Navigating the cryptocurrency market without a plan is like sailing in a storm without a compass.Navigating the cryptocurrency market without a plan is like sailing in a storm without a compass. The volatility and rapid pace can feel overwhelming, but a well-defined approach can transform market chaos into a structured opportunity for growth. The key isn't just to buy digital assets; it's to deploy deliberate cryptocurrency investment strategies tailored to your financial goals, risk tolerance, and time commitment. This guide is designed to provide that structure, moving beyond generic advice to offer a comprehensive playbook of actionable methods.

We will break down ten distinct strategies, each with its own set of rules, benefits, and implementation steps. Whether you're looking for a long-term, set-and-forget approach like Dollar-Cost Averaging (DCA) or a more active method like swing trading, you will find practical instructions here. For those exploring different asset classes, it's insightful to consider how Bitcoin compares to gold as an investment, as understanding its place in the broader financial ecosystem is crucial.

This article cuts through the noise to focus on what matters: execution. We'll explore everything from the foundational HODL philosophy and portfolio diversification to more advanced techniques like yield farming, arbitrage, and technical analysis. For each strategy, you will learn not just the what and why, but the how—with specific tips on using vTrader’s integrated tools to put these concepts into practice. By the end, you will be equipped to build a sophisticated, multi-faceted investment plan that aligns with your objectives and helps you navigate the digital asset space with confidence and precision.

1. Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging, or DCA, is one of the most accessible and effective cryptocurrency investment strategies for navigating market volatility. Instead of trying to "time the market" by purchasing at the absolute lowest price, DCA involves investing a fixed amount of money at regular intervals, regardless of an asset's price. This disciplined approach smooths out your average purchase price over time. When prices are low, your fixed investment buys more crypto; when prices are high, it buys less.

The core benefit of DCA is mitigating risk and removing emotion from investment decisions. It prevents the panic-selling or fear-of-missing-out (FOMO) that often leads to poor choices. A prime example is MicroStrategy, which has systematically purchased Bitcoin since 2020, accumulating a massive position by consistently buying through various market cycles.

How to Implement DCA on vTrader

Implementing a DCA strategy is straightforward, especially with platforms designed for automation. vTrader’s tools make this process seamless.

- Set Up Recurring Buys: Navigate to the vTrader dashboard and select the “Recurring Buy” feature. Choose your desired cryptocurrency, such as Bitcoin (BTC) or Ethereum (ETH).

- Define Your Schedule: Select the frequency that aligns with your income schedule, such as weekly, bi-weekly, or monthly. A common approach is to invest $50 every Friday.

- Automate and Monitor: Link your payment method and activate the plan. vTrader will automatically execute your purchases with zero fees, allowing your portfolio to grow consistently. You can track your average cost basis directly within the platform's portfolio analytics tool.

Key Insight: The power of DCA lies in its consistency. Automating your purchases ensures you stick to the plan without second-guessing market movements, turning volatility from an obstacle into an opportunity. This method is ideal for long-term investors who believe in the fundamental value of a project and prefer a hands-off approach.

2. HODL Strategy

The HODL strategy, a term born from a famous 2013 typo of "hold," is a cornerstone of long-term cryptocurrency investment strategies. It involves buying a cryptocurrency and holding it for an extended period, often spanning years, regardless of short-term price volatility. This approach is rooted in a strong belief in the long-term potential and fundamental value of an asset, ignoring the market noise of bull and bear cycles. It requires patience and a strong conviction to not sell, even during dramatic price swings.

The success of this strategy is best illustrated by early Bitcoin adopters who purchased the asset for mere dollars and held on to see it reach tens of thousands. Similarly, institutional investors like MicroStrategy adopt a HODL-like philosophy, viewing their Bitcoin acquisitions as long-term treasury reserve assets rather than short-term trades. This demonstrates the power of conviction and a long time horizon.

How to Implement the HODL Strategy on vTrader

Executing a HODL strategy starts with acquiring the asset and securing it for the long term. vTrader simplifies the initial purchase and provides the security needed for peace of mind.

- Research and Select Your Asset: Use vTrader’s integrated analytics to research established cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH). Focus on projects with strong fundamentals, a clear use case, and a robust community.

