Your one-stop page for everything Bitcoin

Think of this page as your personal Bitcoin manual. It breaks down what Bitcoin is, why people can’t stop talking about it, how to buy it, keep it safe, and an analysis of what might happen to it in the future.

Use the handy navigation below to jump straight to the sections you find most interesting or just start from the top and soak it all in. Either way, we recommend bookmarking this page. Chances are you’ll want to come back here the next time Bitcoin makes the headlines (which is probably tomorrow).

1. Understanding Bitcoin

What is Bitcoin?

Bitcoin is a decentralized digital currency that allows peer-to-peer transactions without banks or governments. It runs on the blockchain, which is a public ledger that records and verifies transactions.

Blockchain technology

Think of it as a chain of blocks. Each block contains transaction data and links to the previous one. This sharing and linking across a global network keeps Bitcoin secure and tamper-proof.

Where does Bitcoin come from?

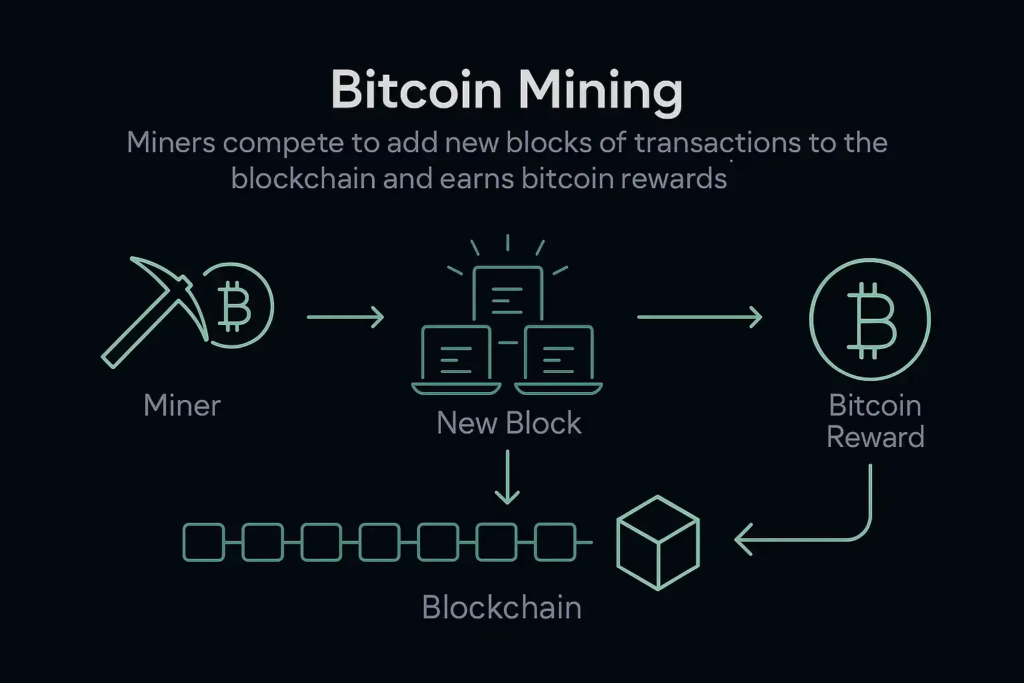

Bitcoin doesn’t come from a printing press or a central bank. It’s created through a process called mining. Mining is when computers all over the world race to solve complex math puzzles that also happen to secure the Bitcoin network.

When a miner’s computer solves the right answer, it gets to add a new block of transactions to the blockchain, and earns freshly minted Bitcoin as a reward. This is how new Bitcoin enters the circulation.

How Bitcoin transactions work

When you send Bitcoin, your transaction travels across a global network of computers called nodes. These nodes use cryptography to check that you actually have the Bitcoin you’re trying to send and that you haven’t already spent it somewhere else.

Once enough nodes agree that your transaction is valid, it gets bundled into a block and permanently added to the blockchain. At that point, it’s locked in — transactions can’t be reversed or edited. That’s why it’s so important to always double-check the address and the amount before hitting send. In Bitcoin, there are no “oops, can I cancel that?” moments.

