When you get down to it, the difference between a custodial and non-custodial wallet boils down to one simple question: who holds your private keys? Think of a custodial wallet like a traditional bank account—a third party, usually an exchange, holds the keys for you. It’s convenient, but you're trusting them with your money.

A non-custodial wallet, on the other hand, is like a personal safe you keep at home. You and only you hold the keys, giving you absolute, undeniable control over your funds.

Understanding the Core Custody Models

At its heart, choosing between custodial and non-custodial solutions is a classic trade-off between convenience and control. This single decision dictates almost everything about your experience with digital assets, from the security measures you need to worry about to how you actually access and use your crypto.

Before we get into the weeds, it's worth understanding the basics of what cryptocurrency is and why everyone is so obsessed with key management. Every crypto wallet has two keys: a public key (like your bank account number) for receiving funds, and a private key (like your PIN) for sending them. The entire custodial vs. non-custodial debate is about who controls that all-important private key.

The Custodial Approach: Convenience with Trust

With a custodial wallet, you’re handing your private keys over to a third-party service. This is the model used by most major exchanges, and it’s typically the first stop for beginners because it feels familiar and straightforward.

- Ease of Use: You get a simple username and password login, just like your online banking portal.

- Recovery Options: Forget your password? No problem. The custodian can help you regain access, which can be a lifesaver.

- Integrated Services: These wallets are almost always built directly into trading platforms, making it incredibly easy to buy, sell, and trade assets on the fly.

Of course, this convenience comes at a price—you have to place a huge amount of trust in the custodian. You’re betting on their security systems and their operational honesty to keep your assets safe.

The Non-Custodial Path: Control with Responsibility

A non-custodial wallet, often called a self-custody wallet, puts you squarely in the driver's seat. You generate and manage your own private keys, which are usually protected by a 12 to 24-word "seed phrase."

The old crypto saying, "not your keys, not your coins," perfectly sums up the philosophy here. True ownership means having sole, undisputed control of your private keys.

This approach gives you complete financial sovereignty, but it also comes with a heavy dose of personal responsibility. If you lose that seed phrase, there’s no customer support line to call for a reset. Your funds could be gone for good.

At a Glance: Custodial vs. Non-Custodial Wallets

To break it down even further, here's a quick side-by-side look at the most critical distinctions between the two.

| Key Aspect | Custodial Wallet (Third-Party Control) | Non-Custodial Wallet (User Control) |

|---|---|---|

| Private Key Control | Held by a third party (e.g., an exchange) | Held exclusively by the user |

| Account Recovery | Possible via customer support (password reset) | Impossible if seed phrase is lost |

| Security Responsibility | Relies on the custodian's security infrastructure | Entirely the user's responsibility |

| Best For | Beginners, active traders, users prioritizing convenience | Long-term holders, DeFi users, privacy advocates |

Ultimately, the right choice depends entirely on your goals and comfort level. Are you looking for a simple, hassle-free way to trade, or are you aiming for true, sovereign ownership of your digital assets?

How Custodial Crypto Wallets Work

For most people dipping their toes into crypto for the first time, custodial wallets are the go-to starting point. Think of them as the crypto equivalent of your online banking portal—they’re built for a familiar, user-friendly experience, hiding all the complicated blockchain tech behind a simple interface. Big exchanges like Coinbase or platforms such as vTrader run on this very model.

The biggest draw here is simplicity. You don't have to worry about managing a long, complex string of characters known as a private key. Instead, you get into your account with a good old-fashioned username and password. If you forget it, there's a recovery process, just like any other website. This convenience alone removes a massive barrier for newcomers who are often anxious about the technical side of crypto.

The Convenience Factor: Onboarding and Trading

Getting started with a custodial wallet is incredibly smooth. You sign up, complete the required identity checks (KYC), and you can be buying, selling, or trading crypto within minutes. These platforms have trading features baked right in, letting you execute orders instantly without the hassle of moving funds between different services.

For anyone trading actively, this all-in-one setup is a game-changer. The speed and liquidity you get on a centralized exchange are tough to beat with a non-custodial wallet, making it the clear choice for traders who need to react to market swings in a flash. The value proposition is simple: you trade a bit of control for a whole lot of convenience.

Behind the Scenes: Security Measures

To win and keep your trust, custodial providers pour huge amounts of money into their security infrastructure. They know they're protecting assets at a massive scale and typically use a multi-layered strategy to keep funds safe from bad actors.

