So, what is a crypto wallet address? At its core, it’s a unique string of letters and numbers used to send and receive digital currencies. Think of it like a bank account number, but for your crypto. It's the public information you can safely share with anyone who needs to pay you.

Your Digital Mailbox, Unpacked

A great way to visualize your crypto wallet address is as your own personal, ultra-secure mailbox on the blockchain. Anyone in the world can find your mailbox number (the address) and drop cryptocurrency into it.

But here’s the critical part: only you hold the special key—your private key—that can open it and access what’s inside. Understanding this separation is the single most important concept in crypto security. Your address is for receiving, your private key is for spending.

While your address is publicly visible on the blockchain, it’s pseudonymous. This means it isn’t directly tied to your real-world identity unless you decide to link them. It’s generated from your wallet’s public key through a one-way cryptographic process, which is a fancy way of saying it’s a one-way street. Your public key can create your address, but nobody can ever reverse-engineer your address to discover your private key.

The Role of Your Public Address

What can you actually do with this digital address? Its main functions are straightforward but form the backbone of your participation in the crypto economy.

- Receiving Funds: This is its primary job. When someone wants to send you Bitcoin, Ethereum, or another crypto, you give them the specific wallet address for that coin.

- Sending Funds: When you send crypto to someone else, your address gets recorded on the blockchain as the sender. This is what creates that transparent, permanent ledger of every transaction.

- Verifying Ownership: Although it doesn't shout out your name, your address serves as proof of your activity on the blockchain, which anyone can view using a public explorer.

The adoption of crypto is exploding, meaning millions of these digital mailboxes are being set up daily. The global user base has mushroomed to an estimated 560 million unique users worldwide. That number is projected to hit 861 million soon, which means more people will have crypto wallets than American Express cards.

To help you remember the key pieces, here's a quick breakdown:

Crypto Wallet Address Key Concepts

| Component | Analogy | Primary Use |

|---|---|---|

| Wallet Address | Your public mailbox number | To receive crypto from others |

| Public Key | The maker of your mailbox number | Rarely used directly by users |

| Private Key | The only key that opens your mailbox | To access and send your crypto |

This table should make it clear how each part works together while staying separate and secure.

Here's a common point of confusion: wallets don't actually "store" your crypto. Your funds always live on the blockchain itself. Your wallet is just the tool that holds the keys, giving you the power to control your crypto at your specific address.

Getting these fundamentals down is the first real step toward managing your digital assets with confidence. For a deeper dive into these and other crypto topics, the vTrader Academy is packed with resources to help you build your knowledge base.

Decoding Different Types of Wallet Addresses

Just like different countries have their own unique mail address formats, different blockchains have their own distinct styles for wallet addresses. It’s a common misconception that all crypto addresses are the same, but understanding the differences is absolutely essential for keeping your funds safe.

In fact, one of the easiest—and most heartbreaking—ways to lose your crypto for good is by sending it to an incompatible address type. The format is a dead giveaway for which blockchain it belongs to. A Bitcoin address, for instance, looks nothing like an Ethereum address. Learning to spot these differences can save you from costly mistakes and even cut down on transaction fees.

