To really diversify a crypto portfolio, you need to do more than just scoop up a bunch of different coins. It’s about being deliberate and strategic, spreading your capital across various types of digital assets. This approach helps soften the blow from market volatility, protocol meltdowns, or sudden news that sends prices tumbling, while still positioning you to catch gains across the entire Web3 ecosystem.

Why Portfolio Diversification Is Crucial in Crypto

We’ve all heard the old saying, "don't put all your eggs in one basket." In the crypto world, that advice isn't just a suggestion—it's a survival tactic. The market is notoriously volatile; a single tweet or a whiff of new regulation can cause wild price swings.

But the real risk goes much deeper than just price action.

Imagine pouring all your funds into tokens built on a single blockchain. If that network suddenly goes down or gets hit with a major security breach, the value of your portfolio could evaporate overnight. It wouldn't matter what the rest of the market was doing. This is exactly why smart diversification is more than just a defensive move—it's how you build a resilient, long-term position.

Beyond Simple Coin Collecting

A genuinely diversified portfolio has multiple layers of protection. Owning ten different meme coins isn't diversification; it's just concentrating all your risk in one of the most speculative corners of the market. You need to think bigger and spread your bets across fundamentally different categories.

A well-rounded portfolio might look something like this:

- Established "Blue Chips": Think Bitcoin (BTC) and Ethereum (ETH). These are the foundation of your portfolio, providing a degree of stability thanks to their massive market caps and deep network effects.

- Promising Altcoin Ecosystems: This means holding assets in innovative platforms like Solana or Cardano. It gives you exposure to different tech stacks and vibrant developer communities.

- Niche Sector Tokens: You'll also want to allocate a slice to emerging sectors like AI, DePIN (Decentralized Physical Infrastructure Networks), or GameFi to capture that bleeding-edge growth potential.

This layered strategy ensures that a slump in one area doesn't torpedo your entire portfolio. For example, if the DeFi market hits a rough patch, strong performance from your AI tokens could balance things out. Using a platform like vTrader is a game-changer here, as its real-time data and zero-fee trading let you build out these varied positions without getting eaten alive by fees.

I see this mistake all the time: people confuse collecting with diversifying. Owning 20 assets that do the same thing on the same blockchain isn’t a strategy—it's a concentrated bet on a single story. True diversification means spreading your money across unique use cases and ecosystems.

A Unique Asset Class for Modern Portfolios

The data doesn't lie. Statistical analysis has repeatedly shown that adding crypto to a traditional investment portfolio can seriously boost risk-adjusted returns. Fresh research from early 2025 confirms that digital assets act as a unique alternative asset class, showing low correlation to old-school stocks and bonds.

Why? Because different crypto assets serve entirely different purposes. Bitcoin is a digital monetary network. Aave is a DeFi lending protocol. Bittensor is a decentralized AI platform. They're all in their own lanes. You can read the full research about crypto in diversified portfolios to dig into the numbers yourself.

This low correlation is what makes crypto such a powerful tool for building a more robust, long-term investment strategy that can ride out market storms and jump on new opportunities.

Building Your Core with Crypto Blue Chips

Every seasoned investor knows that before you go chasing the next 100x moonshot, you need a rock-solid foundation. In the crypto world, that foundation is built with the “blue chips”—the established, high-liquidity giants like Bitcoin (BTC) and Ethereum (ETH).

Think of them as the bedrock of your entire crypto strategy. Their massive network effects, widespread adoption, and sheer market dominance give them a level of stability you just won’t find in newer, more speculative projects. This core is what will help you weather the inevitable market storms.

Why Bitcoin and Ethereum Are the Bedrock

Bitcoin and Ethereum haven't become the two titans of crypto by accident. They’ve earned their stripes through years of resilience and real-world utility. Bitcoin is largely viewed as digital gold, a store of value that many use as a hedge against inflation. Ethereum, on the other hand, is the engine of Web3, powering the vast majority of decentralized applications (dApps), from DeFi protocols to NFT marketplaces.