- Execute Your Purchase: Use the "Instant Buy" feature on vTrader to purchase your chosen cryptocurrency with zero fees. Decide on an initial investment amount that you are comfortable holding for several years.

- Secure and Monitor: While vTrader offers secure custodial wallets, dedicated HODLers often move assets to personal cold storage wallets for maximum security. You can still use vTrader's portfolio tracker to monitor your holdings' value without needing to access them directly, which helps resist the temptation to sell.

Key Insight: HODLing is a test of psychological fortitude. The strategy's success hinges on your ability to disconnect from daily price charts and maintain your conviction through market FUD (Fear, Uncertainty, and Doubt). It is best suited for investors who have a low time preference and believe in the transformative potential of blockchain technology.

3. Swing Trading

Swing Trading is a medium-term cryptocurrency investment strategy that sits between the rapid pace of day trading and the long-term commitment of buy-and-hold. It focuses on capturing gains or "swings" in a cryptocurrency's price over a period of days to several weeks. Traders using this approach rely heavily on technical analysis to identify potential price movements, setting precise entry and exit points to capitalize on market momentum.

The goal of swing trading is not to catch every peak and valley but to profit from the substantial part of a price move. For instance, a trader might identify Bitcoin approaching a strong weekly resistance level and open a short position, or buy into an altcoin that is showing signs of a bullish reversal. Veteran commodity trader Peter Brandt has famously documented successful swing trades in crypto markets, showcasing how technical chart patterns can predict significant price swings.

How to Implement Swing Trading on vTrader

A successful swing trading strategy requires powerful analytical tools and swift execution, both of which are central to the vTrader platform.

- Analyze with Advanced Charting: Use vTrader’s integrated TradingView charts to perform in-depth technical analysis. Identify key support and resistance levels, apply indicators like the Relative Strength Index (RSI) or Moving Averages (MAs), and draw trendlines to map out potential price swings for assets like ETH or BTC.

- Set Precise Orders: Once you identify an entry point, place a Limit Order on vTrader to ensure you buy at your desired price. Simultaneously, set a Stop-Loss Order to manage downside risk and a Take-Profit Order to automatically secure your gains when your price target is hit.

- Track and Adjust: Monitor your open positions in the vTrader portfolio dashboard. Keep a detailed trading journal to record your wins and losses, refining your strategy based on what works. For those new to technical analysis, vTrader's educational resources are a great starting point. Learn more about advanced trading techniques at the vTrader Academy.

Key Insight: Discipline is the cornerstone of successful swing trading. This strategy requires a robust plan with pre-defined entry, exit, and risk management rules. By sticking to your plan and leveraging vTrader's zero-fee advanced order types, you can make calculated decisions based on analysis rather than emotion, turning market volatility into structured opportunities.

4. Portfolio Diversification

Portfolio Diversification is a foundational cryptocurrency investment strategy borrowed from traditional finance, summed up by the adage, "Don't put all your eggs in one basket." This approach involves spreading investments across various digital assets, sectors, and risk profiles to mitigate volatility. By holding a mix of assets, a significant drop in one cryptocurrency's value will have a reduced impact on your overall portfolio's performance, creating a more stable growth trajectory.

This strategy is widely adopted by institutional players like Grayscale, whose Digital Large Cap Fund offers exposure to a weighted basket of top cryptocurrencies. Similarly, index funds like the Bitwise 10 Crypto Index automatically provide diversification by tracking the ten largest crypto assets. A common retail approach involves building a balanced portfolio, for example, with 40% in Bitcoin, 30% in Ethereum, and the remaining 30% spread across promising altcoins.

