This guide is part of the “Guide to Bitcoin” series.

Bitcoin is now considered a lucrative asset, long gone are the days of it being a mysterious digital experiment. Since 2025, institutional investment has skyrocketed along with the price. The addition of ETFs tied directly to the price of bitcoin allows more investors to join in and solidifies it as its own asset class.

If you already own Bitcoin, this guide may show you another way to buy. But if you’re ready to enter the world of Bitcoin, this step-by-step guide will walk you through everything you need to know, from choosing a cryptocurrency exchange to securing your Bitcoin wallet. You’ll learn this and so much more from an expert trader.

The process of buying crypto is so easy nowadays, you can use a credit card, bank app, or even an ATM (Bitcoin ATMs). In this article, we will also touch upon advanced options like Bitcoin ETFs and P2P marketplaces. We’ll show you what the process of trading looks like so you can get an understanding of how to do it on your own. Let’s dive in.

Table of Contents

Step 1 – Choose a cryptocurrency exchange

A cryptocurrency exchange is an online platform that connects buyers and sellers of digital currencies like Bitcoin, Ethereum, Solana, Ripple, and others. It’s where most users go to buy Bitcoin, view real-time prices, and execute any sort of Bitcoin transaction.

When choosing which crypto exchange to use, pay attention to these main factors:

- Commission and fees: Some platforms charge higher transaction fees than others. Over time this adds up.

- Security and reputation: Look for exchanges with strong security and transparent operational practices.

- User experience: A smooth interface makes a huge difference, especially before buying for the first time. Check online reviews from real people.

- Withdrawal accessibility: Ensure you can withdraw funds easily to your bank account or Bitcoin wallet quickly and easily.

After comparing multiple platforms for this guide, we chose one based on a zero commission trading structure, the addition of helpful tools (Ether Gas Tracker), and the opportunity to monitor and buy right on the iPhone through an app. We chose vTrader.

vTrader offers an intuitive and secure platform for buying BTC and supports multiple payment methods, including debit card and bank transfers. It’s an ideal choice for both beginners and experienced traders located in any part of the world.

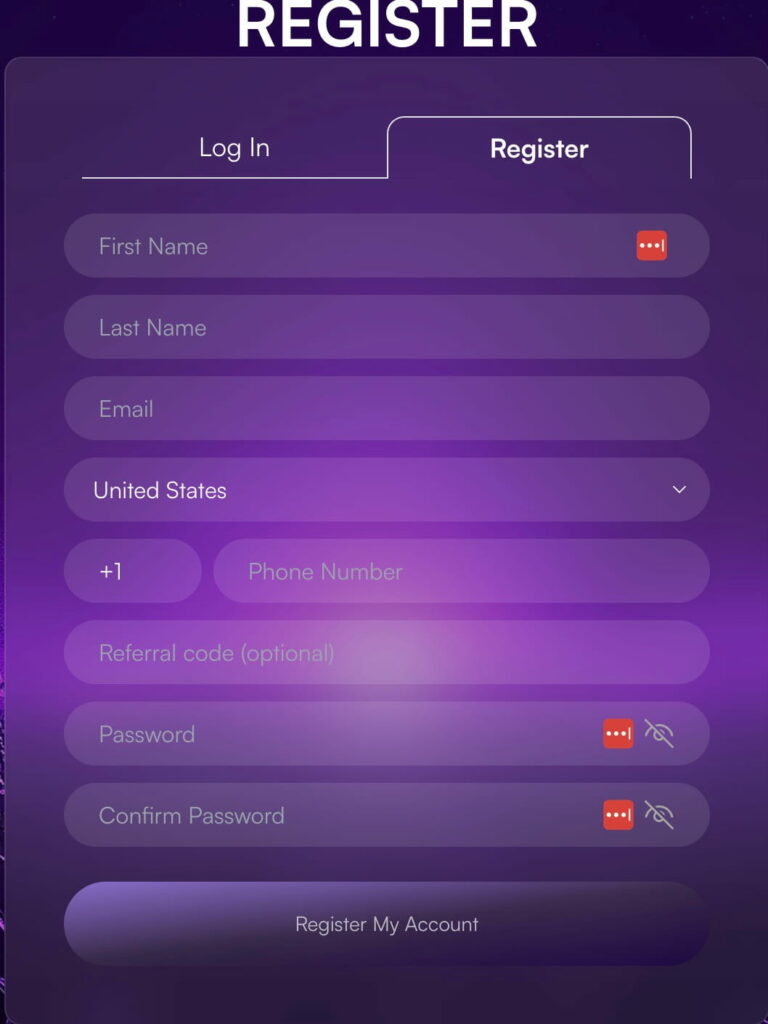

Step 2 – Create and verify your account

After choosing the exchange (vTrader in our case), the next step is to create an account. This process is basically the same anywhere you go and typically involves:

- Providing your name, email, and creating a password.

