To really make it as a crypto day trader, you need three things: a rock-solid strategy, a healthy respect for market volatility, and a trading platform you can count on. It’s a high-stakes game. The potential for quick profits is real, but so are the risks. Ultimately, success comes down to skill and discipline, not a lucky roll of the dice.

Getting Started Without Getting Burned

Let’s be real for a minute. Your social media feed probably makes crypto day trading look like a shortcut to a mansion and a Lambo. The reality is a whole lot less glamorous. This is an active, high-pressure job that demands your full attention, sharp decision-making, and a stubborn refusal to deviate from your game plan. We’re not talking about "HODLing" and crossing your fingers; we’re talking about jumping in and out of dozens of trades to catch small, fleeting price swings.

The dream of fast money is a powerful magnet, but the numbers tell a different story. A staggering 97% of day traders lose money in their first year. Only about 12% ever manage to become consistently profitable. I’m not saying this to scare you off, but to set the record straight. You can succeed, but only if you approach this like a serious business from day one.

Adopting a Professional Mindset

Before you risk a single dollar, you have to get your head in the right place. This is honestly more critical than any chart pattern or technical indicator you’ll ever learn. Professionals are disciplined. They’re patient. They run on a clear, logical plan, not a cocktail of fear and greed.

Throughout this guide, we'll be using vTrader to walk through the entire process. We chose it specifically for its blend of zero-fee trading, powerful charting tools, and a clean interface that works for both new and experienced traders.

The goal isn't just to make winning trades. The real goal is to develop a repeatable process that gives you an edge over the long run, ensuring you can stay in the game and grow your capital systematically.

Your Foundational Checklist

Jumping into the market with just a bit of cash is a recipe for disaster. You need to build a solid foundation of knowledge, preparation, and the right tools. Think of it like training for a marathon, not a 100-meter dash. Your first job is to learn, not earn.

Before you go any further, make sure you've got these concepts down:

- Basic Market Concepts: Get a real feel for what makes prices move. This means understanding things like liquidity, volatility, and market sentiment.

- Risk Management Principles: You need to live and breathe rules like the 1% rule (never risk more than 1% of your capital on a single trade) before you even think about trading.

- A Commitment to Learning: The crypto market never sleeps, and it changes fast. You have to keep learning to stay sharp. Resources like the vTrader Academy are a great place to start with structured courses.

Getting this prep work done is what separates the traders who make it from the ones who blow up their accounts in the first month.

To make sure you’re truly ready, I’ve put together a checklist. Go through it honestly and see where you stand.

Crypto Day Trader Readiness Checklist

This table breaks down the essentials you need before you place your first trade.

| Component | Why It Matters | Action Item |

|---|---|---|

| Solid Capital Base | Trading with "scared money" leads to poor decisions. You need capital you can afford to lose. | Set aside a dedicated trading account with funds you don’t need for living expenses. |

| Defined Trading Strategy | Without a plan, you're just gambling. A strategy defines your entry, exit, and risk. | Research and backtest at least one specific strategy (e.g., scalping, range trading). |

| Emotional Discipline | Fear and greed are your biggest enemies. They cloud judgment and cause costly mistakes. | Practice with a demo account first. Write down your trading rules and stick to them. |

| Technical Proficiency | You must be comfortable with your trading platform and charting tools under pressure. | Spend hours on vTrader’s platform, practicing order types and chart analysis. |

| Continuous Education | The market is always evolving. What worked yesterday might not work tomorrow. | Dedicate at least 3-5 hours a week to market research and learning new concepts. |

This checklist isn't just a formality; it's the foundation of a sustainable trading career. Once you can confidently check off these boxes, you’re ready to start building your trading setup.

Building Your vTrader Trading Cockpit

Your trading platform is more than just software; it's your command center. It’s the digital cockpit where you’ll make and execute every single trade. To survive in the fast-paced world of crypto day trading, you can't just roll with the default settings. You need a setup that is secure, efficient, and perfectly molded to your strategy.

This means looking beyond the simple sign-up and truly fortifying your account for the battlefield of the market. Think of it like a pilot's pre-flight check. Before you even dream of entering a trade, your number one job is capital protection, and that starts with locking down your vTrader account.

