If you’ve ever tried to manage your crypto investments, you know the feeling. A bit of Bitcoin on Coinbase, some ETH in a MetaMask wallet, maybe a few altcoins on Binance, and your long-term holds tucked away on a hardware wallet.

Trying to keep track of it all with a manual spreadsheet is a recipe for a headache. It’s a mess of constant price updates, transaction logging, and messy profit/loss calculations. This is where a crypto portfolio tracker app comes in.

Think of it as a single, clean dashboard that pulls all your scattered investments together. It gives you a real-time, bird's-eye view of everything you own, making it way easier to see how you're doing and decide what to do next.

Why Manual Tracking Just Doesn't Cut It

That trusty spreadsheet starts to fall apart pretty quickly. Besides being incredibly tedious, it’s a minefield for human error. One wrong decimal point or a forgotten transaction can throw off your entire performance picture.

Without a dedicated tool, you’re basically flying blind. Answering simple but crucial questions becomes a huge chore:

- What’s my entire portfolio worth right now?

- Which coins are actually making me money and which are dragging me down?

- How much have I really gained or lost since I started?

Guesswork isn’t a strategy, especially in a market that never sleeps. If you're just getting started, our guide on how do I invest in crypto can help you build a solid foundation.

These apps are powerful because they rely on real-time data streaming to give you instant, accurate updates on your holdings.

Manual Spreadsheets vs a Dedicated Tracker App

Let's be honest, while spreadsheets have their place, they just can't compete with a purpose-built app for crypto. Here's a quick breakdown of why making the switch is a no-brainer.

| Tracking Method | Manual Spreadsheet | Crypto Portfolio Tracker App |

|---|---|---|

| Data Entry | 100% manual; tedious and error-prone | Automated via API; syncs instantly |

| Pricing | Manual updates required; always lagging | Real-time price feeds for all assets |

| Performance | Complex formulas needed; hard to track | Automatic P&L, ROI, and asset analysis |

| Taxes | A nightmare to calculate and report | Generates transaction histories and tax reports |

| Accessibility | Limited to the device it's stored on | Cloud-based; accessible on any device |

| Security | Vulnerable to file corruption or deletion | Secure connections; read-only access |

The bottom line? A tracker app saves you time, reduces costly mistakes, and gives you the clarity needed to manage your crypto with confidence.

A Command Center for Your Crypto

A good portfolio tracker acts as your personal command center. You connect your exchange accounts and wallets using secure, read-only API keys, and the app does all the heavy lifting for you. It automatically pulls in your transactions and balances, giving you that unified view you’ve been missing.

The need for these tools has exploded right alongside crypto adoption. In 2023, there were over 420 million crypto users around the world. That number jumped to more than 562 million by early 2024. As more people get involved, the need for smart, simple ways to manage it all becomes absolutely essential.

Decoding the Features of a Great Tracker App

So, what separates a basic crypto tracker from a genuinely powerful one? Plenty of apps can show you a simple list of what you own. But the best tools give you deep insights, automate the painful grunt work, and actually help you make smarter decisions. These aren't just fancy add-ons; they're the core of what makes a tracker truly useful.

Knowing what to look for is the key to picking an app that fits how you invest. Let's break down the essential features that every top-tier crypto tracker needs to have.

Automated Exchange and Wallet Syncing

This is the big one. Instead of manually typing in every single trade you make—a recipe for mistakes and wasted time—you connect your exchange accounts (like Coinbase or Binance) and public wallet addresses straight to the app. This is usually done with read-only API keys. Think of them as a "look, don't touch" pass that lets the app see your history and balances without any power to trade or move your funds.

Key Takeaway: Automated syncing is the engine that drives a modern tracker. It kills human error, saves you hours of data entry, and makes sure your portfolio is always perfectly up-to-date.

Without this, you’re basically just using a fancy spreadsheet. Automation pulls everything together into one place, giving you a complete and accurate picture of your holdings, no matter where they are.

Real-Time Price Data and Analytics

A great tracker is more than just a record of your past trades; it’s a live dashboard humming with real-time market data. This means your portfolio’s value updates constantly, reflecting the current price of every coin you hold, minute by minute.

But it goes way beyond just showing you a price. The best apps offer powerful analytics that tell the story of your investment journey. With these tools, you can actually see:

- True Profit/Loss (P&L): Know exactly how much you've made or lost on each individual asset and across your entire portfolio.

