Crypto arbitrage is one of those strategies that sounds simple on the surface: buy a digital asset on one exchange and immediately sell it for more on another.You're not trying to predict where the market is headed; you're just profiting from temporary price gaps that already exist. For this guide, we'll be using vTrader to show you exactly how to spot these opportunities and act on them.

How Crypto Arbitrage Actually Works

Let's get past the basic "buy low, sell high" definition. To really succeed, you need to understand why these price differences happen in the first place. These aren't just random glitches; they're created by the natural friction of a global, 24/7 market.

At its heart, arbitrage is all about taking advantage of a temporary price mismatch for the same crypto asset across different trading venues. Imagine seeing Bitcoin priced at $60,000 on Exchange A but simultaneously trading for $60,150 on Exchange B. The arbitrageur’s entire game is to swoop in and pocket that $150 difference before the market self-corrects and the window slams shut.

The Root Causes of Price Gaps

These profit opportunities don't just appear out of thin air. There are specific, real-world market dynamics that create them.

- Market Fragmentation: The crypto market isn't a single, unified entity like a traditional stock exchange. It's a sprawling network of hundreds of individual exchanges, each with its own liquidity and order books.

- Varying Liquidity Pools: A massive buy order on a smaller, low-liquidity exchange can significantly spike the price. That same order on a high-liquidity giant like Binance or Coinbase might barely make a ripple, creating an instant price gap between the two.

- Regional Demand Swings: Big news or regulatory changes in a specific country can cause a surge in local demand, pushing up prices on regional exchanges before the global market has time to catch up.

Even as the crypto market matures, these discrepancies persist. They're a natural byproduct of having so many different platforms, each with its own balance of buyers and sellers.

While often seen as a lower-risk strategy than day trading, arbitrage is a game of speed. Margins can be razor-thin, and success hinges on executing trades in a fraction of a second before the opportunity vanishes.

Your Toolkit for Success

In today's high-speed market, trying to execute these trades manually is a recipe for failure. You're competing against bots that can execute in milliseconds. This is where a specialized tool like vTrader becomes absolutely essential. It does the heavy lifting by scanning dozens of exchanges at once, flagging viable price gaps, and calculating your potential profit after factoring in all the trading and network fees.

A solid grasp of the underlying tech is also a huge plus. Understanding the differences between various blockchain networks helps you anticipate transaction times and costs, which can easily eat into your profits if you're not careful.

Throughout this guide, we'll use vTrader as our practical example. If you want to dive deeper into the theory and build a stronger foundation, the guides over at the vTrader Academy are a great resource. By getting a handle on these fundamentals, you’ll be in a much better position to identify and pounce on real arbitrage trades.

Building Your vTrader Arbitrage Setup

Before you even think about placing a trade, you have to get your foundation right. A profitable crypto arbitrage strategy lives or dies by how well you've prepared your system to strike the second an opportunity pops up. Think of it as getting your toolkit in order before the real work begins.

First things first, you need accounts on several key cryptocurrency exchanges. For arbitrage, spreading your activity isn't just a suggestion—it's essential. I always recommend starting with a blend of high-liquidity giants like Binance and Coinbase, and then adding another solid option like Kraken to give yourself more ground to cover.

Securely Integrating with vTrader

Once you're signed up on the exchanges, it’s time to hook them into your vTrader dashboard. This connection happens through Application Programming Keys, or API keys. These keys are what let vTrader monitor prices and execute trades for you, saving you from frantically logging into multiple exchanges at once.

Security here is absolutely critical. As you generate the API keys on each exchange, you have to be meticulous with the permissions you grant.

- Enable Trading: This one's a must. It gives vTrader the power to place the buy and sell orders that make arbitrage happen.

- Disable Withdrawals: This is the most important security setting, period. Never give withdrawal access to a third-party tool. It’s a simple checkbox that ensures, even in a worst-case scenario, no one can move your funds off the exchange.

This simple setup creates a secure pipeline, giving vTrader the access it needs to do its job while your capital stays locked down under your control.

A rookie mistake I see all the time is rushing the API setup and just granting full permissions. Take the extra 60 seconds to restrict withdrawal access. It's one of the most powerful moves you can make to protect your crypto.