- Cold Storage: The vast majority of user funds—often over 95%—are kept in offline "cold storage" wallets. Since these aren't connected to the internet, they are basically untouchable by online hackers.

- Two-Factor Authentication (2FA): You’ll always be prompted to set up 2FA, which adds a crucial security layer to your account. It requires you to verify your identity from a second device, like your phone.

- Insurance Funds: Many of the top exchanges maintain massive insurance funds (often called SAFU funds) to cover user losses in the unlikely event of a security breach, providing a valuable safety net.

The Centralized Dilemma: While these platforms boast serious security, they also create a single point of failure. Piling all those assets in one place makes them a very attractive target for sophisticated attackers.

The Inherent Risks: Not Your Keys, Not Your Coins

This brings us to the heart of the debate, perfectly summed up by the old crypto mantra: "not your keys, not your coins." When you use a custodial service, you're trusting a company to hold your assets for you. This introduces a whole set of risks that simply don't exist when you hold the keys yourself.

The spectacular collapses of exchanges like Mt. Gox back in 2014 and, more recently, FTX in 2022 are brutal reminders of what can go wrong. In both instances, users lost access to billions of dollars when the platforms went under, kicking off legal battles for fund recovery that have dragged on for years.

The idea of "custody" isn't unique to crypto. Think about family law, where over 90% of child custody disputes are settled through agreements rather than a judge's ruling. It highlights a natural preference for resolving sensitive issues through trusted agreements. In the crypto world, you're essentially making a trust-based agreement with your custodian.

Beyond a platform completely failing, other concerns linger. Your funds could be frozen by the company or a government agency, and your transactions could potentially be blocked. It's the fundamental trade-off: you get an easy-to-use platform but give up the financial freedom that makes cryptocurrency so unique in the first place. For anyone looking to get a firmer grasp on these core concepts, the vTrader Academy has plenty of material to explore in our crypto learning guides.

Taking Control with Non-Custodial Wallets

Making the switch from a custodial service to a non-custodial wallet is a lot like moving out of a rental and buying your own house. Suddenly, you're not just a tenant anymore—you’re the homeowner. You hold the keys, you make the rules, and you're in complete control. That's the core idea behind self-custody: your digital assets are truly yours.

The way it works is both simple and powerful. When you set up a non-custodial wallet, it generates a unique private key—think of it as the master password for your funds. To make things easier, this key is shown to you as a seed phrase (or recovery phrase), which is just a list of 12 to 24 random words. This phrase is the one and only backup you’ll ever have.

This setup gives you total financial sovereignty. Your assets can't be frozen, seized, or blocked by anyone else because no one else can access them. It also swings open the doors to the wider world of Web3, letting you connect directly with decentralized applications (dApps) and DeFi protocols without needing a middleman.

The Spectrum of Self-Custody

Not all non-custodial wallets are built the same, though. They fall on a spectrum that balances tight security with everyday convenience, and knowing the difference is key to picking the right one for your goals.

- Software Wallets (Hot Wallets): These are the apps you run on your computer or phone, like MetaMask or Trust Wallet. They keep your private keys on a device that's connected to the internet, which makes them perfect for daily transactions, trading on decentralized exchanges (DEXs), and playing around with dApps. The downside? Being online makes them more susceptible to things like malware or phishing scams.

- Hardware Wallets (Cold Wallets): Devices from companies like Ledger or Trezor are considered the gold standard for security. They are physical gadgets that store your private keys completely offline, isolated from the internet. When you make a transaction, it’s signed inside the device itself, so your keys are never exposed. This makes them almost bulletproof against hackers and the best choice for securing large sums or for long-term holding.

Choosing between them really comes down to a classic trade-off. Software wallets give you convenience for your daily crypto activities, while hardware wallets offer Fort Knox-level security for the assets you can't afford to lose.

The Weight of Absolute Responsibility

That freedom of self-custody comes with a heavy dose of personal responsibility. There’s no 1-800 number to call if you lose your seed phrase. If you lose it, your funds are gone for good.

Your seed phrase is the ultimate key to your financial kingdom. Guard it with the same seriousness you would a bar of gold, because in the digital world, it holds the same value.

