Consider this page to be your reference guide to Ethereum gas fees. It describes what gas prices are, why they fluctuate so much, and how to control them to reduce costs and speed up transactions.

Today, you’ll learn how the fee structure operates, what influences price increases and decreases, and the most effective ways to control your expenses. You can start at the top and work your way through each topic, or you can use the navigation below to go directly to the sections you’re most interested in.

Either way, we recommend bookmarking this page, you’ll want it close by the next time gas prices spike and you need answers fast.

What are the gas fees for Ethereum?

You’re not alone if you’ve ever sent Ethereum and thought the transaction was more expensive than your morning coffee. One of the most discussed, misinterpreted, and occasionally annoying aspects of using Ethereum are the gas fees.

However, they are also responsible for the network’s decentralization, security, and operation. In early 2025, the average gas fee for Bitcoin was approximately $3.95 per transaction, while Ethereum’s was $8.50. The truth about ethereum fees is they don’t have to be that high, and they’re really easy once you learn to read them. Expert traders even use them like they’re a market signal.

If you really put in the work to master fees, then you too can start using gas fees as a timing tool to gain an edge before you make a transaction. Let’s go over exactly what gas fees are, how they’re calculated, why they change, and how you can turn them from a cost into an informational advantage.

Ethereum gas: what is it?

On Ethereum, computational work is measured in “gas”. Every transaction you make on the blockchain uses a specific quantity of gas units, whether you’re sending cryptocurrency, trading tokens, or purchasing NFTs. Gas can be thought of as funding the network’s “processing power.”

A basic ETH transfer always uses 21,000 gas units. The more complex the transaction, the more gas it consumes. Your wallet is the one that actually sets a gas limit, which is the maximum number of units you’re willing to pay for the transaction.

If the transaction requires less, the unused portion is refunded. This is because the user pays the set gas limit, but the actual gas used is measured at the end of the transaction. If the transaction completes without using the full gas limit, the excess is returned to the user’s wallet.

If the transaction needs more and you didn’t set enough, it will in most cases fail, but you still pay for the attempted transaction.

Who receives gas fees?

Before the 2021 “London” upgrade, gas fees went entirely to miners. Now, after Ethereum’s transition to proof of stake, they’re split. The base fee, which is the minimum network fee required, is burned (removed from circulation), creating a deflationary effect on ETH supply. The priority fee (or “tip”) goes to the validator who includes the transaction in the block.

The fundamentals of Ethereum gas

Ethereum gas fees rest on a few core building blocks that decide not just how much you’ll pay, but also how quickly your transaction will clear. Understanding these basics is the first step to avoiding costly mistakes and gaining speed as your ally.

Gas limit

This is the ceiling on how much computational work you’re willing to pay for. Think of it like setting the maximum level of funding you’ll put in for sending your transaction. Set it too low, and your transaction fails, and you still lose the gas you’ve already burned. Set it too high, and you don’t overpay! The network will simply refund the unused portion. The magic touch is setting it realistically, based on the type of transaction you’re making.

Gas price

This is how much you’re offering to pay per unit of gas, quoted in gwei. One gwei equals one billion wei, and one wei is the smallest possible fraction of ETH. Don’t worry if this is new to you, you’ll get used to it after conducting a few transactions in ETH.

If your gas price is 30 gwei, that means you’re willing to pay 0.00000003 ETH for each unit of gas your transaction consumes. A higher gas price means faster confirmation, as validators prioritize transactions with better tips.

Pre-EIP-1559 transaction fees

Before the London upgrade, the formula was simple but inefficient: gas used × gas price.

The network operated like a blind auction, where you had to guess how high to bid to be included quickly. People often overpaid during times of high demand as a result of this guesswork.

Comprehending Gwei

Quoting gas prices directly in ETH would complicate cost estimation because of the volatile nature of ETH’s market price. Gwei serves as a reliable, readable unit that enables you to compare fees without having to mentally convert ETH amounts all the time. Checking gas prices, like checking the weather before leaving, becomes second nature once you’re used to thinking in gwei.

The impact of the latest update on gas prices

August 2021 (hard fork): The introduction of EIP-1559

To address this volatility and improve the efficiency of the fee market, EIP-1559 was created. A base fee that automatically changes up or down based on network congestion took the place of the chaotic bidding war.

