For most people, crypto starts and ends with buying a coin like Bitcoin or Ethereum and just holding on, hoping the price goes up. This "HODL" strategy is a perfectly fine starting point, but it's like leaving money on the table. What if those digital assets could do more than just sit in your wallet? What if they could actually earn you an income?

That's the entire idea behind generating passive income with crypto. It’s a shift in mindset from being a passive holder to becoming an active earner by tapping into the world of decentralized finance (DeFi). DeFi has opened up a whole new toolbox for investors, creating opportunities that simply didn't exist a few years ago.

This guide will walk you through the most powerful strategies to make your crypto work for you. We'll cut through the jargon and give you a clear, high-level view of the main ways to earn:

- Staking: Think of this as putting your crypto to work. You lock up your coins to help secure a blockchain network, and in return, you get rewarded with more coins.

- Lending: You can loan out your crypto to others through various platforms and earn interest. It’s a lot like a high-yield savings account, but often with much better rates.

- Yield Farming: This is a more hands-on strategy. You provide liquidity (your crypto) to decentralized exchanges (DEXs) to help facilitate trades, earning a cut of the trading fees and other token rewards.

What Kind of Returns Are We Talking About?

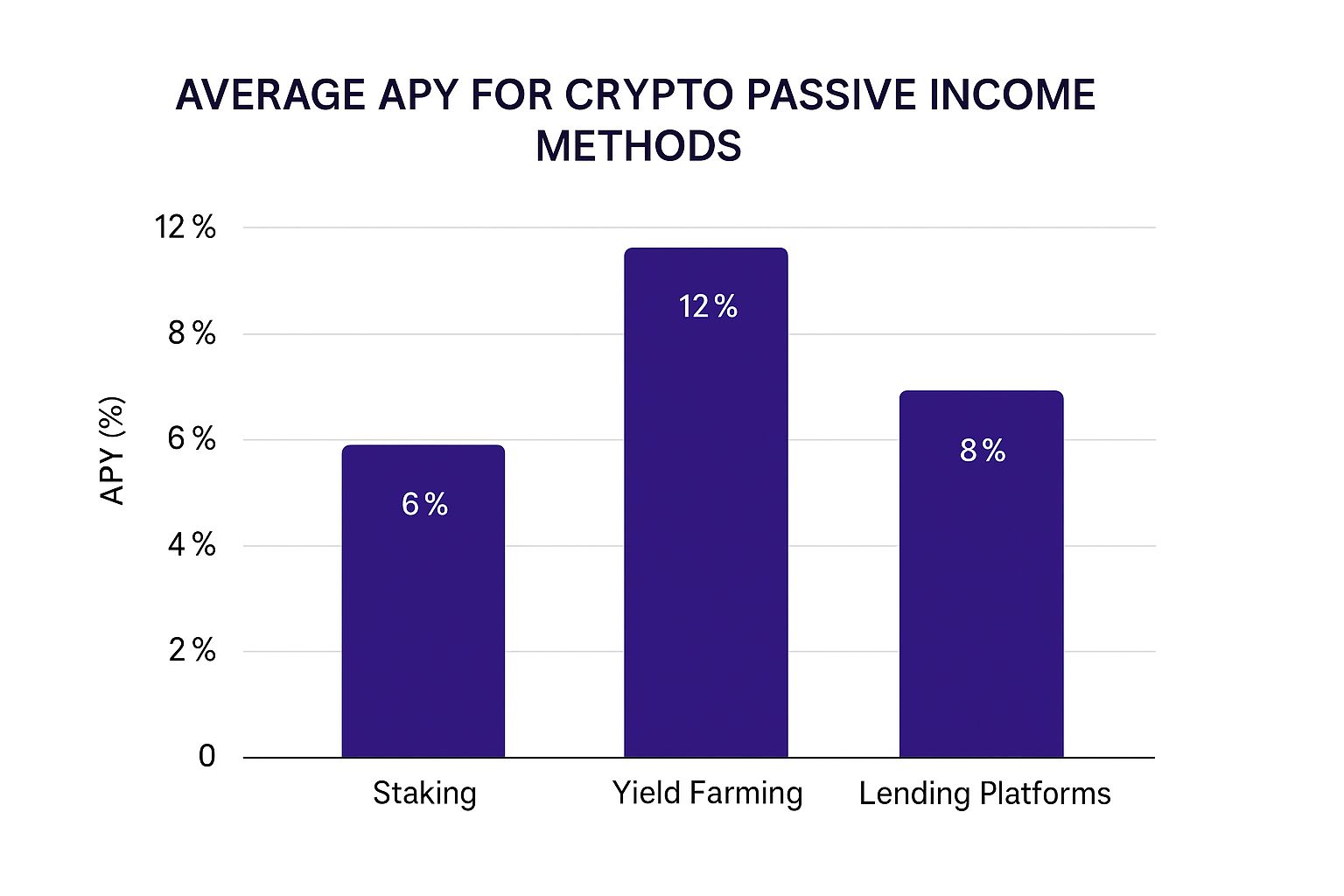

Each method comes with its own balance of risk and reward. Staking is usually the simplest and lowest-risk way to get started. On the other end of the spectrum, yield farming often boasts the highest potential returns—but it also carries the most risk.

The chart below gives you a rough idea of the Annual Percentage Yield (APY) you might see from these strategies.

As you can see, the eye-popping numbers often come from yield farming, but that higher APY comes with more complexity and specific risks, like impermanent loss.

Crypto Passive Income Methods at a Glance

To make it even clearer, here’s a quick breakdown of how these methods stack up against each other.

| Method | Typical APY Range | Risk Level | Complexity |

|---|---|---|---|

| Staking | 3% – 15% | Low | Low |

| Lending | 2% – 10% | Low to Medium | Low |

| Interest Accounts | 1% – 8% | Low | Very Low |

| Liquidity Mining | 10% – 50%+ | High | High |

| Yield Farming | 20% – 100%+ | Very High | Very High |

This table is just a starting point. The real numbers can swing wildly based on the specific coin, platform, and overall market conditions.

