When you first jump into the world of digital assets, it's easy to get tangled up in the terminology. People throw around "coin" and "token" like they mean the same thing, but they're fundamentally different animals.

The simplest way to think about it is this: a coin is the native currency of its own unique blockchain, while a token is built on top of an existing blockchain. That’s it. That’s the core difference. Think of Bitcoin (BTC) on the Bitcoin blockchain versus a project like Shiba Inu (SHIB), which runs on the Ethereum blockchain. This single distinction dictates everything from how they’re created to what they can do.

Coin vs. Token: The Fundamental Divide

Understanding this divide is the first step to making smarter decisions, whether you're investing, building, or just trying to keep up.

A coin is the lifeblood of its blockchain. It’s what you use to pay for transaction fees (like gas on Ethereum), and it’s what miners or validators earn for keeping the network secure. For many, it also acts as a primary store of value. Building a new coin is a massive undertaking because it means creating an entire blockchain from the ground up.

Tokens, on the other hand, are much easier to create. They piggyback on the infrastructure of established blockchains like Ethereum, Solana, or Polygon. This lets developers skip the monumental task of building a new network and focus on creating applications and utility instead. Tokens are brought to life using smart contracts—bits of code that define their rules and functions.

If you want to see this in action, you can explore crypto on our platform to see the huge variety of both coins and tokens out there.

Coin vs. Token At a Glance

This quick table breaks down the most important distinctions at a high level.

| Attribute | Coin | Token |

|---|---|---|

| Blockchain | Operates on its own native blockchain. | Built on top of an existing blockchain. |

| Primary Use Case | Store of value, medium of exchange, network security. | Represents utility, assets, or governance rights. |

| Creation Process | Requires building a new blockchain. | Deployed via a smart contract on an existing chain. |

| Examples | Bitcoin (BTC), Ethereum (ETH), Solana (SOL). | Chainlink (LINK), Uniswap (UNI), Tether (USDT). |

While this gives you the basic idea, the real differences emerge when you look at how each is used in the wild.

Understanding Coins: The Bedrock of Blockchains

To really get the difference between a coin and a token, you have to start with the coin itself. A crypto coin is the native currency of its own blockchain—it's the fundamental piece of the entire decentralized network. Think of Bitcoin (BTC) on the Bitcoin blockchain or Ether (ETH) on the Ethereum blockchain; the coin and its network are one and the same.

This isn't just a technical footnote. It's the whole point. A coin's power comes from being directly wired into the blockchain's mechanics. To see why they're considered the bedrock, it helps to have a good handle on blockchain technology itself. That underlying design is what lets a coin do its job.

The Three Pillars of a Coin's Utility

A coin is basically the economic engine that keeps its blockchain running and secure. Its value is directly tied to how healthy, safe, and widely used that network is.

-

Network Security: Coins are used to pay people for validating transactions and keeping the network safe. On Proof-of-Work blockchains like Bitcoin, miners get new BTC as a reward. On Proof-of-Stake networks, validators lock up (or "stake") their coins to help run the network and earn rewards in return. If that sounds interesting, our guide on how cryptocurrency staking works dives deeper into the process.

-

Transaction Fees: Every single thing you do on a blockchain—from sending money to running a smart contract—costs a tiny amount. These are called transaction fees or "gas" fees. You have to pay them in the network’s native coin, which compensates validators for their work and keeps people from spamming the network with useless transactions.

-

Store of Value: Because they're the foundation of a network and often have a predictable supply, major coins like Bitcoin are seen as a digital version of gold—a reliable store of value.

Key Takeaway: A coin isn't just digital money; it's a vital piece of infrastructure. If you want to create a new coin, you have to build an entire blockchain from the ground up, complete with its own security rules, consensus model, and a community of validators. It's a massive undertaking.

You can see this difference in the real-world data. In 2023, the Bitcoin network handled about 300,000 transactions per day. At the same time, Ethereum, home to a massive token ecosystem, saw over 1.2 million daily transactions. And get this—about 75% of that traffic was from token activity.

This shows you how coins and tokens play different roles. The coin's main job is securing the network, while tokens are what drive all the action on top of it.

Exploring Tokens: The Innovation Layer

If coins are the foundation of a blockchain, tokens are the skyscraper built on top—it's where all the action and innovation really happen. A token is a digital asset that exists on someone else's blockchain. This is the single most important part of the whole "coin vs. token" debate.

Instead of going through the massively expensive and complicated process of building a blockchain from the ground up, developers can just launch tokens using smart contracts on proven networks like Ethereum. This lets them piggyback on the host chain's security and decentralization, so they can focus on what they do best: building cool applications.

