At its heart, crypto yield farming is a DeFi strategy that lets you put your crypto assets to work earning rewards. It’s a lot like the interest you’d earn in a high-yield savings account, but supercharged for the digital age. In exchange for lending or staking your assets, DeFi protocols reward you with a cut of their fees or even brand-new tokens.

What Exactly Is Crypto Yield Farming

Imagine the decentralized finance (DeFi) world as a massive, bustling digital city. For this city to run properly, it needs a constant flow of capital—what we call liquidity—to power all its services, like exchanges and lending platforms. This is where you, the yield farmer, step in. You essentially act as a banker, lending out your assets to keep the city's digital economy humming.

In practice, yield farming means you’re providing your cryptocurrency to a DeFi protocol to help it function. These protocols are automated financial apps built on a blockchain, and they need deep pools of assets to handle trades, loans, and other transactions without a central gatekeeper like a traditional bank.

The Role of Liquidity Providers

People who deposit their crypto into these protocols are known as Liquidity Providers (LPs). When you become an LP, you're not just parking your assets; you're actively contributing to the strength and speed of a decentralized market. For providing this critical service, the protocol pays you back.

The core idea is brilliantly simple: provide value to the network, and the network rewards you for it. This give-and-take relationship is the engine that drives the entire DeFi ecosystem and a must-know concept for anyone looking to get started.

This practice caught on like wildfire. A 2020 CoinGecko survey found that around 23% of crypto users had already jumped into yield farming, a testament to its explosive early growth.

To get a better handle on the moving parts, let's break down the main concepts.

Yield Farming Concepts at a Glance

This table simplifies the key components you'll encounter on your yield farming journey.

| Concept | Simple Explanation | Its Role in Yield Farming |

|---|---|---|

| Liquidity Provider (LP) | You—the person depositing crypto. | You provide the necessary funds that make the DeFi protocol work. |

| Liquidity Pool | The big "pot" of crypto you deposit into. | This is where all user-supplied assets are collected to facilitate trades or loans. |

| Smart Contract | The automated code that runs the protocol. | It handles all the rules, locking up assets and distributing rewards without a middleman. |

| Yield (or APY) | The return you earn on your deposited assets. | This is your profit, paid out for providing liquidity to the pool. |

Understanding these pieces helps demystify the process, turning abstract ideas into tangible actions.

The rewards you earn—your "yield"—typically come in a few different flavors:

- Transaction Fees: You get a slice of the fees from trades or loans made using the pool you contributed to.

- Native Tokens: Many platforms issue their own unique governance tokens as a reward, giving you a voice in the protocol's future.

- Interest Payments: On lending platforms, your reward is the interest paid by borrowers.

Grasping these fundamentals is your first step before diving into more complex strategies. For anyone new to this space, building that foundational knowledge is everything. You can explore more core crypto concepts over in our vTrader Academy.

How the Yield Farming Process Works

At the heart of crypto yield farming, you'll find an engine called a liquidity pool. The easiest way to picture this is as a big, shared pot of digital money. Investors, who we call Liquidity Providers (LPs), are the ones who fill this pot by depositing their crypto assets.

These pools are what make decentralized exchanges (DEXs) tick. They allow users to trade different assets smoothly and instantly, without needing the old-school order books or middlemen that traditional finance relies on.

When you chip in, you become one of these LPs. You’re not just letting your crypto collect digital dust; you're putting it to work and helping the market function. For that service, you get a slice of the trading fees generated within that pool, kind of like how a company shareholder gets dividends.