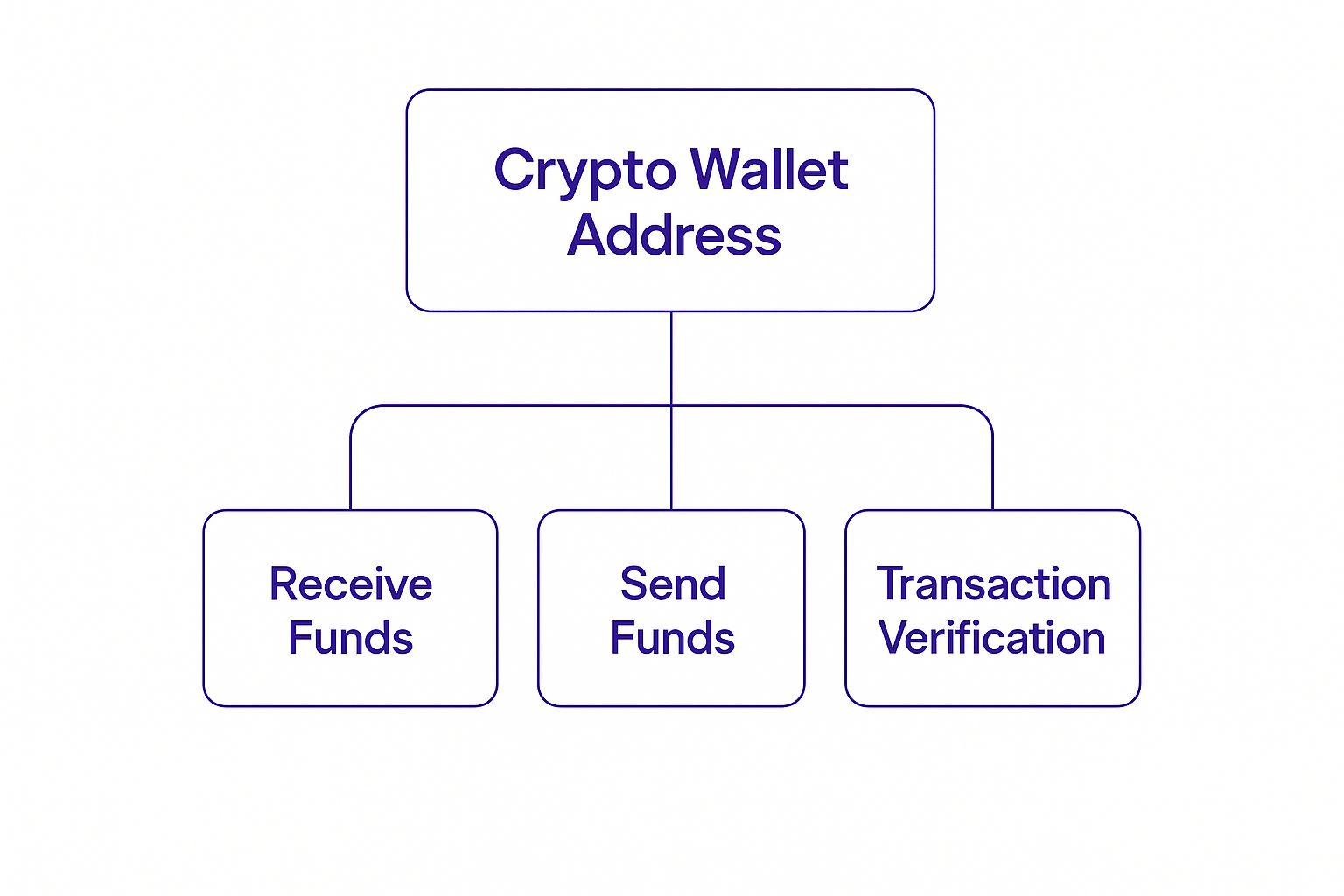

This image breaks down the three core jobs of any crypto wallet address, no matter which blockchain it's on.

As you can see, every address is your public hub for getting paid, sending funds out, and letting anyone on the network verify those transactions. Simple as that.

The Evolution of Bitcoin Addresses

Bitcoin is the perfect case study for how these address formats have changed over the years, mostly to boost security and lower costs. When you go to receive Bitcoin in a modern wallet, you’ll probably see one of these options.

- Legacy (P2PKH): These are the OGs of Bitcoin addresses. They always start with the number '1'. While they still work just fine, they're now considered old-school because they create larger transactions, which means you pay higher network fees.

- SegWit (Bech32): This is the modern standard and the one we recommend. SegWit addresses begin with 'bc1'. They were engineered for efficiency, making transactions much cheaper—sometimes by 30-40% compared to the old Legacy format.

- Taproot (BC1P): The new kid on the block, Taproot addresses start with ‘bc1p’ and are all about boosting privacy and enabling more complex transactions, like smart contracts, on the Bitcoin network.

Simply using a SegWit address is a no-brainer for saving a little cash on every Bitcoin transaction. Most up-to-date wallets, including vTrader, automatically generate these for you.

Ethereum and Its Universal Address Standard

While Bitcoin has several address types, Ethereum keeps things much simpler. The Ethereum ecosystem runs on a single, unified address standard that's both easy to recognize and incredibly flexible.

Every standard Ethereum address begins with '0x' and is followed by a 40-character string of numbers (0-9) and letters (a-f). This universal format is a big reason why Ethereum's ecosystem has grown so massive.

This "0x" address isn't just for sending and receiving Ether (ETH). It’s your all-in-one inbox for the thousands of different ERC-20 tokens built on the Ethereum blockchain, including major stablecoins like USDT and USDC.

And it doesn’t stop there. This same address is also where you store your Non-Fungible Tokens (NFTs), which are based on standards like ERC-721 and ERC-1155. That means your single vTrader Ethereum address can hold your ETH, a portfolio of different tokens, and all your digital art and collectibles in one convenient spot.