The Power of Token Standards

The secret sauce behind tokens is something called token standards. These are basically open-source blueprints for creating new tokens, making sure they can all play nicely together inside the same ecosystem. Think of it like USB ports—they ensure all your different devices can connect and communicate without a problem.

The two big ones on Ethereum you'll hear about constantly are:

- ERC-20: This is the go-to standard for fungible tokens, where every token is identical and interchangeable. Most of the utility tokens, governance tokens, and stablecoins like USDT you've used are built on this.

- ERC-721: This is the famous standard for non-fungible tokens, or NFTs. Each ERC-721 token is totally unique and can't be divided, which is perfect for representing ownership of things like digital art, collectibles, or even real-world assets.

These standards are precisely why your digital wallet can hold a hundred different tokens from a hundred different projects. It's this interoperability that has lit the fuse for the explosive growth in DeFi, GameFi, and NFTs.

Tokens are essentially programmable assets. Their value isn't just in monetary terms but in the access, rights, or utility they provide within a specific application or ecosystem.

Unlocking a Universe of Use Cases

Because tokens are so flexible, their potential uses are practically endless. A single token can represent a dozen different things, and its entire function can change based on the rules coded into its smart contract.

This is why tokens have become the main engine for experimentation in the crypto space. If you want to dive deeper into this vibrant ecosystem, the vTrader Academy has a ton of great resources to get you started.

Just look at the variety out there:

- Governance: UNI tokens let you vote on proposals that decide the future of the Uniswap protocol. Your tokens are your voice.

- Utility: The Basic Attention Token (BAT) is used to reward people for watching privacy-friendly ads in the Brave browser.

- Asset Representation: A token could represent a share in a high-rise building, a piece of a Picasso, or a stake in a decentralized autonomous organization (DAO).

This incredible flexibility is what sets tokens apart from coins, which mostly just act as money or network fuel. Tokens, on the other hand, are the actual building blocks for a whole new digital economy.

Comparing Creation Technology and Security

Definitions aside, the real difference between a coin and a token snaps into focus when you look at how they’re built and secured. Their creation processes are worlds apart, and that leads to completely different security challenges for everyone involved, from developers to investors. This technical divide is key to understanding why they play such distinct roles in crypto.

Making a new coin is a massive undertaking. It means building a whole new blockchain from the ground up. You have to design a consensus mechanism (like Proof-of-Work), write the core software, and convince a global network of miners or validators to join and secure it. It's a multi-year, multi-million dollar commitment for only the most ambitious projects.

Creating a token, on the other hand, is much simpler. Developers can use smart contracts on established blockchains like Ethereum to mint new tokens in a fraction of the time. This lets them piggyback on the host chain's infrastructure, security, and user base. The cost is basically just transaction fees, which might only be a few hundred dollars, depending on how busy the network is. You can even watch these costs in real-time with an Ethereum gas tracker.

Analyzing the Security Models

A coin’s security is completely tied to the strength of its own blockchain. Take Bitcoin—its security comes from a colossal hash rate, which is the combined computing power of every miner on the network. To successfully attack it, someone would need to control over 51% of that power, a task so expensive it's considered practically impossible. The coin’s safety is a direct result of the network's decentralized strength.

A token's security is a bit more complicated; it’s two-layered. First, it inherits the base-layer security of its host blockchain. An ERC-20 token on Ethereum is just as protected from network-level attacks as Ether (ETH) itself. But tokens introduce a second point of failure that coins don't have: the smart contract itself.

A coin is only as secure as its blockchain. A token is only as secure as its blockchain and its smart contract code.

This is a critical distinction. A bug or vulnerability in a token's smart contract code can be exploited, leading to devastating losses, even if the underlying blockchain is running perfectly. It’s why any serious token project must undergo rigorous third-party security audits.

Regulators have also viewed them differently. The U.S. Securities and Exchange Commission (SEC) has often treated tokens from Initial Coin Offerings (ICOs) as securities, which comes with heavy regulation. Between 2017 and 2023, a whopping 85% of the $30 billion raised through ICOs came from issuing tokens. Only 15% was for creating new coins, which shows just how much faster and easier the token route is for fundraising. This regulatory split has had a huge impact on how new projects decide to get off the ground.

Real-World Examples in Action

The technical stuff is one thing, but seeing how coins and tokens work in the wild really drives the point home. These examples show how their basic design leads to completely different jobs, values, and roles in the crypto world.