One of their most critical features is deep liquidity. This means you can buy or sell significant amounts without causing a massive price swing, which is a crucial safety net. By building your core positions with these two, you create a less volatile center of gravity for your portfolio. Using a platform like vTrader is especially smart here; its zero-fee trading lets you accumulate your core holdings over time without fees eating into your capital.

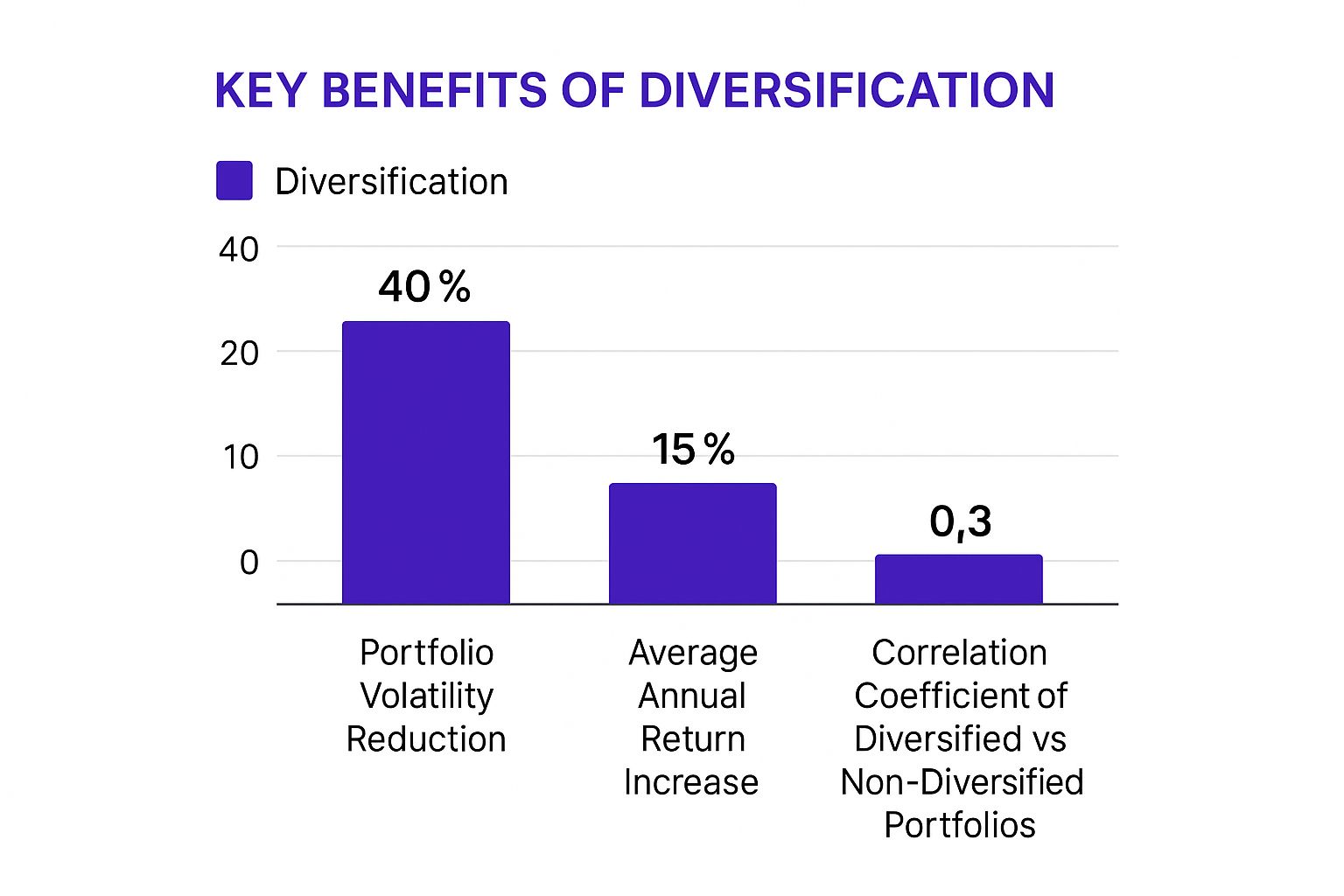

This chart drives home the point.