Fortifying Your Account Security

In the crypto market, security isn't just a nice-to-have feature—it's the bedrock of your entire trading operation. We've all heard the horror stories. Billions have been stolen through phishing attacks and exchange breaches, with active traders being prime targets. This isn't to scare you, but to underscore just how critical your personal security measures are.

Your first, non-negotiable step is enabling Two-Factor Authentication (2FA). It adds a crucial layer of defense, requiring a time-sensitive code from a separate device—usually your phone—before allowing logins or withdrawals.

Here's how to bulletproof your vTrader account:

- Use an Authenticator App for 2FA: Ditch SMS-based codes. Instead, use an app like Google Authenticator or Authy. They're far more secure against common SIM-swapping attacks.

- Set Up an Anti-Phishing Code: This is a brilliant feature. vTrader lets you create a unique code that will appear in every official email from them, making it dead simple to spot fakes.

- Be Smart with API Keys: If you ever connect third-party tools, be stingy with permissions. Only grant what is absolutely necessary and never enable withdrawal access for a portfolio tracker or analytics tool.

Honestly, setting this up might feel like a chore. But spending 15 minutes on it now could literally save your entire trading account down the road. Don't be the person who learns this lesson the hard way.

Funding Your Account and Understanding Wallets

With your account locked down, it’s time to add the fuel: your trading capital. Head over to the "Deposit" section on vTrader, and you'll find a few different ways to fund your account, from bank transfers to direct crypto deposits. Pick the one that works best for you in terms of speed and cost.

Once your funds arrive, they'll land in specific wallets within your account. It's really important to know what each one does so you can manage your money effectively.

- Spot Wallet: This is your home base for buying and selling actual cryptocurrencies. When you buy Bitcoin on the spot market, you own the real BTC, and it sits in this wallet.

- Futures Wallet: This wallet is for trading derivatives contracts. Here, you're speculating on the future price of a crypto asset without ever owning it. This is where more advanced strategies involving leverage happen.

If you're just getting into crypto day trading, stick with the spot wallet. It keeps things straightforward and helps you avoid the high-stakes risks that come with leveraged futures trading. To get a feel for the market, you can explore the crypto offerings on vTrader and look for pairs with the liquidity and volatility that match your trading style.

Customizing Your Dashboard for Peak Efficiency

In day trading, seconds count. A cluttered or confusing interface isn't just annoying; it's a liability that can lead to costly mistakes. The default vTrader dashboard is a solid start, but you need to make it your own. The goal is to get all of your critical info and tools in one immediate view, minimizing clicks and distractions.

Start by arranging the widgets on your trading screen. Make the chart of your main trading pair the star of the show, front and center. You should be able to see the order book, recent trades, and your open positions without having to scroll. A clean, well-organized cockpit lets you analyze, execute, and manage trades seamlessly, keeping you locked in on the market’s pulse.

Reading the Charts on vTrader

Let’s get one thing straight: profitable day trading isn't about gut feelings or chasing pumps. It’s about reading the market’s story, and on vTrader, that story is told through the charts. This is where technical analysis becomes your best friend, helping you use past price action and volume to make educated guesses about where the market is headed next.

Your first stop is always the candlestick chart. Each little candle tells you a story of the battle between buyers and sellers over a set period—one minute, five minutes, an hour, whatever you choose. A green candle means buyers won (the price closed higher than it opened), while a red one means sellers took control. Those thin lines, the "wicks," show you the highest and lowest prices hit during that fight.

Once you start recognizing patterns, like a bullish engulfing candle where a big green candle swallows the previous red one, you get a real-time pulse on market sentiment. These patterns are your first clues, the breadcrumbs that lead to a solid trading plan.

Mastering Essential Day Trading Indicators

After you get the hang of reading raw price action, it’s time to layer in some indicators. Think of them as special lenses that bring different parts of the market's behavior into focus. While vTrader offers a huge library, you only need to master a handful of core tools to build a killer strategy.

The biggest mistake I see new traders make is plastering their charts with a dozen different indicators. It's a recipe for "analysis paralysis," where you're so overwhelmed by conflicting signals that you can't pull the trigger on a trade. The key is to keep it clean—stick to two or three that measure different things, like trend, momentum, and volatility.

