Understanding What Your Crypto Staking Calculator Actually Does

Let's be real, a crypto staking calculator isn't some magic fortune teller. It's not going to predict your future lambos. Think of it more like a budgeting app for your crypto. It helps you map out potential earnings based on the info you feed it. But, just like with budgeting, accuracy hinges on realistic numbers.

Remember the old saying: garbage in, garbage out. This is where so many people trip up. They punch in the highest APY they can find, add a dash of wishful thinking, and voilà – instant millionaire on the calculator screen. I had a buddy do this once; he was convinced he'd 10x his investment in a year! He'd completely forgotten about pesky things like fluctuating staking rewards, validator fees, and, well, the general rollercoaster that is the crypto market.

A solid crypto staking calculator, like the one over at vTrader, takes into account a few key things:

- The amount of crypto you're staking

- How long you plan to stake it for

- The estimated APY

It's also worth checking out vTrader's news section for extra insights on digital asset investments. Articles like "Exploring the Benefits of Digital Asset Investments in 2025" add valuable context to your staking decisions.

The crypto market is a dynamic beast, constantly shifting and evolving with wider adoption trends. Take 2025, for instance: almost one in four people surveyed across the US, UK, France, and Singapore held cryptocurrency – up from 21% the previous year. That's serious growth. Check out this report for more details.

This is why understanding the underlying assumptions of these calculators is so important. It helps set realistic expectations. Remember, the real world doesn't always play by the calculator's rules. Returns can go up and down, and sometimes, they even go down.