How to Choose Your Strategy

So, which path is right for you? It really boils down to your personal goals, how much risk you're comfortable with, and how much time you want to put into managing it all. Are you looking for a steady, set-it-and-forget-it income stream? Or are you willing to navigate more complexity for a shot at much higher yields? Figuring that out is your first move.

By exploring these different avenues, you can build a diversified crypto income portfolio that aligns with your financial objectives. The key is to start with a solid educational foundation.

Before you jump in, it pays to build up your knowledge base. For a deeper dive into the fundamentals, you can explore the resources over at the vTrader Academy. As we continue, we’ll give you the insights you need to confidently pick a strategy and get started.

Earning Consistent Rewards with Crypto Staking

Going beyond just HODLing, staking is probably the most direct way to generate some passive income with your crypto. Think of it like a high-yield savings account. Instead of lending money to a bank, you're helping secure a blockchain network by locking up your digital assets to support its operations.

In return for your help, the network pays you rewards.

This whole process is critical for the security and efficiency of many modern Proof-of-Stake (PoS) networks. The stakers are the validators, confirming transactions and adding new blocks to the blockchain. When you commit your coins, you’re basically casting a vote of confidence in the network's integrity, which makes it stronger and more decentralized.

Choosing Your Staking Path

There's more than one way to stake your crypto. Your best bet will depend on how tech-savvy you are, how much you’re looking to stake, and how much control you want over your funds.

Here are the main ways people do it:

- Direct Staking (Running a Validator Node): This is the most hands-on option. You set up your own node to validate transactions right on the blockchain. While it can deliver the highest rewards since you're cutting out the middleman, it's not for the faint of heart. It requires serious technical know-how, a 24/7 internet connection, and often a hefty minimum stake (like the 32 ETH needed for Ethereum).

- Delegating to a Validator: This is a much more popular route. You delegate your stake to a professional validator or a staking pool. You keep your assets, but you assign their "voting power" to a trusted operator who handles all the technical stuff. They'll take a small commission from your rewards for their service, but it's a great trade-off for convenience and security.