For example, a common and effective setup is using Moving Averages to get a feel for the trend and an oscillator like the RSI to pinpoint your entry. This combination gives you a much richer picture than either one could on its own. And to stay ahead of big market moves, it's always a good idea to see what the pros are watching over in the vTrader news hub.

Identifying Trends with Moving Averages

As a day trader, your first job is to figure out which way the river is flowing. Trading with the trend is like swimming with the current; fighting it is a quick way to drown. Moving Averages (MAs) are the go-to tool for this. They smooth out all the price noise into a single, clean line that makes the underlying trend obvious.

On vTrader, you'll mostly be working with two types:

- Simple Moving Average (SMA): The classic. It's just the average price over a specific period, like 50 days, with every day given equal importance.

- Exponential Moving Average (EMA): This one is a day trader's favorite. It gives more weight to recent prices, so it reacts much faster to what's happening right now.

A classic strategy is to plot two EMAs on your chart—a short-term one (9-period) and a longer-term one (21-period). When the fast line crosses above the slow line, that's a bullish signal. When it crosses below, it's bearish. This "crossover" is a powerful confirmation for getting in or out of a position.

A pro tip I learned the hard way: never rely on a single indicator. A moving average crossover is a great signal, but it's far more reliable when confirmed by strong volume and a supportive candlestick pattern.

Gauging Momentum with the RSI

Okay, you've identified the trend. Now what? You need to find the perfect moment to jump in. The Relative Strength Index (RSI) is a momentum oscillator built for exactly that. It measures the speed and strength of price changes on a simple scale from 0 to 100.

Traditionally, a reading above 70 suggests an asset is "overbought" and might be due for a dip. A reading below 30 means it's "oversold" and could be ready to bounce. So, if you see BTC/USDT in a solid uptrend but the 15-minute RSI dips near 30, that could be your golden ticket for a low-risk entry.

By combining candlestick patterns with a few key indicators, your vTrader chart transforms from a confusing mess of wiggles into a clear, actionable decision-making tool.

To help you get started, here’s a quick breakdown of the three core tools every day trader should have in their back pocket.

Essential vTrader Indicators for Day Trading

This table summarizes the heavy hitters we just discussed. Use it as a cheat sheet to remember what each tool does and when to deploy it.

| Indicator | What It Measures | Best Use Case for Day Trading |

|---|---|---|

| Candlestick Patterns | Market sentiment and psychology within a specific timeframe. | Identifying immediate entry/exit signals and potential reversals at key levels. |

| Moving Averages (EMA/SMA) | The direction and strength of the underlying market trend. | Confirming the overall trend direction to avoid trading against the market's momentum. |

| Relative Strength Index (RSI) | The speed and magnitude of recent price changes (momentum). | Spotting overbought or oversold conditions to time entries into an existing trend. |

Mastering these three—candlesticks for sentiment, MAs for trend, and RSI for timing—gives you a complete framework for analyzing any crypto asset on vTrader.

Executing Trades with Precision

You can have the most dialed-in chart analysis in the world, but it all falls apart without sharp, decisive execution. This is where your strategy finally hits the market—the moment you put capital on the line and turn a plan into a live trade.