Setting Up Your Calculations Like a Seasoned Pro

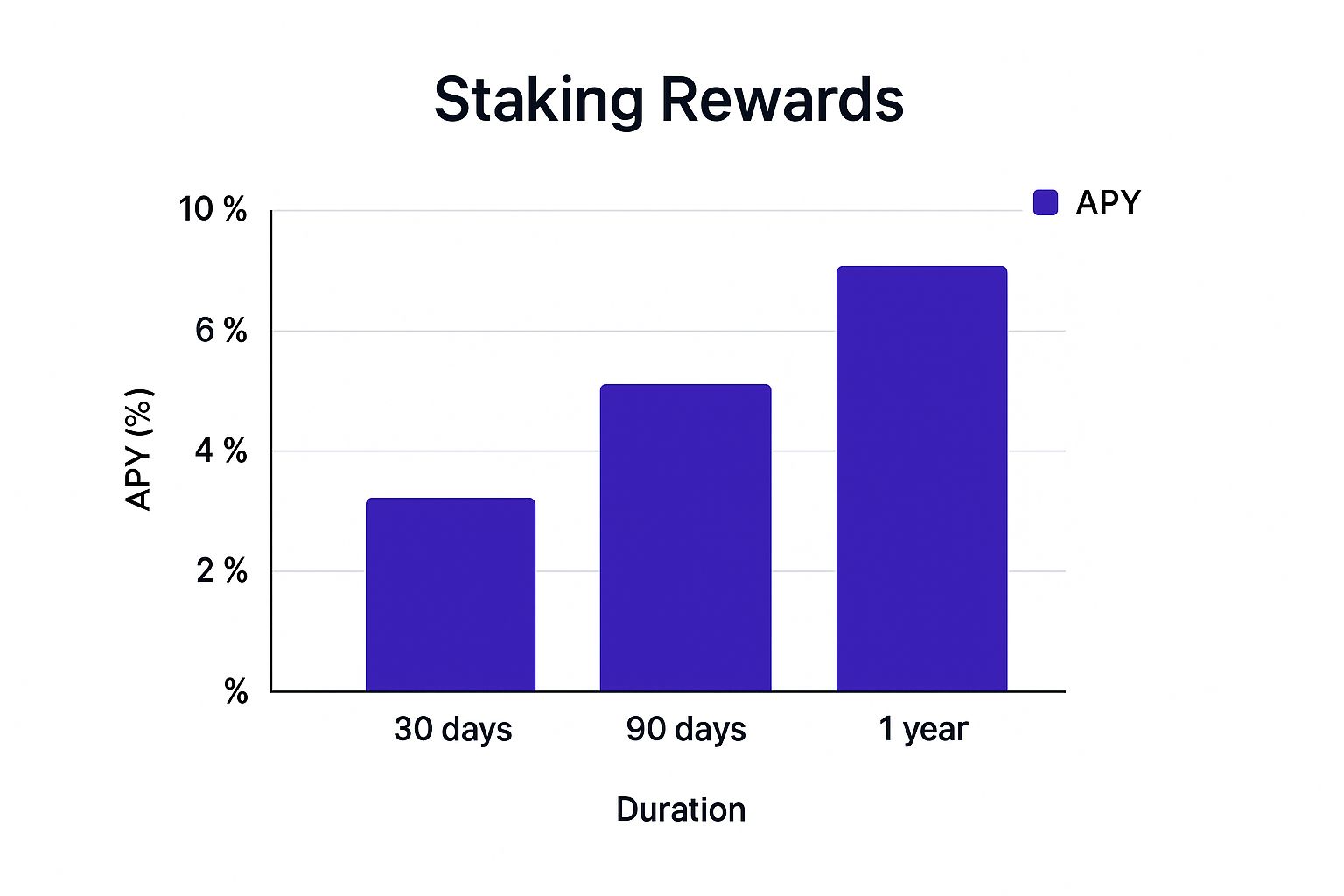

This chart shows how your potential Annual Percentage Yield (APY) from staking crypto can grow over time – 30 days, 90 days, and a full year. The longer you hold, the more those rewards compound, leading to higher overall returns. Even small APY differences become pretty significant with time. It really highlights the power of patience!

Let's talk about using a crypto staking calculator effectively, especially on platforms like vTrader. Accuracy is paramount. Don't just throw in some random numbers. Take your time to input the correct token amounts, realistic APYs, and accurate validator fees.

It's tempting to plug in the highest APY you see, but trust me, researching typical rates and considering network conditions will give you a much more accurate projection of your potential earnings. For more on using AI in your crypto journey, check out this article: Master the Setup: Navigating AI-Driven Crypto Trading Bots in 2025.

Understanding Key Metrics

Understanding how different inputs affect your staking results is essential. It's similar to using a Twitter engagement rate calculator – calculating different metrics gives you valuable data. This kind of analysis is crucial for any staking strategy. Crypto staking has become a big deal for passive income, and the growing interest in staked Exchange Traded Funds (ETFs) in 2025 is likely to bring even more attention to blockchain networks beyond just Bitcoin and Ethereum. Here’s a deeper dive into the regulatory landscape: Discover more insights.

Don’t forget about practical considerations like minimum staking requirements and lock-up periods. These can significantly impact your overall strategy, so factor them into your calculator projections.

To help you understand the key variables involved in staking calculations, let's look at a comparison table:

The following table, "Essential Calculator Inputs Comparison," compares key variables you'll encounter across various crypto staking calculators and their typical ranges. It also provides pro tips to help you maximize your staking rewards.

| Input Variable | Typical Range | Impact on Results | Pro Tips |

|---|---|---|---|

| Token Amount | 0 – ∞ | Directly proportional to rewards | Start small and gradually increase your staked amount as you gain confidence. |

| APY | 0% – 50% (varies significantly) | Major impact; higher APY = higher rewards | Research thoroughly and choose a realistic APY based on current market conditions and the specific platform. |

| Staking Duration | Days, Months, Years | Longer duration generally leads to higher rewards due to compounding | Align your staking duration with your investment goals and risk tolerance. Consider lock-up periods. |

| Validator Fees | 0% – 5% (varies by validator) | Reduces overall rewards; lower fees are preferable | Compare fees across different validators and choose one that offers a good balance of reliability and low fees. |

| Compounding Frequency | Daily, Weekly, Monthly, Annually | More frequent compounding leads to slightly higher overall rewards | Opt for more frequent compounding if available. Even small differences can add up over time. |

As you can see, each input plays a critical role in determining your potential staking rewards. By carefully considering each variable and using the provided pro tips, you can optimize your staking strategy for maximum returns. Remember to adjust your inputs over time as market conditions and your personal investment goals change.

Decoding Your Results Like an Expert

So, you’ve punched in the numbers into a crypto staking calculator and you're looking at that projected return. Tempting, right? Before you get carried away, let's break down what those numbers actually represent. A crypto staking calculator gives you a glimpse based on the current APY, but the crypto market is anything but predictable. I've personally seen a projected 20% return vanish in a week because of a sudden market downturn. It's a good reminder that projections aren’t guarantees.

