This guide is part of the “Intro to Crypto Trading” series.

Trading without a clear plan is a little more than gambling. A trading plan provides a clear structure, helping you make logical choices instead of emotional ones. The market is fast, volatile, and full of opportunity. Without a strategy, it’s very easy to overtrade, chase trades, or panic and sell in a downturn.

Today we will discuss the most popular cryptocurrency trading strategies, some of which have been borrowed from Forex or equities, so you can find one that matches your style and time commitment. Some strategies that we will give you focus on speed and precision, while others on patience and analysis. All of them will require you to be looking at charts and documents to find the true value of the asset you want to trade.

Table of Contents

How to make trading decisions

Every strategy relies on some combination of technical and fundamental analysis. These are the two most popular approaches to making sense of the market.

Technical analysis

Technical analysis (TA) is the study of price movements and trading volume to forecast future market behavior. Instead of looking at the economics of a cryptocurrency or stock, technical analysis focuses on charts and patterns. The reason is the idea that price action reflects all available information. It assumes that supply and demand, and therefore crowd psychology, are visible in the price and volume. Market psychology repeats itself, which creates identifiable trends and signals that traders can use to make decisions.

The most powerful tools in technical analysis are support and resistance levels, moving averages (MA), candlestick patterns, and momentum indicators such as the relative strength index (RSI) or the moving average convergence divergence (MACD) indicator.

Support is the price level where buying is usually strong enough to stop prices from falling any further. Resistance is the price level where selling pressure usually stops prices from going up any further. Moving averages help you see the overall direction of the trend by smoothing out short-term price changes.

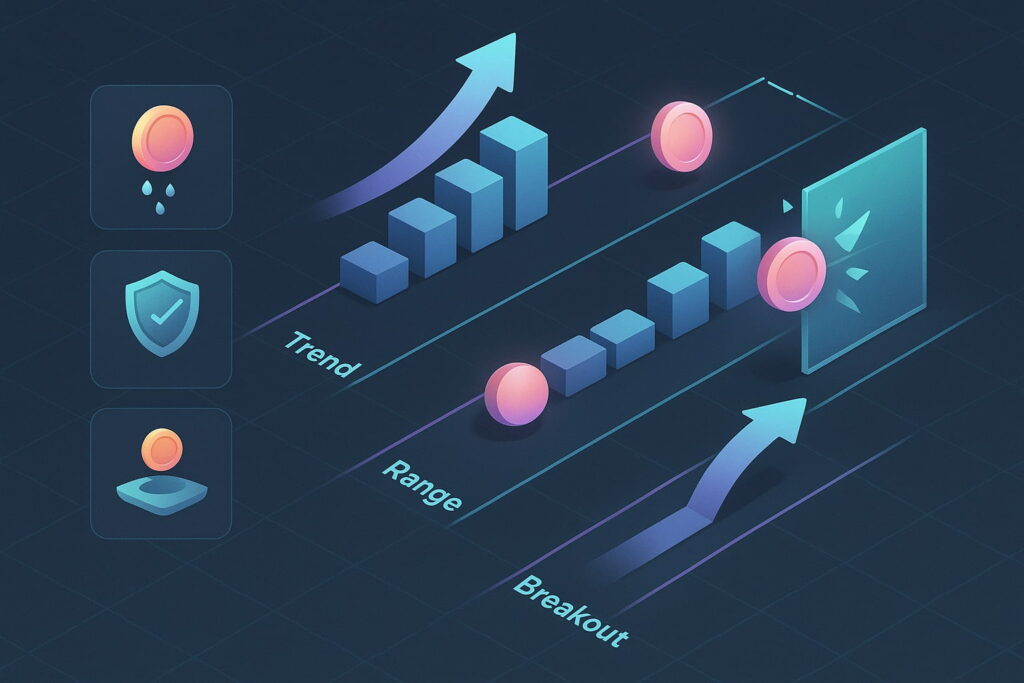

Following trends is an important idea in trading, not just crypto. Most traders make money here. It is a common belief that once a trend starts, it is more likely to keep going than to turn around. That’s why it’s common to buy pullbacks in an uptrend or short small rallies in a downtrend. Breakouts are very important to people who use technical analysis. This is when the price moves clearly through support or resistance, which often causes sharp moves as new momentum builds.