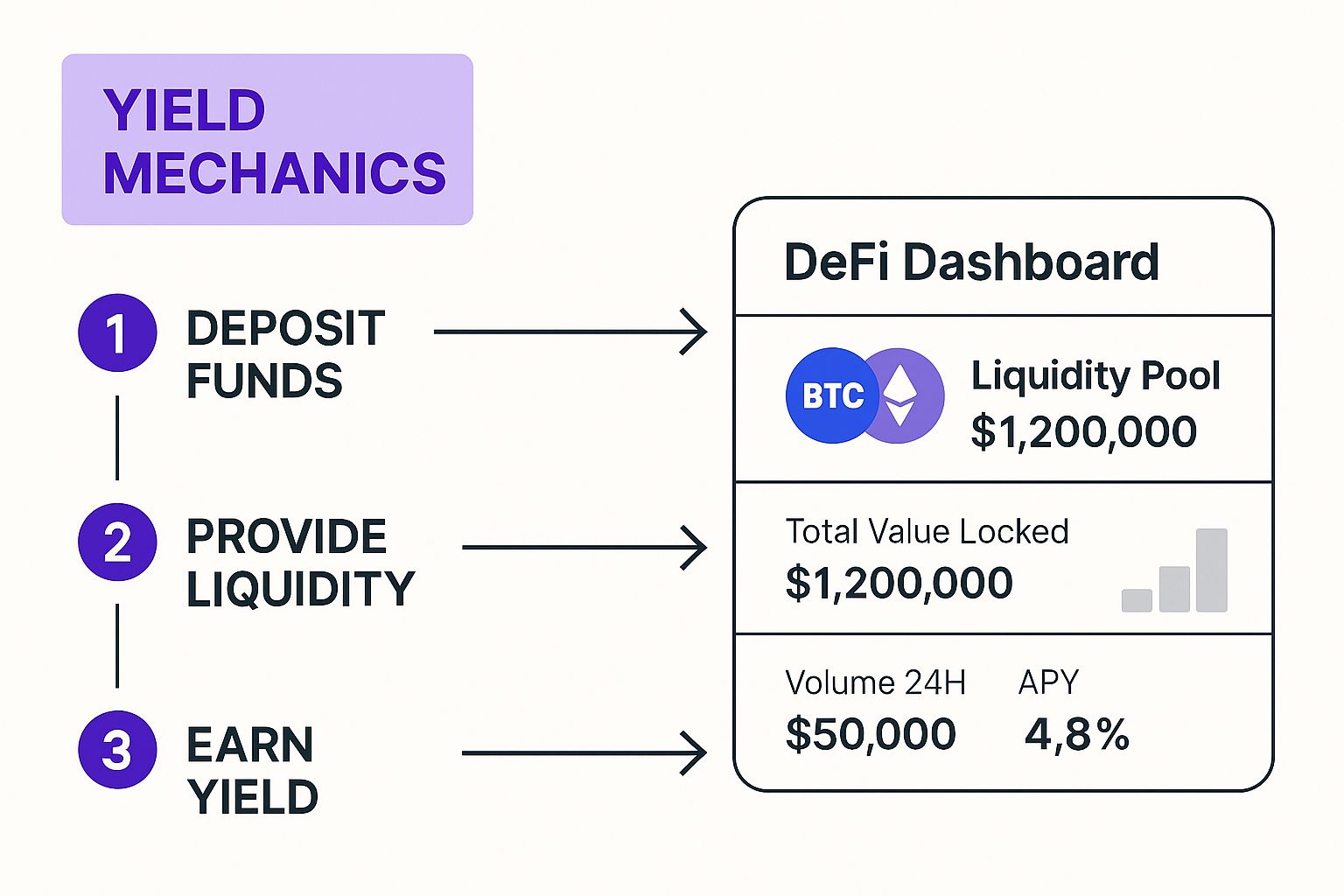

This graphic breaks down the core mechanics of the process, from depositing your assets to seeing those rewards pop up on your DeFi dashboard.

As you can see, the cycle is straightforward: you provide liquidity to a pool, get special LP tokens in return, and then stake those tokens to start earning a yield. This turns your otherwise static assets into a dynamic source of income.

From Deposit to Rewards

So, how does this look in practice? Let's walk through a typical yield farming scenario. Imagine you want to provide liquidity for an ETH/USDT pair on a platform like vTrader. Here’s how it all plays out:

-

Deposit Paired Assets: First, you’ll lock up an equal value of both Ethereum (ETH) and Tether (USDT) in the designated liquidity pool. This entire process is managed by a smart contract—a piece of automated code that enforces the rules without any human meddling.

-

Receive LP Tokens: As proof of your deposit, the protocol gives you special Liquidity Provider (LP) tokens. Think of these as a receipt that represents your specific share of the pool. The number of LP tokens you get is directly proportional to how much liquidity you added compared to the pool's total size.

-

Stake Your LP Tokens: This is where the real "farming" kicks in. You take those shiny new LP tokens and "stake" them in a different smart contract, often called a farm or a gauge. This is the crucial step that qualifies you to earn rewards.