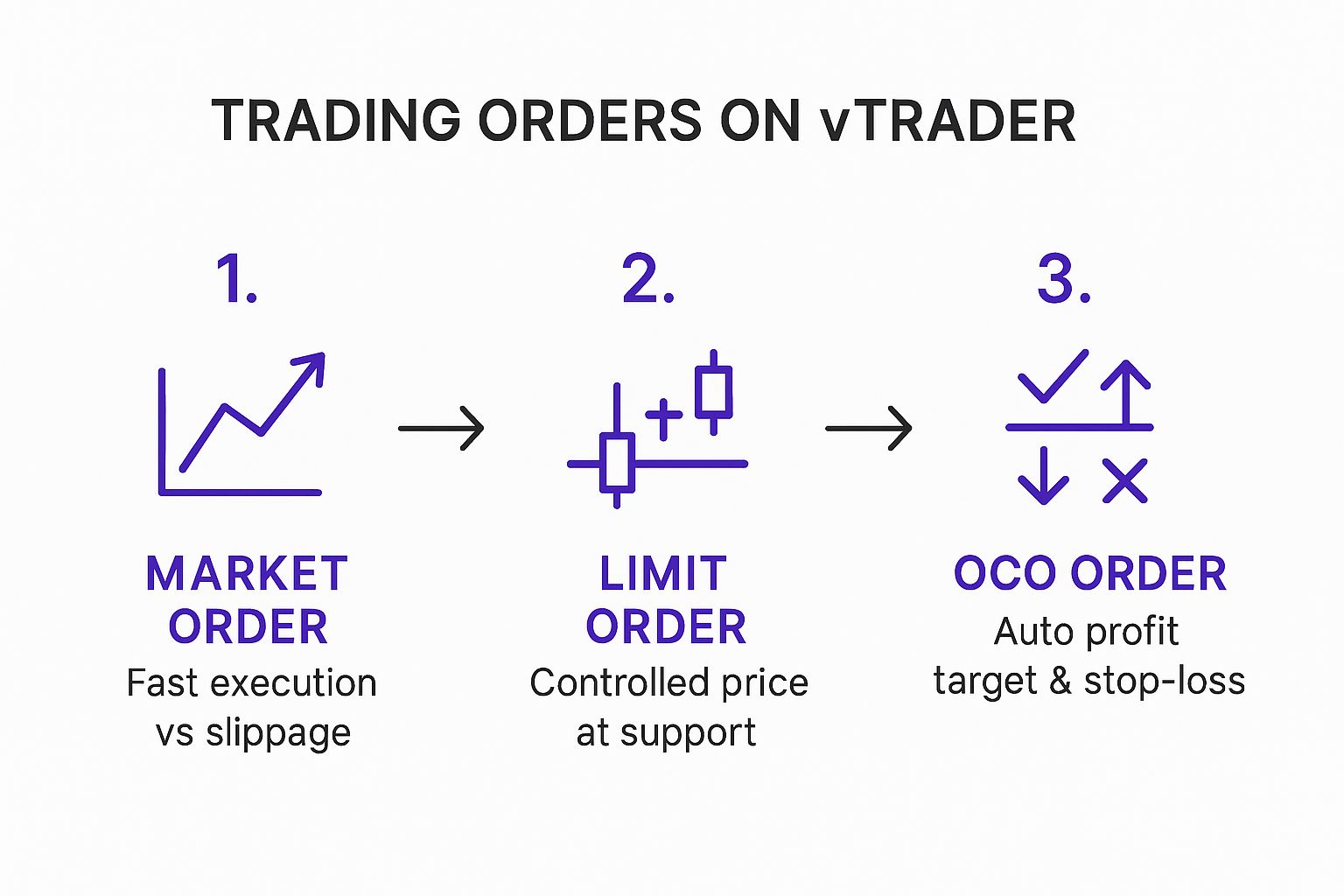

On vTrader, the order types you use are the tools that let you manage your entry, exit, and risk with intention. Mastering them is what really separates calculated trading from just gambling and hoping for the best. Understanding when to blast in with a market order versus patiently setting a limit order is a core skill for any serious crypto day trader.

Choosing Your Entry Weapon: Market vs. Limit Orders

When you’re ready to jump into a trade, your first big decision is how you'll get in. The two most common tools for the job are market orders and limit orders, and they represent a classic trade-off: speed versus price.

A market order is the fastest way to get your foot in the door. You’re essentially telling vTrader, "Get me into this trade right now at whatever the best available price is." This is your go-to when speed is everything—like when a coin is breaking out of a key resistance level and you need to get in before it leaves you in the dust.

The catch? Slippage. In a volatile market, the price you actually get might be a bit different from the one you saw when you hit the button. For a day trader making dozens of trades, those little differences can really start to add up.

A limit order, on the other hand, puts you in complete control of your entry price. You set the exact price you're willing to pay, and the order will only execute if the market moves to your level. This is perfect for strategically entering a trade at a specific support or resistance zone you’ve already mapped out. If you see strong support for ETH/USDT at $3,500, you can place a limit buy order right there and let the market come to you.