- Asset Allocation: See your exposure at a glance. Are you too heavy in Bitcoin? What percentage is in altcoins or stablecoins?

- Historical Performance: Watch your portfolio's growth over time with clear, interactive charts.

A top-tier tracker is brilliant at processing complex on-chain information, turning raw numbers into actionable intelligence through solid blockchain data analysis. This is how you spot trends and figure out if your strategy is actually working.

Advanced Reporting and Custom Alerts

Beyond just watching your portfolio, a quality tracker gives you practical tools to handle complex tasks and stay one step ahead of the market. Two of the most important are tax reporting and custom alerts.

1. Tax Reporting Tools

Let’s be honest, crypto taxes are a nightmare. A good tracker takes the pain out of it by automatically generating detailed reports of your transaction history, calculating capital gains and losses, and even creating forms you can hand straight to your accountant or import into tax software. This feature alone can save you dozens of hours of stress.

2. Customizable Alerts

The crypto market never sleeps, but you have to. Customizable alerts let you set up notifications for specific price moves, so you can jump on opportunities or manage risk without being glued to the charts. For example, you can get a ping when Bitcoin hits a price target or if an altcoin you hold suddenly drops more than 10% in a day.

These platforms now support thousands of cryptocurrencies across hundreds of exchanges. The typical user of a modern crypto tracker is often managing a diverse portfolio of 10-15 different assets, which makes these advanced features absolutely essential for staying on top of everything.

Keeping Your Digital Assets Secure

Handing over any kind of access to your financial accounts can feel a bit nerve-wracking. In crypto, a healthy dose of caution is always a good thing. So when you connect a portfolio tracker to your exchanges and wallets, it's totally fair to ask: is this actually safe?

The short answer is yes, but only if you understand how these apps are designed to protect you.

The magic lies in a concept called read-only access. Imagine giving a friend a copy of your bank statement to look over. They can see all the numbers—your balance, your deposits, your withdrawals—but they can’t actually take any money out or move it around. This is exactly how a secure portfolio tracker works.

Understanding API Key Permissions

When you link an exchange, you generate something called an API key. Think of it as a special password that lets the tracker talk to your exchange. The crucial step here is setting the permissions for that key. You must ensure that only “read” or “view” access is switched on. Withdrawal permissions must always be turned off.

A reputable crypto portfolio tracker will never, ever ask for withdrawal permissions. If an app wants that level of access, it’s a massive red flag. Close the window and walk away. Your funds always come first.

This separation of powers is what keeps your assets safe. The tracker can pull all the data it needs to show you how your portfolio is doing without ever having the ability to touch your crypto.

Essential Security Practices to Follow

Beyond read-only APIs, you need to be proactive. Protecting your crypto is an active job, and that means being smart about common threats. To get ahead of the curve, check out our guide on how to protect against phishing attacks to help you spot and avoid scams.

To keep your data locked down, always choose trackers that take security seriously and follow these best practices yourself:

- Two-Factor Authentication (2FA): Turn this on everywhere. Your portfolio tracker, your exchanges, everything. It adds a critical layer of defense that requires a code from your phone to log in, stopping anyone with just your password in their tracks.

- Data Encryption: Only use apps that openly state they encrypt your data. This scrambles your personal and financial information, making it completely useless to anyone who might try to steal it.

- Strong, Unique Passwords: Don't reuse passwords. It's one of the easiest ways to get into trouble. Use a password manager to create and store different, complex passwords for every single account you own.

Once you get that these tools are built for viewing—not touching—and lock in these basic security habits, you can use a tracker with confidence. It's all about getting those valuable insights without ever putting your digital assets on the line.

Choosing the Right Tracker for Your Strategy

Not all crypto portfolio trackers are created equal. The perfect app for someone holding Bitcoin long-term would be a clunky, complicated mess for a day trader, and vice versa. It’s all about matching the tool’s features to your specific investment style and goals.

Think of it like picking a car. If you just need to get around town, a simple sedan does the job perfectly. But a race car driver needs a machine packed with advanced telemetry and real-time performance data. Your crypto strategy determines the kind of engine you need under the hood.

To find your best fit, you first need to figure out what kind of investor you are. Are you just getting started, or are you already deep in the world of DeFi and NFTs?

