Why Dollar Cost Averaging Is Your Crypto Investment Superpower

Think of dollar cost averaging (DCA) as your calm, cool, and collected crypto investing buddy. This friend isn't swayed by market hype or panicked by dips. They just steadily build their portfolio, like enjoying a daily cup of coffee – no need to overthink the "perfect" brew, just consistent enjoyment. This section dives into why DCA can be the key to building lasting crypto wealth.

DCA takes the guesswork out of timing the crypto market. Instead of trying to predict the unpredictable peaks and valleys of Bitcoin, you invest a set amount at regular intervals. This helps smooth out the price swings common in crypto, reducing the risk of buying high and selling low. For more on smart investing, check out the typethink blog.

Understanding the Power of Averaging

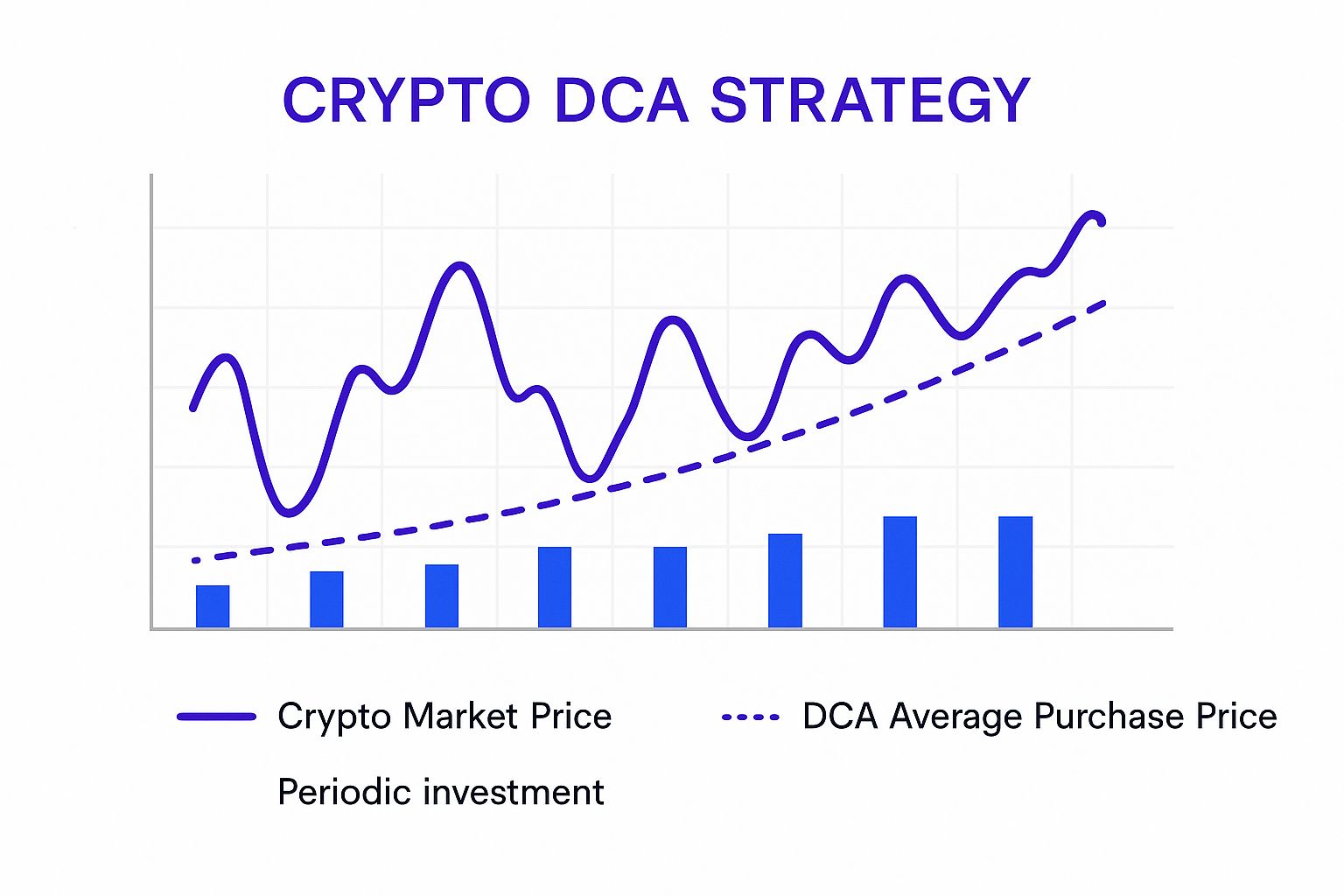

The heart of DCA is all about averaging. Imagine investing $100 in Bitcoin every week. Some weeks, Bitcoin's price is down, so your $100 buys you more. Other weeks, the price is up, and you get less Bitcoin for your money. Over time, your average purchase price balances out the market's ups and downs. This strategy is especially valuable in volatile markets. Here’s a helpful visual from dcabtc.com:

As you can see, consistent investments over time create an average cost that often beats trying to time the market perfectly. It demonstrates how you can potentially achieve long-term gains even with short-term price fluctuations.

The Emotional Advantage of DCA

DCA also offers a crucial psychological benefit. It helps you avoid emotional investing, a trap many investors fall into. When markets crash, fear can trigger panic selling. During market booms, greed can tempt you to buy at inflated prices. DCA helps remove these emotional responses by automating your investments. This consistency builds discipline and prevents impulsive decisions that can hurt your portfolio.

Long-Term Gains vs. Short-Term Volatility

DCA is a long-term game. It's not about quick wins but about steadily growing your wealth over time. While some traders try to beat the market through active trading, their success isn't guaranteed. Consistent DCA investors, however, often see impressive long-term results. Want a practical guide on using DCA with Bitcoin? Check out our guide on How to Buy Bitcoin: The DCA Strategy. This method requires patience and a focus on the bigger picture, but the potential payoff is significant.