Unpacking Your Earnings

Once you've staked your LP tokens, you’ll start to see rewards roll in. These earnings are typically paid out in the platform’s own native token. For instance, a DEX might reward you with its governance token, which not only has cash value but could also give you voting power over the platform's future.

Key Takeaway: The process is a simple two-step dance. First, you provide liquidity to get LP tokens. Second, you stake those LP tokens to earn rewards. It's this layered approach that opens the door to more complex and potentially more profitable strategies.

This reward system creates a really powerful incentive loop. Farmers are encouraged to provide liquidity to earn the native token, and holding that token often unlocks even more benefits, which in turn strengthens the entire ecosystem.

Of course, nothing on the blockchain is entirely free. Every transaction comes with a network fee, and platforms might have their own fee structures. It’s always smart to check a platform's policies, like the transparent overview of vTrader’s fee schedule, to understand all the costs involved. Getting a handle on these expenses is vital for accurately calculating your potential net profit.

Understanding APY And Profitability

When you first dive into crypto yield farming, one metric will jump out at you more than any other: Annual Percentage Yield (APY). Think of this as the potential return you could make on your crypto over a full year, but with a special twist—it includes the power of compounding.

Unlike the simpler Annual Percentage Rate (APR), APY accounts for your earned rewards being automatically put back to work to generate even more returns. This creates a snowball effect, making APY a much more accurate reflection of your potential earnings. If you want to get into the nitty-gritty, it's worth understanding the difference between APR and APY. Just remember, a jaw-dropping APY often comes with higher risk, so it's all about finding the right balance.

The Legendary DeFi Summer

To really get a feel for the explosive profit potential in yield farming, you have to look back at what we now call the "DeFi Summer" of 2020. It was an absolute gold rush for anyone who got in early. The frenzy was kicked off by protocols like Compound Finance, which started giving its COMP governance token to users just for lending or borrowing on its platform.

This new model, quickly dubbed liquidity mining, set the crypto world on fire. Farmers would deposit assets, rake in COMP tokens, and then either sell them for a quick profit or reinvest them. The cycle fueled itself, creating mind-boggling APYs that were completely unheard of in traditional finance.

The DeFi Summer was a defining moment that showcased the immense power of incentivized liquidity. It proved that by rewarding users directly for participation, protocols could bootstrap massive growth and attract billions in capital almost overnight.

Why Yields Have Stabilized

That period of explosive growth was truly historic. Since yield farming first burst onto the scene, its rise has been nothing short of remarkable. During that initial boom, some protocols were offering APYs well over 100%, with some of the more extreme, high-risk farms promising over 4,000%.

The numbers tell the story: the total value locked (TVL) in DeFi protocols skyrocketed from just over $9 billion to an incredible $129 billion in only a year and a half.

But let’s be real—those four-digit APYs were the product of a brand new, highly speculative market. As the DeFi space has matured, those wild yields have naturally come back down to earth. There are a few key reasons for this shift:

- Increased Competition: The secret is out. More farmers are now chasing the same rewards, which naturally dilutes the returns for everyone involved.

- Token Price Fluctuation: A lot of those sky-high yields were propped up by the soaring prices of new governance tokens. As those token prices cooled off or stabilized, so did the APYs.

- Market Maturity: The industry has started to move away from aggressive, short-term incentive schemes and toward building more sustainable, long-term economic models.

Today, you’re far less likely to stumble upon a 1,000%+ APY on a reputable platform. But don't let that discourage you. Yield farming remains one of the most effective ways to generate returns that can still blow traditional financial products out of the water. The game has simply shifted from a speculative frenzy to a more strategic, long-term approach to profitability.

Navigating the Key Risks of Yield Farming

In the world of yield farming, sky-high returns almost always come hand-in-hand with significant risks. Before you jump in and start chasing those impressive APYs, it’s absolutely critical to understand the potential downsides. This isn't about being scared off—it's about making smarter, more informed decisions with your capital.

The landscape of crypto yield farming presents a unique set of challenges you just don't find in traditional finance. From technical weak spots to sudden, gut-wrenching market shifts, knowing what can go wrong is your best line of defense. Let's break down the biggest risks you'll face.