Strategically Funding Your Accounts

With your accounts linked up and secure, the last piece of the setup is funding. An opportunity is worthless if your money is stuck on the wrong exchange. The smart play is to split your trading capital across your chosen platforms.

A well-balanced portfolio might look something like this:

- 50% in Stablecoins: Keep about half your capital in assets like USDT or USDC. Their prices don't fluctuate wildly, making them the perfect ammo for snapping up a target crypto asset instantly.

- 50% in Fiat: Holding currencies like USD or EUR on exchanges that support them gives you the flexibility for direct fiat-to-crypto buys.

This kind of split means you're always ready to pull the trigger. And while your capital is sitting ready for a trade, you can also look into making those idle assets work for you. For instance, you can learn more about how vTrader staking works to potentially generate returns on coins you're holding long-term.

With a secure and funded system, you’re finally ready to start hunting for those profitable arbitrage gaps.

Finding and Qualifying Real Arbitrage Trades

Alright, you've got your vTrader system fired up and funded. This is where the real fun begins. Your vTrader dashboard is now your mission control, flagging potential crypto arbitrage opportunities as they pop up in real-time. But a raw price gap? That's just an invitation. Your actual job is to vet that opportunity like a seasoned pro.

A fleeting price difference is meaningless until you figure out if it’s genuinely profitable. This means you have to do the crucial, non-negotiable work of accounting for all the hidden costs. You have to subtract trading fees, network gas for any transfers, and potential withdrawal costs from the gross profit. Only then do you get the real number.

Beyond the Price Gap

I've seen it countless times: a promising opportunity that turns out to be a 'ghost trade.' These are deals where the hidden costs would completely erase—or even reverse—your expected profit. To sidestep these traps, you need to dig into the trade’s specifics before you even think about hitting 'execute.'

Let's walk through a common scenario. Say vTrader flags a 3% price difference for Solana (SOL) between two exchanges. Before you jump in, you have to check the liquidity on both ends. If the exchange where you plan to sell has a thin order book, your sell order could trigger serious slippage, pushing the price down and killing your profit margin before the trade is even finished.

The most common mistake I see new arbitrage traders make is acting on the headline price gap alone. The pros know the real money is found after subtracting every single fee and accounting for potential slippage. Always, always calculate your net profit.