Before even calculating those staking rewards, using platform tools to compare different staking options can be really helpful. Check out these Tools – they might give you some ideas. Understanding your calculator's results means understanding its assumptions. Most calculators assume stable market conditions. But crypto? Volatile is an understatement. Factoring in price swings is crucial. A 10% staking reward doesn't help much if the token price drops 20%. Smart stakers run different scenarios with varying APYs and price projections to get a feel for the range of possibilities.

Considering Real-World Factors

This is where experience really kicks in. Anyone who’s been staking for a while knows that compounding makes a huge difference over time. A slightly lower APY with frequent compounding can actually beat a higher APY that compounds less often. Don’t forget about validator fees either. These can take a bigger bite out of your returns than you’d think, especially with smaller stakes.

Ethereum staking is a hot topic, and it's predicted to get even bigger. Projections show over 50% of Ethereum’s circulating supply could be staked by the end of 2025, fueled by growing demand and clearer regulations. Discover more insights. This influx of staked ETH could definitely affect staking rewards, something to keep in mind when looking at your calculator's output. Finally, remember timing is key. Market conditions, network upgrades, and even global events can all impact your actual returns. A crypto staking calculator is a great tool, but it’s only as good as the data you provide and your understanding of the overall market.

Advanced Calculator Strategies That Generate Real Results

So, you've got the basics of a crypto staking calculator down. Excellent! But let's be honest, knowing the basics is like knowing how to turn on a computer – it's a start, but there's a whole universe of potential you're not tapping into yet. Let's explore how to really make that calculator work for you.

Modeling Different Market Scenarios

Here's a pro tip: don’t just input the current APY and think you're done. Markets shift, things change. What happens if the APY dips by 5%, 10%, or even 20%? Conversely, what if the price of your staked token moons? Playing around with these variables in your calculator gives you a feel for the potential range of outcomes – good and bad – and helps you build a more robust staking strategy that can weather market fluctuations.

Comparing Staking Opportunities

Take a look at this screenshot from ethereum.org. See how it lays out all those staking options? That's a perfect example of why research is key. Don't just jump into the first pool you see.

Your staking calculator is your best friend here. Don't just focus on the potential rewards. Dig deeper. Look at lock-up periods, unstaking fees (ouch!), and the reliability of the validator. A good calculator will let you compare multiple staking options side-by-side. For example, vTrader offers some excellent tools and resources for comparing different staking opportunities. They provide valuable insights right on their platform to help you make informed decisions.

Factoring in Tax Implications

Let's talk about the less fun part: taxes. Remember, staking rewards are considered income, and you'll owe capital gains taxes when you sell. It's a detail many overlook, but it can significantly impact your actual profits. A decent crypto staking calculator should be able to help you estimate those taxes based on your location and tax bracket. vTrader is a good resource for this, and if you want a more in-depth look at DeFi investing (and taxes!), check out this article: Read also: How To Invest in DeFi.

Long-Term vs. Short-Term Strategies

Last but not least, think about your timeframe. Are you playing the long game, or looking for quicker returns? A calculator can model the effects of compounding over time, which is where the real magic of long-term staking happens. But remember, the crypto market can be volatile. It's a balancing act between maximizing long-term potential and managing risk in the short term.

Avoiding the Costly Pitfalls That Trip Up Most Stakers

Let's be real, staking can be tricky. Even with a crypto staking calculator, there are ways things can go south. I've seen it happen – folks get so excited about potential gains they overlook the real-world stuff that can throw a wrench in the works. A friend of mine staked a bunch of his crypto based on a crazy-high APY projection, only to get hammered when the market tanked. He hadn't thought about price volatility. Tough lesson. Calculators are helpful tools, but they're not crystal balls.

Understanding Unstaking Periods and Liquidity

One major pitfall is forgetting about unstaking periods. Some platforms lock up your staked crypto, sometimes for months. Imagine needing cash for an emergency, but your funds are stuck. Not fun. Just as important is understanding liquidity. Don't tie up every last coin in staking. Keep some accessible for unexpected expenses.