For the Casual Holder

If you’re a “buy and hold” investor, your needs are pretty straightforward. You mostly just want to see the total value of your assets at a glance and watch your portfolio grow over time. For you, simplicity is king.

You’ll want a crypto portfolio tracker app with:

- A clean, intuitive interface: You don’t need a screen cluttered with complex charts or confusing data feeds.

- Reliable exchange and wallet connections: Just make sure it syncs easily with the few places you keep your crypto.

- Basic performance charts: A simple graph showing your portfolio's value over the last few months or years is all you really need.

Your goal is clarity, not complexity. An app with a simple, mobile-friendly dashboard for checking your net worth is usually the best bet.

For the Active Trader

Active traders live and breathe data. You’re making multiple trades a week—maybe even a day—and you need tools that can keep up. Your entire focus is on short-term price moves, real-time profit and loss (P&L), and spotting the next opportunity right now.

The essential features for you are:

- Real-time price data: Lagging information is a deal-breaker. You need updates that are instantaneous.

- Advanced P&L analysis: Seeing your profit and loss on a per-trade basis isn’t a nice-to-have; it’s critical.

- Customizable alerts: Set up notifications for specific price targets so you can execute your strategy without being glued to a screen 24/7.

Your tracker should feel like a co-pilot, feeding you the immediate data required to make fast, informed decisions. For more ideas on how to put these tools to work, you can explore various crypto trading strategies that can sharpen your approach.

For the DeFi and NFT Explorer

If you’re venturing beyond centralized exchanges into the wild west of decentralized finance (DeFi), staking, or NFTs, your tracking needs get a lot more complicated. Your assets aren’t just sitting in a few exchange accounts; they’re spread across multiple blockchains and locked in smart contracts.

Key Insight: A standard tracker might not see your staked tokens or your NFT collection. You need a specialized tool that can scan different blockchains and recognize a wide array of digital assets.

Look for an app that specifically supports:

- Multi-chain wallet tracking: It absolutely must connect to wallets like MetaMask and be able to read data from blockchains like Ethereum, Solana, and others.

- DeFi protocol integration: The app needs to recognize assets you have in liquidity pools, lending protocols, or yield farms.

- NFT gallery and valuation: A dedicated feature to display your NFTs and track their floor prices is a must.

This is where a simple spreadsheet just won’t cut it. You need a tool built to navigate the decentralized world.

The table below breaks down which features matter most based on your personal crypto investment strategy.

Matching Investor Types to Key App Features

| Your Investor Profile | Essential Features to Look For | Primary Goal |

|---|---|---|

| The Casual Holder | Simple UI, basic performance charts, reliable exchange/wallet sync | See long-term growth and total portfolio value at a glance |

| The Active Trader | Real-time price data, advanced P&L, customizable alerts | Make quick, data-driven decisions for short-term gains |

| The DeFi/NFT Explorer | Multi-chain support, DeFi protocol integration, NFT tracking | Get a complete view of all assets across different blockchains |

No matter which profile fits you best, security should always be your top priority. You're connecting financial data, after all.