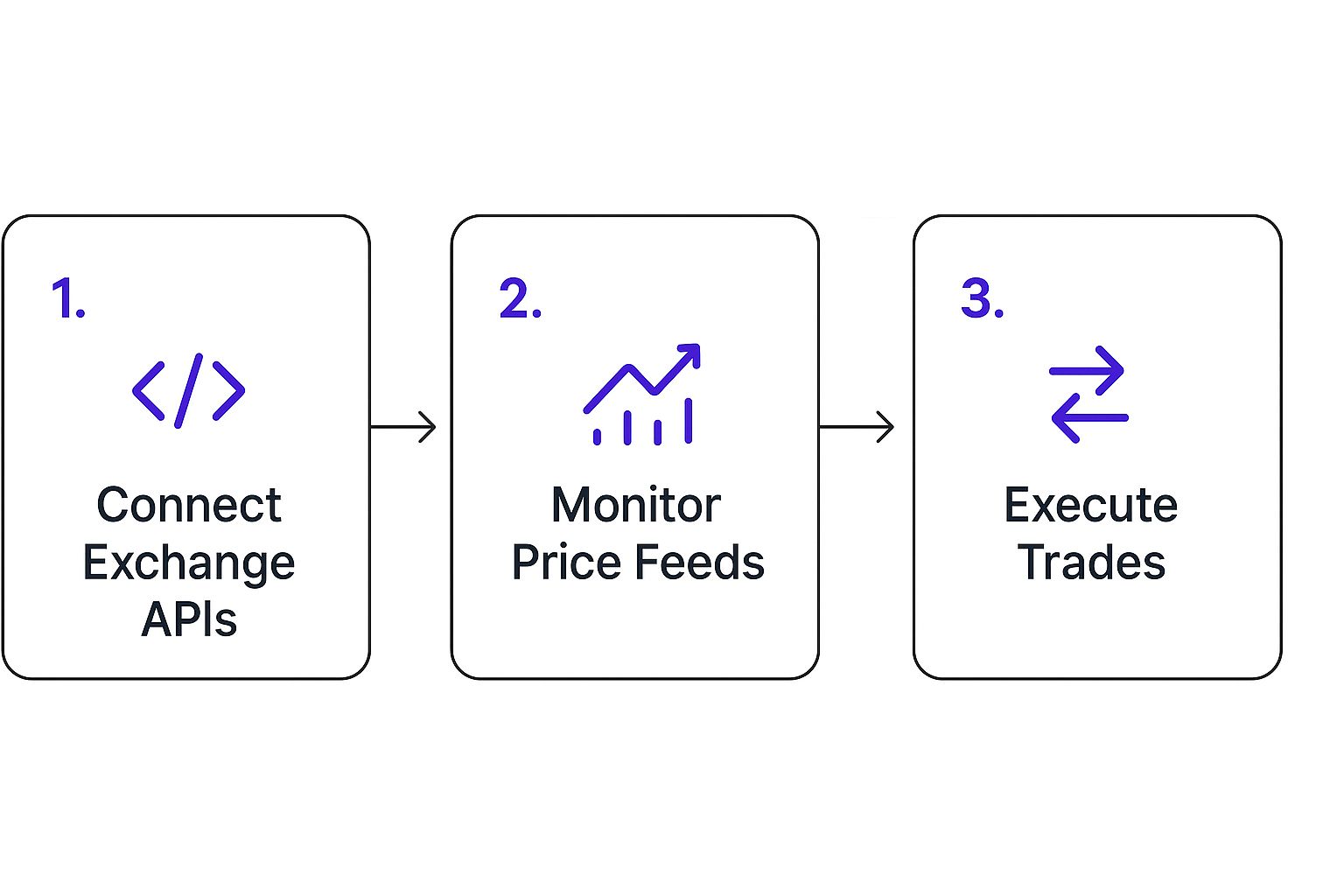

This image really drives home the workflow you should be following.

While the process from connecting APIs to executing trades looks pretty streamlined here, that critical vetting step is what separates a winning trade from a costly mistake. It all happens right there in the monitoring phase.

Calculating Your True Profitability

Let's get down to the brass tacks and talk numbers. The initial calculation seems simple: (Sell Price – Buy Price) x Amount. But the real math is far more involved. You absolutely must factor in every associated cost to know if a trade is viable. Honing your ability to qualify these opportunities is essential, and digging into a complete guide to the due diligence process can give you a solid framework.

To help you out, I’ve put together a quick checklist to run through before you pounce on an opportunity flagged by vTrader. It’s the same mental checklist I run through myself.

Arbitrage Opportunity Vetting Checklist

| Checklist Item | What to Look For | Why It Matters |

|---|---|---|

| Exchange Trading Fees | Maker/Taker fees on both platforms. | These can eat 0.1% to 0.5% or more from each side of the trade. |

| Withdrawal & Transfer Costs | Crypto withdrawal fees and network gas fees. | Moving assets isn't free. Gas fees, especially, can fluctuate wildly. |

| Deposit Fees | Check if the destination exchange charges for deposits. | Less common, but it can be a nasty surprise that cuts into your margin. |

| Order Book Liquidity | The depth of buy/sell orders around the target price. | Thin liquidity means high slippage risk, which can destroy your profit. |

| Wallet & Network Speed | How fast an exchange processes withdrawals. | A slow withdrawal can mean the price gap disappears before you can act. |

Running through this list for every potential trade will save you from a world of financial pain and help you focus only on the opportunities with a real chance of success.

The market has definitely gotten more efficient. As of 2025, those massive spreads that used to define crypto arbitrage are much harder to find. Back in the day, traders might see gaps of 2-5%, but today's average spreads are in a much tighter 0.1-1% range. This makes meticulous cost analysis absolutely critical.

You can find a clear breakdown of platform-specific costs in our guide to vTrader fees to help with these calculations. This increased competition simply means that only the most prepared traders—the ones who account for every single variable—can consistently pull in a profit.