The Mental Game: How Psychology Makes Or Breaks Your Strategy

The biggest hurdle to successful dollar-cost averaging (DCA) in crypto isn't the market's ups and downs, but ourselves. Our brains are hardwired to react emotionally to price swings, often leading us to make less-than-ideal choices. Think about it: when prices explode upwards, FOMO (fear of missing out) takes over, pushing us to buy high. And when the market crashes? Panic sets in, tempting us to sell low.

These emotional responses are fueled by what psychologists call cognitive biases – mental shortcuts our brains use that often lead us astray.

For example, confirmation bias makes us look for information that backs up what we already believe, even if those beliefs are wrong. Imagine you’re convinced a certain crypto is headed “to the moon.” You might unconsciously ignore red flags and focus only on the good news. Crypto Trading for Beginners: Trading Psychology offers some great insights on this topic. This can lead to buying at inflated prices, right before a market correction.

DCA as Your Psychological Armor

Dollar-cost averaging is like a shield against these destructive tendencies. By automating your investments, you resist the urge to react emotionally to market changes. DCA enforces discipline, ensuring you buy consistently, no matter what the price is doing.

Bitcoin's price, historically, has been a rollercoaster. But DCA strategies have proven helpful in managing this risk. Let's say you started a DCA plan during Bitcoin’s peak in 2017, when it almost hit $20,000. If you’d continued through the following downturn to around $3,000 in 2018, your average cost per Bitcoin would have been much lower than if you’d invested a lump sum at the peak. DCA and Bitcoin's volatility explains this in more detail. This steady approach builds resilience and helps you stick to your long-term plan.

Mastering Your Mindset

Beyond automation, successful DCA in crypto means developing the right mindset. This involves cultivating mental toughness to ride out market storms and avoid getting caught up in the hype.

