Jumping into crypto trading for the first time might seem like a huge leap, but it boils down to a few key moves: picking a solid platform, getting your account funded, and learning the ropes of the main digital currencies. Nail these basics, and you'll be trading with confidence from day one.

Your First Steps into Cryptocurrency Trading

The crypto world can feel like a maze at first, but getting started is actually pretty straightforward. Your first real job is finding a trustworthy and secure place to make your trades. This is where a cryptocurrency exchange like vTrader comes in. Think of it as your home base—a digital hub where you can buy, sell, and keep an eye on your crypto.

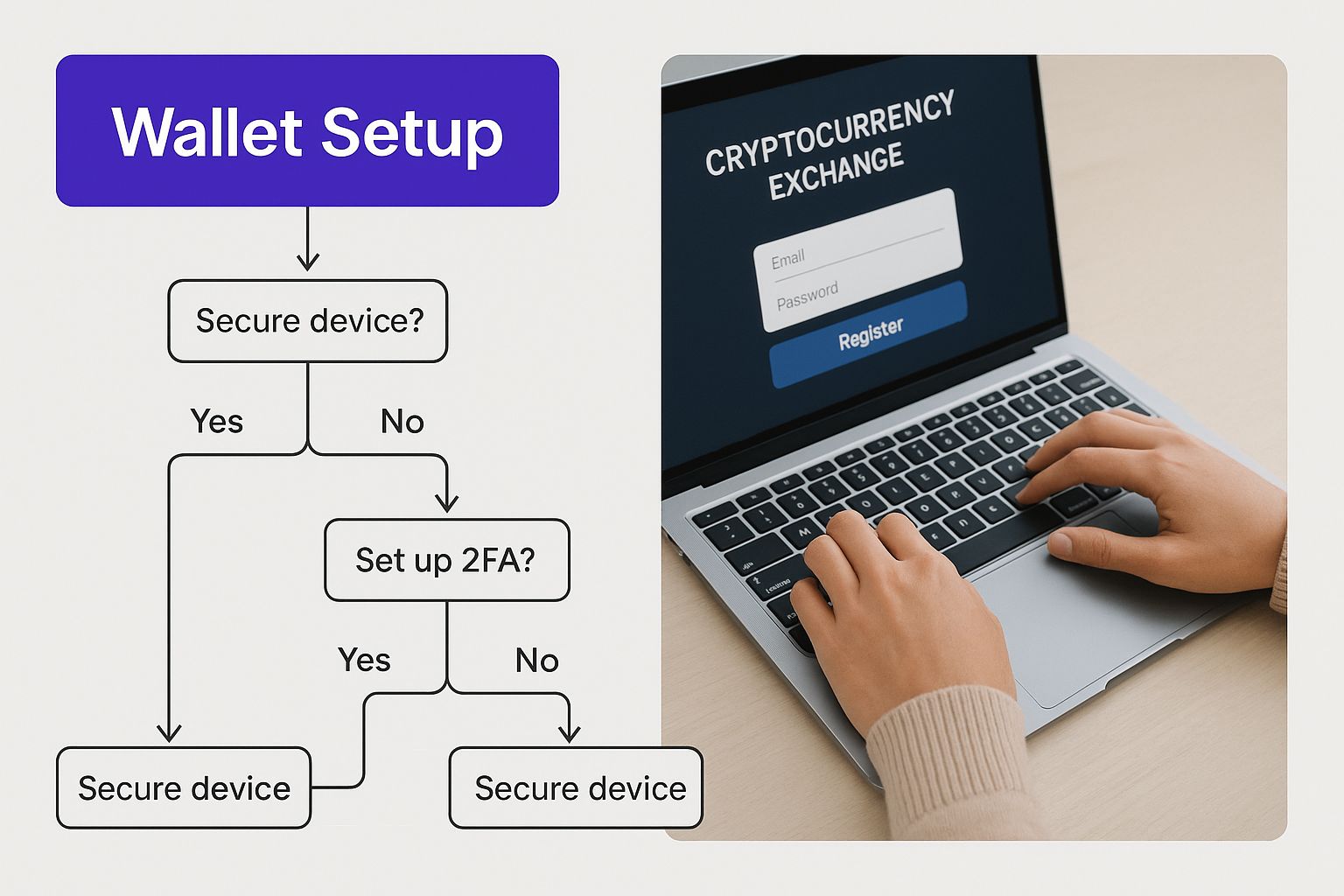

Before you can pull the trigger on a trade, you'll need to create and verify your account. The process is designed to be simple, walking you through the steps to secure your profile and link a way to fund it. Most signup screens, like the one below, are clean and easy to follow.