The Challenge of Impermanent Loss

One of the most common and misunderstood risks in this space is impermanent loss. This happens specifically when you provide liquidity with a pair of assets, like ETH and USDT. Imagine your two assets are on a seesaw. When you first deposit them, that seesaw is perfectly level.

But if the price of one asset (ETH, in this case) skyrockets while the other (USDT) stays put, the protocol has to rebalance your holdings to keep the value on both sides equal. To do this, it sells some of your booming ETH for more USDT. If you were to pull your funds out right then, you'd end up with less ETH than you started with, and the total value might actually be less than if you had just held onto both assets in your own wallet.

Impermanent loss is the difference in value between keeping assets in a liquidity pool versus just holding them. This "loss" only becomes real—or permanent—if you withdraw your funds while that seesaw is tilted.

Often, the trading fees and farming rewards you earn are more than enough to cover this potential loss, but it's a constant factor you need to keep an eye on.

Technical and Platform Dangers

Beyond the whims of the market, the technology itself comes with its own set of risks. DeFi protocols are powered by smart contracts—incredibly complex pieces of code. And as any developer will tell you, no code is ever perfect.

Here are the main technical dangers to be aware of:

- Smart Contract Bugs: A hidden flaw or vulnerability in a protocol’s code can be a goldmine for hackers, potentially leading to the entire liquidity pool being drained. Well-audited platforms certainly lower this risk, but they can't eliminate it completely.

- Rug Pulls: This is a flat-out scam where project developers simply abandon ship and disappear with investors' money. They're most common with new, unaudited projects run by anonymous teams, often luring people in with promises of unbelievable returns.

- Platform Hacks: Even if a protocol's code is solid, the platform or website you use to interact with it can be compromised. Always, always double-check that you're on the correct, official website before connecting your wallet.

Finally, never forget that the crypto market is famously volatile. The value of your deposited assets and the reward tokens you're earning can nosedive without warning. While strategies like crypto staking can offer a simpler risk profile, yield farming demands active management.

If you’re curious about alternatives, you can explore the benefits of staking on vTrader to see how the two approaches stack up. Ultimately, finding success in yield farming is a balancing act between chasing high APY and maintaining a healthy respect for the risks involved.

Finding Your Ideal Yield Farming Strategy

Alright, you've got a handle on the fundamentals of yield farming—the risks, the potential rewards. Now it's time to move from theory to practice.

Choosing the right crypto yield farming strategy isn't about finding some magical "best" option. It's about finding the right fit for your personal goals, how much you’re willing to invest, and frankly, your stomach for risk. What works wonders for a seasoned DeFi pro might be a recipe for disaster for someone just dipping their toes in.

The first step is a gut check. What are you really trying to achieve? Are you aiming for slow, steady returns that let you sleep at night? Or are you willing to dance with volatility for a shot at much higher yields? Your answer will guide you toward one of three main paths.

Comparing Popular Yield Farming Strategies

This side-by-side look at different approaches helps you choose the one that fits your goals.

| Strategy Type | Typical APY Range | Risk Level | Best Suited For |

|---|---|---|---|

| Low-Risk Stablecoin Farming | 5% – 20% | Low | Beginners, risk-averse investors, capital preservation |

| High-Yield Volatile Pair Farming | 30% – 100%+ | Medium to High | Experienced users comfortable with market swings |

| Leveraged Yield Farming | 100% – 500%+ | Very High | DeFi experts with a deep understanding of risk |

Each path offers a unique blend of risk and reward. Let's break them down.

Low-Risk Stablecoin Farming

For anyone just starting out or those who put capital preservation above all else, stablecoin farming is the perfect on-ramp. This strategy is simple: you provide liquidity for pairs made of two stablecoins, like USDC and DAI.

Since both assets are pegged to the U.S. dollar, their prices rarely move far apart. This dramatically slashes the risk of impermanent loss. While the APYs are typically lower here, the returns are often far more consistent and predictable. Think of it as the DeFi version of a high-yield savings account—a much safer way to learn the ropes without getting burned by wild price swings.

High-Yield Volatile Pair Farming

If you're more comfortable with risk and ready to chase bigger returns, farming with volatile pairs is the next level. This means providing liquidity for pairs like ETH/SOL or other popular altcoins. The potential for eye-popping APYs comes from two places: heavy trading fees from these in-demand pairs and juicy token rewards offered by the platform.