The Golden Rule: Never Cross the Streams

If you take away one thing from this, let it be this: Each cryptocurrency must be sent to an address that lives on its native blockchain.

Think of it like trying to mail a letter. You can't send a package to a US zip code using the UK postal code format—the system just won't know what to do with it. The same logic applies here. You absolutely cannot send Bitcoin (BTC) to an Ethereum (ETH) "0x" address. If you try, your funds will vanish into the digital ether, almost certainly lost forever.

Always run through this quick mental checklist before hitting "send":

- Confirm the Coin: Am I sending BTC, ETH, or something else?

- Match the Address: Does the receiving address format match the coin? (e.g., 'bc1…' for Bitcoin, '0x…' for Ethereum).

- Triple-Check the Details: After you copy and paste the address, always verify the first four and last four characters. This quick check ensures the address wasn't accidentally changed.

By keeping these fundamental rules in mind, you can navigate the crypto world with confidence and sidestep the common traps that lead to lost funds.

How to Find and Share Your Address in vTrader

Alright, enough with the theory. Let's get practical and find your actual crypto wallet address inside the vTrader app. Think of this as your public "account number" for receiving funds—and we’ve made finding and sharing it incredibly simple.

The whole process is designed to be crystal clear and secure, so you can manage your crypto with confidence, not guesswork. Whether someone is sending you crypto for the first time or the hundredth, the steps are always the same.

This is the "Receive Crypto" screen in vTrader. As you can see, it gives you both a scannable QR code and the full address string, making it easy to share no matter the situation.

A Step-By-Step Guide to Your vTrader Address

Getting to your address is a quick three-tap process. We designed the interface to be dead simple, cutting out any confusion and helping you avoid common mistakes.

Just follow these steps.

- Head to Your Wallet: Open vTrader and tap the 'Wallet' icon, which you’ll find at the bottom of the main screen. This brings you to your complete portfolio.

- Pick Your Cryptocurrency: You'll see a list of all the digital assets you own. Just tap the one you want to receive, like Bitcoin (BTC) or Ethereum (ETH).

- Hit the 'Receive' Button: On that coin’s screen, you'll see options for 'Send' and 'Receive'. Tap 'Receive', and your unique wallet address will pop right up.

That's it. You're now on the screen with everything you need to get paid.

Sharing Your Address The Smart Way

Once you’re looking at your address, vTrader gives you two foolproof ways to share it. These features were built specifically to prevent the kind of typos that can lead to lost funds—a nightmare for any crypto owner.

- The QR Code: If you’re with someone in person, this is the gold standard. They can scan the code with their wallet app, and your full, correct address instantly appears on their device. No fuss, no mistakes.

- The One-Click Copy Button: Sharing online or through a messaging app? Always use the copy button. It grabs the entire string of characters and puts it on your clipboard, guaranteeing 100% accuracy.

Never, ever try to type out a crypto wallet address by hand. One single mistake—like mixing up an 'O' with a '0' or a '1' with an 'l'—will send the funds into the void. They’ll go to the wrong address and be lost forever.

Best Practices for Safe Transactions

Sharing your address is a daily crypto activity, but a few smart habits can shield you from common scams and costly errors. Before you ever give the final okay on a transaction, get into the habit of checking your work.

The "Bookend" Check

Here’s a great security trick that seasoned traders swear by: the "bookend" check. After you paste your address somewhere, quickly glance at the first four and last four characters. Do they match the address shown in your vTrader app? This simple check is your best defense against clipboard-hijacking malware that secretly swaps your address with a scammer’s.

Remember, all transactions are subject to the platform's rules. For the full scoop on your responsibilities as a user, you can always review the official vTrader terms and conditions. Making these safe habits second nature will let you manage your wallet with total confidence.

Keeping Your Crypto Wallet Address Secure

Knowing how to find and share your crypto wallet address is a great start, but it's only half the story. Now it’s time to shift from function to protection. Keeping your digital assets safe demands a security-first mindset, and it all boils down to one simple, unbreakable rule.

Think of your private key like the PIN to your bank card. You’d never write your PIN on the front of the card for everyone to see, right? The same logic applies here. Your public address is the card itself—safe to hand over—but the private key is the secret code that unlocks it all.

Sharing that private key is the digital equivalent of handing a signed blank check to a stranger. It gives them total control to drain your wallet in an instant, and once those funds are gone, there’s no getting them back.