Critics of technical analysis argue that it can lead to self-fulfilling prophecies, since many traders react to the same patterns, reinforcing the same signals. However, for active market participants, especially in crypto where fundamentals can be harder to measure, technical analysis remains one of the most used approaches to manage entries, exits, and risk.

Fundamental analysis

Fundamental analysis examines the intrinsic value of an asset, rather than solely its price chart. In traditional markets, this means looking at things like profits, sales, interest rates, and other big picture economic factors.

The basics are different in crypto. To find out if a coin or token is worth more or less than it is, you need to look at how useful it is in the real world and how many people use it.

You should pay close attention to the project’s whitepaper, tokenomics, developer activity, partnerships, and community strength. For instance, fixed caps and inflation schedules affect how rare the cryptocurrency is. Next, daily transactions and total value locked (TVL) show you if people are really using the platform. Working with well known companies or becoming part of a larger ecosystem also makes a business more credible and helps it stay afloat.

The goal of fundamental analysis is to get a clear, evidence based picture of a project’s long-term potential and see if its strengths suggest that it will be successful in the future.

If your research shows that a project is working on a real problem, has a lot of activity on the blockchain, and is based on a sound economic model, then short-term price drops might be seen as chances to buy instead of warning signs.

Fundamental investors are more patient and often hold on through ups and downs because they think the long-term value will eventually be recognized.

Which form of analysis should you use?

Both technical and fundamental analysis try to give traders an edge, but they do so in very different ways. Technical analysis looks at price charts and trading patterns, while fundamental analysis looks more closely at the asset’s intrinsic value. Each has its own pros and cons, depending on the situation.

TA shines in short-term trading. Crypto markets run 24/7 with huge volatility, and price charts provide immediate signals. Traders who rely on support and resistance, trendlines, and indicators can act quickly to a changing scenario without the need to understand the full story.

The drawback is that technical signals can be noisy, especially in low liquidity markets as often seen with altcoins, and false breakouts and sudden spikes can wipe out positions if they are leveraged (as they usually are with short-term trading).

Using FA takes longer to make a decision but is more strategic. It’s best suited for investors who want to hold assets over weeks, months, and years. By researching the tokenomics, developer activity, and adoption trends, fundamental investors develop a conviction that can help them hold through market swings. The downside is that crypto fundamentals can take a long time to play out.

In real life, the best traders use a mix of both. Fundamentals tell you what to buy, and technicals tell you when to buy or sell.

Short-term trading strategies

These strategies are all about speed. The goal is to make money from small price changes without keeping positions open overnight.

Scalping

Scalping in crypto is a way of trading that focuses on making a lot of small profits by making a lot of quick trades. The idea is that these small gains, when made over and over again, can add up to big profits over time.

Scalpers depend a lot on volatility and liquidity. People often target high-liquidity pairs like BTC/USDT or ETH/USDT because they let you get in and out quickly. Because the profit margin on each trade is small, traders usually use leverage and tight stop loss orders. A scalper might get into a trade after seeing a quick breakout above resistance and then close it within minutes when the price moves by only a single percent.

This approach requires discipline, speed, and usually automation. Many scalpers use bots or advanced order types to take advantage of opportunities that don’t last long. Many professional firms run high frequency strategies in the crypto space. The biggest risk for stay-at-home traders is that transaction fees, slippage, or sudden reversals can wipe out gains quickly. For this reason, scalping is often seen as better suited for experienced traders with strong technical analysis skills and a fast trading setup.

Timeframe: Seconds to minutes.

Best for highly experienced traders with fast reflexes who can dedicate full attention.

- Pros: Frequent opportunities, limited overnight risk.

- Cons: Stressful, exhausting, and often unprofitable after transaction fees are factored in.

Scalping strategy setups

Breakout retests

Watch for price breaking above resistance or below support on a low timeframe (1-5 minute). After it breaks out, enter on the retest of that level, aiming to grab a few basis points before closing.

VWAP bounce

Volume-weighted average price (VWAP) acts as a magnet in intraday trading. You can buy when price dips into the VWAP during an uptrend, or short when price rises to VWAP in a downtrend, expecting a small continuation after the reversal.