Executing a Flawless Arbitrage Trade

Once you’ve spotted an opportunity and confirmed the numbers pencil out, it's all about speed. In the fast-paced world of crypto arbitrage, a profitable gap can vanish in the blink of an eye. This is where the automation inside vTrader really shines, turning what would be a frantic manual scramble into a decisive, single-click move.

The magic is in the simultaneous trade. vTrader is built to fire off a buy order on the cheaper exchange and a sell order on the more expensive one at almost the exact same instant. This is how you lock in that price spread before the market has a chance to move against you. Any hesitation can flip a guaranteed win into an unexpected loss.

Choosing Your Order Type

Inside the vTrader platform, you'll have to make a quick decision: use a market order or a limit order. This choice comes down to a classic trade-off between speed and price, and learning which one to use is a skill you'll hone with every trade.

-

Market Orders: Think of these as your "go" button for pure speed. A market order executes instantly at whatever the current best price is. When you're chasing a razor-thin, volatile arbitrage gap, this is your best shot at getting the trade filled before it disappears.

-

Limit Orders: These give you control over the price. You set the exact price you’re willing to buy or sell at. While this protects you from negative price slippage, you run the risk of the market moving away from your price and your order never getting filled at all.

For most arbitrage situations where the margins are tight and time is everything, the market order is usually the smarter play. The small risk of a tiny bit of slippage is often a fair price to pay for the certainty of getting your trade executed immediately.

A classic rookie mistake is getting greedy with limit orders to chase an extra fraction of a percent. I've learned from experience that a slightly smaller, locked-in profit is always better than a potentially larger profit that you never actually capture.

The All-Important Step: Rebalancing Your Assets

Making the trade is really only half the job. Now you've got the crypto you bought on one exchange and cash on another. The final, and absolutely crucial, phase is rebalancing your capital so you're ready for the next opportunity.

This means withdrawing the crypto you just purchased and sending it over to the exchange where you sold, topping up your inventory. This is a step where a lot of traders lose momentum and eat into their own profits.

Fine-Tuning Your Post-Trade Workflow

Don't just hit "withdraw" and wait around. You can actively manage this process to slash your turnaround time and get your capital back in the game much faster.

- Withdraw Immediately: The second your buy order fills, start the withdrawal. Don't waste a single second.

- Use a Block Explorer: Don't just take the exchange's "processing" status at face value. Grab the transaction ID (TXID) and plug it into a block explorer for that coin's network (like Etherscan for Ethereum). This gives you a live, honest look at your transfer's progress.

- Know Your Transfer Times: Get a feel for how long different blockchains take to confirm transactions. A Bitcoin transfer will feel like an eternity compared to a transaction on Solana or Polygon. Factoring this into your strategy can help you focus on opportunities that use faster networks.

Getting this cycle down—execute, rebalance, repeat—is what separates the hobbyists from the pros. It ensures your money is always working for you, poised and ready the moment vTrader flags the next profitable spread.

Navigating Risks with Advanced Strategies

Once you’ve got a handle on basic cross-exchange trades, you can start looking at more complex forms of crypto trading arbitrage. These are the plays that carry higher potential rewards—but, as you’d expect, come with equally elevated risks. Getting these right demands a much sharper eye and a more sophisticated risk management plan.

One of the most well-known advanced techniques is triangular arbitrage. This whole strategy plays out on a single exchange by jumping on price discrepancies between three different cryptocurrencies. You might, for example, trade USD for BTC, flip that BTC for ETH, and then immediately sell the ETH back to USD. If you timed it right, you'd end up with more USD than you started with.

The catch? The entire sequence has to execute in a flash. While this gets rid of cross-exchange transfer delays and fees, it brings its own headaches, like needing to watch three pairs at once and dealing with thinner liquidity on some of those pairs.

Managing a Higher Stakes Game

Let's be clear: advanced strategies are unforgiving. A single hiccup, like one leg of your triangular trade failing to execute, can flip a potential profit into a guaranteed loss. This is where your risk management needs to graduate beyond just calculating fees.

Your main concern now shifts to execution risk. This is a broad term for all the things that can go wrong mid-trade and completely derail your plan. You have to be ready for these scenarios before they happen, not while you're scrambling to react.