Bitcoin supply and halving

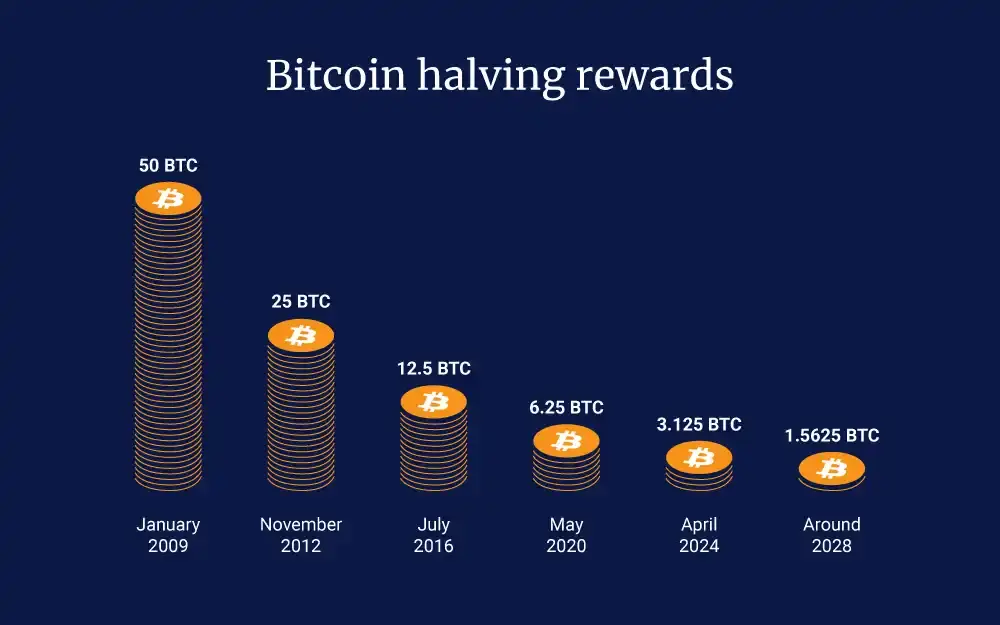

Bitcoin has a hard cap of 21 million coins. This limit is built right into its code, making it impossible to create more out of thin air like governments can with paper money.

To control how quickly new Bitcoin enters circulation, the network follows a schedule. About every four years the reward miners get for adding a new block gets cut in half. This event is called a halving.

The most recent halving happened on April 2024, reducing the reward from 6.25 BTC to just 3.125 BTC per block. These halvings will continue until around the year 2140, when the last tiny fraction of Bitcoin is mined. This steady drop in new supply is a big reason why people call Bitcoin “digital gold.”

2. Benefits of Bitcoin

If you have not already made a conclusion for yourself how Bitcoin might be useful to you, we’ve outlined the main advantages below.

Why do people invest in Bitcoin?

- Protect against inflation: When the prices of things like groceries and rent keep rising, the money in your bank account slowly loses value. Many people buy Bitcoin with the idea that it will grow in value over time rather than depreciate.

- Potential for high returns: Bitcoin’s price swings wildly. That’s risky, but it’s also why some people see it as a chance to make significant profits.

- Be their own bank: Bitcoin isn’t controlled by any government or central bank. People like knowing they can store and move their money without needing permission from anyone.

👉 Get the full picture: Why Should You Buy Bitcoin?

Advantages over traditional currencies

Besides having an appeal to independence, here are some more advantages over fiat currency!

- Send money anywhere anytime: Bitcoin doesn’t care about borders. You can send it to someone on the other side of the world just as easily as to your neighbor.

- Often cheaper for big transfers: Especially for moving large sums internationally, Bitcoin can skip hefty bank fees.

- No surprise rule changes: Your Bitcoin isn’t tied to decisions by politicians or central banks that might print more money or change interest rates.

Economic significance of Bitcoin

Bitcoin gives people a way to move and store wealth outside the usual financial system. It’s also changed how people think about money. Before Bitcoin, you needed banks, SWIFT credit card networks, and whole stacks of paperwork to send money across the globe.