- Staking on a Centralized Exchange: Big exchanges like Coinbase or Kraken make staking super simple. You can start earning with just a few clicks. The downside? You're giving up custody of your keys, and the exchange usually takes a bigger slice of the rewards.

- Liquid Staking Protocols: Platforms like Lido or Rocket Pool have really changed the game. When you stake your ETH, for example, you get a liquid staking token (like stETH) back. This token represents your staked position but can still be traded or used in other DeFi apps. You get to earn staking rewards while your capital stays liquid—a huge plus.

Staking isn't just a niche activity; it's a cornerstone of the modern crypto economy. It provides a reliable income stream while giving participants a direct role in a network's future.

Calculating Your Potential Earnings

The rewards you earn from staking, usually shown as an Annual Percentage Rate (APR), aren't set in stone. They shift based on a few key factors you'll want to keep an eye on.

One of the biggest influences is the total amount of crypto being staked on the network. When more people jump in and stake, the reward pool gets split among more participants, which can push the APR down. On the flip side, if people start unstaking, the APR for those who stick around might actually go up.

Here’s a great visual from Ethereum's own site showing how the APR drops as more ETH gets staked.

This chart makes it crystal clear: there's an inverse relationship between how many people are staking and the reward rates. That's a key dynamic to grasp when trying to forecast your returns.

Performing Diligence on Validators

If you decide to delegate your stake, picking the right validator is everything. Their performance directly affects your earnings.

You'll want to look for validators with high uptime (meaning their node is always online and processing transactions) and a fair commission rate. A low commission looks tempting, but a validator with a spotty performance record can get "slashed"—a penalty for bad behavior or downtime that could cost you a chunk of your staked funds. Always do your homework on a validator's history and reputation before you commit.

Trust in established networks is a massive trend. For example, by 2025, it's projected that around 27.75% of all ETH will be staked, with an average annual reward rate of about 2.05%. That kind of widespread participation shows just how mature staking has become as an income strategy.

Staking offers a compelling mix of simplicity and consistent returns. It’s a powerful tool for anyone serious about building a passive income stream with cryptocurrency.

For a deeper dive into getting started, https://www.vtrader.io/en-us/staking.

Generating Steady Interest Through Crypto Lending

If staking feels like earning dividends, think of crypto lending as the high-yield savings account of the digital asset world. It's a straightforward way to generate passive income: you loan out your idle crypto to borrowers and collect interest payments in return. This strategy puts your assets to work without you having to sell them, creating a consistent income stream.

The crypto lending scene is split into two main camps: centralized finance (CeFi) and decentralized finance (DeFi). Each offers a completely different approach to risk, control, and user experience, so it's vital to grasp the distinctions before diving in.

Comparing DeFi and CeFi Lending Platforms

Deciding between DeFi and CeFi really boils down to what you value most—convenience, control, or transparency.

Centralized platforms, like Nexo, function much like traditional banks. You deposit your crypto, they manage it, lend it out, and pay you interest. They're often easier for newcomers but require a huge amount of trust since they hold your assets.

On the flip side, DeFi protocols like Aave and Compound are built on blockchain-based smart contracts. You interact with them directly from your own wallet, meaning you never give up your private keys. This "trustless" setup is the heart and soul of DeFi.

Let's quickly compare what you're getting into with each.

Comparing DeFi and CeFi Lending Platforms

The choice between decentralized (DeFi) and centralized (CeFi) lending platforms can feel daunting, but it mostly comes down to your comfort level with technology and how much control you want over your funds. This table breaks down the core differences to help you decide which path is right for you.

| Feature | DeFi (e.g., Aave) | CeFi (e.g., Nexo) |

|---|---|---|

| Asset Custody | Non-custodial; you keep your keys | Custodial; the platform holds your keys |

| Transparency | Fully transparent on the blockchain | Opaque; relies on company audits |

| Accessibility | Permissionless; anyone can use it | Requires KYC/AML verification |

| Ease of Use | Steeper learning curve | User-friendly, like a banking app |

| Risk Profile | Smart contract vulnerabilities | Platform insolvency, hacks |

Ultimately, DeFi offers more control and transparency for those willing to navigate a more complex system, while CeFi provides a simpler, more familiar experience at the cost of giving up custody of your assets.