- Completing the Know Your Customer (KYC) verification procedure, which may include uploading your passport, national ID, or a utility bill. This is also a standard procedure.

This step is not just regulatory, it’s essential for preventing fraud and protecting your funds. Use a strong password, enable two-factor authentication (2FA) if possible, and avoid using public Wi-Fi during registration.

Pro tip: Since you’re submitting personal documents and creating a financial account, doing so over an unsecured network increases the risk of your data being stolen or compromised. For financial transactions, always use a secure, private connection and an up-to-date device.

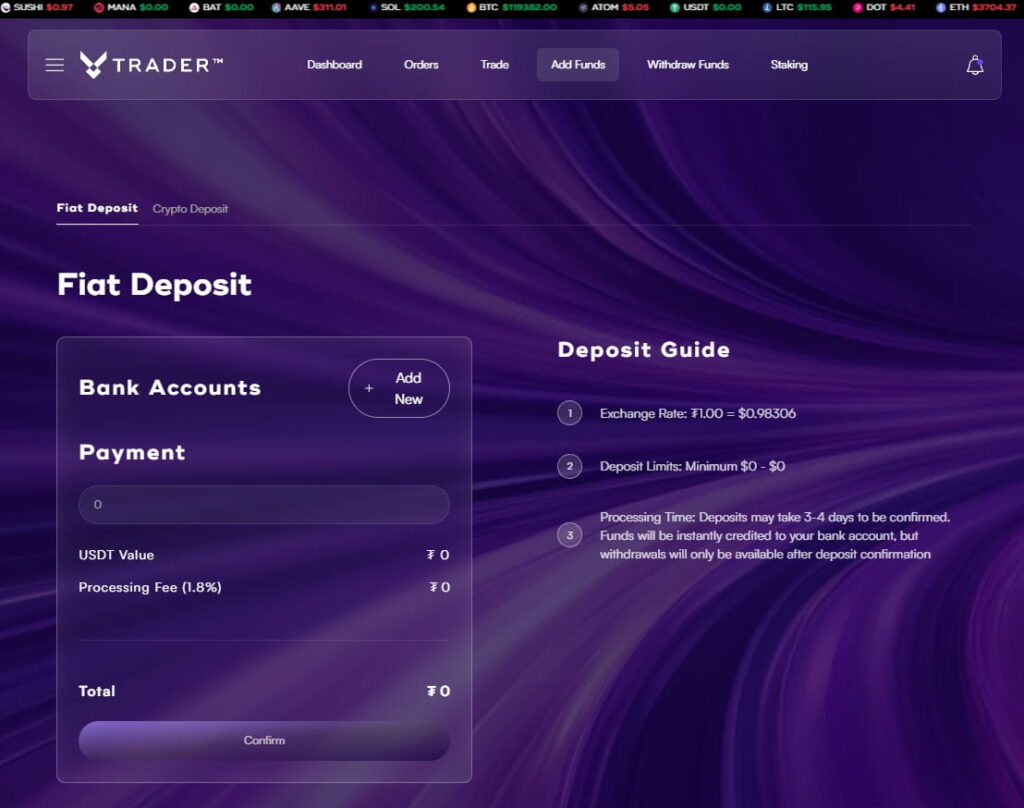

Step 3 – Deposit funds into your account

Before you can purchase any Bitcoin, you need to add funds to your account. Most exchanges accept the following payment methods:

- Bank account transfers. Typically lower in fees, but may take 1–3 business days to settle. Best for larger amounts and those not in a rush.

- Credit card/debit card. Instant deposits, perfect for people who want to buy immediately. However, they usually come with higher transaction fees. Some banks may even treat the purchase as a special transaction, adding extra costs.

- Third-party processors (e.g., PayPal). Convenient and user-friendly, especially for first-timers, but may have withdrawal accessibility restrictions or higher fees depending on the region and account type.

The main thing to remember is your payment method will affect how much you pay in fees, how fast your money arrives, and how much you’re allowed to deposit or withdraw each day, especially if your account is new.

Step 4 – Purchase Bitcoin

With funds in your account, you can finally buy Bitcoin (and other cryptocurrencies).

On any trading platform, you’ll typically have two order types to choose from:

- Market orders: This buys instantly at the best available price.

- Limit order: Lets you set your desired price and waits for the market to match it. Once the price reaches your set limit, the order activates automatically.

Even small purchases can grow meaningfully in crypto markets. While Bitcoin doesn’t guarantee quick gains, its historical performance shows long-term potential. With just $100 and smart risk management, you can start building exposure.

How Much BTC can you get for $100?

Let’s work out how much BTC you could buy for $100 USD if using current market prices:

- You deposit $100.

- Network/exchange fees: Let’s assume a 2% fee (typical for card payments on many platforms).

