your TRX to a personal, non-custodial wallet. This one step puts you in charge and protects you from exchange-specific problems like a hack or a sudden freeze on withdrawals.

Making Your TRX Work For You

Once your Tron is safely tucked away in your wallet, it can do more than just sit there. The Tron network has a bustling ecosystem, and one of the most popular ways to get involved is through staking.

Staking is basically like putting your TRX to work to help run and secure the network. You lock it up, and in exchange for contributing to the blockchain's stability, you earn more TRX as a reward. It's a solid way to grow your holdings passively, without having to trade. If that sounds interesting, you can explore how Tron staking works and see what kind of returns are possible.

It's not just individuals who are seeing the value in Tron. The network is gaining serious credibility on an institutional level, which helps build a strong foundation for its future and long-term value.

Take government adoption, for example. In a huge vote of confidence, the U.S. Department of Commerce chose TRON as a primary network for posting official economic data back in September 2025. It was the first time a federal agency ever published GDP data on public blockchains, which speaks volumes about the network's reliability and scale.

Of course, with any investment, you need a plan. Now that you've got your TRX, it’s a good time to brush up on general risk management strategies to make sure you're protecting your portfolio from potential downsides.

Common Questions About Buying Tron

Jumping into the world of crypto always brings up a few questions. As you get the hang of buying Tron, you’ll probably run into the same queries that most people do. Let's tackle them head-on so you can move forward with confidence.

What Is the Cheapest Way to Buy Tron?

If you want to get the most TRX for your money, it all comes down to minimizing fees.

The cheapest route is almost always funding your exchange account with a bank transfer (ACH). These are significantly cheaper than using a credit or debit card, which usually tack on extra convenience fees.

Once the money is in your account, try placing a "limit order" instead of a "market order." A limit order lets you name your price—the absolute maximum you're willing to pay. This is a great way to protect yourself from sudden price jumps and avoid overpaying.

Can I Buy Tron Instantly?

You bet. If speed is what you're after, using a credit or debit card on a major exchange is the quickest way to get your hands on some Tron. The transaction is usually instant, meaning you can have TRX in your account in just a few minutes.

Just keep in mind, you’ll typically pay a bit more in fees for that convenience compared to a standard bank transfer.

Key Takeaway: While exchanges have solid security, it's always smarter to move your Tron into a personal wallet where you control the private keys. Leaving crypto on an exchange long-term can expose you to risks like platform hacks or frozen accounts.

Another big question for newcomers is taxes. It's a crucial part of owning crypto, and getting it right from the start saves a lot of headaches. For some solid guidance on this, check out resources like Mastering U.S. Crypto Taxes.

And if you have more questions about how things work on our platform, our vTrader FAQ section is packed with helpful answers.

Ready to buy Tron without paying any trading fees? vTrader offers a zero-fee platform that puts more of your money into your investment. Sign up today and get started in minutes. https://www.vtrader.io

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.