Order book imbalances

An order book imbalance happens when there are noticeably more buy orders (bids) than sell orders (asks), or the other way around. Scalpers use level 2 data (the live order book that shows depth of market) to spot these moments.

- If you see an unusually large cluster of buy orders sitting at or just below the current market price in the order book, placing a limit buy into that liquidity can capture a quick uptick before the market rebalances.

Day trading

Day trading in crypto means opening and closing positions within the same day, avoiding overnight risk completely. Unlike scalping, which targets tiny intraday price moves, day traders look for larger swings that play out over hours. The goal is to capture meaningful moves in a single session, using both technical setups and different market news as triggers.

Day traders rely on volatility, but they don’t need super fast execution like scalpers. Instead, they track chart patterns, order books, or news catalysts to enter trades, then they hold for several hours before closing. For example, if Bitcoin breaks below a key support level in the morning, a day trader may short sell BTC and ride the momentum through the afternoon and exit before markets quiet down at night.

This style allows for more breathing room than scalping, but it still requires constant attention. Day traders need to manage their positions carefully with stop loss orders and proper position sizing, since crypto can reverse sharply. The upside is that, by closing trades before the day ends, they avoid the uncertainty of holding positions through overnight news or sudden market gaps.

Timeframe: Minutes to hours.

Best for traders who are skilled with chart analysis and comfortable monitoring screens throughout the day.

- Pros: Clear start and finish to each day, potential for steady income when trading in strong markets.

- Cons: Very time consuming, mentally demanding, and emotionally draining.

Day trading setups

Moving average crossover

This is a classic trade signal used to this day by banks all over the world. It is sometimes called the “golden cross.” You can use it on the 15 minute or 1 hour charts but it works great on daily charts as well. You are looking for a cross between two different moving averages. When that happens it means the short-term trend is shifting compared to the long-term trend.

- Use a fast moving average (like the 9 EMA) and a slower one (like the 50 EMA). When the fast moving one crosses from below to above this confirms that the intraday trend has shifted to bullish. You can hold your position for a few hours or until momentum fades.

Range breakouts

A range is a consolidation of price action, it usually looks like a rectangle on your chart. Day traders then mark intraday highs and lows (the highs and lows from several days). A breakout beyond that range, with strong volume, signals potential for a sustained move that can be traded throughout the session.

- You want to buy or sell in the direction of the breakout. The longer the range carried on, the bigger the expected breakout will be. Always check volume to confirm this setup.

News driven trades

Crypto reacts violently to news like exchange listings, regulatory changes, and protocol upgrades. Additionally watch out for partnership announcements, token burns/supply cuts and unexpected exchange halts or hacks. These catalysts change supply and demand and draw the most attention. You can enter on the initial surge/decline, if you were fast enough to catch the news early, and ride the momentum. Make sure to exit before sentiment changes.

- News driven trades move fast, so reacting early is key. You can use TA to get out before the reversal. The main technical cues that a reversal is coming is a loss of momentum at key levels, often confirmed by candlestick patterns, divergences, and breaks of trend structure.

The main difference is the time horizon. Scalpers take advantage of micro inefficiencies in the market, while day traders look for more structured moves that last for hours.

Medium term trading strategies

Not everyone can or wants to sit at the computer screen all day. These medium length strategies try to take a balanced position between activity and patience.

Swing trading

Swing trading is about capturing bigger price moves that play out over several days to a few weeks. It sits in the middle between day trading and long-term investing. The goal is to hold positions long enough to ride a meaningful part of a trend.

Swing trading relies on both technical and fundamental analysis. On the technical side, watch for patterns like trendline breaks, moving average crossovers, Fibonacci retracements, and momentum indicators. The timeframes that work best usually revolve around the 4 hour, daily, and sometimes weekly timeframes. Fundamental analysis also plays a role. You may take positions based on upcoming events such as token unlocks, hard forks, network upgrades, or broader market catalysts like Bitcoin halving.

The strength of swing trading is that it balances opportunity and time. You don’t have to sit at your screen all day like a scalper, but you also avoid holding indefinitely without a clear exit plan. The risk is that crypto often gaps on overnight news, so managing exposure with stop losses and position sizing is the key to success in this strategy.

Timeframe: Days to weeks.

Best for active traders who don’t want to monitor every tick but still want to make profit from the meaningful moves.