The only risk is that the market might never dip to your price, causing you to miss the move entirely. It's a game of patience.

Don't forget that the cost of the trade itself is a huge factor in your execution. High-frequency trading can let fees eat into your profits fast. It's always a good idea to stay familiar with the vTrader fee schedule to see how it impacts different order types.

Automating Your Strategy with Advanced Orders

Once you're in a trade, the real work begins. Managing your open position is just as critical as your entry. This is where some of vTrader's more advanced order types become your best friends, letting you automate your risk management and profit-taking so you don't have to be glued to the screen 24/7.

The stop-limit order is a two-part command that adds precision to both entries and exits. It combines a stop price (the trigger) with a limit price (the actual execution price). For instance, you could set a stop-limit buy order above the current price to enter a breakout trade only after it proves it has momentum.

But the real game-changer for day traders is the One-Cancels-the-Other (OCO) order. Think of it as your all-in-one trade management toolkit.

An OCO order lets you place two orders simultaneously:

- A limit order to take your profit at a specific target.

- A stop-limit order to cut your losses if the trade turns against you.

The magic is that as soon as one of these orders is filled, the other one is automatically canceled.

This flow shows how these key order types on vTrader fit together in your execution process.

As the infographic shows, you move from the raw speed of a market order to the precision of a limit order, and finally to the automated efficiency of an OCO.

Let’s say you buy Bitcoin at $65,000. You can immediately set an OCO order with a take-profit limit sell at $66,500 and a stop-loss sell at $64,500. This brackets your trade perfectly, defining your maximum risk and potential reward right from the start. Now you can walk away from your desk, knowing your plan will execute automatically, taking emotion completely out of the equation.

Protecting Your Capital at All Costs

Amateur traders get fixated on how much money they can make. The pros? They’re obsessed with how much they can lose.

This isn't just a clever saying; it's the core mindset that separates traders who make it from those who quickly blow up their accounts. If you want to day trade crypto for a living, your number one job isn't to chase profits—it's to live to trade another day.

Capital preservation is your defense. It’s what keeps you in the game when the market inevitably throws a curveball. Think of your risk management plan as the only thing standing between a bad trade and a catastrophic loss.

The Bedrock of Risk: The 1% Rule

Let’s get one thing straight: the single most important rule is the 1% rule. It’s simple, powerful, and absolutely non-negotiable. You never, ever risk more than 1% of your total trading capital on a single trade.

If you’re working with a $5,000 account, your maximum acceptable loss on any one position is just $50. This doesn't mean you can only invest $50. It means the distance between your entry price and your stop-loss, multiplied by your position size, can’t add up to more than a $50 loss.

Why is this so critical?

- It keeps you in the game. You could be dead wrong on 10 trades in a row and still have 90% of your capital left. This takes the emotional sting out of a losing streak, which everyone experiences.

- It forces you to be disciplined. When you can't risk much, you're forced to pick only the best, highest-probability setups instead of gambling on every minor price fluctuation.

Stick to this rule religiously. It’s the mathematical foundation that will save you from your own worst instincts in the wild crypto markets.

Setting Intelligent Stop-Losses on vTrader

A stop-loss is your escape hatch—your pre-planned exit when a trade turns against you. But just slapping a random 5% stop-loss on every trade is a rookie mistake. A smart stop-loss isn't based on an arbitrary percentage; it's dictated by the market's structure.

You should place your stop-loss at the exact price point where your trade idea is proven wrong. For a long (buy) trade, this is usually right below a key support level. For a short (sell) trade, it’s just above a clear resistance level.

Here’s how this looks in a real-world scenario on vTrader:

- You spot a strong support level for SOL/USDT at $142.

- The price bounces cleanly off this level, and you decide to go long, entering at $143.

- Your whole trade is based on the idea that the $142 support will hold. So, if the price breaks below that level, your thesis is busted.

- The logical place for your stop-loss is just beneath that support, maybe at $141.50.

This way, the market tells you when you're wrong, not your emotions. For more nitty-gritty details on setting this up, the vTrader support documentation has everything you need on order mechanics.

The Power of Asymmetric Risk-to-Reward

Now, let’s talk offense. The secret to long-term profitability is making sure your winning trades are significantly bigger than your losing ones. We measure this with the risk-to-reward (R/R) ratio.