Understanding Variable Interest Rates

Don't expect the fixed rates of a traditional savings account here. In crypto lending, interest rates are almost always variable, shifting based on pure supply and demand within the platform or protocol.

When lots of people want to borrow a specific asset, say USDC, the interest rate for lenders goes up to attract more deposits. If the supply of USDC far outweighs the borrowing demand, the rate will drop. This means your APY can change daily, so you'll want to keep an eye on it.

By 2025, crypto lending has become a go-to method for passive income. Platforms like Aave, Compound, and Nexo let users lend out popular stablecoins like USDC and DAI, or major assets like ETH, for returns that often land between 5% and 12% APY. Most loans are overcollateralized to protect lenders from defaults, but the risks, like smart contract bugs, are very real.

A Practical Walkthrough with DeFi Lending

So, how does this actually work? Let's say you have 1,000 USDC you want to lend out on Aave.

- First, you'd head to the Aave dApp and connect your Web3 wallet (like MetaMask) that holds your USDC.

- From there, you'd find USDC in the list of assets and choose to supply it. You’ll need to approve the transaction in your wallet and pay a small gas fee.

- Once confirmed on the blockchain, you’ll receive an equivalent amount of "aUSDC" tokens. These are special interest-bearing tokens that represent your deposited funds and grow in value in real-time as you earn interest.

- Ready to cash out? You can withdraw your original USDC plus all the interest you've earned at any time by simply redeeming your aUSDC tokens.

The real magic of DeFi lending is "composability." Those aUSDC tokens you're holding aren't just sitting there; they can often be used as collateral in other DeFi apps, letting you "stack" your yields for even more advanced income strategies.

Navigating the Inherent Risks

This isn't a risk-free game. With CeFi, the biggest boogeyman is custodial risk. If the platform gets hacked or goes belly-up (as we saw with Celsius), your funds could be gone for good.

In the DeFi world, the main danger is smart contract risk. A tiny bug or exploit in a protocol's code could be all an attacker needs to drain funds. That's why it's crucial to stick with well-audited, time-tested protocols. And before you do anything, always get a handle on the platform's fees. It's smart to look for a clear fee breakdown so you know exactly what to expect.

Diving into Yield Farming and Liquidity Mining

If you're comfortable with a bit more risk, the worlds of yield farming and liquidity mining open up some of the most dynamic ways to earn passive income in crypto. Think of staking and lending as the steady gigs; this is more like venturing into the high-stakes, high-reward heart of decentralized finance (DeFi). Here, you're not just holding an asset—you're actively providing a crucial service to decentralized exchanges (DEXs).

At its core, liquidity mining involves adding your crypto assets to a liquidity pool on a DEX like Uniswap or SushiSwap. These pools are what make decentralized trading possible, allowing anyone to swap tokens without a middleman. By depositing a pair of assets, you essentially become a liquidity provider (LP), helping keep the gears of the DEX turning.

For providing this service, you get a cut of the trading fees from that pool. That’s your baseline earning.

How to Become a Liquidity Provider

The process is definitely more hands-on than a simple stake, but it’s a straightforward sequence. Let's say you want to provide liquidity to a popular ETH/USDC pool on Uniswap.

It breaks down like this:

- Pair Up Your Assets: You'll need an equal value of both tokens. If 1 ETH is trading at $3,000, you’d need to supply 1 ETH and 3,000 USDC.

- Deposit into the Pool: Simply connect your wallet to the DEX, find the right pool, and deposit your paired tokens.

- Get Your LP Tokens: The protocol will then issue you LP tokens. These are your digital receipt, representing your share of that specific pool. You'll need them to track your position and eventually claim your earnings.

From that point on, every time a trade happens in that pool, you automatically earn a portion of the fees—often around 0.3% of the transaction value, split among all providers based on their share.

