Understanding the Foundation: What Coins and Tokens Really Are

To make informed decisions on platforms like vTrader, it's essential to understand the core difference between a coin and a token. While people often use these terms interchangeably, they refer to fundamentally different digital assets. Confusing the two is a common mistake for new investors and can lead to misguided portfolio strategies.

The primary distinction is that coins are the native currency of their own independent blockchains, while tokens are created on top of existing blockchain infrastructure.

What Is a Coin?

Think of a coin as the national currency of a digital nation. It operates on its own self-reliant network—its blockchain—complete with its own rules, economic model, and security protocols. Bitcoin (BTC) is the classic example; it functions on the Bitcoin blockchain and is primarily used as a peer-to-peer electronic cash system and a store of value.

Similarly, Ether (ETH) is the native coin of the Ethereum blockchain. It's used to pay for transaction fees, commonly called "gas," which power the network's operations. These native assets are vital for their respective networks. They provide the economic incentive for miners or validators to secure the blockchain and confirm transactions, which creates a self-supporting ecosystem. Building a new coin is a major technical project because it requires developing and maintaining an entire blockchain from the ground up.

As data aggregators show, the crypto market is enormous, with a diverse range of these assets.

This image underscores the market's scale, where foundational coins often hold top rankings due to their essential role in the digital economy.

What Is a Token?

A token, on the other hand, functions more like an application or a digital asset built upon a pre-existing blockchain. Instead of creating a new network from scratch, developers can issue tokens on established platforms like Ethereum, Solana, or Polygon. This strategy lets them use the host blockchain's security and infrastructure, allowing them to concentrate on their project's unique function.

This key difference is why there are far more tokens than coins. You can learn more about this topic by exploring our detailed guide on what crypto tokens are.

A clear statistical distinction is found in their numbers. As of June 2025, there are over 9,000 different cryptocurrencies in existence, a figure that includes both coins and tokens. Tokens represent the overwhelming majority of these assets. They are created on established blockchains to represent specific assets or provide access to services. To better understand this varied environment, it is useful to explore the details by understanding the complexity of multiple cryptocurrencies. You can find detailed statistics on this growth and discover more insights about the rising number of cryptocurrencies on platforms like Statista.

Technical Architecture: Why Infrastructure Determines Everything

The fundamental difference between a coin and a token boils down to their technical foundation. This distinction shapes everything from their security model to their flexibility for developers. A coin exists on its own native blockchain, which is a self-sufficient, independent digital ledger. Building one is a massive undertaking, requiring the creation of a distributed network of computers (nodes), a secure consensus mechanism like Proof-of-Work or Proof-of-Stake, and an active community of miners or validators to keep the network running.

Think of creating a new coin as building a city from the ground up—you have to construct the roads, the power grid, and the government before anyone can move in. This is why foundational coins like Bitcoin and Ethereum are so important; they built the digital economies that others now leverage. You can explore how these projects established their unique roles in our deep dive on Bitcoin as digital gold and Ethereum as a decentralized hub.

The Token Advantage: Inherited Security and Flexibility

Tokens, on the other hand, are built on top of pre-existing blockchains. This approach dramatically lowers the barrier to entry for new projects. Developers can bypass the complexities of network security and consensus because they inherit these critical features directly from the host blockchain. The most common platform for creating tokens is Ethereum, which offers standardized frameworks like ERC-20, enabling a small team to launch a functional token in just hours.

This architectural choice carries significant weight. A coin's value is directly tied to the security, adoption, and health of its entire blockchain. In contrast, a token's success is tied to the value of the specific project or utility it enables. This allows tokens to be designed for highly specialized purposes, such as:

- Granting voting rights in a decentralized autonomous organization (DAO).

- Representing ownership of a real-world asset.

- Providing access to a specific application or service.

This focused utility opens up a much broader spectrum of applications than is often feasible with a native coin, whose main job is usually to secure its own network.