A professional trader doesn’t need to win more than they lose. They just need their winners to be bigger than their losers. A positive risk-to-reward ratio is how you achieve this.

As a rule of thumb, you should only even consider trades where your potential profit is at least double your potential loss. That’s a 1:2 R/R ratio, and it should be your minimum.

Let’s stick with our SOL/USDT example:

- Entry Price: $143

- Stop-Loss: $141.50

- Your Risk: $1.50 per SOL

For this trade to be worthwhile, you need a potential reward of at least $3 per SOL ($1.50 risk x 2). That puts your take-profit target at or above $146.

By only taking trades that meet this standard, you can actually be wrong more often than you're right and still grow your account. If you win on just 40% of your trades using a 1:2 R/R, you’ll be profitable over the long run.

Finally, remember that protecting your capital goes beyond the charts. It's also about digital security. Learning how to securely send email and protect your data is crucial for keeping your accounts safe from outside threats. Smart trading tactics and strong personal security go hand-in-hand.

Your Crypto Day Trading Questions, Answered

Once you get past the theory, the real questions start popping up. It's one thing to look at a chart, but it’s another thing entirely when your hard-earned cash is on the line. I get it.

Let's cut through the noise and tackle some of the most common questions I hear from traders who are just starting out. Think of this as your quick-reference field guide for the day-to-day realities of the market.

How Much Money Do I Really Need to Start?

You can technically open an account on a platform like vTrader with a few bucks, but let's be realistic. If you actually want to trade and not just gamble, you need enough capital to work with a strategy.

To make the 1% risk rule meaningful and to keep trading fees from devouring all your gains, you should be looking at a starting bankroll of $1,000 to $5,000. This gives you some much-needed breathing room. It means you can take a string of small, managed losses—which happens to everyone—without blowing up your account and getting knocked out of the game.

Never, ever trade with money you can't afford to lose. This isn't a bill payment fund or your rent money. This is risk capital, period.

When Are the "Golden Hours" for Trading Crypto?

The crypto market is open 24/7, but that doesn't mean every hour is a good time to trade. What you're looking for is volume and volatility—that's where the opportunities are. The market isn't always moving with purpose.

For day traders, the action really heats up when the major traditional financial markets overlap. This is when the big players and institutional desks are most active, which usually leads to cleaner trends and tighter spreads.

- London & New York Overlap: This window, roughly from 8:00 AM to 5:00 PM EST, is often prime time. The liquidity is deep, and price action tends to be more predictable.

That said, crypto never truly sleeps. A huge news drop, a protocol update, or a regulatory announcement can send a shockwave through the market at any hour. Always be on your toes.

Can I Just Trade on My Phone?

Yes, you absolutely can, and having a powerful mobile app from vTrader is a lifesaver for managing positions on the go. If you need to quickly exit a trade while you're out, it's indispensable.

But for your main trading activity? A desktop setup is non-negotiable. Trying to perform detailed chart analysis on a tiny screen is a recipe for disaster. You need a big monitor (or two) to see multiple timeframes, draw trend lines with any kind of precision, and execute orders without fumbling on a touchscreen.

My advice: Use your phone as a backup and a monitoring tool. Do your real work at a proper trading station.

How Do I Deal with Taxes on My Profits?

This is the one that trips up so many new traders. Ignoring your tax obligations is one of the fastest ways to turn a great year into a nightmare. In most places, including the U.S., crypto is treated as property, meaning you owe capital gains tax on your profits.

And here's the kicker: every single trade is a taxable event.

- Selling crypto for cash (like USD).

- Trading one crypto for another (like BTC for ETH).

- Even using crypto to buy something.

Profits on any assets you hold for less than a year fall under short-term capital gains, which are usually taxed at the same rate as your regular income. You absolutely must keep a perfect record of every transaction. I can't stress this enough: use a dedicated crypto tax software and talk to a tax professional. Don't try to wing it.

Ready to put this into practice? vTrader gives you the zero-fee trading, pro-level charts, and top-tier security you need to get started the right way. Open your free account and grab a $10 sign-up bonus today!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.