Pros: Less time consuming than day trading, but more potential than simply holding because you’re moving in and out of trades trying to capture chunks of the trend.

Cons: Positions are exposed to overnight and weekend gaps, which can cause unexpected losses.

Swing trading setups

Trendline breakout with retest

Trendlines map out the path a coin has been respecting, either sloping down in a correction or up in a rally. A breakout occurs when price finally pushes through that line, showing a shift in momentum.

- Draw a trendline across lower highs in a downtrend or higher lows in an uptrend. This is how you identify trendlines.

- Once price breaks through the trendline on the daily chart and retests it, this could be a high probability entry point. It means there is potential for a multi-day move in the opposite direction of the trendline.

- Example: A coin trending down forms a descending trendline. Price breaks above it, then drifts back down to test the line from above. If buyers step in, confirming the shift, the next trade that you make should target the previous highs.

Moving average pullback

Swing traders often use the 50 or 200 day moving averages to simplify what the global trend is. The levels drawn by the indicators act as dynamic support or resistance that the market frequently tests and re-tests. Here’s how this strategy works.

- In an uptrend the price should be above the MA, when price pulls back to the 50 day moving average and holds, it often means that buyers are stepping back in. This area can be a clean entry point with a target at or above the previous swing high.

- In a downtrend, the same logic applies but in reverse. If price smashes into a declining moving average and fails, that spot becomes a low-risk short setup with a target back toward recent lows.

Range trading between support and resistance

Not every market is trending. Many coins spend weeks stuck in a defined range, bouncing between support and resistance. Swing traders take advantage of this by buying near support and selling near resistance, until the range eventually breaks.

- When a coin gets locked into a sideways channel, the edges of that range become the trade. Support is where you buy, resistance is where you sell, and your stop loss is just outside the box.

- Example: Ethereum was stuck between $1,800 and $2,100 in June 2023. I would trade that range by placing buy orders around 1,820 with a stop loss just below 1,750. The take profit was around 2,080. The risk to reward ratio for that trade was about 4:1, and I made several of those trades.

Long-term crypto trading strategies

Instead of reacting to every single little move, this strategy focuses on major market cycles and getting in on the bigger swings.

Position trading

Position trading involves holding assets for months or even years, based on major trends and the fundamental strength of the asset. A trader might buy into Ethereum because of its dominance in smart contracts or into Bitcoin during a bull market cycle, with the intention of holding through ups and downs.

Timeframe: Months to years.

Best for patient traders who are confident in their research and who are able to ignore short term volatility.

- Pros: Low stress because there is no need to monitor markets constantly.

- Cons: Capital can be tied up during a bear market, and dedication is required to sit through drawdowns.

HODLing

This is a meme term from back in the day. It comes from a misspelling of “hold” in an old Bitcoin forum post. HODLing has become its own strategy in crypto. It simply means buying and refusing to sell, no matter the price action.

Best for beginners or investors who are believers in the assets they are trading.

- Pros: Very easy to implement, historically effective for top assets.

- Cons: Emotional discipline is required to resist selling during large corrections.

Dollar-cost averaging

This is a strategy used by many pensioners in the US. It’s a basic idea where first you identify a stable and growing asset, and invest each month a specific sum no matter how much the asset is currently worth. Instead of buying all at once, you invest on a regular schedule, regardless of price. This smooths out any volatility and removes the pressure of timing the market.

You still make a sizeable return over the years as you participate in the growth of the market. Best for investors who prefer a systematic approach and want to reduce timing risk.

- Pros: Simple, proven, builds a crypto investment portfolio over time.

- Cons: Limited flexibility if the market falls sharply and you are waiting for a precise entry point.

Advanced and automated crypto strategies

For traders ready to push further, advanced methods add complexity and bring new tools.

Arbitrage trading

This strategy looks for price differences across exchanges. For example, if Bitcoin trades at $60,000 on one exchange and $60,100 on another, you can buy low and sell high instantly.

- Pros: In theory, it has lower risk and is repeatable.

- Cons: These kinds of opportunities are rare, the margins are small, and requires fast connection speed plus significant capital to be profitable.

Algorithmic trading

Bots execute trades automatically based on coded rules, from the moving average crossovers that we discussed above to more complex setups.

- Pros: Removes emotions completely, works 24/7, and is much faster than any human.