Take Bitcoin (BTC), the original coin. It lives on its own blockchain and does just a few things really well: it's a store of value (often called "digital gold"), a way to send money, and the reward that keeps its network running. Bitcoin’s value is tied directly to the health and adoption of its own blockchain.

In the same way, Solana (SOL) is the native coin of the Solana blockchain. You have to use SOL to pay for transactions on its network, which is famous for being fast and cheap. People also use it for staking to help keep the network secure. Just like BTC, SOL can't exist without its blockchain.

The Diverse World of Tokens

Tokens, on the other hand, are built for specific jobs on top of blockchains that already exist. This gives them incredible versatility.

-

Governance Tokens: Uniswap (UNI) is a classic example. It’s an ERC-20 token on Ethereum, so it doesn't have its own blockchain. Instead, holding UNI gives you the power to vote on changes to the Uniswap decentralized exchange. Its value comes from its ability to influence a massive DeFi project.

-

Utility Tokens: Think of ApeCoin (APE), another ERC-20 token. APE is like a key that unlocks special games, services, and features within the Bored Ape Yacht Club world. It was designed for access and use, not to power a blockchain.

-

Stablecoins: Tokens like Tether (USDT) and USD Coin (USDC) are built for one main purpose: stability. They aim to stay pegged to $1.00. These tokens run on multiple blockchains, including Ethereum, giving traders a safe place to park their money during volatile times without cashing out to traditional currency. You can learn more about the mechanics of stablecoins like USDC in our detailed guide.

The job of a coin is to run and protect its own blockchain. The job of a token is to provide a specific function—like access, governance, or utility—inside an application built on someone else’s blockchain.

This difference shows up in the market, too. By the end of 2024, the total crypto market cap was hovering around $2.3 trillion. Coins like Bitcoin and Ethereum accounted for roughly 60% of that, while the token market ballooned to $920 billion, making up the other 40%.

With more than 700,000 unique ERC-20 tokens out there, it’s obvious that while coins are the foundation, tokens are where the explosive growth in new apps and ideas is happening. You can dig deeper into these market trends on BitPay.com.

Making the Right Choice for Your Goals

To get anywhere in crypto, you have to match the asset to your ambition. The core difference between a coin and a token isn't just a technical detail—it defines how you should approach it, whether you're investing capital or building a project from the ground up.

For investors, the decision really boils down to your risk tolerance and what you're trying to achieve with your portfolio. Coins like Bitcoin are the bedrock assets of this space. When you buy a coin, you're not just buying a digital asset; you're investing in its entire decentralized network. Its value is directly tied to the blockchain's security, adoption, and overall health, which generally makes it a less volatile, long-term play.

Tokens are a completely different game. They represent a stake in a specific application or protocol built on top of a blockchain. This makes them inherently riskier, but it also opens the door to explosive growth tied to a single project's success. An investment in a utility token is a bet on the team behind it and their vision for a product.

A Framework for Decision Making

For founders and developers, the choice is even more fundamental. It dictates your entire strategy, from development costs to how you go to market. Creating a new coin means you're building a new blockchain from scratch. This is a massive, expensive undertaking reserved for projects with huge ambitions to create a new protocol. You get total control, but you also need massive resources to build and secure a network of validators.

On the other hand, issuing a token is a much leaner and faster approach. You get to piggyback on an existing blockchain's security and user base, allowing you to focus completely on your application's utility and get to market quickly.