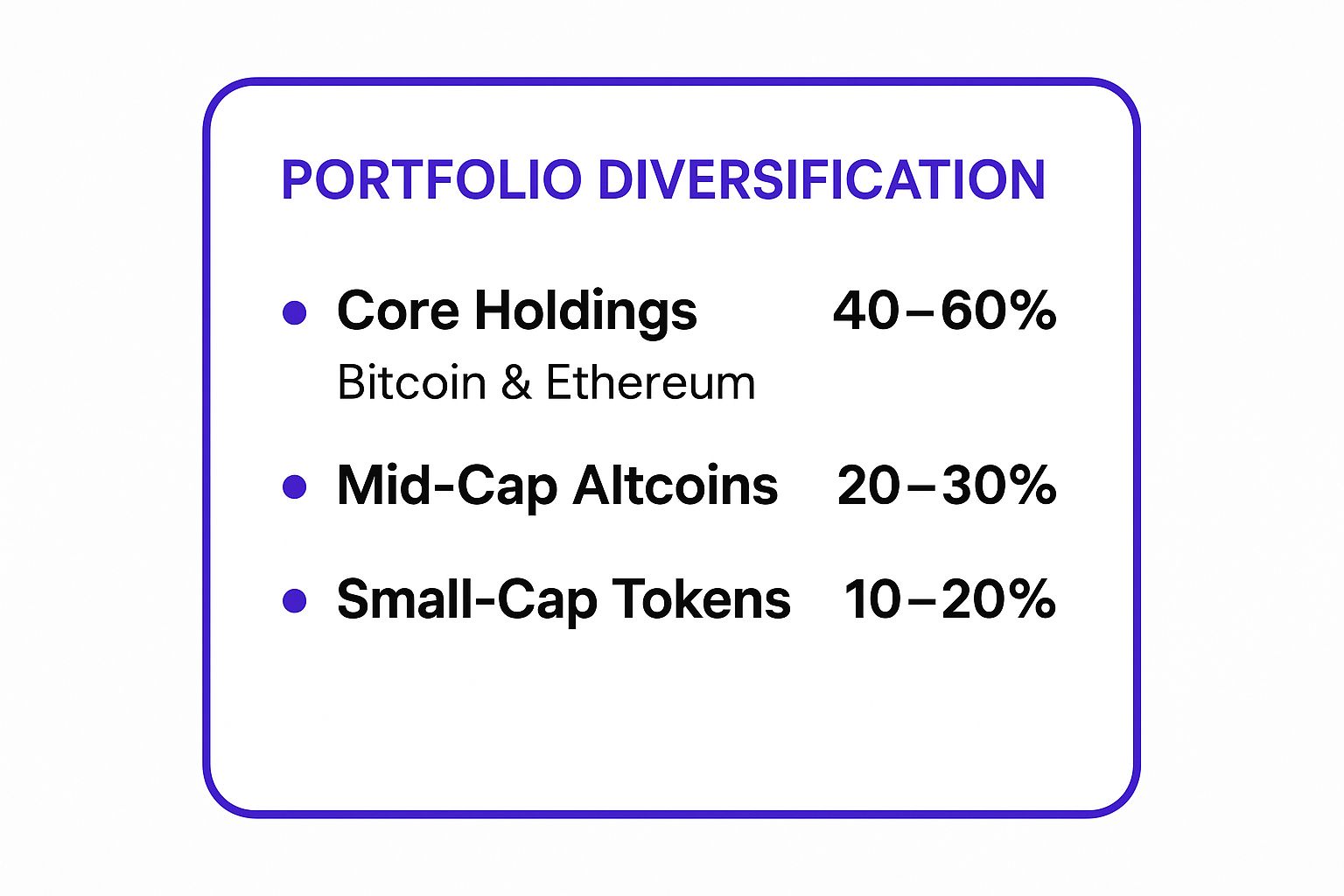

The following visual summary outlines a popular framework for structuring a diversified crypto portfolio.

This model provides a structured approach, anchoring the portfolio in established assets while allowing for calculated exposure to higher-growth, higher-risk projects.

How to Implement Portfolio Diversification on vTrader

Building and maintaining a diversified portfolio is simple with vTrader’s comprehensive tools and access to hundreds of assets.

- Establish Your Core: Start by allocating a significant portion of your capital (e.g., 40-60%) to market leaders like Bitcoin (BTC) and Ethereum (ETH). Use vTrader's "Market" view to analyze and purchase these cornerstone assets with zero fees.

- Add Growth and Speculative Assets: Dedicate smaller percentages to different sectors like DeFi (e.g., UNI), infrastructure (e.g., SOL), or gaming (e.g., MANA). vTrader’s "Discover" tab helps you research and categorize assets by sector to make informed decisions.

- Monitor and Rebalance: Use the vTrader portfolio tracker to monitor your allocation percentages. If one asset’s growth significantly skews your intended balance, consider rebalancing quarterly or semi-annually by selling some profits and reinvesting into under-represented assets.