This idea of one party holding all the responsibility isn't unique to crypto. Think about the real world—in 2018, there were around 12.9 million custodial parents in the U.S., with mothers making up 80% of that figure. These families often face immense economic pressure, which underscores the huge responsibility placed on a single custodian.

In the same way, with a non-custodial wallet, you are the sole guardian. The safety of your assets depends entirely on how well you protect that seed phrase.

Best Practices for Securing Your Seed Phrase

Protecting your recovery phrase is the single most important job you have as a non-custodial wallet user. Here are a few non-negotiable best practices to follow:

- Write It Down Offline: Never, ever store your seed phrase digitally. Don't put it in a notes app, an email draft, or a screenshot on your phone. Write it down on paper or, even better, etch it into metal.

- Store It in Multiple Secure Locations: Don't put all your eggs in one basket. Think about keeping a copy in a fireproof safe at home and another in a totally separate, secure place like a bank's safe deposit box.

- Never Share It: No legitimate company, developer, or customer support agent will ever ask you for your seed phrase. Anyone asking for it is trying to scam you, period. Keeping this information safe is a principle we also stand by, as detailed in the vTrader privacy policy.

The finality of blockchain transactions adds one more layer of responsibility. Once a transaction is confirmed on the network, it’s irreversible. This makes it crucial to be careful and double-check every move you make.

Comparing Wallets by Security, Control, and Use Case

Choosing between a custodial and non-custodial solution isn't just about definitions; it's about understanding how they perform in the real world. The right choice for you really boils down to a head-to-head comparison of security, control, convenience, and recovery options. Each path presents its own set of trade-offs, catering to different needs and appetites for risk.