Of course, greater reward comes with greater risk—specifically, a much higher chance of impermanent loss. If one crypto in your pair skyrockets while the other stagnates, you could end up with less than if you had just held the tokens separately. This strategy demands more active monitoring. It often pays to keep an eye on market sentiment using tools like the Crypto Fear Greed Index.

Pro Tip: Being successful with volatile pairs isn't just about chasing the highest APY. It's about forming a solid opinion on whether the two assets are likely to move in the same general direction while you're farming.

Leveraged Yield Farming

This is the deep end of the pool. Leveraged yield farming is an advanced, high-risk strategy only for experienced DeFi users who know exactly what they're doing. It involves borrowing funds to beef up your farming position, which magnifies your returns—and your losses.

You’re essentially using your deposited assets as collateral to borrow more, which you then add back into the liquidity pool.

A 3x leverage, for instance, could triple your potential APY. But it also triples your exposure to risk, especially from impermanent loss and liquidation. If the market turns against you, your entire position could be sold off automatically to pay back your debt. It's a high-stakes game that requires constant vigilance and a deep understanding of lending protocols. If you get good at it, you could even share your strategies and earn through the vTrader affiliate program by guiding others.

Your Questions About Yield Farming Answered

As you dive deeper into crypto yield farming, you’re bound to hit some roadblocks. This corner of DeFi is packed with unique terms and concepts that can feel overwhelming at first. Let's clear the air and tackle the most common questions head-on, giving you the confidence to start farming.

Can You Actually Make Money With Crypto Yield Farming?

Yes, absolutely. People are successfully using yield farming to generate passive income from their crypto. But it's not a get-rich-quick scheme. Your profitability boils down to a few key things: the farm's Annual Percentage Yield (APY), the price stability of the tokens you're using, and the overall crypto market weather.

High APYs can be tempting, but they often come with higher risks like impermanent loss or shaky smart contracts. The farmers who come out on top are the ones who do their homework, keep a close eye on their investments, and find a smart balance between risk and reward.

Is Yield Farming the Same as Staking?

They often get lumped together, but yield farming and staking are two very different things with separate goals.

Key Distinction: Staking is all about helping to secure a blockchain network. Yield farming is about providing liquidity for a DeFi protocol.

Here’s a simple way to think about it:

- Staking usually means locking up a single crypto coin to support a Proof-of-Stake (PoS) network. You’re helping validate transactions and keep the network secure, and you earn rewards for it.

- Yield Farming is more involved. You typically deposit a pair of assets into a liquidity pool on a decentralized app (dApp). Your funds help facilitate trades or loans on that platform, and you earn a slice of the fees or other token rewards for providing that service.

How Much Money Do I Need to Start?

One of the best parts about DeFi is that you don't need a fortune to get started. You can technically begin yield farming with as little as $100 or even less, which is a great way to learn the ropes without betting the farm.

The biggest hurdle for smaller investors, though, is transaction fees, or "gas fees." On a congested network like Ethereum, these fees can sometimes eat up any potential profits from a small deposit. That's why many newcomers start on Layer 2 networks or other blockchains where gas fees are much cheaper. If you have more questions like this, the FAQ page for vTrader is a fantastic resource to check out.

What Is Impermanent Loss in Simple Terms?

Impermanent loss is one of those unique risks you only find when providing liquidity. It happens when the prices of the two tokens you deposited into a pool drift apart.

Let’s say you deposit an equal value of ETH and USDC. If ETH’s price suddenly shoots up while USDC stays put, the protocol automatically sells some of your ETH for USDC to keep the 50/50 value balance. If you pulled your money out right then, the total value could be less than if you had just held onto your original ETH and USDC.

It’s called "impermanent" because the loss isn't locked in until you withdraw. If the token prices shift back to where they were when you started, that loss simply vanishes.

Finally, as you map out your investment plan, don't overlook the tax implications. A crucial part of any long-term strategy involves understanding your crypto tax obligations to stay compliant and protect your net earnings.

Ready to put your new knowledge to the test? With vTrader, you can explore the world of crypto with zero trading fees, advanced tools, and educational resources all in one place. Start your journey on vTrader today and build your portfolio with confidence.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.