As you can see, platforms like vTrader get you started quickly, asking for just the essential info to get your account created securely.

Preparing for Your First Trade

With your account set up, it's time to get a feel for the market you're about to enter. The global crypto market was valued at around USD 5.7 billion and is on track to hit nearly USD 11.7 billion by 2030. That explosive growth signals massive global interest and opportunity, but it also means you need to come prepared.

For anyone new to the space, sticking to the fundamentals is everything.

- Get to Know the Big Players: Start with the heavyweights like Bitcoin (BTC) and Ethereum (ETH). They have the longest track records and a ton of information available, making them easier to understand.

- Decide on a Budget: This is a golden rule in trading: never invest more than you can afford to lose. Figure out a starting amount that won't leave you stressed if the market takes a dip.

- Lock Down Your Security: A strong password is just the beginning. The first thing you should do is enable two-factor authentication (2FA). It’s a non-negotiable layer of protection for your funds.

To help you stay on track, we've put together a simple checklist. Think of this as your pre-flight inspection before you make your first purchase.

Quick-Start Checklist for Your First Crypto Trade

| Action Item | Why It's Important | Key Takeaway |

|---|---|---|

| Pick a Reputable Exchange | Your exchange holds your funds. You need a platform with a strong security record and good user reviews. | Look for platforms like vTrader that prioritize security and user support. |

| Enable 2-Factor Authentication (2FA) | Passwords can be compromised. 2FA adds a critical second layer of defense against unauthorized access. | Set up 2FA immediately after creating your account—don't put it off. |

| Set a Strict Trading Budget | The crypto market is volatile. A budget protects you from emotional decisions and financial strain. | Only trade with money you are fully prepared to lose. |

| Start with Major Cryptos | Coins like BTC and ETH are more established and less volatile than smaller altcoins, making them better for beginners. | Stick to the top 2-3 cryptocurrencies for your initial trades to learn the ropes. |

| Do a Small Test Transaction | A small initial deposit and trade ensures you understand the process before committing larger amounts. | Buy a tiny fraction of a coin first to see how fees and order types work. |

Following these steps will help you build a solid foundation, ensuring you're not just guessing but making informed moves from the very beginning.

The best way to learn is by doing—but with a safety net. Start small. This lets you get a real feel for how the market moves and how trades work without putting serious money on the line.

If you’re ready to build up your knowledge base, diving into educational content is your next move. For a deeper understanding of the core ideas, check out the free courses at the vTrader Academy. This is the kind of foundational knowledge that will pay off big time as you get more involved.

How to Choose the Right Crypto Exchange

Picking your first crypto exchange feels a lot like choosing a new bank—you want one that's trustworthy, secure, and doesn't hit you with surprise fees. With so many options out there, it’s easy to get overwhelmed. But if you know what to look for, you can find a platform that feels right for you.

Security should be at the top of your list. No question. Look for exchanges that take it seriously by offering two-factor authentication (2FA) and keeping most of their funds in cold storage (offline). That’s how you know they’re serious about protecting your money from online hacks.

This process starts the moment you sign up. A secure registration is the bedrock of a safe trading journey.

Comparing Cryptocurrency Exchange Features

This table compares essential features to consider when selecting a cryptocurrency exchange, helping you choose the best platform for your needs.

| Feature | What to Look For | Why It Matters for Beginners |

|---|---|---|

| Security | Two-factor authentication (2FA), cold storage for assets, regulatory compliance (e.g., FinCEN registration). | Protects your funds from theft and ensures the exchange operates under legal oversight. Non-negotiable. |

| Available Coins | A solid mix of major coins (Bitcoin, Ethereum) and popular altcoins. | You need access to the assets you want to trade without having to jump between multiple platforms. |

| User Interface (UI) | A clean, intuitive dashboard that’s easy to navigate. Clear "buy" and "sell" buttons are a must. | A confusing platform can lead to expensive mistakes, like placing the wrong order or sending funds to the wrong address. |

| Fees | A transparent fee schedule. Look for trading fees (maker/taker), deposit/withdrawal fees, and any hidden costs. | Fees can eat into your profits over time. Low or zero-fee platforms like vTrader can make a huge difference. |

| Customer Support | 24/7 availability through channels like live chat, email, or phone. | When something goes wrong (and it can), you need fast, reliable help to resolve the issue. |

| Educational Resources | Guides, tutorials, and market analysis provided by the platform. | Helps you learn the ropes, understand market trends, and make more informed trading decisions. |

Choosing an exchange is a personal decision, but by evaluating these key areas, you're setting yourself up for a much smoother and more secure trading experience from day one.