When blocks are more than 50% full, the base fee increases slightly, when they’re less than 50% full, it decreases. This automatic adjustment means users no longer have to constantly guess the “right” gas price from scratch.

Key components

- Base fee: Automatically calculated and burned.

- Priority fee: A gratuity for validators. When there is a lot of competition, you can add a priority fee to make sure your transaction is included quickly.

- Max fee: The maximum amount you are willing to pay for the base fee plus tip combined is known as the max fee.

- Variable block size: The protocol permits blocks to momentarily enlarge to accommodate unexpected spikes in demand, then contract again when traffic subsides, as opposed to having a set maximum block gas limit. By doing this, short-term spikes are lessened and fees are kept from rising dramatically in a short period of time.

Benefits

For average everyday users, EIP-1559 means far more predictable fees and fewer situations where you massively overpay just to be included. The system is easier to navigate, even for newcomers, because you’re working within a transparent base fee structure rather than a blind auction.

For the network, burning the base fee introduces a deflationary effect, tying ETH’s scarcity directly to how much the blockchain is used. This is revolutionary, and has made transaction activity an important driver of Ethereum’s economic model. Perhaps due to this deflationary effect, Ethereum will outlive Bitcoin in the long run.

👉 Learn more about the protocol here: How EIP-1559 Affects Gas Fees

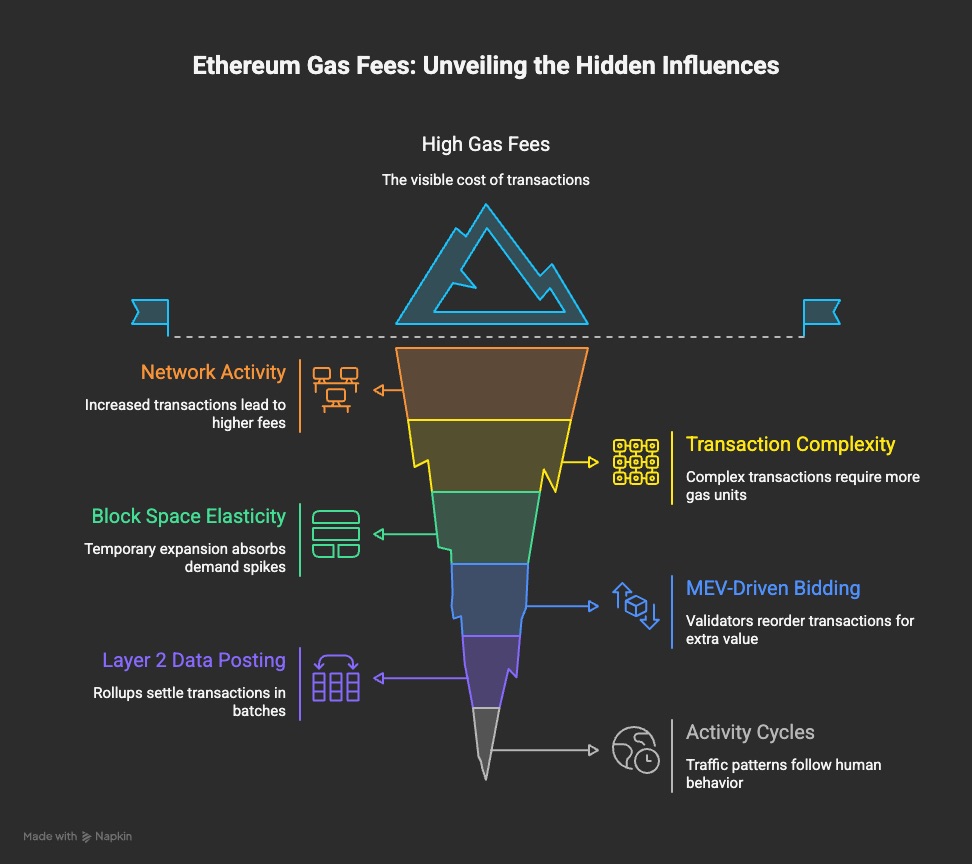

Factors influencing Ethereum gas fees

Ethereum gas fees are always changing because the price of block space changes with supply and demand mechanics. So while the base fee is automatically adjusted, the level you actually pay is influenced by several key factors that every trader and investor should know:

- Overall network activity: When there’s a surge in transactions, such as an NFT mint, a token launch, or some other DeFi activity, block space becomes scarce. The base fee rises as a result of increased competition for the same limited capacity, and tips also increase as users compete for priority.