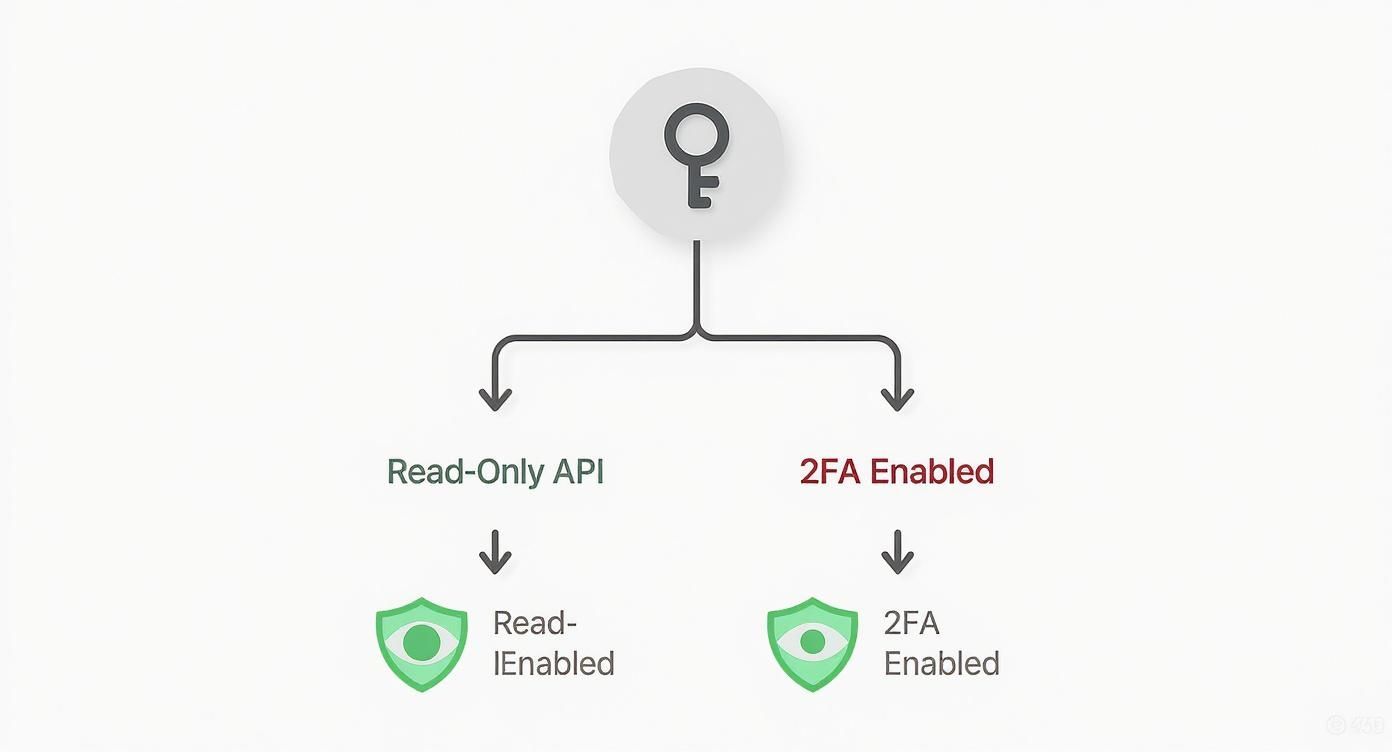

As this flowchart shows, using read-only API keys and enabling two-factor authentication (2FA) are non-negotiable first steps. These two settings are the most direct path to securing your data and giving yourself peace of mind.

Setting Up Your First Portfolio Tracker

Diving into a crypto portfolio tracker for the first time is a lot less intimidating than you might think. Signing up is usually a breeze, taking just a few minutes, much like any other app. The real magic happens next: connecting all your accounts to bring that dashboard to life.

This is the step that turns an empty screen into your personal crypto command center. The goal is to get a single, clear view of everything you hold, whether it's sitting on a big exchange like Coinbase or secured in a personal wallet like MetaMask.

Connecting Your Exchange Accounts

The most common way to get your exchange data synced up is with an API key. Think of an API key as a secure, one-way messenger that lets your tracker talk to your exchange account without ever getting inside. The process is pretty straightforward, but you need to follow one golden rule.

When you go to create an API key on an exchange like Binance or Kraken, you’ll see a list of permissions. It's absolutely critical that you only grant "read-only" or "view" access.

Critical Security Tip: Never, ever give a third-party tracker app permission to trade or withdraw your funds. A read-only key lets the app see your balances and transaction history—that's it. It can't touch your money. If an app asks for more, that’s a massive red flag.

Once you have your read-only API key and its "secret," you just copy and paste them into your tracker. The app takes it from there, automatically pulling in your history and current balances.

Adding Your Public Wallet Addresses

But what about the crypto you’re holding yourself in a wallet? That’s even simpler. For wallets like MetaMask, Ledger, or Trust Wallet, there's no need for an API key. All you need is your public wallet address.

Your public address works a lot like a bank account number—it’s totally safe to share and lets anyone view your activity on the blockchain without having any control over your assets. Just copy your public address for each chain (like your Ethereum or Solana address) and plug it into the tracker.

The app will then scan the public ledger and populate your dashboard with all the tokens and even NFTs held at that address.

By mixing these API connections with your public wallet addresses, you finally get a complete, bird's-eye view of your entire crypto net worth. This kind of clarity is the bedrock for learning how to develop a crypto trading plan that's built on hard data, not just guesswork.