To better understand these architectural differences, the table below breaks down the core technical elements of coins and tokens and explains their direct impact on users and developers.

| Infrastructure Element | Coins | Tokens | Impact on Users |

|---|---|---|---|

| Underlying Blockchain | Operate on their own native, independent blockchain. | Built on top of an existing blockchain (e.g., Ethereum, Solana). | Coins are part of a self-contained ecosystem. Tokens rely on the performance and fees of the host network. |

| Security Model | Secured by a network of miners or validators running a consensus algorithm (e.g., PoW, PoS). | Inherit security from the host blockchain. No separate security mechanism is needed. | Token security is as strong as the host chain. A vulnerability in Ethereum, for example, could affect all ERC-20 tokens. |

| Development & Launch | Requires extensive development to build the blockchain, consensus, and node software from scratch. High cost and complexity. | Radically simpler and faster. Developers use smart contracts and established standards (e.g., ERC-20) to deploy. | Lower barrier to entry for tokens means more innovation but also a higher risk of low-quality or scam projects. |

| Transaction Fees | Paid in the native coin (e.g., ETH for Ethereum transactions) to reward validators/miners. | Paid in the host blockchain's native coin (e.g., ETH for an ERC-20 token transfer), not the token itself. | Users must hold the host blockchain's coin (like ETH) to transact with tokens, adding a layer of complexity and cost. |

This comparison shows that the choice between building a coin and a token is a strategic one. Coins offer complete sovereignty but at a high cost, while tokens provide speed and inherited security, making them ideal for application-specific uses. For users, understanding this distinction is key to evaluating a project's long-term viability and potential network dependencies.

Market Dynamics: Where the Real Money Moves

Beyond the technical designs, the true difference between a coin and a token shows up in how they behave in the market. Grasping these dynamics is critical for building a sound portfolio on platforms like vTrader. Coins, with their native blockchains, often act as the base layers of the crypto economy and can shape wider market sentiment. In contrast, tokens get their value from the performance of specific projects, which results in different investment patterns.

Liquidity and Portfolio Allocation

Seasoned traders often use established coins like Bitcoin and Ethereum as portfolio anchors. Their deep liquidity and broad acceptance make them the main points of entry and exit for significant amounts of capital. However, this perceived stability can hide risks tied to network security and bigger economic trends. For this reason, institutional investors usually allocate a large part of their crypto holdings to these foundational assets to help control overall portfolio volatility.

Tokens bring a different kind of opportunity. While they are generally more volatile due to lower liquidity and project-specific risks, they also offer the potential for substantial returns. A successful token linked to a popular decentralized application (dApp) can deliver gains that significantly exceed the general market. This encourages a strategy where a stable core of coins is balanced with a handpicked group of high-potential tokens, mixing stability with growth prospects.

Market Capitalization and Investor Perception

Market capitalization provides a clear picture of the economic divide between these asset types. A look at any major crypto data aggregator shows the top assets ranked by their market value.

The image confirms that foundational coins with their own blockchains dominate the highest ranks, highlighting their role as the backbone of the digital asset economy.

This observation is backed by solid numbers. For example, market capitalization data from mid-2025 shows a major economic gap between leading coins and tokens. The biggest cryptocurrency by market cap remains Bitcoin (BTC), a coin on its own blockchain, with a valuation around $1.1 trillion as of June 2025. Ethereum (ETH), another coin with its own blockchain, is second at just under $500 billion. In comparison, the largest token by market cap is Tether (USDT), a stablecoin built on several blockchains, valued at about $70 billion. You can find more data on top crypto categories and explore the latest crypto rankings.

This huge difference in valuation shows how investors view coins as long-term stores of value and network infrastructure. Tokens, on the other hand, are often treated as tools for utility or speculation within particular ecosystems. As a result, regulatory news tends to affect them differently. A ruling on a specific token might create isolated price swings, whereas a broad statement on cryptocurrencies often impacts major coins most, sending ripples through the entire market.

Real-World Applications: Beyond the Hype

The practical distinction between a coin and a token becomes sharpest when you examine their real-world applications. Coins function primarily as digital money or a store of value. In contrast, tokens are tools driving concrete progress across industries by representing specific rights, assets, or access privileges. Their adaptability allows them to address business challenges in ways native coins simply cannot.

Where Tokens Deliver Measurable Value

Tokens are proving exceptionally useful in sectors that demand verifiable ownership and transparent histories. In supply chain management, for instance, a token can represent a single product, creating a permanent, unchangeable record of its journey from the factory to the end consumer. This level of transparency dramatically cuts down on fraud and simplifies logistics, saving companies millions.