- Complexity of the transaction: Not every Ethereum transaction is made equally. While a straightforward ETH transfer uses 21,000 gas units, a DEX swap, or contract exchange may need hundreds of thousands of units. The impact of high gas prices is amplified because the more complicated the logic your transaction follows, the more gas you’ll need.

- Block space elasticity: After EIP-1559, blocks can temporarily expand to twice their target size during spikes, which really helps to absorb sudden demand. But if the surge lasts for several blocks, the base fee will still rise quickly until the network balances out.

- MEV-driven bidding: Validators can extract extra value by reordering or inserting transactions in a block, a process known as maximal extractable value (MEV). During periods of intense MEV opportunity, traders will often outbid each other with higher tips to secure favorable positioning, which will in turn drive up the average priority fee for everyone else.

- Layer 2 data posting: Rollups like Arbitrum, Optimism, and zkSync settle transactions to Ethereum in batches. Posting this data uses block space, and if many rollups post large batches at the same time, it can add to mainnet congestion and increase base fees.

- Geographic and time-based activity cycles: Ethereum is a global network, so traffic patterns follow human behavior across time zones. Fees often drop when the U.S., Europe, and Asia are all in off-peak hours simultaneously, and rise when major markets overlap.

A great strategy is watching these factors and combining them with live gas tracking tools. You can anticipate when fees are likely to rise or fall, and plan your transactions to avoid paying overpriced fees.

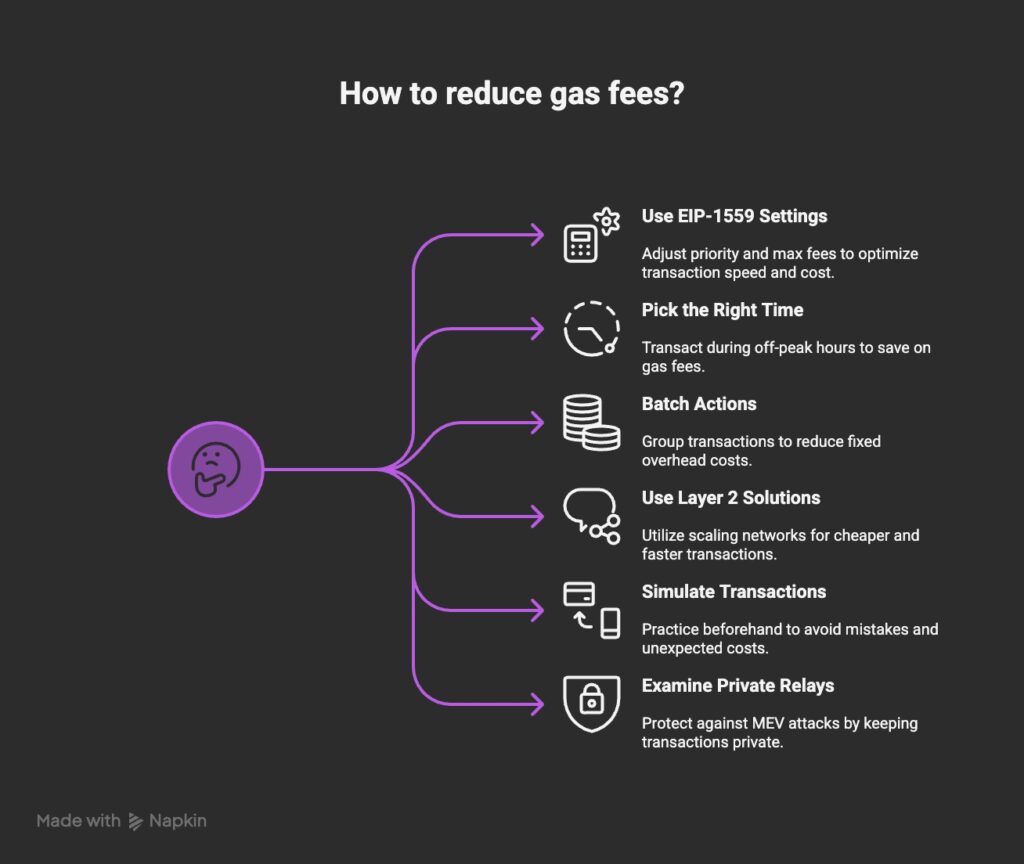

Strategies for managing and reducing gas fees

1. Use EIP-1559 settings correctly

EIP-1559 gives you more control over fees, but you have to set the fields yourself. The priority fee (tip) should match your urgency, we recommend setting just enough to incentivize validators to include your transaction quickly (without overpaying).