Avoiding Common Crypto Security Threats

As the crypto world expands, so do the creative ways scammers try to part you from your funds. Staying vigilant is your single best defense against the common attacks that prey on unsuspecting users. If you know what to look for, you can spot these traps a mile away.

Two of the most common threats you’ll encounter are phishing scams and clipboard-hijacking malware.

- Phishing Scams: These are sneaky attempts to trick you into revealing your most sensitive information. A scammer might send an official-looking email, pretending to be from vTrader, asking you to click a link and "verify" your wallet by entering your private key or recovery phrase. Never, ever do this. vTrader will never ask for your private keys or seed phrase.

- Clipboard Hijackers: This is a nasty bit of malware that works silently in the background. You copy a legitimate crypto address, but the malware instantly swaps it on your clipboard with a scammer's address. If you don't double-check before hitting "send," your crypto is sent directly to them.

The Golden Rule of Crypto Security: Your public crypto wallet address is for receiving funds and is safe to share. Your private key is for accessing and sending funds and must NEVER be shared with anyone, for any reason.

Layering Your Defenses for Maximum Safety

A multi-layered security strategy is non-negotiable for protecting your crypto. Relying on a single line of defense just leaves you exposed. Instead, you need to combine several tactics to build a fortress around your assets.

One of the most powerful layers you can add is Two-Factor Authentication (2FA). It’s a cornerstone of modern digital security. Implementing robust measures like 2-Factor Authentication (2FA) is crucial for safeguarding access to your accounts. Turning on 2FA for your vTrader account means that even if a thief steals your password, they can’t get in without that second code from your phone.

Another brilliant strategy is to separate your funds.

- Hot Wallet: This is your crypto "checking account." You keep a small, manageable amount here for day-to-day trading and spending. Wallets like vTrader are perfect for this role.

- Cold Wallet: This is your "savings account" for the long haul. A hardware wallet—a physical device kept offline—is the gold standard for storing the bulk of your crypto portfolio.

This simple separation dramatically cuts down your risk. If your hot wallet ever gets compromised, the attacker only gets away with a small fraction of your holdings, leaving your nest egg safe and sound.

The Bigger Picture on Crypto Security

The need for these security habits becomes crystal clear when you zoom out and look at the industry as a whole. There are now around 820 million unique cryptocurrency wallets active across the globe. But despite that incredible growth, confidence in security is shaky: only 7% of informed adults feel very confident in crypto security, while 26% feel very unconfident. Even among crypto owners, 13% remain very unconfident, which tells you everything you need to know about the challenges we still face.

These numbers underscore why personal responsibility is so critical. Ultimately, your security is in your hands. While platforms like vTrader provide a secure foundation, your habits and awareness are the final, most important line of defense. For more details on how we handle your data, you can read our vTrader privacy policy. By sticking to these best practices, you can confidently protect your crypto wallet address and the valuable assets tied to it.

How to Track Transactions on the Blockchain

For anyone new to crypto, one of the most surprising concepts is that every single transaction is public. It’s a radical shift from the private statements we get from our banks. The blockchain is an open book, a shared ledger that anyone, anywhere, can inspect.

Getting comfortable with this level of transparency is fundamental to managing your privacy and understanding the world of digital currencies. It means that with just a crypto wallet address, you can see its entire financial history—every transaction sent and received, the exact dates, and its current balance.

This might sound a bit invasive at first, but it’s actually a core feature of what makes blockchain so powerful. It's the reason the system is called "trustless." No single company or government controls the data, and everyone can verify the records for themselves.

Introducing the Block Explorer

So, how do you actually look up this information? You’ll need a tool called a block explorer. Think of it as a specialized search engine for the blockchain. Instead of typing in questions or website names, you search for wallet addresses, transaction IDs, or specific block numbers.

When you pop a wallet address into a popular block explorer like Etherscan for Ethereum or Blockchain.com for Bitcoin, it instantly generates a detailed report. You can see things like:

- Total Balance: The exact amount of crypto the address holds right now.

- Transaction History: A complete log of all incoming and outgoing funds, all timestamped.

- Associated Data: Other details, like transaction fees (gas) paid and which other addresses it has interacted with. You can explore our Ethereum gas tracker to learn more about how these fees work.

Pseudonymity Is Not Anonymity

This brings us to a critical distinction. While your crypto address is public, it's also pseudonymous. By default, it isn't directly tied to your real-world identity—your name, phone number, or government ID. It's just a string of characters.

But pseudonymity isn't the same as total anonymity. If you ever connect your real-world identity to an address, that cover is blown. A common way this happens is by using a regulated exchange that requires KYC (Know Your Customer) verification. Once that link is made, the exchange or law enforcement can connect the dots.