Digging Deeper Into the Details

Once you've narrowed it down, the daily user experience becomes what matters most. A clunky interface is more than just an annoyance; it can lead to costly trading errors, especially when you're just starting out. Platforms like vTrader are built with a clean layout to make sure you can find what you need and place trades without any confusion.

Here are a few more things I always check:

- What Coins Are Available? Does the exchange actually list the crypto you want to trade? Some exchanges boast thousands of coins, but a good starting point is one with the big players like Bitcoin and Ethereum, plus a healthy selection of established altcoins.

- Is It Easy to Use? Seriously, is the platform intuitive? Look for a simple dashboard, obvious trading buttons, and helpful tooltips or guides. The last thing you want is to fight with the interface when the market is moving fast.

- Can You Get Help When You Need It? If you run into an issue, you need to know you can get it resolved quickly. Check for 24/7 support through live chat or email. A responsive support team is worth its weight in gold.

Watch Out for Fees and Check for Compliance

Fees are the silent profit-killers in crypto trading. They can sneak up on you if you’re not careful. Most exchanges charge a percentage for every trade you make (these are called maker/taker fees) and often have other costs for depositing or withdrawing your money.

Be wary of platforms that shout about their "low fees" but then slap you with a massive withdrawal fee when you try to move your crypto. Always read the fee schedule carefully.

This is where a platform like vTrader really shines with its zero-fee trading model. You can see a complete and transparent breakdown on the platform’s official fee page. To understand how this works in the real world, you can learn more about the vTrader fee model and see how it’s designed to help you keep more of your returns.

Finally, and this is a big one, make sure the exchange is compliant with regulations. In the U.S., this means being registered with an agency like FinCEN. This isn't just a piece of paper; it's a sign that the exchange is committed to operating legally and protecting its users from fraud. For anyone wondering, "how do I start trading in cryptocurrency" without getting burned, this is a critical checkpoint.

Setting Up and Securing Your Trading Account

Once you've zeroed in on a solid exchange, it’s time to create and lock down your account. This isn't just about picking a username and password; think of it as building a digital fortress for your assets. I’ll walk you through the process using vTrader as our real-world model to show you exactly how it’s done.

The first gate you’ll pass through on any regulated exchange is the Know Your Customer (KYC) check. This just means you’ll need to provide some form of ID, like a driver’s license or passport. It might feel like a bit of a hassle, but it’s a non-negotiable step that compliant platforms like vTrader use to fight fraud and protect everyone in the ecosystem. Honestly, it’s a good sign—it means the exchange takes its legal duties seriously.

Mastering Your Account Security

Creating your account is just the start. Securing it is an ongoing mission, and the single most critical thing you can do is enable two-factor authentication (2FA). This adds a formidable layer of defense that can stop unauthorized access in its tracks.

Here’s the right way to approach it:

- Authenticator App is King: Forget SMS. Download an app like Google Authenticator or Authy. These generate a unique, time-sensitive code on your phone that you’ll need to enter when logging in.

- Skip the SMS 2FA: While it’s better than nothing, SMS-based authentication is vulnerable to "SIM swapping"—a nasty scam where thieves trick your mobile provider into moving your number to their phone. An authenticator app is a much safer bet.

- Unique, Strong Passwords Only: Create a complex, unique password for your exchange account that you don't use anywhere else. A good password manager is your best friend here, helping you generate and store these securely.

If you’re serious about figuring out how to start trading cryptocurrency safely, these initial security moves are absolutely mandatory.

“Your security is your responsibility. An exchange can have the best defenses in the world, but they can't protect you from a weak password or a compromised device. Take these first steps seriously.”

Advanced Security From Day One

Once you’re in, there are a couple more proactive steps you can take on a platform like vTrader to really tighten the hatches. One of my personal favorites is whitelisting withdrawal addresses.