The max fee should give you a comfortable buffer above the current base fee so your transaction can still clear if the network gets busier right after you send it. A common mistake is setting a max fee too close to the base fee, which can cause your transaction to stall during short-term spikes.

2. Pick the right time

Gas prices tend to be lower during late-night UTC hours and weekends, when fewer people are transacting. If you’re not in a rush, wait for these off-peak windows to save yourself a significant amount. Always confirm with a live tracker before sending, because a busy airdrop or protocol launch can raise fees even during cheaper hours.

3. Batch your actions

Every transaction comes with fixed overhead costs, so grouping actions together (when possible) helps you save. For example, if you know you’ll need to approve multiple tokens for a protocol, approve them in the same session instead of days apart.

Similarly, consolidating payouts or transfers into a single batch transaction can reduce repeated fees. Many professional DeFi users batch trasnactions as part of their regular portfolio maintenance.

4. Use Layer 2 solutions

Scaling networks like Optimism, Base, and zkSync settle transactions to Ethereum in batches, which makes them much cheaper for users. After Ethereum’s EIP-4844 upgrade introduced “blob” data storage, L2 posting costs dropped significantly, lowering user fees even further.

For most everyday DeFi and NFT activity, these networks offer near-instant transactions for a fraction of the mainnet cost.

5. Before sending, simulate

Avoid making a mistake by practicing your transaction beforehand. Gas estimators, which display the anticipated cost based on the state of the network, are available in the majority of wallets and block explorers.

Examine recent on-chain transactions to determine their gas consumption. This helps prevent surprises, particularly when using dApps that make several calls in the background.

6. Examine private relays

Private transaction relays can shield you from MEV (maximal extractable value) attacks like front-running and sandwich trades if you’re trading big quantities or transferring assets in a way that could be abused.

Private relays keep your move hidden until it is verified by sending your transaction straight to validators rather than broadcasting it to the public mempool. It’s a common tool among pro-traders to keep both costs and risks low.

👉 Find more tips and tricks on How to Reduce ETH Gas Fees

Monitoring gas prices and timing your transactions

Tools like the ETH Gas Tracker App (iOS) and ETH Gas Tracker on vTrader give you real-time readings and forecasts for optimal transaction timing. Remember, always check live data before sending important transactions. If you want to learn more about different trading tools, we recommend reading:

👉 How to Use the vTrader Gas Tracker

Timing transactions:

Timing your Ethereum transactions can make the difference between paying a fair fee and overpaying several times over. Throughout the day, network congestion fluctuates, and fees frequently decrease on weekends and late at night UTC when activity around the world slows down.

Traders can identify these periods of low demand and make trades, swaps, or transfers at a fraction of peak prices by keeping an eye on real-time gas trackers. Patience pays off for high-value moves, over time, waiting for a more empty network can result in fee savings of hundreds of dollars.

When you combine this timing with notifications from programs like the ETH Gas Tracker, you can be prepared to take action as soon as fees reach your desired range.

👉 Discover additional tactics and The Best Times to Make Transactions

The differences between ETH and BTC fees

Although both Ethereum and Bitcoin impose transaction fees, they differ greatly in how they determine and rank them.

Bitcoin fees are based on the size of the transaction in virtual bytes, whereas Ethereum fees are based on computation (gas units). With the London upgrade, ETH adopted the base fee + tip model.

Bitcoin works a little differently. Its fees are determined by the transaction size in virtual bytes rather than by computation. A transaction with more inputs and outputs will cost more to include and occupy more block space. In a competitive, first-price auction system, Bitcoin miners give priority to transactions with the highest satoshis per vbyte. There is only a simple bidding war for the few available block spaces; there is no base fee or burning mechanism.

You only need to be aware that the method for avoiding overpaying is the same for both networks: calculate the appropriate fee for the time you want to use and keep an eye on network conditions before sending.