Now anyone with a smartphone can do it themselves, with no middleman. That shift is already forcing the old financial systems to adapt, and it could keep transforming how we save, pay, and invest.

3. How to Buy Bitcoin

Back to 2009 and as early as 2016, the early users of Bitcoin were considered mavericks and pioneers. Today, it’s become so common that some countries even use it alongside their national money. In places with extreme inflation, like El Salvador, many people actually prefer using Bitcoin over their local currency.

Step-by-step guide for beginners

The basic steps for buying Bitcoin are almost the same no matter which platform you use. Here’s how it usually goes:

- You pick a platform. Choose a reputable exchange or broker. Look for strong security, good reviews, and clear fees.

- Create and verify your account. Sign up and complete any ID checks. Most platforms need a photo ID to meet local regulations.

- Add funds. Link your bank account or card, or make a transfer to load money into your account.

- Buy your Bitcoin. Enter how much you want to buy and place your order. You can start with a tiny amount, you don’t need to buy a whole Bitcoin, usually just fractions (0.0000082 BTC = 100 USD).

- Move it to your own wallet. For long-term safety, transfer your Bitcoin off the platform and into a wallet you control. This protects you if the exchange ever gets hacked or freezes accounts.

👉 Read More: How to Buy Bitcoin

👉 Read More: How to Buy Bitcoin Anonymously

Where to buy Bitcoin

At this point, you may be thinking about where do you actually go to buy some Bitcoin? There are plenty of places online that promise easy crypto purchases, but not all of them are safe or reliable. Below are the two most secure and widely used options:

- Exchanges: Like Binance and Coinbase let you trade directly with other buyers and sellers.

- Brokers: Brokers make things simpler. They handle the buying for you at the price you set.

Methods of payment

Most platforms give you a few ways to pay:

- Bank transfer: Often lower fees, though it can take a bit longer.

- Credit or debit cards: Much faster, sometimes costs more.

- Cash: Bitcoin ATMs and peer-to-peer sellers let you pay in cash, adding a layer of privacy.

Common mistakes and how to avoid them

- Falling for scams. Always be on the lookout for scams. Only use well-known platforms. Be suspicious of anyone promising guaranteed returns or asking you to send crypto upfront.

- Leaving your Bitcoin on exchanges. Exchanges can get hacked or freeze accounts. Always move large amounts to your own wallet.

- Ignoring fees. Consider the following: payment processing, trading fees, and blockchain transaction costs, all these small charges can add up. Always check the fee structure before buying.

👉 Don’t fall for this: Common Mistakes When Buying BTC

Ready to get started?

Buying Bitcoin is easier than you think, and some platforms are better than others.

Check out vTrader today. They are a trusted, beginner-friendly platform where you can buy Bitcoin in just a few clicks. It’s fast, secure, and designed to make your first (or next) Bitcoin purchase simple.

4. Storing and Securing Bitcoin

Importance of Bitcoin security

Unlike a bank account that’s protected by laws and insurance, the security of your Bitcoin is completely up to you. If you lose your private keys or they get stolen, there’s no customer support line to call, your Bitcoin is gone forever.

Types of Wallets

| Type of Wallet | Description |

|---|---|

| Hot wallets | Online, easy to access, but more exposed to hacks. |

| Cold storage | Offline, best for large amounts, safest from online threats. |

How to keep your Bitcoin safe

The best practices regarding keeping Bitcoin safe are so simple, yet they are often ignored:

- Enable two-factor authentication on all your accounts.

- Use hardware cold wallets to keep your private keys offline and out of reach of hackers.

- Never share your private keys or recovery phrases with anyone, ever.

Backup and recovery

Write down your seed phrase, that’s those 12 or 24 secret words that unlock your Bitcoin wallet. Keep several copies in safe, separate places. Avoid storing it only on your phone or computer where it could be hacked or lost. A fireproof safe, a secure drawer at a family member’s house, or a safe deposit box are all smart options.

If you ever lose your wallet or hardware device, this seed phrase is your lifeline to recover your Bitcoin. Without it, your funds are gone for good.

👉 Get the full picture: How to Store Bitcoin Safely

5. Understanding Bitcoin Fees

What are Bitcoin transaction fees?