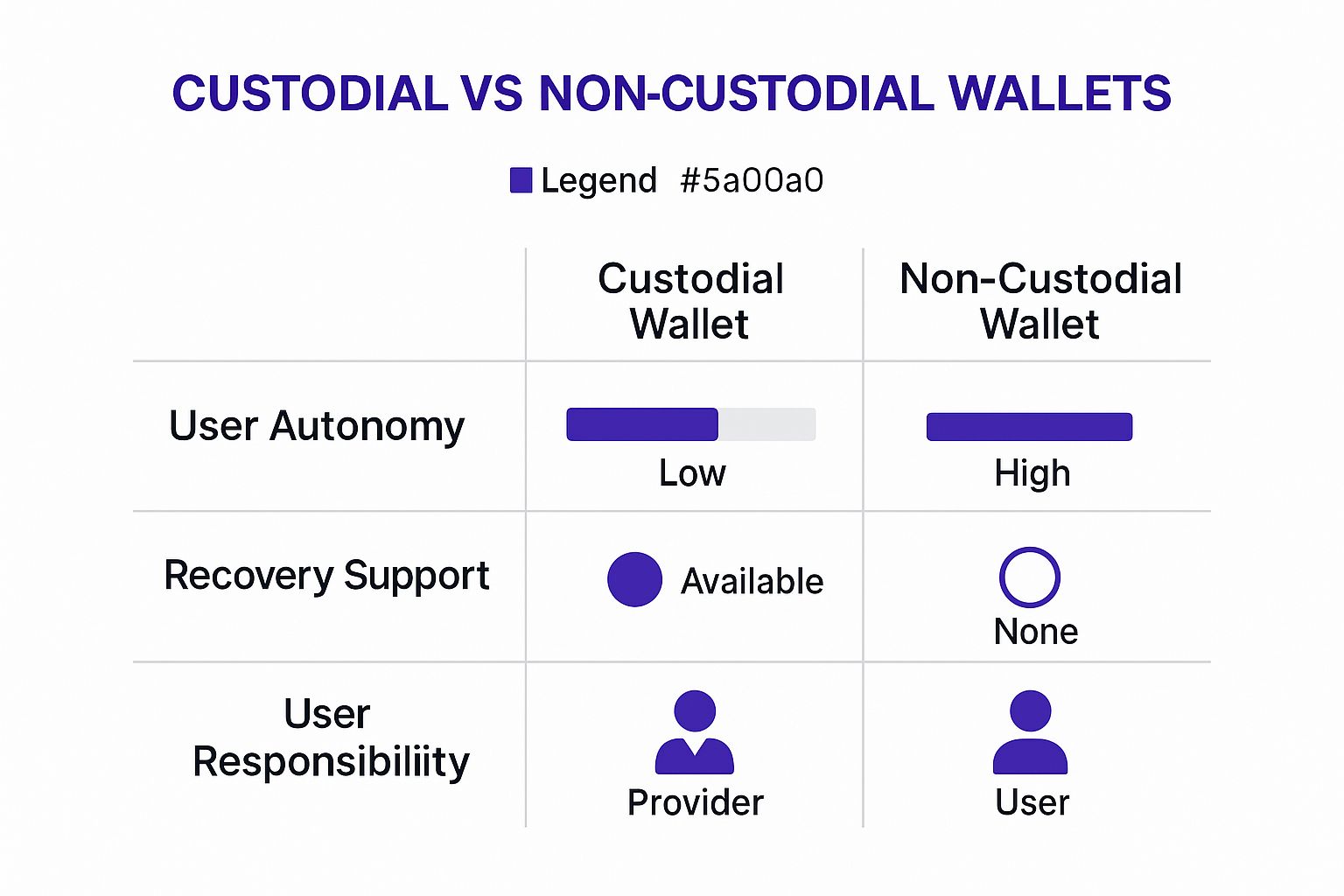

This chart paints a clear picture of the fundamental give-and-take between user autonomy, available support, and personal responsibility.

As you can see, gaining total control with a non-custodial wallet means you're on your own for recovery and must accept full responsibility for your assets.

Security: The Centralized Fortress vs. The Personal Vault

Security is almost always the number one concern, but the dangers you face with each wallet type are worlds apart. It’s the classic dilemma: counterparty risk versus personal risk.

Think of a custodial wallet on a major exchange as a centralized fortress. It’s backed by institutional-grade security, with most assets in cold storage, insurance funds, and entire cybersecurity teams working 24/7. But that concentration of wealth also makes it a massive target for hackers. If that fortress gets breached, the fallout for everyone inside can be catastrophic.

A non-custodial wallet, on the other hand, is your own personal vault. It’s not on any hacker’s radar for a large-scale attack. Instead, the risk shifts entirely to you. The biggest threats are personal slip-ups, like falling for a phishing scam, downloading malware, or simply losing your seed phrase.

Key Insight: With a custodial wallet, you're trusting someone else's security. With a non-custodial wallet, you're trusting only your own.

Control and Sovereignty: The Freedom vs. The Safety Net

The level of control you have over your funds is the biggest philosophical divide in this debate. A non-custodial wallet gives you absolute financial sovereignty. Your assets are yours, full stop. No one can freeze, seize, or block your transactions—it's the core principle of decentralization in action.

Custodial platforms, however, exist within traditional legal and financial systems. This means your funds could be frozen by a court order, a regulatory crackdown, or even just a change in the platform's internal policies. While that sounds restrictive, it also acts as a layer of protection if your account gets compromised.

It's a dynamic that mirrors real-world legal frameworks where custody and responsibility are intertwined. For instance, in the U.S., custodial fathers make up less than 8% of all fathers living with their children, yet they are significantly less likely to need government assistance. This underscores how direct custody often correlates with different support structures and outcomes. You can dig deeper into these findings from the Institute for Family Studies about custodial and non-custodial parents in the US.

Usability and Convenience: The Learning Curve

For anyone just starting out, the user experience of a custodial wallet is undeniably easier. The interface feels familiar, like an online bank or brokerage account. Plus, features like password resets and 24/7 customer support provide a crucial safety net. Forget your password? You can still get back into your account.

Non-custodial wallets demand more from you. You’re responsible for everything, from managing transaction fees (gas) to keeping your seed phrase safe. There’s no help desk to call if you lose your keys—the buck stops with you. It’s a steep learning curve, but the reward is direct, unfiltered access to the entire Web3 ecosystem.