One key strategy is to focus on the long-term potential of your investments, not short-term price action. Remember why you invested in the first place, and trust the fundamental value of the projects you believe in. This long-term vision helps you stay the course, even when the market feels chaotic.

It’s also important to celebrate the small victories. Acknowledge your progress and the discipline you've maintained, especially during tough times. This positive reinforcement builds confidence and strengthens your commitment to your DCA strategy.

What The Numbers Actually Reveal About DCA Performance

The infographic above gives us a visual representation of how market price swings, your average purchase price using Dollar-Cost Averaging (DCA), and your regular investment amounts all relate to one another. Notice how the DCA line smooths out the purchase price, even as the market price bounces around. This creates a more stable and predictable investment experience.

Dollar-cost averaging has become increasingly popular in the crypto world. But what does its track record actually tell us? Let’s dive into how DCA has performed through different market conditions – the good times and the bad.

For example, think back to the 2018 crypto winter. Bitcoin's price plummeted. Those who stuck with their weekly DCA strategy were buying Bitcoin at significant discounts. This put them in a prime position to benefit when the market inevitably recovered.

On the flip side, during the 2021 bull run, DCA investors saw consistent gains. While they might not have caught the absolute peak returns of some fortunate lump-sum investors, they still benefited from the upward trend.

DCA During Market Volatility

The periods between those market extremes really demonstrate the resilience of DCA. In volatile markets, DCA helps you avoid the common pitfall of buying high and selling low.

Imagine this: Investor A puts a lump sum into Bitcoin at the peak of the market. Investor B uses DCA. When the market corrects, Investor A takes a big immediate hit. Investor B, however, continues to buy at the lower prices, effectively lowering their average cost. This shows how DCA can act as a cushion during market turbulence.

Dollar-cost averaging has shown real promise in the crypto space. A recent analysis by Bitcoin Magazine Pro found that investing just $10 weekly in Bitcoin over five years could have generated a 202% return, surpassing traditional assets. Discover more insights. This steady approach can be especially helpful in the often-volatile world of crypto.

Opportunity Costs and Risk Tolerance

Now, DCA isn’t a perfect solution. It’s important to be aware of the opportunity cost. In a consistently rising market, DCA might not perform as well as investing a lump sum. If the price only goes up, buying everything at once would result in bigger profits.

This is where understanding your risk tolerance is crucial. DCA is best for those who prioritize minimizing risk over potentially maximizing gains. Maintaining a strong mindset is essential for long-term success with DCA, so explore strategies for building mental toughness.

Analyzing DCA Frequencies and Amounts

Finally, the success of a DCA strategy depends on factors like how often you invest and how much you invest. Investing weekly might offer smoother averaging than investing monthly, but it also means more transaction fees. Smaller, frequent investments can lead to different outcomes compared to larger, less frequent ones.

Understanding these details is key to fine-tuning your DCA strategy. By thinking carefully about these variables and aligning them with your own financial goals, you can use DCA effectively to navigate the complexities of the crypto market.

Let's take a look at some historical data to illustrate the potential differences in returns:

The table below illustrates historical returns comparing weekly DCA investments versus lump-sum investments across various crypto market cycles. It highlights how DCA can offer a more consistent return profile compared to the potential highs and lows of lump-sum investing.

| Time Period | DCA Weekly Return | Lump Sum Peak Return | Lump Sum Trough Return | DCA Advantage |

|---|---|---|---|---|

| 2018 Bear Market | 5% | -50% | -70% | Significant Protection from Losses |

| 2020-2021 Bull Market | 150% | 300% | 50% | Reduced Volatility, Consistent Gains |

| 2022 Bear Market | -10% | -20% | -60% | Mitigated Losses |

As you can see, DCA can offer more stable returns and downside protection, especially during periods of high market volatility. While lump-sum investing offers the possibility of higher returns, it also carries significantly higher risk.