This feature lets you create a pre-approved list of crypto addresses where you can send funds. Why is this so powerful? If a hacker somehow gets into your account, they can't drain your crypto into their own wallet because it won't be on your pre-approved list. It's a simple, but incredibly effective, theft-prevention tool.

Staying on top of the latest security threats and industry news is also crucial. You can keep your finger on the pulse by checking out the vTrader news hub for timely updates and analysis. Taking these protective measures from the get-go ensures you’re building your crypto journey on a solid foundation of security and confidence.

Funding Your Account and Making a First Trade

Alright, with your vTrader account locked down and secure, it’s time for the fun part: adding some funds and placing your first trade. This is the moment when the idea of trading crypto goes from abstract to very, very real.

The good news? Getting money into your account is a breeze. But the method you pick can make a difference in how fast you can trade and how much it costs.

Here’s the breakdown of your main options:

- Bank Transfer (ACH): This is the go-to for most people starting out. It's typically free, but be prepared to wait a few business days for the money to actually clear and be ready for trading.

- Wire Transfer: Need to move faster? Wires are your friend, often clearing on the same day. Just keep in mind that your bank will likely charge a fee, so this option makes more sense for larger deposits where speed is the name of the game.

- Debit Card: This is the undisputed speed champion. Using your debit card lets you buy crypto instantly. The trade-off is that it usually comes with slightly higher fees compared to a bank transfer.

For most beginners, an ACH transfer hits the sweet spot between low cost and convenience. You link your bank account just once, and from then on, moving funds over is simple.

Placing Your First Crypto Trade

Once the cash lands in your account, you're officially ready to pull the trigger on a trade. This is a huge milestone for anyone just figuring out how do I start trading in cryptocurrency.

Let's walk through a real-world example: buying your first $100 worth of Bitcoin (BTC) on vTrader. When you pull up the trading screen, you’ll see the current price, a chart, and your order options.

The image above highlights the key pieces you’ll be working with: the trading pair (in this case, BTC/USD), the order type, and the box where you’ll enter how much you want to spend.

Now, you have a choice to make between two main types of orders: a market order or a limit order.

A market order is straightforward—it buys the crypto for you immediately at the best price available right now. It's fast and simple. A limit order, on the other hand, lets you name your price. Your trade will only go through if Bitcoin’s price hits your target.

As a newcomer, a market order is the most direct path to getting your hands on some crypto. You'd just type "$100" into the buy field, make sure "Market Order" is selected, and hit confirm. In a few moments, you'll see that fresh Bitcoin sitting in your vTrader wallet. Making that first trade is a massive confidence booster.

And you're in good company. Today, about 40% of American adults own some form of cryptocurrency, a huge leap from just 15% a few years back. With roughly 93 million people in the U.S. crypto space and trading volumes expected to top $2 trillion, you're jumping into a very active market.

Once you’ve bought your crypto, it doesn't just have to sit there. You can actually put it to work. For anyone looking to earn rewards on their digital assets, you can learn more about how to stake your crypto with vTrader and start generating passive income. It’s a fantastic next step after you’ve got the hang of buying.

Smart Risk Management for New Crypto Traders

Making your first trade is a huge milestone. But what really separates the pros from the crowd is how they handle risk. It’s no secret that the crypto market can be a rollercoaster, and without a game plan, it’s all too easy to let emotions take over and make calls that wreck your portfolio.

The most important rule to tattoo on your brain is simple: never invest more than you can comfortably afford to lose. This isn't just a soundbite; it’s the absolute foundation of staying in the game long-term. It’s what keeps you from panic-selling during a dip and lets you think with a clear head.

Building a Defensive Trading Strategy

To really succeed, you have to play defense just as hard as you play offense. This means using the right tools and tactics to shield your capital from big hits. One of the most powerful tools you’ll find on platforms like vTrader is the stop-loss order.

Think of a stop-loss as your personal safety net. It automatically sells your crypto if it drops to a price you’ve already decided on. For example, say you buy Bitcoin at $60,000. You could set a stop-loss order at $57,000. If the market turns and the price hits that level, your position sells automatically. Your loss is capped at 5%, protecting you from a much steeper fall. It's a lifesaver.

Another incredibly effective strategy is dollar-cost averaging (DCA). Instead of trying to time the market perfectly—which is next to impossible—you just invest a fixed amount of cash at regular intervals.