Similarly, governance tokens are paving the way for new organizational models like Decentralized Autonomous Organizations (DAOs). In a DAO, token holders vote on critical business decisions, fostering a more democratic and community-driven approach to corporate management.

To better understand where each asset truly shines, the following table breaks down their practical applications and how their success is measured.

Use Case Analysis: Coins vs Tokens in Practice

Real-world application comparison showing where each asset type delivers measurable value and achieves product-market fit

| Industry Application | Coin Solutions | Token Solutions | Success Metrics |

|---|---|---|---|

| Payments & Remittances | Function as a direct medium of exchange, as seen with Bitcoin for cross-border payments. | Stablecoins (tokens pegged to fiat currency) are used for transfers where low volatility is critical. | Transaction speed, reduction in cross-border fees, network security. |

| Supply Chain Management | Rarely used, as network fees can become too expensive for tracking high-volume goods. | Each item is assigned a unique token on the blockchain for transparent, end-to-end tracking. | Reduction in counterfeit products, higher inventory accuracy, lower logistical expenses. |

| Organizational Governance | Governance is linked to network consensus, such as miners or validators voting on protocol updates. | Governance tokens give holders direct voting rights on project proposals and treasury management. | Voter participation rates, transparent decision-making processes, community engagement levels. |

| Asset Ownership | Represents ownership of the network's value itself. | Can represent fractional ownership of assets like real estate, art, or financial instruments. | Increased liquidity for traditionally illiquid assets, lower investment barriers, improved auditability. |

This table shows that while coins are foundational for payments, tokens unlock sophisticated applications by representing ownership and utility in a more granular way.

The Rise of Real-World Asset Tokenization

The most compelling demonstration of a token's utility is the tokenization of real-world assets (RWAs). This process, which brings tangible financial assets onto the blockchain, underscores the functional differences between coins and tokens. The explosive growth in this sector validates its utility; the RWA token market swelled over 260% in the first half of 2025, climbing from $8.6 billion to over $23 billion.

Tokens representing private credit or government debt are unlocking new liquidity and making these asset classes available to a wider pool of investors. You can read the full analysis on the RWA market surge to explore this trend further. As the decentralized finance space matures, these developments are becoming a major focus. Learn more about how RWA innovations are giving crypto a competitive advantage in our detailed report.

The chart below from DeFiLlama visualizes the total value locked (TVL) across different blockchain ecosystems, a key metric showing where capital and activity are concentrated.

This data reveals that while foundational blockchains hold immense value, a substantial portion of it is locked within token-based applications and protocols. This reinforces the token's role as a primary engine for utility and innovation in the digital economy.

Regulatory Reality: What the Rules Actually Mean

The U.S. Securities and Exchange Commission (SEC) homepage is a constant reminder of the regulatory attention shaping the crypto market. The legal and financial consequences of how an asset is classified are enormous, impacting everything from project development to your trading strategy.

Global regulators are working to define digital assets, and their conclusions carry major weight for both creators and investors. A core issue is whether a digital asset is considered a security. This distinction is one of the most significant factors that separates many tokens from their coin counterparts.

The Howey Test and Its Impact

In the United States, the SEC frequently applies the Howey Test to determine if an asset functions as an investment contract, which would classify it as a security. This legal standard examines if there's an investment of money into a common enterprise with the expectation of profits derived from the efforts of others.

A large number of tokens, particularly those launched through Initial Coin Offerings (ICOs), often fit this description. Founders sell tokens to raise funds, and investors buy them anticipating that the development team's work will drive up the token's value. This structure places many tokens under the SEC’s watch, demanding strict adherence to securities laws, including expensive registrations and ongoing reports. For traders on platforms like vTrader, grasping a token's potential status as a security is essential for evaluating long-term risk.

Navigating Jurisdictional Gray Areas

In contrast, genuinely decentralized coins like Bitcoin are typically seen as commodities, not securities. This is because no central group's efforts are responsible for generating investor profits. This fundamental difference between a coin and a token provides coins with greater regulatory clarity in many regions.