Whenever you send Bitcoin, you pay a small fee. This fee goes to the miners who process and confirm your transaction. The higher the fee you pay, the quicker miners will pick it up.

How are fees calculated?

Bitcoin fees aren’t based on how much money you’re sending, but on how much space your transaction takes up on the blockchain. That means it’s measured in data size (bytes), not dollars. A simple transaction costs less, while a more complex one with lots of inputs or outputs will cost more.

Strategies to minimize fees

Bitcoin fees can fluctuate a lot depending on how busy the network is. Here are smart ways to keep your costs down:

- Transact during off-peak times. Fees spike when lots of people are using the network, like during big market moves or news events. If your transaction isn’t urgent, try sending it early in the morning or on weekends when the mempool (the queue of unconfirmed transactions) is less crowded.

- Use SegWit-compatible addresses. SegWit (short for Segregated Witness) is a Bitcoin upgrade that makes transactions smaller in data size, so they cost less to process. Most modern wallets support SegWit. They use addresses that start with “3” or “bc1.”

- Batch your transactions. If you regularly move Bitcoin, combining several payments into one transaction reduces total fees by spreading them over multiple recipients. This is more advanced, but many businesses do it.

- Double-check transaction settings. Some wallets let you choose your fee manually. Picking a “low” or “economy” option saves money if you’re okay waiting a bit longer for confirmation.

👉 Read More: Guide to BTC Fees

6. Selling Bitcoin

How to sell Bitcoin

- Send Bitcoin to exchange – If your Bitcoin is stored in a personal wallet (like a hardware wallet or a mobile app), you’ll first need to transfer it to an exchange where you can sell it. This means generating a Bitcoin deposit address from your exchange account, then sending your Bitcoin there.

- Place sell order – Once your Bitcoin arrives on the exchange, you can place a sell order. Most exchanges offer two main ways to do this:Market order (You sell your Bitcoin immediately at the current best available price) or Limit order (You set the exact price at which you want to sell).

- Withdraw fiat to bank – After your Bitcoin is sold, you’ll have a balance in your exchange account in your chosen fiat currency (like USD, EUR, or AED). From there, you can withdraw it to your linked bank account.

Be aware that banks and exchanges sometimes have extra fees or take a couple of days to complete the transfer. Also, depending on where you live, your bank might ask questions about the source of the funds, especially for large withdrawals.

👉 Read more: How to Sell Bitcoin

Tax implications

In most countries, when you sell Bitcoin for more than you paid, the profit is considered a capital gain, and you’ll owe tax on it. The rules vary by country, some tax crypto like property, others like stocks.

That’s why it’s crucial to keep detailed records of when you bought your Bitcoin, how much you paid, and when you sold it. This makes it much easier to report accurately and avoid problems if the tax authorities ever ask you for proof.

Trading strategies for timing sales

- Watch market trends. Is Bitcoin on a trend going up with strong buying momentum, or is it falling? Many traders aim to sell into strength, meaning they look to sell when prices are rising and optimism is high, also avoid panic selling during dips.

- Use limit orders to target your preferred price. A limit order lets you choose the exact price at which you want to sell. Instead of constantly checking the screen, you just set your target and let the platform handle the rest.

- Use the 50-day & 200-day moving averages. These are classic signals that are still used by banks and traders. Sell partial positions on a crossover from top to bottom (50 SMA drops below the 200 SMA). Hold when the price stays above both.

7. Bitcoin Price and Volatility

Factors influencing Bitcoin price

- Supply and demand: Bitcoin’s fixed supply (capped at 21 million) means price moves mainly on how many people want to buy versus sell at any moment. When demand spikes (like after bullish news), price climbs fast.

- Regulatory news: Announcements from governments about crypto laws, taxes, or bans can cause sharp moves. Positive regulation often drives prices up, while threats of crackdowns tend to start sell-offs.

- Market sentiment: Headlines, social media hype, and general investor mood have an impact as well. General greed pushes prices up in rallies, fear drives panic selling during downturns.