Key Insight: True diversification goes beyond just buying different coins; it's about selecting assets with low correlation. The goal is to build a portfolio where the components don't all move in the same direction, providing a buffer against sector-specific downturns and maximizing risk-adjusted returns over the long term.

5. Staking and Yield Farming

Staking and yield farming are powerful cryptocurrency investment strategies for generating passive income. Staking involves locking up your crypto assets to help secure and validate transactions on a Proof-of-Stake (PoS) network, earning rewards in return. Yield farming, on the other hand, means providing liquidity to decentralized finance (DeFi) protocols, such as lending platforms or decentralized exchanges, to earn fees and token rewards. Both methods allow your holdings to work for you, creating an additional income stream on top of potential asset appreciation.

These strategies were popularized by the rise of DeFi and the transition of major blockchains like Ethereum to a PoS consensus mechanism. For instance, protocols like Compound and Aave pioneered the concept of lending assets to earn interest, while staking pools for Cardano (ADA) or Polkadot (DOT) allow even small-scale investors to participate in network security and earn rewards. This approach transforms static assets into productive, income-generating investments.

How to Implement Staking on vTrader

vTrader simplifies the process of earning passive income through staking, removing technical barriers and providing a secure environment for your assets.

- Select a Stakable Asset: Go to the “Earn” section on the vTrader dashboard. Here you will find a list of supported PoS cryptocurrencies, like Ethereum (ETH) or Solana (SOL), along with their estimated annual percentage yield (APY).

- Choose Your Staking Amount: Decide how much of your chosen crypto you wish to stake. vTrader offers flexible staking, meaning you can often start with a small amount without needing to meet high minimums, like the 32 ETH required for solo staking on Ethereum.

- Confirm and Earn: Once you confirm the amount, vTrader handles the technical process of delegating your assets to a secure validator node. Your rewards will begin accumulating automatically and can be tracked in real-time directly from your portfolio. You can learn more about how vTrader makes staking easy and secure on our dedicated staking information page.

Key Insight: Staking and yield farming are ideal for long-term holders who want to maximize their returns. By participating in a network's operation or providing liquidity, you contribute to the ecosystem's health while earning consistent rewards. It's a proactive strategy that puts your crypto to work, but always be mindful of risks like smart contract vulnerabilities and lock-up periods.

6. Value Investing

Value investing is a fundamental analysis-driven approach that moves beyond market hype to identify cryptocurrencies trading below their intrinsic or "fair" value. This cryptocurrency investment strategy involves deep, meticulous research into a project's core fundamentals, including its technology, use case, development team, tokenomics, and long-term market potential. The goal is to invest in assets with solid foundations that the broader market has not yet fully appreciated.

This strategy requires patience and a belief that the market will eventually recognize the project's true worth, leading to significant price appreciation. A classic example is an early investment in Chainlink, where value investors recognized the critical need for a decentralized oracle network to connect smart contracts with real-world data long before it became a cornerstone of the DeFi ecosystem. These investors analyzed its whitepaper, assessed the market gap it filled, and invested based on its long-term utility.

How to Implement Value Investing on vTrader

While value investing is research-intensive, vTrader provides the tools to analyze and act on your findings efficiently.

- Conduct In-Depth Research: Use vTrader’s integrated "Project Deep Dive" section. Here, you can access curated links to whitepapers, team backgrounds, and official development roadmaps for hundreds of cryptocurrencies.

- Analyze On-Chain Metrics: Leverage the platform’s advanced charting tools to view key metrics like active addresses, transaction volume, and token distribution. A project with growing on-chain activity but a stagnant price could be a prime undervalued candidate.

- Set Your Entry Point: Once you've identified a promising asset, use vTrader's "Limit Order" feature to set a specific purchase price below the current market rate. This allows you to buy in at the valuation you've determined is fair, with zero trading fees cutting into your principal.

Key Insight: Value investing in crypto is about separating signal from noise. It’s a bet on technological substance and long-term adoption rather than short-term price momentum. This strategy is best suited for discerning investors who are willing to do the homework and hold their positions with conviction, often for years, until their thesis plays out.