Market Realities vs. Calculator Assumptions

Another trap is blindly trusting the calculator's assumptions. Remember, these calculators work with the data you give them. Bad data in, bad data out. Many calculators assume a constant APY, but staking rewards can change drastically. I once saw a project offering a 50% APY, which plummeted to 5% weeks later. Brutal. Always compare the calculator's assumptions to the current market and adjust accordingly. Check out our guide on Spotting Airdrop Scams for more tips on avoiding crypto pitfalls.

Building Realistic Expectations and Backup Plans

Here’s the bottom line: don't let the hype cloud your judgment. A crypto staking calculator is a planning tool, not a guarantee. Factor in real-world risks. Have realistic expectations and a backup plan. Diversifying your staking portfolio and having an exit strategy can help protect you from market downturns and improve your long-term prospects.

Let's talk about some common calculator mistakes. The table below breaks down some frequent errors and how to avoid them.

Common Staking Calculator Mistakes and Solutions

| Common Mistake | Why It Happens | Real Cost | Prevention Strategy |

|---|---|---|---|

| Assuming Constant APY | Calculators often use a fixed APY for simplicity | Can lead to overestimation of returns and poor decision-making. | Regularly update APY input based on market conditions |

| Ignoring Unstaking Periods | Not considering lock-up periods | Inability to access funds when needed. | Factor in unstaking periods in your financial planning |

| Neglecting Network Fees | Not accounting for transaction costs | Reduces actual returns; can even result in losses. | Include network fee estimates in your calculations |

| Overestimating Potential Returns | Hype and unrealistic expectations | Disappointment and potential over-investment. | Research project thoroughly and consider market risks |

| Not Diversifying | Focusing on a single staking opportunity | Increased vulnerability to project-specific risks. | Spread your staked assets across multiple projects |

As you can see, avoiding these common mistakes is crucial for successful staking. By understanding the limitations of staking calculators and factoring in real-world considerations, you can make more informed decisions and maximize your staking rewards.

Building Your Personal Staking Strategy Framework

Now that you've got a handle on crypto staking calculators and the potential hiccups, let’s dive into building a solid staking strategy. It’s not just about chasing those sky-high APYs, it's about crafting a framework that fits your financial goals and how much risk you're comfortable with. Think of it like building a diversified investment portfolio—you wouldn't put all your money into one stock, right? The same goes for staking. Spread your staked assets across different platforms and consider market conditions to balance potential gains and losses.

Setting Realistic Goals and Monitoring Performance

A crypto staking calculator can be a great tool for setting realistic goals. Don't fall into the trap of plugging in the highest APY and dreaming of instant riches. Try out different scenarios. What if the market takes a dip? What if the APY drops? When calculating your potential staking rewards, don't forget to factor in all fees, including any hidden costs like those sometimes found with Forex Brokers (Forex Broker Fees). Understanding the potential downsides is key to a sustainable staking strategy.

Once you've established your goals, keep an eye on your performance. Compare your actual returns against your initial projections. Are you hitting your targets? If not, try to figure out why. Is the market underperforming, or are there issues with the validator you chose? Regular monitoring lets you tweak your strategy when needed. Something else you might find helpful is looking into crypto portfolio allocation (Crypto Portfolio Allocation).

Integrating Calculator Projections into a Comprehensive Investment Plan

Successful stakers don’t just stop at calculator projections; they weave those insights into a bigger investment plan. Consider your overall financial aims, your timeframe, and your risk tolerance. Are you in it for the long haul, or are you looking for quicker gains? Your staking strategy should match your broader investment approach.

Think about how much risk you're comfortable with. Do you prefer high-risk, high-reward strategies, or are you more cautious? A crypto staking calculator can help you model different scenarios and find what feels right for you.

Actionable Templates and Data-Driven Decisions

Finally, make data-driven decisions. Don't just rely on your gut. Track your performance, analyze the data, and adjust your strategy as you go. Simple spreadsheets or online tools can be great for monitoring your staking portfolio. This helps you see what’s working, what's not, and where you can improve. A well-defined staking strategy, consistent monitoring, and data analysis will put you on the path to long-term success in crypto staking.

Start maximizing your crypto staking rewards today with vTrader's advanced platform and integrated tools. Visit vTrader now!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.