Building Your Custom DCA Strategy That Actually Works

Creating a successful dollar-cost averaging (DCA) strategy for crypto isn't about finding a magic formula. It's more like tailoring a workout plan – you wouldn't use the same routine as a marathon runner if you're just starting to jog. This section will help you build a DCA strategy that fits your individual needs.

Aligning Your DCA With Your Financial Reality

First, take an honest look at your finances. Is your income steady or does it fluctuate? This affects how much you can realistically invest. Your investment timeframe matters too. Are you in it for the long haul, like retirement, or are you aiming for quicker gains? A longer timeframe helps you weather market ups and downs. Finally, think about your risk tolerance. Can you handle big price swings or do you prefer a smoother ride? A lower risk tolerance might mean smaller, more frequent investments.

Advanced DCA Techniques

Regular weekly purchases are a solid foundation for crypto DCA. But exploring more advanced techniques can add a powerful edge. Consider adjusting your investment amounts based on market conditions. If the market dips significantly, you might boost your investment to grab some bargains. When prices are skyrocketing, you might slightly reduce it to avoid buying at a premium.

Diversification is also essential. Don't put all your crypto eggs in one basket. Spread your DCA across different cryptocurrencies. This manages your risk and potentially unlocks more growth opportunities. And don't forget the bigger picture: how does your crypto DCA strategy fit into your overall investment portfolio? Make sure it aligns with your broader financial goals.

For a wider look at crypto investing strategies, check out our guide.

Looking at Bitcoin's history highlights the power of DCA. Over the last five years, its price has exploded by over 1,000%. But that growth has come with some wild rides. Discover more insights on Bitcoin's historical performance. By consistently investing a set amount, you ride the long-term upward trend without getting caught up in the short-term swings.

Practical Considerations for Success

The success of your crypto DCA strategy depends on some practical choices. How often you buy makes a difference. Weekly investments smooth out your average cost, but they also mean more transaction fees. Monthly might be better if your income isn't regular. The platform you choose matters too. Look for platforms like vTrader with low fees, strong security, and easy-to-use tools for automated buying.

Adapting Your Strategy Over Time

Life changes, and your DCA strategy should be able to change with it. What about taxes as your crypto holdings grow? How will you adjust if your income changes? Knowing when and how to tweak your approach is crucial. But remember, the core of DCA is consistency and discipline. These should stay the same, even as you adjust the finer points of your plan. By thoughtfully tackling these questions, you can build a strong, adaptable DCA strategy ready for the ever-shifting world of cryptocurrency.

Platform Selection And Setup: Your Implementation Toolkit

Choosing the right platform is essential for a smooth dollar-cost averaging (DCA) experience in crypto. This guide walks you through setting up your strategy, from picking a platform to automating your buys.

Evaluating Your Options

Let's explore popular exchanges and dedicated DCA platforms. We'll look beyond just fees and features, focusing on reliability, security, and how easy they are to use, especially when the market gets bumpy. Some platforms offer helpful tools like automated portfolio rebalancing, which keeps your crypto holdings balanced according to your target allocation. Others have smart stop-loss integration, automatically selling if the price drops too low. Tax optimization tools can also be a lifesaver, simplifying the often-dreaded tax reporting process.

Setting Up Automation

We'll use step-by-step guides and real user experiences to show you how to automate your system while staying flexible enough to adapt when needed.

- Choose a Platform: Research exchanges like Coinbase, Kraken, and Binance, as well as specialized DCA platforms like Swan Bitcoin. Compare their features, fees, and security. For mobile users, check out our guide on Best Mobile Trading Apps.

- Define Your DCA Parameters: Decide how much you'll invest, how often (weekly, bi-weekly, monthly), and which cryptocurrencies you'll buy.

- Set Up Recurring Purchases: Most platforms offer automated recurring buys. Make sure this feature is reliable and matches your chosen frequency.

- Security Measures: Protect your account with two-factor authentication and strong passwords. Think of it like locking your front door and setting the alarm.