7. Arbitrage Trading

Arbitrage Trading is a sophisticated cryptocurrency investment strategy that capitalizes on price discrepancies of the same asset across different exchanges or markets. Unlike strategies that bet on future price movements, arbitrage aims to generate profit from existing market inefficiencies. Traders simultaneously buy a cryptocurrency where it's cheaper and sell it where it's more expensive, locking in the price difference as profit. This approach requires speed and precision to execute before the market corrects itself.

The core principle of arbitrage is capturing near risk-free profit from these temporary pricing gaps. A classic example is the "Kimchi Premium," where Bitcoin historically traded at a higher price on South Korean exchanges compared to global ones. A trader could buy Bitcoin on an international exchange like Binance and sell it on a Korean exchange for an immediate profit. Similar opportunities exist within DeFi, where automated market makers (AMMs) can have slight price variations for the same token pair.

How to Implement Arbitrage Trading on vTrader

While true arbitrage often requires accounts on multiple platforms, vTrader's real-time data and swift execution can be a crucial part of your setup. The key is to identify opportunities and act quickly.

- Monitor Multiple Markets: Use vTrader’s advanced charting tools to track the price of a specific asset, like BTC or ETH, and compare it against real-time data from other major exchanges. Identify significant price gaps that exceed potential trading and withdrawal fees.

- Prepare for Execution: Since speed is critical, ensure you have verified accounts and pre-funded wallets on at least two different exchanges where you've spotted a recurring price difference. Maintain balances of both the cryptocurrency and the stablecoin/fiat you are trading against to enable instant transactions.

- Execute and Calculate: Once an opportunity is confirmed, buy the asset on the lower-priced exchange and simultaneously sell it on the higher-priced one. Start with small amounts to test your process and accurately calculate net profit after subtracting all transaction, network, and withdrawal fees.

Key Insight: Arbitrage is a game of speed and volume. While the profit per trade may be small, successful arbitrageurs execute numerous trades to accumulate significant gains. Automated bots are often used for this, but manual traders can still find opportunities, especially in less liquid markets or during high volatility. This strategy is best for active, experienced traders who can manage complex logistics.

8. ICO/IDO Investment Strategy

An ICO/IDO investment strategy involves participating in Initial Coin Offerings (ICOs) or Initial DEX Offerings (IDOs) to acquire tokens from new projects at their launch price. This high-risk, high-reward approach focuses on identifying promising ventures before they hit mainstream exchanges, offering the potential for exponential returns. It’s akin to venture capital in the traditional finance world, but accessible to everyday investors.

This is one of the more speculative cryptocurrency investment strategies, as it requires backing unproven projects. However, the upside can be immense. For instance, early investors in Ethereum's 2014 ICO purchased ETH for approximately $0.31 per token, a price that generated life-changing wealth for those who held on. More recently, successful IDOs on platforms like Uniswap have provided similar opportunities, though it's crucial to acknowledge that many early-stage projects fail, leading to total investment loss.

How to Implement an ICO/IDO Strategy on vTrader

While direct ICO/IDO participation happens on launchpads or project websites, vTrader is an essential tool for managing the capital and assets involved in this strategy.

- Prepare Your Capital: Use vTrader’s platform to acquire the necessary base currency, like Ethereum (ETH) or BNB, which is often required to participate in IDOs. The zero-fee structure ensures you don’t lose capital on prerequisite trades.

- Secure and Transfer: Once you have the required crypto, transfer it from your secure vTrader wallet to a compatible Web3 wallet (like MetaMask) to connect to the launchpad platform where the sale is happening.

- Manage Your Winnings: If your investment is successful and the new token is listed, you can transfer it back to vTrader. Use our advanced charting tools to monitor its price performance and set price alerts to decide the best time to take profits or hold for the long term.

Key Insight: The success of an ICO/IDO strategy hinges on rigorous due diligence. Never invest more than you can afford to lose. Thoroughly research the project's whitepaper, team background, tokenomics, and community engagement. Diversifying across multiple high-potential projects can help mitigate the inherent risk of a single project failing.

9. Technical Analysis Trading

Technical Analysis (TA) trading is one of the more active cryptocurrency investment strategies, relying on historical price data and market statistics to forecast future price movements. Instead of focusing on a project's fundamental value, TA traders analyze chart patterns, trading volume, and technical indicators to gauge market sentiment and identify potential entry and exit points. This method assumes that price action reflects all relevant information and that historical trends often repeat.