However, the global regulatory environment is far from uniform. Different countries classify assets in various ways, creating a complicated compliance puzzle for crypto projects. Many new teams now incorporate regulatory strategy into their initial design, structuring token sales to avoid being classified as securities. As an investor, staying informed about these distinctions is critical. You can explore this subject further by navigating the crypto regulatory landscape with our comprehensive guide.

Investment Strategy: Building Portfolios That Actually Work

Many crypto portfolios underperform because they fail to distinguish between different types of digital assets. A working investment strategy acknowledges the fundamental difference between a coin and a token, allocating capital with purpose. Insights from fund managers point to a common methodology: using established coins as a portfolio's foundation while deploying capital into specific tokens for targeted industry exposure and asymmetric growth potential.

This balanced approach helps investors construct resilient portfolios that draw from both stability and innovation. It's a strategic framework you can apply on vTrader, no matter the size of your portfolio.

Balancing Stability with High-Growth Potential

Professional investors often treat major coins like Bitcoin as foundational assets. Their deep market liquidity and established role as a store of value in the digital economy make them a solid anchor for any portfolio. While their returns can be significant, they are often linked to the wider market's cycles. An allocation to foundational coins is a practical way to manage overall portfolio volatility.

Tokens, on the other hand, provide a vehicle for investing in specific sectors, such as decentralized finance (DeFi), gaming, or real-world assets (RWAs). Since a token’s value is tied to its project’s success rather than an entire blockchain, it can generate substantial returns that are less dependent on the broader market. A well-chosen group of tokens can give you access to niche growth areas that foundational coins cannot. You can explore more strategies in our guide on effective crypto portfolio allocation.

Correlation and Risk Management in Practice

Understanding how coins and tokens correlate during different market conditions is crucial for effective risk management. Major coins frequently move together, particularly during significant market rallies or downturns. Tokens, however, may show a lower correlation, especially if their utility is strong and their user base is expanding.

The chart below from TradingView compares asset performance, which can help investors visualize these correlation patterns.

This type of visualization can show how a token in a thriving niche might hold its value or even grow while the rest of the market is flat. This means your rebalancing strategies must be specific. For a portfolio heavy on coins, rebalancing might be triggered by shifts in major market trends. For a portfolio focused on tokens, decisions should be based on project-specific milestones, user adoption rates, and other developments within that token's ecosystem.

This dual approach—anchoring with coins and seeking targeted growth with tokens—creates a more durable portfolio structure. It allows you to benefit from the stability of established networks while also capitalizing on the innovation occurring at the application layer of the crypto economy.

Making Smart Decisions: Your Action Plan

Applying the theoretical difference between a coin and a token is where your strategy truly becomes effective. Whether you're evaluating new projects or building a portfolio on vTrader, a clear decision-making framework can turn complex information into confident action. Your personal goals, as either an investor or a developer, must guide your approach.