Which Wallet Fits Your Needs? A Use Case Analysis

So, how does this all shake out in practice? The best wallet for you depends entirely on what you're trying to accomplish. Let's break down some common scenarios.

| User Profile or Goal | Recommended Wallet Type | Why It's a Good Fit |

|---|---|---|

| The New Investor or Trader | Custodial | The familiar interface, password recovery, and customer support create a forgiving entry point without the immediate stress of self-custody. |

| The DeFi & NFT Enthusiast | Non-Custodial | This is a must-have. You need direct control of your keys to interact with decentralized apps, mint NFTs, and participate in liquidity pools. |

| The Long-Term HODLer | Non-Custodial | For holding assets securely over many years, nothing beats the peace of mind of having your keys in a personal vault, offline and away from exchange risks. |

| The Active Day Trader | Custodial | Speed and liquidity are everything. Keeping funds on an exchange allows for instant, low-cost trades without waiting for blockchain confirmations. |

| The Privacy Advocate | Non-Custodial | It offers true financial sovereignty and pseudonymity. No third party is tracking or has the ability to freeze your transactions. |

Ultimately, many seasoned crypto users end up using both. A custodial wallet is great for active trading and quick on-ramping, while a non-custodial one is perfect for long-term storage and exploring the decentralized web. It’s all about using the right tool for the job.

Recovery and Inheritance: Planning for the Future

Getting your account back is pretty straightforward with a custodial wallet. The provider has identity verification procedures to restore access. This also simplifies inheritance, as access can be passed to an heir through standard legal documents like a will.

With a non-custodial wallet, inheritance planning gets a lot more complicated. Since you’re the only one with the keys, you have to create a foolproof and secure plan to pass your seed phrase to your beneficiaries. Without a solid plan, your crypto could be lost forever when you’re gone—locked away in a digital black hole with no hope of recovery.

When to Use Each Type of Wallet

Deciding between a custodial and non-custodial wallet isn't about crowning a winner. It's about matching the right tool to what you're trying to accomplish. The best choice really boils down to your goals, your comfort with risk, and exactly what you plan to do with your crypto.

For most people, the crypto journey kicks off with a custodial wallet. Their familiar feel and built-in safety nets make them a no-brainer for anyone just dipping their toes in the water.

The Case for Custodial Wallets

A custodial wallet is the practical pick in a few key scenarios where convenience, speed, and having a support line are what matter most. If any of these sound like you, a custodial solution is probably your best bet right now.

- You're a Beginner: Just making your first crypto purchase? The simplicity of a custodial wallet is your best friend. You can skip the immediate stress of securing a seed phrase and just focus on learning the ropes in a friendly environment.

- You're an Active Trader: For traders, liquidity and speed are everything. A custodial wallet on an exchange like vTrader gives you instant access to the order books, letting you execute trades immediately without getting bogged down by slow and sometimes pricey blockchain confirmations.

- You Value Recovery Options: If the idea of losing a seed phrase and your entire portfolio keeps you up at night, a custodial wallet offers a crucial backup plan. Password resets and customer support give you a path to recovery that simply doesn't exist with self-custody.

Think of a custodial wallet as a managed service for your digital assets. It takes care of the heavy lifting on security so you can focus on your investment strategy—a tradeoff many find well worth it when starting out or trading frequently.

It's smart to understand how these services operate. You can get the full picture by reading the vTrader terms and conditions to see exactly how user assets are handled. That kind of clarity is key to making a good decision.

When to Embrace Self-Custody

On the flip side, a non-custodial wallet becomes absolutely essential when your priorities shift from convenience to having total control, ironclad long-term security, and direct access to the decentralized world. This route demands more personal responsibility, but it unlocks the true power of digital ownership.

Here’s when a non-custodial wallet isn't just a good idea—it's necessary:

- You're a Long-Term Holder (HODLer): If your game plan is to buy and hold for years, a hardware non-custodial wallet is the gold standard. It takes your private keys completely offline, shielding your portfolio from exchange hacks and other online threats.

- You're into DeFi and Web3: Want to dive into decentralized applications (dApps), join liquidity pools, or use lending protocols? You'll need a non-custodial wallet. It’s your passport to the decentralized web, letting you connect and approve transactions directly.

- You're an NFT Collector: To truly own a non-fungible token (NFT), you have to hold the private keys tied to it. A non-custodial wallet guarantees your digital collectibles are verifiably yours and can't be frozen or moved by anyone else.

The Hybrid Strategy: A Best of Both Worlds Approach

At the end of the day, this isn't a black-and-white choice. Many seasoned crypto users land on a hybrid strategy, pulling the best features from both worlds. This balanced approach gives you both the flexibility for daily activity and the robust security you need for a serious digital asset strategy.

The popular method is pretty straightforward. You use a custodial exchange for what it does best:

- On-Ramping: Easily turning your fiat currency (like USD) into crypto.

- Active Trading: Using the platform’s deep liquidity and trading tools for frequent buys and sells.