The Double-Edged Sword: Impermanent Loss

This is the one risk you absolutely must wrap your head around before jumping in. Impermanent loss happens when the market price of your deposited assets changes from the time you deposited them. The more the prices of the two tokens drift apart, the more significant this potential loss becomes.

Why "impermanent"? Because the loss only becomes real if you withdraw your funds. If the prices swing back to their original ratio, the loss effectively vanishes.

A Quick Scenario: Imagine you deposit 1 ETH and 3,000 USDC when ETH is $3,000. Your total stake is worth $6,000. Then, ETH skyrockets to $6,000. The pool's internal mechanics rebalance your holdings to maintain a 50/50 value split. If you decided to pull your funds out now, you might get back something like 0.707 ETH and 4,242 USDC. Your total is now $8,484—great, but if you had just held your original assets, you'd be sitting on $9,000 (1 ETH worth $6,000 + 3,000 USDC). That $516 difference? That's your impermanent loss.

The key is that your earnings from trading fees need to outpace any potential impermanent loss. That's the constant balancing act of being a liquidity provider.

Stacking Rewards with Yield Farming

This is where things get really interesting. Yield farming cranks the dial on liquidity mining. Because DeFi protocols are hungry for liquidity, many offer an extra layer of incentives to attract LPs.

They let you take those LP tokens—your pool "receipt"—and stake them in a separate "farm." In exchange, you start earning another reward, usually paid out in the platform's own native token (like earning UNI tokens for farming on Uniswap).

This "double-dipping" is what creates those eye-popping, triple-digit APYs you see advertised. You're effectively earning from two sources simultaneously:

- Trading fees from your original liquidity pool.

- Bonus token rewards for staking your LP tokens in the farm.

This layered strategy can seriously amplify your cryptocurrency passive income, but be warned: it also magnifies your risk. You're now exposed to the price swings of three different assets: the two tokens in your pair and the new reward token you're farming. If that reward token's price tanks, it can wipe out your trading fee profits in a hurry.

Given the complexities and risks like smart contract bugs and impermanent loss, yield farming is really for experienced DeFi users who are willing to actively manage their positions. It is far from a "set it and forget it" play, but for those who get it right, the returns can be more than worth the effort.

Building a Resilient Crypto Income Portfolio

It’s easy to get tunnel vision chasing the highest possible APY. I’ve seen it a thousand times—it’s a classic rookie mistake in the crypto income game.

But sustainable success isn’t about hitting a home run on every single farm. It’s about building a portfolio that can take a punch, one that can weather the market’s wild swings and unforeseen disasters. A truly resilient strategy is built on smart risk management just as much as it is on growth.

The world of digital assets is a minefield of unique risks you just don't see in traditional finance. We're talking about everything from smart contract bugs that can drain a protocol dry in minutes to the constant threat of platform hacks. Being proactive here isn't just a good idea; it's non-negotiable.

Identifying the Core Risks

Before you can build your defenses, you need to know what you’re up against. In the DeFi space, the threats are coming from all angles and require different playbooks to handle them. Getting a firm grip on these is your first real step toward building a durable income stream.

Here are the primary dangers you’ll face:

- Smart Contract Risk: This is the big one. It's the risk that a bug, exploit, or flaw in a protocol's code gets discovered and used to steal funds. Even heavily audited platforms aren't bulletproof.

- Platform Risk: This applies to both centralized exchanges and DeFi protocols. It’s the danger that the platform itself gets hacked, goes belly-up, or has its admin keys compromised.

- Impermanent Loss: As we've touched on, this is the stealthy risk for liquidity providers where the value of your staked tokens underperforms what you would have made by just holding them.

- Regulatory Risk: Let’s be real—governments worldwide are still trying to figure out crypto. A sudden rule change can crater the viability of your favorite platform or strategy overnight.

Your goal isn't to eliminate risk entirely—that's impossible. Instead, the objective is to understand, manage, and diversify against these threats so that no single event can wipe out your portfolio.

Diversification Is Your Best Defense

The oldest rule in investing—don't put all your eggs in one basket—is amplified by a factor of ten in crypto. Diversification here means more than just buying different coins. It’s about spreading your capital across different layers of the ecosystem to protect yourself from single points of failure.