Understanding volatility

Bitcoin is famously volatile. It’s not unusual to see 10% price swings in a single day. That can mean rapid gains and sudden drops. Always be mentally and financially prepared for a big move.

Bonus strategies for managing volatility

Beyond just holding on and hoping for the best, there are practical ways to ride out the ups and downs with more confidence. Here are a few proven strategies that experienced investors use to keep risk under control and protect their gains

- Dollar-cost averaging – regularly buying a fixed amount of Bitcoin no matter what the price is, which helps smooth out your average cost over time and reduces the risk of buying everything at a peak.

- Diversify your portfolio – this is why a broker is slightly better than an exchange, you have wider access to asset classes.

- Use stop-loss orders – with the help of technical analysis, chart patterns can be used to limit losses and exit trades that move against you.

👉 Read more: Understanding BTC volatility

8. Common Bitcoin Myths and Misconceptions

Debunking myths

| Myth | Reality |

|---|---|

| Bitcoin is anonymous | No, it’s pseudonymous. Transactions are traceable. |

| It has no intrinsic value | Depends on perspective. Scarcity plus demand creates value. |

| Bitcoin is used only by criminals | Not true, it’s not used by criminals any more than cash. |

| Mining uses too much energy | Mining does use energy, but often relies on renewables. |

👉 Didn’t think you’d be wrong? More Bitcoin Myths

9. The Future of Bitcoin

Potential future developments

Bitcoin’s future is likely to involve even deeper ties with traditional finance. Big institutions continue adding Bitcoin to their balance sheets, which supports demand and brings more legitimacy to the space.

We’re already seeing this play out with Bitcoin ETFs (exchange-traded funds), which are now available in several countries, including the United States. These ETFs let everyday investors buy shares tied to Bitcoin right through their regular brokerage accounts, no wallets or private keys needed.

As the market matures, expect to see more crypto-focused funds, new financial products, and broader access through other mainstream investment vehicles.

Regulatory outlook

At the same time, governments around the world are stepping up oversight. Stricter rules around taxation, anti-money laundering, and how exchanges operate are almost guaranteed. In the long run, these clearer rules could actually make Bitcoin safer and more trusted, encouraging even more people and businesses to get involved.

👉 Explore more: Bitcoin Outlook

Ready to take the next step?

If you’ve read this far, you’re already ahead of most people. Now’s the perfect time to turn what you’ve learned into action.

vTrader makes it simple and secure to start trading Bitcoin , whether you’re buying your first fraction or managing a larger portfolio. With an easy interface and strong safety features, it’s built for both beginners and experienced investors.

Frequently Asked Questions

What exactly is Bitcoin?

Bitcoin is a digital currency that works without banks or governments. It runs on a global network of computers that record every transaction on a public ledger called the blockchain.

Can Bitcoin be converted to cash?

Yes. You can sell Bitcoin on exchanges or through brokers and withdraw the money straight to your bank account. You can also use Bitcoin ATMs in many countries to get cash.

What determines the price of Bitcoin?

Mainly supply and demand. Bitcoin has a fixed maximum supply of 21 million, so as more people want it, the price generally goes up. It’s also heavily influenced by investor sentiment, news, regulations, and big moves by institutional players.

Is Bitcoin mining legal?

In most countries, yes. But some places have banned or restricted it due to concerns over energy use or financial controls. Always check the rules in your country before setting up mining equipment.

Am I too late for Bitcoin?

Not necessarily. While early investors saw huge gains, many believe Bitcoin is still in the early stages of broader adoption. It’s volatile, so smart investors usually take a long-term view.

Is investing in Bitcoin risky?

Yes. Bitcoin’s price can swing dramatically in short periods. That’s why it’s best to treat it as a high-risk asset and diversify your investments.

How many people own Bitcoin?

It’s estimated that over 100 million people worldwide hold some Bitcoin, from tiny amounts in mobile apps to large institutional holdings. The number continues to grow as it becomes easier to buy and store.

Can Bitcoin be hacked?

The Bitcoin network itself has never been hacked. But individuals can lose their Bitcoin through phishing, exchange hacks, or by mishandling private keys. That’s why using secure wallets and practicing good security habits is so important.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.