The numbers don't lie. A well-thought-out, diversified approach can dramatically lower your portfolio's volatility while often boosting your average returns. It’s a classic case of not putting all your eggs in one basket.

How Much Should You Allocate to Your Core?

So, what's the magic number for your core allocation? Honestly, it all comes down to your personal risk tolerance and what lets you sleep at night.

A well-accepted guideline for building a balanced portfolio is to allocate 60-70% to core assets like Bitcoin and Ethereum. This majority stake is designed to provide stability and capture steady, long-term growth.

With that foundation in place, you can then deploy the remaining 20-30% into promising altcoins and more speculative plays. This structure gives you a buffer against the wild swings the crypto market is famous for.

To give you a clearer picture, I've put together a few models based on different investor profiles.

Sample Core vs. Growth Allocation Models

This table shows how you might adjust your strategy based on how much risk you're comfortable taking. Notice how the balance shifts between the established players and more growth-oriented assets.

| Investor Profile | Core Allocation (BTC, ETH) | Growth Allocation (Altcoins) | Speculative Allocation (DeFi, NFTs) |

|---|---|---|---|

| Conservative | 75% | 20% | 5% |

| Balanced | 60% | 30% | 10% |

| Aggressive | 50% | 35% | 15% |

As you can see, there's no single "correct" answer. A conservative investor might push their core holdings up to 75% or even higher, focusing on preserving their capital. In contrast, a trader with a higher risk appetite might dial it back to 50% to free up funds for altcoins that could deliver explosive returns.

The goal is to find your personal sweet spot. Ready to lay your foundation? You can start by checking out how to buy Bitcoin on vTrader and begin building a strong, stable core for your crypto journey.

Expanding into Promising Altcoin Ecosystems

Once you've got your core positions in Bitcoin and Ethereum squared away, it’s time to look beyond the two giants. This is where the real fun begins and where you can diversify your crypto portfolio by tapping into the next wave of blockchain innovation. We're not talking about blindly chasing the latest hyped-up coin. This is about making strategic bets on different technological ecosystems.

Instead of putting all your eggs in one blockchain basket, smart money is spreading across multiple platforms like Solana, Cardano, and Polkadot. This strategy is gaining steam for a good reason: it protects you from platform-specific problems. Each chain brings something different to the table—be it faster transactions, cheaper fees, or unique smart contract capabilities. By diversifying, you're less exposed if one network gets bogged down or runs into protocol issues.

This isn't as simple as just buying more BTC, though. It requires a bit more legwork and a commitment to doing your own research (DYOR) to truly grasp what makes each project valuable.

How To Spot a Winning Altcoin

When you're ready to add altcoins, you need a solid game plan. Just following the noise on social media is a surefire way to get burned. You have to dig into the fundamentals to find projects with real staying power. This is where a platform like vTrader becomes your secret weapon, feeding you the real-time data you need to make intelligent moves.

Here's what I always look at before even considering an altcoin investment:

- What Problem Does It Solve? Does the project have a clear, compelling reason to exist? Is it fixing a real-world issue, or is it just tech for tech's sake? A solid project has a purpose that makes it stand out from the crowd.

- Tokenomics: You have to understand the economics of the token itself. What's the total supply? How is it distributed? Most importantly, what is its utility? A token needs a built-in reason to be in demand, beyond just speculation.

- The Team and Community: A strong, transparent, and experienced team is a massive green flag. Just as important is a vibrant, engaged community. It’s often a leading indicator of a project's health and its potential for widespread adoption.

One of the biggest mistakes I see is people treating all altcoins the same. Investing in a Layer-1 blockchain like Solana is a completely different ballgame than buying a DeFi governance token. You have to judge each on its own terms and where it fits in the market.

Turning Research into Action

Let's make this real. Say you're looking into Cardano (ADA). Your research would lead you to its unique EUTXO model, its academic, peer-reviewed approach to development, and the growing collection of dApps on its network. You’d then dig into its token distribution and staking rewards to get a feel for the economic incentives.