A big part of staying ahead is keeping tabs on what's happening in the industry and with the exchanges themselves. You can stay on top of potential issues by checking the official vTrader news hub for any updates on platform maintenance or market-wide events that could throw a wrench in your trades.

Expert Insight: The biggest difference between a rookie and a pro in arbitrage isn't the strategies they use—it's how they handle trades that go wrong. A pro has a backup plan for everything, from a transaction getting stuck to a sudden API outage.

Statistical Arbitrage and Mitigating Slippage

Another sophisticated method worth knowing about is statistical arbitrage. This is a quantitative approach that hinges on the price relationships between assets that have historically moved together. The strategy is to exploit temporary deviations, betting that their prices will eventually snap back to their historical average. It's a huge step up in complexity.

In crypto, for instance, stat arb often involves pairs like Bitcoin (BTC) and Ethereum (ETH), which have shown pretty strong cointegration over the years. To really get a feel for it, you can dive deeper into how these quantitative crypto strategies actually work. Just know this isn't a strategy for beginners; it requires a solid grasp of statistical models.

With any of these advanced plays, managing price slippage becomes absolutely critical. Here are a few things you can do to keep it in check:

- Test with Small Amounts: Before you put serious capital on the line with a new strategy, run a few small test trades. See what the actual slippage looks like on the specific pairs and exchange you're targeting.

- Set Network Alerts: Use tools to get alerts for high network congestion, especially on blockchains like Ethereum. Spiking gas fees are a red flag for delays and higher costs.

- Create Contingency Plans: What’s your move if one leg of a triangular trade fails? Decide ahead of time. Are you going to hold the intermediate asset, or will you immediately trade it back to your base currency, even if it means taking a small loss?

By actively planning for transaction failures, API issues, and slippage, you can step into the world of advanced crypto arbitrage with confidence, turning what looks like a high-risk gamble into a series of calculated opportunities.

Common Crypto Arbitrage Questions Answered

As you start digging into crypto arbitrage, you're bound to have questions. Everyone does. Think of this section as your quick-reference guide, where we’ll cut through the noise and give you straight answers to the most common concerns we see from traders.

One of the first things people ask is about starting capital. While you could technically start with a few hundred dollars, your real profit potential is tied directly to your investment size. You need enough capital to make trades that are big enough to cover the fixed transaction fees and still leave you with a decent profit. For anyone serious about this, a practical starting point is usually between $1,000 and $5,000, split across at least two exchanges.

Is Arbitrage Still a Viable Strategy?

With all the talk about market efficiency and trading bots, many traders wonder if arbitrage is even profitable anymore. The short answer is yes, but it’s a different game now. The opportunities are smaller and demand much quicker execution than they did in the early days.

Today, success comes down to using fast, reliable tools, keeping your fees to an absolute minimum, and having capital ready to go at a moment's notice. The "easy money" days are over, but for traders who are prepared and disciplined, profitable gaps definitely still appear.

A huge misconception is that market crashes are the biggest danger for arbitrage traders. The truth is, the most significant risks are operational. These are the behind-the-scenes hiccups that can derail an otherwise perfect trade.

The True Risks to Watch Out For

Understanding the real threats is crucial. Your biggest enemies aren't necessarily huge price swings, but failures in the trade execution itself. These are the issues that can really bite you:

- Slow or Stuck Transfers: A crypto withdrawal that gets hung up on the blockchain can make you miss your selling window entirely.

- Sudden Exchange Downtime: An exchange suddenly going into maintenance or its API failing can lock up your funds at the worst possible time.

- Price Slippage: This is the nasty gap between the price you thought you were getting and the actual price your order fills at. It can completely wipe out a thin profit margin.

These operational hurdles are exactly why a solid foundation of knowledge is non-negotiable. If you're new to the crypto world, getting a handle on the basic terms is essential. A good Web3 dictionary can be a huge help. For more specific questions about our platform, make sure to check out our detailed frequently asked questions page.

Ready to stop paying trading fees and start maximizing your profits? vTrader offers commission-free trading, advanced tools, and the speed you need to succeed in crypto arbitrage. Open your free account today!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.