Your on-chain activity creates a permanent digital footprint. While individual transactions may seem random, sophisticated analysis can sometimes uncover patterns that reveal connections between different addresses or even hint at real-world identities.

For example, if Address A consistently sends funds to Address B, and Address B is a known merchant wallet, an observer can start to piece together a relationship. This is why it’s so important to be aware of your on-chain footprint and make informed choices about your privacy.

This transparency also gives us fascinating insights into the health and activity of different networks. For example, looking at daily active addresses, TRON has sometimes shown more engagement than even Bitcoin. While Bitcoin recently averaged around 887,000 active addresses daily, TRON clocked in at about 2.9 million. It's this kind of publicly available data that allows for a deeper understanding of the entire ecosystem.

Common Questions About Crypto Wallet Addresses

As you dive deeper into the crypto world, you'll naturally start having questions. Getting a solid handle on how a crypto wallet address works is one of the biggest steps toward feeling confident and making sure every transaction goes off without a hitch.

We’ll tackle the practical, real-world questions that pop up all the time, from whether it’s safe to share your address to why it sometimes seems to change on its own. Getting these answers straight will help you manage your digital assets like a pro.

Is It Safe to Share My Crypto Wallet Address?

Absolutely. This is probably the most common question out there, and the answer is a firm yes. Your crypto wallet address is meant to be public. Think of it like your bank account number—you have to give it to people for them to send you money.

The critical thing to remember is the difference between your public address and your private key.

- Public Address: Share it freely. This is only for receiving crypto.

- Private Key: Keep this a total secret. It gives anyone full control to spend your funds.

Giving someone your public address is like telling them where your mailbox is. They can put things in it, but they can't open it to take anything out. Only you have the private key to unlock it.

While sharing your address is safe from theft, remember that blockchain transactions are public. Anyone with your address can look up your balance and history on a block explorer. For this reason, many people use new addresses for different transactions to maintain their financial privacy.

Why Does My Wallet Address Keep Changing?

If you've received Bitcoin more than once, you might've noticed something that feels a bit odd: your wallet gives you a different receiving address each time. This can be jarring for newcomers, but it’s a powerful security feature working in your favor.

Many modern wallets, vTrader included, automatically generate a new address for every transaction you receive. This is a core privacy technique. By using a fresh address for each payment, it becomes much harder for an outside observer to connect all your transactions and build a full picture of your financial activity.

It’s like using different P.O. boxes for various deliveries. All the packages end up with you, but it’s tough to trace them all back to a single source. And don't worry—all your old addresses still work and are permanently linked to your wallet. You can still safely receive funds sent to any of them, but using a new one is always the best practice.

What Happens If I Send Crypto to the Wrong Address?

This is the scenario that keeps crypto users up at night, and for good reason. Unlike a bank transfer that can often be reversed, blockchain transactions are final. Once you hit "send" and the transaction is confirmed, there is no undo button.

If you accidentally send crypto to the wrong address, what happens next really depends.

- If you know the owner of the address: Your only recourse is to contact them and hope they’re honest enough to send the funds back. If they refuse, the crypto is gone.

- If you send to a random or non-existent address: The funds are almost certainly lost forever. They will sit at that address for eternity, completely inaccessible because no one has the private key.

- If you send to an incompatible address (e.g., Bitcoin to an Ethereum address): The crypto is almost always lost. The receiving network won't understand the transaction, and the funds will simply vanish into the digital ether.

This is precisely why the "triple-check" rule is so important in crypto. Always, always verify the first and last few characters of an address before confirming any transaction.

Can I Have Multiple Addresses in One Wallet?

Yes, you can—and you already do! A single crypto wallet isn't limited to just one address. Your wallet is actually a powerful tool that manages a whole collection of addresses, all generated from your master private key.

As we covered, wallets often create a new address for each incoming transaction to protect your privacy. This means a single wallet can control hundreds, or even thousands, of different addresses. All the funds sent to these various addresses are pooled together and show up in your total wallet balance.

This gives you a lot of flexibility. For example, you could give one address to your employer for your salary and a different one to a friend who owes you for lunch. Both payments will land safely in the same wallet, but you can track them as separate streams. For more in-depth answers, you can always check out the extensive vTrader FAQ section.

Ready to put this knowledge to work? With vTrader, you can manage your crypto wallet address with ease, trade over 30 cryptocurrencies commission-free, and access advanced tools all in one place. Start building your portfolio with vTrader today and experience a smarter way to trade.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.