The core of TA is identifying patterns and signals that suggest a likely price direction. For example, many traders watch Bitcoin's price action around its 200-day moving average, a key long-term trend indicator. Other common patterns include the "head and shoulders," which can signal a trend reversal, or indicators like the Relative Strength Index (RSI) showing "oversold" conditions, hinting at a potential price bounce. Successful traders like Peter Brandt have famously used classical charting principles to navigate crypto markets.

How to Implement Technical Analysis Trading on vTrader

vTrader’s advanced charting tools provide everything needed to execute a TA-based strategy. The platform integrates real-time data and a full suite of analytical instruments.

- Access Advanced Charts: From the vTrader trading view, select a cryptocurrency pair like BTC/USD. You can access a full-featured charting interface with drawing tools and a wide array of indicators.

- Apply Key Indicators: Start by adding fundamental indicators. Popular choices include Moving Averages (MA), Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence). Use these to identify trends, momentum, and potential reversal points.

- Set Your Orders: Based on your analysis, place your buy or sell orders. Crucially, always implement a stop-loss order to manage risk and protect your capital if the market moves against your prediction. You can find detailed guides on setting up various order types in our FAQ. Learn more about our advanced trading features.

Key Insight: The power of Technical Analysis lies in its ability to provide a structured, data-driven framework for short to medium-term trading. It helps traders remain objective and disciplined, but it requires practice and a strong risk management plan. Combining multiple indicators for confirmation is a best practice to increase the probability of a successful trade.

10. Market Cycle Timing

Market Cycle Timing is an advanced cryptocurrency investment strategy that aims to maximize returns by buying during bear markets and selling during bull markets. This approach requires analyzing historical patterns, market psychology, and on-chain data to identify the distinct phases of a cycle: accumulation, markup (bull run), distribution, and markdown (bear market). Unlike timing the market on a daily basis, this strategy focuses on macro trends that unfold over months or years.

A classic example is Bitcoin's four-year halving cycle, which has historically correlated with major bull and bear markets. Savvy investors who studied the 2017-2018 bubble and subsequent crypto winter were better prepared to accumulate assets during the 2019-2020 lows and take profits during the 2021 bull run. Analysts like Dan Held have popularized this long-term perspective, emphasizing patience and strategic positioning based on these predictable, albeit volatile, patterns.

How to Implement Market Cycle Timing on vTrader

While Market Cycle Timing is more of an analytical strategy than an automated one, vTrader provides the essential tools to execute your decisions effectively.

- Analyze Historical Data: Use vTrader’s advanced charting tools to study past cycles. Compare price action with indicators like Moving Averages (e.g., the 200-week MA) and Relative Strength Index (RSI) to identify historical buy and sell zones.

- Set Price Alerts: During an accumulation phase, set price alerts for key support levels on assets you are monitoring. This allows you to execute buy orders when your target entry points are reached. Conversely, set alerts for target profit levels during a bull run.

- Execute with Limit Orders: To avoid emotional decisions, use vTrader’s “Limit Order” feature. This lets you set a specific price at which you want to buy or sell, ensuring your trades execute automatically based on your pre-defined strategy, not market hype. Stay informed on the latest cycle analysis by following the vTrader news section.

Key Insight: The goal of Market Cycle Timing isn't to perfectly time the top or bottom, which is nearly impossible. Instead, it’s about identifying broad periods of opportunity (accumulation) and risk (distribution). This disciplined, research-driven strategy can yield significant returns but requires patience and a strong understanding of market dynamics.

Cryptocurrency Investment Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Dollar-Cost Averaging (DCA) | Low to Moderate: Set up automated buys | Low: Small, regular investments | Reduced volatility impact, steady accumulation | Long-term investors seeking risk minimization | Minimizes timing risk; builds investing discipline |

| HODL Strategy | Very Low: Buy and hold | Low: Initial capital and secure storage | Long-term capital appreciation | Conviction-driven long-term investors | Simple execution; avoids trading fees and stress |

| Swing Trading | High: Requires technical analysis skills | High: Time-intensive market monitoring | Potentially higher medium-term gains | Traders seeking profits from short-to-mid term swings | Flexibility; profits in bull and bear markets |

| Portfolio Diversification | Moderate: Requires ongoing research & rebalancing | Moderate: Capital spread across assets | Risk reduction; balanced portfolio returns | Investors seeking risk management and growth balance | Reduces single-asset risk; exposure to multiple sectors |