Framework for Evaluation

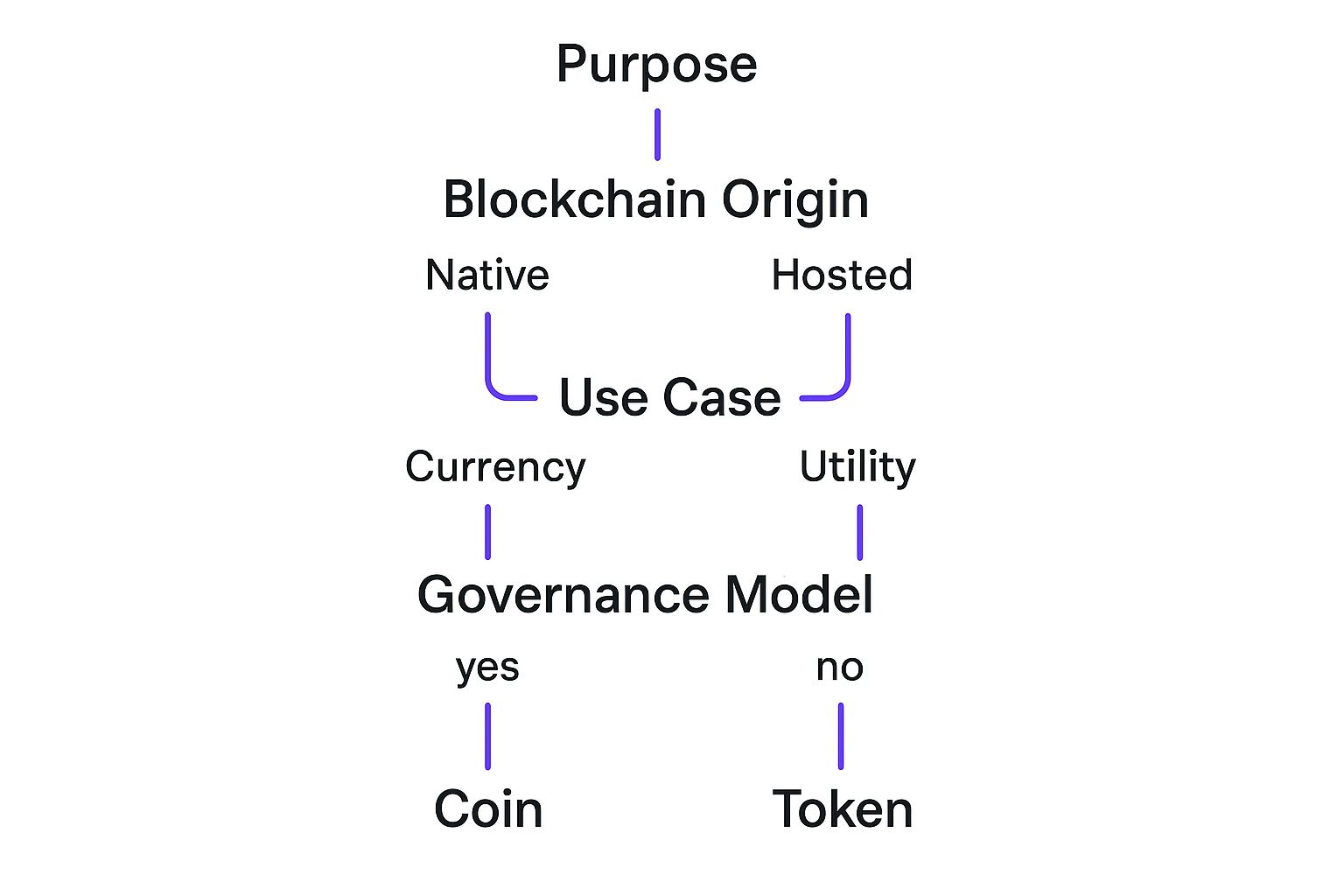

When analyzing a digital asset, go beyond the price chart and start with its fundamental purpose. Is it built to be the native currency for a new digital economy, or is it a utility instrument for a specific application? This first question often points you directly toward its classification as a coin or a token.

From there, examine the technical and operational claims. A project presenting itself as a new Layer-1 blockchain (a coin) without a detailed technical whitepaper, a public development team, and a solid plan for network security should raise a major red flag. Similarly, a token created for a solution that doesn't actually require a blockchain is often a sign of marketing over substance. You must ask: does this project genuinely need a token, or is it just tokenization for its own sake?

This decision tree infographic provides a visual for a structured evaluation process, guiding you from an asset's purpose to its classification.

The visualization clearly illustrates how an asset’s purpose, origin, and use case are sequential criteria that lead to a logical classification.

Actionable Checklists and Red Flags

To put this framework into practice, use a simple due diligence checklist for any potential investment. You should verify these key points:

- Team and Transparency: Is the development team public and credible? An anonymous team is a significant risk.

- Problem-Solution Fit: Does the project solve a real problem that actually benefits from blockchain technology?

- Tokenomics: Is the token distribution fair? A large allocation to the team with a short vesting schedule can signal a potential "rug pull."

- Community and Activity: Is there an active and engaged community? Look for genuine development activity on platforms like GitHub.

By systematically working through these questions, you move beyond the hype and focus on the fundamental value of the asset. This structured approach is essential for identifying legitimate opportunities and avoiding sophisticated but empty projects.

Ready to apply these insights? Start building your portfolio with confidence on vTrader, where zero-fee trading and advanced tools help you make smarter decisions.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.