- Cons: Can and does malfunction, requires deep technical knowledge, and sudden volatility can still trigger big losses that a human would have avoided.

Range trading

When markets are flat (move sideways), range trading is one of the best applicable strategies. Buy near support levels and sell near resistance, making sure that what you plan to capture exceeds how much you would lose if your stop loss was activated.

- Pros: Clear entry and exit points. Multiple trade setups.

- Cons: When the range breaks, losses can be severe if the stops aren’t in place. Slippage, when price gaps over your stop loss, is a major concern.

Event-driven and sentiment based strategies

Crypto moves fast, and news or crowd psychology can drive huge swings in this market. These strategies aim to capitalize on that.

News-based trading

Markets move fastest when fresh information hits the tape. Exchange listings, regulatory rulings, or major partnerships can spark sharp one-direction moves. Your edge will come from speed here. Getting in early on the reaction and getting out before the crowd fades it. Because fades are common (where pro traders bet the price will return closer back to average), stop losses and quick exits are super important.

Listings, airdrops, and token unlocks

Scheduled events create predictable shifts in supply and liquidity. A new exchange listing often brings an increase in demand, while large token unlocks or vesting cliffs increase available supply and can pressure price to the downside.

Big airdrops attract traders looking to sell free tokens. You can track these calendars and plan trades around them because the patterns repeat cycle after cycle, this is what professional crypto investors do.

On-chain statistics and social sentiment

Clues often show up before the price moves. A massive wallet transfer, unusual coding activity, or sudden shifts in funding rates might hint that the price is about to change. Social media chatter is noisy, so use it as background information only. Remember the trade only makes sense once price validates the signal.

How to choose the right trading strategy for you

Picking a strategy depends less on the market and more on you.

- Personality and risk tolerance: Can you handle drawdowns? Do you panic at every little thing? Scalping is better suited for those with precision, while news trading requires you to be monitoring things like CoinDesk and Cointelegraph throughout the day.

- Time commitment: Do you have other obligations? Can you spend that much time trading? You should match your available time to the demands of the strategy.

- Define your investment goals: Do you want to supplement your income through swing trading or HODLing, or do you want to get serious about wealth building and start position trading?

- Backtesting: We don’t cover backtesting in this article. But you can test your strategies with historical data in order to see if something works or to avoid surprises. But remember, markets evolve and strategies can decay over time.

- What’s going on in the market: Market conditions call for different playbooks. In a bull market, trend-following strategies tend to perform best as momentum carries prices higher. In a bear market, the focus shifts to defense, such as dollar-cost averaging into long-term positions or cutting back exposure entirely to limit drawdowns.

Core risk management

Survival in crypto trading comes down to risk controls, not predictions. Strategy means little if you can’t manage your losses.

- Position sizing is crypto specific: Never risk more than 1–2% of your capital on a single trade. Always structure the setup so potential reward is at least twice the potential loss.

- Stops and exits: Protect your capital with clear stop levels. Use stop loss orders not mental stops. Also, you can scale out of positions to lock in profit while keeping some exposure.

- Leverage, fees, and slippage: Leverage is tricky as it cuts both ways, multiplying your losses as well as gains. Trading costs and poor liquidity can quietly drain your profits, so factor those in before increasing your trade size.

- Emotional discipline in trading: Fear and greed ruin more accounts than bad analysis does. Traders who stay calm and consistent outperform those who let emotions or hype dictate their moves.

Building your crypto trading edge

There is no single best crypto trading strategy. Additionally no strategy will work 100% of the time. The right strategy depends on you, your temperament, and your resources. Day trading may suit someone who loves to be glued to the screen, while long-term HODLing or DCA might be the better fit for someone working a day job.

What matters most in trading is consistency. Strategies will come and go, bull markets and bear markets will cycle, but risk management and discipline will never let you down. Build your crypto trading plan, test it carefully, and refine it as you learn more. The traders who last are not the fastest or flashiest, they are the ones who adapt and survive.

Ready to put these strategies into practice? Trade smarter on vTrader, a fully regulated exchange with 0% fees on popular crypto pairs, deep liquidity, and AI analysis tools to help you manage your trades with precision. Sign up today and see why disciplined traders choose vTrader to protect their capital while enjoying the possibilities of crypto.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.