The Future of Crypto Portfolio Management

The way we manage our crypto portfolios is changing. For years, standalone tracker apps have been the go-to tool, but a better approach is taking shape—one that doesn't involve juggling third-party apps and messy API keys. The future is integrated, where tracking is baked right into the platforms you already use to trade.

Think about it: an ecosystem where every buy or sell is instantly reflected in your portfolio analytics, with no manual syncing or external connections needed. That's the power of all-in-one platforms that bundle exchange services with their own native tracking tools. It's a huge simplification that gets rid of the need to manage multiple accounts and secure a bunch of different API keys.

The Rise of Integrated Platforms

This shift is about more than just convenience; it’s a big step forward for security and efficiency. When you keep everything under one roof, you completely remove the risk of sharing your sensitive data with third-party applications. Your transaction history and balances are already in the system, which means you get perfect, real-time data that external apps can only ever try to imitate.

This unified model creates a much smoother experience where trading and analysis are two sides of the same coin. You can execute a trade and immediately see how it impacts your overall asset allocation, P&L, and long-term performance—no lag, no gaps.

The core idea is to transform portfolio tracking from a reactive, backward-looking task into a proactive, integrated part of your investment strategy. It’s about managing your assets, not just monitoring them.

Smarter Tools for a Smarter Investor

As these integrated platforms get more popular, they’re also getting smarter. The market is blowing up, with global demand for crypto portfolio trackers projected to grow at a compound annual rate of 25% over the next five years, according to insights from Kraken. This explosion in demand is pushing the whole industry to innovate.

We're already seeing the first wave of AI-driven insights built directly into these platforms. This means your portfolio tool won't just tell you what you own; it will help you understand it on a deeper level. For anyone curious about where this is heading, our guide on how to use AI for crypto trading strategies and tools digs into this exciting trend.

The end goal is a single, powerful hub that not only makes tracking dead simple but also gives you intelligent tools to manage your digital assets more effectively.

Frequently Asked Questions

Jumping into crypto portfolio management always brings up a few questions, especially around security and what these tools actually do. Let's clear up some of the most common ones.

Are These Tracker Apps Truly Safe To Use?

Absolutely, as long as you stick with reputable providers. The good ones are built with security as their number one job. They connect to your exchange accounts using something called read-only API keys.

Think of it like giving someone a key that only lets them look into a room but not touch anything inside. The app can see your balances and trade history, but it’s completely blocked from making trades or moving your funds.

For extra peace of mind, always double-check that you're only giving "read-only" permissions when setting up an API key. And definitely turn on two-factor authentication (2FA) on both the tracker and your exchange accounts. It’s a simple step that adds a huge layer of security.

Key Takeaway: A legitimate tracker’s job is to look, not touch. It views your public data without ever gaining control over your funds, keeping your assets safe where they belong—in your accounts.

Do I Need To Pay For A Good Portfolio Tracker?

Not necessarily. Many of the best tracker apps have fantastic free versions that give the average investor everything they need. You can usually connect a few exchanges and wallets to get a solid overview of your portfolio without spending a dime.

So, who are the paid plans for? They’re really aimed at power users. A premium subscription typically unlocks features like:

- Unlimited Connections: For those who trade across a dozen different platforms.

- Detailed Tax Reporting: Automatically generate the documents your accountant will love you for.

- Advanced Analytics: Dive deep into performance metrics and other pro-level insights.

If you're a serious trader or have a really complex portfolio, the upgrade can be worth it. Otherwise, free is often more than enough.

How Can A Tracker Help With My Crypto Taxes?

This is where a good tracker really shines. Honestly, it might be one of the most valuable features. Forget about spending a weekend digging through thousands of transaction records in a spreadsheet.

A tracker automates all of it. It pulls in your trade data from every linked account, crunches the numbers to figure out your capital gains and losses on each trade, and spits out the exact reports you need for tax time. This feature alone can save you dozens of hours of headache and helps make sure you're staying on the right side of tax laws.

Ready to stop juggling spreadsheets and start making smarter, data-driven decisions? With vTrader, you get powerful, integrated portfolio tracking built right into our zero-fee exchange. Sign up today at https://www.vtrader.io and get a complete, real-time view of your assets without the hassle.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.