👉 Check out this article to learn more: Comparing BTC & ETH Fees

Troubleshooting common gas fee issues

Even experienced Ethereum traders occasionally run into fee-related problems. Knowing the cause and fix can save you both time and money.

Error: Out of gas

This occurs when your gas limit is set too low for the amount of work required to finish your transaction. This happens if you base your fee on a straightforward transfer, but the contract you’re working with actually makes more calls in the background. You will still lose the gas used up to the point of failure even though the transaction fails and the network reverses the state.

Increasing your gas limit and sending again is the easy solution. Check recent successful transactions to the same contract if you’re not sure of the right limit, or let your wallet recommend a reasonable amount.

Transactions that are stuck

Your transaction may remain in the mempool indefinitely if your max fee or priority fee is too low in relation to the state of the network. You can “speed up” in this situation by sending the same transaction again with the same nonce (number that keeps track of the order of your transactions), but there will be a higher cost.

Pro tip: Use the same nonce to send a zero-value transaction to your own address if you must cancel it completely. However, charge a reasonable fee to ensure that it is confirmed quickly.

High gas for easy tasks

For what appears to be a simple task, you may occasionally see an abnormally high gas estimate. This may occur if the dApp you’re using includes extra steps like unwrapping tokens, wrapping ETH into WETH, or performing multi-hop swaps across several liquidity pools.

The amount of gas needed may increase due to these hidden complications. Before approving, always review the transaction details. To make sure the cost is justified, try simulating the transaction or looking for similar actions in recent on-chain activity.

Unexpected spikes at confirmation

Occasionally, you’ll approve a transaction at a reasonable fee, but by the time it’s included in a block, the base fee has jumped. This is more likely during periods of volatile network activity.

The simple fix is to use the max fee settings with a reasonable buffer, this will protect you from failed transactions caused by sudden spikes.

Reverting transactions

A revert means the transaction was processed but the intended outcome failed (for example, a trade that didn’t meet its slippage requirements). While you get no result, you still pay for the computation. Verify terms like price slippage, contract balances, and allowances one last time before sending to prevent this error.

Ethereum gas fees’ future

Layer 2 rollups are the main focus of Ethereum’s long-term scaling strategy. By implementing blob storage for less expensive data posting, EIP-4844 has already decreased L2 fees.

The goal of upcoming improvements like full danksharding is to further reduce costs. L1 will probably continue to be premium space, primarily utilized for high-value transfers, settlement, and protocols requiring direct mainnet communication.

Frequently Asked Questions

When is the best time of day to buy ETH gas?

Due to fewer transactions, gas prices are typically lowest on weekends and late at night (UTC). Patterns aren’t flawless, though. To avoid being caught in an unexpected spike, always check a live gas tracker before pressing “send.”

Why does gas cost less at night?

Because there is less competition. Fewer transactions are competing for block space when global activity slows, in turn the base fee decreases and you pay less.

What occurs if the gas price is too low?

Your transaction may be dropped completely or remain in the pending pool for hours if your fee is too low. You will need to replace the old one by sending it again with a larger fee so that it is processed.

Does ETH 2.0 solve gas fees?

Not directly. The term “ETH 2.0” is outdated, and “The Merge” mainly switched Ethereum to proof of stake for efficiency and security. Lower fees come from Layer 2 networks and future upgrades like data sharding, not from the consensus change itself.

Are ETH gas fees refundable?

Only if the blockchain doesn’t receive your transaction. Even if a transaction doesn’t work out, the gas you used for computation is gone because the network already paid for the work.

Turning gas fees into an advantage

Gas fees are often seen as a frustrating cost, but they’re actually a window into Ethereum’s inner economics. They tell you when the network is crowded, when it’s quiet, and how much demand there is for block space right now.

Traders who pay attention to gas patterns not only save money, but they time entries and exits better. Investors who understand the burn mechanism see how gas fees directly influence ETH’s long-term scarcity.

The more you work with Ethereum, the more you’ll see gas fees not as a hindrance, but as one of the most transparent, reliable signals in all of crypto. Learn to read it, and it becomes another tool in your trading edge.

If you’re ready to put this knowledge into action, start tracking live gas prices with the ETH Gas Tracker App (iOS) or ETH Gas Tracker by vTrader, and be prepared for your next move by knowing exactly when and how much to pay in fees when you buy Ethereum.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.