- Fee = $100 × 0.02 = $2

- Fee = $100 × 0.02 = $2

- Amount credited to the account:

- $100 – $2 = $98

- $100 – $2 = $98

- BTC purchased at market price:

- $98 ÷ $119,364 ≈ 0.000820 BTC

- $98 ÷ $119,364 ≈ 0.000820 BTC

What Happens if BTC Grows 20%?

- A 20% price increase from $119,364 → $143,237

- Your 0.000820 BTC × $143,237 ≈ $117.54

- That’s a $17.54 profit on your initial $100 investment, a 17.5% gain

As you can see, even a modest price change can result in gains, but keep in mind that Bitcoin can also move in the opposite direction. Timing, patience, and risk tolerance all play a role when buying Bitcoin.

Once the transaction completes, your BTC will appear in your exchange wallet. You can leave it there temporarily, but for better security, consider transferring it to your own Bitcoin wallet.

Step 5 – Secure your Bitcoin

This is one of the most important steps, storing your BTC after purchase. If you want to go the extra mile in securing your funds you need to get yourself a crypto wallet. You have two main options for storing your Bitcoin:

- Hot wallets are connected to the internet. They come as mobile apps, browser extensions, and desktop software. They’re convenient and fast for daily use, but like anything online, they’re more exposed to hacking, malware, and phishing attacks.

- Cold wallets are offline. These include hardware wallets like Ledger or Trezor, and are for advanced users. Cold wallets are like safes for your Bitcoin, virtually immune to online threats but remain physically vulnerable.

If you plan to hold your bitcoin for months or years, don’t forget it on an exchange. Move it to a cold wallet as soon as possible. It’s what serious bitcoin traders do to stay protected.

Pro tip: When you set up a cold wallet, you’ll get a recovery phrase. It is the 12 to 24 random words you get when opening up a wallet. It’s important that you write these down and store them offline, preferably in multiple safe locations. Never store them digitally or share them with anyone. If you lose this phrase, there is no way to recover your Bitcoin.

Alternative ways to buy Bitcoin

Not everyone buys Bitcoin the way outlined above, and that’s the beauty of it. When dealing with crypto, you have the following options available depending on your preferences:

- Bitcoin ATMs: I’ve seen them in malls, airports, and in different city centers. These let you buy Bitcoin using cash or a debit card. It’s private and fast, but fees can range from 7–15%, so it’s not ideal for large purchases.

- Peer-to-peer (P2P) marketplaces: Sites like Paxful or Bisq connect buyers and sellers directly. You can choose a variety of payment options, negotiate rates with buyers and sellers, and transact without intermediaries. However, trust and caution are your main allies. Only trade with verified users and use any available escrow services (which hold the trade until you get paid).

- Bitcoin ETFs and trusts: If you prefer investing through a stock broker and don’t want to manage a Bitcoin wallet, ETFs like GBTC or BITO give you exposure to Bitcoin’s price movements. Just remember that you’re not actually holding BTC, you’re buying a financial product that tracks its price.

Tips for buying Bitcoin safely

Bitcoin gives you this incredible freedom, but with that, the user bears all the responsibility. Some people are not used to that kind of responsibility. Here is a list of practical, experience-based safety habits that I follow to keep my funds protected:

- Use a secure internet connection. I only access exchanges or wallets from private, encrypted networks.

- Activate 2FA on everything: Add a second layer of protection to all accounts, text-based or, better yet, app-based like Google Authenticator.

- Keep two secret locations of private keys. Also, never tell anyone your recovery phrase. No support team will ever ask for them. So if anyone does, you know it’s a scam.

- Double-verify wallet addresses. I always triple-check before sending funds. Malware can replace copied addresses with a scammer’s, auto-paste functions on cellphones can be manipulated, always be vigilant.

- Bookmark official websites. Phishing websites are designed to look identical to real platforms but are, in fact, stealing your login information.

Owning Bitcoin means taking full control of your money. That’s powerful, but only if you treat security as part of the investment. Think long-term, stay thorough, and never rush. If a deal or platform feels off, just walk away and do more research. Scammers thrive on urgency and FOMO.

Start strong, stay smart, grow free

Buying Bitcoin isn’t just a transaction, it’s a lifestyle shift. You’re stepping into a world where you are your own bank, and financial independence comes with both opportunity and responsibility.

Take your time to understand the tools, respect the security risks, and prioritize trusted platforms. With a platform like vTrader, buying Bitcoin is easier and safer than ever before. Whether you’re in the United States or abroad, choose your payment method wisely, secure your BTC in a cold wallet, and keep learning as you grow.

This isn’t just about crypto, it’s about taking control of your financial independence. And the best time to start was yesterday. The second best is now.

Buy Bitcoin today at www.vTrader.io and own your financial security.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.