Then, once your trades are done or you've built up a sizable stack for the long haul, you transfer those assets out of the custodial exchange and into your personal, non-custodial hardware wallet. It's a simple move that ensures your long-term investments are secured under your complete control—the right tool for the right job.

Choosing the Right Wallet for Your Crypto Strategy

The whole custodial versus non-custodial debate doesn't have a one-size-fits-all answer. Honestly, the right choice boils down to your personal strategy, how much risk you're comfortable with, and your tech-savviness. A quick self-assessment is all it takes to figure out which path makes the most sense for you.

To get started, just ask yourself a few straight-up questions. Your answers will pretty quickly point you in the right direction.

Key Questions for Your Decision

- How much responsibility do you want? If the thought of losing your private keys keeps you up at night, the safety net of a custodial wallet is a no-brainer. But if absolute control is your non-negotiable, then non-custodial is the only way to go.

- What's your main game in crypto? Are you an active trader who needs speed and liquidity at your fingertips? Or are you a long-term HODLer focused on locking down your assets securely? What you do with your crypto is a huge factor.

- How will you handle passing on your assets? Custodial services can often work with legal inheritance documents, which simplifies things immensely. With a non-custodial wallet, you’ll need a rock-solid, clearly communicated plan for someone to access your seed phrase.

The "best" wallet is the one that lets you sleep at night. Whether that means trusting a secure, regulated platform or holding the keys yourself, your peace of mind is the ultimate metric.

In the end, it’s a trade-off between convenience and control. A newcomer might feel more comfortable starting with a custodial service for its simplicity and customer support. A seasoned DeFi pro, on the other hand, will demand the freedom only a non-custodial wallet can offer.

Understanding this balance is key to moving forward with confidence. For more transparency on how funds are managed on our platform, you can always check out the vTrader refund policy.

Frequently Asked Questions

When you dig into the custodial versus non-custodial debate, a lot of practical questions bubble up about security, access, and what’s next for the technology. We’ve rounded up some of the most common ones to give you the clarity you need to make the right call.

Can a Non Custodial Wallet Be Hacked

It can, but the method is rarely what people think. The risk isn’t with the wallet’s code itself—the real vulnerability is you. The underlying tech of a good non-custodial wallet is incredibly robust.

Hackers don’t waste time trying to crack the wallet; they go after the user. They trick people into giving up their credentials through phishing scams, infect computers with malware to log keystrokes, or find a seed phrase jotted down on a sticky note. When you hold the keys, your security is entirely in your hands.

What Happens If I Forget My Password on a Custodial Exchange

Losing your password on a custodial platform isn't the disaster it would be with a non-custodial wallet. Think of it like a bank account. These services have recovery processes in place, so you can usually just reset your password through your registered email.

You'll likely have to jump through a few extra hoops for security, like showing a government-issued ID or answering personal questions. It’s a bit of a hassle, but your funds are safe and sound because the exchange is the one controlling the private keys. For a deeper dive into our account security measures, check out the comprehensive vTrader FAQ section.

Key Takeaway: With custodial services, you trade a bit of control for the peace of mind that comes with account recovery. For many investors, that safety net is a huge plus.

How Do I Move from a Custodial to a Non Custodial Wallet

It's actually a pretty simple process—it’s just a standard crypto withdrawal. All you have to do is start a "withdrawal" or "send" transaction from your custodial wallet or exchange.

From there, you'll paste your new non-custodial wallet's public address into the recipient field. Confirm the details, clear any two-factor authentication (2FA) prompts, and the exchange will send the transaction to the blockchain. Once the network confirms it, the funds will pop up in your wallet. Pro tip: always send a small test amount first to make sure everything works.

Are There Hybrid Wallet Models

Absolutely. The industry is getting creative, and we're seeing some really interesting hybrid solutions emerge, especially with Multi-Party Computation (MPC) technology.

Instead of one person holding a single private key, MPC wallets break the key into multiple "shards" and spread them across different devices or parties. This setup gets rid of the single point of failure that comes with a traditional seed phrase, but without handing over control to a central custodian. It's a clever way to blend the security and recovery options from both worlds.

Ready to start your trading journey with a secure and user-friendly platform? Join vTrader today and enjoy zero-fee trading on over 30 cryptocurrencies, advanced tools, and a seamless experience. Get started at https://www.vtrader.io.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.