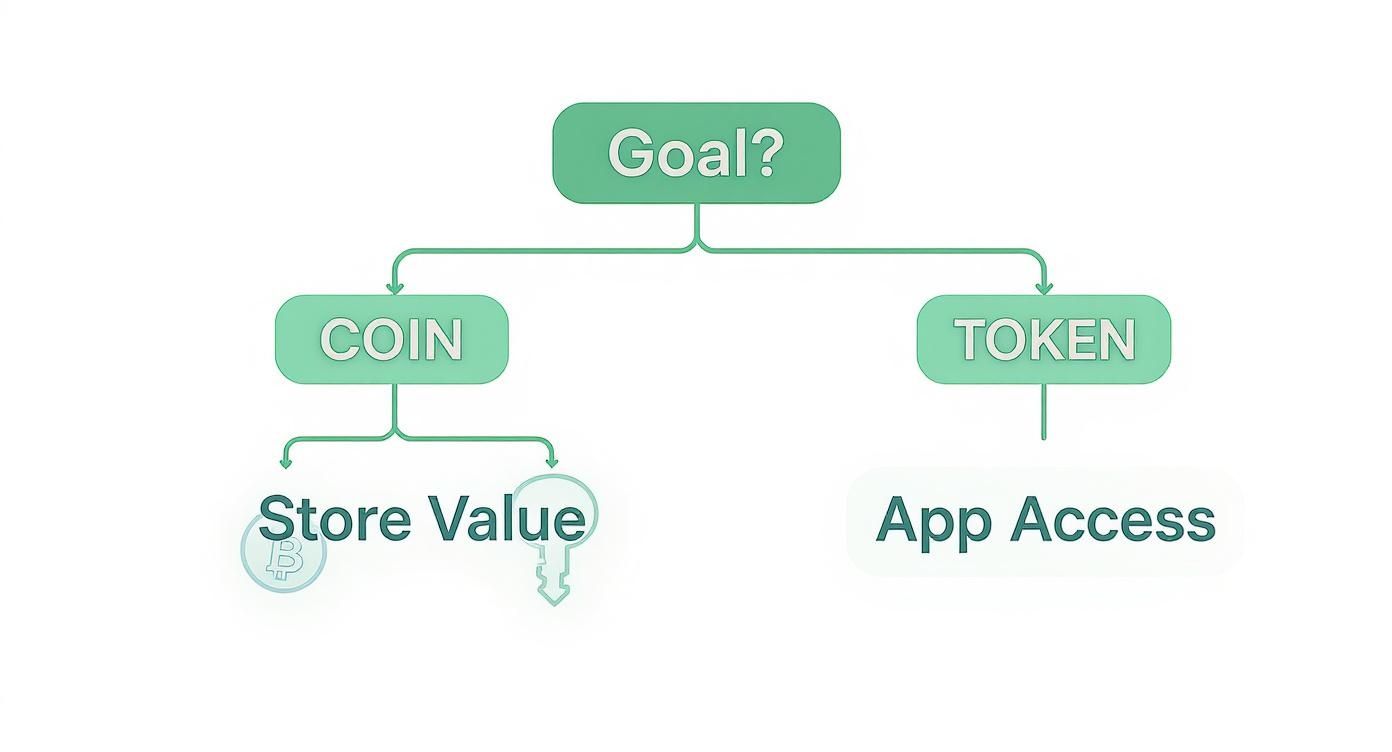

This decision tree helps break down the choice based on what you want to accomplish.

As you can see, if you're focused on storing value or transacting directly on a native network, a coin is your tool. But if your goal is to interact with a specific application or access a service, a token is what you'll need.

Got More Questions?

Once you start digging into the coin vs. token difference, a few specific questions always seem to pop up. Let's clear the air on some of the most common ones.

Can a Token Become a Coin?

You bet. The process is known as a mainnet swap, and it’s a pretty common path for ambitious projects.

Many teams first launch an ERC-20 token on a battle-tested network like Ethereum. It’s a great way to raise funds, get the word out, and build a community without having to build an entire blockchain from scratch. Once their own independent blockchain is developed and ready for prime time, they orchestrate a migration. During this swap, the old tokens are exchanged for brand new, native coins on the new network.

A great real-world example is Cronos (CRO), which started its life as a token before transitioning to become the native coin of the Cronos blockchain.

Are All Tokens Valuable?

Not even close. The barrier to entry for creating a token is incredibly low, which means the market is absolutely flooded with them. Thousands of tokens have little to no real-world use, are attached to projects that have already failed, or were created purely for a quick speculative flip.

Before you even think about buying a token, you have to do your homework. What problem does it actually solve? Who is the team behind it? What are the tokenomics—is there a capped supply or endless inflation? A token's value is almost always tied directly to the health and adoption of its underlying project.

Key Insight: A coin's security depends on the strength and decentralization of its own blockchain. A token’s security is a two-part equation: it inherits the security of its host network, but it's also only as secure as its own smart contract code.

Which Is More Secure: a Coin or a Token?

It's not a simple "one is better than the other" answer because they have entirely different security models.

A coin’s security is a direct function of its own blockchain. For proof-of-work coins like Bitcoin, security comes down to decentralization and raw hash rate—the more computing power protecting the network, the safer it is.

A token, on the other hand, borrows its security from its host blockchain. An ERC-20 token running on Ethereum is fundamentally as secure as the Ethereum network itself. But there's a catch: tokens introduce a second potential point of failure. A bug or vulnerability in the token's smart contract code can be exploited, even if the underlying blockchain is perfectly secure.

Ready to put your knowledge into action? With vTrader, you can explore a wide variety of both coins and tokens with zero trading fees, advanced tools, and a secure, user-friendly platform. Start building your portfolio today at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.