A smart diversification strategy means spreading your bets across different blockchains, like Ethereum, Solana, and Avalanche. This keeps you from being overexposed if one network gets congested or has a major security flaw.

It also means using multiple protocols for similar strategies. For instance, you could split your lending capital between Aave and Compound. If one platform has an issue, you're not completely out of the game.

Finally, mix up your strategies. A well-balanced portfolio might have a big chunk in lower-risk activities like ETH staking while allocating a smaller, more speculative slice to high-APY yield farming. This gives you a nice blend of stability and growth potential.

Practical Steps for Protecting Your Capital

Beyond smart diversification, there are concrete tools and habits you need to adopt to add extra layers of security. These practices can seriously reduce your vulnerability to the most common threats out there.

- Vet Projects Thoroughly: Never, ever put money into a protocol you don't understand. Look for multiple security audits from reputable firms, check for an active and engaged community on Discord and Twitter, and see if the team is public with a solid track record.

- Use Smart Contract Insurance: Services like Nexus Mutual offer coverage against smart contract failures for a small premium. For any significant positions in DeFi protocols, this can be a lifesaver.

- Monitor and Adjust: Passive income in crypto is rarely "set it and forget it." You have to regularly review your positions, track your performance, and stay on top of protocol updates or security alerts.

Managing a portfolio also means getting your house in order for tax season. Keeping detailed records of every single transaction—rewards, fees, swaps—is absolutely essential for accurate reporting down the line.

Many find that sharing their strategies and learning from others can be a huge advantage. In fact, some platforms even reward this kind of community building. You can learn more about how to grow your network and get rewarded for it through the vTrader affiliate program.

Common Questions About Crypto Passive Income

Jumping into crypto for passive income always stirs up a few questions. From how to get your feet wet to the dreaded topic of taxes, getting solid answers is the first step toward building a real strategy. Let's clear up some of the most common ones.

Is It Really a Passive Activity?

While it’s definitely more hands-off than day trading, earning passive income in crypto is rarely a "set it and forget it" deal. It’s less like watching paint dry and more like tending a garden. You still have to do the initial work—researching platforms, picking your strategies, and putting your capital to work.

After that, you'll need to check in on things. That means monitoring performance, keeping an eye on risks, and knowing when to take profits or shift your positions. Staking is usually on the lower-maintenance side, but something like active yield farming can require more frequent tweaks to stay profitable.

What Are the Tax Implications?

This is a big one, and the answer really depends on where you live. In most places, like the United States, any rewards you get from staking, lending, and farming are typically considered taxable income. The IRS usually wants you to report the value based on the asset's market price the moment you receive it.

Keeping detailed records of every single transaction isn't just a good habit—it’s crucial for staying compliant. Note the date, amount, and value of every reward you earn.

The rules can be tricky and are always changing, so it's a smart move to talk to a tax professional who knows their way around digital assets. They'll make sure you're buttoned up.

How Much Money Do I Need to Start?

One of the best parts about DeFi is that it's open to just about everyone. You can often get started with less than $100, which tears down a lot of the traditional barriers to entry.

But you have to watch out for transaction fees, or "gas fees," especially on busy networks like Ethereum. When the network is clogged, these fees can get high enough to wipe out any potential gains on very small investments. To be safe, a starting pot of a few hundred dollars is often more practical to absorb those costs and make it worth your while.

Which Method Is Best for Beginners?

For most people just starting out, the best bets are staking or lending stablecoins on a major, reputable platform. These strategies generally have a much smoother learning curve and deliver more predictable returns.

They're far less complex than something like yield farming, which throws higher risks like impermanent loss into the mix and demands more active management. Starting simple lets you get comfortable with how everything works before you dive into the deep end. For more specific questions, you can always check out a comprehensive crypto FAQ page to get more details.

Ready to put your crypto to work? With vTrader, you can start your journey with zero-fee trading and access powerful tools to build your passive income portfolio. Sign up today and get started

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.