With that fundamental knowledge, you can jump onto vTrader and watch its price action, trading volume, and other metrics in real-time. This blend of deep research and live market data is how you make an educated decision. You can actually explore more about Cardano (ADA) on our platform right now to see how the data looks. This is the methodical process you use to build out your portfolio and capture some of the most exciting innovations happening in Web3.

Generating Passive Income with Staking and DeFi

A truly powerful way to diversify your crypto portfolio is to make your assets work for you. Don't just sit around waiting for prices to go up. You can generate a steady stream of passive income through strategies like staking and decentralized finance (DeFi), adding a completely new dimension to your portfolio—one that produces returns even when the market is moving sideways.

Think of it like earning dividends on your stocks, but for crypto. This income can then be reinvested, letting your holdings compound over time without you having to add a single dollar of new capital. It’s a serious wealth-building tool that turns your static assets into productive ones.

Putting Your Assets to Work with Staking

Staking is one of the most direct ways to start earning passive returns. Simply put, you "lock up" your holdings to help secure and validate transactions on a Proof-of-Stake (PoS) blockchain. The network then rewards you with more of that same crypto for helping out.

A perfect real-world example is staking Ethereum (ETH). By staking your ETH, you're contributing directly to the security and operation of the entire Ethereum network. For providing that service, you earn rewards, usually shown as an Annual Percentage Yield (APY).

Staking is essentially an agreement with the network. You provide security, and in return, the network gives you a yield. It aligns your financial incentives with the long-term health and success of the blockchain itself.

Thankfully, you don't need to be a tech wizard to do this. Integrated platforms like vTrader make the whole process incredibly simple. Instead of fumbling through complex technical steps, you can stake your assets right from your portfolio with just a few clicks. You can see which assets are available to put to work by exploring the current staking opportunities available on vTrader.

Exploring Yields in Decentralized Finance

If you’re looking for something more dynamic, DeFi takes passive income a step further, often offering higher-yield strategies. One of the most common methods is yield farming, where you provide liquidity to a decentralized exchange (DEX).

Here’s how that might look in a real scenario:

- Provide Liquidity: You deposit a pair of assets, like ETH and a stablecoin such as USDC, into a DEX liquidity pool.

- Earn Fees: In return, you get a cut of the trading fees every time someone swaps between those two tokens.

- Additional Rewards: Many DEXs will also reward you with their own governance token, giving your overall yield an extra boost.

While DeFi can deliver some impressive returns, it definitely comes with its own set of risks, like impermanent loss and smart contract vulnerabilities. The key is to start small, stick to reputable platforms, and never invest more than you're willing to lose.

By carefully adding staking and DeFi to your strategy, you’re not just holding a diverse set of assets; you’re building a multi-faceted financial engine designed for long-term growth.

Advanced Diversification with Niche Crypto Sectors

So you've built a solid core and have your feelers out in the major altcoin ecosystems. You're ready for the next frontier. True, sophisticated diversification isn't just about owning a bunch of different coins—it’s about strategically investing in the unique, emerging economic sectors bubbling up within crypto itself. This is how you stop just diversifying by asset and start diversifying by industry.

This next level is all about diversifying your crypto portfolio by homing in on specific narratives and use cases with serious growth potential. For the seasoned investor, this is where you gain a real edge, spotting trends before they hit the mainstream consciousness.

You're essentially trying to pinpoint the next wave of innovation before it crests. This is where platforms like vTrader become absolutely essential, giving you the advanced charting and real-time analytical tools you need to dig into these niche sectors and pick out the potential winners.

Exploring Emerging Crypto Narratives

To really elevate your portfolio, you've got to look at specific, high-growth categories. These sectors are distinct corners of the Web3 economy, each with its own drivers, community, and risk profile. By dedicating a small slice of your capital here, you get exposure to potentially explosive growth that often moves independently of the broader market.

Here are a few of the most compelling sectors I’m watching right now:

- AI Tokens: Projects like Bittensor (TAO) are leading the charge, creating decentralized networks for machine learning models. These tokens are the fuel for AI services on the blockchain, a narrative that has absolutely exploded in popularity.