| Staking and Yield Farming | Moderate: Knowledge of platforms and lock-up terms | Moderate: Must lock assets for rewards | Passive income plus potential asset appreciation | Passive income seekers with medium risk tolerance | Generates passive rewards; supports network security |

| Value Investing | High: Extensive fundamental analysis | Moderate to High: Research time and capital | Potential high returns from undervalued assets | Long-term investors focusing on project fundamentals | Based on deep research; less sensitive to hype |

| Arbitrage Trading | Very High: Requires automation, speed | High: Substantial capital and tech needed | Consistent, market-neutral profits | Traders with access to multiple exchanges and tech | Lower directional risk; scalable with capital |

| ICO/IDO Investment | High: Due diligence on early-stage projects | Moderate to High: Capital with high risk | High-risk, high-reward potential | Risk-tolerant investors seeking early opportunities | Access to new projects at low prices; diversification |

| Technical Analysis Trading | High: Steep learning curve, charting skills | High: Time for analysis and practice | Informed, timely entry/exit points | Active traders using market data and indicators | Clear trade signals; applicable in various markets |

| Market Cycle Timing | High: Requires cycle pattern recognition | Moderate: Research and monitoring | Potential maximized returns via timing | Investors aiming to buy low/sell high in cycles | Framework for long-term planning; avoids crashes |

Final Thoughts

Navigating the dynamic and often turbulent world of cryptocurrency requires more than just capital; it demands a well-defined plan. We've explored a comprehensive suite of cryptocurrency investment strategies, from the patient, long-term discipline of Dollar-Cost Averaging (DCA) and HODLing to the active, precision-based approaches of Swing Trading and Technical Analysis. Each strategy offers a unique lens through which to view the market and a distinct toolkit for building wealth.

The key takeaway is that there is no single "best" strategy. Your ideal approach is a deeply personal synthesis, crafted from your financial goals, risk tolerance, available time, and market perspective. A passive investor might find a combination of HODLing, staking, and diversification to be the perfect formula for steady, long-term growth. In contrast, an active trader may thrive by blending technical analysis with arbitrage opportunities to capitalize on short-term market inefficiencies.

Synthesizing Your Personal Strategy

The true power of this guide lies not in choosing one strategy, but in understanding how to blend them into a cohesive and resilient portfolio plan. Think of these strategies as modular components you can assemble to fit your unique financial architecture.

- Foundation: Start with a core strategy that aligns with your primary goal. For most, this will be a combination of HODLing key assets like Bitcoin and Ethereum and using DCA to build positions over time, mitigating the impact of volatility.

- Growth Engine: Layer on strategies designed for active growth. This could involve allocating a smaller percentage of your portfolio to Swing Trading based on market cycles or dedicating funds to high-potential ICO/IDO investments after rigorous research.

- Income Generation: Integrate passive income streams to make your portfolio work for you. Staking your proof-of-stake coins or engaging in Yield Farming on reputable platforms can generate consistent returns, which can then be reinvested, creating a powerful compounding effect.

- Risk Management: Portfolio Diversification is the essential safety net that underpins your entire approach. Spreading your investments across different asset types, sectors (DeFi, NFTs, Layer-1s), and risk levels is non-negotiable for long-term survival and success.

From Knowledge to Action

Mastering these cryptocurrency investment strategies transforms you from a passive spectator into a confident market participant. It shifts your mindset from speculative gambling to calculated investing, enabling you to make decisions based on data and a clear plan rather than emotion and hype. This methodical approach is what separates fleeting gains from sustainable wealth creation in the digital asset space.

Remember that the crypto market is ever-evolving. A strategy that works today may need to be adapted tomorrow. The most successful investors are perpetual learners, constantly refining their methods, staying informed about market trends, and leveraging powerful tools to gain an edge. Your journey doesn't end here; it's a continuous process of learning, applying, and adjusting. By committing to this process, you are not just investing in assets; you are investing in your own financial acumen and future.

Ready to put these strategies into action? vTrader provides all the tools you need, from advanced charting for technical analysis to automated DCA bots and integrated staking modules, all on a zero-fee platform. Start building your personalized cryptocurrency investment strategy today by signing up at vTrader.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.