Coinbase Example

Here's a peek at the Coinbase interface:

Coinbase's clean layout is beginner-friendly. The clear buy/sell buttons and prominent price displays make it easy to navigate. Setting up recurring buys for your DCA strategy is straightforward thanks to the intuitive design.

Troubleshooting and Adapting

We'll also cover common issues. Imagine setting up automatic buys, only to have your bank decline a transaction because of insufficient funds. This throws your DCA schedule off track. We'll offer solutions for these scenarios and discuss how to stick with your DCA approach during market extremes or unexpected financial hiccups.

Maximizing Your DCA Results

Some platforms offer advanced features to boost your results. Automatic portfolio rebalancing helps maintain your desired asset mix, preventing one cryptocurrency from taking over. Smart stop-loss integration acts as a safety net, automatically selling if the price drops below a certain point. Tax optimization tools can automate parts of the tedious crypto tax reporting process. These features can add real value to your DCA strategy, potentially making it more efficient and profitable.

To help you compare different platforms, we've put together a table summarizing key features and considerations:

DCA Platform Feature Comparison: This table compares major platforms offering DCA functionality, including fees, features, and security measures.

| Platform | DCA Frequency Options | Supported Coins | Fees | Security Features | Automation Level |

|---|---|---|---|---|---|

| Coinbase | Daily, Weekly, Bi-Weekly, Monthly | BTC, ETH, LTC, and many more | Varies by transaction size | 2FA, Whitelisting | High |

| Kraken | Weekly, Bi-Weekly, Monthly | BTC, ETH, XRP, and many more | Varies by transaction size | 2FA, API Key Permissions | High |

| Binance | Daily, Weekly, Bi-Weekly, Monthly | Wide range of cryptocurrencies | Varies by transaction size and VIP level | 2FA, Anti-phishing code | High |

| Swan Bitcoin | Daily, Weekly | BTC only | Varies by plan | 2FA, Cold Storage | High |

| (Add other platforms as needed) |

As you can see, different platforms offer varying levels of flexibility, security, and coin support. Consider your specific needs and risk tolerance when choosing.

By understanding these practical aspects, you can avoid frustration and build a reliable system that supports your long-term crypto DCA goals. This sets you up for consistent investing and minimizes emotional reactions that can often derail even the best plans. With the right tools and setup, your dollar-cost averaging strategy becomes a powerful engine for building wealth in the crypto space.

Avoiding The Pitfalls That Destroy DCA Success

Dollar-cost averaging (DCA) into crypto sounds simple enough, right? Set a schedule, stick to it, and watch your investment grow over time. But like navigating a winding mountain road, the journey can be full of unexpected turns. Let's explore some common mistakes that can throw your long-term crypto DCA success off course, drawing wisdom from seasoned investors who've weathered multiple market cycles.

Emotional Interruptions

Picture this: You've diligently followed your DCA plan for months, only to be confronted by a sudden market crash. Panic sets in. You sell everything, locking in losses and wiping out your hard-earned gains. This scenario highlights a major DCA pitfall: emotional reactions. Fear can lead to impulsive decisions, while the fear of missing out (FOMO) during bull markets can tempt you to stray from your plan and over-invest. Maintaining emotional discipline and sticking to your predetermined strategy is key to avoiding these costly mistakes. For more insights into common beginner pitfalls, check out: Crypto Trading for Beginners: Common Mistakes.

Over-Diversification and Platform Concentration

Diversification is generally seen as a good thing, like not putting all your eggs in one basket. But over-diversification in crypto can actually dilute your potential returns. Spreading your investments too thin might prevent you from fully benefiting from the growth of promising assets. On the flip side, concentrating your investments on a single platform exposes you to significant platform risk. Imagine if that platform suffers a security breach or faces regulatory issues – your entire portfolio could be jeopardized.