- DePIN (Decentralized Physical Infrastructure Networks): This sector uses crypto to incentivize building out real-world infrastructure, from decentralized wireless networks to community-owned energy grids. It’s a powerful idea that bridges the gap between the digital and physical worlds.

- GameFi: It’s still speculative, no doubt, but blockchain-based gaming is constantly evolving. The tokens in this space power in-game economies, representing a massive potential market as gaming and digital ownership finally start to merge in a meaningful way.

Real-World Assets (RWAs) are another total game-changer. These are tokens representing actual ownership of tangible things like real estate or bonds. They offer a unique hedge against crypto's inherent volatility by bringing stable, off-chain value directly onto the blockchain.

Research and Analysis on vTrader

Spotting a promising project in these niche sectors takes a lot more than a quick glance at the market cap. You have to dive deep into the data, and that’s where having a powerful platform really shines. With vTrader’s advanced toolset, you can conduct the kind of thorough research needed to tell the high-potential gems from the short-lived hype.

Let's say you're sizing up an AI token. You can use the platform’s charting tools to analyze its on-chain volume and stack its performance against other AI projects. You can set custom alerts for major price moves or sudden spikes in trading activity, helping you nail your entry points.

This kind of granular analysis is absolutely critical when you venture beyond blue-chip assets into the complex, fast-moving world of niche crypto sectors. It’s the final layer that helps you build a truly resilient and forward-looking portfolio.

Common Questions on Crypto Portfolio Diversification

Even with a solid plan in hand, questions are bound to pop up once you start to diversify your crypto portfolio. The crypto market doesn't sleep, and knowing how to navigate common scenarios is the key to staying confident in your strategy. Let's tackle some of the most frequent questions I see from investors.

So, how many coins should you actually own? While there's no single magic number, I’ve found the sweet spot for most people is holding between 10 to 20 well-researched cryptocurrencies. This range gives you meaningful diversification without becoming completely overwhelming to manage.

Sticking to just three or four coins puts you in a risky spot. If one of those projects hits a wall, your entire portfolio feels the pain. On the flip side, owning 50 or more coins turns your strategy from smart investing into a collecting hobby—it’s just impossible to keep up.

The real goal here is quality and variety, not just racking up a huge number of coins. A strong mix usually includes mainstays like BTC and ETH, a few promising altcoins from different sectors (think DeFi, AI, or Gaming), and assets spread across several blockchains to sidestep platform-specific risk.

How Often Should I Rebalance?

Rebalancing is a non-negotiable part of keeping your portfolio aligned with your goals. The tricky part is deciding how often to do it. If you trade too much, you can get eaten alive by fees and tax events, but if you rebalance too little, your portfolio can get dangerously lopsided.

From my experience, two main approaches work best:

- Calendar-Based Rebalancing: This is the set-it-and-forget-it method. You simply review and adjust your holdings on a fixed schedule, like every quarter or twice a year. It’s a great way to instill discipline and stop you from making panicked, news-driven trades.

- Threshold-Based Rebalancing: This is a more active approach. You only jump in when one of your assets drifts from its target allocation by a specific amount—say, 5%. This ensures you’re responding directly to significant market shifts.

A platform like vTrader can make this a whole lot easier, with tools that can track your portfolio and even alert you when it's time to rebalance. It takes the guesswork out of the equation.

Are Stablecoins Necessary in My Portfolio?

While you don't have to own them, carving out a small slice for stablecoins—I usually suggest 5-10% of your total portfolio—is a very smart defensive play. Stablecoins like USDC are pegged to fiat currencies, offering a safe harbor right within the crypto ecosystem.

They serve two critical functions. First, they act as a shock absorber, cushioning your portfolio’s value during those gut-wrenching market downturns. Second, they're your "dry powder"—capital that’s ready to go, allowing you to scoop up other assets at a discount during a dip without having to sell off your long-term holds or rush to deposit new cash.

If you have more questions, the comprehensive vTrader FAQ section is a great resource for detailed info on trading, security, and managing your account.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.