The cryptocurrency market is buzzing with activity this September, reflecting a mix of investor apprehension and strategic advancements. With Ethereum ETFs witnessing significant outflows and new trading opportunities emerging, the industry finds itself at a fascinating crossroads.

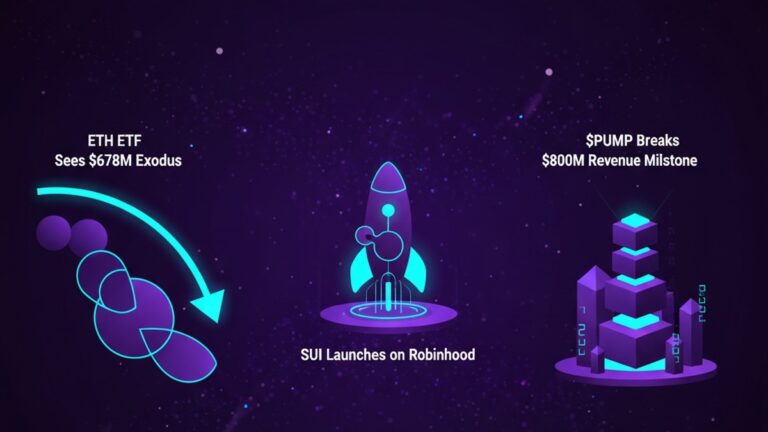

Ethereum ETF Outflows: A $678 Million Shift

In the past three days, Ethereum exchange-traded funds (ETFs) have seen a staggering $678 million in outflows. This sudden movement has raised eyebrows in the crypto community, with analysts speculating about potential causes. Some attribute this trend to the broader economic environment, as investors brace for the Federal Reserve’s upcoming minutes, which could signal interest rate changes. Others point to technical adjustments within the market, suggesting that these outflows might be temporary.

Despite this, many remain optimistic about Ethereum’s long-term prospects. “Ethereum has a robust ecosystem,” says crypto analyst Jenna Lee. “While these outflows are noteworthy, they’re not indicative of the network’s overall health or future capabilities.” Indeed, Ethereum continues to innovate, with its transition to a proof-of-stake model gaining traction and further enhancing its appeal as a sustainable and scalable solution.

Bitcoin and Market Dynamics

Bitcoin hasn’t been immune to market fluctuations either. A recent $400 billion drain from the reverse-repo market has been linked to Bitcoin’s price dip, signaling how traditional financial mechanisms can impact digital currencies. Strategy stocks tied to Bitcoin have also hit four-month lows following recent purchases, illustrating the volatile nature of crypto investments.

Interestingly, 2025 has seen Decentralized Autonomous Trusts (DATs) surpass venture capital funding, marking a pivotal shift in how projects secure financial backing. This evolution highlights a growing preference for decentralized and community-driven funding mechanisms, aligning with the core tenets of blockchain technology.

SUI Trading Now Live on Robinhood

In a move that’s likely to invigorate retail investors, SUI trading has gone live on Robinhood. The platform, known for its user-friendly interface and commission-free trades, is set to offer millions of users access to SUI tokens. This development could foster increased participation from individual investors, further democratizing access to cryptocurrency markets.

Robinhood’s decision underscores its commitment to expanding its crypto offerings, catering to the burgeoning interest in digital assets. As more users embrace these technologies, platforms like Robinhood play a crucial role in bridging the gap between traditional finance and the digital frontier.

Stablecoins: The Future of Finance?

Wyoming has made headlines as the first state to launch a state-backed stablecoin. This innovative move could pave the way for other states to follow suit, blending the stability of fiat currencies with the flexibility of digital assets. Financial expert William Bessent is betting on stablecoins to meet growing debt demand, suggesting they could become a cornerstone of financial transactions in the near future.

Stablecoins have also found favor in corporate circles, with Bullish settling its $1.15 billion IPO using this digital currency class. This development signals a broader acceptance of stablecoins in high-stakes financial dealings, potentially redefining how companies approach capital raising.

Industry Developments and Future Prospects

Elsewhere in the crypto sphere, ALT5 Sigma, allegedly tied to former President Trump, has denied rumors of an SEC probe, highlighting the tightrope companies walk in maintaining regulatory compliance. Meanwhile, SoFi is set to integrate Bitcoin’s Lightning Network for payments, promising faster and cheaper transactions for its users.

Anthony Scaramucci’s plans to tokenize real-world assets on the Avalanche network demonstrate the expanding use cases for blockchain technology, while political figure Bo Hines’ decision to join Tether marks another intriguing crossover between politics and cryptocurrency.

As the market navigates these dynamic shifts, the future of cryptocurrency remains both uncertain and promising. While challenges like regulatory scrutiny and economic pressures persist, innovation continues to drive the industry forward. Whether it’s through new trading platforms, the rise of stablecoins, or the increasing tokenization of assets, the crypto landscape is evolving at an unprecedented pace.

In this ever-changing environment, investors and enthusiasts alike must stay informed and agile, balancing optimism with caution. As we look ahead, one thing is clear: the world of cryptocurrency is here to stay, and its impact on global finance is only just beginning.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.