- Here’s how it works: You decide to invest $100 into Ethereum every single Friday, no matter what the price is.

- The result? Some weeks you’ll buy more ETH when prices are low, and other weeks you’ll buy less when they're high. Over time, this smooths out your average purchase price and dramatically reduces the impact of wild price swings.

This kind of disciplined approach takes the emotion out of investing and helps you build up your holdings without the stress.

Don't put all your eggs in one basket. Even if you're starting small, spreading your funds across a few different cryptocurrencies is smart. A single coin might have a terrible week, but it’s far less likely your entire diversified portfolio will take the same dramatic hit.

Staying Informed in a Growing Market

Understanding the big picture is another critical piece of managing risk. The crypto market is growing up fast, with more big institutions getting involved and regulations constantly changing.

The numbers tell a story of massive growth. The market is projected to swell from around USD 910 million to nearly USD 1.9 billion, riding an 11.1% compound annual growth rate. This trend, which got a major kickstart during the global pandemic, shows just how resilient this market is and why you need to stay on top of it. To dig deeper into these trends, you can check out more insights on the global cryptocurrency market.

By combining hands-on tools like stop-loss orders with steady strategies like DCA and a commitment to staying educated, you’re no longer just asking "how do I start trading in cryptocurrency?" You’re actually building a smart, resilient approach for the long haul.

Common Questions from New Crypto Traders

Once your account is set up and you’re staring at the trading dashboard, it's completely normal for a flood of questions to hit you. Making the leap from setup to actually managing your digital assets is where the real learning begins.

Let's walk through some of the most common things new traders ask. Getting these fundamentals down is the key to building confidence and figuring out how do I start trading in cryptocurrency the right way.

How Much Money Do I Need to Start Trading?

You can actually get started with a lot less than you might think. Many platforms, vTrader included, let you begin with as little as $10 or $20. Honestly, the exact dollar amount isn't what matters most. The golden rule is to only invest an amount you'd be okay with losing if the market takes a nosedive.

Starting small is your best friend. It lets you learn the ropes—placing trades, watching market swings, managing a portfolio—without putting serious cash on the line. For a lot of people just starting out, somewhere between $100 and $500 is a great entry point. That’s usually enough to grab a piece of a major coin like Bitcoin or Ethereum and maybe even explore a few smaller altcoins.

What Is a Hot Wallet vs a Cold Wallet

This is a huge one for security, and it all boils down to a single factor: internet connection.

- Hot Wallet: Think of this as your everyday spending wallet. It's connected to the internet, which makes it super convenient for active trading. The wallet you get on an exchange like vTrader is a hot wallet—your funds are always ready for a quick trade. The trade-off is that this online connection makes it more vulnerable to online threats.

- Cold Wallet: This is your crypto vault. It's a physical device, like a specialized USB drive from brands like Ledger or Trezor, that stores your crypto completely offline. Since it's disconnected from the web, it's the gold standard for long-term, secure storage.

When you begin, you'll be using your exchange's hot wallet. As your crypto portfolio grows, it’s a smart move to transfer the funds you aren't actively trading into a cold wallet for safekeeping.

Key Takeaway: Use a hot wallet for your active trading funds and a cold wallet for your long-term savings. This simple strategy balances convenience with maximum security.

Do I Have to Pay Taxes on My Crypto Trades

The short answer is yes. In most places, including the U.S., tax authorities view cryptocurrencies as property. This means you owe taxes on your profits. A taxable event happens any time you:

- Sell crypto for cash (like U.S. Dollars).

- Trade one crypto for another (like swapping Bitcoin for Ethereum).

- Use crypto to buy something, like a coffee or a laptop.

You'll need to figure out the difference between what you paid for the crypto (cost basis) and what you got when you sold or traded it. The good news is that platforms like vTrader give you detailed transaction reports to make this less of a headache. Still, it’s always a good idea to talk with a tax professional who knows the ins and outs of crypto. For more detailed answers to platform-specific questions, the vTrader FAQ page is an excellent resource.

Ready to stop asking questions and start trading with confidence? Join vTrader today to experience commission-free trading on Bitcoin, Ethereum, and over 30 other altcoins. With our advanced tools, secure platform, and extensive learning resources, you'll have everything you need to succeed. Sign up now and get a $10 bonus to start your portfolio!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.