Risk Management Techniques

So, how can you navigate these potential hazards? One key strategy is to diversify across several reputable platforms. This spreads out the risk, protecting you from the potential downfall of any single platform. Just as important is maintaining a separate emergency fund. This safety net prevents you from having to dip into your DCA investments during unexpected financial hardships, allowing you to stay the course with your long-term strategy. If you're exploring opportunities in the crypto space, consider resources like Crypto Jobs for potential career paths.

Navigating Life Changes and Market Shifts

Life is full of surprises. Job losses, family emergencies, or major life changes can all impact your ability to stick to your DCA plan. It's wise to anticipate these uncertainties by having a clear plan for adjusting your DCA amounts or frequency if needed. Extended bear markets, periods of prolonged price decline, can test the patience of even the most seasoned investors. A predefined exit strategy for different market scenarios can help you avoid making rash decisions driven by fear and uncertainty. Finally, remember the technological risks inherent in cryptocurrency. Staying informed about security best practices, like using hardware wallets and strong passwords, is crucial for protecting your investments.

Learning From the Experiences of Others

One of the most valuable resources for avoiding pitfalls is the experience of others. By studying the journeys of long-term crypto investors, you can gain insights into the challenges you might encounter and effective strategies for overcoming them. These shared experiences offer practical guidance for navigating the complexities of dollar-cost averaging in crypto and maximizing your chances of long-term success. Understanding common mistakes and adopting proactive risk management will equip you to face the challenges ahead and strengthen your path toward achieving your crypto investment goals.

Your DCA Success Action Plan

Now, let's turn our discussion about dollar-cost averaging (DCA) into a practical plan you can use today. Think of this as your personal roadmap to successful crypto investing.

Getting Started: Laying the Foundation

Before we jump in, we need to set our coordinates. First, define your financial goals. What are you hoping to achieve? A down payment on a house? A comfortable retirement? Knowing your destination helps you map out the journey.

Knowing your goals also helps determine your investment timeline. Short-term goals require different strategies than long-term ones. This ties into how much you can comfortably invest, so assess that as well.

Finally, think about your risk tolerance. Are you comfortable with big price swings, or do you prefer a smoother ride? This will influence your investment choices and how often you make DCA purchases. Even $10-$25 a week is a great starting point.

Implementing Your Plan: Putting DCA into Action

With our foundation set, let's put the plan into motion. First, select a reputable platform. Look for security, low fees, an easy-to-use interface, and a good selection of cryptocurrencies. vTrader, for example, offers a secure and straightforward experience.

Next, automate your purchases if possible. Many platforms offer recurring buy options. This takes the emotion out of investing and keeps you consistent. If your platform doesn't offer this, set calendar reminders.

Finally, track your progress. A simple spreadsheet or a portfolio tracker can help you visualize your growth and stay motivated, especially during market dips.

Staying the Course: Long-Term Success With DCA

DCA is a long-term strategy. The key is discipline and patience. Tune out the daily market noise and focus on your long-term goals.

Remember to review your strategy periodically. Life changes, and your investment plan should adapt accordingly. A salary increase might mean you can invest more. Changing goals might require a different approach.

Don't forget to acknowledge your progress. Celebrate the discipline you've maintained, especially during tough market conditions. These small victories keep you motivated.

Making Informed Adjustments: Fine-Tuning Your Approach

Knowing when to adjust your DCA strategy is crucial. Market conditions can signal a need for change. During a significant price drop, you might increase your investment to buy at a lower price. Conversely, you might decrease it slightly during rapid price increases.

Life events also matter. A job change or unexpected expense might require temporarily reducing your DCA amount or frequency. The key is to make informed decisions, not emotional reactions. Stick to the core principles of DCA while adapting to your changing circumstances.

Ready to start your crypto journey with dollar-cost averaging? vTrader makes it easy to buy, sell, and hold crypto with zero commissions and advanced trading tools. Start building your future today! Get started with vTrader now!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.